What Is Competitive Benchmarking and How Does It Work?

What is competitive benchmarking? Learn how to use it to understand rivals, find market gaps, and make smarter decisions that fuel your startup's growth.

Let’s be honest, competitive benchmarking sounds like something you’d hear in a stuffy boardroom full of suits. But it’s really just a fancy way of saying you’re peeking over your competitor’s fence to see how your own garden is growing.

So What Is Competitive Benchmarking, Really?

Forget the textbook definitions for a second. Imagine you're opening a coffee shop. You wouldn't just invent a price for a latte out of thin air, would you? Hell no. You'd hit the streets, visit every coffee joint in a five-block radius, and check out their prices, their most popular drinks, and how they handle that chaotic morning rush.

That’s it. That’s competitive benchmarking in a nutshell.

It’s the structured process of measuring your own products, services, and strategies against the best in the business. This isn’t about blindly copying what others are doing. It’s about figuring out the why behind their success—or spectacular failure—so you can make smarter moves for your own company.

For a startup, this isn't some "nice-to-have" exercise; it's a survival tool. It means digging into what your rivals are doing with their:

- Pricing Strategy: Are they the cheap-and-cheerful option or the top-shelf, "this-better-be-good" choice?

- Marketing Funnels: How are they actually getting people to sign up or buy something?

- Customer Reviews: What do people absolutely love, and more importantly, what do they hate about their product?

- Public Failures: What big bets did they make that completely bombed? Learning from their expensive mistakes is free.

This isn’t just some passing fad, either. The competitive benchmarking market has ballooned into a USD 51.22 billion industry for a reason. Businesses know that if you’re not measuring yourself against the competition, you’re just guessing. And guessing is a great way to end up in the startup graveyard.

Benchmarking At-a-Glance: Your Quick Cheatsheet

It's easy to get the wrong idea about what benchmarking truly is. This quick table breaks down the smart approach versus the common traps people fall into.

| What It Is (The Smart Move) | What It Is Not (The Common Trap) | | :--- | :--- | | A systematic, ongoing process. | A one-and-done peek at the competition. | | Looking for strategic insights and why things work. | Blindly copying features or prices without context. | | Comparing performance using specific metrics. | Just gathering a random list of what rivals do. | | A way to set realistic, ambitious goals. | A tool for making excuses or feeling defeated. | | Understanding the entire customer experience. | Focusing only on a single feature or metric. |

Getting this right from the start sets you up for a process that actually drives growth, instead of just creating a report that gathers dust on a shelf.

It’s Broader Than You Think

To get the full picture, you can't just look at your direct rivals. True benchmarking involves understanding indirect competitors—the companies solving the same customer problem, just in a completely different way.

And while it’s a close cousin, benchmarking is different from pure competitive intelligence, which often has a broader scope. If you want to dive deeper into that side of things, check out our guide on what is competitive intelligence.

Ultimately, it’s about making informed decisions instead of flying blind. You can spend months guessing what might work, or you can spend a few focused hours benchmarking. The choice is pretty clear.

Why Benchmarking Is Your Startup Superpower

Okay, so you get the "what." But why should you, a busy founder with a to-do list a mile long, actually spend precious time on this?

It's simple: building a startup without benchmarking is like driving blindfolded. It’s slow, dangerous, and you’re probably heading straight for a cliff you can't even see.

Think of competitive benchmarking as your official strategy cheat code. It’s the difference between guessing what your customers want and knowing what they’re already paying for somewhere else. This is about making decisions based on market realities, not just wishful thinking scribbled on a whiteboard at 2 AM.

And the best part? You get to learn from your competitors' most expensive mistakes—for free. You can see the feature they launched that nobody wanted, the pricing model that totally backfired, or the marketing campaign that fell completely flat. Every misstep they made is a lesson you don’t have to pay for with your own time and money.

Stop Guessing and Start Knowing

At its core, benchmarking swaps out dangerous assumptions for hard data. Every startup is built on a set of beliefs about its market, but what if those beliefs are just plain wrong? Benchmarking is how you stress-test them against what’s actually happening out there.

Without it, you’re basically just gambling.

- Pricing: You might just pluck a number out of thin air and hope it sticks. Benchmarking shows you exactly what the market will tolerate and what your rivals charge for similar value.

- Feature Development: You could sink six months into building a complex new feature you think is brilliant. Benchmarking might reveal that a competitor tried the exact same thing last year and it crashed and burned.

