10 Market Research Strategies That Aren't Total B.S.

Stop guessing. Here are 10 actionable market research strategies for startups, from competitor analysis to pricing. Find your edge before you build.

Let's be real: most advice on 'market research strategies' is garbage. It's a mix of MBA jargon and obvious tips like "talk to your users." Groundbreaking. The truth is, you're a smart founder with a great idea, but you're surrounded by blind spots. What if a competitor already tried your "brilliant" feature and it bombed? What if customers describe their problem using words you've never even thought of? What if you're building for a market that's too small to ever be profitable?

Bad research isn't just an academic problem; it leads to months of wasted development time, a cringe-worthy marketing budget, and a launch that lands with a quiet thud. This isn't another boring textbook list. This is a battle-tested roundup of 10 market research strategies that help you find real answers, fast. Understanding the full toolkit is your first step. Before diving into our specific, actionable strategies, getting a broader view of the 10 essential kinds of market research can provide a solid foundation for everything that follows.

We'll skip the fluff and give you the exact steps, tools, and shortcuts to validate your idea, find your unique angle, and build something people will actually pay for. We’ll cover everything from sizing your market and analyzing competitors to digging into search data and nailing your pricing. Ready to stop guessing and start knowing? Let's get into it.

1. Competitive Intelligence & Benchmarking

Think of competitive intelligence as sanctioned corporate espionage, but legal. It’s the systematic process of figuring out what your rivals are doing, what they're planning, and how customers feel about them. This isn't just a quick glance at their website; it's a deep dive into their product features, pricing, marketing campaigns, and overall strategy to find gaps you can exploit.

This is one of the most fundamental market research strategies because it directly informs your positioning. Before launching, Slack famously monitored over 200 communication tools to understand the landscape, and Figma meticulously studied Adobe and Sketch to build a better alternative. They weren’t guessing; they were making informed bets based on their competitors' strengths and, more importantly, their weaknesses.

When to Use This Strategy

This isn't a one-and-done task. You should be doing this constantly, but it's especially critical during:

- Pre-launch: To validate your idea and find a unique market position.

- Product planning: To decide which features to build next (or which to avoid).

- Fundraising: To show investors you understand the market and have a plan to win.

How to Implement It

You can go deep down the rabbit hole here, but start with these actionable steps:

- Identify Your Players: List 5-10 direct (solve the same problem for the same audience) and indirect (solve the same problem for a different audience) competitors.

- Analyze Their GTM: How do they acquire customers? Look at their ads, content, social media presence, and SEO.

- Dig into Customer Reviews: Scour sites like G2 and Capterra. This is a goldmine for understanding what users love and hate about their products.

- Track Key Changes: Monitor their pricing pages, feature release notes, and even job postings (a great tell for their product roadmap).

> Pro Tip: Don't just copy features. Instead, analyze the customer pain points revealed in competitor reviews and build solutions that address the core problem better.

Tools of the Trade

You can do this manually, but it's a soul-crushing time suck. Tools like Semrush and SimilarWeb are powerful for SEO and traffic analysis, but they can be expensive. For a more focused and automated approach, platforms like Crayon and Already.dev are designed specifically for competitive intelligence, helping you track everything from website changes to customer sentiment automatically.

2. Customer Interview & Discovery Research

If competitive intelligence is about your rivals, discovery research is about your future biggest fans. This is the art of sitting down and having real, direct conversations with your target audience to understand their world. It’s about uncovering their deepest pain points, motivations, and the "why" behind their behaviors, providing rich context that charts and graphs can never show you.

This is one of the most crucial market research strategies because it prevents you from building something nobody wants. The Airbnb founders famously went door-to-door interviewing hosts, Superhuman’s product was sculpted from hundreds of user interviews, and Zapier built its empire by systematically talking to users about their workflow headaches. They didn't just guess what people needed; they asked them directly.

When to Use This Strategy

This strategy is foundational and should be referenced often, but it's absolutely non-negotiable during:

- Idea validation: Before writing a single line of code, to confirm the problem you're solving is a real, painful one.

- Early-stage product development: To inform your MVP and core feature set.

- Pivoting or repositioning: To understand why your current approach isn't working and find a new direction.

