Market Analysis for Startups: A Founder's No-BS Guide

Master market analysis for startups with this simple guide. Learn how to find your customers, analyze competitors, and build a winning launch strategy.

So, you've got a brilliant idea for a startup. Awesome. But let's be real, an idea is just the starting point. Turning that spark into a business that actually makes money requires a roadmap, and that roadmap is called market analysis.

Think of it as the cheat sheet you get before a big exam. It's the process of digging into your potential customers, your competition, and the industry as a whole to make sure people will actually pay for what you're building. It's how you avoid building something nobody wants.

Why Market Analysis Is Your Startup’s Secret Weapon

Let's be honest, "market analysis" sounds like a topic from a business school lecture designed to induce a coma. But for a founder, it's the difference between launching to a crowd of eager customers and launching to the sound of crickets.

It’s your best defense against the most dangerous assumption in business: "I just know people will want this." Spoiler: you don't.

Finding Your Path to Success

Imagine you’re planning an epic cross-country road trip. You wouldn't just hop in the car and start driving, right? You'd check the map for the best route, look at the weather, and check for traffic jams. Doing a market analysis for your startup is the exact same thing.

This process helps you spot the wide-open highways (market opportunities), steer clear of the bumper-to-bumper gridlock (saturated markets), and make sure you have enough gas in the tank (funding) to get where you're going. It's all about asking the tough questions before you sink a single dollar into development.

Without it, you’re flying blind. You risk building a product nobody cares about, setting a price that’s completely off, or getting blindsided by a competitor you never even knew existed.

> Key Takeaway: Solid market research isn't a box to check for investors; it’s a tool that reduces risk and builds confidence. It shifts your strategy from pure guesswork to data-backed knowledge.

The startup world is no joke. With 5 million startups competing across more than 350 ecosystems globally, a good idea alone doesn't cut it. The competition is fierce, and making decisions based on real data is what separates the winners from the "what ifs." You can get a better feel for these shifting centers of innovation from the latest global startup ecosystem report.

The Foundation of a Winning Strategy

A good analysis is the bedrock of your entire business strategy. It dictates everything—from the features on your roadmap to the words you use in your marketing.

By gathering the right info upfront, you can build a smarter, more resilient company. In many ways, proper market analysis is the first step toward building powerful marketing intelligence for your business.

Ultimately, it answers the most important question any founder has: "Should I actually build this thing?" It gives you the evidence to charge forward with conviction or the insight to pivot before it's too late.

Core Components of Market Analysis at a Glance

To put it all together, think of market analysis as a puzzle with a few key pieces. Here’s a quick breakdown of what those pieces are and why each one is critical for your startup's survival.

| Analysis Component | What It Tells You | Why It Matters for Your Startup | | :--- | :--- | :--- | | Industry Overview | The size, growth, and trends of your market. | Helps you see if the pond you're fishing in is big enough. | | Target Audience | Who your ideal customers are, what they need, and how they behave. | Prevents you from building for "everyone" and helps you focus on people who will actually buy. | | Competitive Landscape | Who your competitors are and what their strengths/weaknesses are. | Shows you where the gaps are and how you can position your startup to win. | | Pricing & Forecasts | What customers are willing to pay and your potential revenue. | Ensures your business model is viable and helps you set realistic financial goals. |

Each of these components gives you a different lens to view your business idea, and together, they create a complete picture that guides you away from common pitfalls and toward a sustainable business.

Finding Your Niche and Sizing Up the Market

If you try to build a product for "everyone," you’ll end up building it for no one. This is the biggest trap for early-stage founders. You get excited, you see potential everywhere, but your first job is to get laser-focused on a tiny, specific group of people.

Trying to please the whole world is a surefire way to make a bland product that nobody truly loves. The goal is to find your niche—a small corner of the market with a problem so painful they’ll be thrilled to find your solution.

This is where you start connecting who your customers are with how big that group actually is.

