Build a Killer Competitor Analysis Matrix

Learn to build a competitor analysis matrix that uncovers rival weaknesses and sharpens your product strategy. Get actionable steps and real-world examples.

Let's be real, a competitor analysis matrix is your secret playbook for world domination. Or, you know, just for not getting steamrolled by the other guys. It’s a simple grid where you stack your company up against your rivals, comparing everyone on the stuff that actually matters—like features, pricing, and who you're all trying to sell to.

Think of it as fantasy football, but for your startup. And you actually make money.

Your Secret Weapon for Market Domination

So, why bother with yet another spreadsheet? Because this isn't just busywork. A solid competitor analysis matrix takes a messy pile of market info and turns it into a crystal-clear picture you can actually use. It’s how you spot those golden opportunities your rivals are sleeping on and sidestep potential disasters before they even happen.

Ultimately, it’s about making smarter decisions. Instead of guessing your next move, you’ll have a map showing you exactly where the treasure is buried. To really get why this is so powerful, it helps to understand what competitive intelligence is and how it fuels these kinds of strategic plays.

More Than Just a Fancy Chart

This whole idea isn't new. It’s built on classic business strategy, with roots in frameworks like SWOT and Porter’s Five Forces. In fact, over 70% of companies still use SWOT analysis to map out competitor strengths and weaknesses. The wide use of these kinds of structured comparisons just proves how essential they are, no matter what market you're in.

And this isn't just a game for massive corporations with huge analyst teams. For startups and scrappy product teams, a competitor matrix delivers three massive wins:

- Spotting Market Gaps: You can immediately see which customer needs are being totally ignored. That's your chance to swoop in.

- Sharpening Your Message: Seeing how everyone else talks about themselves helps you find a unique voice that actually gets heard.

- Informing Your Roadmap: It guides you on what to build next, based on what the market is missing or where your competitors are dropping the ball.

> Key Takeaway: A competitor analysis matrix isn't about copying what others are doing. It's about understanding the entire playing field so you can carve out a unique, winning path for your own business.

Pulling all this info together can feel like a mountain of work. Tools like Ahrefs or Semrush can help, but they can be expensive. For a more focused option, platforms like already.dev can automate the data gathering, saving you a ton of time and cash. If you want to get into the nitty-gritty, check out our guide on the complete framework of competitive analysis.

How to Build Your Matrix Without Losing Your Mind

Alright, let's get our hands dirty. Building a competitor analysis matrix sounds way more intimidating than it actually is. Forget the PhD and lab coat—think of it more like putting together IKEA furniture, but with a clearer instruction manual and a much lower chance of a meltdown.

The whole point here is to drive action, not get bogged down in "analysis paralysis." We're going to pinpoint who you're really up against, figure out what's worth tracking, and then put it all together in a way that makes sense.

First Things First: Who Are You Fighting?

Before you even think about opening a spreadsheet, you need to know who to put on it. Your competitors aren't just the big, obvious names. They usually fall into a few different buckets, and understanding the difference is key.

- Direct Competitors: These are the companies offering a nearly identical product to the same audience. Think Coke vs. Pepsi. When a customer is choosing, it's often a coin toss between you and them.

- Indirect Competitors: These folks solve the same core problem, just with a totally different solution. For a project management tool like Trello, an indirect competitor could be a simple to-do list app or even just a shared Google Sheet. They're still grabbing your potential customers.

- Emerging Competitors: These are the new kids on the block, often with a fresh angle or a disruptive business model. They might seem small now, but they can grow fast and eat your lunch if you're not paying attention.

Don't just jot down the first three companies that pop into your head. A quick Google search for your main keywords will show you who's consistently showing up. That’s a fantastic starting point for identifying who your customers are actually seeing.

> Pro Tip: Go talk to your sales and customer service teams. They’re on the front lines and hear every single day which other companies prospects are considering. Their intel is pure gold.

Choosing Your Weapons: The Right Metrics to Track

Now for the fun part: deciding what you’re actually going to compare. The biggest mistake I see teams make is trying to track a hundred different data points that don't really matter. You'll just drown in useless information.

The trick is to focus on the things your customers actually care about when they're making a buying decision.