How to Implement It

Getting good at interviews takes practice, but these steps will put you on the right track:

- Define Your Target: Who are you building for? Be specific. "Small business owners" is too broad. "Etsy sellers with 50+ monthly orders" is better.

- Find & Schedule: Recruit interviewees from communities like Reddit, LinkedIn, or niche forums. Offer a small gift card for their time.

- Ask Open-Ended Questions: Avoid "yes/no" questions. Instead of "Would you use an app for that?" ask, "Tell me about the last time you struggled with [problem]."

- Listen, Don't Pitch: Your goal is to learn, not to sell. Talk less, listen more. Record the call (with permission) so you can focus on the conversation.

> Pro Tip: Pay close attention to the exact words and phrases customers use to describe their problems. This language is pure gold for your future website copy, ads, and SEO.

Tools of the Trade

You can manage this process with simple tools like Calendly for scheduling and Otter.ai for transcribing. As you scale, dedicated user research platforms like UserTesting or Maze can help you recruit and manage participants, though they can become costly. For organizing your findings, a simple spreadsheet works, but dedicated tools like Dovetail can help you tag and analyze qualitative data more effectively.

3. Market Sizing & TAM Analysis

Think of this as the business equivalent of asking, "how big is the pond we're fishing in?" Market sizing is the process of estimating the total potential revenue you could make if you captured 100% of a specific market. It’s a reality check that prevents you from building something amazing for a market of ten people and a dog.

This is one of the most critical market research strategies for anyone seeking funding. Investors don't just want to see a cool product; they need to see a massive potential return on their investment. To accurately gauge the potential scale of your business, a clear understanding of your Total Addressable Market (TAM) is essential. Stripe famously did this by sizing the global payment processing market at over $500 billion, which made their ambitions feel much more credible.

When to Use This Strategy

While it's always good to have a sense of your market size, it's absolutely non-negotiable during:

- Fundraising: This is table stakes for any pitch deck. It's often the first slide investors look for after the problem.

- Initial Idea Validation: Before you write a single line of code, you need to know if the market is big enough to sustain a business.

- Strategic Pivots: If you're considering entering a new vertical or geography, a TAM analysis tells you if the move is worthwhile.

How to Implement It

You can approach this from two directions: top-down (using industry reports) and bottom-up (calculating from potential customers). The best approach is to do both and see if they converge.

- Define Your Market: Get hyper-specific. Are you selling to all SMBs, or just US-based tech startups with 50-200 employees?

- Top-Down Approach: Find industry reports from sources like Gartner or IDC. If they say the "Global CRM market is $50B," start there and narrow it down to your niche.

- Bottom-Up Approach: Calculate the total number of potential customers and multiply it by your potential annual revenue per customer. (e.g., 100,000 potential companies x $5,000/year = $500M TAM).

- Calculate SAM and SOM: Determine your Serviceable Addressable Market (SAM, the portion you can reach) and Serviceable Obtainable Market (SOM, what you can realistically capture in the first few years).

> Pro Tip: Don't just present one big, scary number. Segment your TAM by customer type, geography, and use case to show you have a focused go-to-market plan.

Tools of the Trade

You'll be doing a lot of Googling and spreadsheet work here. Data sources like Gartner, IDC, and PitchBook are industry standards but can be eye-wateringly expensive. For more accessible data, check government statistics (e.g., U.S. Census Bureau), industry association reports, and public company financial filings. While not a direct market-sizing tool, platforms like Already.dev can help you analyze competitor positioning within that market to understand who is capturing what share.

4. Keyword & SEO Research Strategy

Think of every Google search as a tiny, honest confession. Keyword research is the art of listening to these confessions at scale to understand what your customers actually want, in their own words. It goes beyond simple marketing by revealing the language people use to describe their problems, the questions they're asking, and the solutions they're looking for, often before they even know your product category exists.

This is a powerful market research strategy because it uncovers raw, unfiltered customer intent. Zapier didn't invent the term "no-code automation," but by tapping into emerging search trends, they captured an entire movement. Similarly, Notion masterfully ranks for "Notion alternative" and keywords related to its competitors, turning their rivals' brand recognition into a source of leads. This is how you find pockets of demand your competitors have completely missed.

