What is Market Intelligence? A Guide to Making Decisions That Don't Suck

Discover what is market intelligence and how it helps you gather insights on competitors and customers to make strategic, data-driven decisions.

Let's be honest: Market intelligence is your business's superpower for seeing around corners. It’s the art of gathering clues about your entire industry—what your competitors are planning, what customers actually want, and where the market is headed—so you can make smart decisions without just winging it.

What Is Market Intelligence Anyway?

Let's cut the corporate jargon. Imagine you're a detective on a case. You wouldn't just look at one piece of evidence, right? You'd talk to witnesses (customers), check out other suspects (competitors), and get a feel for the whole crime scene (the market). That's exactly what market intelligence is.

It’s not just about spying on your rivals, though that’s definitely a fun part of it. It’s a 360-degree view that combines different types of info to give you the full picture. And no, it’s not just for mega-corporations with bottomless budgets. Even small businesses can (and should) use it to find their footing and outsmart the big guys.

The Four Pillars of Market Intelligence

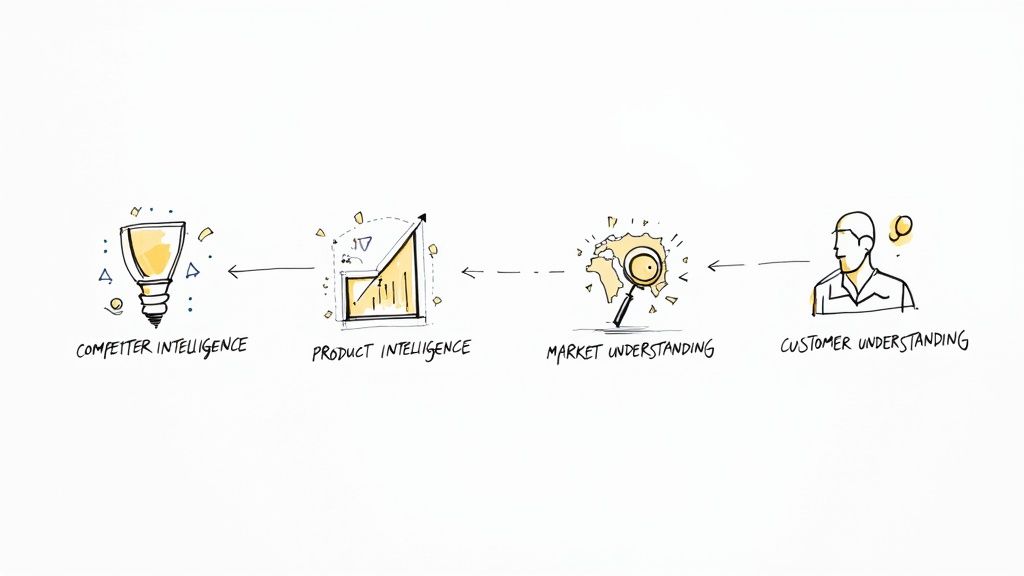

So, what goes into this "secret sauce"? It’s less complicated than it sounds. Think of a solid market intelligence strategy as a sturdy table held up by four legs. Each one is critical for keeping your business balanced and informed.

Here's a quick and dirty breakdown of those four pillars:

The Four Pillars of Market Intelligence

| Pillar | What It Means In Simple Terms | A Quick Example | | :--- | :--- | :--- | | Competitor Intelligence | Knowing what the other players are doing—their pricing, their new features, and how they talk to customers. | You notice a top competitor just dropped their prices by 15% and launched a huge ad campaign. Busted. | | Product Intelligence | Understanding how your product stacks up and what features customers are practically begging for. | Customer reviews for a rival product constantly complain about a missing feature that your product already has. Score! | | Market Understanding | Getting a feel for the overall health of your industry, including new trends and stuff that could blow everything up. | You see a sudden rise in demand for eco-friendly packaging, signaling a shift in what people care about. | | Customer Understanding | Digging into who your customers are, what problems they need to solve, and why they choose you (or your competitors). | You discover on social media that your target audience values speedy customer support more than anything else. |

By keeping an eye on all four of these areas, you go from making wild guesses to making data-backed decisions.

