How to Identify Competitors (Without Losing Your Mind)

Tired of generic advice? Learn how to identify competitors with real-world detective work and smart tools. Find your direct and indirect rivals today.

Alright, let's talk about finding your competition. It sounds simple, right? "Who else sells the same widget as me?" Wrong. That's like saying the only thing that competes with a movie ticket is another movie ticket. You're forgetting about Netflix, bowling, or just staying home and staring at the wall.

You have to spot the indirect rivals—the ones offering a totally different solution to the same core need.

Who Are You Really Competing Against, Anyway?

Let's be real. Most guides on this topic give you the same tired advice: "Google your keywords." Wow, thanks, Captain Obvious. We're skipping that and jumping into a way of thinking that actually works.

This is about separating the real threats from the background noise. It all boils down to understanding the two types of rivals you'll face.

- Direct Competitors: These are the obvious ones. They're selling a similar product or service to the exact same audience. Think Coca-Cola vs. Pepsi—it doesn't get more direct than that. You probably know a few of these already.

- Indirect Competitors: These are the sneaky ones. They solve the same customer problem but with a completely different product. Think of a movie theater competing with a bowling alley. Both are selling a "fun Friday night out," but the product is totally different.

> Pro Tip: Getting this distinction right is the secret handshake of smart business. It’s less about filling a spreadsheet and more about building a mental map of your competitive world. This map tells you who to watch, who to learn from, and—just as importantly—who you can safely ignore for now.