- Market Positioning: You may describe your product in a way that makes perfect sense to you but completely confuses your customers. Benchmarking helps you nail the messaging that already resonates with your target audience.

This whole process is designed to stop founders from pouring months of work into a dead-end idea. It's really about finding those juicy, underserved gaps in the market that your product can fill perfectly.

> "The goal of a competitive analysis is not only to peek into the inner workings of your competitor but to also validate your own content and marketing strategy."

In other words, it’s not just about spying; it’s about making your own game plan so much sharper.

From Data Overload to Clear Action

Let's be real, gathering this information used to be a massive headache. You could spend weeks buried in spreadsheets, manually tracking dozens of competitors and trying to make sense of it all. Analysts often lean on powerful but pricey SEO suites like Ahrefs or Semrush, which can be total overkill (and way too expensive) for a lean startup.

This is where modern tools completely change the game. A platform like Already.dev automates this entire discovery process. Instead of you hunting down every competitor and logging their every move, an AI agent does all the heavy lifting. You get the clear, actionable insights you need without any of the manual grunt work.

So, what is competitive benchmarking, really? It's your unfair advantage. It gives you the confidence to build a product people actually want to buy, create a pricing strategy that works, and craft a marketing message that truly hits home. It turns the terrifying uncertainty of building something new into a calculated, data-driven mission.

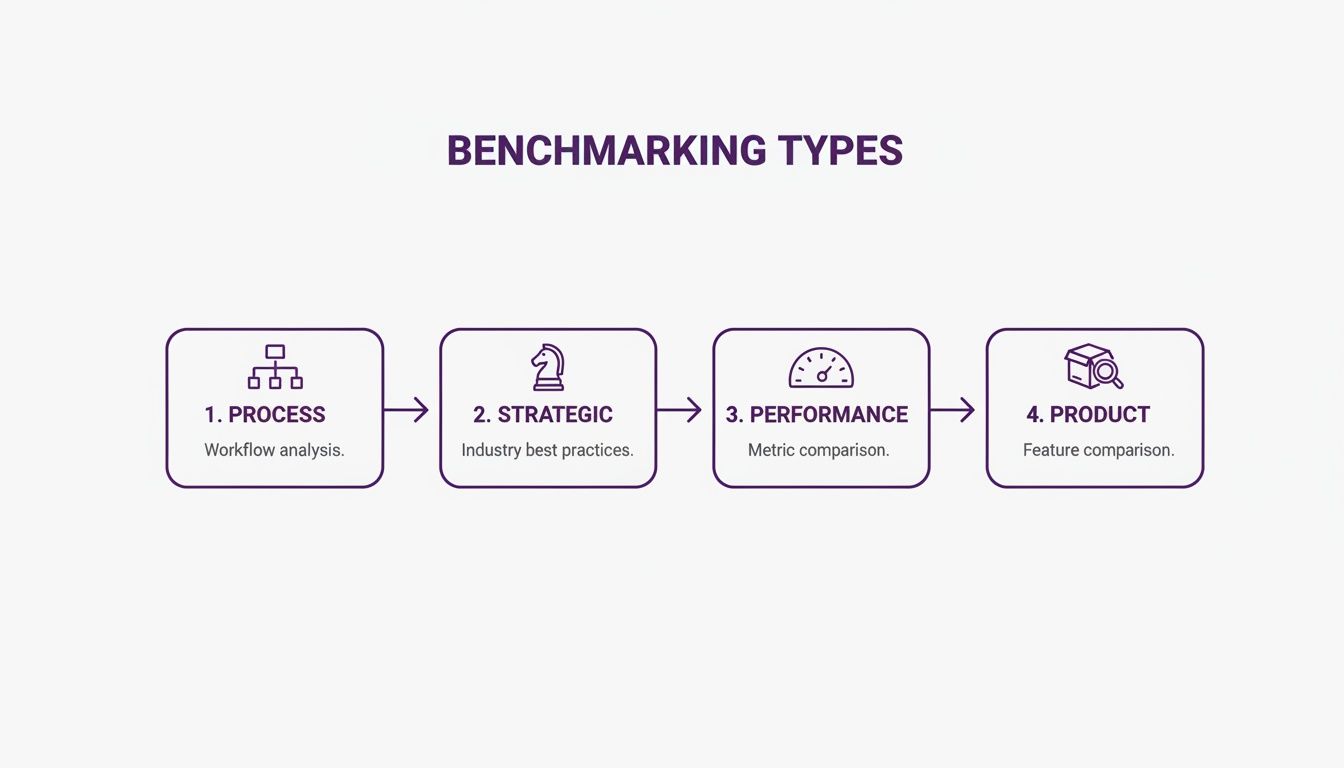

The Four Main Flavors of Benchmarking

Let's get one thing straight: "benchmarking" isn't a single, one-size-fits-all activity. It's more like a Swiss Army knife. You wouldn't use the corkscrew to tighten a screw, right? The same logic applies here. Picking the right type of benchmarking is the key to getting insights you can actually use, not just creating busy work for your team.

