A Painless Guide to Competitive Analysis for Marketing

Stop guessing and start winning. This guide to competitive analysis for marketing gives you the tools and tactics to outsmart your rivals.

Let's be real, "competitive analysis" sounds like a term straight out of a stuffy MBA textbook. But it’s just a fancy way of saying "spying on your competitors so you can do a better job."

Think of it as ethical spying. It’s your secret weapon to dodge dumb mistakes, spot juicy gaps in the market, and learn from your rivals' biggest wins and most spectacular face-plants.

Stop Flying Blind and Start Spying Ethically

Doing a competitive analysis for your marketing isn't about building giant spreadsheets that collect digital dust. It’s about getting quick, useful intel to make smarter decisions now. You wouldn't build a product without knowing if anyone wants it, right? So why would you launch a marketing campaign without knowing what you're up against?

This whole spy game is a key piece of marketing intelligence, where you're constantly collecting data to understand your market. It’s what separates the companies that adapt and thrive from those that get totally blindsided by a new player on the scene.

Why Bother With Competitor Research?

Ignoring your competition is like driving with your eyes closed. Sure, you're moving, but you have no clue where you're headed or what truck is about to flatten you. A solid analysis gives you a map of the battlefield.

- Don't reinvent the wheel: See what's already working (and what's bombing) in your market. This way, you don't waste precious time and cash on ideas that are already proven duds.

- Find your unique voice: Once you see how everyone else is talking, you can find a unique angle that makes you stand out. Are they the cheap option? The premium one? Maybe you can be the one that’s easiest to use.

- Steal their best ideas (ethically, of course): Figure out the marketing channels, keywords, or content that's making them money. Then, adapt those winning strategies for your own business.