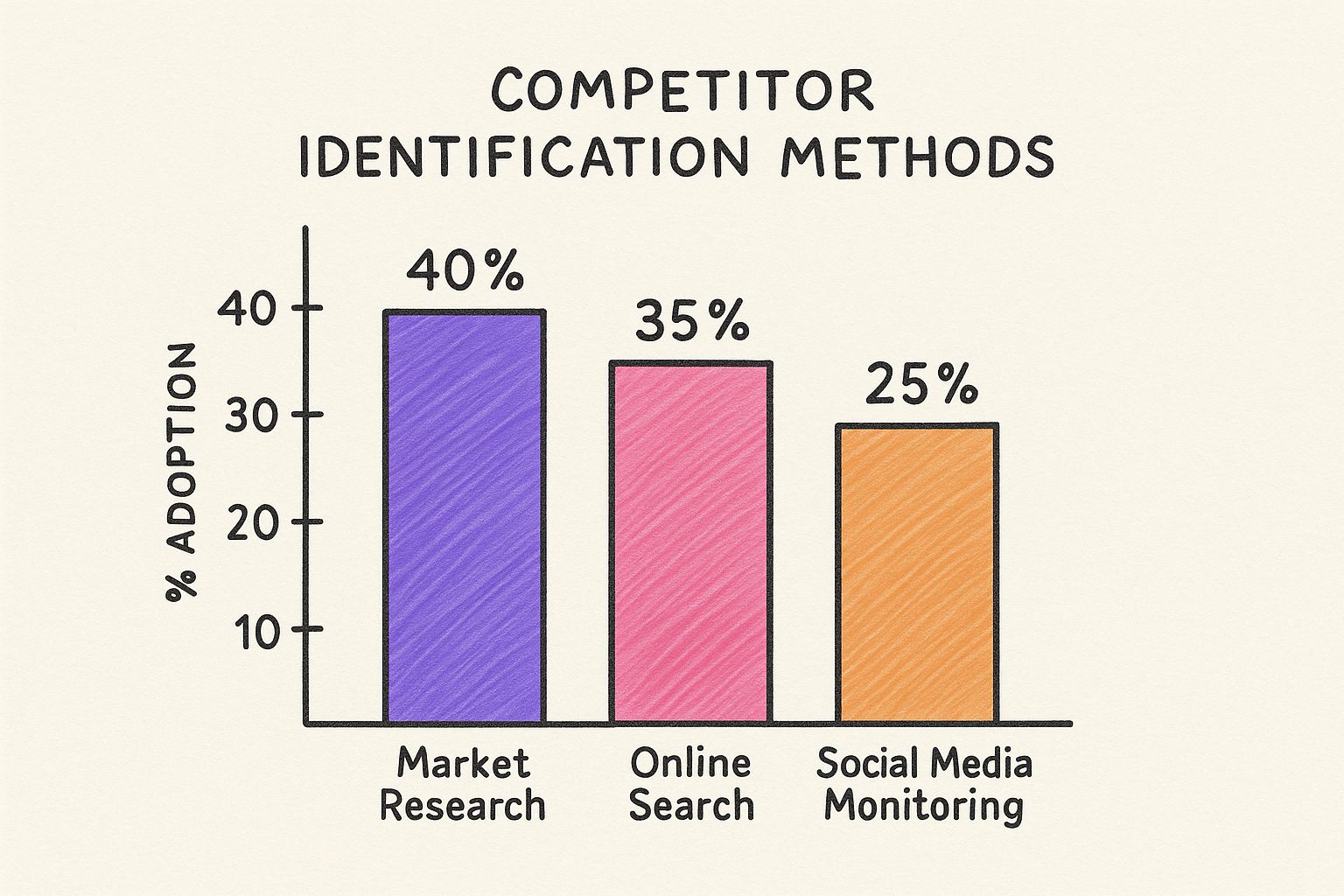

This chart breaks down the most common ways businesses actually go about finding these rivals.

As you can see, while a simple online search is a big piece of the puzzle, good old-fashioned market research still comes out on top. It really drives home the point that you need a blended approach to get the full picture.

Why This Matters More Than You Think

Getting this first step right changes everything. Seriously.

If you only focus on your direct competitors, you're setting yourself up to be blindsided. Imagine you sell high-end cameras and you're only watching what Nikon and Sony are doing. Meanwhile, you're completely ignoring the massive leaps in smartphone camera technology. That’s a classic, and potentially fatal, indirect threat.

Quick Guide: Direct vs. Indirect Competitors

Use this quick-glance table to help categorize the competitors you find. Knowing the difference changes your entire strategy.

| Characteristic | Direct Competitors | Indirect Competitors | | ------------------- | ---------------------------------------------------------------- | ---------------------------------------------------------------------- | | Product/Service | Sells a very similar or identical product. | Sells a different product that fulfills the same basic need. | | Target Audience | Aims for the same customer segment with the same marketing message. | May target the same customer, but often with a different value proposition. | | Problem Solved | Solves the exact same problem in the same way. | Solves the same core problem but with a different method or approach. | | Example | Mailchimp vs. ConvertKit (Email Marketing) | Netflix vs. a good book (Evening entertainment) |

Don't just glance at this table—really internalize it. Every competitor you identify will fall into one of these two buckets, and how you decide to compete with them will be wildly different.

Time to Put on Your Detective Hat and Do Some Manual Sleuthing

Before we jump into any fancy tools, let's roll up our sleeves and do some old-fashioned detective work. Honestly, this is the best way to find your real rivals because you're tapping into where actual people are talking, not just where algorithms are sending traffic. The only thing it costs is a bit of your time. No credit card required.

Think about it for a second. Where do your ideal customers hang out online when they need to vent, ask for recommendations, or find a fix for something that's driving them crazy? That’s your goldmine. This part of the process is less about spreadsheets and more about becoming a digital anthropologist.

Lurking in All the Right Places

Your first mission, should you choose to accept it, is to become a fly on the wall in your audience's digital hangouts. You're not there to sell anything. You're just there to listen.

Start poking around in these specific spots:

- Reddit Threads: Don't just search for your product category, like "project management tool." That's too generic. Instead, look for threads where people are describing their problems. Try searching for something like, "how to stop missing deadlines with my team." The tools people recommend in the comments? Those are your competitors.

