What Is Competitor Intelligence & Why It Matters

Learn what is competitor intelligence and how to use it to make smarter business decisions, find market gaps, and gain a real competitive edge.

"Competitor intelligence" sounds like something you'd hear in a stuffy boardroom, right before everyone falls asleep. But really, it’s just the art of ethically snooping on your rivals.

Think of it like being a great poker player. You wouldn't just blindly throw your chips in without trying to read the table. You’re watching the other players, looking for tells, and trying to figure out what cards they’re holding. That’s all competitor intelligence is—figuring out what your rivals are up to, who they're selling to, and what their next big move might be.

What Is Competitor Intelligence Anyway?

Let's cut the jargon. Competitor intelligence (CI) is the process of legally and ethically gathering info about your competitors and the market.

This isn’t about hacking their servers or bribing their janitor for secrets. That's corporate espionage, and it’s a one-way ticket to a lawsuit (and probably a terrible movie plot).

Good CI is about piecing together a puzzle using clues that are already out in the open. You’re looking at their website, press releases, social media, customer reviews, and even their job postings. The goal is simple: make smarter, faster decisions for your own business.

It's Not Corporate Spying

It's super important to draw a hard line between smart research and shady business. One gets you ahead, and the other gets you into some serious trouble.

To make it crystal clear, here’s a quick breakdown of what makes CI strategic and what lands you in hot water.

Competitor Intelligence vs Corporate Spying

| Activity | Competitor Intelligence (Smart & Legal) | Corporate Spying (Illegal & Dumb) | | :--- | :--- | :--- | | Information Source | Public data (websites, news, social media) | Private, confidential info (hacking, theft) | | Methods Used | Research, analysis, monitoring, and listening tools | Deception, trespassing, bribery, or hiring moles | | The Goal | To understand the market and inform your strategy | To steal trade secrets or sabotage a rival | | The Outcome | A strong competitive advantage | Fines, jail time, and a ruined reputation |

Think of it this way: reading your competitor’s public blog is CI. Reading their internal emails because you "guessed" a password is a felony. Simple.

Why Does This Matter for You?

So, why bother becoming a professional lurker? Because your competitors are constantly leaving a trail of breadcrumbs that lead directly to their strategy. By picking up that trail, you can gain a massive edge.

- Anticipate Market Shifts: See where the industry is heading before it gets there.

- Identify Hidden Gaps: Find those customer needs that your rivals are totally ignoring.

- Avoid Their Mistakes: Learn from their expensive failures without spending a dime yourself. Now that's a bargain.

- Refine Your Own Strategy: Use their wins and losses to sharpen your own product, pricing, and marketing.

Ultimately, competitor intelligence turns public information into a private advantage. For a deeper dive, explore these competitive intelligence strategies and insights. It’s how you stay prepared and win the game without cheating.

Why You Absolutely Need Competitor Intelligence

https://www.youtube.com/embed/E4C4xdCoWBU

Thinking a great product is all it takes to win is a fast-track ticket to failure. The hard truth is your competitors are out there running plays every single day. If you're not paying attention, you're not just standing still—you're actively falling behind.

This is where competitor intelligence (CI) stops being a "nice-to-have" and becomes your secret weapon.

Let’s be real: business is a game. Without CI, you’re playing poker blindfolded. You have no idea what cards your opponents are holding, how they're betting, or if they're about to go all-in with a game-changing feature.

Learn from Their Expensive Mistakes

One of the best parts about CI is letting your rivals make the costly blunders for you. Did they just spend a fortune on a marketing campaign that totally flopped? Great. You now know what messaging doesn't connect with your shared audience, and it didn't cost you a thing.

> Every time a competitor launches a poorly-received feature or gets roasted online for a clumsy ad, they're basically paying for your market research. Your job is to simply watch, listen, and learn.

By keeping an eye on their customer reviews and social media chatter, you get a front-row seat to their headaches. That insight is pure gold, helping you sidestep the same traps and build a better customer experience from the start.

Spot the Gaps Everyone Else Is Ignoring

Competitors aren't just cautionary tales; they're also a massive blinking arrow pointing toward opportunity. As you dig into their products and marketing, you'll start to see the holes in their strategy.

These are the market gaps—the customer needs they're either too busy or too blind to address.

Maybe their pricing is way too complicated, or their product is missing a key integration that users are begging for in online forums. These aren't just complaints; they're invitations for you to swoop in and be the hero. A small startup, armed with this intel, can carve out a profitable niche right under the nose of a much larger player.

