Your Competitive Landscape Analysis Template

Grab our competitive landscape analysis template to find market gaps and outsmart competitors. Perfect for building a real-world business strategy.

Think of a competitive landscape analysis template as your business's personal battle map. It’s not some stuffy report destined to collect dust; it's your cheat sheet for outsmarting everyone else in your space. This map shows you who your rivals are, what they’re good at, and—most importantly—where their Achilles' heel is.

So, Why Even Bother With a Competitive Analysis?

Let's be real. You probably have a gut feeling about who your main competitors are. But gut feelings don't impress investors, and they sure as heck don't win market share. A proper competitive landscape analysis is what turns those hunches into cold, hard, actionable data.

It's like playing poker. Would you rather go all-in based on a hunch, or would you prefer to have a good idea of the cards everyone else is holding? This analysis is your way of legally peeking at their hand.

You're not just staring at the two or three companies you lose deals to. You're getting a feel for the entire battlefield. Is your biggest rival a slow-moving, heavily armored tank, or are they a nimble, sneaky ninja? Your strategy needs to change depending on the answer.

Spotting Opportunities Everyone Else Missed

A solid analysis goes way beyond just listing competitor logos on a slide. It's about uncovering the golden opportunities hiding in plain sight.

- Find Unserved Customers: You might realize that all your competitors are laser-focused on enterprise clients, leaving a massive, underserved market of small businesses wide open for you. Cha-ching.

- Identify Content Gaps: By seeing what your rivals are—and aren't—talking about, you can pinpoint topics where you can easily become the go-to authority.

- Discover Pricing Weaknesses: Maybe everyone in your industry uses a confusing, multi-tiered pricing model. Coming in with a simple, transparent price could be your killer advantage.

Going through this process saves you from pouring money into marketing campaigns that are dead on arrival or building features that sound cool but that nobody actually wants. You can also dive deeper into structuring your findings by checking out this guide on creating a better competitive analysis report template.

> The whole point isn’t just to make a list of strengths and weaknesses. It's about using that intel to chart your own course, carve out a defensible niche, and make sure you never get blindsided by a threat you should have seen coming.

Navigating the Information Overload

A few years ago, a simple spreadsheet might have done the trick. Not anymore. The game has changed.

We're now swimming in a sea of unstructured data—from thousands of customer reviews and social media chatter to real-time market trends. Old-school tools just can't keep up.

To really win today, you need a much broader view that looks beyond your direct rivals and keeps an eye on emerging industry trends and sneaky new entrants who could disrupt everything.

A good competitive analysis should cover several key areas to give you a complete picture. Here’s a quick breakdown of what you should be looking at.

Key Focus Areas of a Solid Analysis

| Focus Area | What It Tells You | Why It Matters | | :--- | :--- | :--- | | Product & Services | Core features, quality, and unique selling propositions (USPs). | Helps you find gaps in their offerings and highlight your own strengths. | | Pricing & Business Model | How they charge customers (subscription, one-time, freemium). | Uncovers opportunities for you to offer better value or a simpler model. | | Marketing & Sales | Channels they use (SEO, social, ads) and their key messaging. | Shows you where they are winning customers and how you can compete for attention. | | Customer Experience | Reviews, support quality, and overall brand reputation. | A competitor's weakness here can become your biggest strength. | | Strengths & Weaknesses | What they do exceptionally well and where they are vulnerable. | Gives you a clear roadmap for where to attack and where to defend. |

Ultimately, a well-structured analysis helps you move from just guessing to truly knowing. It transforms all that raw, messy data into a clear path forward for your business.

Building Your Competitor Analysis Template

Alright, let's get our hands dirty and build this thing. I'm a firm believer in building your own tools, so forget downloading some generic file that doesn't quite fit your world. We’re going to construct your competitive landscape analysis template from scratch, piece by piece.

The whole point is to create a living document you'll actually use, not some fancy report that gets read once and then buried in a shared drive. A simple spreadsheet is all you need—Google Sheets or Excel works perfectly. No need to overcomplicate it.

The Foundational Blocks

First, we need the basics. These are the non-negotiable sections that give you a high-level snapshot of who you're up against. Think of this as the foundation of your entire analysis.

- Company Overview: This is way more than just their name. Jot down their founding year, company size (employee count), and any recent funding announcements. Little details like that tell you if you're fighting a scrappy startup or a well-funded behemoth.