Think of it as choosing your mission. Are you trying to map out a competitor's grand strategy, or do you just want to figure out why their checkout process is so ridiculously smooth? Each question requires a different lens. Most of what you’ll be doing will fall into four main categories.

Process Benchmarking

This is all about the how. Process benchmarking is where you peek behind the curtain to understand a competitor's specific workflows and operations. It’s less about the final product and more about the machine that builds it.

You're asking questions like:

- What’s their average response time for a customer support ticket?

- What does their user onboarding flow look like, step-by-step?

- How do they handle returns or cancellations so efficiently?

Imagine you’re running an e-commerce store and your shipping times are a mess. You’d use process benchmarking to study how Amazon gets a package from its warehouse to a customer's doorstep in what feels like 20 minutes. You’re not trying to copy their entire business, just that one specific, brilliant process.

This simple visual from Wikipedia shows how it works.

It's a continuous loop: you plan, you gather data, you analyze, and then you adapt. This isn't a one-time project; it's an ongoing cycle of getting better.

Strategic Benchmarking

If process benchmarking is about the "how," then strategic benchmarking is about the "why" and the "where." This is the high-level, big-picture stuff. You’re not looking at a single workflow—you’re analyzing their entire business model and long-term game plan.

> Strategic benchmarking is like playing chess. You're not just looking at your opponent's next move; you're trying to understand their entire strategy for winning the game.

Here, you're trying to piece together answers to questions like:

- How do they decide which new markets to enter?

- What's their core business model? Are they high-volume, low-margin, or the other way around?

- What key partnerships give them an unfair advantage?

This is what a founder does when they're trying to figure out where their startup fits into the world. You’re comparing your company’s fundamental approach to theirs to find your unique angle of attack.

Performance Benchmarking

Welcome to the numbers game. Performance benchmarking is probably the most straightforward of the bunch. It’s a direct, quantitative comparison of key performance indicators (KPIs). You’re putting your metrics right next to theirs to see who comes out on top.

This is where you compare things like:

- Website Traffic: Who’s getting more visitors?

- Conversion Rates: Who is better at turning those visitors into paying customers?

- Customer Churn: Who is better at keeping the customers they win?

- Market Share: Who owns a bigger slice of the pie?

This kind of analysis can be a real wake-up call. You might think your growth is phenomenal until you see your main competitor is growing twice as fast. While tools like Ahrefs and Semrush can provide some of this data, they can be incredibly expensive for a small team. A platform like Already.dev is designed to surface these kinds of performance insights without the enterprise price tag.

Product Benchmarking

Finally, we have product benchmarking. This is the classic, feature-for-feature, price-for-price teardown. If you're a product manager, this is probably where you spend a lot of your time.

You’re creating a direct comparison of your product against a competitor’s, looking at:

- Features: What can their product do that yours can’t (and vice-versa)?

- Pricing: How do their pricing tiers and models compare to yours?

- User Experience (UX): Is their product genuinely easier or more enjoyable to use?

- Quality: How does the performance and reliability stack up in the real world?

This is absolutely critical for building your product roadmap and defining your market positioning. It helps you answer the most important question of all: "Why should a customer choose us over them?" By knowing exactly where you stand on features, price, and experience, you can build a better product and tell a much more compelling story.

How to Run Your First Benchmarking Project

Alright, theory is great, but now it's time to roll up your sleeves. Running your first competitive benchmarking project can feel like you're about to wrestle an octopus made of spreadsheets, but don't worry. We're going to break this down into a simple, step-by-step process that won't make you want to throw your laptop out the window.

The trick is to start small and stay focused. You don’t need to analyze every single competitor on the planet. You just need to find answers to a few critical questions that can make a real difference for your business, right now.

