A Better Competitive Analysis Report Template

Tired of useless reports? Our competitive analysis report template helps you find real insights. Learn to spy on rivals and uncover winning strategies.

Let's be real. Most competitive analysis reports are a total snooze fest. They're usually these dense, over-the-top documents that get filed away and never looked at again. But a truly great competitive analysis report template isn't just another spreadsheet. It's a treasure map that points directly to your competitors' weak spots.

Why Most Competitor Research Is a Waste of Time

The biggest reason competitor research falls flat is that people get bogged down in useless details. Teams burn weeks meticulously listing out every single competitor feature or tracking every tweet, and what do they get? A mountain of data with zero useful takeaways. It's analysis paralysis in action.

The point isn't to become an expert on every little thing your competitor does. It's about finding specific, exploitable gaps in their strategy. A solid template forces you to stop collecting random facts and start actually connecting the dots to find those golden opportunities.

Stop Thinking of it as a Static Spreadsheet

Your analysis should be a living, breathing document, not some one-and-done project you tick off a list. The trouble with static reports is that they’re obsolete the moment you save the file. The whole point is to help you make smarter, faster decisions in real-time. That's where a standardized template becomes your secret weapon.

A structured approach can slash your research time by up to 40% compared to just winging it. Even better, it helps teams spot real competitive threats and market opportunities with 25% more accuracy, according to research from CleverX. This clarity is what lets you move quickly and with confidence.

> The goal of a competitive analysis isn't to write a perfect encyclopedia on your rivals. It's to uncover one or two game-changing insights that give you a real edge.

At the end of the day, turning simple competitor snooping into a strategic advantage for your company all comes down to having the right framework. To make sure you've got the basics down, you can check out our guide on how to do competitor research.

Choosing a Template That Actually Helps You Win

Googling "competitive analysis report template" unleashes a flood of options. You’ll find everything from basic spreadsheets to dashboards so complex they look like they could launch a satellite. So, how do you find one that's genuinely useful and not just more digital clutter?

Let's be honest, you probably don't need a template with 50 different tabs and a tangled web of formulas. What you really need is a tool that forces you to zero in on what truly matters. A great template guides your focus with clear, dedicated sections for the essentials.

Must-Have Template Sections

Forget the fluff. Your template absolutely needs clean, organized spaces for these four core areas:

- SWOT Analysis: A simple grid to map out your competitors' Strengths, Weaknesses, Opportunities, and Threats is non-negotiable. This is where you find their Achilles' heel.

- Market Positioning: How do they talk about themselves? Are they the "cheap and easy" choice, or the "premium, white-glove" service? This tells you exactly who they're trying to win over.

- Feature & Pricing Comparison: You need a straightforward table comparing your core features and pricing tiers side-by-side with theirs. It’s the fastest way to spot gaps in the market you can exploit.

- Marketing Deep-Dive: Where are they spending their time and money? What's their core message? Are they all over TikTok, or are they still relying on print ads? This helps you uncover underserved channels.

