A No-Nonsense Guide to Competition Landscape Analysis

Tired of jargon? Learn how a real competition landscape analysis works. Uncover rival strategies and find your market gap with practical, actionable steps.

Let’s be honest, "competition landscape analysis" sounds like something you’d hear in a stuffy boardroom, not a scrappy startup. But forget the jargon. It’s really just about getting a clear, honest picture of who you’re up against so you can find a smart place to play—and win.

Ditching the Fluff: What This Analysis Really Is

Think of it as your startup's survival guide. It's the process of mapping out your market to see who the big players are, who's nipping at their heels, and—most importantly—where the hidden opportunities are just waiting for someone like you to snatch them up.

This isn't about creating a 100-page report that no one will ever read. It's about gathering practical intel to make better decisions every single day. You're not just listing names on a spreadsheet; you're on a mission to answer the tough questions that will define your product, marketing, and overall strategy.

Why It's Not Optional Anymore

Maybe a few years ago, you could get by with a vague sense of your top two or three rivals. Not anymore. There's a reason the competitive intelligence market is absolutely booming—it was valued at around $50.9 billion and is on track to hit $122.8 billion. This explosion shows that deeply understanding your competitive world isn't just for massive corporations; it’s a non-negotiable for everyone. You can dig into more insights on this market's growth to see why.

This whole process isn't about being defensive. It’s about proactively finding your edge. It's how you answer the questions that keep founders up at night:

- Product: Are we building something people actually want more than what's already out there?

- Marketing: Where are our competitors finding customers? What channels are they completely ignoring?

- Pricing: Are we leaving money on the table? Or are we priced so high we’re scaring people away?

- Positioning: In a sea of lookalikes, what’s our unique story? Why should anyone care?

> A great analysis doesn't just tell you who your competitors are. It tells you where you can be better, faster, or smarter than them. It’s your roadmap to finding an unfair advantage.

At the end of the day, a solid competition landscape analysis delivers clarity. It replaces gut feelings with real-world data, giving you a game plan to not just enter the market, but to actually make a dent in it.

To get started, it's helpful to categorize the different players you'll be looking for. I've put together a quick cheat sheet to help you think through this.

Your Competitor Analysis Cheat Sheet

Here’s a quick breakdown of the types of competitors you should be looking for and why each one is worth your time.

| Competitor Type | Who They Are | Why You Should Care | | :--- | :--- | :--- | | Direct Competitors | Companies offering a very similar product to a very similar audience. You’re fighting for the same customer dollars. | These are your obvious rivals. You need to know their features, pricing, and marketing tactics inside and out to differentiate. | | Indirect Competitors | Businesses solving the same core problem but with a different solution or for a slightly different audience. | They reveal alternative ways your customers think about their problems. You can learn a lot from their positioning and marketing angles. | | Failed Competitors | Companies that tried to do what you're doing (or something similar) and shut down. | Their mistakes are your free lessons. Why did they fail? Was it the product, the market timing, or poor execution? |

Looking at the competitive landscape through these three lenses gives you a much richer, more complete picture than just staring at your main rival all day. It helps you see the threats and the opportunities.

Finding Your True Competitors in the Wild

Alright, time to put on your detective hat. Finding your real competitors isn’t just about typing "my idea + competitor" into Google and calling it a day. That’s like fishing in a bathtub and expecting to catch a shark.

You need to get out into the digital wilderness where your future customers are actually hanging out.

The goal here is to build a complete picture of the battlefield, not just a list of the usual suspects. This means uncovering three key groups: the direct rivals, the sneaky indirect players, and even the ghosts of startups past. Each one holds a different piece of the puzzle for your competition landscape analysis.

Uncovering Direct and Indirect Rivals

Let's start sleuthing. Direct competitors are the obvious ones—they sell a similar product to the same audience you’re after. But digging up all of them, especially the scrappy new ones, takes a bit of creativity.