And this isn't just some fluffy trend; it's a business necessity. The market intelligence industry was valued at around $12.1 billion in 2024 and is expected to balloon to $21.4 billion by 2031. That growth tells you companies are relying on this stuff to stay ahead.

Why Market Intelligence Is Not Just a Nice-To-Have

Okay, so you get the "what." Market intelligence is your company’s private eye, digging up clues on competitors, customers, and where the industry is headed. But let's get real: Why should you actually care?

Think about it. Launching a new product without market intelligence is like trying to navigate a new city blindfolded. You might stumble forward, but you're probably going to walk into a pole. This isn't about some fancy buzzword like "strategic alignment" from a business textbook. It's about survival.

Your Secret Weapon for Growth

Good market intelligence is what separates a calculated risk from a wild, desperate gamble. It gives you the power to see what's coming, letting you sidestep potential disasters and floor it toward real opportunities.

> "Market intelligence is the foundation of any successful business strategy. Without it, you’re navigating in the dark." – Warren Buffett, Chairman and CEO of Berkshire Hathaway

That quote hits the nail on the head. The companies that really invest in understanding their market are the ones that don't just survive—they thrive. In fact, a 2024 report found that top-tier companies boosted their market intelligence budgets by 24% since 2021. And get this: 75% of them strongly agree those investments paid off big time. They aren't just throwing money at data; they're buying a map to the future.

