Your Ultimate Guide to Competition Matrix Analysis (Without the Boring Bits)

Tired of confusing charts? Learn to build a competition matrix analysis that gives you real insights to beat your rivals. No fluff, just action.

Think of a competition matrix analysis as your secret decoder ring for the business world. It’s basically a scorecard that lines your business up against the competition, feature by feature, showing you exactly who’s winning and where. This isn't some boring homework assignment; it's a treasure map for finding opportunities and sidestepping landmines.

Your Business Battle Plan, on a Napkin (Almost)

Let's be real—a competition matrix is your strategic battle plan, all laid out on a simple grid. Forget those dense, soul-crushing spreadsheets nobody ever looks at. This is a visual tool that instantly tells you where you stand against your rivals. It’s designed to get you out of the "I think..." mindset and into making sharp, data-backed decisions.

This isn't just another box to tick on your quarterly to-do list. A well-built competition matrix analysis brings some serious clarity. It helps you nail down the answers to the big questions:

- Where are my competitors totally dropping the ball?

- What are we genuinely better at than anyone else?

- Is there a customer need that the entire market is sleeping on?

- How does our pricing really look next to the other guys?

By putting all this info in one place, you turn a jumble of data into a clear snapshot of your market. This whole process is a key part of what is competitive intelligence—the art of using information to outsmart the competition.

From Buzzwords to Winning Moves

The real magic happens when you start using the matrix to shape your strategy. It’s not enough to know a competitor launched a new doohickey; you need to understand why they did it and what it means for you. For a high-level view of what's happening out there, checking out resources like the Global Competition Review Live events can give you a much wider perspective.

And this isn't just theory. The impact is real. We’ve seen businesses that use this kind of analysis report a 15-20% improvement in their market position in under two years. That jump comes from smarter product and marketing decisions—a practice that’s been a staple in top-tier companies since the early 2000s.

> A competition matrix turns vague feelings about your market into cold, hard facts. It’s the difference between saying "I think we're better" and proving "Here’s exactly where we dominate and where we need to improve."

At the end of the day, the goal is simple: find their weak spots and put a spotlight on your own strengths. It’s a tool that ensures you’re putting your resources where they’ll actually make a difference, giving you a clearer path to winning your market.

Finding Your Real Competitors, Not Just the Obvious Ones

Alright, quick question: who are your competitors?

If you immediately listed the two or three companies that look and feel just like yours, you're only seeing part of the picture. The competitive landscape is way bigger than that, and your competition matrix analysis will be pretty useless if you're missing most of a football team's worth of players.

Most people get stuck on direct competitors. These are the usual suspects—the ones selling a nearly identical product to the same market. Think Pepsi vs. Coke. Simple enough.

But the real threats often come from the competitors you aren't even watching.

The Competitors Hiding in Plain Sight

The rivals who can truly torpedo your business are often the ones you don't even classify as competition. I'm talking about your indirect competitors. They solve the exact same problem your customer has, but they do it in a completely different way.

Let's make this real. Imagine you sell project management software, something like Trello.

- Direct Competitors: This is easy. You’re thinking of Asana, Monday.com, and other look-alikes. They’re all selling dedicated project management tools.

- Indirect Competitors: Now, think bigger. What about Slack? Notion? Or even a shared Google Doc? None of these are just for project management, but plenty of teams use them to solve that core "how do we organize our work?" problem.

Ignoring these indirect players is a huge mistake. You get so focused on the company doing the same thing as you that you completely miss the one making your entire approach irrelevant.

> The biggest threat isn't always the rival who does what you do better. It's the one who makes what you do irrelevant.

Uncovering the Full Roster Without Breaking the Bank

So, how do you actually find these hidden competitors? You don't need a huge budget. I know that enterprise tools like Ahrefs or Semrush can be crazy expensive, and that's not always realistic.

The good news is, you can do some serious recon work for free.

- Become a Google Search Pro: Don't just search for your product category. Get creative. Use search terms like "[Your Competitor] vs," "alternative to [Your Product]," or "how to solve [customer problem] without [your product type]." This is how real customers look for solutions.

- Talk to Your Customers (Seriously): When you lose a deal or a customer leaves, find out why. Ask them what they chose instead. Their answers are pure gold and might point you to a competitor you’ve never even heard of.

