Your Competitive Analysis Template Made Simple

Stop guessing and start winning. Our competitive analysis template helps you legally spy on rivals and uncover market gaps. Get actionable insights today.

Think of a competitive analysis template as your cheat sheet for spying on the competition. It’s usually a spreadsheet that gives you a structured way to track what they're up to—from their products and pricing to their marketing tricks and where they're totally fumbling the ball. This way, you can spot your chance to swoop in and win.

Why You Actually Need a Competitive Analysis

Okay, let's be real. "Competitive analysis" sounds like a term straight out of a stuffy business school textbook. It can feel like a huge, boring chore. But what if you thought of it as your secret weapon for making smarter, faster decisions?

A solid competitive analysis isn't about filling out a spreadsheet just to say you did it. It’s about taking all that messy, confusing market data and turning it into a clear roadmap. It helps you stop guessing and start answering the big questions:

- "Are we priced right?" A quick peek at what everyone else is charging can help you find that "just right" price.

- "What marketing actually works?" See which channels your rivals are crushing it on and which ones they’re hilariously ignoring.

- "Where are the gaps in the market?" Pinpoint customer needs that your competitors are completely sleeping on.

From Messy Notes to a Clear Game Plan

Without a template, you’re probably just clicking around competitor websites, maybe scribbling notes on a sticky pad that will inevitably get lost behind your desk. A structured approach organizes all that intel, making it way easier to spot patterns and pounce on opportunities. It’s not just a hunch, either. Industry surveys show that 85% of firms using a dedicated competitive analysis template report having much clearer strategies and faster product launches. You can dig into those findings to see just how much it can shape your game plan.

> The real goal here isn't just to know what your competitors are doing. It's to figure out what they're doing badly and use that knowledge to win. This is all about finding their blind spots and turning them into your biggest strengths.

Instead of feeling like you're drowning in data, a simple template helps you zero in on what truly matters. You can quickly compare marketing strategies, product features, and customer reviews side-by-side, transforming a chaotic jumble of information into an actual, actionable plan.

Building Your Competitor Tracking Dashboard

Alright, time to roll up your sleeves and actually build this thing. Don't worry, you won't need a Ph.D. in data science. The best way to think about your competitive analysis template is like a fantasy football draft board. But instead of quarterbacks and running backs, you're tracking your rivals' every move.

The goal here isn't to create a spreadsheet so complicated it looks like a mission control panel at NASA. It’s about focusing on the handful of metrics that actually lead to smarter business decisions. The point is to turn data into action, and that means following some core principles for building an effective business dashboard that prioritizes strategy over useless stats.

