A Guide to Win and Loss Analysis That Actually Works

Tired of guessing why you win or lose deals? Learn how win and loss analysis gives you the real answers to improve strategy and boost sales.

Let's be real. You're probably tired of high-fiving over wins you can't explain and shrugging at losses you didn't see coming. A solid win and loss analysis is your secret weapon to finally figure out the why behind every deal.

This isn't about making another boring report. It's about turning your sales data into a goldmine of insights you can actually use.

So You Won (or Lost) a Deal. Now What?

A win/loss analysis isn't just tallying scores for a quarterly review. It’s the nitty-gritty work of digging into your sales process to figure out what’s clicking with buyers and what’s making them run for the hills.

Think of it as sales forensics, minus the crime scene tape. It's all about getting unfiltered, honest feedback straight from your buyers so you can finally stop guessing.

You've probably seen the same old excuses pop up in your CRM:

- “Price was too high.”

- “Missing X feature.”

- “They just went with competitor Y.”

These are symptoms, not the actual disease. The real story is almost always more interesting—and way more useful. Was the price really too high, or did your team just bomb at showing the value? Did you actually lose to a competitor, or did your own sales process feel like a straightjacket? A good analysis gets you these answers.

Why Bother with Win/Loss Analysis?

The whole point is to move from making wild guesses to acting on evidence. It’s about building a system that turns raw feedback into a real strategic advantage. This helps you make smarter decisions across the entire company, from marketing campaigns to your product roadmap.

Make no mistake: this isn't just another sales exercise. When you do it right, it becomes a core business function.

> The old way is basically high-fiving in the dark. You celebrate a big win without knowing how to repeat it, or you mourn a tough loss without a clue how to prevent the next one. The new way? It's like flipping on the lights.

This shift from guesswork to informed strategy is catching on. The global market for win-loss analysis services was valued at around $1.35 billion recently and is projected to hit $3.6 billion by 2033. This boom shows just how many companies are waking up to the power of truly understanding their sales outcomes. You can learn more about these market trends and the drivers behind this growth.

Here's a quick look at why you should stop guessing and start analyzing.

| The Old Way (Guesswork) | The New Way (Analysis) | | :--- | :--- | | Relies on sales rep anecdotes and gut feelings. | Uses direct, unbiased buyer feedback. | | Product roadmap is based on the loudest voice. | Product decisions are backed by hard data. | | Competitor threats are a total mystery. | You know exactly why you win or lose against them. | | Marketing messages are generic and boring. | Messaging is fine-tuned to what actually works. | | Sales training is one-size-fits-all. | Top-performer habits become a teachable playbook. |

Ultimately, a win/loss analysis gives you a repeatable playbook for success. It helps you pinpoint what your most successful reps are doing right so you can train the rest of the team to copy them. It shines a spotlight on the exact features that close deals and the specific messaging that makes a buyer's eyes light up.

It’s about building a predictable revenue engine, one conversation at a time.

Building Your Win/Loss Program Without the Headache

Let's be honest—the thought of launching a win/loss program probably sounds like a massive chore. Most people picture a swamp of spreadsheets and a calendar full of meetings that just go in circles. But it doesn't have to be that way. The trick is to start small and keep it simple.

Before you touch a single piece of data, figure out what you really want to learn. Seriously, don't try to boil the ocean. Just pick one or two nagging questions that are keeping you up at night.

Maybe you’re trying to pin down answers like:

- Pricing: Are we losing because our price is too high, or are we just bad at showing our value?

- Product Gaps: Is there one specific feature competitors have that’s costing us deal after deal?

- Sales Process: Is our sales cycle a confusing mess? Or is a particular competitor consistently outplaying our sales team?

Nailing down a clear focus right from the start is crucial. It’s the one thing that will save you from drowning in a mountain of useless data later on.

Who Needs to Be in the Room?

