How to Create a Competition Battle Card That Wins Deals

Stop losing to competitors. This guide shows you how to build a competition battle card that gives your sales team the intel they need to win.

Think of a competition battle card as your sales team's secret weapon. It’s a simple, one-page cheat sheet giving them the exact talking points, competitor weak spots, and key differentiators they need to win when a prospect mentions a rival. It’s the cliff notes for outsmarting the competition, right in the middle of a call.

Why Winging It Is a Terrible Idea

Let's be honest, "competition battle card" sounds like something you’d find in a nerdy board game. But when you're in the sales trenches, it's the difference between a confident close and that awkward, deal-killing silence.

Picture this: your salesperson is nailing a demo. The prospect is hooked. Then, BAM: "This looks great, but how are you different from Competitor X?"

Without a battle card, this is where the panic sweat starts. Your rep might stumble, repeat some generic marketing fluff, or worse, just mumble that they don't really know. That hesitation is all it takes to lose a deal.

The Real Cost of Being Unprepared

In the startup world, you can't afford to ignore your competition. A staggering 42% of startup failures happen because they just didn't get the market they were in. That’s not just a random statistic; it’s a giant, flashing warning sign. Flying blind is a great way to go out of business.

A solid battle card flips that vulnerability into a major strength. You can dig deeper into these market dynamics in this competitive intelligence industry report.

A well-made battle card is more than a list of facts. It’s a strategic weapon that helps your team:

- Handle Objections with Poise: Instead of freezing up, they have proven, concise answers ready to go.

- Highlight Your Strengths: It trains them to pivot the conversation back to where you clearly win.

- Expose Competitor Weaknesses: It arms them with "landmine" questions to subtly guide prospects toward a competitor's shortcomings.

- Boost Confidence: A prepared salesperson is a confident one, and prospects can smell confidence (and fear) from a mile away.

> The goal isn’t to turn your team into a walking encyclopedia on every rival. It's to give them a cheat sheet that provides the confidence and clarity to navigate competitive conversations and turn tricky questions into opportunities.

Beyond Just Features and Pricing

A truly high-impact battle card goes way beyond a simple feature checklist. It gets into the stuff that actually influences a buyer's decision—intel on their reputation, common customer complaints, and sneaky pricing traps.

For example, maybe a competitor looks cheaper. But a good battle card would highlight that they tack on huge fees for implementation and support. That’s the kind of golden nugget your sales team needs to close the deal.

Gathering this kind of intel used to take days of boring manual research, sifting through pricey tools like Ahrefs or Semrush (which can cost a fortune). Now, platforms like Already.dev can automate this entire process, delivering deep competitive insights in minutes, not weeks.

Ultimately, a battle card isn't about trash-talking the competition. It's about accurately positioning your product as the best solution for the customer's problem. It’s all about preparation, confidence, and giving your team every possible edge to win.

Gathering Competitive Intel Without Losing Your Mind

Alright, you’re sold on the idea of a competition battle card. But where do you actually find all this juicy intel without falling into a Google black hole? Staring at your competitor's homepage is a start, but that’s like trying to understand an iceberg by only looking at the tip. It’s what they want you to see.

The real gold is hidden a few clicks away from their polished marketing content. You need to become a digital detective, looking for the unfiltered truth about how they operate, what their customers really think, and where they’re quietly heading next.

This used to be a painful, week-long slog of manual scraping and spreadsheet-building. Thankfully, things have gotten a lot easier.

Digging in the Right Places

First things first: get away from their homepage. The best, most honest competitive intel comes from third-party sources and candid conversations. These are the spots where the corporate mask comes off.

Here's a quick checklist of where to start your treasure hunt:

- Review Sites (G2, Capterra, etc.): This is your number one stop. Pro tip: read the 3-star reviews first. They are almost always the most honest, balancing what’s good with very specific, painful-to-read cons. Look for recurring complaints about missing features, bad support, or a clunky onboarding.

- Online Communities (Reddit, Forums): Search for your competitor's name on Reddit. You’ll find brutally honest threads from actual users discussing bugs, pricing frustrations, and what they wish the product could do. These are your future talking points.

- Job Postings: A company’s "Careers" page is basically a public roadmap. If they’re suddenly hiring a dozen enterprise reps, they’re trying to move upmarket. If they’re hiring a team of engineers with a specific AI skillset, you know what feature is coming next.