- Niche Social Media Groups: Find dedicated Facebook Groups, LinkedIn Groups, or even Discord servers for your industry. Keep an eye out for posts that ask, "What tools do you all use for X?" The answers are a direct line to your competition.

- Industry Forums: Yep, they still exist! And these old-school forums are often where the most passionate pros share their completely unfiltered opinions on the tools of their trade.

> The whole point here is to gather raw intel by observing real customer conversations. You’re looking for the names that pop up over and over again when someone asks, "How do I solve [this specific problem]?"

It's so important to remember that competitors can show up where you least expect them, especially as customer needs shift. Just look at what happened in the British supermarket world. For years, the 'big four' dominated, but then discount retailers like Aldi and Lidl started gaining ground as the economy changed. Eventually, Aldi's market share actually surpassed one of the major players, all because they tapped into a shift in what shoppers valued. You can see more data on how market dynamics can reveal competitors over on Statista.com.

Mastering the Art of the Google Search

Okay, I know I just said not to "just Google it," but there are much smarter ways to go about it. A few simple search tricks, known as operators, can help you slice through the noise and see who’s really in the ring.

Try plugging these into your search bar, swapping out "your keyword" with what your business does:

- "your keyword" vs — This is a classic. It often pulls up comparison articles where someone else has already done half the work for you.

- "best alternative to [known competitor]" — This is great for finding the up-and-comers who are specifically positioning themselves against the big names in your space.

- "your keyword" inurl:blog — This little gem helps you find competitors who are going all-in on content marketing, which is a key strategy you'll want to keep an eye on.

This manual sleuthing will give you a solid, foundational list of rivals. Once you have this raw list, you can start digging deeper. For the next steps, check out our detailed guide on how to analyze competitors to learn what to do with all this great intel.

Using Smart Tools to Uncover Hidden Rivals

Manual detective work is great for getting a real feel for the market, but let's be honest, you only have so many hours in the day. It’s time to bring in the tech to automate the grunt work and find rivals you’d otherwise completely miss.

Of course, powerful SEO and market analysis platforms can dig up mountains of data. You’ve probably heard of the big ones, like Ahrefs and Semrush. They're fantastic for telling you exactly who’s ranking for your target keywords or who’s getting backlinks from the same industry blogs.

The catch? They can also be crazy expensive. For many startups and small businesses, their steep monthly fees just aren't realistic. It’s like wanting to find a single parking spot and being told you have to buy the whole garage first.

Getting Smart Insights Without Breaking the Bank

Luckily, you don't need to take out a second mortgage to get powerful competitor insights. The real goal isn't to drown yourself in data anyway. It’s about using tools strategically to get answers quickly.

This is where more focused, AI-driven tools like already.dev really shine. Instead of forcing you to piece together clues from multiple expensive platforms, it does the heavy lifting for you. You just describe your business idea, and its AI gets to work, scanning hundreds of sources to find direct, indirect, and even failed competitors. It's a great alternative to the pricier options.

This screenshot from already.dev shows you what I mean—it delivers instant insights on rivals based on a simple idea.

Notice how it immediately starts classifying the competition for you? That alone saves you from the tedious job of sorting through a messy spreadsheet.

> My Takeaway: The right tool shouldn’t just give you data; it should give you answers. You want to spend your time acting on insights, not digging for them.

What to Look for in a Competitor Tool

Whether you go with an expensive platform or a more focused tool like already.dev, you’re essentially looking for a few key pieces of information to identify competitors beyond a simple Google search.

From my experience, here are the non-negotiable reports you should be running:

- Keyword Overlap Analysis: This tells you which websites rank for the same keywords you do. If a site consistently shows up for terms vital to your business, they are a competitor. Period. Even if their product seems totally different on the surface.

- Backlink Gap Report: Who is linking to your competitors but not to you? This not only uncovers rivals but also hands you a ready-made list of potential link-building opportunities. It’s a two-for-one.

