How to Find Your Competitors Without Losing Your Mind

Learn how to find the competitors of a company using practical, real-world methods. This guide goes beyond basic searches to give you actionable insights.

Figuring out who you're up against is part detective work, part common sense. It's a mix of clever Google searches, digging through industry lists, and sometimes using special software to see the whole playing field. The real trick? Thinking beyond the obvious rivals. You need to uncover the sneaky, indirect alternatives—the weird ways customers are solving their problems right now, probably without a product that looks anything like yours.

Why Finding Competitors Is Your First Smart Move

Okay, you've got a killer idea. That's fantastic! But let's get real for a minute: you're probably not the only genius who's had it. And honestly, that’s a good thing. Learning how to find a company's competitors isn't about crushing your dreams; it’s about getting street-smart before you spend your first dime.

Okay, you've got a killer idea. That's fantastic! But let's get real for a minute: you're probably not the only genius who's had it. And honestly, that’s a good thing. Learning how to find a company's competitors isn't about crushing your dreams; it’s about getting street-smart before you spend your first dime.

Think of it as strategic eavesdropping. In the startup world, where a shocking 90% of new ventures fail, this is your secret weapon. The crazy part is, many of those failures happen because founders were blindsided by competition they didn't even know was a thing.

Broaden Your Definition of a Competitor

Your competition isn’t just the company with a similar logo and a slick tagline. To get a useful map of the battlefield, you have to think bigger.

-

Direct Competitors: These are the obvious ones. They sell a similar widget to the same people. Think Uber vs. Lyft. Easy peasy.

-

Indirect Competitors: These guys solve the same problem, just with a totally different gizmo. If you're building a project management tool like Asana, an indirect competitor could be a simple spreadsheet, a team's trusty whiteboard, or even a chaotic mess of sticky notes.

-

Failed Competitors: Don't sleep on the ghosts of startups past. Finding companies that tried and tanked in your space is like finding a treasure map where "X" marks the spot of a giant pitfall. Their mistakes are your free education.

> Your real competition is often not another startup, but the customer’s existing habit or messy workaround. Breaking that habit is the real challenge.

Understanding this whole ecosystem is the foundation of a solid plan. It lets you see where others screwed up, spot gaps in the market just waiting for you, and figure out how your idea can actually stand out. This whole process is a cornerstone of what we call marketing intelligence, which is just a fancy way of saying "know your market, dude."

Master Keywords to Think Like Your Customers

You have to stop searching for competitors using your weird internal company jargon. I see this all the time. Your team might talk about "synergistic protein intake optimization," but I guarantee your customers are just typing "best post-workout snack" into Google.

To find who you’re really up against, you need to search like a real person with a real problem.

This isn’t about becoming an SEO guru overnight. It’s more like becoming a digital anthropologist with a funny hat. Your job is to figure out the exact words people use when they’re frustrated, looking for answers, or trying to decide between two things that look exactly the same.

