A Competitor Analysis Template That Doesn't Suck

Tired of useless reports? Download our practical competitor analysis template to uncover real insights and make smarter decisions that drive growth.

A solid competitor analysis template should be a living, breathing document that helps you spot real opportunities—not just a spreadsheet destined to die in a forgotten folder. The best ones are lean, focused, and actionable, forcing you to gather intel that actually moves the needle for your business.

Why Your Last Competitor Analysis Was a Waste of Time

Let’s be brutally honest for a second. Most competitor analysis reports are a one-way ticket to Snoozeville. They’re bloated, stuffed with vanity metrics, and usually end up as a forgotten file on a shared drive.

Someone spends 40 hours building a spreadsheet so complex it needs its own instruction manual, presents it once, and it’s never seen again. Sound familiar?

The old-school approach is just broken. It encourages digital hoarding—collecting every scrap of data you can find without a clear purpose. We're not doing that here. This guide is about creating a tool, not a tombstone.

The All-You-Can-Eat Data Buffet

One of the biggest traps people fall into is trying to track everything. You start by listing a competitor's social media followers, then their top five blog posts, then the hex codes of their brand colors. Before you know it, you're 12 tabs deep and no closer to a useful insight.

The goal isn't to create a perfect replica of your competitor's business on paper. It's about finding their weaknesses and your opportunities.

> The point of a competitor analysis isn't just to know what your competitors are doing. It's to figure out what you can do better, differently, or first.

Relying on Expensive and Overwhelming Tools

Another classic mistake is thinking you need a pricey subscription to get good data. Don't get me wrong, tools like Ahrefs or Semrush are incredibly powerful, but their cost can be a gut punch for smaller teams or early-stage startups. Seriously, they can get expensive.

They can also flood you with so much information that you get stuck in "analysis paralysis."

While those platforms definitely have their place, you can get much of the same foundational data using smarter, more affordable alternatives. For instance, a tool like already.dev can give you a clear picture of a competitor's positioning and feature set without the five-figure annual contract.

The key is to start lean and only pay for more firepower when you have a specific question that needs answering. We're building a focused competitor analysis template that prioritizes action over data overload, using tools that make sense for your budget and your goals.

Building Your Actionable Analysis Template

Alright, let's ditch those generic spreadsheets you download, open once, and immediately lose in a folder somewhere. We’re going to build your perfect competitor analysis template from the ground up, focusing only on the stuff that actually helps you make smarter decisions. Think of it as your strategic command center, not a data graveyard.

You can build this in Google Sheets, Notion, or even a fancy Moleskine notebook if you’re old school. The tool doesn't matter nearly as much as the categories you choose to track. Get these right, and you'll have a powerful machine for spotting opportunities everyone else is missing.