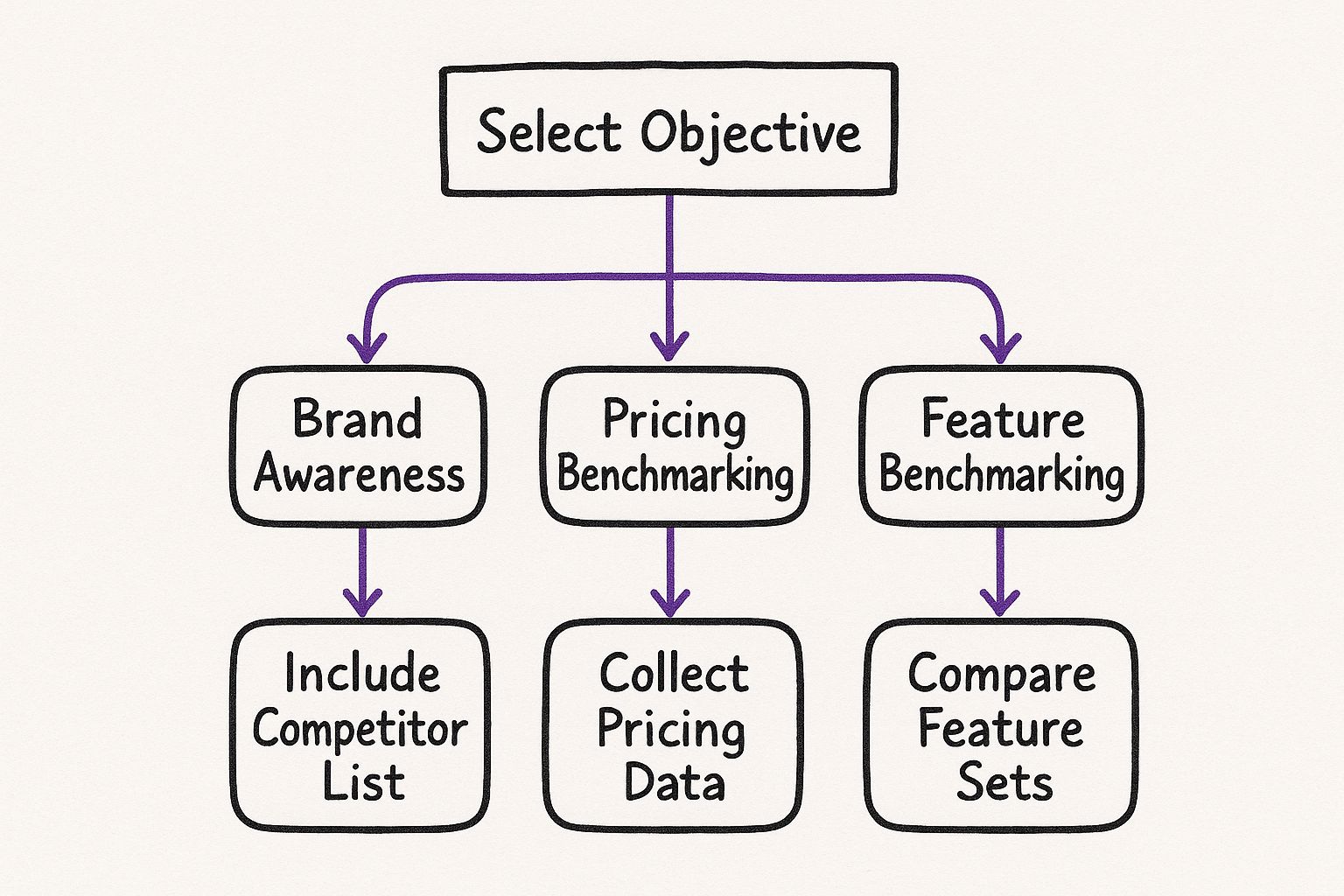

This decision tree gives you a great visual for how your main goal should dictate the focus of your analysis.

As the graphic shows, if your goal is to benchmark features, that directly tells you what kind of data you need to hunt down.

So, where do you find a template with these features? It's easy to get caught up in the free-versus-paid debate, but what matters most is what helps you get the job done efficiently.

Template Features: What Really Matters

This table breaks down the essentials from the nice-to-haves.

| Feature | Why You Need It | Good Enough (Free) | Better (Paid) | | :--- | :--- | :--- | :--- | | SWOT Analysis Grid | Quickly visualizes competitive advantages and vulnerabilities. | Basic 4-quadrant table in Google Sheets or Docs. | Interactive boards (Miro) or templates with prompts. | | Feature Comparison Matrix | Highlights product gaps and your unique selling points. | A simple spreadsheet with columns for each competitor. | Automated tracking tools that monitor feature releases. | | Pricing Table | Directly compares value propositions and identifies pricing sweet spots. | Manual entry into a spreadsheet. | Tools that scrape pricing pages and track changes over time. | | Marketing Channel Overview | Shows where competitors are winning customers. | Manual research and notes in a document. | Platforms like Semrush (which can be expensive) that analyze traffic sources automatically. |

Ultimately, a free Google Sheet can get you surprisingly far. But if you find yourself pulling tons of data regularly, an integrated tool might be a better investment.