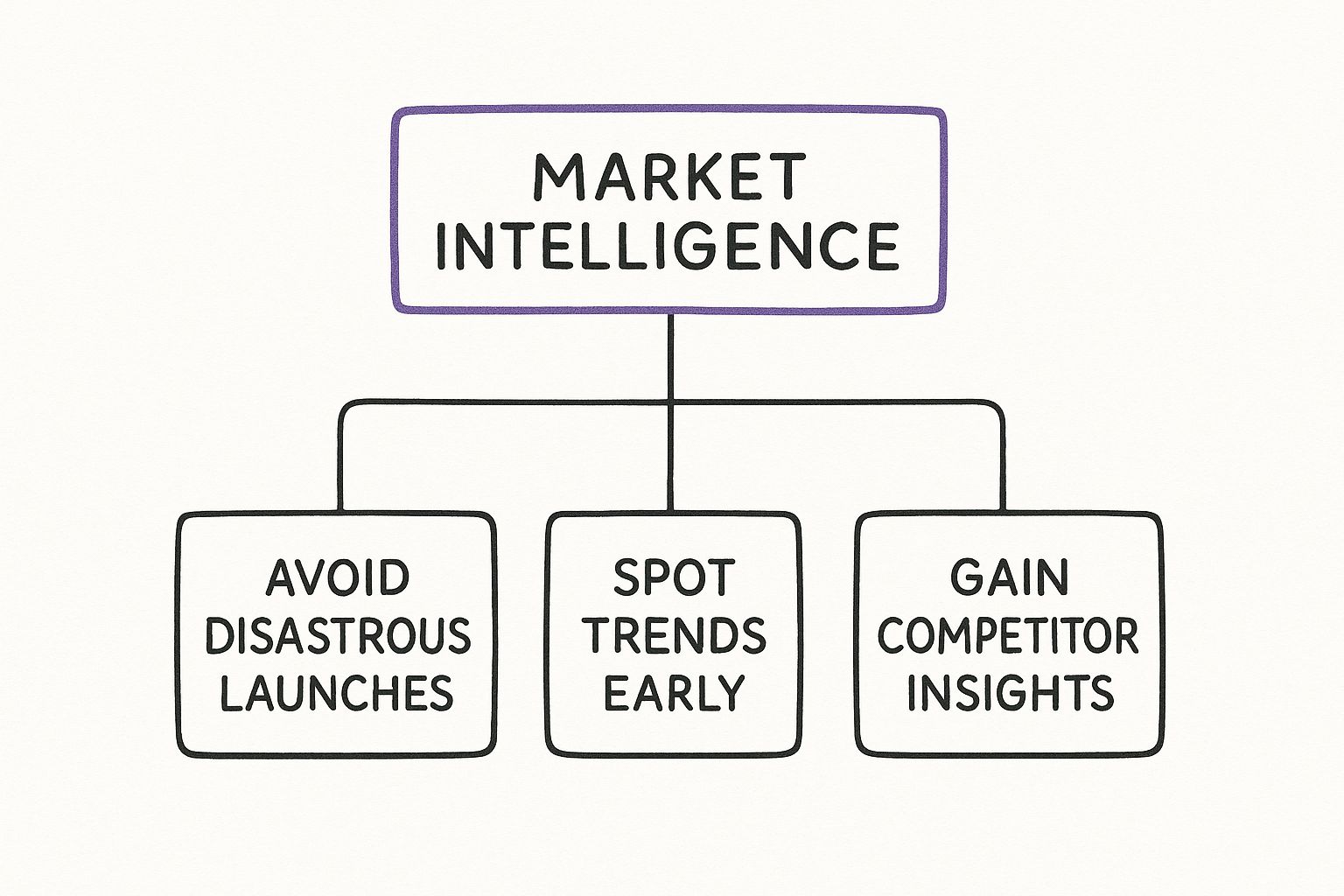

This infographic lays out the core benefits pretty clearly.

As you can see, it's not just one thing. These benefits all work together, creating a flywheel effect that leads to smarter, faster decisions and actual growth.

The High Cost of Flying Blind

History is a graveyard of giants who thought they were too big to fail. Remember BlackBerry? They owned the mobile phone market. But they completely missed the boat on touchscreens and apps. While they were busy perfecting a physical keyboard, Apple was creating a tiny computer that could fit in your pocket. Their downfall wasn't a bad product; it was a spectacular failure of market intelligence.

Here’s what you get when you actually pay attention:

- Dodge Disastrous Launches: You’ll find out if your "genius" idea is something people will actually buy before you pour a fortune into it.

- Spot Trends Before They're Obvious: Catch the next big wave while it's still forming, and you can ride it as a leader instead of paddling frantically to keep up as a follower.

- Get Inside Your Competitor's Head: Figure out why your rivals are winning (or losing) and use that intel to sharpen your own game. It's like getting a peek at their playbook.

At the end of the day, market intelligence isn’t just another line item on a budget. It's an investment in not becoming the next BlackBerry. It's how you make sure your business stays relevant, competitive, and profitable for years to come.

Exploring the Four Types of Market Intelligence

Alright, so market intelligence is your all-seeing eye on the industry. But to really get it, you need to see it less as one big thing and more like a Swiss Army knife. It has four main tools, and each one helps you solve a different kind of problem.

Let's break them down without the corporate mumbo jumbo.

Competitor Intelligence: Stealing Their Playbook

Think of competitor intelligence as getting a peek at the other team's playbook before the big game. It's all about knowing what your rivals are up to. What are their prices? What shiny new features are they rolling out? Who are they targeting with their ads?

This isn’t about some cloak-and-dagger corporate espionage; it’s just paying attention. For example, a small e-commerce brand might see a competitor launch a "buy now, pay later" option and then blast it all over TikTok. That’s a massive signal about where the market is headed. While big-name tools like Semrush and Ahrefs can track this stuff, they can also be ridiculously expensive. A more focused tool like Already.dev gives you that same competitive insight without breaking the bank.

Product Intelligence: Playing Feature Detective

Next up, product intelligence. This is where you put on your detective hat and investigate what makes the products in your space tick. What features do customers rave about? What do they constantly complain about in online reviews? And most importantly, how does your own product compare?

Imagine you run a project management software. You could spend a weekend digging through G2 or Capterra reviews for your biggest competitor and notice a recurring theme: everyone hates their clunky user interface. Bingo! That's your opening. You can go all-in on making your UI the smoothest experience out there and make that the core of your marketing.