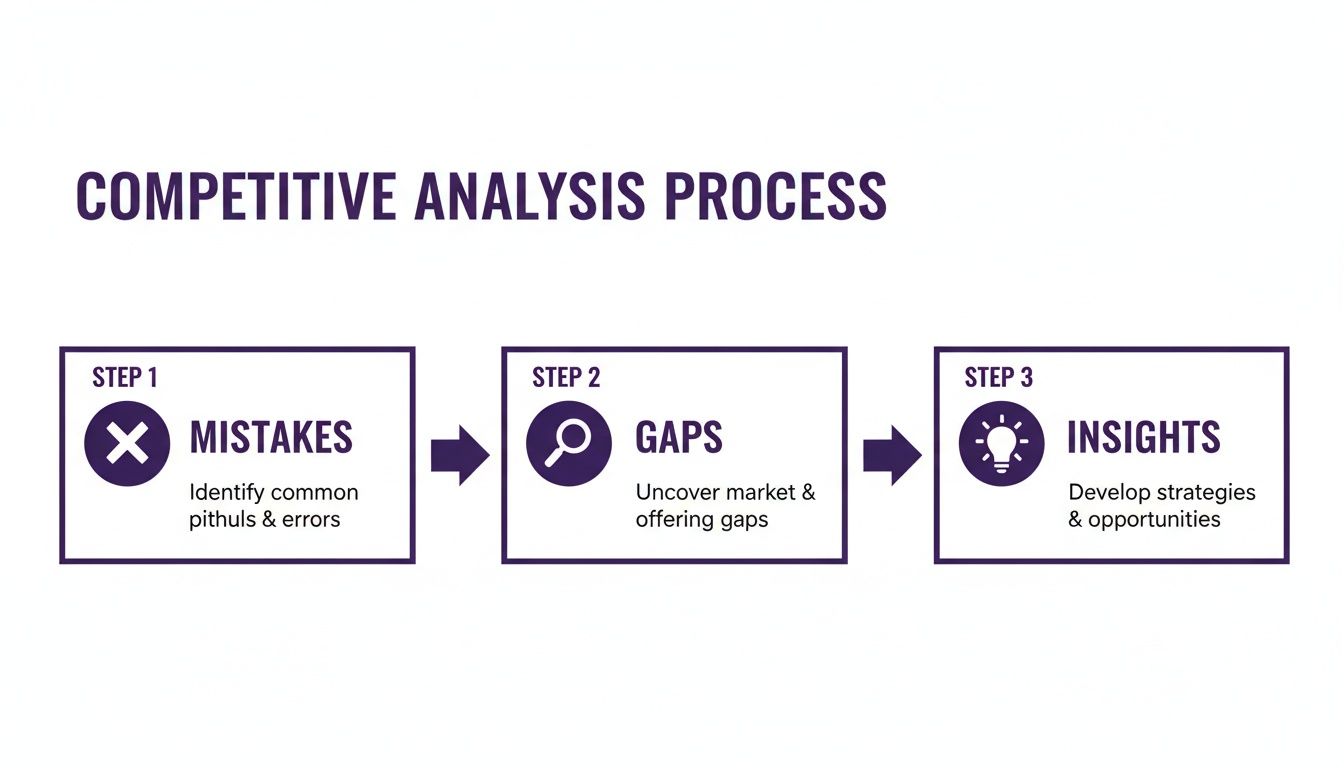

This simple flow really breaks it down: you spot their mistakes, find the gaps, and turn that into a killer game plan for your own brand.

The key here is that this isn't a one-and-done task. It's a continuous loop of learning and acting.

And believe me, the market for this kind of intel is blowing up. The global market for competitive analysis tools generated around USD 1.72 billion in revenue in 2024. That's expected to nearly double, hitting USD 3.35 billion by 2030. If you really want to stop flying blind, learning the 5 ways to spy on competitors can give you a serious leg up.

> Your competitors are your best, cheapest source of market research. They are spending money to test what works. Your job is to watch, learn, and do it better.

Building Your Marketing Spy Kit

Alright, you’re ready to put on your trench coat and start peeking over the digital fence. But where do you even look? Just staring at your competitor's homepage is like trying to understand a movie by only watching the trailer—you’ll miss the whole plot.

To do a proper competitive analysis, you need to hunt for specific clues. These are the little breadcrumbs that reveal their entire playbook. The goal is to build a complete picture of their marketing machine so you can find the loose screws and rusty gears.

This process isn't about random snooping; it's a focused mission. Here’s a quick-reference guide to what you should be tracking.

Key Marketing Signals to Track From Your Competitors

| Marketing Area | What to Look For | Why It Matters | | --- | --- | --- | | SEO & Keywords | Top organic keywords, keyword gaps, backlink profile, estimated traffic value. | Reveals their customer acquisition strategy and who they're trying to reach. | | Content Strategy | Blog post frequency, content formats (video, guides), top articles, content tone. | Shows you what topics their audience loves and where you can fill a content gap. | | Social Media | Primary channels, engagement rates, community size, ad campaigns. | Uncovers their brand personality and which platforms their (and your) customers use. | | Product Positioning | Homepage headlines, taglines, feature descriptions, "About Us" story. | This is the story they tell the world. It shows who they want to be and what they value. | | Pricing & Offers | Pricing tiers, free trial details, discount strategies, up-sell tactics. | Highlights their target customer and potential weaknesses you can exploit. | | Paid Ads | Ad copy on Google/social, landing page design, calls-to-action (CTAs). | Gives you a direct look at the messages they think are most effective for conversions. |

By gathering this data, you're not just looking at competitors; you're reverse-engineering their entire marketing strategy.

Uncovering Their SEO Secrets

First up is Search Engine Optimization (SEO). This is how most companies get found online, and it’s where you’ll find the juiciest intel. You need to know what keywords they're ranking for, especially the ones you’re missing.

Think of it like this: every keyword they rank for is a tiny plot of internet real estate they own. Your job is to figure out which plots are most valuable and which ones are poorly defended. Are they ranking for high-intent keywords like "best project management software for small teams"? Or are they winning with weird, long-tail phrases you've never even thought of?

You can use big-name tools like Ahrefs or Semrush to get this data, but be warned—they can be expensive, often running hundreds of dollars per month. A more affordable tool like already.dev can help you uncover these insights without selling a kidney. There's also a great list of the best competitor analysis tools that covers options for any budget.