- Products & Services: What are their main offerings? Are they a one-trick pony, or do they have a whole suite of products? I like to make notes here on the quality and breadth of their features.

- Target Audience: Who are they really selling to? Don't just guess. Look at their website copy, read their case studies. Are they targeting small businesses, enterprise giants, or a super-specific niche like dentists who love skydiving?

Getting this initial stuff down gives you a clear "who's who" in the market zoo. It lets you quickly compare the major players at a glance before you dive into the really deep stuff.

> A great template isn't about collecting every possible data point. It's about collecting the right data points that lead to smarter decisions, helping you avoid analysis paralysis.

Adding the Functional Parts

Now we get to the fun part. We'll add the components that show you how these competitors actually operate in the wild. This is where you start seeing their strategy take shape and can begin to poke holes in it.

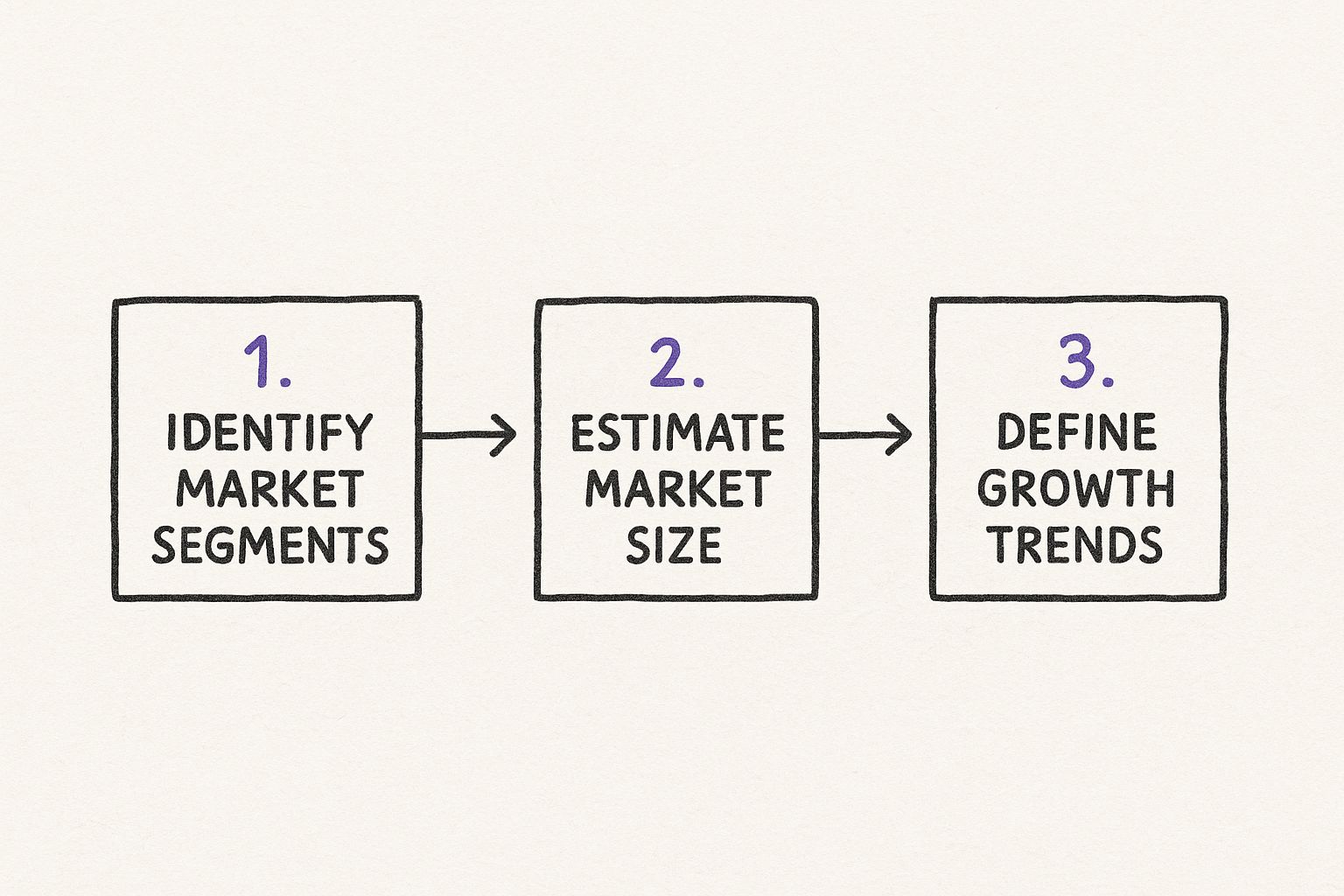

The first step is always to understand the market's structure—where your competitors play and, more importantly, where you can win.