Position Your Brand to Win

Understanding your competition is the bedrock of positioning your brand. Without that context, you’re just another voice shouting into the void. Competitor intelligence helps you answer the most critical question in business: Why should a customer choose you over everyone else?

By tracking your rivals, you can:

- Set Smarter Prices: See how they structure their pricing to find a sweet spot that highlights your value without starting a race to the bottom.

- Craft a Unique Message: If everyone else is talking about speed, you can stand out by focusing on customer service or ease of use.

- Develop a Winning Roadmap: Notice they just launched a feature that’s getting tons of buzz? That intel can help you prioritize your own development—either by building a better version or by focusing on a different area they’ve neglected.

Powerful tools can help you gather this data automatically. While platforms like Ahrefs or Semrush are incredible, they can be super expensive. For a more modern and accessible approach, a tool like already.dev can give you a comprehensive view without destroying your budget.

In the end, CI isn't about copying. It's about finding your unique angle to stand out and win.

The Four Key Areas of Competitor Intelligence

Alright, so you’re sold. Competitor intelligence isn't just for spies in movies; it's a real-deal superpower for your business. But where do you actually start digging? It's easy to get lost in an ocean of data and end up with a pile of useless facts.

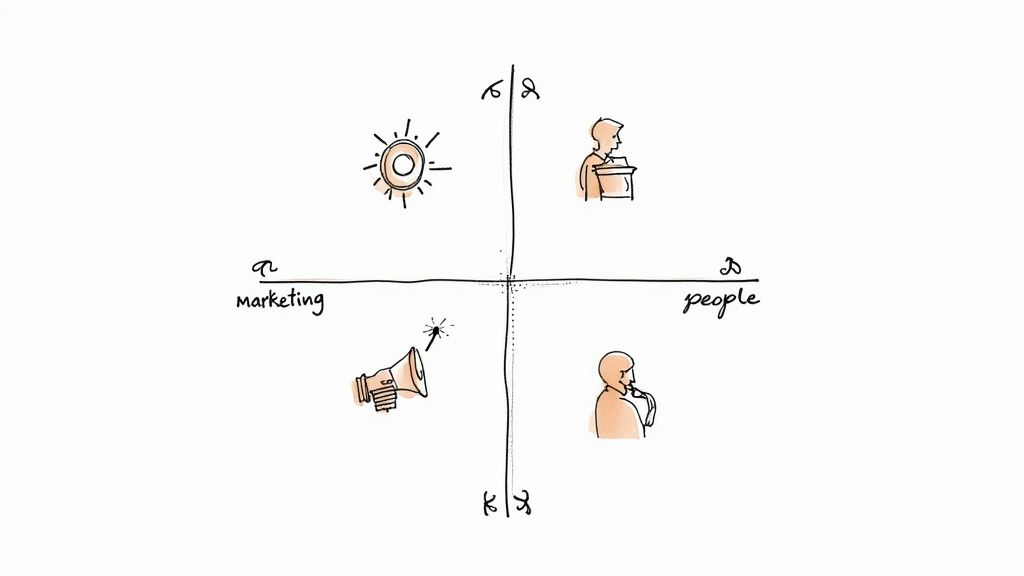

To keep it simple, we can break down CI into four main areas. Think of them as the four corners of your competitive battlefield. By focusing your energy here, you’ll gather the intel that really matters.

Product Intelligence: What Are They Building?

This is where you put on your product manager hat. Your mission is to figure out what your competitors are selling, how they’re selling it, and—most importantly—if their customers actually like it. It’s all about getting inside their product strategy so you can build something way better.

Start by digging into their public roadmap, feature announcements, and update logs. This tells you where they’re spending their engineering firepower. Next, dive deep into customer reviews on sites like G2 or Capterra. These are goldmines for figuring out what features people love and what drives them crazy.

You're hunting for answers to questions like:

- What features did they just launch? This is a huge clue about their priorities.

- How have they changed their pricing? A price drop might mean they're feeling the heat; a price hike could signal new confidence.

- What are the most common complaints in their reviews? These are your opportunities, served up on a silver platter.

Marketing Intelligence: How Are They Making Noise?

Next up: marketing. You can build the best product in the world, but if nobody knows it exists, you’re dead in the water. This part is about dissecting how your rivals attract and convert customers. You need to understand their messaging, the channels they're using, and what’s actually working.

The big-gun tools like Ahrefs or Semrush are fantastic for this, but they can be expensive, often running hundreds of dollars a month. A more focused and wallet-friendly alternative like already.dev can get you the insights you need without the hefty price tag. You can also start simple by following their social media, signing up for their newsletter, and just looking at their ads.