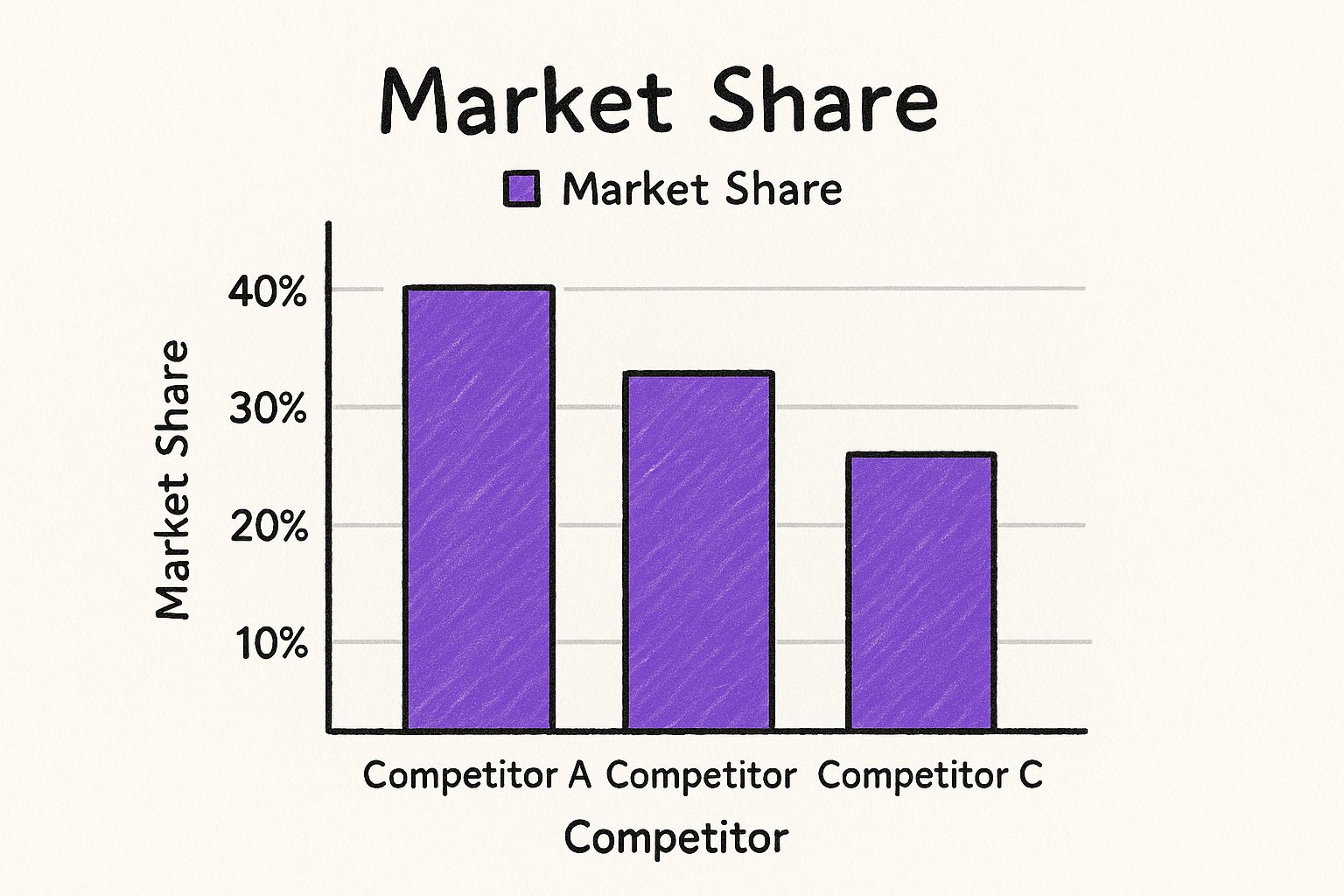

This chart gives a quick snapshot of the market share among the big players.

It’s pretty clear Competitor A has a huge lead, but Competitor B and C together own a significant chunk of the market. This tells me the landscape is fragmented and probably ripe for a new player to come in and shake things up.

The Non-Negotiable Template Sections

Your template needs a few core pillars to be effective. The key is to start simple and only add more detail later if you feel something critical is missing. These are the big ones that will give you 80% of the insights for 20% of the effort.

Here’s a breakdown of what every solid template should have:

- Company Overview: This is your at-a-glance section. Just the basics: their name, URL, a one-sentence description of what they do, and who they’re trying to sell to. It seems basic, but it sets the stage for everything else.

- Product & Pricing: What are they actually selling, and what does it cost? Jot down their core features, different pricing tiers, and whether they offer free trials or freemium plans. This is where you’ll start spotting gaps—are they way too expensive for small businesses? Are they missing a key feature everyone seems to be asking for?

- Marketing & SEO: How are they getting people in the door? Look at the main keywords they rank for, their estimated organic traffic, and which pieces of content are pulling in the most eyeballs. You don't need a thousand-dollar tool for this; some platforms can give you these key insights without the hefty price tag.

> The goal isn't to copy your competitor's every move. It’s to understand their playbook so you can write a better one. Focus on their strategy, not just their tactics.