- Hang Out in Online Communities: Find the Reddit subreddits, Slack communities, or industry forums where your ideal customers are. Pay attention to the tools and workarounds they recommend to each other. It’s unfiltered, honest insight.

Getting this list right is the absolute first step. If you start with a flawed or incomplete list of competitors, your entire matrix will be built on a weak foundation. For a much deeper dive into this, check out our guide on how to find company competitors. It walks through even more practical ways to make sure you haven't missed anyone important.

Gathering the Right Intel Without Going Crazy

Alright, you've figured out who your real competitors are. Now for the part that often feels like a chore: digging up the actual data to fill out your competition matrix. Don't sweat it. You don't need a private investigator or a month buried in spreadsheets to get what you need.

The whole point here is to find actionable intelligence, not just a mountain of random numbers. We're going to zero in on the handful of metrics that truly matter.

What to Actually Look For

Let's be ruthless. You only need to track a few key data points to get a surprisingly clear picture of the competitive landscape. Everything else is just noise. Globally, most businesses using these matrices focus on an average of 8-12 key criteria. We'll stick to the essentials.

Here’s your detective’s toolkit—the core info to hunt down:

- Pricing: How much are they charging? Dig into their pricing model. Is it a flat fee, a per-user cost, or something else entirely? The number is only half the story.

- Key Product Features: What are their 3-5 killer features? Don't get lost in a list of 100 minor functions. Focus on the benefits they scream about on their homepage.

- Target Audience: Who are they really selling to? Pay close attention to their website copy, case studies, and testimonials. Are they courting scrappy startups or chasing massive corporations?

- Marketing Channels: Where do they spend their time and money online? Are they all-in on TikTok, or do they live and breathe on LinkedIn? This is a massive clue about where your shared customers are.

- Customer Reviews: What are real customers saying? Jump onto sites like G2, Capterra, or even Reddit. This is where you find the unfiltered truth—the good, the bad, and the ugly.

Where to Find the Goods (Without Spending a Dime)

You'd be amazed at how much you can find without ever pulling out your credit card. It just takes a bit of digital sleuthing. To really get the most out of this process, having a solid grasp of mastering market research methodology is a huge advantage.

Put on your detective hat and start poking around these places:

- Their Website: I know, it sounds obvious, but people skim. Devour their pricing page, feature lists, and the "About Us" section. You'll find gold.

- Public Reports & Press Releases: Is your competitor a public company? Bingo. Their financial reports are a treasure trove. If they're private, check their press releases for clues about growth, funding, and strategic direction.

- Customer Forums & Social Media: This is where you hear what people really think. A quick search on Reddit for "[Competitor Name] review" can often tell you more than their entire marketing site.

> The best competitive intel doesn't come from a fancy, expensive report. It comes from listening to what your competitors' customers are screaming from the rooftops, both good and bad.

Your Competitor Data Gathering Toolkit

While you can get a lot for free, sometimes paid tools can save you a ton of time and give you deeper insights. Here’s a quick breakdown of how you might approach gathering different types of data.

| Data Point | Free Method | Paid Tool Example (Mentioning Cost) | Alternative Tool | | :--- | :--- | :--- | :--- | | Pricing Model | Manually review their website's pricing page. | Competitors App (Plans start around $10/month) | Price2Spy | | SEO Keywords | Use Google Keyword Planner or Ubersuggest's free tier. | Semrush (Can be expensive, starting around $130/month) | already.dev | | Website Tech Stack | Use browser extensions like Wappalyzer or BuiltWith. | SimilarTech (Can get pricey fast) | already.dev | | Social Media Buzz | Manually search platforms like Reddit, Twitter, and LinkedIn. | Brand24 (Plans start around $79/month) | already.dev |

This isn't about spending money for the sake of it. It's about deciding where your time is best spent. Manual research is powerful, but a focused tool can get you specific answers much faster. Just remember that the best competition matrix analysis is fueled by smart questions and keen observation, not just expensive data subscriptions.

Building Your Matrix and Making Sense of It All

You’ve done the legwork, gathered a mountain of data, and figured out who you’re really up against. Now for the fun part: turning all that intel into something that actually helps you make decisions. Don't worry, you don’t need any fancy software for this—a simple spreadsheet and some clear thinking are all it takes to build a powerful competition matrix.