With that in mind, you'll want to add columns in your template for these critical areas:

- Pricing & Business Model: How do they make money? Is it a subscription, a one-time fee, or some kind of freemium model? Make sure to document their actual price points. This is often where you'll find the most obvious opportunities to slip in.

- Marketing Channels: Where do they hang out online? Dig into their SEO, social media presence, and any paid ads you can find. Big-name tools like Semrush or Ahrefs can give you a firehose of data, but they can be seriously expensive. For a more affordable approach, already.dev can help uncover competitor SEO strategies without that hefty price tag.

- Unique Selling Proposition (USP): What’s their main sales pitch? In one sentence, what do they claim makes them so special? Is it speed, price, amazing customer service, or one killer feature?

By filling this section out, you're not just listing facts—you're basically reverse-engineering their entire go-to-market strategy. And that’s where the real insights come from.

How to Gather Intelligence Without Breaking the Bank

Alright, now for the fun part—a little corporate espionage. Kidding... mostly. This is where you roll up your sleeves and find the actual data to fill out your shiny new competitive landscape analysis template.

Let's be real for a second. The big-name tools like Ahrefs and Semrush are fantastic, but they can also cost a small fortune. Not every team has that kind of budget lying around.

The screenshot above shows how a tool like already.dev can give you a quick visual map of the competitive landscape for a new idea, saving you hours of painful manual digging. You get a clean, organized view of who you're up against without the massive price tag.

We're going to focus on being scrappy here. The goal is to get 80% of the insights for 20% of the cost. It’s all about knowing where to look.

Start With the Free Stuff

Before you even think about pulling out a credit card, start with some good old-fashioned digital snooping. You’d be amazed at how much intel you can uncover just by paying attention.

Your first stop should always be your competitors' websites. And I don't mean just a quick glance at the homepage.

- Read their blog posts. What topics are they hitting?

- Dissect their pricing page. How do they structure their tiers?

- Scour their customer case studies. This is where they flat-out tell you who they serve and what problems they solve.

Next, jump over to their social media feeds. What are they posting about? Even better, what are their followers saying in the comments? That’s raw, unfiltered customer sentiment right there for the taking.

Finally, dive into review sites. Places like G2, Capterra, or even random Reddit threads are goldmines. This is where you find the unvarnished truth about their strengths and, more deliciously, their weaknesses.

Smart Tools That Won't Empty Your Pockets

Once you've squeezed every last drop out of the free methods, it's time to level up with some affordable tools. This is how you can gain a real edge without that enterprise-level price tag.

While the big platforms are powerful, they often drown you in so much data that you end up with analysis paralysis. Smart, focused tools are the way to go.

> The secret to effective competitive analysis isn't having the most data; it's having the right data. Affordable tools give you exactly what you need to make smart decisions, minus all the noise.

Tools like already.dev are perfect for this exact scenario. They’re designed to give you deep insights into a competitor's SEO, content strategy, and traffic sources—all without requiring you to take out a second mortgage.

The demand for these data-driven insights is absolutely exploding. The product analytics market, which powers a lot of this intelligence, is projected to hit USD 11.39 billion by 2025 and just keeps growing.

Cloud-based tools are leading the charge, making up a whopping 87% of the market because they offer powerful analytics without the massive upfront investment.

By combining some manual digging with a few smart, affordable tools, you'll have everything you need to fill out that template with high-quality data that leads to real, actionable insights.

From Raw Data to Real-World Strategy

Okay, so you've done the legwork and now you're staring at a spreadsheet filled to the brim with competitor data. That’s a solid start, but let's be honest—right now, it's just a pile of facts and figures. Raw data on its own won't move the needle.

The real value comes from connecting the dots. This is where you put on your detective hat and start looking for the patterns, gaps, and golden opportunities that are hiding in plain sight. Your mission isn't just to make a pretty chart; it's to uncover insights that will actually shape your next move.

