How to Build a Competition Analysis Framework (Without Boring Yourself to Tears)

Tired of guessing? This guide breaks down a simple competition analysis framework to help you understand rivals and build smarter business strategies.

A competition analysis framework is your secret playbook for figuring out what your rivals are up to. Think of it like watching game tape before the big match—you’re studying your opponents' moves, spotting their weaknesses, and figuring out exactly how to score.

So, What's a Competition Analysis Framework, Really?

Let’s cut the business-school jargon. You’re probably already doing some form of competitor analysis. You’ve Googled your rivals, creeped on their pricing pages, and maybe scrolled way too deep into their social media history. We’ve all been there.

The problem is, that kind of random "research" is messy. It's like trying to bake a cake by just yeeting ingredients into a bowl and hoping for the best. A competition analysis framework is the recipe. It gives you a structured way to stop guessing and start making smart moves based on what’s actually happening in your market.

This isn't just for giant corporations with bottomless budgets. Even a simple framework gives any business a clear roadmap to:

- Understand the Market: Get a bird's-eye view of the entire playing field, not just the company you hate-follow on Twitter.

- Identify Opportunities: Find those sweet spots and customer needs that your competitors are completely whiffing on.

- Avoid Costly Mistakes: Learn from your rivals' face-plants so you don't have to repeat them.

- Win More Customers: Because at the end of the day, it's about turning all that data into a real advantage that makes you money.

For a deeper dive, The Ultimate Guide to Competitor Analysis for Emerging Businesses offers a fantastic starting point for understanding these core concepts.

The Real Goal of Using a Framework

Look, the point of a competition analysis framework isn't to create a beautiful spreadsheet that you'll never look at again. That’s just procrastinating with style.

> The real goal is to turn boring data into killer insights. It’s about finding that one chink in a competitor's armor, that one group of customers they’re ignoring, or that one marketing channel they haven’t discovered yet.

This process is a huge part of building a solid business strategy. It's a key piece of a bigger discipline called competitive intelligence, which is just a fancy way of saying "knowing what the other guys are doing."

Ultimately, a good framework helps you answer the most important question in business: "How do we win?" It organizes your thinking, focuses your efforts, and gives you the confidence that your next move is a smart one—not just a shot in the dark.

The Core Parts of Any Analysis Framework

No matter which framework you choose—and we’ll get to specific ones later—they all share a few basic ingredients. Understanding these helps you see the "why" behind the process.

Here are the essential building blocks you'll find in pretty much any framework.

| Component | What It Means In Plain English | Why It Matters for You | | :--- | :--- | :--- | | Data Collection | Gathering all the dirt—like pricing, features, marketing slogans, and what their customers are complaining about online. | You can't analyze what you don't have. This is where it all starts. | | Competitor Profiling | Creating a "dossier" on each main rival. Who are they, what do they sell, and who buys their stuff? | This helps you see your competitors as actual players with their own goals, not just a faceless blob. | | Market Positioning | Figuring out where everyone stands. Are they the cheap option? The fancy one? The one with the weird mascot? | Knowing this helps you find your own unique spot where you can stand out and win. | | SWOT Analysis | A classic for a reason. Pinpointing their Strengths, Weaknesses, Opportunities, and Threats. | It's a simple but stupidly powerful way to spot strategic openings and potential dangers fast. |

Getting a handle on these four elements is the first step. They provide the structure you need to stop doing random research and start building a real competitive advantage.

The Three Pillars of Smart Analysis

You don't need a fancy MBA or a spreadsheet with a million tabs to figure out your competition. The big consulting firms love to make it sound complicated, but their approach boils down to three simple steps.

This method, used by giants like BCG and McKinsey, follows a simple flow: Assess, Benchmark, and Strategize. It’s not just theory, either. A wild 85% of Fortune 1000 companies use some version of this to see how they stack up. Even better, 75% of them now use these insights to get ahead of the market instead of just reacting to it. If you're curious, you can explore how top firms structure their competitive analysis for a deeper dive.

So, let's break down what these three pillars actually mean for you.

