Your Guide to a Competitor Pricing Analysis Template That Works

Stop guessing on pricing. Grab our competitor pricing analysis template and learn how to use it to find the perfect price point without the usual headache.

Think of a competitor pricing analysis template as your secret decoder ring for pricing. It’s just a fancy term for a spreadsheet where you track what your rivals charge, what they offer for that price, and whether their customers are happy or screaming into the void. This gives you a map of the market, taking the guesswork out of the equation.

Why You Actually Need a Pricing Template

Let’s be real, pricing is terrifying. Price too high, and your website becomes a digital ghost town. Go too low, and you're basically paying people to use your stuff. It’s a classic startup nightmare.

This is where a good competitor pricing template saves the day. It’s not about blindly copying what everyone else is doing; that’s a race to the bottom. It’s about understanding the market’s “price gravity” so you can find the perfect spot for your awesome product.

Stop Guessing and Start Selling

A simple template gives you the hard data you need to stop pulling numbers out of thin air. Think of it as your cheat sheet for not going broke. When you lay it all out, you can:

- Spot the Gaps: See where your competitors are weak or what customer needs they’re totally ignoring. Maybe everyone charges per user, creating a perfect opening for you to introduce a usage-based model that doesn't punish growth.

- Justify Your Price: It becomes crystal clear how your features stack up, giving you the confidence to either charge a premium or prove you're the best bargain on the block.

- Understand Customer Expectations: Pricing sets expectations. Your analysis reveals what people in your niche are actually willing to pay for certain benefits.

> Here’s the deal: launching without a pricing analysis is like trying to navigate a new city blindfolded. You might get lucky, but you’ll probably just walk into a pole.

The Modern Customer Is a Super-Sleuth

Today’s buyers are basically detectives. In the cutthroat world of retail, a whopping 84% of buyers check prices at multiple stores before they even think about buying. It's just what people do now.

In fact, retailers who actually use pricing analysis templates have seen 15-25% revenue growth just by finding that sweet spot. You can get more details on how pricing analysis drives growth if you like big numbers. This just proves that knowing what your rivals are up to isn't optional—it's survival.

Finding Your Competitors Without Going Insane

First things first: who are you really competing against? It's easy to just look at the big names on Google, but your true competition is often hiding in plain sight.

You’ve got a few different flavors of rivals to watch out for:

- Direct Competitors: The obvious ones. They sell a product that looks and smells a lot like yours.

- Indirect Competitors: This group is trickier. They solve the same customer problem, but with a totally different solution (like a spreadsheet vs. your fancy software).

- Emerging Competitors: The new kids on the block who could sneak up and eat your lunch while you're not looking.

Trying to track all these folks down by hand is a soul-crushing waste of time. Seriously. To nail your competitor pricing analysis, you have to get smart about gathering intel. There are some seriously effective ways to spy on competitors that can give you a major edge.

Ditching the Manual Grind for Automation

Sure, you could use powerful SEO tools like Ahrefs or Semrush, but let’s be honest—they can be expensive, which is a tough pill to swallow when you're just starting out. This is where automated tools really shine. A platform like Already.dev does the heavy lifting for you, digging through startup directories, forums, and app stores to uncover competitors you didn't even know existed.

This isn’t just about convenience; it’s a big deal. The Competitor Analysis market is projected to skyrocket from $4.3 billion in 2021 to over $15.4 billion by 2033. Even investors are paying attention—startups that use data-driven pricing are securing 2.5x more funding on average.

> The goal isn't just to find competitors; it's to build a complete map of your market battlefield. You need to know who’s out there, what they’re charging, and where the opportunities are hiding.

By automating this part, you can stop wasting hours on mind-numbing research and start focusing on what actually matters: analyzing the data and filling out your competitor pricing analysis template.

How to Actually Use This Template

Okay, so you have a template and a list of competitors. Now what? How do you turn that blank spreadsheet into something useful without it feeling like homework?

The point isn't just to list who charges what. That's surface-level fluff. We're going to dig into your competitors' pricing pages to understand the why behind their numbers.

Finding What They Really Charge For

Pricing pages are often intentionally confusing. Your first job is to ignore the marketing fluff and find their value metrics. This is the "per whatever" they base their pricing on. Is it per user? Per 1,000 contacts? Per gigabyte of storage? This one detail tells you a ton about their business.

Once you know that, hunt for these details:

- Feature Gating: What specific features do you get in the "Basic" plan that you don't get in the free one? What’s the big jump to "Pro"? Jot down the top 3-5 features that define each tier.

- The Upsell Levers: Look for that one critical feature—like single sign-on (SSO) or advanced reporting—that's locked away in a pricey enterprise plan. That’s a classic upsell trap. Make a note of it.