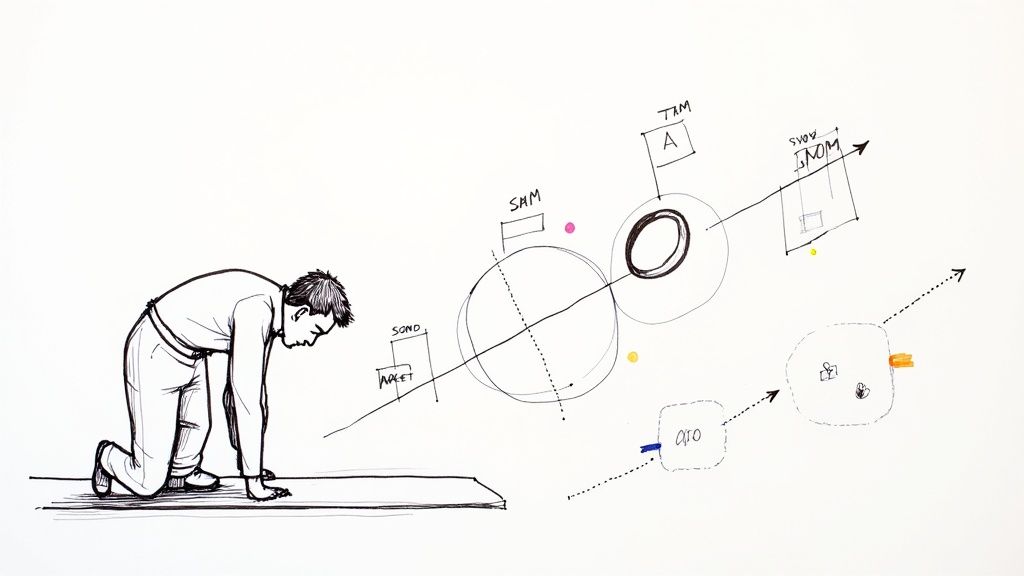

As you can see, it's a connected process. Start with your customer, and the other puzzle pieces will begin falling into place.

Creating Your Ideal Customer Persona

Before you can size up your market, you need to know exactly who you're talking to. This means creating a customer persona. No, this isn't some fluffy marketing exercise. It's about building a fictional character who represents your ideal customer so well they feel like a real person.

Give them a name. A job. A stupid pet peeve. The more real they feel, the better.

Here’s a quick example:

- Name: "Marketing Mia"

- Job: Marketing Manager at a mid-sized tech company.

- Problem: She spends hours every week manually pulling reports from five different platforms just to prove her campaigns are working. She hates spreadsheets with the fire of a thousand suns.

- Goal: She just wants a simple dashboard that shows her what’s working and what’s not, so she can spend more time on creative strategy instead of mind-numbing data entry.

Now, instead of building a vague "reporting tool," you're building a tool specifically for Mia. Every feature you consider can be run through a simple filter: "Would Mia actually use this?" See the difference? That's the power of getting specific.

Sizing the Stadium: TAM, SAM, and SOM Explained

Okay, so you know who you're targeting. Now you have to figure out how many of them are out there. This is where investors will start throwing around acronyms like TAM, SAM, and SOM. It sounds way more complicated than it is.

Let's break it down with a sports analogy:

-

TAM (Total Addressable Market): The entire stadium. Every single person who could potentially be a sports fan in the world. It’s a huge, often unrealistic number.

-

SAM (Serviceable Available Market): The section of the stadium watching your sport. Out of all sports fans, these are the ones interested in basketball. It’s the portion of the market you can realistically reach.

-

SOM (Serviceable Obtainable Market): The group of fans wearing your team’s jersey. It’s the slice of the basketball market you can realistically capture in the next few years. This is your real target.

> Don’t get hung up on precision. Your goal isn’t to get a number that’s 100% accurate. It's about making an educated guess to prove there’s a real business opportunity. Is your SOM big enough to build a company around? That’s the real question.

Finding Your Data on a Budget

So where do you get the numbers for all this? The good news is you don't need to commission a $10,000 market research report. The answers are often hiding in plain sight.

-

Dig Through Online Communities: Go hang out on Reddit, in Facebook Groups, and industry forums where your "Marketing Mias" live. What are they complaining about? The exact language they use to describe their problems is pure gold for your marketing copy.

-

Scour Public Data: Look for industry reports, government statistics (like Census data), and trade publications. These can give you solid, credible numbers to start estimating your TAM and SAM.

-

Use Smart Tools: Tools like Semrush and Ahrefs are great for seeing how many people are searching for solutions to the problem you solve, but they can be expensive. For startups on a tighter budget, a platform like already.dev can help you understand the competitive landscape and market demand without breaking the bank.

By piecing together these low-budget research methods, you can build a surprisingly accurate picture of your market. This analysis gives you the confidence to know you’re not just building something cool—you're building something people will actually pay for.

How to Analyze Your Competition Without Being Obvious

Think of your competitors as a goldmine of free research. It’s time to put on your digital trench coat and become a professional (and totally legal) spy. Competitive analysis isn't about ripping off ideas; it’s about finding the gaps they’ve left wide open for you.