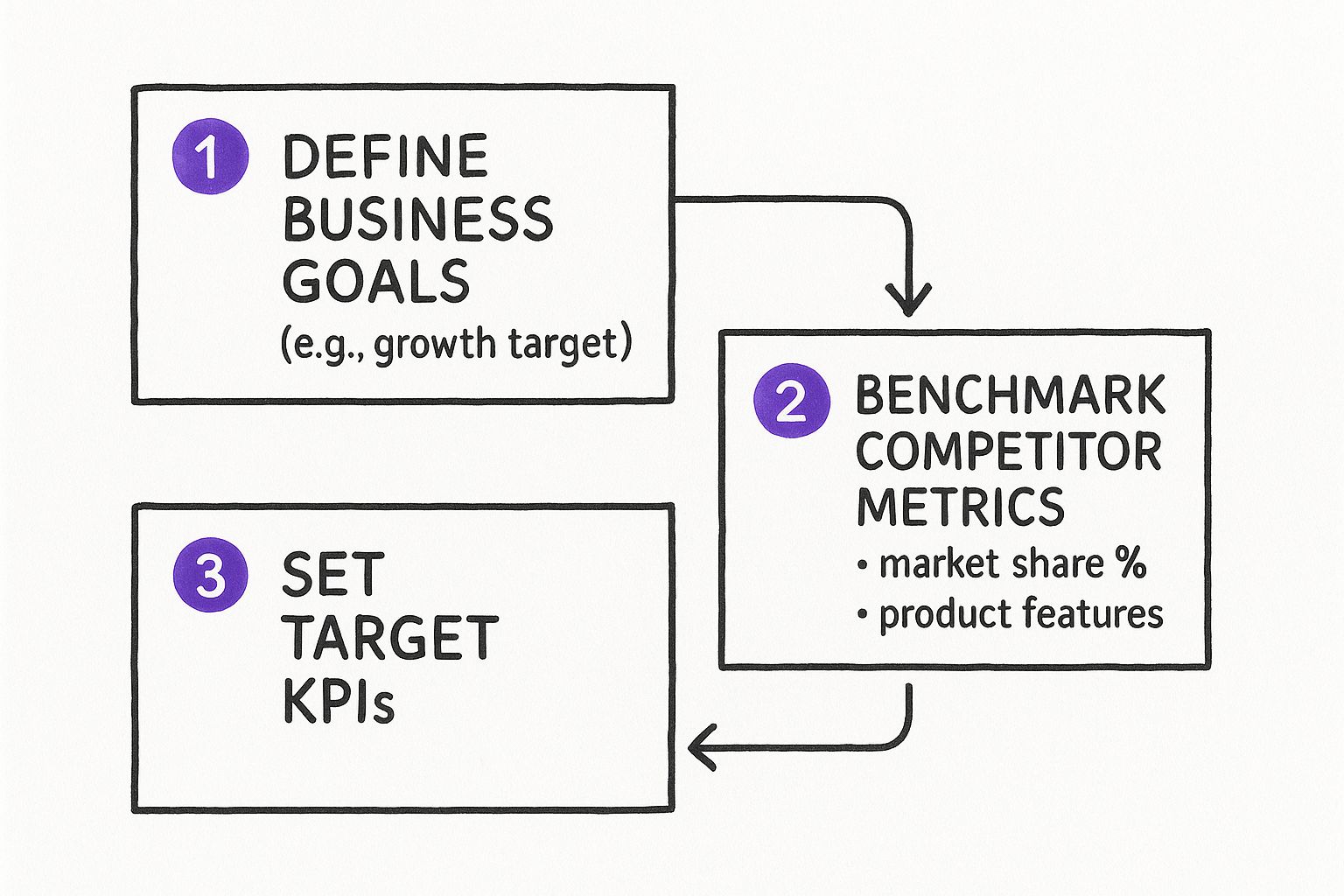

This simple flow shows you how to connect your big-picture goals to the specific things you track.

As you can see, everything flows from your business goals. Those goals tell you which competitor benchmarks and KPIs are worth your time.

What to Actually Put in Your Template

So, what data points really make the cut? My advice is to start with the basics before you go full-on private investigator. A simple spreadsheet is your best friend here.

Let's break down the essential components you'll want to include in your dashboard. These are the core pieces of information that give you a solid foundation for understanding who you're up against.

Core Components for Your Competitor Dashboard

| Data Point | What You're Looking For | Why This Actually Matters | | :--- | :--- | :--- | | Company Overview | Website, founding year, funding, employee count. | Gives you a quick read on their scale, resources, and if they're a dinosaur or a newbie. | | Product/Service Breakdown | Core offerings and, crucially, their pricing tiers. | Tells you if they're the budget option or the premium choice, defining their market position. | | Target Audience | The language and imagery on their site, their blog topics. | Reveals if they're targeting scrappy startups or enterprise giants. | | Marketing & Social | Main social channels, follower counts, general engagement. | Shows you where their marketing muscle is strongest and where their audience hangs out online. |

Getting these basics down for each competitor will immediately start to paint a clear picture of the competitive landscape.

> The real magic happens when you see this data side-by-side. The point isn't just to collect stats—it's to make them comparable. Putting your top three rivals next to each other will instantly highlight gaps you can exploit and threats you need to watch.

While you can definitely gather a lot of this information with some manual digging, a few good tools can save you a ton of time. Some teams splurge on expensive platforms like Ahrefs or Semrush, but you can get what you need without breaking the bank. A tool like already.dev can automate a surprising amount of this research.

For a deeper dive into your options, check out our guide on the https://blog.already.dev/posts/best-competitor-analysis-tools.

Gathering Intel Without Breaking the Bank

Alright, time for the fun part—the actual spying. You might think you need to drop a small fortune on fancy tools to get the good stuff. While platforms like Ahrefs or Semrush are incredibly powerful, they can be expensive. Let's be honest, they’re often overkill and come with a soul-crushing price tag.

You don't need a bazooka to hunt a rabbit. This is all about being resourceful and getting 80% of the value with just 20% of the budget.