Digging Deeper Into Their Strategy

Once you've got the basics covered, it's time to add some layers that reveal what they’re really thinking. This is where you graduate from simply collecting data to finding true competitive intelligence.

A huge part of this is looking at their user experience. I’ve seen data showing that businesses analyzing feature differentiation can improve their product-market fit by around 28% in the first year alone. And if you use a template to evaluate things like their site navigation and design, you can cut down on design flaws by about 19%, which directly helps with customer retention. You can learn more about building an effective template from this insightful guide.

So, what does that mean for your template? It means you need to add sections that go way beyond surface-level stats.

Key Sections for Your Competitor Template

This table breaks down the non-negotiable sections for your template, what to look for, and why it's crucial for your strategy.

| Template Section | What Data to Collect | Why This Actually Matters | | :--- | :--- | :--- | | SEO & Content Strategy | Top 5-10 keywords they rank for, their blog's main topics, content formats (videos, guides, etc.) | This shows you where their organic traffic comes from and what problems they're solving for customers. You can find keyword gaps they're ignoring. | | Social Media Presence | Platforms used, follower count, engagement rate (likes/comments per post), best-performing posts. | This isn't about vanity metrics. It tells you where their community lives and what kind of content resonates with them. | | Unique Value Proposition | Their main headline, slogans, and what they claim makes them different or better. | This is their core message. Understanding it helps you position your own brand to stand out against them. | | Customer Voice & Reviews | Snippets from G2, Capterra, or Reddit. Look for common complaints and praises. | This is pure gold. Their customers will tell you exactly what they're doing wrong and what you can do right. |

Ultimately, building your own competitor analysis template makes sure it’s perfectly suited to your specific goals and industry. If you’re looking for a great place to start, check out our guide on creating a competitor analysis template in Excel to get a head start.

Finding the Competitive Intel That Actually Matters

Alright, your competitor analysis template is set up and ready to go. Now for the fun part: playing detective. This is where you grab your metaphorical magnifying glass and start digging for the intel that will give you a real edge.

The goal isn't just to collect a mountain of data. It's about being strategic and finding the specific pieces of information that can change your game. Let's kick things off with the big one: SEO and content.

Cracking Their SEO and Content Code

Figuring out how your competitors pull in organic traffic is like getting a copy of their playbook. You need to see exactly which keywords they're ranking for and what content is doing all the work for them.

Sure, the big-name tools like Ahrefs or Semrush are powerful, but let's be honest—they can be expensive. If you're not ready to shell out hundreds a month, don't worry. A more budget-friendly tool like already.dev can still give you a fantastic overview of their keyword strategy without breaking the bank. It's all about finding the terms their customers are actually using.

When you're digging in, keep an eye out for these key things:

- Top Keywords: What are the top 5-10 non-branded keywords sending them traffic? These are the terms you need to compete for.

- Content Gaps: Are there any high-value keywords they’ve completely missed? That's your golden opportunity.

- Best-Performing Content: Pinpoint their most successful blog posts, guides, or landing pages. This is a direct signal of what their audience wants.

Of course, this all starts with knowing who you're up against in the first place. If that's still a bit fuzzy, our guide on how to identify competitors will help you get crystal clear.

Become a Professional Lurker

Sometimes the most valuable insights come from simply watching your competitors in their natural habitat. This is how you see their strategy play out in real-time. It’s time to go undercover.

First up, get on their email list. Use a burner email, of course—no need to tip them off. This gives you a front-row seat to their entire marketing funnel. You'll see how they talk to leads, what kind of promotions they offer, and the overall vibe of their messaging.

> Pay close attention to the rhythm and type of emails they send. Are they all about the hard sell, or are they focused on providing real value? This tells you a ton about how they view their customer relationships.

Next, become a ghost on their social media channels. Follow them everywhere they're active. But don't get distracted by follower counts; that's just a vanity metric. Look at their engagement. Are people actually talking back, commenting, and sharing? What types of posts spark the most conversation?