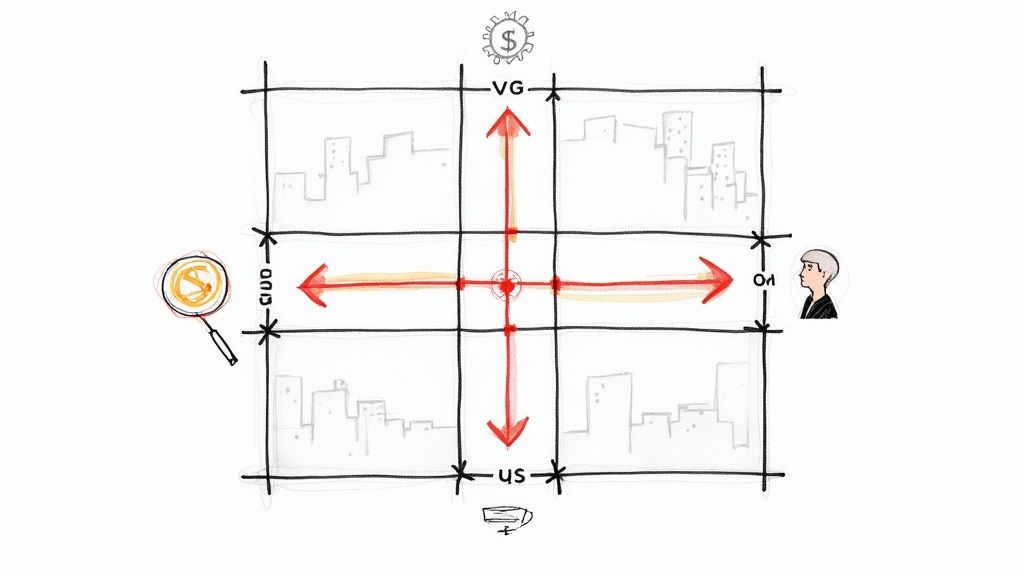

The process is pretty straightforward: compare your offerings, find where the market has gaps, and then decide on your next move.

To get you started, I've put together a starter template showing the key categories and specific data points to track for a software or SaaS product. This will help you focus on what truly matters.

Essential Metrics for Your First Competitor Matrix

| Category | Metric/Feature | Why It Matters | Example Data Point | | :--- | :--- | :--- | :--- | | Product | Core Features | This is the bread and butter. What can the product do? | "Offers AI-powered scheduling" | | | Unique Selling Prop (USP) | What's their one big claim to fame? What do they hang their hat on? | "The only tool with real-time collaboration" | | Pricing | Pricing Tiers | How is their pricing structured? Free plan? Enterprise option? | "Free, Pro ($15/mo), Business ($49/mo)" | | | Perceived Value | Do customers feel they're getting a bargain or being ripped off? Check reviews! | "Users complain the Pro plan is overpriced" | | Marketing | Target Audience | Who are they trying to sell to? Be specific. | "Freelancers and small agencies" | | | Key Marketing Channels | Where do they find their customers? SEO, social media, ads? | "Heavy focus on Instagram ads and SEO content" | | Customer Base | Customer Reviews & Sentiment | What are real users saying? Are they happy, angry, or just confused? | "G2 rating of 4.2 stars; common praise for UI" | | | Market Share | How big of a player are they in the market? | "Leader with an estimated 30% market share" |

Remember, this is just a launchpad. If you’re an e-commerce brand, you’d absolutely want to add things like "Shipping Costs" and "Return Policy." The key is to customize it to what drives decisions in your market.

Assembling the Matrix: A Practical Guide

Okay, you’ve got your list of competitors and your metrics. Time to actually build this thing.

Forget about fancy, expensive software for now. A simple spreadsheet is your best friend here. Seriously.

List your company and your competitors across the top row (the columns). Then, list all the features and metrics you chose down the first column (the rows). Now, the real work begins: start filling in the boxes. It's that simple to get started.

To make this even easier, you can grab a pre-built worksheet. We put together a free competitor analysis template to give you a massive head start. It has all the right categories laid out and ready to go.

Now, gathering all this data can be a grind. You'll be digging through websites, reading reviews, and probably signing up for a few free trials (hot tip: use a burner email address for this). This manual approach works, but it can easily eat up dozens of hours.