But this isn’t just a data-entry exercise. The real value comes when you step back and see the story your data is telling. A finished matrix gathering digital dust is useless. The whole point is to spot patterns, uncover gaps in the market, and get crystal clear on what makes your business unique.

Setting Up Your Spreadsheet

Alright, let's get practical. Open up a fresh spreadsheet.

Down that first column, you're going to list out all the key factors you've decided to track. These become your rows. Think about things like:

- Pricing Model: How are they charging? Subscription, one-time, freemium?

- Top 3 Features: What are their absolute must-have, standout functions?

- Target Audience: Who are they really talking to in their marketing?

- Main Marketing Channel: Where do they seem to live online? SEO, social, paid ads?

- Customer Sentiment Score: A quick 1-5 rating based on what you’ve seen in reviews.

Now, across the top row, list your company first, then each of your main competitors. These are your columns. From there, it's just a matter of filling in the boxes with all the great research you've done. It’s that simple. If you want a bit of a head start, you can grab a ready-to-go grid from our complete competitor analysis template guide.

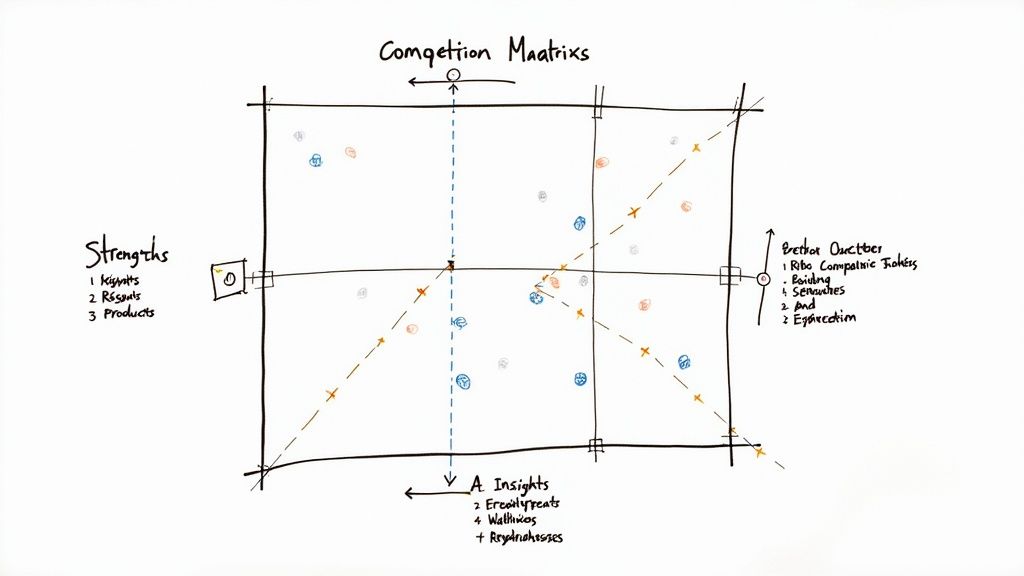

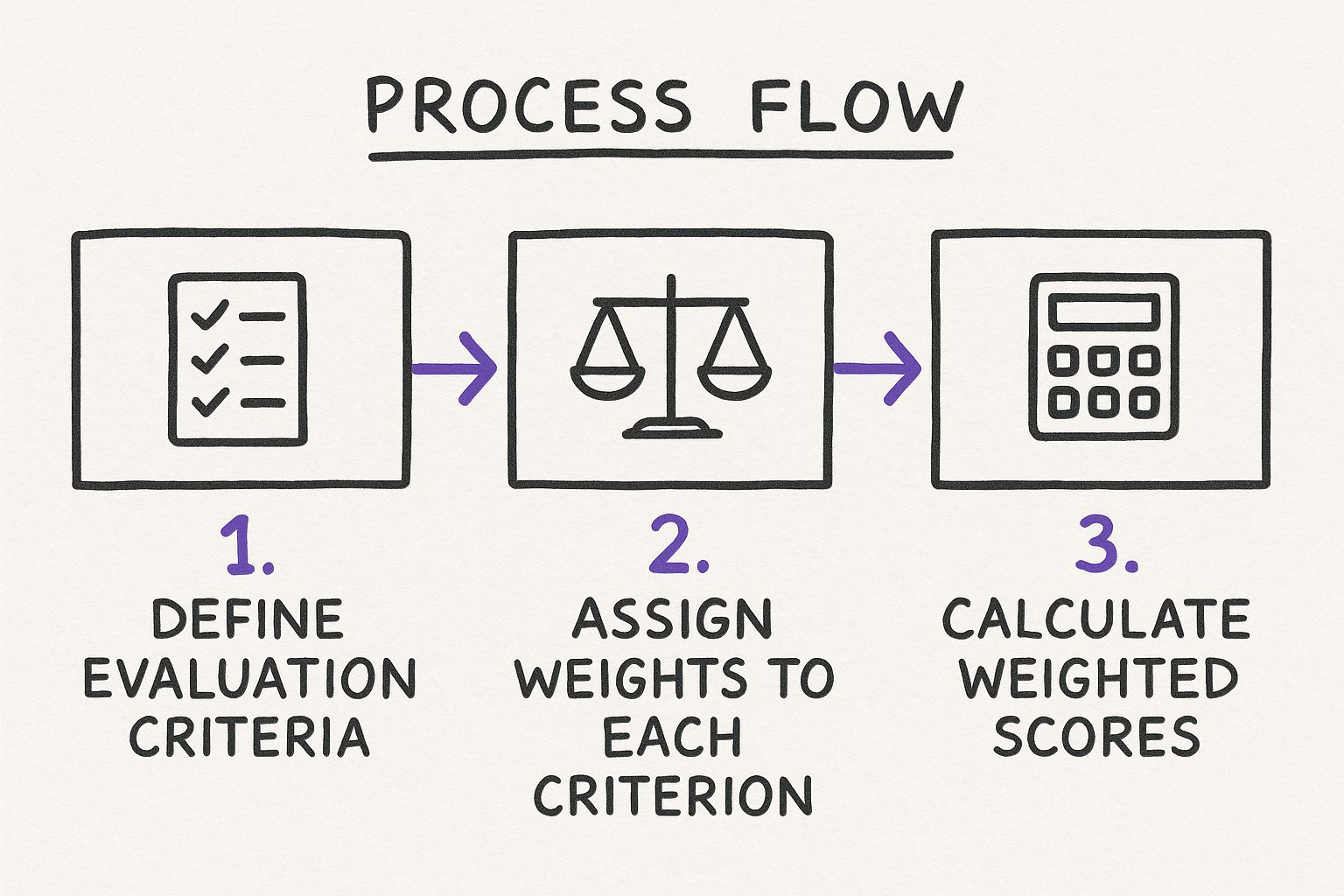

This basic visual breaks down how to turn raw notes into a scored matrix. You're defining your criteria, giving them weight, and then scoring everyone (including yourself).

This simple act transforms a bunch of subjective observations into a more objective scoring system, making it way easier to see who’s actually leading the pack in specific areas.