Market Understanding: Your Industry Weather Report

This one is the 10,000-foot view. Market understanding is like being a weather forecaster for your industry, spotting big storms and sunny spells before they arrive. Are new regulations coming? Is some new technology about to shake everything up? Are customer habits shifting?

A simple example: a local coffee shop owner starts noticing more people asking for oat milk. That's a market trend in a nutshell. Ignoring it means losing business, but leaning into it could make them the most popular spot on the block.

Customer Understanding: Becoming a Mind Reader

Finally, we have what might be the most crucial piece: customer understanding. This is the closest you’ll get to reading your customers' minds. It’s about digging past surface-level demographics and getting to the heart of who they are, what keeps them up at night, and what truly motivates them to buy.

> A perfect example is discovering that people don't buy your productivity app just for its features; they buy it because it makes them feel less stressed and more in control. That's an emotional trigger, and it's absolute marketing gold.

When you get this right, you can solve the problems they actually have. This is a key part of the broader concept of marketing intelligence, which you can read more about on our blog. By weaving all four types together, you can finally stop guessing and start making confident, data-backed decisions.

How to Gather Market Intelligence on a Budget

https://www.youtube.com/embed/jSzgvQgLmHQ

Alright, time to roll up our sleeves and play detective. Gathering market intelligence often sounds expensive, like something only giant corporations with rooms full of analysts can do. But you can uncover some killer insights without a massive budget. You just have to be scrappy and know where to look.

Think of yourself as a market spy on a mission. Your job is to gather intel using clever, and often free, methods.

Your DIY Market Spy Toolkit

Let's start with the free stuff. You can learn a shocking amount just by paying attention to what people are already saying online. This isn't rocket science; it's just smart listening.

Here are a few places to start your mission:

- Social Media Listening Posts: Don't just post content; listen to the conversation. Search for keywords related to your industry on platforms like X, Reddit, and LinkedIn. What problems are people complaining about? What are they praising? This is raw, unfiltered feedback.

- Customer Review Deep Dives: Head over to sites like G2, Capterra, or even Amazon and read the reviews for your competitors. Look for patterns in the 1-star and 5-star reviews. The complaints are their weaknesses, and the praises tell you what the market truly values.

- Public Data Goldmines: Government websites and industry reports are often packed with data on market size and trends. It might feel a bit dry, but the insights are pure gold and totally free.

Leveling Up with Smart Tools

When you're ready to get a bit more serious, you can look at specialized tools. Powerful platforms like Ahrefs or Semrush are incredible, but let's be real—they can be ridiculously expensive, often running hundreds of dollars per month.

This is where more focused, accessible alternatives come in.

> An intelligent tool doesn't have to drain your bank account. The goal is to get the specific insights you need to make one better decision. Find a tool that does that job well without charging you for a dozen features you'll never use.

A platform like Already.dev is built for this exact purpose. It helps you track competitors and understand market trends without the enterprise-level price tag. It automates the painful parts of research, giving you the key takeaways you need to act fast. Think of it as having a research assistant who works 24/7 for a fraction of the cost.

The global market research field, which includes market intelligence, is projected to hit about $140 billion in revenue in 2024. That number alone shows just how vital this data is. You can explore more market research statistics to see the full picture. Your goal is to get your slice of that intelligence without paying a fortune for it.

How AI Is Changing the Market Intelligence Game

The old playbook for market intelligence is being torn up, and artificial intelligence is doing the shredding. For decades, gathering intel was a painful, manual grind. It meant slogging through spreadsheets, poring over reports, and hoping you didn't miss something critical.

AI is flipping that script. It’s turning a slow, clunky process into something fast, smart, and actually useful.

Think of it this way: trying to gauge customer sentiment used to be like trying to listen to every single person in a massive stadium at once. You'd only catch bits and pieces. With AI, you suddenly have a superpower—the ability to hear the entire crowd, understand the mood, and even pick out the most important conversations.

From Manual Drudgery to Automated Insight

The real magic of AI is its knack for taking over the tedious work. It automates the soul-crushing data crunching that used to take all your time, freeing you up to actually think about the big picture.