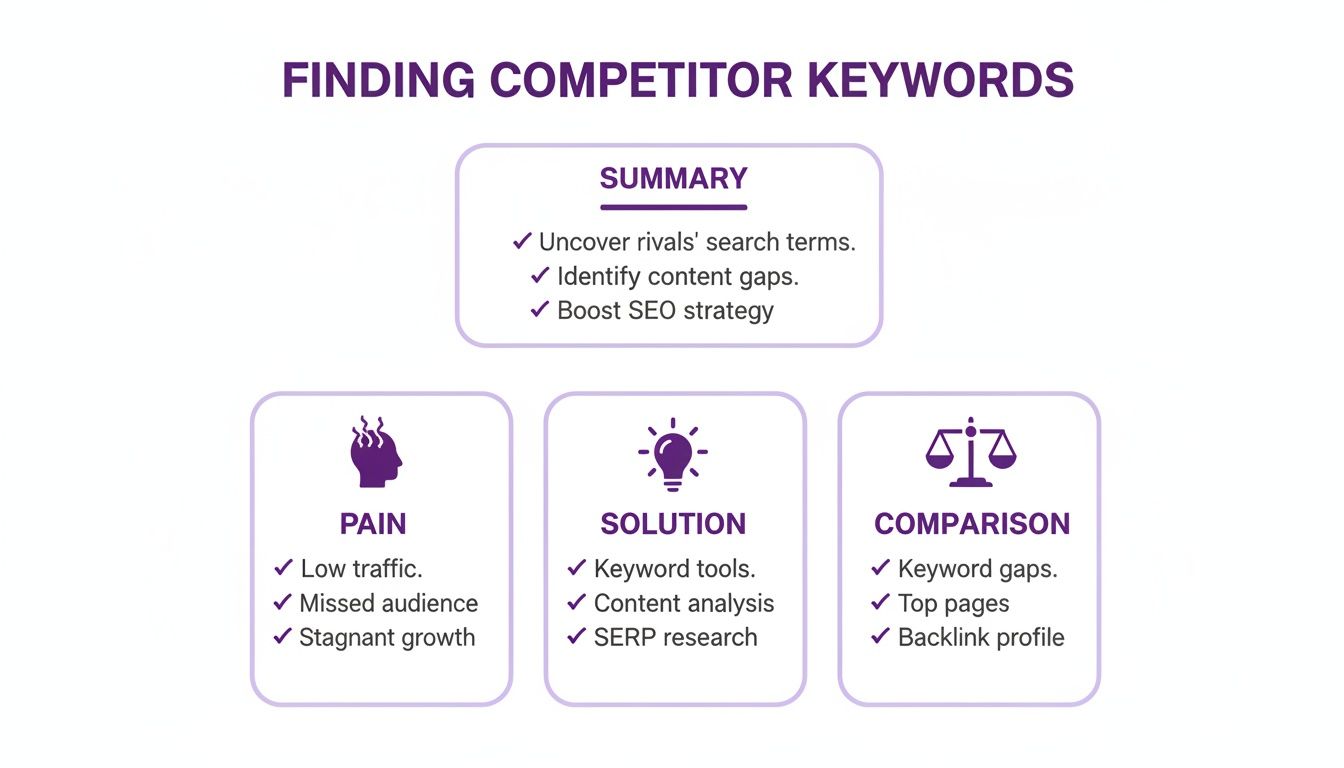

Uncover What Your Customers Are Actually Searching For

The best keywords often have nothing to do with a solution—they’re all about the problem. People search for their pain long before they know what magical product will fix it.

Here’s what you should be looking for:

-

Pain Point Keywords: Put yourself in the shoes of a very annoyed customer. They aren't looking for you yet. They’re typing things like, "my sales pipeline is a disaster" or "how to stop wasting so much food." The companies that pop up for these cries for help are your true competitors because they're solving the core problem.

-

Solution-Aware Keywords: This is the next stage. Now, they know a category of solution exists. Their searches get more specific, like "best CRM for remote teams" or "meal planning app." These will lead you straight to the companies you're probably already sweating about.

-

Comparison Keywords: This is the gold mine. When someone searches for "Asana alternative" or "Mailchimp vs. ConvertKit," they are seconds away from pulling out their credit card. The businesses that show up for these are your fiercest rivals.

> Forget what you call your product internally. The only thing that matters is what your customer calls their problem. Once you get that, you’ll start seeing your real competitors everywhere.

It’s also worth noting that the search world is getting weirder every day. Understanding how AI is impacting customer searches is becoming a huge piece of the puzzle. For a great deep-dive on this, check out a practical guide to AI Search Engine Optimization.

This simple mind-shift is the key that unlocks everything else. Once you start using your customer’s language, a completely new competitive landscape will pop into view.

Your Digital Detective Toolkit for Finding Hidden Rivals

Google’s front page is just the highlight reel—it's what companies want you to see. The real, unfiltered competition is hiding in plain sight in the internet's back alleys, where actual customers are talking smack. Forget the polished ads for a minute; let's go find out who people are actually using and complaining about.

Your first stop should be startup and product directories. Places like Crunchbase, Product Hunt, and G2 are absolute treasure troves. You can see who's getting boatloads of cash, launching new features, and what the cool kids are buzzing about. This is where you’ll find the scrappy up-and-comers who haven’t hit the big leagues yet.

Digging in the Digital Crates

Next, it's time to dive into forums and online communities. I’m talking about Reddit, Quora, and niche Facebook groups. These are the places people go when they want real advice, not a sales pitch from a guy in a blazer. They want a real solution from a real person.

You can unearth incredible insights by getting clever with your search commands. Don't just search for "CRM software." That's boring. Instead, try something like this directly in Google:

site:reddit.com inurl:/r/smallbusiness "software to manage"

This little trick tells Google to only search the small business subreddit for phrases containing "software to manage." Suddenly, you're reading raw, honest conversations about what real business owners are using. This is exactly how you find the competitors that big, expensive tools often miss.