Of course, a great first step is learning how to find your competitors in the first place—you might uncover rivals you never knew you had.

> The goal isn’t to copy their marketing playbook. It's to understand their strategy so you can find a different, smarter way to reach your audience. If they’re spending a fortune on Google Ads, maybe you can win by creating amazing content that ranks organically.

Sales and Customer Intelligence: Who Are They Wooing?

This is all about figuring out who their ideal customers are and how their sales team closes deals. Understanding their customer profile helps you do one of two things: target the same audience more effectively, or go after a segment they’re completely ignoring.

Take a look at their case studies, testimonials, and the customer logos they plaster all over their website. This tells you the size and type of companies they’re winning. Even better, check out their job postings for sales roles. The descriptions often spill the beans on their sales process, target quotas, and the customer segments they’re chasing.

People and Strategic Intelligence: What Are Their Big Moves?

Finally, pay attention to the people. A key hire or a sudden departure is often the earliest signal of a major strategic shift. Did they just hire a VP of International Expansion? You can bet they're planning to go global. Did their head of product suddenly bounce? That could signal internal chaos or a big pivot.

Following key employees on LinkedIn and setting up news alerts for your competitors can give you a massive leg up. This kind of intelligence is becoming core to modern business. The global market research field is projected to hit around USD 150 billion by 2025. It’s no longer just about tracking rivals; it’s about understanding the entire market.

Your Competitor Intelligence Starter Kit

So, you're ready to start gathering intel, but your budget is closer to "instant ramen" than "international spy." Good news. You don't need a massive bank account to get started. The trick is to blend free, scrappy methods with a few powerful, cost-effective platforms.

Think of it like building a championship team. You don’t just sign the most expensive players; you find the right mix of talent. Your CI toolkit should be the same.

The Free and Scrappy Foundation

Before you spend a dime, you can uncover a surprising amount of info with tools you already use. This is your ground game. It isn't flashy, but it's essential.

- Google Alerts: This is the OG of free monitoring. Set up alerts for your competitors' brand names, products, and even their execs. Google will email you whenever they get a mention. It’s like having a little robot scout bringing you daily briefings.

- Social Media Lurking: Don't just follow your competitors—study them. Dig into their mentions, see what real customers are saying (both good and bad), and note the influencers they're cozying up to. Their social media is a live feed of their marketing and customer sentiment.

- Newsletter Sign-ups: Grab a burner email address and subscribe to every competitor's newsletter. This gives you a direct line into their promos, content strategy, and product announcements.

This manual approach is a fantastic way to get started. A huge part of this involves B2B data enrichment. To turn that raw data into something useful, check out a comprehensive guide to B2B data enrichment.

Leveling Up with Specialized Tools

Once you’ve got the basics down, you’ll want to graduate from grunt work to automated insights. The market for these platforms is booming. The global competitive intelligence tools market is projected to skyrocket to $1.12 billion by 2032. You can discover more insights about this growing market to see how critical these tools are becoming.

Platforms like Ahrefs and Semrush are the heavyweights. They’re incredible for deep-dive SEO analysis, letting you see exactly which keywords your competitors rank for. The downside? They can be seriously expensive, often running hundreds of dollars per month—a tough pill for a startup to swallow.

For a modern approach that won’t make your accountant cry, there’s already.dev. It's built for product teams and founders who need to understand the competitive landscape quickly and affordably.

Here’s a glimpse of how already.dev presents competitor data visually.

This kind of dashboard instantly shows you the key players and how they position themselves, turning hours of manual research into a quick summary.

> The big difference is focus. While expensive SEO suites drown you in data, a tool like already.dev gives you specific, actionable insights to validate an idea or sharpen your strategy, saving you time and money. For a detailed comparison, check out our guide on the best competitive intelligence tools.

Building your CI starter kit is all about being resourceful. Start free, then strategically invest in a tool that aligns with your goals.

Turning Your Insights Into Action

Let's be real. Piling up data is easy. You can collect every tweet, blog post, and press release from your competitors until you’re swimming in info. But data on its own is just noise. The real trick is turning that noise into a clear game plan.

Collecting intel without a plan is like going grocery shopping without a recipe—you’ll come home with a random cart full of stuff and no clue what to make for dinner. This section is your recipe.

