Track Competitors Prices Without Losing Your Mind

Stop guessing and start winning. Learn how to track competitors prices with this simple guide, using smart tools to save time and make more money.

If you want to get a real handle on your market, you need a system that automatically snoops on your competitors' pricing pages and pings you when something changes. We're not talking about a once-a-month manual check-in. This is about getting real-time data to sharpen your own strategy, stop losing customers, and quit leaving money on the table.

Why Bother Tracking Competitor Prices Anyway?

Let's be real, you have a million other things on your plate. Is spying on your competition’s pricing page really worth the effort?

Absolutely. Flying blind on pricing is one of the fastest ways to lose sales or accidentally price yourself out of the market. It’s like driving on the highway with your eyes closed—sure, you might be fine for a second, but it’s not a sustainable strategy.

This isn’t about boring theory. It's about seeing how dynamic pricing directly impacts your bottom line, helps you react before customers churn, and gives you the confidence to price your product right.

The Real Cost of Guessing

When you don’t track your competitors' prices, you're just guessing. You might think your new "Pro" tier is a steal at $99/month, but what if your main rival just launched a similar plan for $79? Suddenly, your amazing deal looks overpriced, and you start losing prospects without even knowing why.

This isn't just a hypothetical. In the hyper-competitive SaaS world, tracking prices is a survival tactic. Companies actively monitoring their rivals can achieve up to 5-10% higher profit margins than those stuck with static models.

For startups, a single pricing mistake can mean losing market share overnight. In fact, one analysis found that startups ignoring this data lose an average of $1.2 million in potential revenue over just two years. It's a crucial survival tactic for a reason.

> Think of it this way: Your competitors are constantly talking to your potential customers through their pricing. Are you listening to the conversation? If not, you’re letting them set the terms for the entire market.

What You Gain from Paying Attention

Keeping an eye on competitor pricing isn’t just about playing defense; it’s about going on offense. It gives you the intelligence to make smarter, more strategic moves.

- Spot Market Gaps: You might discover there’s no solid mid-tier option in your niche, creating a perfect opening for you to launch a new, highly profitable plan.

- Prevent Customer Churn: When a competitor runs a huge promotion, you'll know instantly. This gives you the chance to decide whether to counter with your own offer to keep your customers happy.

- Price with Confidence: Knowing where you stand allows you to justify your value. If you’re more expensive, you can clearly articulate why—better features, superior support, a stronger community, you name it.

Ultimately, tracking competitor prices moves you from guessing to knowing. It transforms pricing from a shot in the dark into a data-driven strategy.

Your Spy Kit For Tracking Competitor Prices

Alright, you're sold on the idea of keeping tabs on the competition. But how do you actually do it without hiring a team of private investigators or chaining an intern to a desk to manually refresh pricing pages all day?

Let's get one thing straight: manually tracking this stuff in a spreadsheet is a terrible, terrible idea. It's a soul-crushing, error-prone task that becomes outdated the second you close the tab. We're skipping that entirely and jumping straight to the real-deal options.

Think of this section as your guide to tooling up for some serious competitive intel.

The Big Guns (And Their Big Bills)

First up, you have the giant, all-in-one marketing platforms. I’m talking about tools like Ahrefs or Semrush. They're incredibly powerful, no doubt, and can give you a firehose of data on keywords, backlinks, and traffic. Some even have features to help track competitor prices, but let's be honest—it’s rarely their main focus.

The catch? They can be expensive. Like, really expensive. If you’re a startup or a smaller team, dropping hundreds or even thousands of dollars a month on a tool you'll only use 10% of is just bad business. It’s like buying a Formula 1 car just to drive to the grocery store. Overkill. As a great alternative, a more focused tool like Already.dev can give you exactly what you need without the bloated feature set and scary price tag.