Become a Digital Detective

Your first stop is your competitor's own turf: their website. This is the story they want to tell the world, and it’s absolutely packed with clues. Don’t just skim the homepage; you need to dig into every nook and cranny.

Here’s your mission, should you choose to accept it:

- Dissect Their Messaging: What words do they use over and over? Are they pitching themselves as the "affordable" option or the "premium, life-changing" one? This reveals their entire market position.

- Stalk Their Blog and Case Studies: This tells you exactly who their ideal customer is. If all their success stories feature massive enterprise clients, you know they aren’t chasing small businesses.

- Sign Up for Everything: Get on their email list. Request a demo. Download their free PDF. This lets you see their sales process from the inside and learn how they turn curious prospects into paying customers.

This initial sweep gives you a solid foundation for understanding their strategy. It’s a crucial part of the process, and you can learn more about how to conduct market research without spending a dime.

> The most honest intel you'll ever get comes from unhappy customers. Your competitors' one-star reviews are a goldmine of opportunities, spelling out exactly where they're failing to deliver.

This is where you can find major gaps to exploit. If everyone complains about their terrible customer support or a confusing interface, you’ve just found your secret weapon.

Peeking Behind the Curtain with Smart Tools

Okay, manual digging is great, but a few clever tools can save you hours of work. Instead of shelling out for expensive tools like Ahrefs or Semrush, there are smarter, more focused alternatives.

An affordable tool like already.dev can give you crucial insights into your market without the enterprise-level price tag. It's built to give you the data that actually matters, helping you find direct and indirect competitors you didn't even know you had.

Regularly updating your competitive analysis template with this kind of intel is what separates the winners from the ones that get left behind. In fact, companies that routinely update their market intelligence see about a 25% increase in successful product launches compared to firms that don't. It’s solid proof that staying aware is the key to staying ahead.

From Messy Data to a Clear Game Plan

Alright, you've done the hard work. Your competitive analysis template is probably looking like a beautiful, terrifying spreadsheet overflowing with notes, numbers, and links. So... now what?

Let's be real: raw data on its own is pretty useless. It's time to connect the dots and turn all that information into a killer strategy.

Find Your Superpower with SWOT

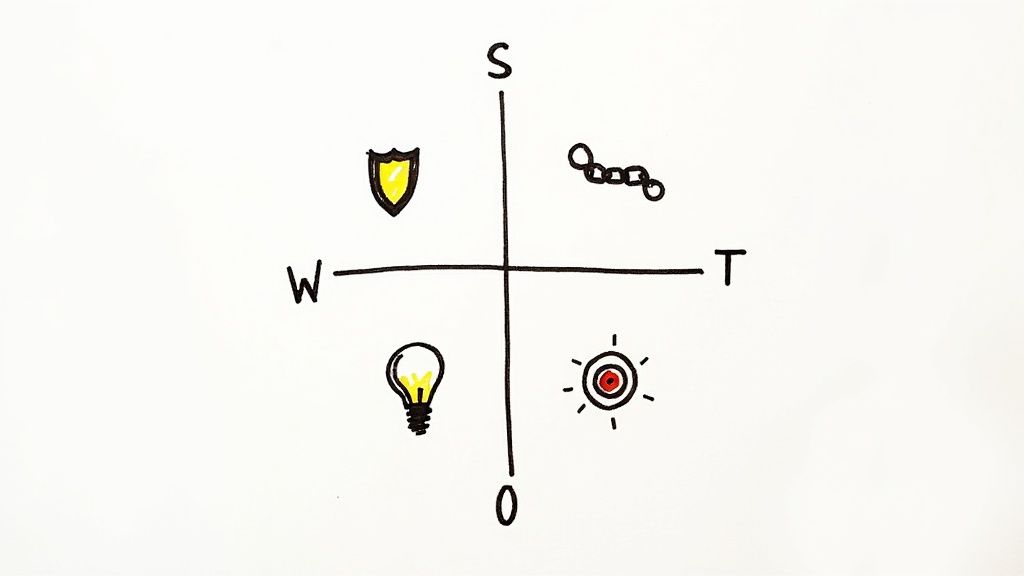

This is where a classic SWOT analysis comes in handy. I know, it might sound like a stuffy business school exercise, but think of it as finding your unique advantage—your superpower in the market.