If you want to speed things up, there are tools for that. Big players like Ahrefs and Semrush are incredibly powerful for digging into SEO and marketing data, but let's be real—they can be wildly expensive, especially for a startup. For a more direct and automated approach to finding and analyzing competitors without breaking the bank, a platform like already.dev can deliver a comprehensive report in minutes, not days. It does the grunt work so you can focus on strategy.

Once your grid is full, take a step back and look at what you’ve built. You've just created a powerful strategic tool that turns a chaotic market into an organized map. At a glance, you can now see exactly where you stand.

Finding the Data You Actually Need

So, you’ve got a beautiful, empty spreadsheet just begging to become a competitor analysis matrix. It’s a work of art. But a matrix without data is like a car without gas—it looks nice but isn't going anywhere. Now for the fun part: becoming a data detective on a startup budget.

A great matrix is fueled by good intel, but you don't need a secret agent budget to find it. The best place to start is by doing the things that don't scale. Think like a customer and put on your Sherlock Holmes hat.

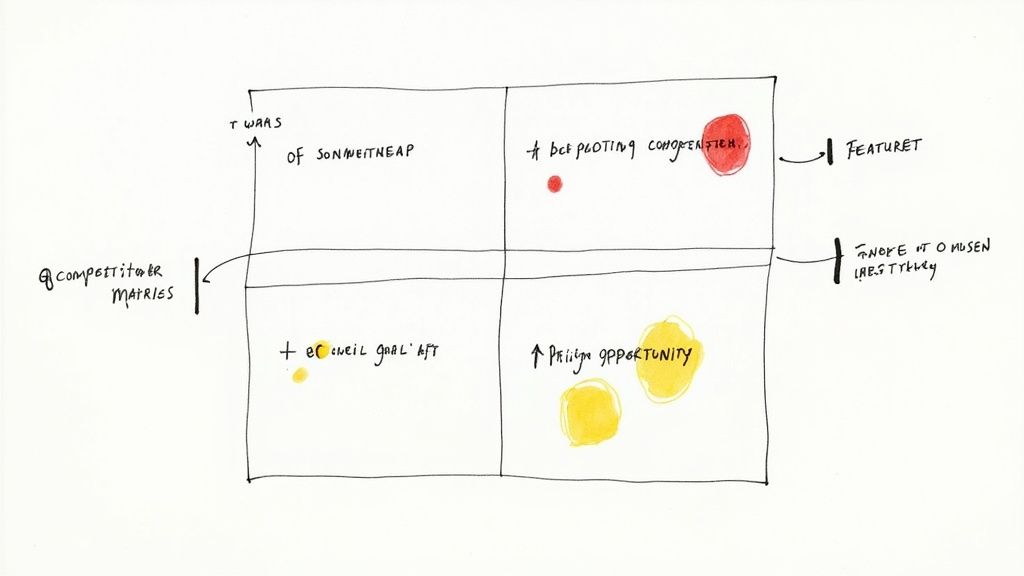

This image perfectly captures the spirit of the mission: digging into reviews and documents to uncover what people really think. Your first job is to hunt down the public-facing clues your competitors leave all over the internet.

The Scrappy Detective Toolkit

Before you even think about pulling out a credit card, you can uncover a shocking amount of information for free. Seriously, most of what you need for a solid first draft of your competitor matrix is just hiding in plain sight.

You just need to know where to look.

- Their Website is a Goldmine: Comb through their entire site. Read their "About Us" page to understand their story, check their pricing page for structure and value props, and read their blog to see what they talk about. Their language tells you everything about who they think their customer is.

- Become a (Fake) Customer: Sign up for their free trial. Use a burner email address if you have to. Click every button, test every feature, and experience their onboarding flow. This is the single best way to understand their product's strengths and weaknesses firsthand.

- Read the Reviews (All of Them): Go to sites like G2, Capterra, and Trustpilot. Don't just look at the star rating; read the actual comments. What features do people rave about? More importantly, what do they complain about? These complaints are your opportunities.

> Key Takeaway: The goal of this initial "scrappy" phase is to get a feel for the customer experience. You're looking for patterns in what people love, what drives them crazy, and how your competitors position themselves in their own words.