When to Use This Strategy

SEO research is a continuous engine for growth, but it's especially vital during these stages:

- Go-to-Market (GTM) Planning: To discover the most effective language for your messaging and find content gaps you can own from day one.

- Content Strategy: To build a roadmap of blog posts, landing pages, and resources that directly answer your audience's questions.

- Product Expansion: To gauge demand for potential new features or use cases based on what people are searching for.

How to Implement It

Diving into keyword data can feel overwhelming, but a focused approach works best:

- Map "Problem" Keywords: Forget your solution for a minute. List the pain points your customers face. What would they Google if they didn't know your product existed? (e.g., "how to share meeting notes with team").

- Analyze Competitor Gaps: Use tools to see which keywords your competitors rank for, but more importantly, which valuable keywords they don't. Look for high-intent, low-competition phrases.

- Focus on Search Intent: A keyword's volume is vanity; its intent is sanity. Understand if the searcher wants to learn (informational), compare (commercial), or buy (transactional).

- Target Long-Tail Keywords: Go after specific, multi-word phrases (e.g., "CRM for small law firms") that signal stronger intent and have less competition than broad terms.

> Pro Tip: Don't just look at what people search for. Use a tool that shows you the "People Also Ask" and "Related Searches" sections of Google results. This is a direct pipeline into your customers' minds.

Tools of the Trade

Heavy-hitters like Ahrefs and Semrush are the industry standard for deep SEO analysis, but their price tags can be intimidating for early-stage teams. For a more streamlined and affordable approach, you can combine free tools like Google Keyword Planner with platforms like Already.dev to keep an eye on competitors' content and keyword strategies without breaking the bank.

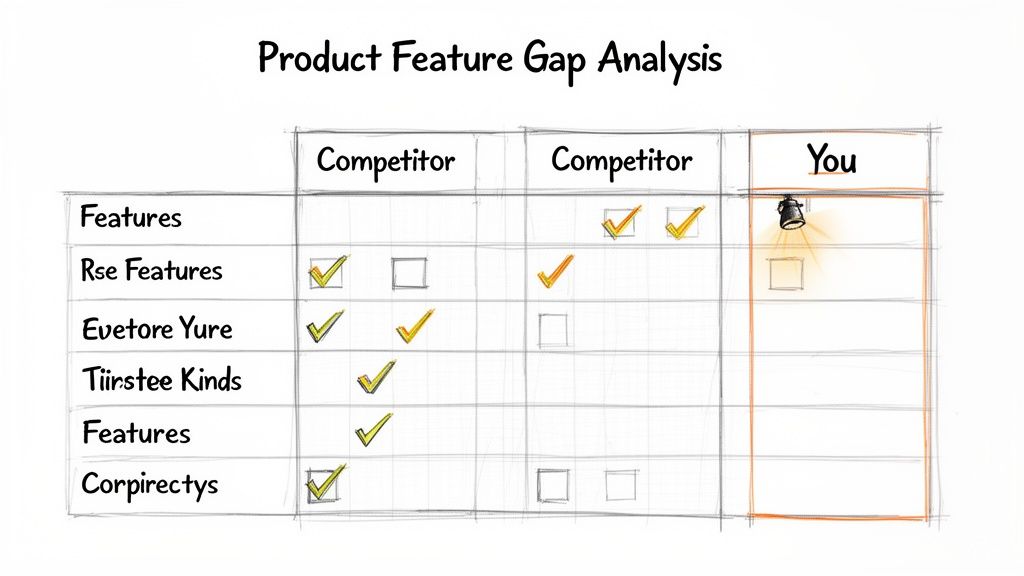

5. Product Feature Gap Analysis

If competitive intelligence is espionage, then feature gap analysis is building the dossier on your rival's arsenal. It’s a methodical process of mapping every feature your competitors offer against what customers actually need. The goal is to find the “gaps”: valuable features the market is screaming for that no one has built yet.

This is one of the most tactical market research strategies for informing your product roadmap. Figma created a detailed feature matrix comparing itself to Adobe XD and Sketch, not to copy them, but to identify the collaborative and web-native features they were missing. This analysis directly highlighted their biggest opportunities for differentiation and market capture.