> A competitor's SEO strategy is a public roadmap. The keywords they target tell you exactly who they think their customer is and what problems they're trying to solve.

Decoding Their Content and Social Game

Next, look at their content and social media. This isn't just about counting blog posts. It’s about understanding the what and the why behind their stuff.

- What formats are they using? Are they all-in on TikTok videos? Do they host monthly webinars? Or are they old-school, pumping out massive downloadable guides?

- What topics resonate? Look at their most-shared or commented-on posts. This tells you what their audience actually cares about, giving you a shortcut to creating content that people will actually read.

- What’s their social vibe? Are they super corporate and boring on LinkedIn? Or are they cracking jokes and posting memes on X (formerly Twitter)? Their tone reveals how they want to be seen by customers.

By mapping this out, you can spot the gaps. Maybe everyone in your industry is creating boring blog posts, but nobody is making helpful, two-minute tutorial videos. That’s your opening.

Analyzing Positioning and Pricing

Finally, zoom in on their product positioning and pricing. This is where you figure out how they frame their value to the world. Read their homepage, their "About Us" page, and their product descriptions.

Pay close attention to the exact words they use. Do they call themselves the "easiest" solution? The "most powerful"? The "cheapest"? This language is a massive clue about who they’re targeting and what weaknesses they’re trying to hide.

Then, go straight to their pricing page. Is it simple and transparent, or a confusing mess? How do they justify their price? A competitor with a convoluted pricing page is practically begging you to come in with a simple, straightforward offer. It’s a classic weak spot.

By combining these three areas—SEO, Content/Social, and Positioning/Pricing—you become a full-blown marketing detective. You’ll have a complete dossier on their strategy, giving you everything you need to find the chinks in their armor.

How to Gather Intel Without Wasting Your Life

Let’s be honest. Nobody has time to manually sift through endless Google search results and social media feeds. That's a surefire way to burn out, and frankly, it’s a terrible use of your brain. This part of the playbook is all about smart ways to collect competitive data without losing your mind.

The old-school way? It involved a dangerous amount of caffeine and a spreadsheet with a million tabs, slowly chipping away at your will to live as you copied and pasted snippets from your competitors' websites. You’d burn hours, even days, just trying to piece it all together.

It’s painful, slow, and by the time you're done, the data is probably already old. This is the kind of mind-numbing work that makes people hate competitive research.

Think of it like building a spy kit. You wouldn't use a magnifying glass if you had a satellite, right? Modern intelligence gathering is all about working smarter, not harder.

The Better Way: Let the Robots Do the Dirty Work

Thankfully, we don’t have to do it the hard way anymore. The modern approach is to use tools built for this job. They automate the boring stuff, letting you skip straight to the fun part—analyzing the data and building a winning strategy.

You’ve probably heard of the heavy hitters like Ahrefs or Semrush. They're powerful, but let's be real: they can be ridiculously expensive, often costing hundreds of dollars every single month. For a startup or small business, that price is a deal-breaker.

This is where a tool like already.dev is a game-changer. It automates the whole process, delivering a comprehensive report in minutes. You just describe your idea, and its AI agents get to work, crawling hundreds of sources to find rivals you didn't even know you had.

> The goal isn’t to drown in data; it's to get actionable insights, fast. The right tool can turn a week-long research project into a ten-minute task.

Your Secret Weapon for Quick Analysis

Instead of you manually building out a competitive landscape, a tool like already.dev does all the heavy lifting. This isn't just faster; it's more thorough. You’ll uncover competitors you never would have found on your own.

The time savings are almost comical. A manual competitive research project can easily eat up 40 hours of pure manual work. An automated tool can shrink that down to under four minutes. That’s a time reduction of over 99%.

What to Look for in Your Intel-Gathering Toolkit

When you're picking tools for your spy kit, here are a few things to keep in mind:

- Speed: How quickly can you get from a question to an answer? The whole point is to save time.