Step 1: Start With a Question, Not Data

This is the most important step, and it’s the one everyone tries to skip. Before you open a single browser tab, you have to define exactly what you want to learn. Starting with a vague goal like "see what competitors are doing" is a recipe for disaster—you'll just end up with a mountain of useless trivia.

Instead, get specific. Turn your goal into a sharp, focused question.

- Bad Goal: "Research competitor pricing."

- Good Question: "Are our pricing tiers confusing compared to our top three competitors, and is that causing us to lose sign-ups?"

See the difference? The first is a chore; the second is a mission. A good question gives your research purpose and a clear finish line.

Step 2: Find Your Real Competitors

Next up, figure out who you're actually up against. This goes way beyond just Googling your main rival. You need to think about direct, indirect, and even the "ghosts" of competitors past—the ones who tried and failed.

Getting this right is crucial, and it can be surprisingly tricky. To make it easier, we've put together a complete playbook on how to find your startup competitors that dives much deeper.

For now, here’s a quick breakdown:

- Direct Competitors: They sell a similar product to a similar audience. (Think Pepsi vs. Coke).

- Indirect Competitors: They solve the same core problem but with a different solution. (Think Netflix vs. a movie theater).

- Aspirational Competitors: The big players you look up to, even if they aren't direct rivals today.

Step 3: Gather the Intel the Smart Way

Now for the fun part: data gathering. This used to be an incredibly painful, manual slog. Analysts would spend weeks building massive spreadsheets, relying on expensive and complex tools like Ahrefs or Semrush to pull data. These platforms are powerful, but their price tags can make a startup founder's eyes water.

Luckily, you don't have to do it that way anymore.

A modern tool like Already.dev completely automates this discovery phase. You just describe what you're building, and its AI agents go out and do the heavy lifting for you. It finds the competitors, analyzes their pricing, maps out their features, and pulls their marketing messages into one clean report. What used to take a week now takes minutes.

Whether you go manual or automated, you're looking for patterns in a few key areas:

- Pricing Pages: What are their tiers? What features are locked behind higher plans? Do they offer a free trial?

- Feature Lists: What are their core value propositions? What do they highlight on their homepage?

- Marketing Copy: What language do they use? Who are they talking to? What pain points do they hammer home?

The market for this kind of tech is exploding for a reason. The competitive intelligence software market for SMBs is projected to jump from $2.56 billion to $6.02 billion by 2030. This growth shows that even small teams can no longer afford to fly blind, which is why CI teams have grown by 24% year-over-year.

Step 4: Turn Data Into Actionable Insights

You’ve gathered the data. Now what? This is where raw information becomes a genuine strategic advantage. Don't just stare at the numbers; look for the story they're telling you.

> The goal isn't to create a beautiful chart. It's to find one single insight that you can act on tomorrow to make your business better.

Keep an eye out for gaps, patterns, and outliers.

- The Gap: "Wow, none of our competitors offer a simple, pay-as-you-go plan. Maybe we could own that niche."

- The Pattern: "Everyone seems to be targeting enterprise clients. Is there an opportunity to serve the small business market they're ignoring?"

- The Outlier: "Competitor X is charging double what everyone else is... but their reviews are incredible. What are they doing so right?"

This breakdown of the different types of benchmarking can help you focus your analysis on what matters most for your specific question.

By choosing the right "flavor"—whether it's digging into a competitor's process or their high-level strategy—you can turn a messy pile of data into a clear action plan. Pick one insight, make one change, and measure the result. That's how you win.

Finding The Signal in The Noise

Alright, you're sold. Competitive benchmarking is your secret weapon. But here’s the thing: once you start digging, it's incredibly easy to drown in a sea of data points, charts, and useless trivia.

Seriously, do you really need to know your competitor's favorite shade of blue for their CTA buttons? Probably not.

This is all about finding the signal, not getting lost in the noise. To sidestep "analysis paralysis," you have to be ruthless about what you track. The goal isn't to build the world's most comprehensive spreadsheet; it's to uncover a handful of key insights that actually help you make better decisions.

