A Practical Guide to Competitor Price Data

Stop guessing your pricing. Learn how to find and use competitor price data to make smarter decisions, find market gaps, and price your products to win.

So, what's competitor price data? It's just a fancy term for knowing what your rivals charge. Think of it as peeking at your neighbor's homework, but for business—it gives you the context you need to see if your own pricing makes any sense.

Why Competitor Price Data Is Your Secret Weapon

Let's be honest, setting a price can feel like you're just throwing darts in the dark. You could pick a number out of thin air and hope for the best, but that's a fast track to either leaving money on the table or pricing yourself out of the market entirely. Smart companies don't guess; they use data.

This isn't about mindlessly copying what the other guy is doing. It's about understanding the battlefield. Knowing your competitors' pricing helps you find that sweet spot where customers see your value and are happy to pay for it.

More Than Just a Number

The pricing game is changing. Gut feelings are out; data is in. Price elasticity is climbing, which means businesses can't get away with lazy, one-size-fits-all price hikes anymore. You can dig into the top trends impacting consumer goods pricing to see just how much is shifting.

Think of it this way: a competitor's price is a signal. It tells you a story about:

- Their Target Customer: Are they chasing enterprise clients with deep pockets or scrappy startups on a budget?

- Their Value Proposition: Do they see themselves as the premium, feature-packed solution or the affordable, no-frills option?

- Market Health: Are prices trending up, suggesting high demand, or is everyone in a race to the bottom?

I once worked with a startup that was convinced they had to be the cheapest option to win. After looking at the data, they realized they were so cheap that customers assumed their product was junk. They doubled their price, and—get this—their sign-ups actually increased because they were suddenly perceived as a legitimate player.

> Key Takeaway: Competitor pricing isn’t a rulebook. It’s a set of clues that helps you understand your market’s expectations and what your product is actually worth to them.

Finding Your Place in the Market

Without this data, you're flying blind. You might build an amazing product but position it so poorly that it never finds its audience. Good analysis lets you confidently answer the questions that shape your entire business strategy.

Suddenly, you can ask the right questions:

- Where's a gap in the market we can fill?

- Are we charging enough to reflect the unique features we offer?

- Could we introduce a new, higher-priced tier for our power users?

And the great thing is, you can start seeing results almost immediately.

Quick Wins from Competitor Price Data

Here’s a quick look at the immediate benefits you can get from keeping an eye on your rivals' pricing strategies.

| Area of Impact | What You Learn | Potential Action | | :--- | :--- | :--- | | Product Positioning | How your features stack up at each price point. | Repackage features into new tiers or adjust your marketing copy. | | Sales Objections | Why prospects say you're "too expensive." | Arm your sales team with battle cards comparing your value. | | New Market Entry | The established price range for a new region or vertical. | Set an introductory price that is aggressive but sustainable. | | Promotional Strategy | The frequency and depth of competitor discounts. | Plan your own promo calendar to counter theirs or find an opening. |

This isn't just theory; these are the practical, money-making insights you can get by just paying attention.

Of course, you could try to piece this together with big, expensive tools like Ahrefs or Semrush, but they're often overkill and can cost a fortune. For focused, automated pricing intel without the enterprise price tag, a platform like Already.dev is a fantastic alternative. It does the heavy lifting so you can focus on what to do with the information.

Finding Where Competitors Hide Their Pricing

So, you're ready to play detective. But where do you even start looking? The good news is that most competitor pricing isn't locked away in a high-security vault. It's usually hiding in plain sight, scattered across the internet like breadcrumbs. Your real job is knowing where to look and how to piece it all together.

Don't just stop at the big, shiny /pricing page on their website. That's level-one stuff. We need to dig deeper to uncover the full story—not just what they charge, but how they charge it. Is it per user? Based on usage? Are there sneaky setup fees? These details often matter more than the sticker price.

The Obvious and Not-So-Obvious Spots

Let's start with the easy wins and work our way to the real goldmines. The best pricing intel comes from combining insights from a few different places. This isn't just about finding a number; it's about building a complete picture of their entire strategy.

Of course, their public website is the starting line. But don't just glance at the pricing page. Be sure to check out:

- Case Studies & Testimonials: These often hint at the ROI customers are getting, which is how they justify the price. A customer bragging about a "300% increase in efficiency" is a big clue that the service doesn't come cheap.