When to Use This Strategy

Feature gap analysis is your go-to move when the market is crowded and you need a sharp edge. It's most critical during:

- Product planning: To prioritize your roadmap with features that will actually win customers.

- Competitive repositioning: When you need to find a new angle to attack entrenched incumbents.

- User onboarding & retention: To understand which missing features cause churn or prevent signups.

How to Implement It

You can easily get lost in an endless spreadsheet. Keep it focused and actionable with these steps:

- Create a Feature Matrix: List your top 3-5 competitors in columns. List all relevant features down the rows.

- Categorize Features: Group features into logical categories like "Core Functionality," "Collaboration," or "Integrations." This makes the analysis much cleaner.

- Map Competitor Offerings: Go through each competitor and mark which features they have. Be brutally honest about where your own product stands.

- Identify the Gaps: Look for two things: "table stakes" features you're missing and, more importantly, features no one has but that customer interviews or reviews indicate are high-value.

> Pro Tip: Don't just analyze feature availability. Weight each feature by customer importance. A missing "nice-to-have" feature is noise; a missing "must-have" that a competitor offers is a critical vulnerability.

Tools of the Trade

Manually tracking competitor features is a recipe for insanity, as their products change constantly. You can mine user reviews on G2 and Capterra for feature requests, but it's a grind. For a smarter, automated approach, platforms like Already.dev are designed to generate these feature grids automatically and monitor competitors for new releases, saving you from the mind-numbing manual work.

6. Pricing Strategy & Market Positioning Research

Pricing isn't just a number on a page; it's a direct signal about your product's value, your target audience, and your place in the market. This research goes beyond just spying on competitor price tags. It's about dissecting their entire pricing model, understanding what customers are truly willing to pay, and aligning your price with the value you deliver.

This is one of the most critical market research strategies because getting it wrong can cripple your growth. Slack's per-user, tiered pricing scaled perfectly from tiny teams to giant enterprises, while Notion attracted a massive user base with a generous free plan and a simple, low-cost unlimited option. Their pricing wasn’t an afterthought; it was a core part of their growth engine, informed by a deep understanding of customer value.

When to Use This Strategy

Pricing is a dial, not a switch. You should be thinking about it constantly, but it's most crucial during these moments:

- Pre-launch: To establish your initial market position and avoid anchoring your product at a price that's too low.

- After finding product-market fit: When you have a stable user base and can start optimizing for revenue.

- When entering new markets: To adapt your pricing to different customer segments or geographic expectations.

How to Implement It

You don't need a complex algorithm to get started. Focus on these fundamental steps:

- Map Competitor Models: Don't just list prices. Analyze how they charge. Is it per-user, usage-based, or a flat fee? What features are included in each tier?

- Conduct Willingness-to-Pay (WTP) Surveys: Directly ask segments of your target audience what they would pay for your solution using methods like the Van Westendorp Price Sensitivity Meter.

- Analyze Value Metrics: Identify the core action or feature that provides the most value to customers (e.g., contacts for a CRM, projects for a PM tool). This should be the basis of your pricing scale.

- A/B Test with Small Segments: Roll out different price points or package structures to a small percentage of new users to gather real-world data on conversion rates.

> Pro Tip: Your first price will almost certainly be wrong. Frame your pricing as an experiment and plan to iterate on it every 6-9 months based on customer feedback and performance data.

Tools of the Trade

You can gather a lot of this data manually through surveys and competitor site-crawling. For more sophisticated analysis, tools like ProfitWell by Paddle offer incredible resources and analytics for SaaS pricing optimization. For tracking competitor pricing page changes and feature announcements automatically, competitive intelligence platforms like Already.dev can save you from the manual grind of checking websites every week.

