Understanding the Types of Competitor Spying on You

Stop guessing who you're up against. Learn the different types of competitor—direct, indirect, and others—to build a smarter, sharper business strategy.

Figuring out who you're really up against can feel like trying to play chess in the dark. It’s way too easy to focus on that one rival that looks just like you, but when you do that, you're missing most of the game board. The truth is, your competition comes in a few different flavors—direct, indirect, and emerging—and each one calls for a completely different game plan.

Your Competitors Are Not Who You Think They Are

Ever had that gut-wrenching feeling that you’re fighting hard on one front, only to get blindsided from a direction you never even thought to look? That’s what happens when you think too small about your competition. It’s a classic mistake: obsessing over the obvious rival—the Pepsi to your Coke—while completely ignoring the other players quietly stealing your customers.

To really get a handle on who you're up against, you have to think bigger. This isn't just some boring business school exercise; it's about survival. There's a reason the market for this stuff is blowing up. Back in 2021, the global Competitor Analysis Evaluation market was already worth around $4.32 billion, and it's projected to climb to $6.60 billion by 2025. That kind of cash tells you just how vital this intel has become.

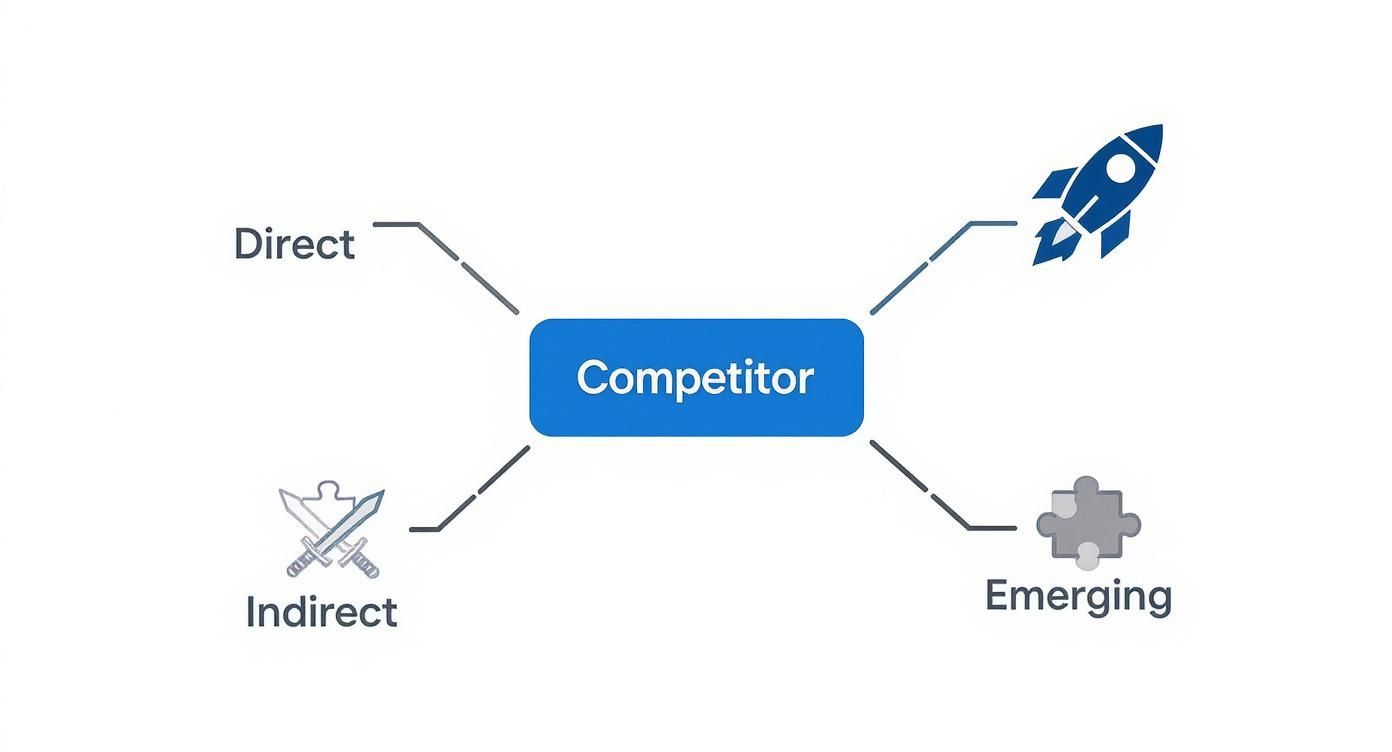

This visual map gives you a great starting point for the main types of competitors you'll run into.