- Annual Reports & Investor Docs: For public companies, these are treasure troves. They won't list specific product prices, but they’ll talk about pricing strategy, average revenue per user (ARPU), and target customers.

- FAQs & Knowledge Bases: This is where you find the dirt. These sections can reveal details about overage fees, add-on costs, and what happens when a customer hits a usage limit—all crucial parts of the total cost.

This initial sweep gives you a solid baseline. If you're still building your list of who to even look at, our guide on how to find competitors can help you get organized.

> Pro Tip: Don't forget the Wayback Machine! Checking historical versions of a competitor's pricing page shows you their entire pricing journey. Did they just have a massive price hike? Did they kill a popular cheap plan? This tells a story about their confidence and market position.

Digging Deeper for Hidden Pricing Intel

Once you've squeezed everything you can from their main website, it's time to get creative. Pricing information pops up anywhere a company is actively trying to make a sale. You just have to think like a customer.

Some of the best secondary sources include:

- App Stores & Marketplaces: Platforms like the Apple App Store, Google Play, or the Salesforce AppExchange often force vendors to list their pricing tiers and in-app purchase costs right there in public.

- Email Newsletters & Promo Offers: Get on their mailing list. Seriously. You'll get a firsthand look at their discount strategies, limited-time offers, and the exact language they use to justify their value.

- Sales Demos & Quotes: If you see a "Contact Sales" button, don't be shy. Going through the process can reveal a ton about their enterprise-level pricing, volume discounts, and which features they hold back for the big spenders.

Uncovering these details effectively takes a sharp eye. If you want to get better at spotting these clues and connecting the dots, it's always a good idea to improve your research skills. That's how you go from just collecting numbers to generating real strategic insights.

How to Gather Data Without Going Insane

Let’s be real: manually checking dozens of competitor websites every week sounds like a nightmare. Spoiler alert: it is. This is where we stop working harder and start working smarter. Trying to keep a spreadsheet updated with every pricing change is a recipe for burnout and, even worse, bad data.

You have better things to do than copy-pasting numbers all day. The goal is to get the competitor price data you need without sacrificing your sanity. That means moving away from those painful manual checks to a more automated approach.