And don't just look at the big dogs. Your competition is everyone—from the industry giants to the scrappy newcomers who just launched last week. You need to understand the entire playground.

The goal is to figure out their playbook so you can write a better one.

The Art of Digital Sleuthing

So, where do you start? You become a ghost in their machine. Sign up for their newsletters, follow them on social media, and maybe even buy their product. Yes, you should actually use what they're selling to see what the experience is like.

Pay close attention to the little things:

- Their Marketing Language: What words do they use over and over? Are they all about speed, price, or simplicity? This tells you who they think their customer is.

- Pricing Tiers: How do they structure their plans? The features they lock away in their most expensive packages are usually what they believe is most valuable.

- Customer Reviews: This is where the real treasure is. Read the 5-star reviews to see what people love, but spend most of your time on the 1, 2, and 3-star reviews. These are your instruction manual for building a better product.

Those complaints? That’s your to-do list. Every time a customer says, "I just wish it did X," that’s a feature you should seriously consider.

Mapping the Battlefield with a SWOT Analysis

Okay, you’ve gathered a ton of intel. Now what? Organize it with a classic but incredibly effective tool: the SWOT analysis. It’s not fancy, but it forces you to think clearly.

A SWOT analysis helps you map out the competitive landscape by looking at four key areas for each competitor (and for your own startup, too):

- Strengths: What are they genuinely good at? (e.g., massive brand recognition, dirt-cheap prices)

- Weaknesses: Where are they dropping the ball? (e.g., terrible customer service, a clunky user interface)

- Opportunities: What market trends or gaps can they (or you) jump on?

- Threats: What could knock them off their game? (e.g., new tech, changing regulations)

> Pro Tip: For every weakness you find in a competitor, ask yourself, "Could this be one of my strengths?" Their biggest flaw might just be your unique selling proposition.

This simple exercise helps you spot patterns and carve out a strategic position. The startup funding world is getting more crowded, and investors are looking for clear differentiators. The current boom in AI, where early-stage startups raised a record $32.9 billion in the first five months of the year, shows that even in hot markets, having a unique angle is everything.

Using Tools for Deeper Insights

While manual snooping is essential, a few tools can give you an edge. Big-name platforms like Ahrefs or Semrush can show you what keywords your competitors are ranking for and where their traffic comes from. Be warned, though—they can be incredibly expensive for a bootstrapped startup.

For a more founder-friendly approach, already.dev can help you uncover competitors you didn't even know you had, giving you a clear picture of their market positioning without needing a venture-sized budget. There are also great best free competitor analysis tools you can use.

The Best Market Analysis Tools for Bootstrapped Founders

Alright, let's talk tools. You don't need a Silicon Valley-sized budget to get powerful market insights. In fact, some of the best tools are completely free—they just require your time and curiosity.

This part is all about piecing together a clear market picture without draining your bank account.

Starting with the Free Stuff

Before you pull out your credit card, max out the free resources available. You can get surprisingly far with just these three.

- Google Trends: Think of this as your crystal ball for customer interest. Is your idea part of a growing trend or a dying fad? Google Trends shows you how often people are searching for specific terms over time. It's perfect for spotting patterns or just validating that people are actually looking for solutions.

- Social Media Listening: Your target customers are already talking about their problems online. You just have to find them. Go to Reddit, Facebook Groups, and X (formerly Twitter) and just listen. Search for keywords related to your industry and see what people are complaining about. Those complaints are your roadmap.

- Simple Surveys: Tools like Google Forms or Typeform offer free plans that are more than enough to get started. Create a quick, 5-question survey and share it in relevant online communities. Ask about their biggest challenges—you'll get pure gold.

These free tools are your first line of attack. They help you build a foundational understanding of the market before you commit any real cash.

The Heavy Hitters (and Their Price Tags)

Once you've got some initial traction, you might consider more powerful platforms. When you're ready to explore, it's essential to understand the full array of comprehensive marketing analysis tools available.

Industry-standard tools for SEO and competitor intelligence are usually Ahrefs or Semrush. They are fantastic for deep-diving into what your competitors are doing, what keywords they rank for, and where their traffic comes from.

The catch? They can be seriously expensive, often running hundreds of dollars per month. For a brand-new startup, that's a tough pill to swallow.

A Founder-Friendly Alternative

This is where a new generation of tools comes in. Instead of trying to be everything to everyone, they focus on doing one thing well for a specific audience: founders.