This manual approach gives you an incredible qualitative feel for the market. You'll gather quotes and frustrations that data alone can't provide. But let's be honest, it's also a massive time sink.

Leveling Up with the Right Tools

Once you’ve done your on-the-ground recon, it's time to bring in some technology to speed things up and get deeper insights. This is where you can start pulling in quantitative data to back up your initial findings.

You've probably heard of the big dogs like Ahrefs and Semrush. They are incredibly powerful for digging into a competitor's SEO strategy, backlink profile, and online ad spend. The downside? They can be ridiculously expensive, with plans often running hundreds of dollars a month—a tough ask for any startup.

This is where more focused, accessible alternatives come into play. A tool like already.dev is built specifically for this kind of deep competitive research without the enterprise price tag. Instead of spending 40 hours manually digging, you can describe your product idea and get a comprehensive report on direct, indirect, and even failed competitors in minutes. It automates the painful parts of data collection, like feature comparisons and pricing analysis, so you can focus on strategy. You can find more options in our deep dive into the best competitor analysis tools.

What to Look For with Paid Tools

When you do invest in a tool, you're looking for data that's hard or impossible to find manually. You want to move beyond surface-level observations and into strategic intelligence.

Here’s what to focus on:

- Keyword Gaps: What keywords are your competitors ranking for that you aren’t? This shows you where their organic traffic is coming from and highlights content opportunities for your own blog.

- Marketing Channel Mix: Where are they spending their ad money? Tools can often give you an estimate of their traffic from paid search, social media, and display ads. If a competitor is pouring money into LinkedIn ads, that's a strong signal their target audience hangs out there.

- Feature and Pricing Trends: Automated tools can quickly scrape and organize feature lists and pricing tiers from dozens of competitors. This allows you to spot industry-standard features versus unique differentiators at a glance, saving you hours of tedious spreadsheet work.

Ultimately, finding the right data is a mix of scrappy detective work and smart tool usage. Start with the free methods to build your foundation, then layer in insights from an affordable tool like already.dev to fill in the gaps and validate your assumptions. This two-pronged approach gives you the most complete picture for your competitor analysis matrix without forcing you to eat ramen for a month.

How to Read What Your Matrix Is Telling You

So, you did it. You wrestled with spreadsheets, channeled your inner data detective, and now you have a fully populated competitor analysis matrix. It’s a thing of beauty, all organized and packed with data.

But now what?

A matrix full of data is a lot like a fridge full of ingredients—it's pretty useless until you actually cook something. This is where the real magic happens. It's time to turn all those cells and data points into a strategic roadmap that tells you what to do next.

Don't just stare at the grid. Let's break down how to read the tea leaves and turn your hard work into action.

Hunting for Patterns and Gaps

Your first pass shouldn't be some deep, soul-searching analysis. Just scan the grid. Get a feel for the landscape. You're looking for the obvious stuff, the things that jump right out at you.

Think of it like one of those "Magic Eye" pictures from the 90s, but instead of a hidden sailboat, you're looking for market opportunities.

- Look for the empty columns: Is there a feature or benefit that nobody is offering? If you see a row where every single competitor has a "No" or a low score, that’s not just a gap. That’s a gaping hole in the market you could drive a truck through.

- Spot the sea of sameness: On the flip side, do you see a feature that everyone has? That's a table-stakes feature. It's the cost of entry. If you don't have it, you're already behind. If you do, great—but don't waste your marketing budget bragging about it.

- Find the pricing outliers: Is one competitor bizarrely cheap or absurdly expensive? This tells you a ton about their strategy. The cheap one is gunning for volume, while the expensive one is betting on premium quality or a very specific niche. Where do you want to fit in?

> Your matrix isn’t just a static document; it's a living map of your market. The patterns you see today will guide the decisions you make tomorrow, from your product roadmap to your next marketing campaign.

These initial observations are your breadcrumbs. They're what lead you from simple data points to powerful strategic insights.

Translating Data Into Actionable Insights

Okay, you've spotted some patterns. Now it's time to ask the single most important question: "So what?"

Every single finding needs to be translated into a potential action. If you don't, you just made a pretty spreadsheet for no reason.