A No-Fluff Comparison Of Price Tracking Methods

Here's a quick breakdown of the most common ways to track competitor prices, focusing on what really matters: cost, effort, and data quality.

| Method | Best For | Typical Cost | Effort Level | Key Downside | | :--- | :--- | :--- | :--- | :--- | | Manual Tracking | Very small-scale projects (1-2 competitors) | Your time | Very High | Prone to errors, not scalable, instantly outdated | | DIY Web Scraping | Teams with dedicated developers & legal counsel | Developer salary | High | Legal risks, site changes break scripts, requires constant maintenance | | All-in-One Suites | Large enterprises with huge marketing budgets | $500 - $2,000+/mo | Low | Expensive, features are often generalized, not price-specific | | Dedicated Trackers | Most businesses needing focused, reliable data | $50 - $500/mo | Very Low | Can be overkill if you only need one-off reports |

As you can see, for most people, the sweet spot is a dedicated tool that gets the job done without the drama or the enterprise-level price tag.

Smarter, Focused Tools For The Job

Instead of overspending or getting tangled in a mess of custom code, a much better approach is to use a tool built specifically for competitive intelligence. You need something that automates the grunt work. A crucial part of your 'spy kit' involves gathering information directly from your competitors, often found by analyzing competitor pricing plans to see how they structure their tiers and features.

This is where a platform like Already.dev really shines. It's designed to turn what used to be a 40-hour manual slog into a quick, clean report. You just tell it what you’re looking for, and it does all the heavy lifting for you.

Instead of just scraping a single page and calling it a day, this kind of tool understands the context. It compares features, positioning, and pricing across the market, giving you a much richer picture.

This automated approach gives you a clear map of the tool landscape, so you can pick the right weapon for your budget and needs. For a deeper dive, check out our guide on the best competitor analysis tools to see a full comparison.

> The Goal: Don't just collect prices. Collect intelligence. The right tool won’t just tell you what your competitor charges; it will help you understand why and how you fit into the bigger picture.

Ultimately, your spy kit should make your life easier, not add another complicated piece of software you have to manage. Find a tool that’s fast, focused, and gives you actionable insights you can use today—not a mountain of data you’ll get around to sifting through "someday."

Let's Build Your First Price Tracking System

Alright, enough with the theory. It's time to roll up our sleeves and actually build this thing. This is where the magic happens—we’re going to take all these concepts and turn them into a real, working system that gets you the intel you need.

First, Nail Down Your "Why"

Before you write a single line of code or sign up for a tool, you have to get crystal clear on what you’re trying to accomplish. Seriously. Why are you even doing this?

Are you constantly losing deals to a cheaper alternative? Are you trying to find an unserved niche in the market? Or do you just have a nagging feeling that you're priced too high (or too low)? Your goal will shape every single decision you make from here on out. Don't just tell yourself, "I need to track competitor prices." That's way too vague.

> Get Specific With Your Goal: A weak goal is "track competitor pricing." A strong, actionable goal sounds more like this: "I need to know if our 'Pro' plan is priced more than 10% higher than our top three competitors' equivalent plans, and I want an alert within 24 hours of any change."

Who Are You Really Competing Against?

Next up: who are we actually tracking? This sounds obvious, but it’s a place where a lot of people go wrong. You can't just list the two big names everyone in your industry talks about. The real competitive landscape is often much messier.

Your biggest threat might not be the established giant; it could be a scrappy startup that just launched or even a completely different type of product that solves the same core problem.

Sit down and make a real list. Think beyond the obvious.

- Direct Competitors: These are the companies selling a nearly identical product to your exact audience. You know who they are.

- Indirect Competitors: They tackle the same customer pain point but from a different angle. Think of how a dedicated invoicing tool competes with the invoicing feature inside a full accounting suite.

- Aspirational Competitors: Who's the market leader you admire? Even if you're not directly competing today, watching their pricing moves can give you a roadmap for your own future.

Once you’ve got that list, it’s time to figure out what data points you actually need to grab. And trust me, it’s about a lot more than just the price.

Pinpoint the Data That Actually Matters

Just grabbing the monthly price is a rookie mistake. A price without context is just a number; it doesn’t tell you anything about value. To get a real, apples-to-apples comparison, you need to dig a little deeper.