Pillar 1: Assess Your Surroundings

First up is the Assess phase. Think of yourself as a detective arriving at a crime scene. Your only job right now is to gather clues. You’re figuring out what’s going on, who the main players are, and what they've left behind.

You’re not making any judgments yet—just collecting the facts. This is where you answer a few key questions:

- Who are my competitors? This means listing out the obvious direct rivals and those sneaky indirect ones who solve the same customer problem with a completely different thing.

- What are they selling? Get a crystal-clear picture of their product features, what their service is like, and how much they're charging for it.

- Who loves them? Pinpoint their target audience. Are they chasing the same people you are, or have they found their own little fan club?

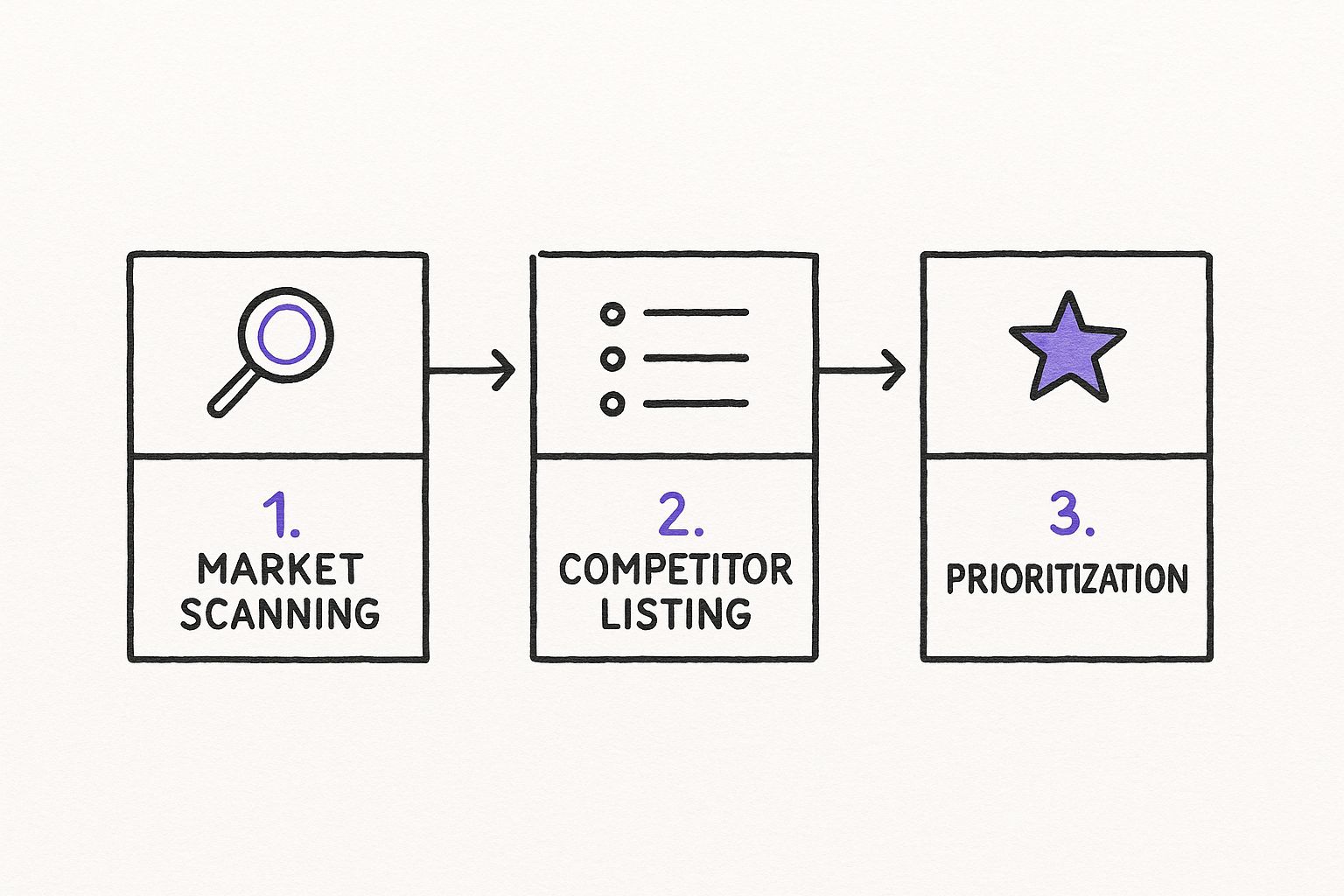

Going through this process helps you build a detailed map of your market. This infographic gives a great visual of how this initial assessment flows.