- Top Pages Report: See which pages on a competitor's site get the most organic traffic. This is a goldmine for understanding what their audience cares about and what their most successful content actually is.

Running these simple analyses gives you a data-backed view of the competitive landscape. If you want to go deeper into organizing all this information, our post on creating a framework of competitive analysis lays out more practical steps. This approach ensures you're not just guessing who you're up against but using real data to find every threat and opportunity out there.

Finding Competitors You Never Saw Coming

If you only focus on companies that look and act just like you, you’re setting yourself up for a nasty surprise. The real knockout punches often come from outside your immediate weight class. The most dangerous competitors are the ones you never see coming.

This is where you have to broaden your horizons past the usual suspects. Your biggest threat might not even sell a similar product. It could be a new software feature, a subtle shift in consumer behavior, or a global trend that makes your entire solution feel old-fashioned overnight.

Think about it this way: a new AI note-taking app could suddenly become a fierce competitor to a dedicated project management tool. Why? Because it solves the user's core problem—"organizing my team's thoughts"—in a much simpler or more intuitive way.

Reading the Tea Leaves of the Market

So, how do you keep tabs on these big-picture factors without needing a degree in economics? You don't need a crystal ball, just a slightly wider lens. It’s really about learning to spot the early signs that point to future disruptions.

I’d suggest keeping a casual eye on a few key areas:

- Technological Shifts: What new tech is making waves? Pay close attention to things like AI, automation, or new platforms that could completely change how your customers solve their problems.

- Economic Trends: How are people’s spending habits changing? When money gets tight, a cheaper, "good enough" solution can suddenly look a lot more attractive.

- Adjacent Industries: Take a look at the industries that border yours. A company in a related field might see your market as its next logical step for expansion.

This is all about developing a gut feeling for the market's currents. Finding hidden competitors is fundamentally tied to understanding these bigger dynamics. For example, recent global volatility has slowed trade growth and added all sorts of complexity. This means rivals can pop up from unexpected places simply due to shifting policies or new infrastructure. A great read on this is the World Economic Forum's report on how global economic futures impact competitiveness.

> Your biggest threat isn't the company that does what you do. It's the company that makes what you do obsolete.

This kind of forward-thinking separates businesses that thrive from those that just survive. It's not about just listing who sells what. It's about deeply understanding the problem your customers have and anticipating all the new ways it could be solved. This is the real heart of competitive intelligence.

By looking beyond your direct rivals, you can anticipate threats, spot opportunities for your own innovation, and build a more resilient business that isn't so easily blindsided. If you're looking to build out this skill, we have more articles on competitive intelligence that can help guide your strategy.

Letting Big Government Point to Big Competitors

Here's a slightly unconventional trick that works surprisingly well if you want a shortcut to finding the major players in your space: see who the government is watching. It sounds a bit like something out of a spy movie, but it's all public information.

Think about it. Major mergers, antitrust lawsuits, and regulatory crackdowns are like giant, flashing neon signs pointing directly at the most dominant companies. When a behemoth like Company A tries to swallow Company B, it’s not just a business deal—it’s a public declaration of who they see as a threat or a valuable asset.

This whole approach is less about fumbling with keyword tools and more about understanding raw market power. The best part? You don't need a law degree to figure it out.

Tapping into Public Intel

So, how do you actually track this stuff without getting lost in a sea of legal jargon? You don't need to read a 500-page court filing. Just stick to the headlines and summaries from regulatory bodies.

When you see news about a big merger getting side-eyed by regulators, just ask yourself a few simple questions:

- Why is Company A trying to buy Company B?

- What part of the market does this deal shake up?

- Which smaller companies might get steamrolled if this goes through?

The answers give you a bird's-eye view of the competitive chessboard. You’re not just seeing who the big dogs are today, but who they plan on being tomorrow. It’s like getting a peek at their five-year plan without any of the corporate fluff.