- Social Media Comments: Don’t just look at their pretty posts; read the comments. This is where angry customers, users begging for features, and confused prospects air their grievances in public.

To make sense of all this, it's crucial to understand how your product stacks up and conduct detailed competitive comparisons. This is where you connect their customers' complaints with your product's strengths.

The Old Way vs. The Smart Way

Traditionally, this meant firing up expensive subscriptions to tools like Ahrefs or Semrush. While powerful, those platforms can be overkill and are often designed for SEO experts, not a marketer who just needs to know why they keep losing deals to Competitor Z. The manual labor is still massive, and they're not cheap.

This is where things have gotten much better. The competitive intelligence tools market is exploding—it’s forecasted to surge by USD 27.95 billion between 2024 and 2029. Why the boom? Because AI is making this entire process ridiculously fast and easy. For a deeper dive, you can explore the full market analysis from Technavio.

> Instead of spending a week manually compiling a messy spreadsheet, what if you could get a comprehensive report in a few minutes? That’s the entire game-changer. You don't need a massive budget or a data science degree anymore.

This is exactly where a tool like Already.dev comes in. You describe your product in plain English, and its AI agents go to work, scanning hundreds of sources to find direct rivals, indirect threats, and even the ghosts of failed attempts in your space.

The interface is designed to be simple: you describe what you're building, and the AI takes over the heavy lifting.

This approach automates the whole discovery process, turning what used to be 40 hours of painful research into a four-minute task. If you're looking for a more in-depth guide on this initial discovery part, check out our guide on how to find competitors for your startup.

Organizing Your Findings for the Battle Card

Once you have all this intel, don't just let it rot in a Google Drive folder. The goal is to organize it into bite-sized chunks that a salesperson can absorb in 30 seconds.

I like to start a simple document for each competitor and create sections for the key info that will eventually make it onto the battle card.

- Pricing Traps: What hidden fees, sneaky contract lock-ins, or ridiculous overage charges do they have?

- Feature Gaps: Where does our product do something they simply can't? Be specific.

- Common Complaints: What themes keep popping up in those 3-star G2 reviews? (e.g., "terrible support," "slow interface").

- Their "Tell": What's the one thing they hate customers asking about? Every company has one.

By focusing on these practical sources and leaning on modern tools, you can gather all the intel you need for a killer battle card without losing your mind. You’ll be armed with the insights that actually win deals, not just a list of features you copied from their website.

The Anatomy of a Battle Card That Actually Gets Used

Let’s be honest. If your competition battle card is a giant wall of text, congratulations—you’ve just created a document that will never, ever be used.

No salesperson has time to read a novel right before a call. They need a cheat sheet, not a research paper. A truly effective battle card is scannable, sharp, and built for speed. It's designed to be glanced at, not studied. The whole point is to turn a mountain of data into a handful of razor-sharp talking points.

Forget exhaustive feature lists; focus on the stuff that actually closes deals.