As you can see, it’s all about scanning the market, listing the players, and then deciding who’s actually important enough to track.

Pillar 2: Benchmark Against the Best

Okay, you've gathered your intel. Now it's time to Benchmark. This is where you basically create a report card, comparing your business directly against your top competitors. You’re moving from asking "what are they doing?" to "how do we stack up?"

This isn’t about feeling bad because a competitor is crushing it in one area. It's about getting an honest, objective look at where everyone stands.

> Benchmarking is your reality check. It forces you to set aside your ego and see your business through a customer's eyes, comparing features, price, and experience side-by-side.

You'll want to compare things like:

- Product Features: Do they have a killer feature you’re missing?

- Pricing & Value: Is their pricing more attractive? Do customers get more bang for their buck?

- Marketing & SEO: Who's winning the battle for Google's top spots? Who gets all the love on social media?

Tools like Ahrefs or Semrush are awesome for this, but let's be real, they can be crazy expensive. For a more focused and affordable option, a tool like already.dev can deliver the crucial competitive insights you need without the hefty price tag.

Pillar 3: Strategize Your Winning Move

Finally, we get to the fun part: Strategize. You’ve done the homework, you've graded the tests, and now it's time to build your action plan. All that juicy intel from the first two pillars is totally useless if it just sits in a folder on your computer.

This is where you translate your findings into actual things you're going to do. Your goal is to answer one simple question: "So, what are we going to do about it?"

Your strategy should be all about exploiting your competitors' weaknesses while doubling down on your own strengths. For example:

- Spot a competitor with awful customer reviews? Your move is to launch a marketing campaign that screams about your amazing customer support.

- Notice a rival is missing a key feature? Your plan could be to fast-track development for that very feature in your own product.

- Discover an untapped keyword they're completely ignoring? The action is clear: create a bunch of content that targets that term and own it.

This three-pillar framework—Assess, Benchmark, and Strategize—gives you a repeatable process for turning market noise into a real competitive advantage. It’s your roadmap for going from just watching your rivals to actively outmaneuvering them.

Classic Frameworks That Still Win

You know, sometimes the old ways are the best. You don't always need some brand-new, complicated technique to figure out what's happening in your market. A couple of classic competition analysis frameworks have stuck around for decades for one simple reason: they just work.

They’re like the cast-iron skillet of the business world—not flashy, but incredibly reliable and more powerful than you'd think. Let's get into two of the heavy hitters: Porter's Five Forces and the good old SWOT Analysis. I promise, we’ll skip the dry textbook definitions and get to what actually matters.

Porter’s Five Forces: The Industry Smackdown Map

Picture your entire industry as a wrestling ring. Porter's Five Forces is the model that helps you figure out who has the upper hand in the smackdown. It was cooked up by a Harvard professor, and its focus isn't on your company, but on the power dynamics of the whole industry you're in.

This framework helps you answer the big questions. Is this market a goldmine or a minefield? Who’s really holding all the cards—is it you, your suppliers, your customers, or some new disruptor about to jump into the ring?

Here’s a quick rundown of the five forces at play:

- Competitive Rivalry: How intense is the fight between the companies already in the game? If everyone is slashing prices and constantly one-upping each other, it’s a tough neighborhood.

- Threat of New Entrants: How easy is it for a new company to pop up and start stealing your lunch money? If you need a billion-dollar factory to compete, the threat is low. That's a good thing for you.

- Bargaining Power of Suppliers: Can your suppliers jack up their prices whenever they feel like it? If you're completely dependent on one supplier, they hold all the power.

- Bargaining Power of Buyers: On the flip side, how easily can your customers switch to a competitor or demand lower prices? When they have tons of options, their power goes way up.