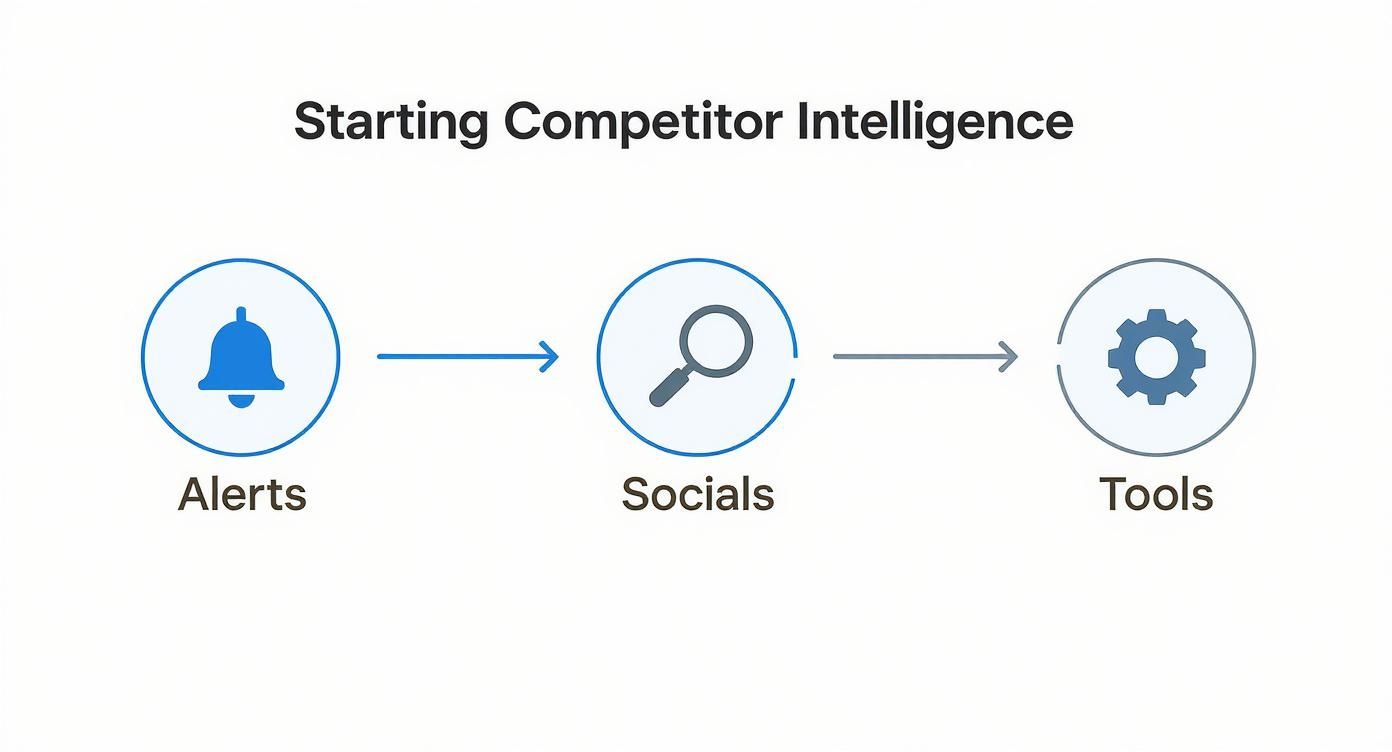

This flow chart gives a high-level view of how to get started, from setting up alerts to using specialized tools.

It shows that a solid process is a mix of automated monitoring and good old-fashioned manual deep dives. You need both to get the full picture.

Step 1: Define Your Goals

First things first: know what you’re looking for. What specific question are you trying to answer? Without a clear goal, you're just wandering in the dark.

Imagine you’re opening a new indie coffee shop, and a giant Starbucks is across the street. Your goal can't just be to "beat Starbucks." That's way too vague.

Instead, your goals should be laser-focused:

- Find a niche Starbucks ignores: What kind of customer do they not serve well?

- Set the right price: How can we price our coffee to feel premium but still be fair?

- Create marketing that cuts through the noise: How do we get the word out without a huge ad budget?

See the difference? Now you have a mission. Every piece of intel should help you answer one of these questions.

Step 2: Collect the Right Intel

With clear goals, you can focus your efforts. Instead of grabbing every piece of data, look for specific clues that matter.

For our coffee shop example, this means:

- Lurking at Starbucks: Seriously, go sit there. Who are the customers? Students glued to laptops or business people having quick meetings?

- Reading their reviews: Check their Google and Yelp pages. What do people complain about? "The Wi-Fi is slow," "It's too loud," "The coffee tastes generic." These complaints are pure gold.