Spotting the "Aha!" Moments

Let's walk through a practical example. Imagine you run a small, independent coffee shop in a bustling part of town. You've just filled out your competitive landscape analysis template on your three main rivals: the big coffee chain, another local indie spot, and that little cafe tucked inside the bookstore.

As you scan through your notes, a few things jump out:

- All three of them shut their doors by 6 PM.

- None offer a simple way to order online for pickup.

- Their social media is a predictable stream of latte art on Instagram; no one is even touching TikTok.

At the same time, you know your neighborhood is swarming with young professionals and college students who are always working late and glued to their phones.

> See what just happened? That's not just data anymore; it’s a massive opportunity. You’ve pinpointed a huge, underserved need. Staying open later and rolling out an easy online ordering system could instantly make you the go-to spot.

Using SWOT Without the MBA Jargon

A great way to organize these "aha!" moments is with a SWOT analysis. It sounds a bit corporate, I know, but it’s really just a simple framework for sorting your thoughts. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Let's plug our coffee shop findings into this framework:

| SWOT Category | Coffee Shop Example | | :--- | :--- | | Strengths | Your unique, locally roasted coffee blend is a huge plus. | | Weaknesses | Let's face it, your brand recognition isn't as strong as the big chain's. | | Opportunities | All your rivals close early and don't have online ordering. Plus, TikTok is an untapped channel. | | Threats | That big chain has a marketing budget you can only dream of. |

Boom. Suddenly, a clear path forward starts to emerge. You can tackle your weakness (low brand recognition) by pouncing on your opportunity (TikTok). Imagine creating fun, snappy videos that target the late-night study crowd, showing off your new extended hours and super-convenient pickup option.

This simple exercise transforms a spreadsheet from a data dump into a strategic roadmap. For a deeper dive into this, you can learn more about how to analyze competitors and structure your findings.

Ultimately, it’s all about getting from "what" to "so what?" Sure, Competitor X has 100,000 Instagram followers, but so what? The real insight is that their engagement is abysmal and their comments are filled with complaints about slow service. Now that is an opportunity you can run with.

Putting Your Competitive Analysis Into Action

An analysis that just sits in a folder is a complete waste of time. Let’s be real, you didn’t do all that snooping just to create a pretty document. This is where your hard work pays off—turning the insights from your competitive landscape analysis template into actual business moves.

Think of it like getting fresh battlefield intel. You wouldn't just file it away; you'd use it to plan your next attack. The same goes for business. Every weakness you find in a competitor is a green light for you to charge ahead.

From Findings to a Game Plan

So, what does this actually look like day-to-day? It’s all about turning your observations into concrete actions.

-

You found: A major competitor has a sea of 1-star reviews all complaining about their terrible customer service.

-

Your action: Time to double down on your own support. Make it ridiculously good, then shout about it from the rooftops in your marketing. You’ve just turned their biggest weakness into your new superpower.

-

You found: There’s a pricing gap in the market. Everyone is either super cheap and basic or wildly expensive and complicated.

-

Your action: Get your team together and start brainstorming a new product tier that hits that sweet spot right in the middle.

> The goal is to move from "huh, that's interesting" to "okay, here's what we're doing next Tuesday." Don't let your insights go stale. You have to act on them while they're still fresh and relevant.

This process is becoming even more critical with new tech. By 2025, the global AI market is expected to grow at an annual rate of about 38%, which is fueling a new wave of analysis tools. These platforms can help you make sense of everything from a competitor’s social media chatter to their press releases. You've got powerful tools like Semrush (which can be pricey) or more focused options like already.dev. To get a better sense of what's coming, you can dive into the future of AI in competitor analysis to learn more.