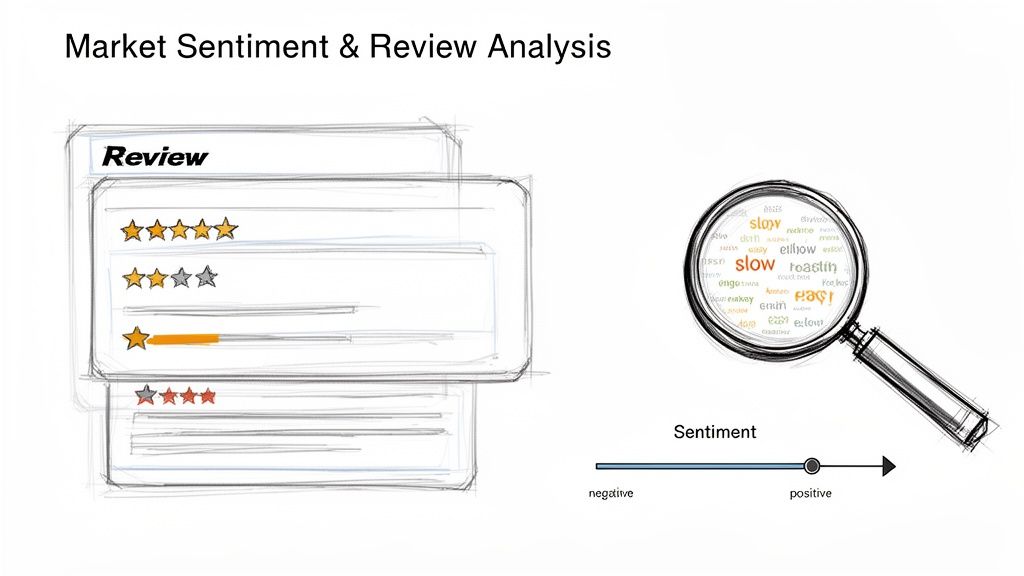

7. Market Sentiment & Review Analysis

This strategy is like eavesdropping on the entire market at once. It involves mining publicly available customer feedback from review sites, social media, and online communities to understand what people really think about your product, your competitors, and the problems they face. You’re looking for patterns in praise, complaints, and feature requests to find your next big opportunity.

This is one of the most powerful market research strategies because it provides raw, unfiltered customer feedback at scale. Before Notion became a giant, its team could have analyzed Evernote reviews to see users begging for more flexibility and a cleaner UI. Similarly, Linear’s early success was fueled by developers publicly complaining about Jira's clunky, slow interface on platforms like Twitter and Hacker News. They didn't just build a new tool; they built an answer to a very loud, public pain point.

When to Use This Strategy

Sentiment analysis is a continuous pulse-check on your market, but it’s most crucial during:

- Idea validation: To discover if the problem you want to solve is a real, urgent pain for a vocal audience.

- Feature prioritization: To identify which missing features cause the most frustration for your competitors' users.

- Brand and messaging tests: To see how the market perceives your positioning versus your rivals.

How to Implement It

You can easily get lost in the noise. Focus your efforts with these steps:

- Map Your Listening Posts: Identify where your target audience hangs out. This includes review sites like G2 and Capterra, forums like Reddit and Hacker News, and social platforms like Twitter and LinkedIn.

- Look for Emotional Keywords: Search for terms like "frustrating," "love," "wish," and "alternative to" alongside competitor names. These are flags for strong opinions.

- Categorize the Feedback: Group feedback into themes: bugs, feature requests, pricing complaints, or customer support issues. This reveals systemic weaknesses.

- Analyze Sentiment Trends: Is sentiment for a competitor dropping after a recent price change or feature removal? That's your cue to make a move.

> Pro Tip: Don't just count the number of good or bad reviews. Focus on the intensity and specificity of the complaints. A single, detailed post about a critical workflow issue is worth more than ten generic one-star ratings.

Tools of the Trade

Manual analysis is a great start, but it doesn’t scale. Tools like Brandwatch and Sprout Social offer powerful social listening capabilities but come with a hefty enterprise price tag. For a more startup-friendly approach, platforms like Already.dev can help you automate the process of tracking customer sentiment and analyzing competitor reviews without breaking the bank.

8. Emerging Trends & Innovation Scanning

If competitive intelligence is about what your rivals are doing now, innovation scanning is about what the entire market will be doing next. It's the forward-looking practice of identifying emerging technologies, new business models, and macro-level shifts in customer behavior. This isn't about chasing fads; it's about anticipating the wave before it forms.

This is one of the more advanced market research strategies, but it’s how you avoid becoming obsolete. Think about how the rise of AI forced nearly every SaaS company to develop an AI-powered feature or how async-first work tools exploded post-COVID. Companies that were already tracking these signals were years ahead of the curve, while others were left scrambling to catch up.