As you can see, your competitive world is really split into three core groups, and each one poses a totally unique kind of threat.

Why You Need to Know Every Player

Sorting your competitors into these buckets helps you build a smarter, more resilient strategy. It’s the difference between constantly putting out fires and proactively looking for your next big win. Think of this guide as your playbook for identifying and outsmarting every single player on the field, not just the ones wearing the same jersey as you.

Here's a quick rundown of why each type matters:

- Direct Competitors: These are your head-to-head rivals. They offer the exact same thing to the same people. Ignoring them is like ignoring the person in the lane right next to you during a race. You're gonna have a bad time.

- Indirect Competitors: These are the sneaky ones. They solve the same core problem as you, but with a totally different product or service. Think Netflix vs. a movie theater—both solve the "I'm bored and have $20" problem.

- Emerging Competitors: These are the wild cards. They’re often startups armed with new tech or a disruptive business model, and they can completely rewrite the rules of the game before you even know what's happening.

To make this crystal clear, here’s a simple table that breaks it down.

Quick Guide to Competitor Types

| Competitor Type | What They Do | Analogy (If Your Business is a Coffee Shop) | | :--- | :--- | :--- | | Direct | Sells the same product to the same audience. | The other coffee shop right across the street. | | Indirect | Solves the same problem with a different solution. | The smoothie bar next door selling energy drinks. | | Emerging | A new player that could become a direct or indirect threat. | A new mobile app for ordering artisanal tea delivered to your office. |

The key takeaway? You don't have to become paranoid about every single company out there.

> The goal is to develop a 360-degree view of your market. That way, you can make sharp decisions, carve out your unique advantage, and avoid those nasty surprises that can knock you off course.

By the end of this guide, you’ll have a solid framework for spotting each of these competitors out in the wild. And if you want to go deeper into the whole field of tracking your rivals, you should check out our guide on what is competitive intelligence.

Analyzing Your Direct Competitors

Let's dive into the most familiar face in the competitive landscape: your direct competitors. These are the companies that probably keep you up at night. They're the Pepsi to your Coke, the Lyft to your Uber.

Simply put, they're chasing the exact same customers you are, with a product that does pretty much the same thing.

This head-to-head rivalry means every move they make—a new feature, a price drop, a marketing blitz—has an immediate impact on your business. You're both casting your lines into the same pond, using the same bait, and hoping to reel in the same fish. It often feels like a zero-sum game; their win can feel like your loss.

A classic, big-league example is the eternal battle between Apple and Samsung in the smartphone arena. For well over a decade, they've been locked in a fierce duel, offering similar high-end phones to the same global audience. It's a textbook case of direct competitors defining an entire industry.

Spotting Your Doppelgangers in the Wild

So, how do you find these rivals if they aren't already glaringly obvious? The best trick is to put yourself in your customer's shoes.

Imagine you're a potential user with a problem your product solves. What would you type into Google? Those search terms are your treasure map. If you're building a project management tool, you’d be looking at phrases like "best project management software" or "Trello alternative." The names that pop up again and again? That's your direct competition.

You can also go hunting where your customers hang out online:

- App Stores: Just look at the "similar apps" or "you might also like" sections.

- Review Sites: Scout platforms like G2 or Capterra for your specific category.

- Online Communities: Pay attention to what tools people are comparing on Reddit, Slack channels, or industry forums.

Doing this by hand gets old, fast. While powerful (and pricey) tools like Ahrefs or Semrush can show you who you're battling in the search rankings, they can also be expensive. A more focused platform like already.dev can automate this discovery for you, pinpointing who’s targeting your keywords without the enterprise-level cost.

> The goal isn't just to make a list of names. It’s to really understand how they position themselves, what features they scream about, and who they’re successfully winning over. This is step one in carving out your own unique space.