This process is absolutely essential in high-stakes situations. For example, a deep understanding of your competitive landscape is a cornerstone of venture capital due diligence, where investors need to know exactly where a company stands before cutting a check.

Let's walk through a real-world example. Imagine you're building a new project management tool.

You find this in your matrix: "Competitor A has no mobile app, and their customer reviews are full of complaints about it."

- What It Could Mean: There's a huge, unmet demand from users who need to manage projects on the go, and a major player is completely fumbling the ball.

- Potential Action: You immediately prioritize building a killer mobile app. You make "Manage Your Projects from Anywhere" a central pillar of your marketing. You've just found their weakness and can turn it into your core strength.

Here's a quick look at how you can translate your findings from the matrix into clear, strategic moves for your product, marketing, and sales teams.

Interpreting Your Matrix Findings

| Finding in Matrix | What It Could Mean | Potential Action | | :--- | :--- | :--- | | Everyone has nearly identical pricing plans. | The market is commoditized. Customers are likely choosing based on minor features or brand loyalty. | Differentiate with a unique pricing model (like usage-based) or by bundling a killer feature into your mid-tier plan. | | Competitor B gets constant praise for their amazing customer support. | Customers in this space really value human interaction and fast help. They're willing to pay for it. | Invest heavily in your own support team. Make "24/7 Human Support" a key selling point on your homepage. | | No one is targeting freelancers; everyone is focused on big teams. | A massive, underserved market segment is being completely ignored by the major players. | Create a dedicated landing page and pricing plan just for freelancers. Run targeted ad campaigns in freelance communities. |

This simple exercise is what transforms your matrix from a research document into a strategic playbook for your entire company.

Uncovering Your Win Rate and Real Threats

Your matrix can also shine a bright light on your sales performance. By cross-referencing this data with your CRM, you can do some powerful win/loss analysis.

For instance, you might discover that you lose 100% of deals against a competitor you only face once a quarter. That's interesting, but not a crisis.

But what if you're losing just 15% of deals to a rival you go up against every single day? That's a five-alarm fire. That signals a massive problem with your product or your positioning that needs to be fixed yesterday.

By grouping your competitors—think 'legacy giants' vs. 'scrappy upstarts'—you can see where your true vulnerabilities lie. Are you losing to the old guard because of their reputation, or are the new kids out-innovating you on features?

Ultimately, reading your matrix is an act of translation. You're taking raw data and turning it into a story—a story about where the market is, where it’s going, and exactly how you can win. Don't let this document gather digital dust. Revisit it quarterly, update it with new players and features, and keep listening to what it’s telling you.

The market never stops talking. Your matrix is how you listen.

Common Mistakes That Make Your Matrix Useless

Let's be real for a second. You can spend a week building the most beautiful, color-coded competitor analysis matrix the world has ever seen, and it can still be completely and utterly useless. It happens more often than you’d think.

A matrix is just a tool. And like any tool, if you use it wrong, you’re more likely to hit your thumb with the hammer than build a sturdy house. Here are the common traps people fall into that turn their strategic masterpiece into a digital paperweight.

Falling into Analysis Paralysis

This is the big one. It's so easy to get obsessed with gathering every single data point that you never actually do anything with the information. You spend weeks digging into every competitor's social media follower count from 2018, their CEO's favorite brand of coffee, and their website's font choice.

Suddenly, a month has passed, and your matrix is a sprawling monster of trivia. You're paralyzed by the sheer volume of data and have no idea where to even start.

> The Hard Truth: A good-enough matrix that you act on today is infinitely better than a "perfect" one that you finish next quarter. Your goal isn't to write a doctoral thesis on your competitors; it's to find a few key insights that help you make your next move.

Don't let the pursuit of perfection become the enemy of progress. Set a firm deadline, grab the essentials, and then force yourself to move on to figuring out what it all means.

Tracking Pointless Vanity Metrics

Another classic mistake is filling your matrix with numbers that look impressive but tell you absolutely nothing about your competitor's actual strength or your own opportunities. A competitor's Twitter follower count is the perfect example. Sure, it's a big number, but what does it really mean?

Does it tell you if their customers are happy? Does it tell you if their product is solving the right problems? Nope. It’s just noise.