What Is the Matrix Actually Telling You?

Once your matrix is filled out, it's time to switch gears from data collector to strategist. Stop staring at individual cells and start looking for the bigger picture.

Are all your competitors laser-focused on enterprise clients, completely ignoring small businesses? Boom, that’s a gap. Do they all have killer features but their customer reviews are a dumpster fire? That’s your opening to win on stellar service.

This isn't just theory; it has a real-world impact. Some market research shows that companies who do this kind of thorough analysis see up to a 25% higher rate of successful product launches. It just makes sense—when you can visually map out the landscape, you can more easily find what customers desperately want but aren't getting.

> The goal isn’t to copy your competitors. It’s to understand the game they’re playing so you can choose to play a different one—one you’re actually positioned to win.

Always look for the "so what?" behind every piece of data. A competitor’s rock-bottom price isn’t just a number. It probably means they’re cutting corners on quality or support, which is an angle you can lean into with your own marketing. Think of your competition matrix as a treasure map, pointing you directly to their strategic weak spots.

Turning Your Insights Into a Winning Game Plan

So, you’ve built your masterpiece—a beautiful, data-packed competition matrix. High five! But let's be brutally honest for a second: an analysis is completely useless if it just sits in a folder collecting digital dust. It’s only as good as the action it inspires.