Why Direct Competitors Demand Your Immediate Attention

Keeping a close eye on these rivals is non-negotiable. They're your most important benchmark. They force you to get brutally honest and answer the hard questions. Why should a customer pick you over them? Is your product faster? Cheaper? Easier to use? Does it serve a specific niche they’re completely ignoring?

Take Asana and Trello. Both help teams manage projects, but they come at it from different angles. Trello’s magic is its simplicity—the card-based system is perfect for people who want a visual, no-fuss tool. Asana, on the other hand, packs in more powerful features for complex project tracking, which appeals to bigger teams with more intricate workflows. They’re direct competitors, sure, but they’ve differentiated by appealing to slightly different user needs within the same market.

To see a great breakdown of how to analyze a direct competitor, check out this comparison of Cometly and HubSpot Marketing Hub. It’s a solid example of how to dissect features and positioning. And if you want to go even deeper, our full guide on how to perform a website competitor analysis has you covered.

2. Uncovering Your Indirect Competitors

Alright, let's talk about the sneakiest competitors out there: the indirect ones. These are the rivals that don’t look like you and don't sell what you sell, but they're secretly solving the same core problem for your customer.

Think of it this way. A movie theater's direct competitor is the other theater across town. Obvious, right? But its indirect competitors are Netflix, a local board game cafe, a good book, or even just a long nap on the couch. They all compete to solve the same problem: "What should I do on a Friday night?"

This is a huge blind spot for so many businesses. It’s easy to get obsessed with what your direct rival is doing, completely missing the fact that your customers are starting to solve their problems in a totally different way.

The Jobs-to-be-Done Mindset

To find these hidden rivals, you have to stop thinking about what you sell and start thinking about the "job" your customer is "hiring" your product to do. This is the whole idea behind the Jobs-to-be-Done (JTBD) framework, and it's a game-changer for spotting indirect competition.

For example, people don't buy a drill because they want a drill. They buy a drill because they want a hole in the wall. The "job" is the hole, and anything that makes a hole is a potential competitor—a nail and hammer, a screw, even some ridiculously strong adhesive hook.

Here are a few SaaS examples to make it click:

- Zoom vs. Business Travel Agencies: One sells video calls, the other sells flights and hotels. Wildly different, right? But both get hired for the same job: "Help my team collaborate with people in another city."

- Airtable vs. Specialized CRM Software: Airtable is a flexible spreadsheet-database hybrid, while a dedicated CRM is purpose-built for sales pipelines. Yet, both can be hired for the job of "managing customer relationships."

- Google Docs vs. Microsoft Word: This one feels almost direct now, but for years they solved different primary jobs. Word was for creating perfect, printable documents. Google Docs was for real-time collaboration. The lines have blurred, which just goes to show how indirect competitors can creep in and become direct threats.

How to Find Your Hidden Rivals

So, how do you actually spot these companies? You won't find them by searching for "[Your Product] alternative." You have to get more creative and, most importantly, listen to your customers.

1. Conduct Customer Interviews (and Actually Listen)

Talk to your customers, especially the ones who almost didn't buy from you. You need to ask them questions that reveal their old habits:

- "Before you found us, how were you getting this done?"

- "If our product disappeared tomorrow, what would you do instead? And no, you can't just name another company like ours."

- "What were you searching for on Google that eventually led you here?"

Their answers are pure gold. You might hear them mention spreadsheets, a messy combo of free tools, or even hiring a freelancer. Bam—those are your indirect competitors.

2. Analyze Broader Search Terms

You have to dig into the search keywords people use before they know a solution like yours even exists. People don't search for solutions; they search for their problems.

> A person who needs project management software probably isn't searching for "Trello." They're more likely searching for "how to keep my team on the same page" or "best way to track project deadlines."

The tools and articles that pop up for these problem-based queries will show you who else is trying to solve that same core pain point. While powerful keyword tools like Semrush or Ahrefs can uncover this data, they can be really expensive. An alternative like already.dev can help you discover these broader keyword battlegrounds and identify the players competing for your customers' attention before they've even heard of your category.

4. Spotting Emerging and Substitute Competitors

If direct competitors are the rivals you see coming and indirect competitors are the ones you find by thinking a little differently, then emerging and substitute competitors are the ones that come out of nowhere and flip the whole game board over. This is where true disruption happens.

These two are often overlooked until it’s way too late. They don’t play by the established rules, which makes them incredibly dangerous—and a huge source of opportunity if you can spot them early.