Of course, doing all this crawling manually is a soul-crushing grind. A more streamlined way is with a tool like already.dev, which is built specifically for this kind of deep discovery. You can explore some of the best competitive intelligence tools to see how they all stack up.

The goal isn't just to find product names; it's to understand the language customers use to complain about their problems and praise the solutions they find.

As you can see, effective competitor discovery starts with feeling your customer's pain, not just searching for similar products.

Competitor Discovery Channel Smackdown

Trying to decide where to focus your energy? Here's a quick-and-dirty comparison of the main channels for playing detective.

| Discovery Channel | What You'll Find | Effort Level | Best For Finding | | :--- | :--- | :--- | :--- | | Google Search | The big, obvious, high-ranking players. | Low | Top-of-mind, well-funded competitors. | | Product Directories | Emerging startups, funded companies, and user reviews. | Medium | Up-and-comers and niche leaders. | | Online Forums | Honest user recommendations and "hidden gems." | High | The competitors your customers actually use. | | Automated Tools | A comprehensive list from all sources, fast. | Low | A complete market view without the manual grind. |

Each channel gives you a different piece of the puzzle. Relying on just one is a recipe for getting blindsided.

Manual research, while insightful, can be a huge time sink with surprisingly little to show for it. I've seen teams spend weeks scanning directories, only to launch into a market where some quiet rival already owned 70% of the customers. Relying on Google’s first page alone can cause you to miss up to 80% of the relevant players, and while forums help, they might only add another 10% to the picture. It's rough out there.

Using Pro Tools Without a Pro Budget

Let's be real. When you hear "competitor analysis," tools like Ahrefs and Semrush probably pop into your head. These platforms are the big guns, fantastic for geeking out on who's ranking for what and where they're blowing their ad money.

But here's the catch: they can be ridiculously expensive, often running hundreds of dollars every single month. If you're just starting out, that's like using a cannon to hunt a squirrel. It's overkill. You can also try a smart alternative like already.dev. You need a faster, smarter, and way more budget-friendly way to map out your competition.

The Smart Alternative to Pricey Subscriptions

This is exactly where a purpose-built platform like already.dev shines. Instead of you spending hours manually digging through search results and directories like a digital gopher, its AI agents do the heavy lifting. You give it a simple description of your idea, and it scours hundreds of sources for you.

> It’s the difference between trying to build a fishing rod from scratch and simply casting a giant, automated net that brings all the fish to you.

The old-school way of doing research just can't keep up. Manually building a solid competitor report can easily eat up 40 hours of your life, and even then, you'll likely only uncover less than 30% of your actual rivals.

In stark contrast, an AI-powered tool like already.dev can give you the whole picture in about 4 minutes. It scans everything from business directories and app stores to niche online communities, then neatly sorts your competitors based on where they fit in the market.

To effectively track your rivals, leveraging the right tools is key. Explore the best tools for SEO analysis to gain an edge without breaking the bank. For a deeper dive into free options, you can also check out our guide on the best free competitor analysis tools. This approach saves you both time and a boatload of cash.

Turning Your Competitor List Into a Strategy

Alright, so you’ve got a massive, maybe slightly terrifying, list of competitors. Great. Now what? The biggest mistake you can make is letting that list sit in a spreadsheet gathering digital dust. A list is just data—it’s time to turn it into an actual plan.