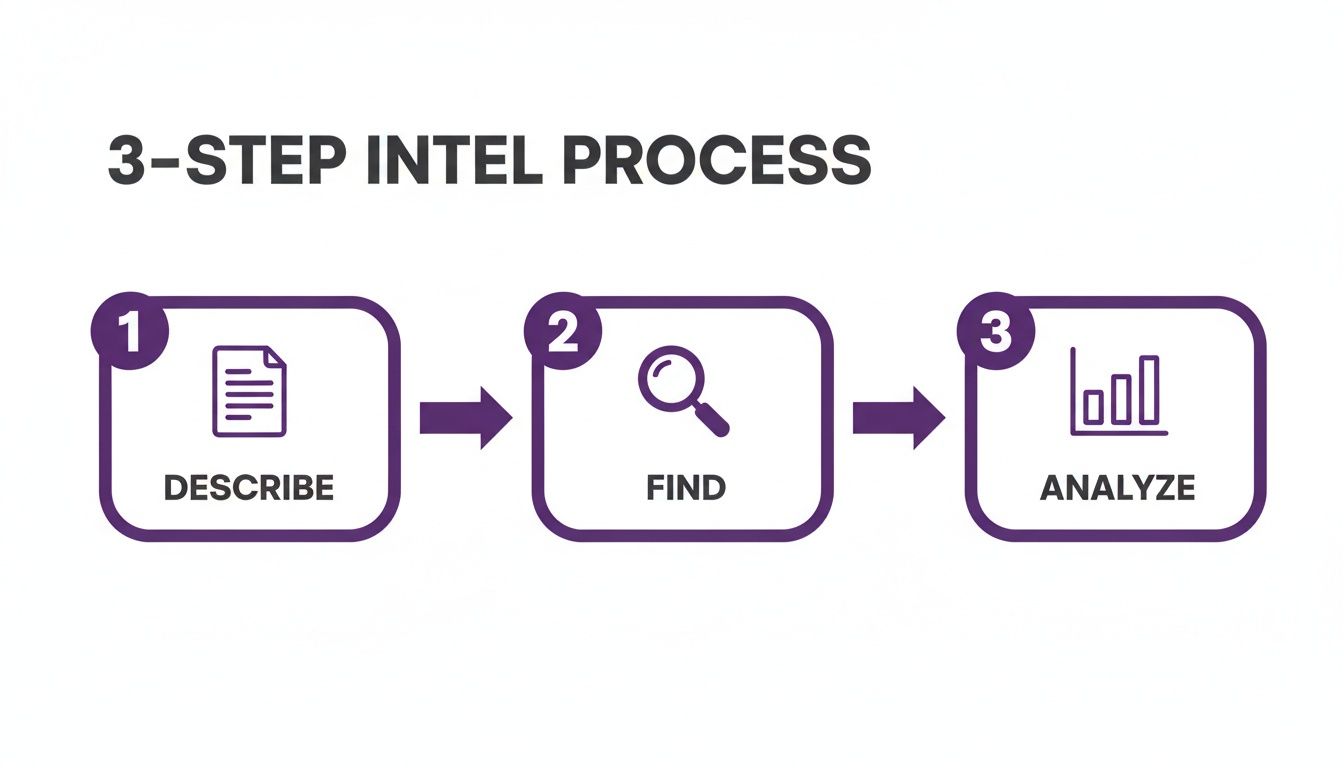

This is all about refining raw data into actionable intel your team can use on the front lines. The process is pretty straightforward.

You describe the problem, find the relevant data, and then analyze it to pull out those winning talking points. Simple, right?

Must-Have Sections for Every Battle Card

Think of your battle card like a car’s dashboard. It needs clear, distinct sections that answer the most common questions a salesperson faces in the heat of the moment. Don't try to cram every single piece of intel you found onto one page. Less is more.

To get started, here's a quick rundown of the essential fields I always include. This table lays out the non-negotiable sections that every high-impact competition battle card needs.

| Section Title | What It Is | Why It Matters | | :--- | :--- | :--- | | Quick Competitor Overview | A one-sentence summary of who they are and their target customer. | Gives immediate context. E.g., "They're the cheap, clunky option for SMBs who don't care about support." | | "Why We Win" Bullets | 3-5 undeniable reasons your product is the better choice. | These are the confident, punchy talking points your reps need to have locked and loaded. | | "Why We Lose" Bullets | An honest look at the top reasons you lose deals to them. | Prepares your team for common objections so they aren't caught off guard. Honesty builds credibility. | | Pricing Traps & Gotchas | A breakdown of their hidden fees, mandatory setup costs, or confusing tiers. | Helps reps reframe your price as transparent and valuable, turning a potential weakness into a strength. |

These core elements give your team a 360-degree view at a glance, arming them with both offensive and defensive talking points.

The Secret Weapon: Landmine Questions

Now, this is where your battle card goes from being a helpful document to a deal-winning weapon.

Landmine questions are clever, open-ended questions your sales team can ask a prospect to expose a competitor's weaknesses without ever mentioning their name. The beauty of a good landmine is that it helps the prospect discover the competitor’s flaw on their own. It feels natural, not like you're just bad-mouthing them.

Crafting them is a simple three-step process:

- Identify a Known Weakness: Start with something you know is a common complaint. Maybe you've seen in G2 reviews that their customer support is notoriously slow.

- Frame it as a Pain Point: Turn that weakness into a question about the prospect’s needs or past frustrations.