Your Go-To Benchmarking Metrics Starter Pack

To make this super practical, let's break down the metrics that really matter. Think of this as your starter pack—a go-to list of benchmarks that deliver genuine strategic value, organized by who needs them most.

| Business Area | Key Metric to Benchmark | Why It Matters | | :--- | :--- | :--- | | Product | Feature Adoption & Usage | Reveals which features customers actually value, highlighting opportunities to double down or fill gaps in the market. | | Product | User Onboarding Flow | A clunky competitor onboarding is a golden opportunity to create a smoother experience that wins customers from day one. | | Product | Pricing Tiers & Structure | Uncovers how competitors anchor their value—is it per user, per feature, or usage-based? This informs your own pricing strategy. | | Founder | Market Positioning & Messaging | Shows you the story they're telling the market. Are they the "fastest," "cheapest," or "most secure"? This is their core strategy in a nutshell. | | Founder | Customer Acquisition Cost (CAC) | Helps you understand the sustainability of their growth engine, guiding you toward more efficient channels for your own business. | | Founder | Brand Sentiment | Exposes vulnerabilities. A competitor might look good on paper, but if customers are unhappy, you've found a weak spot to target. | | Marketing | Conversion Rates | The ultimate measure of effectiveness. Benchmarking sign-up, trial, and paid conversion rates shows you where you're winning or losing. | | Marketing | Channel Performance | Reveals where their traffic comes from (SEO, ads, social), helping you decide where to invest your own marketing budget. | | Marketing | Content Strategy | Shows you what topics their audience cares about, allowing you to create more relevant content or tackle subjects they've ignored. |

This table isn't exhaustive, but it's the perfect place to start. Focusing on these core areas will give you the most bang for your buck without getting bogged down in data that doesn't move the needle.

For The Product Manager

If you live and breathe product roadmaps, your focus is squarely on how your product stacks up in the real world. You’re not just comparing feature lists; you're benchmarking the entire user experience to find that elusive competitive edge.

Your key metrics are:

- Feature Adoption & Usage: Are people actually using that killer feature you spent months building? Compare your adoption rates to what you can piece together about a competitor's core features from their case studies and customer reviews.

- Pricing Tiers & Structure: Don't just glance at the price tag. Analyze how they structure their pricing. Is it per user, per feature, or based on usage? This tells you a ton about how they anchor their value in the customer's mind.

- User Onboarding Flow: Go sign up for their free trial. Seriously, do it. How quickly do they get you to that "aha!" moment? A clunky onboarding process is a massive opportunity for you to create a smoother, more delightful experience that wins customers from day one.

For The Founder

As a founder, you’re playing the long game. You have to look beyond the product to the bigger picture of market dynamics and overall business health. You're benchmarking to answer one critical question: "Where do we fit, and how do we win?"

Focus your energy on these areas:

- Market Positioning & Messaging: How do your competitors talk about themselves? Are they the "fastest," the "easiest," or the "cheapest"? This language reveals their entire strategy and the specific customer segment they're chasing.

- Customer Acquisition Cost (CAC): Okay, this one is tough to get exact numbers on. But you can get a pretty good estimate by looking at their marketing channels. Are they running pricey ads, or are they killing it with organic content? Understanding their acquisition engine helps you build a more sustainable one.

- Brand Sentiment: What are real people saying about them on social media, review sites, and forums? A competitor might look great on paper, but if their customers are miserable, that’s a massive vulnerability you can exploit.

> The most powerful insights often come from focusing on just a few critical metrics rather than trying to track everything. Quality over quantity is the key to turning data into a decisive advantage.

The impact of this focused approach is huge. One estimate suggests businesses could slash operational costs by $379 billion if every major industry fully deployed real-time competitive benchmarking.

Even better, a recent survey of over 1,200 companies revealed that 80% reported revenue jumps thanks to these tools. This isn't just theory; it's the engine powering smart, data-driven decisions. You can learn more about how companies are using data to power their market expansion and benchmarking.

For The Marketer

For marketers, benchmarking is all about performance. You’re in a constant battle for attention, so you need to know which channels are working, what messages are landing, and who is doing a better job of turning eyeballs into customers.

Your must-track metrics include:

- Conversion Rates: From website visitors to trial sign-ups, and from trial to paid. This is the ultimate report card on your marketing effectiveness.

- Channel Performance: Where is their traffic coming from? Big SEO tools like Ahrefs or Semrush can give you this data, but they can be painfully expensive. A more focused tool like Already.dev can help you understand a competitor's go-to-market channels without the hefty price tag.

- Content Strategy: What topics are they writing about? Are they creating videos, podcasts, or whitepapers? Analyzing their content shows you what their audience cares about and, more importantly, where you can fill the gaps.

How AI Is Changing The "Benchmarking" Game

Let's be real for a second. The old way of doing competitive benchmarking was a total nightmare. It meant endless Googling, building spreadsheets that looked like a crime scene, and having that nagging feeling you were definitely missing a key competitor hiding on page seven of the search results.