- Actionable Output: Does it just dump a mountain of raw data on you, or does it present the findings in an easy-to-digest format?

- Affordability: Does the price make sense? For most startups, a tool that costs less than a fancy dinner but delivers thousands of dollars in strategic value is a no-brainer.

- Scope: Does it look beyond the obvious? A great tool will find competitors in app stores and niche communities—places you wouldn't think to look.

Keeping tabs on your rivals over time is also key. It’s worth exploring different strategies for monitoring competitor website changes so you get an alert whenever they shift their messaging.

Ultimately, modern, AI-driven tools have completely changed the game. What was once a massive, painful time-sink is now a quick, repeatable task.

Turning All That Messy Data Into a Winning Game Plan

You’ve done it. You’ve gathered a mountain of intel on your competitors—their keywords, their pricing, their weirdest social media posts. Your desktop is now a chaotic mess of screenshots and spreadsheets.

So... now what?

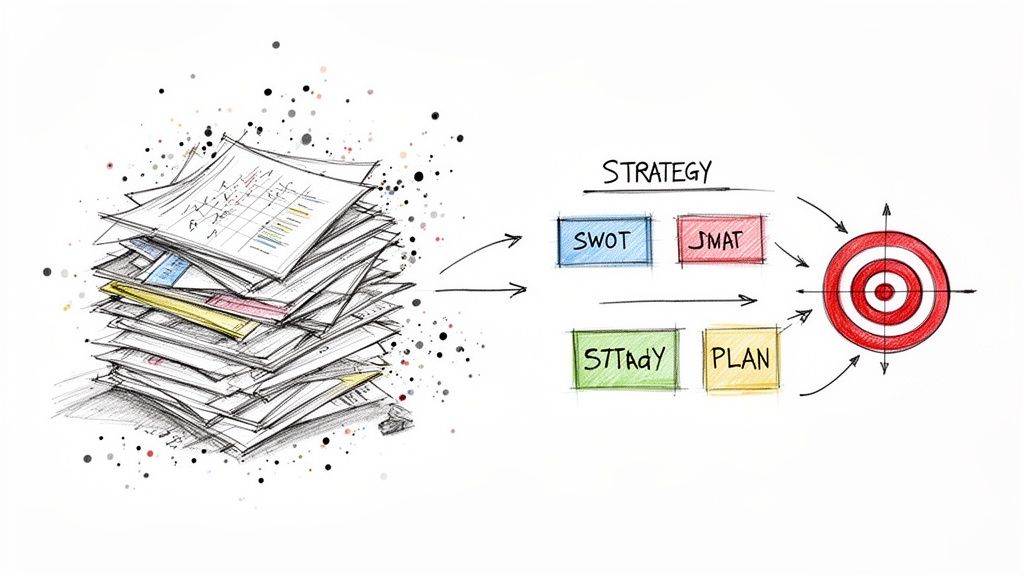

This is where most competitive analysis efforts die a quiet death. A pile of facts is useless until you turn it into a strategy. It’s like having all the ingredients for a five-star meal but no recipe.

Let’s turn that messy kitchen into a game plan. The goal isn't to create a 50-page report nobody will read. It's to find one or two critical insights that will actually change how you do business.

Stop Drowning in Data and Start Analyzing

First, don't just stare at the spreadsheets until your eyes glaze over. You need a simple framework. The most classic tool for this is the SWOT analysis—Strengths, Weaknesses, Opportunities, and Threats.

I know, the mere mention of "SWOT" probably makes you want to take a nap. But we’re going to do the non-corporate, actually-useful version. Forget the jargon and think of it like this:

- Strengths (Your Superpowers): What are you genuinely awesome at? Is your customer support legendary? Is your product ridiculously easy to use?

- Weaknesses (Your Kryptonite): Where do you suck? Be brutally honest. Is your pricing confusing? Is your website slower than a sloth on vacation?

- Opportunities (Hidden Treasure): Where are the gaps in the market? Did you notice none of your competitors offer a free trial? Is there a customer segment everyone is ignoring?