- Make it Open-Ended: Don’t ask a "yes" or "no" question. You want the prospect to talk.

For example, if you know Competitor X has terrible support, your landmine question could be:

> "Thinking back on software you've used, when you've needed urgent help, what's a typical response time you've come to expect?"

This simple question forces the prospect to think about the importance of good support. It plants a seed of doubt about any solution that can’t deliver and perfectly sets you up to highlight your own team's stellar response times.

Where to Dig Up Your Intel

Of course, building these sections requires solid intel. You could use big, expensive SEO tools like Ahrefs or Semrush, but honestly, they're often overkill and too costly for this task. Your best bet is an alternative like Already.dev.

From my experience, the best competitive gold comes from digging through the trenches: customer reviews, Reddit threads, and community forums where real users are talking.

This is where a tool like Already.dev becomes a game-changer. It automates the painful, manual process of sifting through hundreds of sources. It pulls out common complaints, feature gaps, and pricing models so you can quickly populate your battle card with proven data, not just guesses. It does the heavy lifting, letting you focus on crafting those killer talking points.

By sticking to this simple anatomy—a quick overview, clear win/loss points, pricing traps, and a few deadly landmine questions—you’ll create a battle card that your sales team not only uses, but loves. It’s the difference between showing up to a fight with a strategy versus just hoping for the best.

Real-World Battle Card Examples and Templates

Theory is great, but seeing a competition battle card in action is what makes everything click. It's one thing to talk about "landmine questions," but it's another to see how they look on a doc your sales team can actually use.

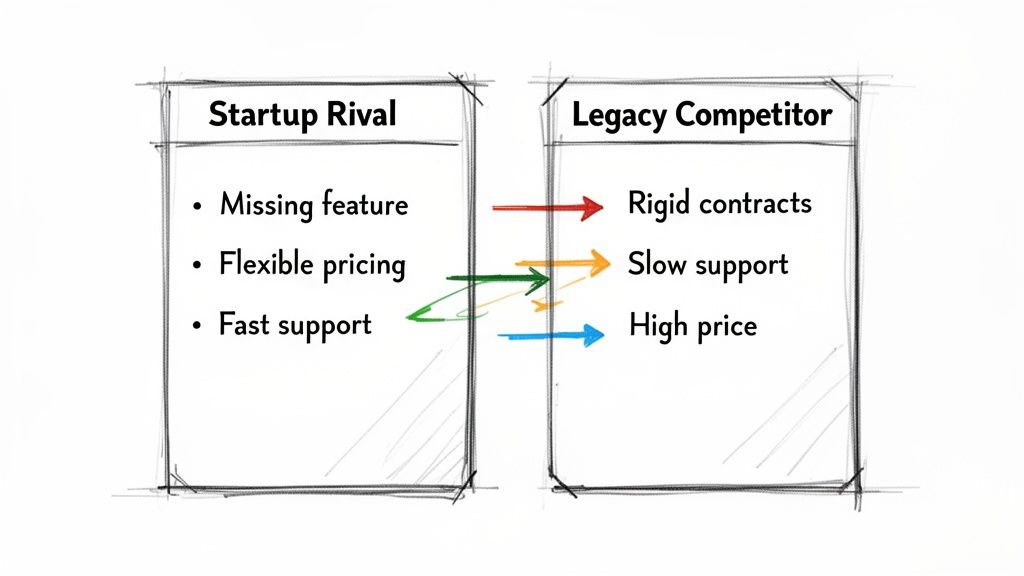

So, let’s get our hands dirty. We're going to break down what a battle card looks like for two very different types of competitors: the scrappy startup nipping at your heels and the clunky legacy giant everyone loves to hate.

The strategy for each is completely different, which is why a one-size-fits-all approach to battle cards falls flat.

Sizing Up a Scrappy Startup Rival

When you're going toe-to-toe with another startup, the fight often comes down to features. They're likely nimble, have a sleek interface, and are probably priced similarly. Simply trash-talking their tech is a dead end—because it’s probably pretty good.

This is where you have to get surgical. Your battle card needs to focus on the subtle but critical gaps in their offering.

- Feature Gaps: Do they lack a key integration that you have? Is their reporting super basic compared to yours? Find that one thing they can't do.

- Proof & Credibility: Are they the new kid on the block? Your battle card should highlight your established customer base, your case studies, and any glowing G2 reviews.

