A Competitive Landscape Analysis Framework That Actually Works

Tired of theory? Learn a competitive landscape analysis framework that delivers real-world insights. Outsmart rivals and find your market sweet spot.

Think of a competitive landscape analysis framework as your business's cheat sheet. It’s a structured way to spy on what your competition is up to so you can make smarter moves. You're basically scouting the other teams to learn their plays, find their weak spots, and figure out an open lane to score.

What Is This Competitive Analysis Thing, Anyway?

Let's be real—"competitive landscape analysis framework" sounds like a mouthful, probably something you’d find in a stuffy MBA textbook. It's jargon that sounds complicated and, frankly, a little boring. But all it really means is having a repeatable system to keep an eye on your rivals.

Think of it like prepping for a big game. You wouldn't just show up and hope for the best. You'd study game tapes, learn the other team's star players, their go-to plays, and where their defense is leaky. That's exactly what this is: gathering intel to build a strategy that actually wins.

It's Not About Making Fancy Charts

The point here isn't to create beautiful, complicated spreadsheets that get filed away and never seen again. The real goal is to pull out the specific insights you need to make smarter, faster decisions. This whole process is designed to give you a clear map of your market, showing you exactly where you have a unique opportunity to shine.

This kind of analysis is a crucial piece of a bigger strategy. For a deeper dive, you can check out our guide on what competitive intelligence is and how it all connects.

As you start mapping things out, you’ll run into two main types of rivals.

Direct vs. Indirect Competitors

It's easy to spot the obvious players, but the sneaky ones can sometimes be the most disruptive. You've got to watch out for both.

- Direct Competitors: These are the companies you go head-to-head with every day. They sell a similar product to the same audience. If you sell project management software, a company like Asana is a direct competitor. No surprise there.

- Indirect Competitors: These guys are trickier. They solve the same core problem for your customer but with a totally different solution. For that same project management software company, a simple spreadsheet, a shared team calendar, or even a Trello board could be an indirect competitor. They get the job done, just differently.

Here's a quick way to think about it.

Direct vs Indirect Competitors At a Glance

Use this simple guide to quickly identify the different players crowding your space.

| Competitor Type | What It Means | Example (If You Sell Project Management Software) | | :--- | :--- | :--- | | Direct | Sells a similar product to the same target audience. | Asana, Monday.com, ClickUp | | Indirect | Solves the same problem with a different solution. | Google Sheets, a shared Outlook calendar, a physical whiteboard |

Understanding both is key. If you only focus on your direct competitors, you might get blindsided by a simpler, cheaper, or more convenient solution that solves your customer's problem just as well.

> The real purpose of a competitive analysis isn't to copy your rivals; it's to find the gaps they've left wide open for you. Your best opportunities often live in the spaces your competitors ignore.

By mapping out both direct and indirect players, you get the full 360-degree view of what you're up against. This allows you to position your product or service in a way that makes you the no-brainer choice for your ideal customer.

Gearing Up: Assembling Your Competitor Analysis Toolkit

Before you dive headfirst into analyzing the competition, you need the right gear. A solid competitive analysis hinges on having the right tools and frameworks at your disposal.

And I'm not talking about those overly complex models from business school textbooks. We're focused on practical stuff that real businesses use to make smart decisions. This isn't about creating analysis for the sake of it; it's about building a toolkit that gives you actionable intelligence without going broke.

Let's assemble your kit.

Start with the Classics (They Work for a Reason)

Sometimes, the old ways really are the best. The SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is the undisputed champ for a reason. Think of it as the Swiss Army knife of strategy—it's simple, versatile, and gets the job done.

I use it all the time to get a quick, high-level snapshot of where a company and its competitors stand. It has stuck around because it forces you to look at both internal factors (Strengths, Weaknesses) and what's happening out in the wild (Opportunities, Threats).

In fact, SWOT is still the go-to for over 80% of Fortune 500 companies. That tells you something.

> My Pro Tip: Don't just make lists. Turn your SWOT into a game plan. For every "Strength," ask, "How can we use this to crush a competitor's weakness?" For every "Threat," ask, "What move can we make right now to neutralize this?" This simple shift turns a boring list into a dynamic strategy.