This is where your competition matrix analysis shifts from being a research project into a real-world game plan. Your matrix now holds the answers to some of your biggest business questions.

From Data Points to Decisions

Every cell in your spreadsheet is a clue pointing toward your next move. It’s time to stop just looking at the data and start asking, "So what?"

Did you discover that every single competitor uses a confusing, tiered pricing model? That’s not just an observation; it’s a screaming opportunity to win with a simple, flat-rate price. Are their customer reviews full of complaints about a missing feature you could build in a weekend? That’s your next product update, right there.

Let’s look at a couple of real-world scenarios:

-

For a SaaS Company: Imagine your matrix shows all major players are targeting massive enterprise clients. You also notice their customer reviews mention that onboarding is a nightmare for smaller teams. This is a massive gap in the market. Your game plan? Double down on features and marketing that serve scrappy startups and small businesses who are being completely ignored.

-

For an E-commerce Store: Your analysis reveals a key competitor has amazing products but charges a fortune for shipping. You, on the other hand, have a great local logistics partner. Your winning move is to offer free or flat-rate shipping and shout about it from the rooftops. You’re not competing on product anymore; you’re winning on convenience.

> A competition matrix doesn’t tell you to copy your rivals. It shows you exactly where they’re vulnerable so you can do the opposite and create a space in the market that is uniquely yours.

Prioritize and Attack

Your head is probably buzzing with ideas now. The final step is to turn that excitement into a prioritized to-do list. You can't do everything at once, so focus on the moves that offer the biggest bang for your buck.

Look for the "low-hanging fruit"—the quick wins that require minimal effort but could have a big impact. Then, map out the bigger, more strategic plays. The goal isn't just to react; it's to build a deliberate strategy based on the market weaknesses you’ve uncovered.

Use your matrix to make one smart decision at a time, and you’ll be well on your way to outmaneuvering the competition.

Got Questions About Your Competition Matrix? Let’s Clear Things Up.

Alright, so you're geared up to build your first competition matrix, but I bet you've got a few questions rattling around. That's a good thing. Let's tackle the common ones right now so you can move forward with confidence.

How Often Should I Update This Thing?

Think of your competition matrix as a living, breathing document. It’s not a one-and-done project you can file away and forget.

In a fast-paced market like SaaS or e-commerce, things change in the blink of an eye. I'd recommend giving your matrix a solid refresh every three months. If your industry is a bit more slow-and-steady, you can likely stretch that to every six months or even annually.

The real answer, though? Update it whenever something significant happens. Did a new competitor just launch? Did a major player just slash their prices or roll out a game-changing feature? That's your cue to open up the spreadsheet and get to work.

What’s the Single Biggest Mistake I Could Make?

Easy. The absolute biggest mistake is treating it like a data-gathering exercise instead of a decision-making tool. People spend weeks building these beautiful, color-coded spreadsheets filled with incredible insights, and then… they let them gather dust in a folder somewhere.

That’s what’s known as analysis paralysis. The entire point of this matrix is to spur you to do something.

A close second is getting laser-focused on your direct, head-to-head competitors. You can get so caught up watching the company that looks just like you that you completely miss the scrappy startup that's solving the same problem in a totally different way. Broaden your horizons.

> Your competition matrix should be a catalyst for action, not a museum of data. If it doesn't lead to a decision, it's just a pretty spreadsheet.

Can I Really Do This on a Shoestring Budget?

You absolutely can. Don't let the big, expensive subscription tools intimidate you. While platforms like Ahrefs or Semrush are powerful (and expensive), you don't need them to get started. Honestly, a simple spreadsheet and your own brain are your most valuable assets here.

So much of the crucial information you need is just sitting out there in the open. You can find pricing, features, and customer pain points right on your competitors' websites, their social media feeds, and on public review sites.

For a boost, tools like already.dev can give you a much deeper analysis without the hefty price tag of enterprise software. But remember, the tool doesn't make the strategy—you do.

Ready to stop guessing and start winning? Already.dev uses AI to do the heavy lifting, delivering a comprehensive competitive analysis in minutes, not weeks. Get the data-driven confidence you need to build something that truly stands out. Get started for free at https://already.dev.