This isn't some far-off concept; it's happening right now. Technologies like natural language processing (NLP) let AI read and understand human language—the good, the bad, and the sarcastic. It can scan thousands of customer reviews and social media comments in minutes to tell you how people really feel about a product.

> AI doesn't just gather data faster. It finds the hidden patterns that even a sharp human analyst might miss after their third cup of coffee. It connects the dots between what customers are saying and what the competition is doing.

This is a complete game-changer. By 2025, AI-powered tools are expected to slash the time it takes to analyze consumer behavior. These platforms are already cutting down data processing from weeks to just a few hours, helping companies make smart decisions almost in real time.

Predicting the Future and Finding Your Edge

AI isn't just about looking in the rearview mirror, either. It’s getting scary good at predicting what’s next. It can spot tiny, emerging patterns in online conversations, giving you a heads-up on the next big thing before it hits the mainstream.

As AI continues to redefine how we collect information, understanding the relationship between data infrastructure and AI's role in intelligence gathering becomes essential for anyone who wants to stay ahead.

This is exactly what tools like Already.dev are built for. Instead of dumping a mountain of raw data on your lap, they use AI to deliver a clear report that points directly to your biggest opportunities and threats. This is the heart of AI-powered market research—turning overwhelming information into a simple, actionable advantage. It's how you stop reacting to the market and start shaping it.

Got Questions About Market Intelligence? We’ve Got Answers.

Alright, let's clear up some common questions that pop up when people start diving into market intelligence. Think of this as the FAQ section for the stuff you're probably wondering about.

Market Research vs. Market Intelligence: What’s the Real Difference?

This one trips people up, but it's pretty simple.

Think of market research as taking a snapshot. It’s a one-off project to answer a specific question, like, "What do millennial moms think of our new packaging?" It has a clear beginning and end.

Market intelligence, however, is like watching a movie. It’s the continuous, real-time feed of what's happening across your industry. It’s about keeping a finger on the pulse of competitors, customers, and trends to inform your daily decisions. Research is a project; intelligence is a lifestyle.

How Often Should I Be Doing This?

This isn't a "set it and forget it" thing. The trick is to weave it into your regular workflow, not treat it like a massive annual project.

If you’re in a fast-paced space like SaaS or e-commerce, a weekly pulse check on your rivals might be smart. For more stable industries, a monthly deep-dive might be enough. The goal is consistency, not cramming.

> The secret is building a system that feeds you information so you don't have to hunt for it. That’s where an automated tool like Already.dev comes in handy—it’s on the lookout 24/7. You just check in for the highlights when you need to make a big decision.

This way, you stay in the loop without adding another overwhelming task to your plate.

Can a Small Business Actually Afford This?

Yes, absolutely. You don't need a Fortune 500 budget to get game-changing insights. You can gather a ton of valuable intel for free just by being observant.

- Listen in on social media: What are people praising or complaining about in your industry? The answers are right there.

- Keep up with industry blogs: See what the experts are buzzing about.

- Just talk to your customers: Seriously, this is a goldmine. Ask them what their biggest challenges are. It’s shockingly effective.

When you're ready to get more sophisticated, you don't have to jump to enterprise-level platforms that cost a fortune. While powerful SEO suites like Ahrefs or Semrush are great, they can be expensive overkill. More focused tools like Already.dev are built for businesses that need sharp, actionable insights without the six-figure price tag. Trust me, the cost of flying blind is way higher.

What Is the Single Most Important Piece of Market Intelligence?

If I had to boil it all down to one thing, what would it be? Easy. It’s truly understanding your customer's "job to be done."

Forget your product for a second. What fundamental problem is your customer trying to solve when they "hire" a solution like yours? Everything else—your competitor’s latest feature, a new market trend, flashy tech—is just noise compared to this. If you can deeply understand and solve your customer's core problem, you'll always have an edge.

Ready to stop guessing and start knowing? Already.dev uses AI to do the heavy lifting, delivering competitor and market insights in minutes, not weeks. Discover your strategic advantage today.