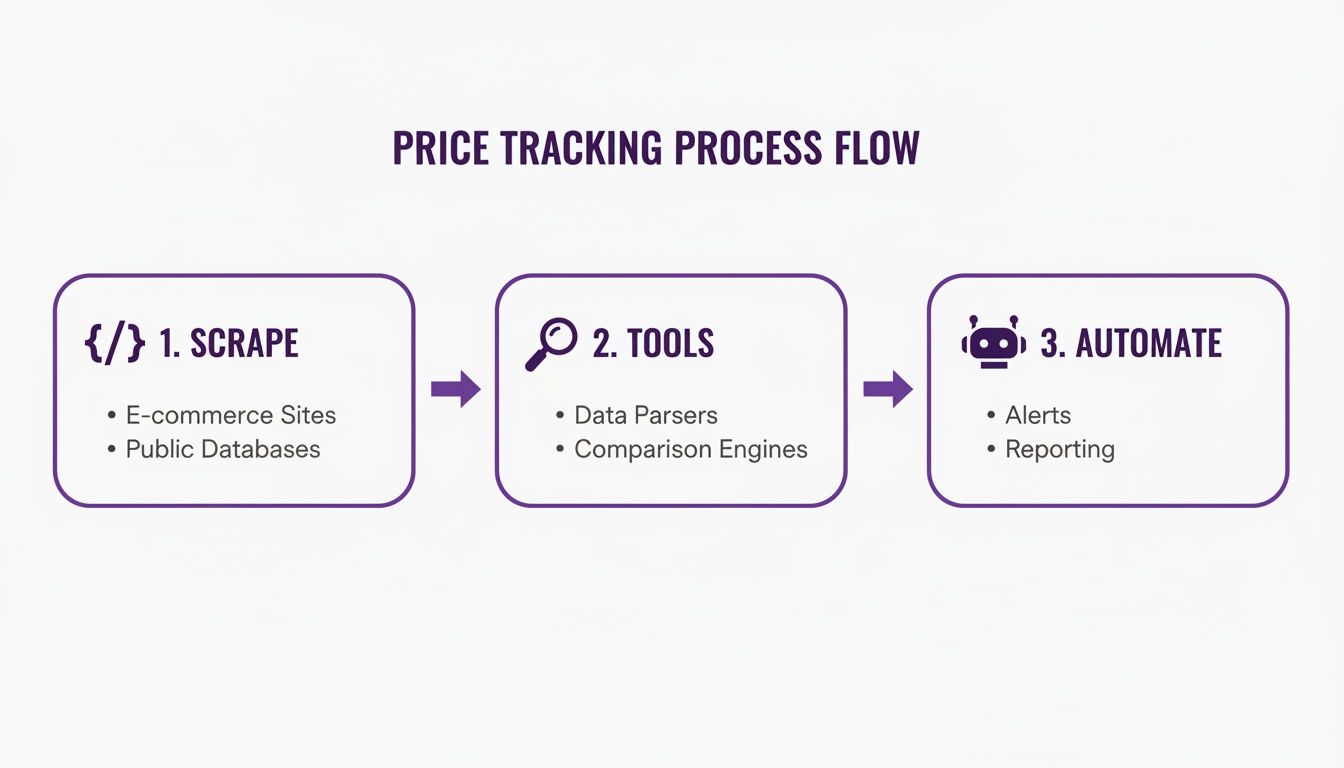

The whole process really breaks down into three core phases: getting the data, analyzing it, and then automating the reporting so you can focus on the strategic side of things.

This flow shows that the real power isn’t just in scraping the data—it's in building a repeatable system that consistently feeds you insights.

To make that happen, you need to be methodical. Whether you’re using a simple spreadsheet or a purpose-built tool like Already.dev, you need to capture the right details for each competitor's plan.

At a minimum, you should be tracking:

- Plan Name: What do they call their different tiers? ("Starter," "Growth," "Business," etc.)

- Monthly Price: The standard, no-commitment cost.

- Annual Price (and Discount): The yearly cost and, more importantly, the percentage discount offered. This is a huge conversion lever.