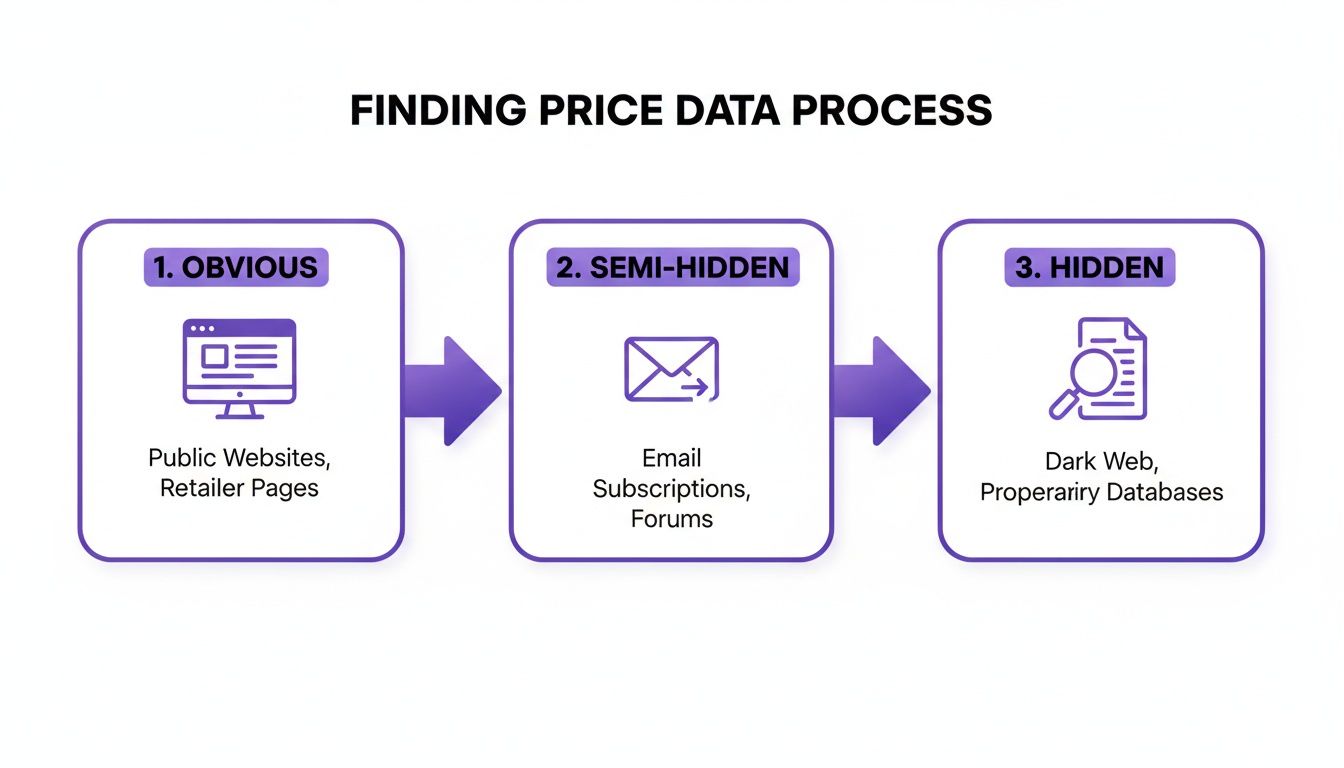

This infographic breaks down the hunt for pricing data, from the most obvious public sources to the slightly more hidden ones you need to look for.

As you can see, the process evolves from a simple glance at a website to digging into semi-hidden sources like newsletters, and eventually analyzing more obscure clues to understand the complete picture.

The Manual Grind vs. Automated Genius

Doing things by hand is fine for a little while. If you only have two or three direct competitors, a quick monthly check might be all you need. It’s simple, it's free, and it keeps you connected to what’s happening in your little corner of the market.

But the second your competitive landscape gets even slightly more complex, the manual method completely falls apart. It's painfully slow, ridiculously prone to human error (did you forget to check their UK site this month?), and it completely misses sudden price drops or flash sales. You'll always be reacting to old news.

This is where automation comes in. Think of it as hiring a robot intern who never sleeps, never complains, and never gets tired of refreshing pricing pages. The whole idea is to set up a system that watches your competitors for you and only pings you when something important actually changes.

A Quick Word on Web Scraping

One popular way to automate this is through web scraping. It’s just a fancy term for using a script to automatically pull specific information (like prices) from a website. When done ethically, it’s a perfectly legitimate way to gather public data.

However, "done ethically" is the key phrase. It’s not the wild west. This means:

- Respect

robots.txt: This is a file on every website telling bots what they are and aren't allowed to look at. Always, always follow its rules. - Don't be a nuisance: Never send so many requests that you slow down or crash their website. That's just rude, and it will get your IP address blocked fast.

- Public data only: Never try to scrape information that’s behind a login wall or isn't meant for the public. That crosses a serious line.

For the big e-commerce players, this kind of automation isn't just a neat trick; it's the core of their business. Major retailers use massive, automated systems to monitor millions of products and adjust prices constantly. You can learn more about how large-scale price scraping works and see why it’s so critical for them. For most of us, though, building a custom scraper from scratch is total overkill.

Finding the Right Tool for the Job

Luckily, you don't need to be a coding wizard to automate this stuff. There are plenty of tools out there designed to handle competitor analysis and data collection for you.

You'll run into the big all-in-one marketing platforms like Ahrefs or Semrush, which can provide broad market intelligence, but they often come with a painfully high price tag. They're built for massive agencies, not for a startup that just wants clear, focused pricing intel. It’s like using a sledgehammer to hang a picture frame—powerful, but way more than you need and seriously expensive.

> The Smart Alternative: Instead of a generic tool, look for something built specifically for competitive intelligence. You need a platform that automates the grunt work of both finding competitors and tracking their every move, especially when it comes to pricing.

This is where a dedicated tool like Already.dev becomes a lifesaver. It’s designed to be that robot intern for you. It automatically discovers your real competitors (not just the ones you already know about) and then tracks their websites, features, and pricing over time. You get all the crucial data delivered to you without ever having to open another spreadsheet.