- "Why We Win" Talking Point: A great line for your sales reps might be: "They have a slick UI, sure, but they're missing the enterprise-grade security features our customers need to stay compliant. How do you handle data security today?"

For this kind of competitor, your battle card is all about precision. It’s not about broad attacks; it's about finding that one small-but-critical weakness and driving the conversation right to it.

Taking on the Clunky Legacy Competitor

Fighting a big, old incumbent is a completely different sport. They probably have a massive feature set and a brand name that’s been around forever. Trying to win on a feature-by-feature comparison is a losing battle.

Your strategy here is to pivot the conversation away from the product and focus on the terrible experience of being their customer.

> Against a legacy giant, you're not just selling software; you're selling a modern, painless alternative. Your battle card should arm your sales team with talking points about flexibility, support, and ease of use.

Focus your intel gathering on these pain points:

- Horror Stories: Dig through online reviews for complaints about awful customer support, long hold times, and surprise fees. These are gold.

- Inflexible Contracts: Do they lock customers into painful multi-year deals? This is a massive weak spot.

- Clunky UX: Their product is probably a nightmare to use. Frame this as wasted time and employee frustration for the prospect.

- "Why We Win" Talking Point: Try this: "Their platform might have a million features, but how many do you actually need? We focus on doing the important things perfectly, and our support team will actually pick up the phone when you call."

See the difference? For the startup, you attack the product's gaps. For the giant, you attack the company's outdated business model.

Your Turn to Build One

Alright, enough talk. It's time for you to build your own. Staring at a blank page is the worst, so we’ve put together a simple template to get you started. It has all the essential sections we’ve discussed, laid out in a clean, scannable format.

This isn't some fancy, locked-down PDF. It's just a straightforward starting block. You can grab our free competitor analysis template to kick things off. It takes the guesswork out of the structure so you can focus on plugging in the intel that will actually help your team win.

Keeping Your Competitive Intel From Going Stale

Let's be real. A battle card you made six months ago is now a historical artifact. It's a quaint snapshot of what the market used to be, but for a sales rep on a call today, it’s useless. If you aren't keeping your intel fresh, you're sending your team into a gunfight armed with a butter knife.

The competitive landscape can change overnight. A rival might drop a game-changing new feature, slash their pricing, or announce a massive funding round. When that happens, your perfectly crafted talking points go right out the window. Your goal isn't to create a static PDF; it's to build a living resource that gives your team a real advantage.

Set a Simple Update Cadence

You don't need some overly engineered, complicated process. Consistency is what matters. Think of it less like a massive annual project and more like a regular, quick check-up.

A simple schedule like this works wonders:

- Quarterly Refresh: Once a quarter, block off a couple of hours to do a deep dive on your top 3-5 competitors. Go through their pricing pages, read their latest blog posts, and see what new complaints are bubbling up on G2. This is a low-effort way to catch most of the big shifts.

- Trigger-Based Updates: Some news can't wait. You have to act on these immediately. These "triggers" are things like a competitor announcing a new funding round, a major acquisition, or a significant product launch.

This proactive mindset is becoming the norm. The market for competitive intelligence software is projected to leap from USD 2.56 billion in 2023 to USD 6.02 billion by 2030. Continuous monitoring is the new standard. If you want to dig deeper, you can explore more insights about the future of competitive intelligence on superagi.com.

Make Your Battle Cards Easy to Find

Even the most brilliant battle card is worthless if it’s gathering digital dust in a forgotten Google Drive folder. You have to put your intel where your sales team actually lives and works. Friction is the mortal enemy of adoption.

> If a salesperson has to click more than twice to find a battle card, they won't use it. End of story. Make it ridiculously easy to access right when they need it most.

Here are a few spots to park them for maximum visibility:

- In your CRM: This is the best option. Link directly to the relevant battle card from the competitor's account page in Salesforce or HubSpot.

- A dedicated Slack channel: A

#competitive-intelchannel is perfect for posting updates and pinning the latest versions of your cards. - Your company wiki: A tool like Notion or Confluence can serve as a central, searchable hub for all things competitive.

Create a Feedback Loop

Don't forget that your sales team is on the front lines every day. They are your best source of on-the-ground intel. They hear the latest gossip, the newest objections, and the tough questions from prospects firsthand.