Okay, you’ve got your goals. Now, let’s assemble the team. Pro tip: this isn’t just a sales-only mission. A classic mistake is relying only on the sales team for win/loss intel. They’re great, but their view is naturally skewed.

> One study revealed a sobering stat: 60% of sellers are either partially or completely wrong about why they actually lost a deal. It's not a knock on them; their job is to close business, not perform a forensic analysis after the fact.

To get the real story, you need different perspectives. Getting product and marketing involved from day one is a total game-changer. Product managers are starving for this kind of direct feedback to build the roadmap, and marketers need to know if their messaging is actually hitting the mark with real buyers. When everyone has some skin in the game, the insights you uncover become so much more valuable.

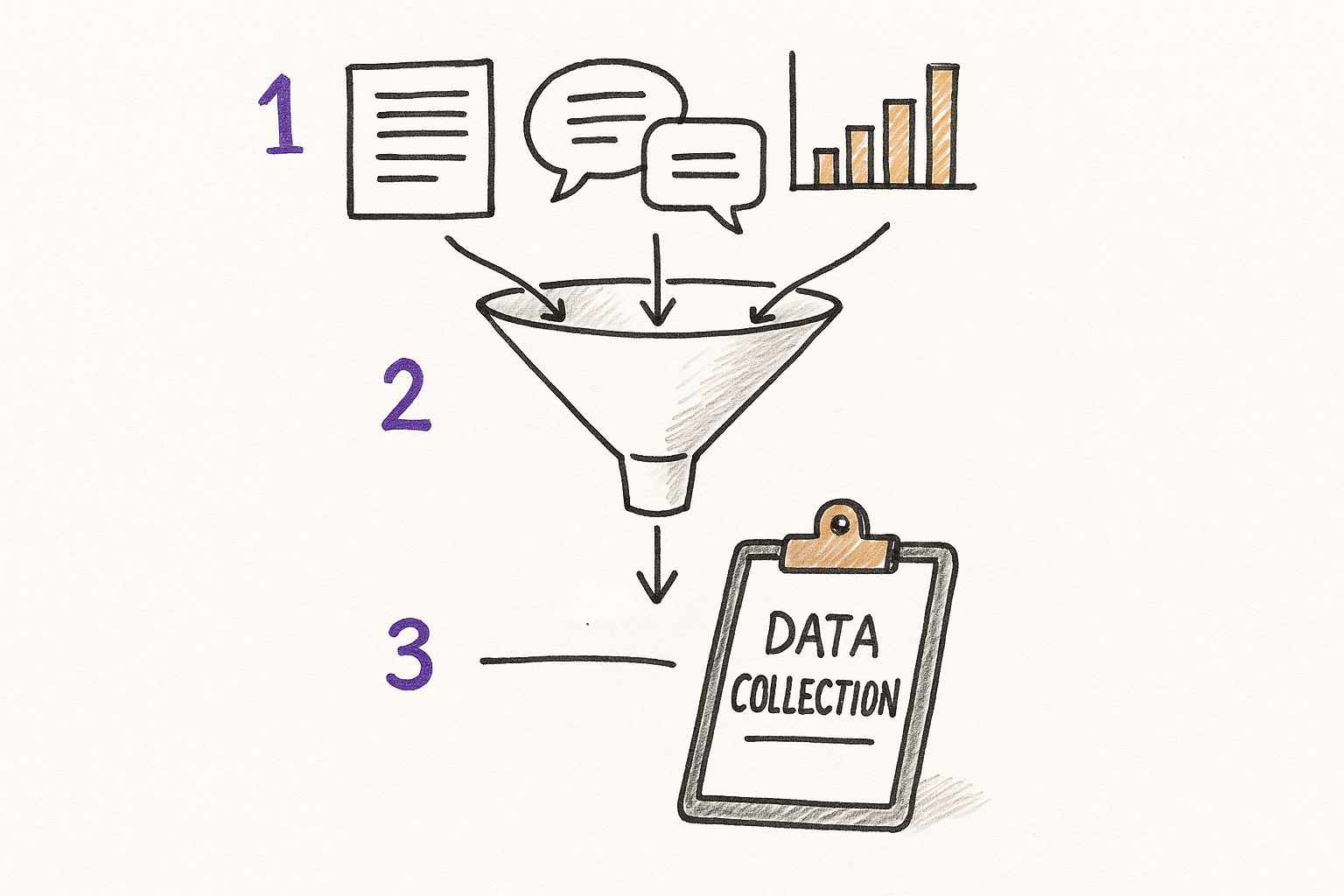

This process is all about pulling together different threads of information—from documents and customer chats to internal data—into one central place for analysis.

As you can see, a solid program draws from multiple channels. This stops you from making huge decisions based on a single, potentially biased viewpoint. If you want to dig deeper into setting up this initial phase, our guide on how to approach market research and data analysis is a great place to start.

Keep Your Tools Simple

You don't need a fancy, expensive tech stack to get this off the ground. A simple spreadsheet and your CRM are perfectly fine to start.

When it comes to competitive intelligence, big platforms like Ahrefs or Semrush are powerful, but they can be expensive. A more focused and budget-friendly tool like already.dev can give you the competitive insights you need without the enterprise price tag. At the end of the day, a smart process will always beat shiny, expensive software.

How to Collect Customer Feedback That Doesn't Suck

Let's be real. Your entire win/loss program is only as good as the feedback you collect. Garbage in, garbage out. It’s that simple.

So, how do you get past the polite, vague non-answers and dig into what really happened? It all comes down to being smart about how—and who—you ask. Let's walk through your options, from the quick-and-dirty to the gold standard.

Internal Intel from Your Sales Team

Your first and easiest stop is your sales team. They're on the front lines and usually have a gut feeling about why a deal went south. This is a great place to start, but it's just that—a start.