Your goal is to sift through all that intel and answer four simple questions. This isn't just about theory; it’s about finding real, practical leverage you can use right now.

- Strengths: What are you genuinely better at? Maybe your customer service is legendary while your competitor's is a total dumpster fire. That's a huge strength.

- Weaknesses: Be honest—where are you falling short? If a rival is outspending you 10-to-1 on ads, you can't ignore that. Acknowledge it.

- Opportunities: What gaps have you spotted? If you noticed their checkout process is a clunky nightmare, that’s your golden ticket to offer a seamless, one-click experience.

- Threats: What’s lurking around the corner? Is a new, deep-pocketed competitor about to crash the party? You need to know.

These insights are gold. For instance, digging into a competitor's pricing model is essential when you need to develop a robust pricing strategy that makes your offer a no-brainer.

> Your template isn't just a place to dump facts; it's a tool for finding your narrative. That story might be, "We're the simple, easy-to-use alternative," or "We offer premium, expert support." Find your story, and you've found your strategy.

This whole process is what turns your research from a pile of random facts into an actual roadmap. If you want to go even deeper, our guide on market research can help you really dig into the findings: https://blog.already.dev/posts/market-research-data-analysis. It's all about making that data work for you.

Keeping Your Competitive Insights Fresh

Here’s the thing about competitive analysis: it’s not a "set it and forget it" task. You can't just build a beautiful template, fill it out once, and call it a day. The market moves way too fast for that.

New players emerge, your rivals launch new campaigns, and what worked last quarter might be totally irrelevant now. A template that's six months old isn't a strategy document; it's a history lesson. The real trick is keeping your insights current without it turning into a second job.

Making It a Habit

The best way to stay on top of things is to build a simple, repeatable habit. Think of it like watering a plant—a little bit of attention on a regular basis prevents a total disaster later.

Here’s a practical schedule I recommend starting with:

- Monthly Quick Scan: Just set aside 30 minutes once a month. Pull up the websites, blogs, and social feeds of your top three competitors. You're just looking for the big stuff—new product launches, major marketing campaigns, or a sudden change in messaging.

- Quarterly Deep Dive: This is where you block out a couple of hours every three months to really update the core data in your template. This is your chance to connect the dots and spot the bigger, more meaningful trends.

This whole idea of continuous monitoring is quickly becoming the norm. In fact, recent studies show that over 70% of large companies are using live tools to track market shifts constantly, not just once a quarter. You can read more on this trend to get a sense of where things are heading.

> Your template should be a living document, not a museum piece. A quick, scheduled check-in is far more valuable than a massive, once-a-year audit that’s outdated the moment you finish it.

Your Competitive Analysis Questions Answered

Alright, let's tackle some of the common questions that pop up when you're about to dive into a competitive analysis. Think of this as a quick FAQ to get you started on the right foot.

How Many Competitors Should I Actually Track?

This is a big one. It's tempting to want to analyze every single company in your space, but trust me, that's a recipe for disaster. You'll get completely bogged down in data and end up with nothing useful.

The magic number is usually 3-5 direct competitors.

Who are they? These are the companies your ideal customer is actively weighing against you moments before they decide to buy. Keeping your focus tight on this core group ensures the insights you gather are sharp, relevant, and something you can actually act on. You can always add more later on, but start here.

What's the Biggest Mistake People Make?

Easy. Treating competitive analysis like a one-and-done project. I've seen it a hundred times: a team spends weeks building a gorgeous, detailed template, fills it all out, and then archives it in a folder, never to be seen again.

Six months down the line, that document is basically a history lesson. It's useless.

> Your competitive landscape is constantly shifting. The whole point is to create a living document, not a museum piece. Make a plan to come back and update your analysis at least once a quarter. That's how it stays valuable.

Is a Simple Spreadsheet Good Enough for This?

One hundred percent, yes. In fact, I often recommend it. For most businesses, a well-structured spreadsheet in Google Sheets or Excel is the perfect tool for the job.

It’s free, everyone knows how to use it, and you can customize it to track exactly what matters to you. You don't need to drop a ton of cash on some fancy platform to find game-changing insights. Start simple—you can always upgrade if you need to.

Stop guessing who your competitors are. already.dev uses AI to find every direct, indirect, and hidden competitor in your market, delivering a comprehensive report in minutes, not weeks. Get your free analysis at https://already.dev