> The Takeaway: You don't need the most expensive tools; you need the right tools for your stage. Start lean, get scrappy, and only pay for software when it solves a specific, painful problem.

A platform like already.dev is built specifically for this. It helps you gather critical market and competitor data without the enterprise-level price tag. Instead of paying for a dozen features you'll never use, you get focused insights that directly inform your market analysis.

The platform is designed to quickly turn a simple idea into a structured report, saving you hours of manual digging. By focusing on the essentials, you can get the data you need to make smart decisions and get back to what matters most: building your product.

A Founder's Guide to Market Analysis Tools

To help you decide what's right for you, here’s a quick breakdown of some popular tools, what they're best for, and how they fit into a startup's budget.

| Tool | Best For | Cost | Startup-Friendly Alternative | | :--- | :--- | :--- | :--- | | Google Trends | Validating market demand and spotting trends | Free | N/A | | Ahrefs / Semrush | In-depth SEO, backlink analysis, and keyword research | $$$ (Starts at ~$100/mo) | already.dev, free Google tools | | Typeform / Google Forms | Gathering direct customer feedback and validation | Free / $$ | N/A | | Reddit / X | Listening to raw, unfiltered customer conversations | Free | N/A | | already.dev | All-in-one market & competitor analysis for founders | $ | Manual research using free tools |

Choosing the right tool at the right time is key. Start with the free options, and only invest in paid tools when you have a clear problem they can solve more efficiently than you can on your own.

Building Your Go-to-Market Strategy from Your Research

Okay, you've done the heavy lifting. You've stared at spreadsheets, dissected your competitors' every move, and built a customer persona so real you’re tempted to send them a birthday card.

But here’s the thing: all that brilliant research is just a pile of data until you do something with it.

Now for the fun part—turning those insights into a plan of attack. This is where you map out your go-to-market (GTM) strategy. Think of it as your game plan for launch, designed to make sure your big idea makes a splash, not just a quiet little ripple.

This isn’t about creating some 50-page document that gathers dust. It's about making sharp, deliberate decisions based on the evidence you've already uncovered. This is the bridge from "I have a cool idea" to "I have a real business."

Turning Insights into Action

All your research has given you the raw ingredients. Your customer persona tells you how to talk to people. Your competitor analysis shows you exactly where the gaps are. And your market sizing gives you a tangible goal to shoot for.

The aim is to weave these threads into a coherent strategy. For instance, your research might point toward an aggressive market penetration strategy to grab a foothold quickly. This is how you move from guesswork to confident execution.

The 4 Ps: A Simple Framework for Your Launch

Let's keep this practical. The classic "4 Ps of Marketing" is a straightforward and effective framework for building a GTM strategy. Here’s a startup-friendly spin on it.

1. Product (The Solution to Their Problem)

Your research should have made one thing crystal clear: what specific, nagging problem are you solving? Dig into your competitor analysis to sharpen your Unique Selling Proposition (USP). What truly sets you apart?

- Is it one killer feature nobody else has?

- Is your user experience just ridiculously simple?

- Is it your top-notch, human-powered customer support?

Your product strategy needs to zero in on what makes you the only logical choice for your ideal customer.

2. Price (The Value Exchange)

Pricing can feel like a shot in the dark, but your research gives you a flashlight. You know what your competitors are charging and, more importantly, what their customers are complaining about ("This is way too expensive for what it does!"). That's your opening.

> Your price is a marketing message. A low price screams "we're the budget-friendly choice," while a high price signals "we're the premium option." Make sure your message matches your USP.

Think about the model that makes the most sense. Freemium? Subscription tiers? A simple one-time purchase? Your research into customer expectations should guide you here.

3. Place (Where Your Customers Are)

This isn’t about a physical storefront. It's about the digital corners of the internet where your target audience lives. Where will you sell and market your product?

- Social Media: Are your people scrolling LinkedIn, getting lost on TikTok, or debating in niche Reddit forums?

- Content: Will you find them through a blog, a YouTube channel, or a newsletter?

- Partnerships: Who else already has the trust of your audience? Can you team up with them?

The golden rule is to go where your customers already are. Don’t waste energy trying to make them come to you.

4. Promotion (How You'll Spread the Word)

Time to put that customer persona to work. Use the exact language they use to talk about their pain points in your marketing copy. Speak their language, not yours.

Your promotion plan should outline your first few marketing plays. Will it be hyper-targeted social media ads? A slow-burn content strategy? Or will you go all-in on getting featured by industry influencers? You can't be everywhere at once, so pick one or two channels and own them.