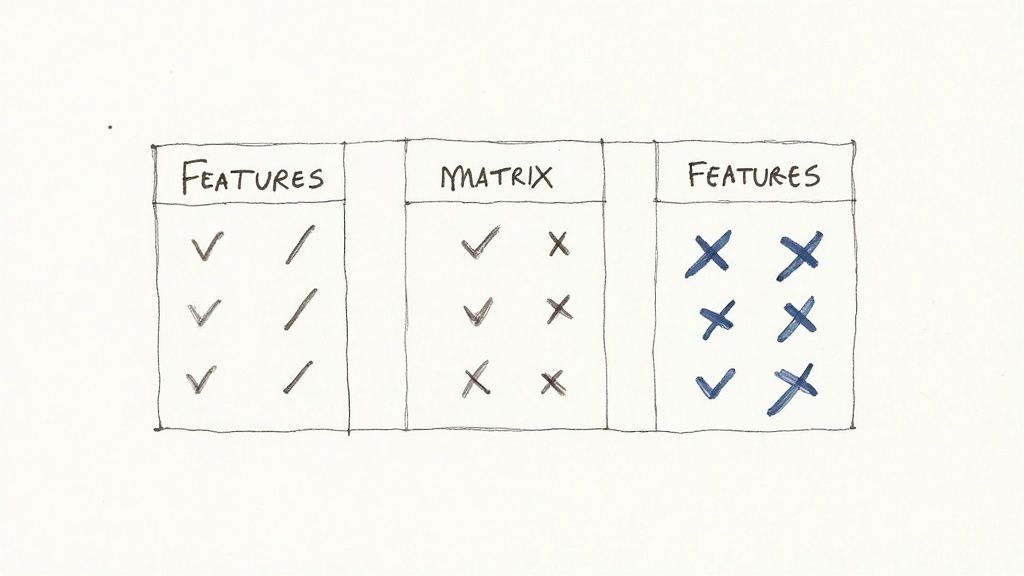

Prioritizing Your Moves

You're probably going to come out of this with a dozen great ideas, but you can't do everything at once. You need a simple way to prioritize what matters most.

I’m a big fan of a basic Impact/Effort matrix. Just plot your ideas on a four-quadrant grid:

- High Impact, Low Effort (Quick Wins): Do these immediately. This is your low-hanging fruit.

- High Impact, High Effort (Major Projects): These are your big strategic bets. Plan for them carefully.

- Low Impact, Low Effort (Fill-ins): Tackle these when you have spare capacity, but don’t stress over them.

- Low Impact, High Effort (Time Sinks): Avoid these like the plague. Seriously.

This simple framework transforms your long list of ideas into a real, actionable roadmap. It tells you what to do now, what to plan for next quarter, and what to forget about entirely.

Your final step? Share these insights with your team in a way that gets them fired up and ready to go. Remember, your analysis isn't the finish line—it's the starting gun.

Got Questions? We've Got Answers.

Alright, you've stuck with me this far. That tells me you're serious about getting this right. As you dive in, a few questions always seem to pop up. Let's get ahead of them.

So, How Often Do I Need to Update This Thing?

Look, I get it. You build this beautiful analysis, and you want to high-five yourself and move on. But please, don't let your competitive landscape analysis template gather digital dust. It's a living document, not a museum piece.

Markets change on a dime. For most businesses, giving it a solid quarterly refresh is the sweet spot. This keeps your insights relevant without making competitive analysis your entire job.

Now, if you're in a particularly chaotic industry—think a fast-moving SaaS niche or a trendy e-commerce space—you might want to do a quick monthly gut check on your main rivals. You don't want to get caught flat-footed.

Direct vs. Indirect Competitors—What's the Real Difference?

This one trips up even seasoned pros, so let's clear it up.

-

Direct Competitors: These are the companies you immediately think of. They're selling a very similar thing to the very same people you are. It’s Coke vs. Pepsi. You're fighting for the same dollar, head-to-head.

-

Indirect Competitors: These are the ones that can sneak up on you. They solve the same fundamental problem your customer has, but in a completely different way. Think of a movie theater (direct competitor: another movie theater) versus Netflix (indirect competitor). Both are vying for your "Friday night entertainment" budget.

> You have to keep an eye on both. Honestly, sometimes those indirect competitors are the ones that completely upend an industry because they attack the problem from a blind spot you never saw coming.

How Many Competitors Should I Actually Track?

It’s easy to fall into the trap of wanting to analyze everyone. Resist that urge. You’ll just end up with a mountain of data and zero actionable takeaways. This is all about quality over quantity.

I always tell people to start with their top 3-5 direct competitors. You know who they are—the ones whose names come up on sales calls, the ones you secretly check out on social media. Get a deep understanding of them first.

Once you’ve got that down, you can start layering in maybe one or two key indirect competitors and an "up-and-comer" who seems to be making moves. Trying to tackle 20 companies from the jump is just a straight path to burnout.

Ready to stop guessing and start knowing? The already.dev platform uses AI to map your entire competitive landscape in minutes, not weeks. Ditch the manual spreadsheets and get the data-driven confidence you need to build a winning strategy. Discover your true competitors by visiting https://already.dev.