- Threat of Substitutes: Can customers solve their problem with a totally different thing? For a coffee shop, a substitute isn't just another coffee shop—it could be an energy drink or just taking a nap.

This kind of analysis is getting more attention than ever. With global competition on the rise, regulators are looking at markets a lot more closely. In fact, one report pointed to a nearly 20% jump in enforcement actions by competition authorities worldwide between 2019 and 2023. This shows how critical it is to understand the forces shaping your industry. You can dig into the full OECD Competition Trends 2025 report to see how this stuff is evolving.

SWOT Analysis: Your Business Therapy Session

If Porter's Five Forces is about sizing up the industry, a SWOT analysis is about looking in the mirror. Think of it as a really productive therapy session for your business. It forces you to be honest with yourself while also keeping an eye on what’s happening outside.

SWOT is just an acronym for Strengths, Weaknesses, Opportunities, and Threats. Its beauty is its simplicity.

> A SWOT analysis is your cheat sheet for strategic planning. It organizes your internal reality (Strengths, Weaknesses) and the external world (Opportunities, Threats) into one clear picture.

Here’s the simple breakdown:

- Strengths (Internal): What do you do exceptionally well? This could be a killer product feature, a brand that people adore, or a super-efficient team.

- Weaknesses (Internal): Where are you falling short? Time to be brutally honest. Is your tech a bit janky? Is your customer service slow?

- Opportunities (External): What trends or gaps in the market can you jump on? This could be a new technology, a shift in customer behavior, or a competitor’s major screw-up.

- Threats (External): What’s out there that could sink you? Think new regulations, a shaky economy, or a new competitor who just got a truckload of funding.

The real magic happens when you start connecting the dots. How can you use your Strengths to pounce on those Opportunities? And how can you fix your Weaknesses to defend against the Threats? This simple four-box grid turns a jumble of thoughts into a clear path forward.

How to Gather Intel Without Going Broke

Alright, so you’re ready to build your own competition analysis framework. But then you think: where do I actually get all this juicy data? You might be picturing a team of analysts in a dark room, surrounded by glowing screens and subscribed to a dozen super-expensive tools.

And sure, platforms like Ahrefs or Semrush are absolute powerhouses, but their price tags can make your wallet cry. They're often built for big agencies with equally big budgets.

The good news? You can become a world-class data detective without breaking the bank. It just takes a bit of creativity. The best intel is often hiding in plain sight.

Become a Digital Sherlock Holmes

First, put on your detective hat and start snooping. Your competitors' own websites are goldmines. They are literally telling the world how they want to be seen.

Here's your low-budget intel-gathering checklist:

- Stalk Their Website: Seriously, read every page. Pay close attention to their homepage headline, their "About Us" story, and the words they use to describe their products. This tells you their market positioning.

- Sign Up for Their Email List: This is non-negotiable. It’s like getting their marketing playbook delivered right to your inbox. You’ll see their sales funnels, promotions, and content strategy firsthand.

- Read Customer Reviews: Scour sites like G2, Capterra, or even plain old Google Reviews. This is where customers get brutally honest, revealing what they love (strengths) and what drives them crazy (weaknesses).

- Lurk on Their Social Feeds: Check their LinkedIn, Twitter, and Instagram. How do they talk to people? What content gets engagement? This gives you a feel for their brand personality.

As you're pulling all this competitive intelligence together, it’s critical to know how to evaluate information sources. You want to make sure you're basing your strategy on solid data, not just random internet noise.

Finding Affordable Tools That Punch Above Their Weight

While manual digging is essential, the right tools can speed things up without costing a fortune. This is especially true when it comes to SEO and content analysis.

You absolutely need to know which keywords your competitors are ranking for and what topics they’re writing about. This is where you find the gaps you can swoop in and own.

> The big secret is that you don't need every feature an enterprise tool offers. You just need the right data to make smart decisions.

This is where an affordable alternative like already.dev comes in. It’s designed to give you those crucial SEO and content insights—like top keywords, content gaps, and competitor positioning—without the eye-watering enterprise price tag.