When to Use This Strategy

This is an ongoing "always-on" activity for any strategic team, but it’s especially vital during:

- Annual and quarterly planning: To inform your long-term roadmap and strategic bets.

- New product development: To ensure what you're building will be relevant in 2-3 years, not just today.

- Market expansion: To identify new, untapped markets created by technological or cultural shifts.

How to Implement It

You don't need a crystal ball, just a systematic process for gathering intel:

- Follow the Money: Track venture capital funding trends on sites like Crunchbase and PitchBook. See where the "smart money" is placing its bets to understand which sectors are heating up.

- Read Industry Reports: Subscribe to publications from Gartner, Forrester, and CB Insights. They literally get paid to analyze and predict future trends.

- Monitor Patent Filings: Keep an eye on the patents your biggest competitors are filing. It’s a direct window into their future innovation pipeline.

- Study the Failures: Look for startup post-mortems. Understanding why others failed (like Quip's struggle with enterprise collaboration post-Salesforce acquisition) provides invaluable lessons on market pitfalls.

> Pro Tip: Create a "Trend Radar" and review it quarterly. Map trends based on their potential impact and your company's ability to act on them. This turns abstract scanning into a concrete strategic tool.

Tools of the Trade

You can piece this together manually, but it’s a full-time job. Platforms like CB Insights and Crunchbase are fantastic for tracking funding and startup activity, but they’re enterprise-grade and priced accordingly. While not its primary function, a platform like Already.dev can help you monitor signals from emerging competitors who are often on the bleeding edge of new trends, giving you a ground-level view of innovation as it happens.

9. Customer Segmentation & Targeting Research

Trying to sell to "everyone" is a surefire way to sell to no one. Customer segmentation is the antidote to this common startup disease. It’s the process of dividing your potential market into distinct groups based on shared characteristics like demographics, behaviors, or needs, and then deciding which of these groups to go after.

This is a critical market research strategy because it forces focus. Instead of building a generic product, you build a specific solution for a specific group of people with a specific problem. Slack didn't initially target all of corporate America; they focused on engineering and tech teams. Figma won by zeroing in on UI/UX designers, not every creative professional. They picked a beachhead and dominated it before expanding.

When to Use This Strategy

Segmentation research is foundational and should inform your entire go-to-market strategy. It's especially vital during:

- Pre-launch: To define your Ideal Customer Profile (ICP) and avoid boiling the ocean.

- Go-to-Market planning: To create messaging and marketing campaigns that actually resonate.

- Scaling: To identify adjacent segments for future growth and product expansion.

How to Implement It

Get granular and avoid broad strokes. Your goal is to find an underserved niche with a burning problem.

- Brainstorm Segments: Identify 3-5 potential customer groups with distinct needs. Think about roles (engineers vs. marketers), company size (startups vs. enterprise), or user behavior (power users vs. casual users).

- Size Them Up: Research the size, growth rate, and budget potential of each segment. Is the market big enough to be interesting?

- Analyze Competitors: Figure out which competitors are already serving each segment. Look for the groups that are ignored or poorly served by existing players.

- Talk to People: Interview a handful of people from each of your top segments. Dig into their specific pain points and see if your solution is a "must-have" for them.

- Prioritize & Position: Choose the segment where the pain is highest and the competition is lowest. Tailor your entire product positioning and messaging specifically for them.

> Pro Tip: Don't just segment by demographics. Use "Jobs-to-be-Done" (JTBD) theory to segment by the outcomes customers are trying to achieve. It’s a much more powerful way to understand their true motivations.

Tools of the Trade

You can start this process with user interviews and survey tools like SurveyMonkey or Typeform. As you grow, CRM data from HubSpot or Salesforce becomes a goldmine for behavioral segmentation. For a more automated way to understand how your product usage maps to different customer segments, product analytics platforms like Amplitude and Mixpanel are the standard, though they can get complex and pricey for early-stage teams.

10. Go-to-Market & Distribution Channel Research

Having a great product is only half the battle; how you get it into customers' hands is the other half. This research strategy is about reverse-engineering your competitors' customer acquisition models and finding your own unique path to market. It’s about figuring out which channels they use, what their partnerships look like, and where the untapped opportunities are for you to swoop in.