- Analyzing their menu: What do they sell? What’s the price for a latte versus a fancy seasonal drink?

This isn’t random snooping; it’s targeted intelligence gathering.

Step 3: Connect the Dots

This is where you ask, "So what?" You've collected the data, now figure out the story it's telling you.

For our coffee shop, the insights will start to jump out:

- Insight 1: Starbucks is packed with remote workers, but reviews say it's noisy and impersonal. Opportunity: We can create a quiet, cozy space designed for focus.

- Insight 2: Their price for a simple black coffee is high, but they make their real money on sugary drinks. Opportunity: We can offer exceptional, locally-roasted coffee at a competitive price. We'll be the "serious coffee" spot.

- Insight 3: All their marketing is about big, national campaigns. Opportunity: We can run hyper-local marketing focused on community events and partnerships.

Step 4: Act and Repeat

Finally, it's time to turn insights into action. This is the most crucial step—and the one most people skip. Based on your analysis, you have to make real moves.

So, for our coffee shop:

- Action: Design the shop with comfy chairs, sound-dampening panels, and tons of outlets. Market it as a "focus-friendly" space.

- Action: Price our drip coffee competitively but highlight its quality. Keep the menu simple and elegant.

- Action: Sponsor a local art fair and give out free coffee, or partner with the bookstore next door.

This process is so critical that the market for competitor intelligence tools has exploded. North America alone held around 43.61% of that market in 2019, showing how vital this is. Companies need to analyze tons of data to make these smart decisions. You can read the full research on CI tool adoption to see how widespread this is.

The point of this cycle is to create clear summaries of what you’ve learned. For a fantastic template, check out our guide on creating powerful competitor battle cards. It's the perfect way to give your team the insights they need to win.

Common Questions About Competitor Intelligence

Alright, let's clear the air. As soon as you start digging into competitor intelligence, questions pop up. It can feel a bit murky, like trying to figure out where "smart research" ends and "creepy lurking" begins.

Let's tackle the big ones head-on with straight, no-fluff answers.

Is Competitor Intelligence Legal and Ethical?

This is the big one. Yes, it is 100% legal and ethical, as long as you’re not doing anything shady.

Ethical competitor intelligence is just using publicly available information. We're talking about:

- Reading their company blog and press releases.

- Following their social media accounts.

- Checking out product reviews on sites like G2 or Capterra.

- Signing up for their newsletter with a spare email.

This is just good research. You only cross the line into illegal territory when you do things like hacking, lying to get inside info, or stealing private documents. So, unless you're auditioning for a spy movie, you're in the clear. Stick to the public domain, and you’re just being a savvy business owner.

How Much Time Should I Spend on This?

You don't need to quit your day job. It’s all about consistency, not cramming.

A few focused hours a week is a fantastic start. Maybe you block off a "CI Friday" morning to check your alerts and scan social media. A little effort every week is way more effective than a massive research panic once a year when a new competitor appears.

Start small and make it a habit.

Can I Do Competitor Intelligence Without Expensive Tools?

Absolutely. While paid platforms speed things up, you can get surprisingly far for free. The info is out there; it just takes more manual effort to piece it together.

Powerful tools like Ahrefs and Semrush are amazing for deep dives into SEO, but they can be seriously expensive, easily running hundreds of dollars per month. A more modern and accessible alternative like already.dev gives you the insights you need without making your wallet weep.

But if your budget is zero, you can still build a solid foundation:

- Set up Google Alerts: Monitor competitor names and products. It's free and simple.

- Follow Them Everywhere: Keep tabs on their social media, read their blog, and subscribe to their newsletter.

- Check Job Postings: These are goldmines for figuring out their strategic direction.

> The biggest advantage of a tool is speed and organization. It automates collection, saving you hours of grunt work so you can spend your time on analysis, not just gathering data.

What Is the Biggest Mistake People Make?

Easy. The number one mistake is becoming a copycat.

The point of competitor intelligence isn't to mimic everything your rival does. It’s to understand why they do it, see how customers react, and then use that insight to find your own unique angle. If you just copy their pricing and features, you'll always be one step behind and you’ll never build a brand that stands for anything.

Let competitor intelligence inform your strategy, not become your strategy. Be inspired, not a clone. The goal is to learn from them so you can find a smarter, different, or better way to win.

Ready to stop guessing and start knowing what your competitors are up to? already.dev uses AI to automate your competitive research, turning hours of manual work into a clear, actionable report in minutes. Find your true competitors and uncover their strategies before you write a single line of code.