A platform like this can automate the heavy lifting, giving you a clear picture of the competitive landscape in minutes, not hours. It lets you focus on strategy instead of getting lost in spreadsheets. For more options, you can also explore some of the best free competitor analysis tools to add to your toolkit.

The demand for this kind of accessible data is exploding. The global Business Intelligence software market is on track to hit $78.42 billion by 2032, because businesses of all sizes need this data to compete.

In fact, over 60% of companies now use automated tools to gather competitor information. That's a massive leap from under 25% just a decade ago, showing a clear shift toward using smart, automated solutions to get an edge.

Turning Your Research Into an Action Plan

So you’ve done it. You’ve gathered mountains of data, stalked your competitors’ social media until you feel like a P.I., and have a spreadsheet that would make a data scientist proud. High five!

But let’s be brutally honest: information is completely useless without action. All that research is just a fun little project if it doesn’t lead to a real battle plan.

This is the moment where we connect the dots and turn that messy pile of research into a sharp, focused strategy. This isn’t about creating a 50-page report that will become a very expensive coaster. It’s about building a to-do list that gives you a real competitive edge.

Let's walk through a dead-simple, four-step process to make this happen.

Step 1: Organize Your Findings

First, get everything out of your head and into one place. Don’t overcomplicate this. A basic spreadsheet is your best friend.

Create columns for each competitor and rows for the different data points you’ve collected—pricing, key features, marketing channels, customer review sentiment, and so on.

The goal is to create a side-by-side view that makes patterns jump out at you. You’re not just listing facts; you’re creating a visual map of the competitive landscape.

If you’re staring at a blank spreadsheet and feeling overwhelmed, don’t worry. You can grab our free competitor analysis template to get started immediately.

Step 2: Pinpoint Key Opportunities

With your data neatly organized, it’s time for the fun part: finding the gaps. Scan your spreadsheet and look for areas where your competitors are dropping the ball. These are your golden opportunities.

Your mission is to identify 2-3 key opportunities. Maybe you notice that none of your rivals have a strong presence on TikTok, or their customer reviews consistently complain about a missing feature that your product already has. These are strategic openings.

> An opportunity isn't just something your competitor is doing badly. It’s a specific weakness you have the unique strength to exploit.

Think about it this way:

- Content Gaps: Are they all ignoring a specific high-value keyword? That’s your content plan for the next quarter.

- Service Flaws: Do their customers constantly complain about slow support? Make “lightning-fast support” your new marketing slogan.

- Pricing Confusion: Is their pricing model a convoluted mess? Position yourself as the simple, transparent alternative.

Step 3: Identify Major Threats

Now, let's flip the script. It’s not all offense; you also need a solid defense. Look at your spreadsheet again, but this time, focus on where your competitors are absolutely crushing it. What poses a direct threat to your business?

Pinpoint 1-2 major threats you need to defend against. Perhaps one competitor just raised a ton of money and is pouring it all into Google Ads, pricing you out of the market. Or maybe another one has a killer feature that your customers keep asking for.

Ignoring these threats is like leaving your front door wide open. You need a plan to either neutralize them or make them irrelevant.

Step 4: Define Your 90-Day Actions

This is where the rubber meets the road. Based on the opportunities and threats you’ve identified, it’s time to get specific. Forget about vague, long-term goals. We’re talking about concrete actions you can take right now.

Define three specific, measurable actions you will take in the next 90 days. Why 90 days? It’s long enough to make real progress but short enough to create urgency.

Here’s what that might look like:

- Action 1: Launch a blog series (5 posts) focused on the keyword gap we found.

- Action 2: Create a new landing page highlighting our superior customer support.

- Action 3: Start development on the feature our top competitor has that we’re missing.

Use a simple framework to keep yourself accountable. This isn't just about listing ideas; it's about committing to a plan.