- Hidden Fees: Do they charge extra for setup? Is premium support an add-on? Sometimes you have to dig into the FAQ to find these, but they're crucial.

> You're basically a pricing detective. Don't just log the sticker price. Uncover the entire strategy, from the free plan they use as bait to the enterprise tier they use as the hook.

Let's Look at a Real SaaS Example

Imagine we’re analyzing a few project management tools, like Asana, Monday.com, and Trello. A simple entry like "$10/month" is useless. Your template needs to tell the full story.

Here's how a modern tool like Already.dev can automatically visualize this kind of competitor data for you.

Seeing it laid out like this makes it immediately obvious how different companies position their plans and features against each other.

After this research, you might find that Asana's pricing is built around team features, Monday.com's is all about workflow customization, and Trello's strength is simplicity. Each one is solving a slightly different problem, and their pricing shows it. A detailed competitor price comparison is the perfect way to map these nuances.

When you fill out the template with this level of detail, you’re not just collecting data. You’re building a map of the market that shows you exactly where you fit in—and where the opportunities are.

Turning Your Data Into Smart Decisions

So, your competitor pricing template is full of juicy data. Awesome. But a spreadsheet full of numbers is just a spreadsheet. Now it’s time to find the stories hidden in that data.

This isn’t about number-crunching; it’s about making smart moves. The patterns you're about to find will point to huge opportunities you’d otherwise miss.

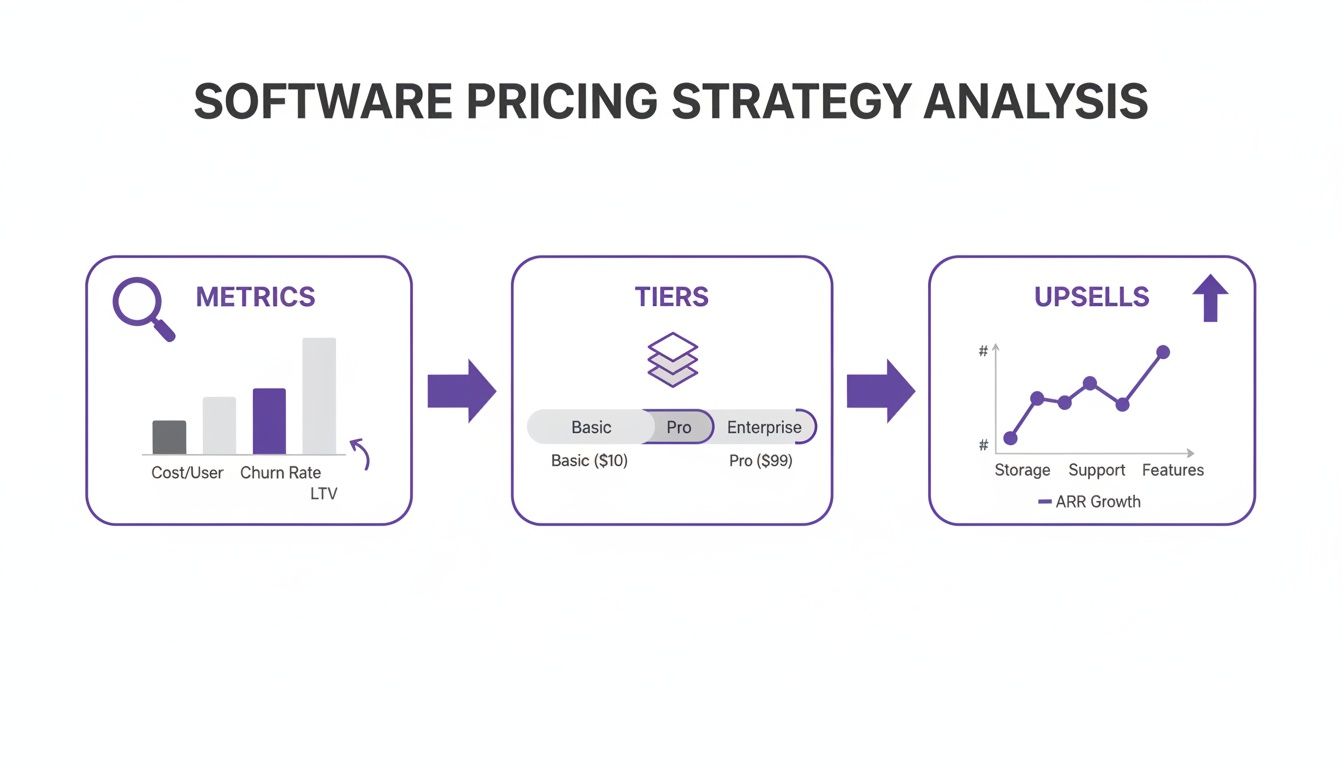

This breakdown shows how to look at the whole picture—from the metrics that matter most to how your competitors are nudging customers into bigger plans.