You have to take this feedback with a huge grain of salt. A rep's perspective is inherently biased. One study even found that 60% of sellers are flat-out wrong about why they actually lost a deal. They’ll often blame price when the real killer was a clunky product demo or a confusing sales process. Think of their notes as clues, not conclusions.

Surveys: The Good, the Bad, and the Automated

Surveys are great for getting a ton of data quickly. You can set them up to go out automatically whenever a deal closes, letting you spot high-level trends almost in real time. They’re cheap, fast, and give you hard numbers to back up your hunches.

The big trade-off? They're shallow. You can't ask "why?" five times to get to the root cause. A survey might tell you that you lost on price, but it won’t explain why the buyer thought your price was too high. Was it because a competitor had a killer feature you lacked, making your solution seem less valuable? You'll never know from a multiple-choice question.

> Pro Tip: Keep your surveys brutally short. I'm talking under seven minutes. Any longer and your response rates will tank faster than your team's morale after a tough loss.

Direct Customer Interviews: The Gold Standard

This is where the magic happens. A direct, 30-minute chat with a customer—whether you won or lost their business—is the single best way to understand what went down. Nothing beats hearing the story in their own words.

But there’s a catch. Getting brutally honest feedback is tough. Buyers often try to be nice and soften the blow, especially if they're talking to the same salesperson who just spent weeks trying to win them over.

This is exactly why having a neutral third party conduct these interviews is a game-changer. When someone from product marketing, a dedicated research team, or even an outside consultant makes the call, the dynamic shifts. The buyer knows it's a genuine research call, not a last-ditch effort to revive the deal, and they open up.

Here’s a quick breakdown of your options:

| Method | Pros | Cons | | :--- | :--- | :--- | | Sales Rep Notes | Fast, easy, and gives you some initial context. | Highly biased, often incomplete or just plain wrong. | | Surveys | Scalable and great for seeing broad patterns. | No depth or context; can't ask follow-up questions. | | Customer Interviews | The richest, most detailed, and insightful feedback. | Time-consuming and can be tough to get unvarnished truth. |

At the end of the day, the best approach is to blend all three. Use the sales notes to get your bearings, send out surveys to spot the big trends, and then use targeted interviews to dig deep into the "why." This layered approach ensures you’re not just collecting data, but gathering real intelligence that will help you win a whole lot more.