Get a Feel for the Industry's Vibe

Once you've got your SWOT snapshot, it’s time to zoom out. Is your market a friendly neighborhood potluck or a full-on shark tank? This is where Porter's Five Forces comes into play. It sounds a bit academic, but it’s really just a way to check the competitive pressure in your space.

It helps you answer some critical questions:

- How intense is the rivalry? Are your competitors constantly at each other's throats with new features and price cuts?

- How easy is it for new players to show up? Is the barrier to entry a giant wall, or could a startup disrupt you overnight?

- How much power do your buyers and suppliers hold? Who really calls the shots in your market?

- Is there a looming substitute? This is the classic Blockbuster vs. Netflix scenario. What could make you obsolete?

This framework helps you see the invisible forces shaping your industry. It's less about how to compete and more about figuring out where you should even be playing.

Gather Your Intel Without Breaking the Bank

Now for the fun part—digging into the data. You need tools to see what your competitors are actually doing online, from their marketing campaigns to their website traffic.

The big-name platforms everyone talks about are Ahrefs and Semrush. They're incredible, no doubt, offering deep dives into SEO, content, and advertising. The only problem? They can be seriously expensive, often running hundreds of dollars a month. That's a tough pill to swallow for a lot of businesses.

But here’s the good news: you don't need to spend a fortune to get quality intel.

More accessible tools like already.dev give you a fantastic overview of a competitor's online footprint. You can uncover their strategies and see how they're positioned without that hefty enterprise price tag. And if you're looking to round out your toolkit, we’ve put together a guide on the best free competitor analysis tools to get you started.

This is what you see when you start a project on already.dev. It’s all about getting you from idea to insight, fast.

By combining a classic framework like SWOT with a modern, affordable data tool like already.dev, you can build a practical and powerful competitor analysis process that actually works.

A Framework That Actually Works

Let's cut to the chase. Most guides on competitive analysis throw some overly complicated, 10-step process at you that looks great on a slide but is a nightmare to actually use. You end up buried in data with no clear idea of what to do next.

The best competitive landscape analysis framework is one you'll actually use—something simple, repeatable, and designed to drive action.