- Core Features: What are the top 3-5 things a customer gets with that plan? What are the key value propositions?

- Usage Limits: This is where the "gotchas" are often hidden. Are there caps on users, API calls, contacts, or projects?

- Hidden Fees: Always look for things like mandatory setup fees, implementation costs, or paid add-ons that aren't obvious on the pricing page.

Getting this level of detail is what separates a quick, surface-level look from true competitive intelligence. It allows you to build a genuine value matrix, not just a simple price list. Do this right, and you’ll have a rock-solid foundation for making much smarter pricing decisions.

Turning Pricing Data Into Smart Decisions

Collecting data is actually the easy part. A spreadsheet full of prices is just a sad collection of numbers until you actually do something with it. This is where you get to transform all that raw data into strategic moves that really help your business grow.

So, you’ve got a system humming along, pulling in competitor prices. Now what? The worst thing you can do is let that data get stale. The first step is to start looking for the story the numbers are trying to tell you.

Did a rival just roll out a cheaper annual plan? Are they quietly testing a new entry-level tier? These aren't just random events—they're signals. They could be feeling the pressure, targeting a whole new customer segment, or getting ready for a much bigger launch down the road.

From Raw Data To Actionable Alerts

The real power move here is to automate your awareness. You need to set up alerts so you're the first to know about a significant price change, not the last one to hear about it from an unhappy customer.

Instead of manually checking a dashboard every single day, you can use your tools to get notified instantly. The key is to set up smart alerts, not just noisy ones that you'll eventually ignore.

Here’s what you should absolutely be watching for:

- Major Price Drops: Any sudden change greater than 10% should set off an immediate alert. This is a big deal and you need to know about it now.

- New Tier Launches: When a competitor adds a new plan, it’s a huge sign they’ve identified a market gap you might be missing.

- Feature Shuffling: Did they suddenly move a must-have feature from their "Pro" plan down to their "Starter" plan? That's a massive shift in their value proposition.

> You don't need to react to every tiny change. The goal is to separate the signal from the noise. A $2 price tweak is just noise; a 30% discount on all annual plans is a signal you simply can't ignore.

We've seen how this plays out in historical pricing battles. One report found that a staggering 72% of B2B buyers will ditch their cart if they find a competitor that’s just 10% cheaper. With e-commerce price volatility sometimes swinging by 15% in a single quarter, companies with static pricing have watched their revenue drop by nearly 20%. It's a tough market out there.

Connecting The Dots Back To Your Strategy

Once an important alert hits your inbox, the real question is: what do you do? The answer is almost never "panic and slash your prices." That's a race to the bottom.

First, take a breath and analyze the why. Is this a desperate, short-term promotion to hit a quarterly number, or is it a permanent, strategic shift? Use their pricing to validate your own value. If a competitor undercuts you but strips out three key features to do it, you now have a powerful sales argument. You can confidently tell prospects, "Yes, we cost a bit more, and here’s exactly what you get for that investment."

Ultimately, all this tracking is about using competitor data to inform your own pricing adjustments and product strategy. It's about turning that raw information into real insights that drive effective data-driven decision making.

For instance, think about how much easier it makes presenting your findings to the rest of your team. Instead of walking into a meeting and saying, "I think we might be too expensive," you can show them the facts: "Our top three competitors all offer a mid-tier plan between $49-$59, and our equivalent is priced at $99. Here’s the data."

This completely shifts the conversation from opinion to fact. If you want to dig deeper into this process, check out our guide on how to analyze https://blog.already.dev/posts/competitor-pricing-data.

Staying Legal and Ethical With Price Tracking

Let's talk about the elephant in the room: getting a nasty letter from a competitor's lawyer. While tracking public pricing information is generally above board, there are definitely some lines you don’t want to cross. This is your friendly guide to staying on the right side of things.

The goal isn't to scare you with dense legal jargon. It's to give you some simple, common-sense rules so you can track competitor prices without constantly looking over your shoulder. Think of this as the "play nice" chapter of your price tracking adventure.