Go beyond basic searches and try some more specific queries.

- Google Search Modifiers: Use phrases like

"[your core feature]" vsor"best tool for [customer pain point]". This shows you who your potential customers are already comparing. - Review and Directory Sites: Dive into platforms like G2, Capterra, and even niche industry forums. You'll quickly see who is consistently ranked and what real users are saying about them.

- Product Hunt & BetaList: These sites are gold mines for spotting up-and-coming startups before they go mainstream. Don't forget to check the "Similar Products" sections on listings.

This is also where you’ll start to stumble upon your indirect competitors. These are the companies solving the same problem you are, but in a completely different way. Think of Slack’s indirect competitor not as another chat app, but as email, or even just a tap on the shoulder in the office.

If you want to go deeper, this guide on identifying direct competitors and alternatives is a great resource.

Learning from the Ghosts of Startups Past

One of the most underrated sources of intel? Failed competitors. These are the companies that tried to build something like your idea and, well, didn't make it. Their failure is a free—and often painful—lesson in what not to do.

> Don't just look for success stories. The most valuable insights often come from autopsy reports. Why did they fail? Was it the market, the product, or the timing? Their graveyard is your classroom.

Finding these digital ghosts can be tricky, but it’s absolutely worth the effort. Search for old press releases on sites like TechCrunch or look for abandoned social media profiles. The comment sections on old launch articles often reveal brutally honest feedback from early users.

Finally, you need a way to track all this intel. While powerful tools like Ahrefs or Semrush can give you tons of data, they can be really expensive. For early-stage teams, a more affordable alternative like already.dev can automate much of this discovery process, helping you find direct, indirect, and even failed competitors quickly.

Gathering Actionable Intel on a Budget

Alright, you’ve mapped out your rivals. Now for the fun part—the recon mission. If you're thinking this requires a massive budget and a team of analysts, think again. You don't need to take out a second mortgage to figure out what your competition is up to.

Sure, the big players love to throw money at expensive, all-in-one tools like Ahrefs or Semrush. And don't get me wrong, they're incredibly powerful. But their price tags are enough to make any founder break out in a cold sweat. The good news? You can get the same kind of game-changing insights without that eye-watering monthly bill. An alternative like already.dev can give you the intel you need without the corporate price tag.

Setting Up Your Listening Posts

The whole point here is to build a simple, repeatable system for gathering data that you can actually use to make better decisions. Think of it as setting up a few digital listening posts to pick up on the most important signals your competitors are sending out. You can get deep into all the different research data collection methods, but for a startup, it really boils down to tracking a few key things.

Here are the signals I always tell people to watch like a hawk:

- Pricing Changes: Did a competitor just slash their prices or roll out a shiny new tier? That’s a massive clue about their go-to-market strategy and who they're trying to attract.

- Feature Announcements: Keep a close eye on their blog, press releases, and social feeds. Every new feature they launch is a breadcrumb telling you where they think the market is headed.

- Marketing Tactics: Are they suddenly pouring cash into Google Ads? Did they just launch a podcast out of nowhere? Watching their marketing moves gives you a front-row seat to what's working (or what they hope will work) for them.

> The secret isn't to collect all the data; it's to collect the right data. Focus on the signals that reveal your competitors' strategic moves, not just their daily noise.

Your Budget-Friendly Intel Toolkit

Let’s talk tools. You don't need a corporate credit card to build a solid intel-gathering habit. It’s mostly about being smart with a few free or low-cost tools and a bit of good old-fashioned hustle.

A fantastic—and free—place to start is by setting up Google Alerts for each competitor's brand name. It’s dead simple and will drop any news, blog posts, or mentions right into your inbox. I also recommend manually checking their social media a couple of times a week. What posts are getting all the likes and comments? That’s free customer research right there.