Set up a simple way for them to feed that information back to you. This could be a quick form, a dedicated Slack channel for field notes, or a recurring 15-minute sync. Ask them what's working, what's missing, and what intel they wish they had. This transforms your battle card program from a one-way broadcast into a collaborative system that gets smarter with every sales call.

How to Know If Your Battle Cards Are Actually Working

You've put in the hours, built the battle cards, and rolled them out. Now for the big question: Is any of it actually working? The last thing you want is for these docs to become digital dust bunnies in a forgotten folder.

Let's cut through the noise and talk about how to tell if these things are helping you win more deals.

The most direct and powerful metric is your win rate against a specific competitor. It's that simple. If you started with a 15% win rate against "MegaCorp Inc." and three months later you're hitting 25%, you're doing something right. This is the hard number that justifies the effort.

You don't need a PhD in data science to figure this out. Most CRMs can pull this report in a few clicks.

Look Beyond Just the Win Rate

While the win rate is king, it doesn't tell the whole story. Other indicators can show you that you're on the right path.

Keep an eye on these two metrics:

- Sales Cycle Length: Are competitive deals closing faster? When reps have the perfect counter-point ready, they can dismantle objections on the spot and keep the momentum going.

- Deal Size: Confident reps are less likely to jump to discounting. When they can clearly articulate your value over the competition, they hold the line. Are your competitive deals closing at a higher average value?

> The goal isn't just winning more often, but winning better. Think bigger deals that close faster because your team is ridiculously prepared. That's how you prove a battle card is a revenue-generating tool, not just another internal document.

Don't Forget to Talk to Your Team

Sometimes, the most important insights aren't in a dashboard. The real proof comes from talking to your sales reps. Do they feel more confident on calls?

Ask them straight up. Are the talking points hitting the mark? Are the "landmine" questions tripping up the competition? Their intel from the trenches is gold and is essential for making your next round of battle cards even better.

This feedback loop is also a key part of running a solid win and loss analysis, which will help you sharpen your entire competitive strategy over time.

When you blend the hard data (like win rates) with the qualitative feedback from the field, you get the full picture. You'll know, without a doubt, whether your battle cards are true game-changers or just another file lost in the digital ether.

Common Questions We Get About Battle Cards

Even with the best game plan, a few questions always pop up when you're diving into building competition battle cards. Let's tackle some of the most common ones.

How Many Competitors Should I Actually Track?

Look, don't try to boil the ocean. You get ambitious and want a battle card for every company that even remotely smells like a competitor. All that gets you is a pile of half-baked, outdated documents.

Stick to your top 2-3 direct competitors to start. I'm talking about the names your sales team brings up constantly—the ones they're genuinely going head-to-head with every day. It's way more effective to have three killer, always-current battle cards that your reps love than ten flimsy ones that collect digital dust.

What's the Single Biggest Mistake People Make?

Information overload. Hands down. A battle card is a cheat sheet, not a PhD thesis on your competitor.

Here’s the reality check: if a sales rep can't pull out what they need in 30 seconds flat, it's a failure. They’re juggling a dozen things at once. They need quick, sharp, actionable intel, not a novel. Your job is to curate the knockout punches, not drown them in data.

> The goal is clarity, not complexity. Your focus should be on the top three reasons you win and the top three landmines to plant. Everything else is just noise.

Okay, But How Do I Get Sales to Actually Use Them?

This is the big one, isn't it? You can pour your heart into creating the perfect battle card, but it’s useless if it just sits there. The secret? Get the sales team involved from the beginning.

Before you type a single word, go talk to them.

- Which competitors are really tripping them up on calls?

- What are the toughest questions prospects are throwing at them?

- What's that one piece of information that would give them an instant confidence boost?

When they have a hand in creating the tool, they'll actually feel invested in it. Then, make it ridiculously easy to find. Pin the battle cards in your sales Slack channel, embed them directly into your CRM, and make them front-and-center in your company wiki. Don't just bury them in a forgotten Google Drive folder.

Tired of building battle cards with stale intel? Already.dev uses AI to pull fresh, relevant competitive insights in minutes, not weeks. Stop the manual grunt work and give your team the edge they deserve. Explore how it works at Already.dev.