Turning Raw Feedback Into 'Aha' Moments

Alright, you’ve done the heavy lifting. You're sitting on a pile of interview notes, survey results, and CRM data. Now what? This is where the real fun begins—transforming that messy jumble of feedback into game-changing 'aha' moments.

Don't panic; you don’t need to be a data scientist. The goal is to find the patterns that tell a compelling story. Put on your detective hat. You're sifting through clues to uncover the truth. The first move is to start tagging and categorizing everything you've gathered.

It sounds more technical than it is. You're really just creating buckets for common themes.

Simple Tagging for Sanity's Sake

Start by just reading through your interview transcripts or survey answers. As you do, highlight ideas that keep popping up. Trust me, you'll start noticing them pretty quickly.

Then, create a straightforward set of tags. Here are a few no-brainer categories to get you going:

- Product: Anything about features, usability, or stuff your product doesn't do. Think tags like "Feature Gap" or "Clunky UI."

- Pricing: All comments about cost, perceived value, or your pricing model. For example, "Price Too High" or "Confusing Tiers."

- Sales Process: Feedback on your reps, the demo, or the entire buying journey. Tags could be "Great Demo" or "Slow Follow-Up."

- Competitor: Every time a specific rival gets a shout-out. Use tags like "Lost to Competitor X" or "Competitor Y Cheaper."

As you tag your feedback, you'll start to see which of these buckets are overflowing. That's your first major clue pointing to where the biggest problems—and opportunities—are hiding.

Digging Deeper Than the Obvious

This next part is crucial, and it’s where most win-loss programs fail. You have to separate the symptom from the root cause. A buyer might say, "Your price was too high," but that's almost never the whole story.

> The real question isn't what they said, but why they felt that way. Was the price objectively too high, or did your sales team just fail to build a strong enough value case? Was your competitor's product actually that much better, or was their sales process just smoother?

Getting past these surface-level excuses is everything. When you see a pattern like "price," force yourself to ask what's really driving it. Does that tag often show up alongside "Missing Feature" or "Unclear ROI"? Connect those dots. Maybe your price only feels high because buyers can't see the incredible value they’re getting for it.

Recent win-loss analysis reports really hammer this point home, showing a clear shift from basic feedback gathering to providing deep, strategic value. Top-tier programs are all about unearthing the fundamental drivers behind sales outcomes. You can discover more about these value-centric findings and see how they're making an impact.

Your ultimate goal is to build a narrative. Instead of just telling your boss, "We lose on price 30% of the time," you can deliver a real insight: "We tend to lose on price when we’re up against Competitor X, primarily because our reps struggle to explain how our superior analytics justify the 20% price difference." Now that is something your team can actually fix.

Putting Your Findings to Work Across the Company

Okay, you've unearthed some absolute gems from your interviews. Awesome. But now comes the most important part: making sure those insights actually do something.

An insight is useless if it just sits in a report. The final, and most crucial, step in any win and loss analysis is to take what you’ve learned and drive real change. It's time to make sure this program becomes a core part of your company's strategy, not just another report that gathers digital dust.

Tailor Your Message for Different Teams

You can't just drop a 30-page report on everyone's desk and expect magic. Different teams care about different things. To get them to listen, you need to serve up your findings in a way they can actually use.

- Product Team: These folks are starving for this stuff. Give them the raw, unfiltered truth. Direct quotes about missing features or clunky user experiences are pure gold for their roadmap. Frame it like this: "Customers who chose Competitor X consistently brought up their simpler onboarding."

- Marketing Team: They live and breathe messaging. Your job is to tell them if it's working. Share insights on how buyers really see your brand and which value props are landing. This is exactly what they need to fine-tune campaigns.