It was slow, tedious, and packed with human error. You could easily sink a full week into hunting for data and still end up with a blurry, incomplete picture of the market. That old-school method just doesn't fly anymore when new rivals can pop up overnight.

The New Way: AI Does The Heavy Lifting

Thankfully, that manual grind is becoming a thing of the past. AI-powered platforms have completely flipped the script, turning what was once a week-long research project into something you can knock out during a coffee break.

Instead of you having to manually hunt for every scrap of information, automated agents do all the grunt work for you. Think of it like sending out a team of tiny, hyper-efficient robot spies to crawl hundreds of sources at once.

They scan everything:

- Product review sites

- App stores and marketplaces

- Startup directories and forums

- Social media discussions

This is the core value of a tool like Already.dev. It takes your idea and instantly translates it into a full-blown research plan, bringing all the insights directly to you without you having to open a single spreadsheet. For a deeper dive, you can learn more about how AI-powered market research works and see how it saves founders from wasting precious time.

Speed and Accuracy Are The New Standard

The two biggest wins with this modern approach are blinding speed and pinpoint accuracy. A comprehensive competitive report that used to take a team a solid week of manual labor can now be generated in just a few minutes.

This isn't just about saving time; it's about making better decisions, faster. You get an instant, 360-degree view of the entire competitive landscape.

> The real advantage of AI in benchmarking isn't just faster reports. It's the ability to see the market with a clarity that was previously impossible, allowing you to pivot and adapt before your competitors even know what's happening.

This means you can instantly identify direct rivals, uncover sneaky indirect threats you never knew existed, and spot emerging market trends right as they happen.

This technology helps you sharpen your positioning, validate (or kill) your assumptions, and make confident, data-backed moves. The definition of what is competitive benchmarking is constantly changing with this tech, and you can even explore more specialized competitor AI analysis tools that are pushing the boundaries.

This hands scrappy startups a strategic advantage that, until recently, was only available to massive corporations with huge research budgets. It completely levels the playing field, turning your blind spots into your biggest opportunities.

Got Questions? We've Got Answers

Let's tackle a few of the questions we hear all the time about competitive benchmarking. I'll give you the straight-up, no-fluff answers.

How Often Should I Do This?

Think of benchmarking less like a one-time project and more like a regular health checkup for your business. It's not something you do once and forget about.

For a fast-paced world like SaaS, getting into a rhythm of a full, deep-dive analysis every quarter is a solid plan. But you should also be doing quick, focused "mini-benchmarks" anytime you're about to make a big decision. Launching a new feature? Reworking your pricing? Thinking about a new marketing campaign? Those are perfect moments to take a quick pulse of the competitive landscape.

It's an ongoing conversation with your market, not a one-off task to check off your list.

Is Benchmarking Legal and Ethical?

Absolutely. 100% yes. As long as you're using information that's already out in the public domain, you are completely in the clear. At its heart, competitive benchmarking is just smart, organized research—it's not corporate espionage.

You're simply looking at information that companies willingly share with the world:

- Their public websites and pricing models

- Official press releases and blog announcements

- What their customers are saying on review sites like G2 or Capterra

- App store descriptions and feature lists

The line gets crossed only when you try to access confidential, private information. So, no Mission Impossible stunts to steal their internal roadmap, okay? Stick to what's public, and you're good to go.

What's The Biggest Mistake People Make?

This one is simple: turning into a copycat. The single biggest trap is seeing what a successful competitor is doing and just trying to clone their every move. That’s a recipe for becoming a second-rate version of someone else.

> The goal of benchmarking is to inform your strategy, not to become your strategy. Use the insights to find gaps in the market and discover where you can be different and better.

A close second is "analysis paralysis." This happens when you get so buried in data and spreadsheets that you never actually make a decision. Don't let the quest for perfect information stop you from making progress.

Your goal is to find an actionable insight, make a change, and measure the result. While comprehensive tools like Ahrefs or Semrush are powerful, they can be overwhelming and pricey. Sometimes, a more focused tool like Already.dev is the perfect way to cut through the noise and get to the one piece of intel that matters most.

Ready to stop guessing and start building with confidence? With Already.dev, you can run a complete competitive analysis in minutes, not weeks. Get the clarity you need to build a winning product without all the manual grunt work. Try it for free at Already.dev and see your market in a whole new light.