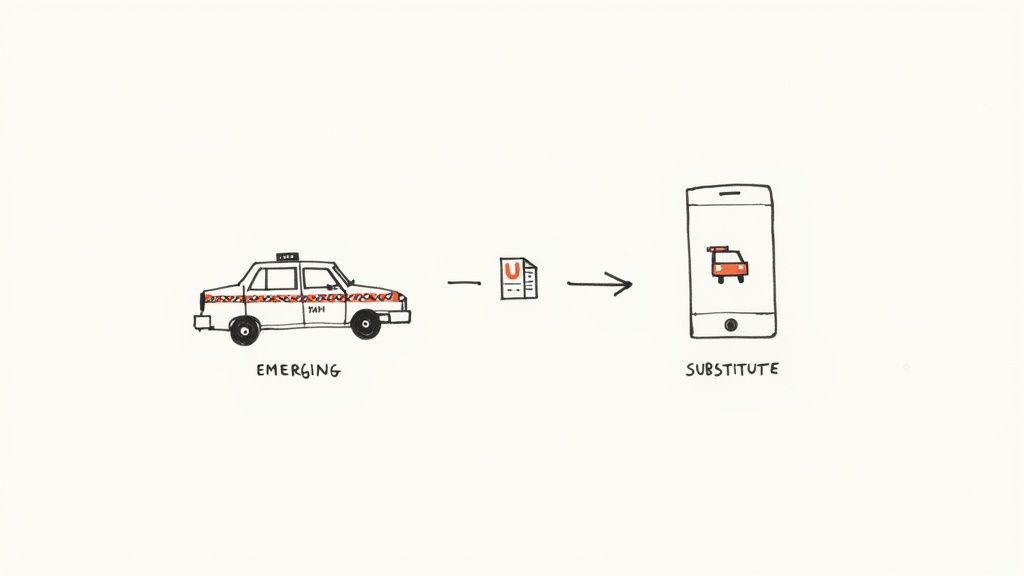

The Upstarts: Emerging Competitors

Emerging competitors are the new kids on the block. They’re usually armed with fresh technology, a slicker business model, or a completely different angle on an old problem. Think of them as the ambitious garage band that’s about to go global while the established rock stars are still arguing about their next album cover.

The classic, almost painful, example is the taxi industry getting blindsided by ridesharing apps. For decades, the taxi business was a stable, regulated world. Then came Uber and Lyft, not as better taxi companies, but as tech platforms connecting drivers and riders in a totally new way. They didn't just compete; they fundamentally rewired customer expectations for an entire industry.

> Spotting these threats isn’t about looking for a slightly better version of your product. It’s about asking, "What new tech or trend could make our current solution look slow, clunky, and outdated?"

One of the biggest drivers of emerging competition today is AI. All of a sudden, tasks that required complex software or a human touch can be automated. This is creating a flood of new, hyper-efficient tools that can challenge established players seemingly overnight.

The "Good Enough" Solutions: Substitute Competitors

Then you have substitute competitors. These aren't even companies in your industry. A substitute is a completely different way of getting the job done, and often, it’s a "do-it-yourself" solution your customers have cobbled together.

The ultimate substitute competitor for almost any B2B software? A spreadsheet.

Seriously, think about it. Before dedicated CRMs were everywhere, where did businesses track their customers? Spreadsheets. Before project management tools, where did teams list their tasks? Spreadsheets. It’s not a perfect solution, but it’s cheap (or free), flexible, and good enough for a lot of people. This is a fundamental threat because it challenges your entire value proposition. Why should someone pay for your elegant software when a simple spreadsheet gets them 80% of the way there?

For a great example of this in action, look at how no-code platforms are changing software development. You can see how Xano provides a competitive alternative to traditional backend development, essentially replacing a complex, manual process with a much more accessible approach.

How to Keep Your Ear to the Ground

You can’t just Google "my emerging competitors" and hope for the best. Spotting these threats requires some real detective work and a shift in focus—away from just your market and toward the wider world. The goal is to catch the faint signals before they become a massive earthquake.