- Threats (The Incoming Asteroids): What could seriously mess you up? Is a giant competitor about to enter your space? Are your customers’ needs changing?

The magic happens when you connect the dots. Your strengths should be aimed directly at your competitors' weaknesses. That’s how you find your winning angle.

> The point of a SWOT analysis isn't to fill out a pretty chart. It's to find where your competitor's weakness meets your strength. That's your strategic sweet spot.

Mapping Out the Competitive Landscape

Once you have a handle on your SWOT, it's time to map out the competitive landscape. This is huge for visualizing where everyone stands and, more importantly, where you want to stand.

Are you the budget-friendly, no-frills option? The high-touch, premium service? Or the quirky upstart with one killer feature nobody else has?

To figure this out, pick two factors that really matter to your customers. It could be Price vs. Quality, Ease of Use vs. Number of Features, or Target Audience (SMB vs. Enterprise). Then, plot yourself and your competitors on a simple chart.

Let's Run Through a Scenario: Project Management Tools

Imagine you're building a new project management tool. You might map the landscape like this:

- X-Axis: Simplicity (Easy to Use vs. Complex)

- Y-Axis: Price (Affordable vs. Expensive)

You might see that most of your competitors are clustered in the "complex and expensive" corner, all fighting over the same big companies. But what if there’s a wide-open space in the "simple and affordable" quadrant for freelancers and small teams?

Bingo. That’s your territory. That's the uncontested ground where you can plant your flag.

Finding Your Unique Position

This mapping exercise leads you straight to your unique positioning. It’s the answer to the most important question in marketing: "Why should a customer choose you over everyone else?"

Your positioning statement can't be a generic slogan like "We're the best!" It needs to be specific. By comparing your strengths against their weaknesses, you can carve out a marketing position that makes you the obvious choice for a specific type of customer.

Here's a simple template:

For [Target Customer], who [has a specific problem], [Your Brand] is the only [Category] that provides [Your Unique Benefit] because [Your Secret Sauce].

Let's plug in our project management tool example:

"For freelancers and small agencies, who get overwhelmed by complicated software, ProjectSimple is the only project management tool that provides a stress-free, one-click setup because we stripped out every non-essential feature to focus on simplicity."

See how powerful that is? You've just used your competitive analysis to define exactly who you are, who you're for, and why you're different. This single sentence can now guide all your marketing.

You've officially turned that messy pile of data into a sharp, actionable game plan.

Putting Your Insights Into Action

Alright, let's get to the good part. Analysis is cool, but taking action is what gets you paid. You’ve done the heavy lifting and now you have a game plan. It’s time to actually do something with it.

A pile of competitive insights without a clear next step is like a gym membership you never use. It feels good to have, but it’s not doing a thing for you. The goal is simple: move from just knowing what your competitors are doing to actively beating them.

This is where the rubber meets the road. Let's translate all that research into real-world results.

Outsmart Their SEO and Content Game

One of the best opportunities you'll find is inside your competitor's SEO strategy. It’s a public blueprint of what they care about and, more importantly, what they've missed.

Did your analysis reveal a valuable keyword they're ignoring? Perfect. That’s your opening. Instead of fighting them for the big, hyper-competitive keywords, swoop in and own the long-tail variations they've overlooked.

- Here's how it works: Let's say your main competitor ranks #1 for "project management software," but completely ignores a long-tail keyword like "project management tool for freelance designers."

- Your action plan: You create content specifically for that niche. A blog post titled "Why Freelance Designers Need a Different Kind of Project Tool," a landing page comparing your features to generic ones, and a short video tutorial. Just like that, you’ve created a magnet for a highly specific, underserved audience.

This isn't about outspending them; it’s about out-thinking them. Powerful tools like Ahrefs or Semrush can help you find these keyword gaps, but they come with a hefty monthly bill. A more direct and affordable path like already.dev can pinpoint these market positioning gaps without the enterprise-level price tag.

> Every keyword your competitor ignores is a market you can own. Your competitive analysis is a treasure map pointing you to these underserved niches.