This is also a great place to spot their vulnerabilities.

Reading Between the Lines of Customer Reviews

Customer reviews are an absolute goldmine. People are rarely shy when they're either ecstatic or furious about a product or service. Head to sites like G2, Capterra, or even relevant Reddit threads to get the unfiltered truth.

Don't just scan the five-star praise. The real intel is buried in the two- and three-star reviews. This is where you'll find the recurring complaints, the frustrating limitations, and the customer service horror stories.

Every single one of those pain points is a potential opportunity for you to step in and do it better.

Analyzing Their Social Media Game

Let's dive into social media. This isn't just a place for your uncle to post blurry vacation photos anymore—it's a goldmine of competitive intelligence. But analyzing a competitor's social game isn't about mindlessly counting their followers. That’s a vanity metric, and we’re here for strategy, not ego.

The real mission is to reverse-engineer their playbook. What kind of content actually gets their audience fired up and talking? Are they killing it with hilarious TikToks while their Instagram feels like a ghost town? This is the kind of intel that points you directly to the biggest opportunities.

Look Beyond the Follower Count

Seriously, anyone can buy followers. What you can't fake is a genuinely engaged community. So, when you're poking around their profiles, ignore the big, flashy numbers and look for the real story buried in the comments and shares.

- Engagement Rate: This is the metric that matters most. Are people actually liking, commenting, and sharing their stuff? A brand with 100,000 followers and 10 likes per post is getting smoked by one with 1,000 followers and 100 likes. It's not even close.

- Audience Sentiment: Get a feel for the vibe in the comments. Is it a love-fest of people praising their customer service, or is it a dumpster fire of complaints and angry emojis? This is raw, unfiltered customer feedback handed to you on a silver platter.

- Content That Resonates: Scroll through their feeds and pinpoint the posts that absolutely blew up. Was it a behind-the-scenes video? A heartfelt customer story? A ridiculously funny meme? Make a note of the formats and themes that work, then think about how you can adapt the idea—not the content itself—for your own brand.

Using Tools Without Breaking the Bank

Of course, there are plenty of powerful tools that can automate this whole process for you. The big-name platforms can track every hashtag, mention, and sentiment score under the sun, but they often come with a hefty (and expensive) price tag. You've got tools like Ahrefs and Semrush, but you also have great alternatives like already.dev.

But you don't always need a pricey subscription. For a more focused approach, you just need to know what to look for manually. And if you do decide you want a wider view, you can check out our guide on the best competitive intelligence tools to see what's out there.

> The most valuable social media intel isn't about how many people follow your competitor. It's about why they follow them. Find that "why," and you've found a weakness to exploit or a strength to emulate.

This is more than just casual snooping; it's a strategic necessity. Looking ahead, using a social media-focused competitor analysis template can give your marketing a serious boost. One study even showed a 35% improvement in campaign engagement when teams used these insights to shape their strategy. It's clear that the shift from random manual checks to data-rich dashboards is changing how smart marketers operate. You can discover more about how dashboards are shaping strategy to see just how deep this trend goes.

Make sure your template has columns for each platform they're on, their average engagement rate, their most successful content formats, and the general sentiment of their audience. This intel helps you sidestep their mistakes and double down on what’s clearly working for their audience—which, in many cases, is your target audience, too.

Turning Your Data Into Winning Moves

So, you’ve filled out your shiny new competitor analysis template. It’s packed with data, insights, and maybe a few shocking discoveries. Now what? Don't just let it gather digital dust on your hard drive. Data is just noise until you turn it into a real plan.

This is where the real work—and the real fun—begins. We’re going to connect the dots and find the story hidden in all those rows and columns. It’s time to shape that raw information into a concrete business strategy that gives you an actual edge.

From Spreadsheet to Strategy

The easiest way to make sense of all this information is to get visual. Your brain is wired to spot patterns in a picture far better than in a spreadsheet. Two of the most effective tools I’ve used for this are a simple competitor matrix and a quick-and-dirty SWOT analysis.