When you want to dig deeper into their SEO and content strategy, a specialized tool really is worth its weight in gold. But instead of forking over hundreds for the big names which can be expensive, a more affordable platform like already.dev can automate this for you. It lets you see exactly what keywords they’re targeting and which content is bringing in their traffic, giving you a huge leg up.

Staying on top of these shifts is absolutely critical. Just look at the broader economy—tech firms have completely bulldozed traditional companies to become the most valuable in the world. It’s a stark reminder of how fast the ground can shift under your feet.

So, how do you keep all this information organized? Don't overdo it. Honestly, a simple spreadsheet is often all you need to get started.

Making Sense of the Data with Simple Visuals

A giant spreadsheet full of data points is where good insights go to die a slow, boring death. The real magic happens when you turn all that raw information into a visual story that your whole team can actually understand in about five seconds.

Let’s skip the overly complex frameworks that consultants love and focus on two simple but powerful tools: the Feature Grid and the Positioning Map. These aren't just for making your presentation look good; they are what spark those critical 'aha!' moments and make your next strategic moves feel obvious.

Spotting Gaps with a Feature Grid

First up, the Feature Grid. This is your quickest path to understanding where you stand in the market, feature-for-feature. It's so simple, it’s almost criminal.

Just list all the key features in your product category down one side and your competitors (plus your own product!) across the top. Then, go down the list, putting a checkmark next to who has what. Suddenly, you get a bird's-eye view of the entire market.

- Opportunity Gaps: See a whole row of empty boxes? That might be an underserved need just waiting for you to jump on.

- Table Stakes: Notice a feature that everyone has? That’s now a basic requirement. If you don't have it, you'd better have a really good reason why not.

- Your Unique Edge: What’s the one feature only you have a checkmark for? That’s your unique selling proposition right there. Yell it from the rooftops!

This simple exercise cuts right through the marketing fluff and shows you the raw product reality.

For example, here's a stripped-down grid comparing a hypothetical project management tool against some big players.

Sample Feature Grid: Your Product vs. The World

| Feature | Your Product | Competitor A | Competitor B | Competitor C | | :--- | :--- | :--- | :--- | :--- | | Kanban Boards | ✅ | ✅ | ✅ | ✅ | | Gantt Charts | ❌ | ✅ | ✅ | ❌ | | Time Tracking | ✅ | ✅ | ❌ | ✅ | | AI-Powered Reporting| ✅ | ❌ | ❌ | ❌ | | Mobile App | ✅ | ✅ | ✅ | ✅ | | Free Tier | ✅ | ❌ | ✅ | ✅ |

See? With one glance, you can tell that "AI-Powered Reporting" is your key differentiator, while not having "Gantt Charts" might be a weakness you need to address or ignore intentionally.

If you want a deeper dive, our guide on building a competition matrix analysis walks through this process in much more detail.

Finding Your Spot with a Positioning Map

Next, let's talk about the Positioning Map. If the Feature Grid is about what you do, the Positioning Map is about who you are in the customer's mind.

It's a simple two-axis chart where you plot every competitor based on two key attributes that matter to your customers. Think Price (low to high) vs. Power (simple to complex), or maybe Target Audience (individual to enterprise).

You don't need fancy software for this. A whiteboard or a simple slide works perfectly. Plot yourself and every competitor on the map.

> Suddenly, the entire competitive landscape is crystal clear. You can instantly see where the market is crowded and—more importantly—where the wide-open spaces are. That empty quadrant on the map isn't a void; it's an invitation.

Is everyone fighting it out in the "high price, high power" corner? Maybe there’s a massive opportunity for a simple, affordable solution that nobody is paying attention to. This map makes those strategic gaps leap out at you.

Turning Your Analysis Into a Winning Strategy

So you've done the hard work. You've gathered all the intel, created some slick-looking charts, and now you’re staring at a spreadsheet that could intimidate a secret agent.

Now what?

Let's be real: an analysis without a strategy is just a very time-consuming hobby. The final, and most crucial, step is translating all that data into actual decisions. This is where the rubber meets the road.