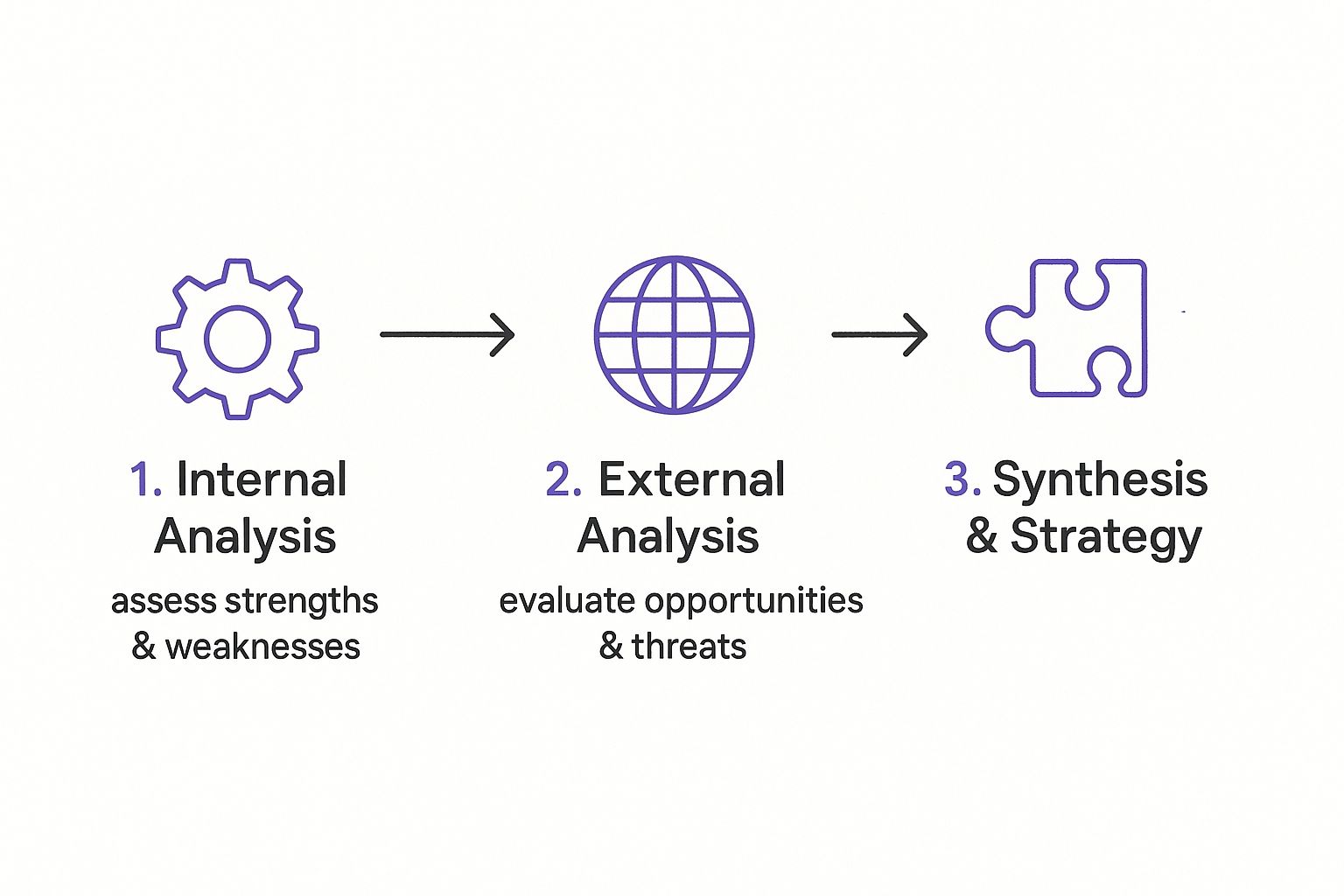

I've found a three-phase approach that works every single time: Assess, Benchmark, and Strategize. This isn't just theory; it's a proven method for turning a messy pile of competitor data into a clear game plan. Organizing your analysis this way keeps you locked in on what truly matters, which is why strategic consulting giants like BCG and McKinsey use a version of it for everything from product launches to market entry.

This graphic gives you a quick, high-level look at how the process flows—from looking inward, to scanning the field, and finally, to making your move.

As you can see, it’s a logical path. You can’t build a winning strategy until you have a firm grip on your own capabilities and the forces at play in the market.

Assess Your Battlefield

The first phase, Assess, is all about mapping the terrain. This is where you figure out who you’re really up against.

It’s easy enough to spot the obvious players—your direct competitors. The real insight, though, comes from uncovering the less obvious, indirect competitors.

These are the companies solving the same customer problem, just with a different solution. Think about Slack. They aren't just competing with Microsoft Teams; they’re also competing with email, Zoom calls, and even a quick tap on a colleague's shoulder. Ignoring these alternatives is like training for a boxing match only to get tackled by a wrestler you never saw coming.

To get this right, you need to:

- List your direct rivals: Who pops up when you google your main product category? More importantly, who does your sales team consistently lose deals to? Ask them. They know.

- Identify indirect threats: How did people solve this problem before you came along? What’s the "good enough" alternative they might be using right now? That’s your competition, too.

- Spot the newcomers: Use tools like Google Alerts or platforms like already.dev to catch new startups entering your space before they grow into a major threat.

This first step gives you a true 360-degree view, making sure you don't get blindsided.

Benchmark What Actually Matters

Next up is the Benchmark phase. Now it’s time to get into the nitty-gritty and compare apples to apples. The goal here isn't just to build a massive spreadsheet checking off feature boxes. It's about deeply understanding how and why your competitors win customers.

> Don't fall into the trap of a simple feature-for-feature comparison. Instead, benchmark the entire customer experience. A competitor with fewer features might be cleaning up because their onboarding is ridiculously smooth or their customer support is legendary.

To avoid getting lost in the data, focus your benchmarking on a few key areas:

- Product & Pricing: How does their core offering really stack up against yours? Break down their pricing tiers and figure out what value they’re promising at each level.

- Marketing & Messaging: What’s their brand’s personality? What unique value prop do they hammer home on their homepage, in their ads, and across their content?

- Customer Reviews & Reputation: What are real customers saying? Dig through review sites like G2 and Capterra, or even forums on Reddit, to get the unfiltered truth about their biggest strengths and most glaring weaknesses.

This phase gives you the raw material you need to find their weak spots and, more importantly, your biggest opportunities. If you need a hand keeping all this information straight, a good competitor analysis template can be a lifesaver.