As you can see, it’s all connected. Analyzing feature tiers, pricing metrics, and upsell paths gives you a complete view of what’s happening in your market.

Spotting Market Gaps and Opportunities

First, zoom out. Do all your competitors use per-seat pricing? That could be your golden ticket. You could swoop in with a usage-based model that smaller teams would love.

If you want to get nerdy with the numbers, a frequency distribution calculator can show you exactly how different price points are clustered across the market.

Or maybe you spot another pattern: everyone offers a 14-day free trial, but no one has a real freemium plan. That’s a massive gap. A permanent free tier could become your most powerful way to get users in the door, pulling in a huge audience your competition can't reach.

> Your goal is to find the "unsaid" rules of your market—and then decide if you want to play by them or smash them. The biggest wins often come from zigging when everyone else zags.

Defining Your Market Position

Next, figure out the average price for different feature tiers across your competitors. This simple number is surprisingly powerful. It tells you, almost instantly, where you might fit in.

Are you the scrappy, affordable option? Or the premium, "you get what you pay for" choice?

There's no right answer, but you absolutely must choose. Your pricing tells a story about your brand's value long before a customer clicks "buy."

Trying to be the cheapest is a race to the bottom you probably won't win. But being the best value for a specific audience? That’s a strategy that lasts.

Pricing Pitfalls That Can Sink Your Strategy

You’ve filled out the template. You feel like a genius. Hold on—this is where the costliest mistakes happen. Let's walk through the common traps so you can sidestep them.

The biggest one? 'Set it and forget it' pricing. You can't do this once and call it a day. The market is always changing. A static analysis is a snapshot of a moving train; it's outdated the moment you finish it.

Don't Just Copy the Industry Goliaths

I see this all the time: a new company just mimics the pricing of the biggest player in their space. It's a classic mistake. Just because a giant like Salesforce can command a premium doesn't mean your new CRM can. They've spent decades and millions building their brand. You haven't... yet.

> Pricing is a core part of your brand's story. When you just copy someone else's, you're telling the market you don't have a story of your own. It looks insecure.

Keep an eye out for these other blunders:

- Getting stuck in feature wars: It's easy to get bogged down comparing every single feature. But customers don't buy features; they buy a solution to their problem. Connect your features back to the real-world value they provide.

- Forgetting the 'indirect' guys: You know that quirky little startup that solves the same problem as you, but in a totally different way? Don't dismiss them. They could be the ones disrupting everything in a year.

- Tunnel vision on the price tag: Price is just one piece of the puzzle. What if your competitor’s support is awful, or their UI looks like it was designed in 2005? Those pain points are your golden opportunities to justify a higher price with a better experience.

Think of your competitor pricing analysis template as a compass, not a GPS. It shows you where you are, but you still have to steer the ship. Dodge these mistakes, and you’ll be in a much better spot.

Got Questions? We've Got Answers

You probably have a few questions now. Let's tackle the most common ones.

So, How Often Should I Actually Update This Thing?

Look, this isn't a one-and-done project. If you let this analysis collect digital dust, you'll be making decisions on old, irrelevant data.

For most industries, a quarterly review is a good rule of thumb. Seriously, go set a recurring calendar reminder right now.

That said, if a major competitor revamps their pricing or a new player enters the scene, it’s time for an immediate refresh. Think of it as a living document.

What If My Product Has Features No One Else Does?

That’s awesome! Unique features are your golden ticket to justifying a premium price, but you have to be smart about it.

This is where your analysis becomes your best friend. Look at what your competitors charge for their highest-tier plans. That price is now your starting point. You can confidently price your unique feature above that, because you're delivering value they simply can't.

Should I Just Go for Broke and Be the Cheapest?

In a word: no. Please don't.

Competing on price is a brutal race to the bottom. It’s a battle that small businesses rarely win against massive companies with deep pockets. It's not a sustainable way to build a business.

> Instead, use your analysis to find a price that reflects the true value you offer. It’s far more powerful to be the best value for a specific group of people than it is to be the cheapest for everyone.

Find your niche, solve their problems better than anyone else, and charge a fair price for it.

At Already.dev, we built a platform that automates this entire discovery and analysis process, turning weeks of manual work into a few minutes of AI-powered research. Get data-driven confidence with a free trial of Already.dev.