This is one of the most critical market research strategies because it directly impacts your growth engine and financial model. Slack’s viral, team-by-team adoption was a stark contrast to the top-down enterprise sales common at the time. Similarly, Zapier grew exponentially by partnering with thousands of other SaaS companies, turning them into a massive, built-in distribution network. They didn't just build a product; they built a GTM machine.

When to Use This Strategy

Your go-to-market strategy will evolve, so this research isn't a one-off project. It's especially crucial during:

- Pre-launch: To build a realistic customer acquisition forecast and budget.

- First 12 months: To test and validate which channels actually work for your audience.

- Scaling: To identify new, more efficient channels to fuel growth beyond your initial user base.

How to Implement It

Get ready to put on your detective hat. Here’s a simple process to get started:

- Map Competitor Channels: Where do they get customers? Analyze their ads, SEO strategy, content marketing, and social media presence. Are they product-led, sales-led, or something in between?

- Analyze Partnership Ecosystems: Look at their integration marketplaces and partner pages. Who are they working with? This reveals their distribution strategy.

- Benchmark GTM Metrics: Research industry benchmarks for Customer Acquisition Cost (CAC) and Lifetime Value (LTV). This helps you understand if a channel is financially viable.

- Interview Customers: Ask new users how they found you and what other tools they considered. This is direct, unfiltered feedback on what’s working.

> Pro Tip: Look at your competitors' job postings. If they're suddenly hiring a dozen "Channel Partner Managers," you've just discovered a major shift in their go-to-market strategy.

Tools of the Trade

You can manually track ads and partnerships, but that gets old fast. SEO tools like Semrush or Ahrefs are great for analyzing traffic sources, though their subscriptions can be costly. For a more automated and focused approach, a competitive intelligence platform like Already.dev can help you monitor competitor partnerships, GTM messaging, and website changes without the manual grunt work.

10-Point Comparison of Market Research Strategies

| Method | Implementation Complexity 🔄 | Resources & Speed ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ | |---|---:|---:|---|---|---| | Competitive Intelligence & Benchmarking | Medium–High; continuous monitoring, tooling & processes | Medium resources (tools + analysts); fast with automation ⚡ | Clear competitor maps, pricing signals, timely alerts | Pre-launch competitor mapping; pricing moves; roadmap validation | Actionable market context; avoids duplicate builds; ⭐⭐⭐⭐ | | Customer Interview & Discovery Research | Medium; requires skilled interview design & synthesis | Low–Medium (researcher time); slow per cycle ⚡ | Deep qualitative insights; real customer language & motivations | Early product validation; positioning; JTBD discovery | Validates assumptions; uncovers hidden needs; ⭐⭐⭐⭐ | | Market Sizing & TAM Analysis | Medium; data collection and modeling across sources | Medium (reports, data synthesis); moderate speed ⚡ | Quantitative TAM/SAM/SOM estimates for prioritization | Fundraising; go/no‑go decisions; market prioritization | Investor-ready metrics; segment focus; ⭐⭐⭐ | | Keyword & SEO Research Strategy | Low–Medium; tooling + content planning | Low resources (SEO tools + content); long-term ROI ⚡ | Search demand signals; content opportunities and organic growth | Content strategy; messaging; bootstrapped user acquisition | Reveals customer search language; sustainable traffic; ⭐⭐⭐ | | Product Feature Gap Analysis | Low–Medium; feature inventory and matrixing | Low–Medium (competitor data + customer input); quick to surface gaps ⚡ | Prioritized feature list; differentiation opportunities | Roadmap planning; avoid building unwanted features | Identifies table-stakes vs differentiators; saves dev time; ⭐⭐⭐ | | Pricing Strategy & Market Positioning Research | Medium–High; experiments, WTP studies, elasticity modeling | Medium (surveys, tests); iterative adjustment required ⚡ | Optimized pricing, packaging, improved revenue potential | Monetization launch; tier design; revenue optimization | Aligns price to perceived value; increases monetization; ⭐⭐⭐⭐ | | Market Sentiment & Review Analysis | Low–Medium; scraping + sentiment analysis | Low (aggregation tools); fast collection, analysis may require manual review ⚡ | Authentic pain points, praise patterns, positioning gaps | Messaging refinement; competitor weakness discovery | Captures real customer voice; early trend signals; ⭐⭐⭐ | | Emerging Trends & Innovation Scanning | High; broad horizon scanning and interpretation | High (reports, experts, patent tracking); slow long‑term payoff ⚡ | Strategic foresight; future feature/market signals | Long-term roadmap, R&D, partnership scouting | Early opportunity ID; avoids repeat mistakes; ⭐⭐⭐ | | Customer Segmentation & Targeting Research | Medium; segmentation modeling and validation | Medium (data + interviews); moderate speed ⚡ | Distinct target segments, TAM by segment, CAC estimates | GTM targeting; prioritize beachhead segments | Improves PMF and lowers CAC; focused growth; ⭐⭐⭐⭐ | | Go-to-Market & Distribution Channel Research | Medium–High; cross-functional channel analysis | Medium (data, interviews, tracking); variable speed ⚡ | Channel mix optimization, CAC/LTV insights | Launch strategy; scaling acquisition; partner go‑to‑market | Reveals cost‑effective channels and partnerships; ⭐⭐⭐ |