- Sales Team: This is all about arming them for the next battle. Turn your findings into actionable sales battlecards. If you learned a key objection that keeps coming up, give them the perfect counter-argument. If you know exactly why you beat a competitor, make sure every rep knows that winning story.

The goal is to translate your data into a language each department understands and cares about.

> An insight is only as valuable as the action it inspires. Don't just report what you found; recommend what the company should do about it. Be the catalyst for change, not just the messenger.

Build a Continuous Feedback Loop

This can't be a one-and-done project. For this to have a lasting impact, your win and loss analysis needs to become a living, breathing part of your company's rhythm. You have to build a formal feedback loop where insights are shared regularly and—critically—acted upon.

A great way to show the program's value is by tracking core metrics like sales win rates. A win rate is simply the percentage of deals won out of all closed deals. If you close 100 deals and win 40, your win rate is 40%. Even tiny improvements in this number can mean huge revenue gains.

To make it all stick, get recurring meetings on the calendar with key stakeholders from Product, Marketing, and Sales. Use this time to review the latest insights and create accountability. This also keeps you plugged into the ever-changing competitive landscape. If you're seeing new names pop up in your loss interviews, it might be time to check out our guide on how to identify competitors.

Ultimately, making your findings matter comes down to communication and persistence. Be the champion your data deserves.

Your Top Win/Loss Analysis Questions, Answered

Alright, let's tackle some common questions that pop up when teams first start digging into their wins and losses.

How Many Interviews Should We Really Do?

This is always the first question, and the answer isn't a magic number. Forget about needing a massive sample size right out of the gate.

A great starting point is 8-10 interviews per segment you're studying—whether that's for a specific competitor, product line, or customer profile.

The real goal is to hit "thematic saturation." It’s that point where you start hearing the same reasons and the same stories over and over. You'll know you're there when you can pretty much predict what the next person is going to say. Don't let analysis paralysis stop you; just start with a handful of interviews. You'll be amazed at the patterns that emerge.

Should We Do This Ourselves or Hire an Outside Firm?

This is a classic "time vs. money vs. bias" dilemma.

Doing it in-house is obviously cheaper. The big catch? Bias. Your sales team is great, but let's be honest, they're not impartial. On top of that, customers often soften their feedback because they don't want to hurt the feelings of the rep they've been working with.

> Hiring a neutral third party costs more, but they bring a superpower: pure objectivity. Customers are shockingly more candid with someone who has no emotional stake in the outcome.

If your budget is tight, start in-house. My advice? Have someone from a more neutral team, like product marketing, lead the charge to minimize the bias as much as possible.

What Tools Do I Actually Need to Get Started?

You can get a surprising amount done with tools you probably already have. A simple spreadsheet and your CRM are more than enough to get the ball rolling. Seriously, don't let a lack of fancy software be your excuse. The process and the conversations are what matter most, not the platform.

When you're ready to get more serious about competitive intelligence, you'll hear about giants like Ahrefs or Semrush, which are powerful but can also get pricey. If you're looking for a more focused tool to help you understand your rivals without destroying your budget, something like already.dev can be a game-changer. For more on this, check out our guide on how to do competitor research.

How Can I Convince Customers to Even Talk to Me?

This is all about respect and transparency. The golden rule is to make it crystal clear that this is a research call, not a sneaky sales pitch in disguise. No one has time for that.

Here are a few tips that work:

- Be upfront about your goal: "We're trying to learn and make our product better."

- Respect their time by keeping the interview request short and to the point.

- If your budget allows, a small gift card is a great way to say "thank you."

- Often, just explaining that their feedback will shape the future of the product is incentive enough for people who want to see you succeed.

Frame yourself as a humble student trying to learn from their experience. It's a disarmingly effective approach.

Ready to stop guessing what your competitors are up to and start knowing for sure? already.dev uses AI to surface your true competition, giving you the confidence to build a better product. Ditch the weeks of manual research and get a full competitive report in just minutes.