Turn Their Weaknesses Into Your Strengths

Your competitors aren't perfect. Your deep dive probably found a few chinks in their armor. Maybe their pricing page is a mess, their customer support has terrible reviews, or their product is notoriously hard to set up.

These aren't just weaknesses—they're marketing opportunities, gift-wrapped and handed to you.

Let's take a common one: pricing confusion.

- The scenario: Your top competitor has five different pricing tiers and a pricing page that looks like a tax form. Customers complain about surprise fees in their reviews.

- Your action plan: You go all-in on simplicity. Your new headline becomes: "Simple, Transparent Pricing. No Surprises, Ever." You create a clean comparison chart showing your one or two plans next to their confusing mess. Then, you feature testimonials that specifically praise how easy your pricing is.

You've just reframed the entire conversation. You’re no longer just another option; you are the clear, simple, and trustworthy alternative.

Choose Underdog Marketing Channels

Did you notice that every single one of your competitors is pouring their budget into Google Ads and LinkedIn? This is common. It also means those channels are crowded and expensive. Your analysis can help you find the "underdog" channels where you can actually make a splash.

- Consider this: Everyone in your space is fighting over the same keywords on Google, driving the cost-per-click through the roof. But your research shows that your target audience—say, early-stage startup founders—are active in niche Slack communities and on platforms like Indie Hackers.

- Your action plan: Forget the bidding war. You pivot to community marketing. You start actively participating in those Slack groups, offering genuine advice without being spammy. You share your journey on Indie Hackers.

While your competitors are burning cash on ads, you're building real relationships and brand loyalty in places they've overlooked. This is the essence of smart competitive marketing—finding the path of least resistance.

Common Questions About Competitor Analysis

Jumping into a competitive analysis for marketing can feel overwhelming. It sounds like a massive, complicated project, but it really doesn't have to be. Let's tackle some of the most common questions.

No fluff, just straight answers.

How Often Should I Do a Competitive Analysis?

This isn't a one-and-done deal. Think of it like checking your car’s oil. You don't do it every day, but you'd be asking for trouble if you never did it. The market is always moving, and your competitors are always making plays.

For most businesses, a full, deep-dive analysis once a quarter is a great rhythm. That’s frequent enough to catch major strategic shifts without getting lost in the noise. I also recommend a quick-and-dirty version anytime you're about to launch something big, like a new feature or ad campaign.

How Many Competitors Should I Actually Analyze?

It's easy to get carried away here and end up with a spreadsheet with 50 names and a bad case of analysis paralysis. You want quality insights, not just a huge amount of data.

Keep it manageable. Start with three to five key competitors. This gives you a solid picture of the landscape without creating a mountain of work. A good mix usually looks like this:

- 2-3 Direct Competitors: The obvious ones selling a similar product to your exact audience. Think Coke vs. Pepsi.

- 1-2 Indirect Competitors: They solve the same problem but with a different solution. Think a local pizza place vs. a meal kit service like HelloFresh.

This blend gives you a much more realistic view of who you're really up against.

What's the Difference Between Competitor Analysis and Market Research?

This one trips people up, but it's pretty simple. I like to explain it this way:

> Market research is like looking at a map of the entire country. You're studying the overall terrain, climate, and highways. Competitor analysis is zooming in on three specific cities to study their traffic patterns, local events, and best restaurants.

Market research is the big picture—the entire industry, broad customer trends, and market-wide shifts. Competitive analysis for marketing is a specialized piece where you zero in on what your rivals are actually doing. You need both, but they serve different purposes. One gives you context, the other gives you a battle plan.

Plenty of tools can help with both. Big players like Ahrefs or Semrush are powerful but can be crazy expensive. For a more direct and affordable approach that focuses purely on competitor intel, a tool like already.dev gives you exactly what you need without the bloat.

Ready to stop guessing and start winning? Already.dev uses AI to run a comprehensive competitive analysis for you in minutes, not weeks. Uncover your competitors' strategies, find gaps in the market, and get the data-driven confidence you need to build something people will love. Start your free trial today.