Instead of tracking fluff, focus on metrics that are tied directly to customer decisions and business health. Think about it this way:

- Customer Sentiment: Don't just count their G2 reviews; read them. What specific features do customers consistently complain about? That’s your opportunity, right there in plain text.

- Pricing Value: Instead of just listing their price, dig into the perceived value. Are customers saying the pro plan is a total rip-off? That's a pricing weakness you can exploit.

- Marketing Focus: Forget their follower count. Use a tool to see what keywords they're actually ranking for or spending ad money on. This shows you exactly where they are placing their bets to find new customers.

Treating It Like a One-and-Done Project

The market doesn't stand still, and your matrix can't either. The biggest mistake you can make is to spend 40 hours building it, presenting it once, and then letting it rot in a forgotten Google Drive folder.

A new competitor can pop up overnight. An old one could release a game-changing feature. If your matrix is six months old, you might as well be navigating with a map from the 1800s. It’s a snapshot of a world that no longer exists.

Set a calendar reminder to revisit and update your matrix at least once a quarter. This doesn't mean you have to start from scratch every time. It’s just a quick check-in to see:

- Who are the new players?

- Have pricing models changed?

- What major new features have launched?

This simple habit turns your matrix from a static document into a living, breathing strategic tool that keeps your team sharp and ready to adapt.

Got Questions About Your Competitor Matrix? Let's Get Them Answered.

Okay, so the theory is solid, but you're probably hitting some real-world snags now that you're in the thick of it. Let's tackle the common questions that always come up when you're staring at a half-finished spreadsheet. Think of this as your personal FAQ session.

How Often Should I Update This Thing?

First off, don't let this matrix become a digital fossil. The market just moves too damn fast. A good rhythm is to do a full, deep-dive refresh every quarter. This keeps you from operating on outdated assumptions.

But that's just the baseline. You also need to be ready to jump back in when something big happens. Did a competitor just announce a monster funding round? Did a buzzy new startup just pop up on your radar? These are your cues to open the file and see how the landscape has shifted. The quarterly review keeps your strategy sound; these quick-hit updates keep you from getting caught flat-footed.

What If I Can’t Find Data on a Competitor?

This happens. All. The. Time. Especially with private companies or startups playing their cards close to the vest. The key is not to get discouraged. You have to accept that you'll never find perfect data for every competitor, especially things like exact revenue or active user counts.

So, you become a detective. Instead of a blank cell, you look for proxies—clues that point to the answer.

- Can't find revenue figures? Check their employee count on LinkedIn. A sudden hiring spree or steady growth is a pretty strong signal that business is good.

- No details on a new feature? Go read the one-star reviews on sites like G2 or Capterra. Frustrated users are incredibly detailed about what a product doesn't do.

> The Big Idea: When the front door is locked, look for the open windows. Things like job postings, customer complaints, and employee growth often paint a surprisingly clear picture of what's really going on.

How Do I Share This Without Boring My Team to Death?

Seriously, whatever you do, don't just email a link to the spreadsheet with the subject "FYI." You'll be met with a wall of silence. Your analysis is only as good as the action it inspires, so you need to sell the story.

The trick is to distill your findings into a narrative. Forget walking them through the entire grid. Instead, pull out the top 3 most surprising insights and the top 3 biggest opportunities you uncovered.

Try framing your presentation this way:

- Start with the "Uh Oh" Insight: "So, I was digging into Competitor X, and it turns out their customers are absolutely torching them in reviews over their clunky mobile app."

- Frame the Opportunity: "This is a massive gap in the market. While they're dropping the ball, we have a chance to become the go-to solution for mobile users."

- Propose a Concrete Action: "Based on this, I think we need to push the 'Mobile UI Redesign' project to the top of our Q3 roadmap. Right now."

Nobody gets excited about a spreadsheet. But a clear plan to outsmart the competition? That gets people moving.

A solid competitor matrix is your map, but you still need to do the exploring. Instead of burning 40+ hours digging through websites and reviews, let already.dev handle the grunt work. Our platform delivers an AI-powered competitive report in minutes, giving you back weeks of your life. Get the clarity you need to make smarter product and positioning decisions at https://already.dev.