Your goal here isn't to create a dusty report that gets filed away and forgotten. You’re building a living, breathing guide that helps your team make smarter moves every single day.

From Data Points to Decisions

It's time to tackle the big, scary questions your analysis was meant to answer in the first place. This is where you connect the dots between your feature grids, positioning maps, and the real world.

Your findings should be the fuel for your strategy, helping you answer questions like:

- Pricing: Looking at the market, should we be the premium option, the budget-friendly choice, or somewhere in the middle?

- Marketing: What channel is everyone else ignoring? Is there an untapped audience we can completely own?

- Positioning: What's the one thing we can do better than anyone else? How do we tell our unique story in this crowded room?

- Product: What's that one missing feature a specific, high-value customer segment is desperate for? Can we build it?

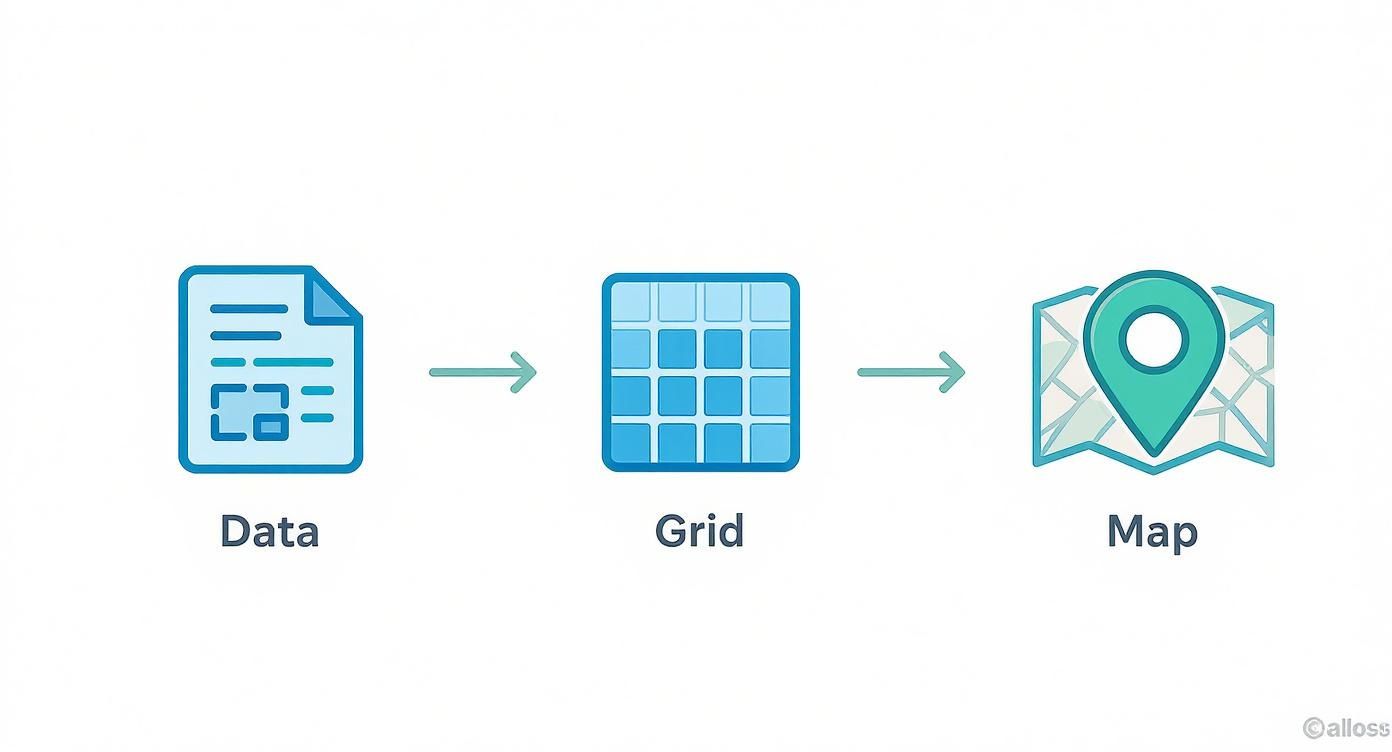

This whole process—turning raw, messy data into clean visual artifacts like grids and maps—is designed to make these strategic paths jump out at you.