By using a focused tool, you shift your time from mind-numbing data entry to high-value strategic thinking. You can explore even more options in our roundup of the best competitor analysis tools. Ultimately, the right platform lets you focus on what to do with the data, which is where the real magic happens.

Turning Messy Data Into Smart Decisions

So, you did it. You’ve wrangled a mountain of competitor price data. The bad news? It’s probably a chaotic mess of different currencies, confusing billing cycles, and feature names that don't line up. Honestly, this is the part where most people throw their hands up and quit.

But this is also where the real magic happens. Raw data is just noise; organized data is intelligence. Turning that jumble of numbers into something you can actually use is the most critical step. It’s how you go from "I think they charge less" to "I know exactly where the gap in the market is."

First things first, you have to clean up the mess. This process is called normalization, which is just a fancy way of saying "make it all apples-to-apples." Without it, you’re just comparing noise.

Making Sense of the Chaos

Your first job is to get everything into a common format. Think of it like prepping ingredients before you cook—you can't just toss everything in a pot and hope for the best.

Here’s your non-negotiable cleanup list:

- Single Currency: Convert everything to your primary currency. A competitor charging €99 isn't the same as one charging $99, and those little differences add up fast.

- Standard Billing Cycle: Some competitors push annual plans hard, while others focus on monthly. You need to calculate the effective monthly cost for everything to get a true baseline. An annual plan of $1,200 is $100/month, not just "a cheaper option."

- Translate Features: Your "Pro Plan" might be their "Growth Tier." Create a master list of common features (like "Number of Users," "API Access," or "Priority Support") and map each competitor's plan to it.

A simple spreadsheet can be your best friend here. But if the thought of wrestling with VLOOKUPs makes you want to cry, a platform like Already.dev can automate this whole normalization process and save you from spreadsheet hell. For a deeper dive, our guide on how to perform a competitor price comparison walks through this in more detail.

> The Goal: Get a clean, standardized dataset where you can look across a single row and see exactly how Competitor A, Competitor B, and your own product stack up on price and features, without doing any mental gymnastics.

Simple Tricks for Powerful Insights

Once your data is clean, you can finally start asking the right questions. And you don't need a Ph.D. in data science to find gold here. A few simple analysis techniques will reveal 90% of what you need to know.

This is why the market for pricing tools has exploded. Companies are realizing how vital this intelligence is. Solutions can range from a few hundred to over €1,500 per month, offering everything from basic tracking to deep market insights. They’re a testament to how valuable clean, analyzed pricing data really is.

Let's look at a few practical ways to slice up your newly organized data.

Map Out the Market Landscape

This is where you visualize where everyone fits in the bigger picture. One of the most effective ways to do this is by creating a Positioning Map. It's just a simple chart with two axes—usually Price (low to high) on one and a key value metric (like "Number of Features" or "Target Audience," from startup to enterprise) on the other.

Plot yourself and your competitors on this map. Suddenly, the market structure becomes crystal clear.

- Are you all clustered in one corner, fighting over the same customers?

- Is there an empty quadrant, like a "high-feature, low-price" spot just waiting for a disruptor? (Just be careful that isn't the "unprofitable" quadrant.)

- Who is the clear "budget" leader? Who is the "premium" player?

This simple visual immediately tells you where you are and where you could go. To take this a step further, you can start benchmarking with competitors to turn that map into an actual action plan. This isn't just an academic exercise; it's about spotting real opportunities before anyone else does.

Common Pricing Traps and How to Dodge Them

Having a pile of competitor price data feels like a superpower. But like any good superpower, if you use it wrong, you can cause a lot of damage. It’s shockingly easy to fall into a few classic traps that can turn your valuable intel into a strategic disaster.

The most common and most dangerous trap? Blindly copying a competitor’s price. You see their number, you match it. Simple, right? Dead wrong.

You have absolutely no idea what their costs are, who their ideal customer is, or how much brand equity they've built up. Their price is part of their story, not yours. They might be running on razor-thin margins you can't afford, or maybe they’re deliberately undercutting the market to grab users before a big funding round. Unless you know the "why" behind their price, copying it is just a high-stakes guessing game.