Your Next Move: Turn This Research Into a Real Advantage

Alright, we’ve covered a ton of ground. From deep dives into your competitors' playbooks to decoding the exact words your customers use in Google, you now have a full arsenal of powerful market research strategies at your disposal. If you’re feeling a bit overwhelmed, that’s normal. The sheer volume of data you could be collecting is infinite.

But here’s the secret: the goal isn’t to boil the ocean. It’s to find the right temperature for your next swim. The biggest mistake founders and product managers make is either analysis paralysis (researching forever) or "gut-feel" gambling (researching nothing). The sweet spot is in the middle: targeted, decisive research that answers your most urgent questions right now.

From List to Action: Prioritizing Your Research

Don't try to implement all ten of these market research strategies at once. That's a surefire recipe for burnout and a hard drive full of spreadsheets you’ll never look at again. Instead, treat this list like a menu. What's the most pressing "hunger" your business has today?

- If you're constantly getting blindsided by competitors... start with Competitive Intelligence and Product Feature Gap Analysis. Understand their strengths so you can build on your own unique advantages.

- If your user growth is flat and you're not sure why... dive deep into Customer Interviews and Keyword & SEO Research. You need to hear directly from your market and understand the problems they are actively trying to solve.

- If you're preparing to pitch investors or enter a new market... your focus should be on Market Sizing (TAM/SAM/SOM) and Go-to-Market Channel Research. You need to prove the opportunity is massive and you have a realistic plan to capture it.

- If your pricing feels like a wild guess... it's time for dedicated Pricing Strategy Research and Market Sentiment Analysis. See what customers are willing to pay and how they perceive the value you offer versus the alternatives.

Pick one or two strategies that directly address your biggest blind spot. Master them, act on the insights, and then move on to the next one when a new business question arises.

The Real Goal: Making Smarter, Faster Decisions

Market research isn't an academic exercise. It's a tool for de-risking your business. Every insight you gain from these strategies helps you kill a bad idea faster, double down on a winning feature, or pivot your messaging before you spend thousands on ads that don't convert. It's about replacing "I think" with "I know, because..."

Many of the most powerful strategies, especially deep competitor analysis and keyword research, can be incredibly time-consuming and expensive. Tools like Ahrefs and Semrush are fantastic, but their costs can add up quickly for an early-stage team. This friction often leads to teams skipping the research altogether. We believe that's a critical error. That’s why we built Already.dev—to automate the most painful, manual parts of this process. It can turn 40 hours of tedious competitor discovery and feature mapping into a comprehensive report in just a few minutes.

Ultimately, the best market research strategies are the ones you actually use. They should lead to action, not just a beautifully formatted report. Use this guide to stop guessing, build with confidence, and create something the market can't help but notice. You've got the playbook; now it's time to run your play.

Tired of spending weeks on manual research? Let Already.dev handle the heavy lifting by automating your competitive analysis, market sizing, and feature gap reports. Get the strategic insights you need in minutes, not months, by visiting Already.dev and running your first report for free.