Here’s a simple framework for your surveillance mission:

-

Monitor Tech and Investment Trends: Keep an eye on tech news sites, industry publications, and platforms that track venture capital funding like Crunchbase or PitchBook. Where is the "smart money" going? If you see a sudden explosion of investment in a new category that happens to solve a problem you solve, pay very close attention.

-

Lurk in Online Communities: Your customers are already talking about their problems and the scrappy ways they solve them. Spend time in the Reddit, Slack, Discord, and Facebook groups where they hang out. Listen for mentions of "DIY" setups, custom scripts, or questions like, "Has anyone figured out a way to connect X with Y to do Z?" Those are the seeds of substitute solutions.

-

Use Modern Discovery Tools: While pricey tools like Semrush and Ahrefs are great for tracking keywords of known competitors, they can easily miss these outside threats. This is where a platform like already.dev shines. It’s built to cast a much wider net and uncover these non-obvious players by analyzing the problem space itself, not just a list of companies you already know about.

Putting Your Competitor Insights Into Action

Okay, so you’ve done the legwork. You’ve identified all the different players lurking in the shadows and staring you down from across the street. But let’s be real for a second: a list of names is completely useless on its own. It's like having a map without a destination.

Now comes the fun part—turning that raw data into a real, actionable game plan. The goal isn't just to know who your rivals are; it’s to figure out which ones actually matter and what you’re going to do about them. You simply don't have the time or energy to obsess over every single player on the field.

This is where you shift from being a spectator to a strategist. You need a simple, no-nonsense way to sort the major threats from the minor annoyances.

Creating Your Threat Matrix

You can't possibly monitor everyone, every single day. That’s a one-way ticket to burnout. Instead, what you need is a quick way to prioritize. I like to think of it as a "Threat Matrix"—a simple grid that helps you decide who gets your precious attention.

It all boils down to two simple questions:

- Impact: If this competitor knocks it out of the park, how badly will it hurt my business? A direct competitor launching a killer new feature is a high-impact event. A substitute solution used by a tiny niche? That’s low-impact.

- Visibility: How much noise are they making in the market? A well-funded startup plastering ads everywhere is high-visibility. An obscure open-source tool is low-visibility.

Plotting your competitors on this grid instantly brings your priorities into sharp focus. That high-impact, high-visibility direct competitor? You watch them like a hawk. The low-impact, low-visibility one? Maybe check in on them once a quarter. This simple exercise can save you countless hours of wasted effort.

From List to Action Plan

Once you know who to focus on, you can start digging deeper. The real mission here is to find their weaknesses, spot gaps in the market, and identify opportunities you can jump on. This is where you get tactical.

> The most powerful competitive insights don't come from copying your rivals. They come from understanding where your rivals are failing their customers—and then doing that one thing better than anyone else.

This is the very core of smart strategy. You're not just reacting; you're proactively looking for chinks in their armor. A detailed plan for this is a massive advantage, and if you need a step-by-step guide, our full article shows you exactly how to conduct competitive analysis.

Your Competitor Analysis Template

To make this even easier, you need a central place to track everything. A simple spreadsheet is your best friend here. It transforms messy notes into a clean, comparative overview that lets you spot patterns at a glance. This isn't about creating some monstrous document you never look at again. It's about building a living tool that informs your decisions on pricing, features, and marketing.

To get you started, here’s a practical template you can build to map out your findings.

Competitor Analysis and Prioritization Template

| Competitor Name | Type (Direct, Indirect, etc.) | Key Features | Pricing Model | Threat Level (1-5) | | :--- | :--- | :--- | :--- | :--- | | RivalCorp | Direct | Feature A, Feature B | Tiered Subscription | 5 | | AltSolution | Indirect | Solves Problem X | Freemium | 3 | | NewStartup | Emerging | AI-Powered Widget | Pay-per-use | 4 | | Spreadsheet | Substitute | Manual Tracking | Free | 2 |

A simple grid like this gives you an immediate visual summary of the entire competitive landscape. Instead of drowning in data, you get instant clarity on who poses the biggest threat and why.

While powerful (and expensive) platforms like Semrush and Ahrefs can help gather some of this data, a dedicated tool like already.dev can automate the discovery and analysis process, populating this kind of grid for you without the hefty price tag.