The flow is simple but powerful. You move from chaotic spreadsheets to a clear map of the market, which makes those tough strategic choices feel less like a wild guess and more like a logical next step.

Distilling It Into a One-Page Battle Card

Let’s be honest: nobody has time to read a 20-page document. The best way to make your findings stick is to boil everything down into a simple, one-page summary or "battle card."

This isn't just another executive summary; it's a cheat sheet for your entire team. It needs to be visual, scannable, and brutally concise.

> Your final output should be a weapon, not a history book. It should arm your product, marketing, and sales teams with the exact intel they need to win their daily battles.

This one-pager is your go-to reference. It should feature your positioning map, your top three strategic takeaways, and a bold, clear statement on your primary competitive advantage. It's a constant reminder of where you're playing and how you plan to win.

And remember, competitive advantage is always shifting. A great analysis today is old news tomorrow. You've got to keep your head on a swivel.

A Few Common Questions I Get Asked

Alright, let's tackle a few common questions that always pop up when I talk about competition landscape analysis. No fluff, just straight answers to help you get moving.

How Often Should I Be Doing This?

Think of it less like a one-and-done project and more like a regular check-up. I recommend doing a really deep dive maybe once a quarter. But you absolutely need to be doing quick "check-ins" weekly or bi-weekly.

Markets move fast. A competitor launching a new feature or suddenly slashing their prices is something you need to know now, not three months from now when it's too late.

> Your analysis should never become a historical document. The whole point is to have a living, breathing guide that reflects the market as it is today, not as it was last year.

What's the Biggest Mistake You See People Make?

Oh, that's an easy one: analysis paralysis. I've seen teams get so obsessed with gathering every single scrap of data that they never actually do anything with it. They end up with these massive, beautiful spreadsheets that are completely useless.

Your goal isn't to write the world's most detailed encyclopedia on your competitors. It's to find a handful of key insights that give you a clear direction for your product, your marketing, or your sales strategy. Focus on action, not just endless collection.

Do I Really Need to Buy Expensive Tools for This?

Honestly? Nope. You can get surprisingly far with Google Alerts, a simple spreadsheet, and some dedicated time to just poke around competitor websites and social media feeds. The main thing paid tools give you is speed and automation.

Tools like Ahrefs or Semrush are incredibly powerful, but they can also be ridiculously expensive, which is a tough pill to swallow for an early-stage team. A more focused, budget-friendly alternative like already.dev can automate the most annoying parts—like digging up competitors and tracking their SEO—without that massive price tag.

But never, ever let a lack of fancy tools be an excuse not to start.

What if I’m in a Brand-New Market With No Competitors?

If you're creating a totally new category, it’s tempting to think you have no competitors. I've heard it a million times, and it's almost always a dangerous assumption. Your competition isn't just another company doing the exact same thing you are.

It’s the old, clunky way people are solving the problem right now.

- Building a new project management tool? Your real competitor might be a messy spreadsheet or a wall of sticky notes.

- Launching an innovative food delivery service? You’re competing against a trip to the grocery store.

In these cases, your analysis just shifts focus. You need to deeply understand those existing behaviors and then position your solution as a vastly superior alternative to the status quo. You’re not just fighting other startups; you’re fighting ingrained habits.

Ready to stop guessing and start knowing? Already.dev uses AI to run your entire competitive analysis in minutes, not weeks. Get the clarity you need to build a winning strategy. Start your free trial at https://already.dev