A competitor matrix is basically a chart where you plot your business and your rivals against two key factors—say, "Price" on one axis and "Features" on the other. Seeing everyone on a grid instantly shows you who’s fighting it out in the crowded, low-price corner and who’s owning the premium space.

Then there's the SWOT analysis (Strengths, Weaknesses, Opportunities, Threats). It’s a classic for a reason. Your template just handed you all the intel you need for the "Threats" and "Opportunities" sections. Your own business knowledge fills in your "Strengths" and "Weaknesses." Simple.

> Data is a flashlight, not a crystal ball. It won't tell you the future, but it will show you exactly where the pitfalls are and where the clear path forward is.

Using these visual tools isn't just for show; it genuinely helps you make better decisions, faster. In fact, companies that use competitor matrix visualizations report a 25% faster identification of positioning gaps. Similarly, presenting a SWOT analysis visually can boost scenario planning efficiency by 33%. You can learn more about how visual templates speed up strategy if you want to dig into the numbers.

Spotting Your Golden Opportunities

With your data laid out visually, the opportunities should start jumping out at you. Your mission is to find the strategic gaps that nobody else is filling.

Start looking for patterns and ask yourself a few direct questions:

- Is there a pricing gap? Maybe everyone is clustered at the high end, leaving a huge opening for a more affordable, focused solution.

- Is there a content angle everyone is ignoring? Perhaps your competitors only create dry, technical blog posts. This is your chance to be the funny, relatable expert in the field.

- Is there a common customer complaint? If every competitor's online reviews mention a clunky user interface, building a sleek, intuitive product becomes your number one weapon.

The whole point of your competitor analysis isn't just to hoard data—it's to find that one powerful move you can make right now. Find that gap, own it, and you'll stop chasing your competitors and start making them chase you.

A Few Common Questions About Competitor Analysis

Alright, let's tackle a couple of the big questions that always come up when you're diving into this stuff. These are the things people often get stuck on, so let's clear them up right now.

How Often Should I Actually Update My Template?

Think of your competitor analysis template as a living, breathing document. If you just fill it out once and shove it in a folder, it's pretty much useless. The market doesn't stand still, and neither should your intel.

A full-blown, deep-dive review every quarter is a great rule of thumb. This cadence is perfect for catching major moves—like a rival launching a new feature set, a sudden pricing change, or a big marketing campaign that came out of nowhere.

In a really fast-paced space like SaaS or e-commerce, you might even want to do a quick monthly check-in. You don't have to redo the whole thing, but a quick scan of their social media ads, new blog posts, or pricing page can keep you from getting blindsided.

> The goal is to keep your analysis fresh and relevant. An outdated template is worse than no template at all because it gives you a false sense of security.

What If I Have a Zillion Competitors?

Feeling overwhelmed? That's normal. If you're in a crowded market, trying to analyze every single player is a recipe for burnout. Don't even try.

Instead, start by picking 3-5 of your most direct competitors. These are the companies that are constantly in your face, going after the exact same customers you are. Get to know them inside and out first.

Once you have a handle on them, you can start to layer in a couple of other types:

- Indirect Competitors: These guys solve the same core problem for your customers, just in a completely different way. Think of how a project management tool like Asana isn't just competing with Trello, but also with spreadsheets, sticky notes, and even a simple notebook.

- Aspirational Competitors: Who do you look up to? These are the brands you admire, even if they're in a totally different industry. Maybe you love how Patagonia handles its branding or how Zappos built a legendary customer service reputation. Study what makes them great and see what you can borrow.

This focused approach keeps your analysis from becoming a massive, unmanageable data dump. It stays sharp, practical, and actually helps you make decisions.

Ready to stop guessing and start winning? Already.dev uses AI to build your competitive landscape in minutes, not weeks, giving you the clarity to make your next move with confidence. Get started for free at Already.dev.