Your Simple Competitor Analysis Checklist

https://www.youtube.com/embed/kDKyXeqeX9c

Alright, we’ve covered a ton of ground. We’ve identified the usual suspects, sniffed out the sneaky ones, and hopefully, you’re feeling more like a chess master than a pawn in the game. Now, let’s turn all that theory into a simple, actionable to-do list you can start on today. No fluff, just the steps.

This isn’t just a summary; it’s your launchpad. The goal is to get this process out of your head and into motion. We want to turn "competitor analysis" from a scary monster into a manageable, recurring habit.

Ready? Let's go.

Your Quick-Start Checklist

Here’s a step-by-step process to get your first analysis off the ground. Seriously, don't overthink it—just start checking things off the list.

-

Brainstorm Your Top 5 Direct Rivals: Grab a whiteboard or a notebook. Who are the first five names that pop into your head when you think, "Who else does what I do?" Don't second-guess yourself; just get them down on paper.

-

Identify 3 Core Customer Problems: Forget about your features for a second. What are the three biggest, hair-on-fire pain points your product actually solves for people? This is your key to unlocking all those indirect competitors.

-

Find 3 Indirect Competitors: Based on those problems you just listed, find three other ways your customers are currently solving them. This could be a clunky spreadsheet, a totally different type of software, or even just hiring a freelancer. These are your indirect threats.

-

Pinpoint 1 Emerging Threat: Time for a quick search. Head over to tech news sites or investor databases. Find one new, interesting startup that’s tackling the same space with a fresh approach (especially if they’re screaming about AI). Put them on your radar.

> Competitor analysis isn’t about being paranoid; it's about being prepared. It’s the difference between reacting to the market and leading it. You’re not spying—you’re just doing your homework to build something better for your customers.

Make It a Habit, Not a Headache

The single biggest mistake you can make is treating this as a one-and-done task. The market moves way too fast for that. To make this stick, you’ve got to build it into your workflow.

-

Set Up Keyword Alerts: Use a tool to get notified when competitors are mentioned or when key industry buzzwords pop up. While powerful tools like Ahrefs or Semrush can do this, they can get expensive. A platform like already.dev can automate this discovery and keep you informed without the huge bill.

-

Schedule a Quarterly Review: Put it on the calendar right now. Once every three months, run through this checklist again. See who’s new, who’s fallen off, and whose strategy has totally changed.

This process keeps your business agile and smart. It’s all about maintaining a healthy awareness that empowers you to zig when everyone else zags.

Got Questions About Competitor Types? We've Got Answers.

Alright, let's dive into some of the questions that always come up when people start trying to make sense of their competitive landscape. Think of this as the quick-and-dirty guide to clearing up the confusion.

How Many Competitors Should I Actually Track?

Honestly? Probably fewer than you think. It's incredibly easy to fall down a rabbit hole and end up with a list of 50 companies, which is a surefire recipe for analysis paralysis.

A great place to start is with a tight, focused list: 3-5 direct competitors, 2-3 indirect competitors, and maybe 1-2 emerging threats that are on your radar. This gives you a solid, manageable group to keep an eye on without completely overwhelming your team. The goal isn't to be a walking encyclopedia of every company in your space; it's to deeply understand the key players who can actually affect your bottom line.

What's the Biggest Mistake People Make When Analyzing Competitors?

The number one trap people fall into is getting tunnel vision and only looking at their direct competitors. You get so wrapped up in what the company across the street is doing—the one that looks and smells just like you—that you don't even notice the scrappy startup solving your customer's core problem in a totally different way.

> Focusing only on direct rivals is like playing checkers when your opponent has already moved on to chess. You're playing the wrong game and you don't even know it.

How Often Should I Refresh My Competitor Analysis?

This definitely isn't a "one and done" kind of task. The market just moves too fast for that. For your most important direct competitors, it’s smart to do a quick check-in at least monthly. For the rest of the companies on your list, a more in-depth review once a quarter should be plenty.

The trick is to make it a habit. Throw a recurring event on your calendar. This simple discipline turns competitive analysis from a massive, dreaded project into a routine part of how you stay sharp and avoid getting blindsided.

Ready to stop guessing and start knowing exactly who you're up against? Already.dev uses AI to automatically find and analyze every type of competitor for you—direct, indirect, and emerging—turning weeks of manual research into a four-minute report. Get the clarity you need to build a smarter strategy at https://already.dev.