While powerhouse platforms like Ahrefs or Semrush can be expensive, they offer incredible analytics. An alternative like already.dev can automate a lot of this data collection without the huge financial commitment.

> The best template isn't the fanciest one. It's the one you'll actually use consistently to make smarter decisions. If it feels like a chore to fill out, you've got the wrong one.

Time to Play Digital Detective and Gather Some Intel

Alright, you've got your competitive analysis report template ready to go. Awesome. But let's be honest, an empty template is just a pretty box. The real work—and the real fun—starts now. It’s time to fill it with the kind of intel that gives you a genuine edge.

Think of yourself as a digital detective on a mission. And every good investigation starts at the scene of the crime: your competitor's own turf.

Start by just poking around their website. Sign up for their newsletter. Follow them on every social media channel they use. You'd be amazed at how much companies reveal about their strategy when you simply pay attention. If they're constantly hyping up a new feature, that's a massive clue about where their focus is for the next quarter.

Digging Deeper for the Good Stuff

Once you’ve done the surface-level sweep, it's time to find out what people really think. This is where you'll find the gold.

Head over to customer review sites, dive into Reddit threads, and scan recent press releases. This is where you find the unfiltered truth about their actual strengths and—even better—their biggest weaknesses.

This is also where a few good tools can save you a ton of time. Sure, massive platforms like Ahrefs or Semrush can pull in a mountain of data, but they can also be painfully expensive.

For a more practical approach, a tool like already.dev can give you the key insights on competitor positioning and features without breaking the bank. If you're not even sure who to watch, our guide on how to identify competitors is a great place to start.

Don't underestimate the power of solid data. One study found that including details like competitor revenue and company size helps 75% of business leaders make smarter resource decisions. And adding context like buyer personas gives 60% of companies the ammo they need to predict a competitor's next move.

> Your goal isn't just to collect data points; it's to uncover the story behind them. Why did they choose that pricing model? What customer frustration are they failing to address? Those are the questions that lead to winning strategies.

By mixing some clever, low-cost snooping with the right tools, you can turn that empty competitive analysis report template into a powerhouse of actionable information.

From Raw Data to a Winning Game Plan

So, you've done the digging and now you're staring at a mountain of data. Awesome! But let's be real, a filled-out competitive analysis report template is useless if it's just a collection of facts. The real value comes from connecting the dots and turning all that raw information into a clear strategy for how you're going to win.

Anyone can list a competitor's features or pricing. The real skill is understanding the why behind their every move. Don't just jot down their pricing tiers; ask what that pricing tells you about their target customer. Is a competitor charging a premium? They're likely going after enterprise clients who prioritize top-tier support over a million features.

Reading Between the Lines

Treat every piece of data in your template as a clue in a larger mystery. Instead of just listing their last five blog posts, look for a common thread. Are they all hammering home the idea of "saving time for busy managers"? Bingo. You've just uncovered their core value proposition. You're not just filling in boxes; you're reverse-engineering their entire playbook.

Here's how I like to break it down:

- SWOT Analysis: Don't just write "strong brand recognition" as a strength. Reframe it into an action item: "Their established brand makes it tough for newcomers to build trust, so we need to find a unique angle to break through."

- Marketing Channels: Go beyond "They use Instagram." A better insight is, "Their Instagram is fueled by user-generated content, which tells me their community is a major asset. How can we build one that's even more engaged?"

> Your report should tell a story. By the end, the conclusion should be obvious: "And this is exactly where we can beat them."

Putting Insights Into Motion

Competitive analysis templates have come a long way. They're not just simple tables anymore; they're powerful tools for developing some serious strategic foresight. It’s no surprise that an estimated 85% of companies say that a solid template helped them slash market entry failures by 20%. This is about making calculated moves, not just collecting stats. You can see more about these strategic findings on Miro.com.

The final, most crucial step is turning what you've learned into concrete actions. If you discover a competitor's weakness is a clunky onboarding process, your action item is crystal clear: make your onboarding experience incredibly smooth and shout it from the rooftops in your marketing. If their content is dry and outdated, your opportunity is to create something vibrant and valuable.

To really get an edge, you might want to look into some of the best competitive intelligence tools that can automate a lot of this data gathering. This whole process is what transforms a simple report into your secret weapon for growth.