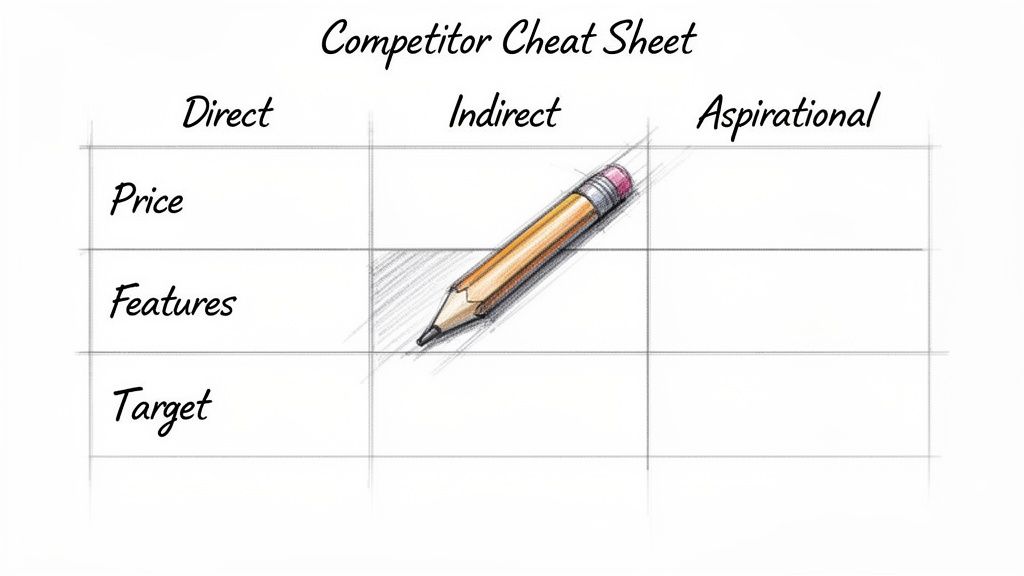

The first move is to stop seeing them as one big, faceless mob of "the competition." You’ve got to sort them into manageable buckets. This isn't about writing a 50-page report; it’s about creating a simple cheat sheet so you know exactly who you’re up against and why you should care.

Your Three Buckets of Competition

Putting your rivals into categories helps you focus your energy where it’ll do the most good. Every company on your list can probably be shoved into one of these three groups:

-

Direct Competitors: These are the ones everyone thinks of first. They sell a nearly identical product to the same audience you do. Think McDonald's vs. Burger King. You're both fighting for the same french-fry-loving customer.

-

Indirect Competitors: These are a little sneakier. They solve the same core problem your customer has, but with a totally different solution. If you sell project management software, an indirect competitor could be a simple spreadsheet, a physical whiteboard, or a messy pile of sticky notes.

-

Aspirational Competitors: These are the big shots in your space. They might not be your direct rivals right now, but they're the companies you look up to. Following them gives you a playbook for what works when you finally get to their level.

> Simply knowing how to find the competitors of a company isn't the whole story. The real breakthrough happens when you organize that information to see the entire competitive landscape clearly.

Once you’ve sorted everyone, your next step is to build a basic competitor matrix. Seriously, just open up a spreadsheet—nothing fancy.

Create columns for the company name, their pricing, what you see as their three best features, and who you think their ideal customer is.

Going through this simple exercise forces you to dig deeper than just their homepage. You’ll start to see patterns pop up almost immediately. You might spot gaps in pricing, an entire group of customers that's being ignored, or a unique mix of features nobody else is offering.

This isn't about copying what they do. It’s about finding the open space on the board where your company has a real shot at winning.

Your Top Questions, Answered

Let's tackle the questions that always pop up when you're deep in the research weeds. Here are some quick, no-BS answers to the most common hurdles people face.

How Many Competitors Should I Actually Analyze?

Please don't try to boil the ocean. You'll go insane. Start by focusing on your top 3-5 direct competitors—the ones that feel like they're practically reading your mind.

Then, add 2-3 interesting indirect competitors to the mix. The goal here isn't to create an encyclopedia of every single company in your space. It's about spotting patterns, not drowning in data.

> Quality insights from a small, focused list will always beat a massive, overwhelming spreadsheet. Always.

What If I Can't Find Any Direct Competitors?

This is a classic "good news, bad news" situation. The good news? You might have stumbled upon a completely untapped market. The bad news? It might mean there’s no market there at all, and you've invented a solution to a problem nobody has.

Your next move is crucial: shift all your focus to the indirect competitors. How are people solving this problem right now without a product like yours? Your first real competitor is almost always the status quo—messy spreadsheets, a jumble of different tools, or just good old-fashioned manual work.

Is Competitor Research a One-Time Thing?

Nope. Thinking of it as a one-and-done task is a rookie mistake. Your initial deep dive is like studying for a final exam—intense and comprehensive.

After that, it's more like checking your mirrors while driving. It's a quick, regular habit. Set up some Google Alerts for their brand names, follow their CEOs on social media, and do a quick refresh on their strategy every quarter. Markets change fast, and you really don't want to get sideswiped by a rival you stopped watching six months ago.

Stop wasting weeks on manual research. With already.dev, our AI agents crawl hundreds of sources to build a comprehensive competitor report in minutes, not days. Get the clarity you need to build with confidence. Start your free trial today.