Looking Through a Telescope, Not Binoculars

Another huge mistake is getting tunnel vision. It’s so easy to obsess over your direct competitors—the ones who look just like you and sell a nearly identical product. But often, your real threat is the "indirect" competitor who solves the same customer problem in a completely different, and maybe much cheaper, way.

Think about it:

- If you sell project management software, your competitor isn't just other PM tools. It's also Trello, a souped-up spreadsheet, or even a pen and paper.

- If you offer a high-end design service, your competitor is Canva, not just other agencies.

Ignoring these indirect players means you’re missing a huge chunk of the market. You might be in a price war with a rival while a completely different type of solution is making you both obsolete. Your competitor price data needs to include a wide-angle view of every way your customer can solve their problem.

> The Hard Truth: Customers don’t care about your product category. They care about their problem. If someone else solves it for cheaper or easier, you lose, no matter how great your direct competitor analysis is.

Staying on the Right Side of the Law

Finally, let's talk about the big one: ethics and legality. In your quest for data, it can be tempting to get a little… creative. But this is a line you can never cross. Shady tactics will destroy your reputation and could land you in serious legal trouble.

Here are the non-negotiables:

- Use Public Data Only: If it’s on their public website, in a press release, or in an app store listing, it’s fair game.

- No Deception: Don’t pose as a fake customer just to get a quote unless that's a standard part of their sales process. Never try to access information behind a login wall.

- No Collusion: Never, ever discuss your pricing plans with a competitor. Price-fixing is a massive illegal offense that regulators take very seriously.

The goal is to be informed, not to be a spy. Using a professional tool for data collection is a good way to ensure you stay compliant. While expensive options like Ahrefs or Semrush exist for broad market analysis, a more focused tool like Already.dev automates data gathering while keeping you well within ethical boundaries.

Think of these traps as potholes on the road to a smart pricing strategy. Now you know where they are, you can easily steer around them.

Answering Your Burning Questions on Competitor Pricing

We've gone deep on competitor pricing, but I'm sure a few questions are still bouncing around in your head. Let's get them sorted out.

How Often Should I Be Checking Competitor Prices?

Honestly, it all comes down to the speed of your market. If you're slinging products in a fast-moving e-commerce space, you might need to check prices weekly, or even daily, just to keep pace.

For most SaaS companies, though, a monthly or quarterly check is perfectly fine. That's usually frequent enough to catch important shifts without getting lost in the noise. The real key is consistency. Set a schedule and stick to it. An automated tool is a huge help here, watching things for you and pinging you only when something actually changes.

What Do I Do if a Competitor Hides Their Pricing?

Ah, the ol' "Contact Us for a Demo" trick. Don't sweat it—that's a piece of data right there. It screams that they're chasing enterprise clients and have a custom-quote process. You're not flying blind, though.

Here’s how you can still get a read on their pricing:

- Dig into their case studies. Look for any mention of ROI or specific financial outcomes. These often give clues about the value—and therefore the likely cost—of their service.

- Scour review sites. You'd be surprised what people share. Customers sometimes drop hints about what they're paying on sites like G2 and Capterra.

- Use market intelligence platforms. These tools can often estimate a price range based on the competitor's feature set and who they're selling to.

Is It Legal to Scrape Competitor Pricing Data?

This is a bit of a gray area, but the general consensus is that scraping publicly available information is legal. The most important thing is to be a good digital citizen. Think of it as the "don't be a jerk" rule.

That means don't slam their website with so many requests that you slow it down for everyone else. Always check and respect the robots.txt file on their site—it’s their way of telling bots which areas are off-limits. And whatever you do, never try to access anything that’s behind a login. Using a professional service for this is usually the safest bet.

Should I Just Copy My Competitors' Prices?

Please don't. That's the fastest way to become just another face in the crowd, a forgettable commodity. Think of competitor price data as a compass, not a set of turn-by-turn directions.

> Your price should be a direct reflection of your unique value, your market position, and your own business costs.

If your product genuinely delivers 10x more value, your price should reflect that. Use competitor data to understand the landscape, but let your own value proposition be your guide when setting your price.

Still feel like tracking all this is a mountain of work? Already.dev can put the entire process on autopilot—from finding your competitors to monitoring their pricing over time. You get to focus on making smart, informed decisions. Get the clarity you need in minutes, not weeks.