Don't Be a Robot Jerk

Most websites have a little text file called robots.txt. You can think of it as the bouncer at a club—it clearly tells automated bots like yours which areas are off-limits. Respecting this file isn't just good manners; it's a critical first step in ethical scraping.

Ignoring it is like barging past the bouncer and heading straight for the VIP section. You’re going to get noticed, and not in a good way.

On a related note, don't bombard a competitor's site with a million requests a second. That's what’s known as a Denial-of-Service (DoS) attack, and it's not just rude, it's straight-up illegal. Any decent tracking tool will automatically be respectful, but if you're building a solution yourself, just be a good internet citizen.

> The Golden Rule of Scraping: Don't break their website. If your tracking slows down their site or costs them money in server resources, you’ve crossed a line from competitive research into something much messier.

Terms of Service and The Fine Print

You know that "Terms of Service" or "Terms of Use" page every website has? The one nobody ever reads? Well, if you plan to scrape their data, you should probably give it a skim. Many sites explicitly forbid any kind of automated data collection.

While the legal enforceability of these terms can be a bit of a gray area, violating them puts you on their radar. A simple cease-and-desist letter is the best-case scenario. The worst case involves lawyers and courtrooms, and nobody wants that.

Here are a few key distinctions to keep in mind:

- Public vs. Private Data: Only track publicly available information. If you have to log in to see a price, that data is not fair game.

- Competitive Intelligence vs. Espionage: The difference is huge. We cover what defines ethical competitive intelligence in our detailed guide.

At the end of the day, your goal is to gather data without being disruptive or shady. Play by the rules, respect their digital property, and stick to public information. This approach keeps your price tracking both effective and ethical.

Got Questions About Competitor Price Tracking?

You're not alone. When you first dive into tracking competitor prices, a few common questions always pop up. Let's tackle them head-on with some straight talk and practical advice.

How Often Should I Actually Check Prices?

Honestly, it all comes down to your industry. If you're slinging products in a cutthroat e-commerce market, prices can shift on an hourly basis. In that world, daily—or even more frequent—checks are just the cost of doing business.

But for most SaaS companies, you can take a breath. A weekly or bi-weekly check is often the perfect rhythm. The goal isn't just to catch every tiny fluctuation; it's about consistency. A regular, predictable schedule is what helps you spot real trends and separate them from the daily noise.

What Do I Do If a Competitor Suddenly Tanks Their Price?

First thing's first: don't freak out. Your immediate instinct might be to match them, but that's usually the fastest way to start a race to the bottom. And in that race, there are no winners.

Instead, channel your inner detective and figure out the why behind their move.

- Is this just a short-term promotion to juice their quarterly numbers?

- Did they strip out valuable features to make the new, lower price make sense?

- Are they just trying to offload an old product version or an outdated subscription tier?

Really dig into how their change affects your own value proposition. More often than not, the most powerful and confident response is to hold your ground and do nothing at all.

> Ignoring the pricing game can be brutal. Remember Netflix's 2011 Qwikster debacle? They misread the market, ignored what Hulu was doing, and lost 800,000 subscribers. More recently, when Adobe hiked enterprise prices, rivals like Canva jumped in with bundles that were 40% cheaper, shaking things up in a big way. You can see how these pricing showdowns ripple through the economy in this global economic outlook.

So, Is It Illegal to Scrape Pricing Data?

This one's a bit of a gray area. Generally speaking, pulling publicly available information like pricing isn't illegal. But—and this is a big but—you have to be a good internet citizen about it. That means respecting a website’s Terms of Service and paying close attention to their robots.txt file.

If your scraping is so aggressive that it slows down their site, you're going to get your IP address blocked. In a worst-case scenario, you could even face legal trouble. This is exactly why going with a professional, purpose-built tool is almost always the smarter, safer route.

Stop guessing and start knowing. Already.dev uses AI agents to automatically track your entire competitive landscape, from pricing and features to market positioning, turning 40 hours of manual research into a four-minute report. See how it works at https://already.dev.