Presenting Your Findings So People Actually Care

You’ve done the heavy lifting. Your competitive analysis is packed with brilliant insights. But here’s the hard truth: none of it means a thing if your boss or team tunes you out.

Let's be honest, nobody wants to be trapped in a meeting with a 50-slide PowerPoint. That's a one-way ticket to nap-town. Your real goal isn't just to share a spreadsheet; it's to spark action and position yourself as the team's strategic hero.

The secret? Stop presenting data and start telling a story. Your audience doesn't care about a dozen different metrics. They care about what those metrics mean for the business.

From Data Dump to Punchy Story

Your whole presentation needs to build up to a few key takeaways. You have to think like a journalist—what's the headline here? Lead with your most surprising or impactful finding to grab them from the start.

> "The single biggest mistake in presenting data is giving it all equal weight. Your job is to have a strong opinion about what matters and what doesn't."

For example, don't just say, "Competitor X has 20% more social media followers."

Instead, frame it with impact: "Competitor X is absolutely dominating the conversation on TikTok with our exact target audience, and we don't even have a presence there. We're leaving a massive opportunity on the table."

See the difference? One is a boring fact. The other is an urgent call to action.

To make your story impossible to ignore, I always boil my findings down to this simple three-part framework:

- The "What": State one crystal-clear observation. (e.g., "Our main rival’s new pricing model is really confusing their customers.")

- The "So What?": Explain the direct impact this has on your business. (e.g., "That confusion is driving their users to actively search for simpler alternatives.")

- The "Now What?": Give a clear, actionable recommendation. (e.g., "We need to launch a marketing campaign focused on our simple, transparent pricing right now.")

When you frame your findings this way, you turn a dry report into a compelling argument for change. It makes your analysis a tool for action, not just another file saved on the server.

Got Questions? We've Got Answers

You've got the template, but a few questions are probably still rattling around in your head. Let's tackle the common ones I hear all the time.

How Often Should I Actually Run This Analysis?

Your competitive analysis report isn't a "one-and-done" kind of thing. It's a living, breathing document. For most folks, a quarterly review is the perfect rhythm. This keeps you on top of major market shifts without it turning into a second job.

But, if you're swimming in a fast-paced pool like SaaS or e-commerce, you might need to check in monthly. A good rule of thumb? At the very least, refresh your report anytime a competitor makes a big splash, like dropping a new product or launching a massive marketing campaign.

So, How Many Competitors Do I Really Need to Watch?

It’s tempting to track every single player, but trust me, you'll just drown in data. The magic number is usually 3-5 key competitors. That's it.

Your goal is a focused list, not a phone book. Make sure you have a good mix:

- Direct Competitors: These are the obvious ones—the companies offering a super similar product to your exact audience. Your classic rival.

- Indirect Competitors: They solve the same customer problem you do, but in a completely different way. Think of a restaurant competing with a meal-kit service.

- Aspirational Competitors: These are the industry leaders you admire. You might not go head-to-head with them today, but you can learn a ton from their playbook.

Always remember, deep insights on a few key players will beat shallow data on twenty.

> Here's a pro-tip: The most valuable insight isn't just seeing what your competitors do well. It's finding the gap between what customers are begging for and what the market is actually giving them. That gap is where you win.

Can I Pull This Off Without a Big Budget?

You absolutely can. Don't get me wrong, paid tools like Ahrefs or Semrush are fantastic and can save you a lot of time (though they can be expensive). But you can uncover a goldmine of information for free if you're willing to do a little digital detective work.

Get your hands dirty. Go through their website with a fine-tooth comb. Sign up for their newsletter. Pore over every customer review on sites like G2 or Capterra. Stalk their social media feeds and see what real customers are saying—both the good and the bad. You can build an incredibly effective report without spending a cent.

And when you're ready to get some of that time back, a tool like already.dev can give you those critical insights without the enterprise-level price tag.

Tired of spending hours buried in spreadsheets? Already.dev can take all that tedious research and turn it into a clear, strategic report in just minutes. It's time to stop guessing what your competitors are up to and start outsmarting them. Get your AI-driven competitive analysis today.