> This method is fantastic for identifying the old guard and gives you a heads-up on market consolidation. You can spot the up-and-comers before everyone else does.

This gets even easier when you realize that global competition authorities are getting bigger budgets and more staff, which means more public monitoring for you to observe. For example, enforcement agencies track everything from cartel cases to merger activity, essentially mapping out the competitive landscape for you. By following these signals, you see exactly who the regulators think is big enough to worry about. You can learn more about how global competition trends reveal market leaders.

Where to Look for This Information

You don’t need an expensive subscription to some legal database. A few smart searches will get you what you need. Start by checking the press release or news sections on the websites of major competition authorities:

- The Federal Trade Commission (FTC) in the U.S.

- The Competition and Markets Authority (CMA) in the U.K.

- The European Commission's competition division

A quick pro-tip is to set up a news alert for terms like "antitrust" or "merger review" along with your industry's name. It's a low-effort way to keep a steady drip of high-level competitive intel coming your way. While expensive tools like Ahrefs are great for seeing the game on the ground, this strategy shows you who owns the whole stadium.

And for a more direct and affordable way to see the field, tools like already.dev can instantly map out the very competitors these giants might be targeting next.

Common Questions About Finding Competitors

Alright, you've been doing some serious detective work. As you start digging, a few questions always seem to pop up. Let's tackle some of the most common ones with quick, no-nonsense answers so you can get back to building your empire.

How Often Should I Check for New Competitors?

Honestly, this isn't a one-and-done task. Think of it like checking the weather—you don’t just check it once a year and hope for the best.

A deep dive every quarter is a solid baseline to see who’s new on the scene or making big moves. But on top of that, you should keep a casual eye out all the time. I like to spend 30 minutes every Friday peeking at relevant social media tags or forums. The market changes fast, and the rival who sinks you could be one that wasn't even on your radar three months ago. Consistency beats intensity here.

I Found 50 Competitors, Now What? Do I Track Them All?

Heck no! That's a one-way ticket to analysis paralysis, and nobody has time for that. You’ll end up with a spreadsheet so big it has its own zip code, and you won’t actually do anything with the information.

The goal is to focus on the vital few. Here’s a simple, sane approach:

- Pick your top 3-5 direct competitors—the ones most similar to you.

- Choose 1-2 'aspirational' competitors (the big names you admire).

- Add 1-2 interesting indirect competitors (the quirky ones solving the problem differently).

This gives you a manageable group to actually learn from. You’ll get 80% of the insight with 20% of the headache.

> The point isn’t to create a phone book of rivals; it's to create a small, focused study group. You want to understand their strategies deeply, not just list their names.

Are Expensive Competitor Analysis Tools Worth It?

This is the million-dollar question, sometimes literally. Tools like Ahrefs and Semrush are incredibly powerful, but their price tags can make your eyes water. They can save you dozens of hours of manual work, which is a huge plus.

However, it all comes down to your budget and time. If you're a startup or flying solo, you can get most of the way there with the free manual methods we discussed and more affordable, AI-powered alternatives like already.dev.

My advice? Start with the free approaches first. If you find yourself spending way too much time on manual research and have the cash to spare, then a paid tool can be a great investment. Just don't buy one until you know exactly what problem you need it to solve for you.

What's the Biggest Mistake People Make?

The single biggest mistake is only looking for a mirror image of your own business. It's classic tunnel vision. People search for companies with the exact same product, the same pricing, and the same marketing shtick.

This blinds them to the real threats. It’s the indirect competitors and emerging disruptors that often change the game. Always, always ask yourself, “What would my customer do if my business vanished tomorrow?” The answer to that question reveals your true, complete competitive landscape.

Feeling a little overwhelmed by all the manual digging? Let AI do the heavy lifting for you. Already.dev can uncover your direct, indirect, and even failed competitors in minutes, not days. Stop guessing and start getting clear, actionable insights. Get your free competitor report at already.dev and see who you’re really up against.