A Simple Competitor Analysis Action Plan

Use this template to turn your research into concrete next steps.

| Competitor | Key Weakness or Opportunity | Your Action Item for Next 90 Days | How You'll Measure Success | | :--- | :--- | :--- | :--- | | Competitor A | Their customers complain about slow support. | Launch a "24-Hour Support Guarantee" campaign. | 15% increase in lead conversion from the new landing page. | | Competitor B | They ignore high-intent keywords in their blog. | Write and publish 5 blog posts targeting those specific keywords. | Achieve top 10 ranking for at least 2 of the 5 keywords. | | Competitor C | Their pricing is complex and confusing. | Create a simple pricing comparison page. | Reduce bounce rate on pricing page by 20%. |

This four-step process takes your competition analysis framework from a theoretical model to a practical tool that drives real business results. No more analysis paralysis—just clear, focused steps to get ahead.

Why This All Actually Matters

Alright, let's be real. Sifting through charts and competitor websites can feel like a massive chore. You might be tempted to skip it, thinking, "I already know my market." But this isn't just some boring academic exercise; it's a direct line to building a smarter, stronger business.

Using a competition analysis framework is like switching from fumbling around in the dark to playing with the lights on. It’s the difference between reacting to what your rivals do and making them react to you.

From Guesswork to Game Plan

When you consistently analyze your competition, you unlock some serious advantages. You start to see the bigger picture.

- Spot Trends Early: You’ll notice market shifts before they become mainstream, giving you a serious head start.

- Find Untapped Needs: You can identify pain points your competitors are ignoring and build a solution customers are desperate for.

- Avoid Expensive Mistakes: Why make your own blunders when you can learn from theirs for free?

- Price with Confidence: Understanding where your product fits in the market helps you price it correctly, maximizing your value without scaring customers away.

> This whole process is about turning external noise into internal clarity. It moves you from anxiety about the competition to confidence in your own strategy.

Real-World Wins from Simple Insights

This isn't just theory. Small businesses score big wins with these insights all the time. Think of the local bakery that noticed every competitor focused on fancy, expensive cakes. They launched a simple, affordable line of "everyday celebration" cupcakes and cornered a new market.

Or consider the software startup that read dozens of negative reviews about their competitor's terrible customer support. They made 24/7 human support their core selling point and built a fiercely loyal customer base. These aren't revolutionary ideas; they're smart moves based on paying attention. A solid competition analysis framework points you directly to where you can win.

Frequently Asked Questions

Got questions? We've got answers. Here are a few of the most common things people ask when they're ready to put a competition analysis framework into action.

How Often Should I Actually Do a Competitive Analysis?

This is a great question, and the honest answer is: it depends. A full, deep-dive analysis is a big project, so you probably don’t need to do one every single month.

For most businesses, a comprehensive review every six to twelve months is a great rhythm. This keeps your insights fresh without becoming a massive time-suck.

That said, you should always be in a state of "light monitoring." Keep an eye on your top 2-3 rivals’ social media, sign up for their newsletters, and periodically check their pricing. This way, you’ll never be caught completely off guard.

What’s the Biggest Mistake People Make With This?

Hands down, the single biggest mistake is analysis paralysis. This is what happens when you get so obsessed with collecting every single data point that you never actually do anything with the information. You end up with a beautiful spreadsheet but your business strategy hasn't changed one bit.

> The goal of a competition analysis framework isn’t to create a perfect report. The goal is to make one or two smart decisions that give you an edge.

Don't let perfect be the enemy of good. Gather enough data to spot a clear opportunity or threat, and then act on it. Action is always better than endless research.

What Tools Do I Really Need to Get Started?

You can get surprisingly far with a zero-dollar budget. Seriously. Google, your competitors' websites, their social media, and customer review sites are all free and packed with insights.

When you’re ready to get more serious, especially with SEO, you’ll want a specialized tool. A lot of people jump to big names like Ahrefs or Semrush, which are fantastic but can also be incredibly expensive.

A more focused and affordable alternative like already.dev can give you the crucial SEO insights you need—like what keywords your rivals rank for—without the giant price tag. The key is to start free, then add tools that solve a specific problem.

Ready to stop guessing and start winning? Already.dev uses AI to run a comprehensive competitive analysis in minutes, not weeks. Uncover your rivals' strategies, find market gaps, and get the data you need to build a smarter business.