A solid plan is more crucial than ever. Venture capital is getting tighter, and investors are placing their bets on startups that show up with a clear, well-researched path to growth. A sharp GTM strategy shows them you’re not just another dreamer; you’re a founder with a plan.

Common Market Analysis Questions from Founders

Alright, you've made it this far. You're either incredibly dedicated or you've skipped to the cheat sheet. Good news: this is the cheat sheet. We're about to tackle the most common questions founders have when they start digging into market analysis.

No jargon, no fluff—just straight answers.

How Often Should I Do a Market Analysis?

Think of market analysis like checking the weather. Before a long road trip, you do a detailed check. But you still glance at the daily forecast, right? It’s not a one-and-done task.

Your market is a living thing. New competitors pop up, customer tastes change, and new tech can upend everything overnight. If you only do your analysis once, you’re making future decisions based on an old, outdated map.

Here’s a good rhythm:

- The Big One: Do a massive deep dive before you launch or make a big pivot.

- Quarterly Pulse Check: Every three months, take a look around. What have your main competitors launched? Are there new conversations happening in customer communities?

- Annual Refresh: Once a year, revisit your entire analysis. The assumptions you made last year might be hilariously wrong now.

Staying on top of this means you get to adapt because you want to, not because you're forced to scramble after a competitor eats your lunch.

What if My Startup Has No Direct Competitors?

First off, congratulations on finding a unicorn! Or... maybe not. The first thing to do when you think you have zero competitors is to check again, but look harder. A true "blue ocean" market with no competition is incredibly rare.

If you still come up empty, it usually points to one of two things: you've either stumbled upon a truly revolutionary idea, or you've found a problem that isn't painful enough for people to bother solving.

Your real competition is often indirect. Ask yourself: how are people solving this problem right now? Their solution might be a clunky workaround, but that's your competition.

- Building a slick new project management tool? You’re not just fighting Asana. You're also up against spreadsheets, sticky notes, and chaotic email chains.

- Creating a beautiful meal-planning app? You're not just competing with other apps. You're up against dusty cookbooks, disorganized Pinterest boards, and the panic of someone staring into their fridge at 6 PM.

If you genuinely have zero competition, your job just got much harder. You now have the monumental task of educating an entire market that a problem they didn't know they had even exists. That’s a long, expensive road.

Can I Do Market Analysis with a Zero-Dollar Budget?

Absolutely. One hundred percent. It will take more hustle, but you can get 80% of the insights you need without spending a dime. Your two most powerful tools are free: curiosity and effort.

Forget the expensive reports. Get back to basics.

- Become a Professional Lurker: Spend hours in the Reddit, Facebook, and Slack communities where your target audience hangs out and complains. Their uncensored frustrations are your business plan.

- Use Free Google Tools: Google Trends and the Google Keyword Planner are goldmines for gauging interest and seeing the exact words people use when they're looking for solutions.

- Just Talk to People: This is the most underrated and powerful free tool of all. Find five people who fit your ideal customer profile and ask if you can buy them a coffee (or hop on a 15-minute Zoom call). Ask them about their problems, not about your brilliant solution. Their answers are worth more than any report you could buy.

The big-name tools like Ahrefs or Semrush are powerful, but they come with hefty price tags. A tool like already.dev can give you a more budget-friendly middle ground, but never underestimate what you can accomplish with pure grit.

How Do I Know When My Analysis Is Good Enough?

This is the million-dollar question, because market analysis can feel like a bottomless pit of research. The real danger is "analysis paralysis"—getting so stuck on gathering data that you never actually start building.

Your analysis is "good enough" when you can confidently answer a few core questions without thinking too hard.

> Your "Good Enough" Checklist: > * Can I describe my ideal customer in detail, including their single biggest frustration? > * Do I know who my top 3-5 direct and indirect competitors are? > * Can I name at least one major flaw for each of those competitors that I can build a strategy around? > * Do I have a gut feeling that this market is large enough to build a real, sustainable business?

If you can nail these four points, you have enough information to get moving. Your analysis is never truly "done." The goal isn't to eliminate all risk—that's impossible. The goal is to gather enough info to make an informed bet, take the leap, and start building.

You will learn infinitely more from your first ten real users than you ever will from one more spreadsheet.

Ready to stop guessing and start building with confidence? Already.dev uses AI to run a comprehensive market and competitor analysis in minutes, not weeks, giving you the clarity you need to build something people will actually buy. Get your data-driven edge today at https://already.dev.