Strategize Your Winning Moves

Finally, we arrive at the Strategize phase. This is where you connect all the dots and turn your research into actual, concrete decisions. An analysis is completely useless if it just collects dust in a folder. The whole point is to create an action plan with 3-5 key moves you can make right now to gain an edge.

Don't try to do everything at once. Based on your assessment and benchmarking, what are the most impactful moves you can make?

Maybe you discovered a key feature your top competitor is missing—it's time to shout about it from the rooftops. Perhaps you found a gap in the market for a mid-tier pricing plan. Or it could be as simple as rewriting your website copy to speak directly to a pain point your rivals completely ignore.

This structured method prevents your competitive analysis from becoming a purely academic exercise. Instead, it becomes a powerful, living tool that informs your strategy, sharpens your market position, and gives you a clear path to winning.

Understanding Your Industry’s Power Dynamics

Ever look at an industry and wonder why it feels like an impenetrable fortress? Or why another one seems like a free-for-all where anyone can set up shop and immediately get into a price war?

It all comes down to the invisible power dynamics at play. To really get a grip on this, you need a map. The best one for the job is a classic competitive landscape analysis framework known as Porter’s Five Forces.

Don’t worry, we're skipping the MBA jargon and getting straight to the good stuff—how it helps you figure out where to compete and how to win.

The Five Forces That Shape Your Market

Porter’s Five Forces has been a cornerstone framework since 1979 for a reason: it's brilliant for gauging how competitive an industry is and, frankly, how much money is up for grabs. The framework breaks down the competitive pressure into five key areas. For a deeper dive into the theory, Alpha Sense has some great insights on this classic.

Think of these forces as five levers that control the difficulty setting of your industry. Understanding them reveals hidden opportunities and threats you’d otherwise miss.

-

Competitive Rivalry: This is the obvious one. How intense is the scrap for customers between the existing players? Think about the fast-food world, where the rivalry between McDonald's and Burger King is legendary. High rivalry means lower profits for everyone.

-

Threat of New Entrants: How easy is it for a new challenger to just show up and start competing? Starting an airline is incredibly difficult thanks to massive costs and regulations (a high barrier to entry). But starting a new dropshipping store? Pretty easy (a low barrier).

-

Bargaining Power of Buyers: Who really calls the shots—you or your customers? If you're one of a dozen freelance web designers, buyers have all the power to negotiate your price down. If you're the only company that makes a critical part for Boeing, you hold all the cards.

-

Bargaining Power of Suppliers: This is just the flip side. How much control do the companies you rely on have over you? A small, independent coffee shop is at the mercy of its bean supplier's prices. But a giant like Starbucks can negotiate incredible deals because of its sheer volume.

-

Threat of Substitutes: This one’s the silent killer. It's the risk of your customers finding a completely different way to solve their problem. Taxis didn't see Uber as a direct competitor at first, but it was a substitute that completely changed the game.

Putting the Framework into Action

So, how does this actually help you? By analyzing these five forces, you can answer some brutally honest questions about your market. Is it a calm blue ocean, or is it a bloody red ocean full of sharks?

Let's imagine you want to start a new craft brewery.

- Rivalry is high. There are tons of breweries already out there.

- Threat of new entrants is moderate. It takes capital, but it's not impossible.

- Buyer power is high. Customers have endless choices.

- Supplier power is moderate. Hop and grain suppliers have some leverage.

- Threat of substitutes is high. People can just drink wine, spirits, or even non-alcoholic beverages instead.

> Looking at this, you quickly realize competing on price is a losing game. The only way to win is to create something truly unique—a hyper-niche beer style, an amazing taproom experience, or a killer brand story that builds a loyal tribe.

This simple exercise instantly moves you from guessing to strategizing. It shows you exactly where the pressure points are and helps you build a business that can actually withstand them. It's not about avoiding competition; it's about understanding the rules of the game so you can play it better than anyone else.

Turning Your Insights into a Winning Game Plan

You’ve done the hard work. You’ve dug into the data, stalked your rivals’ websites, and now you’re sitting on a mountain of notes. So… what now?

Let’s be honest, all that research is completely pointless if it doesn't lead to action. An analysis that just sits in a folder is a waste of everyone's time. This is where we turn those scattered insights into a simple, visual, and actionable game plan. It’s time to move from "what are they doing?" to "what are we going to do about it?"

Create Your Competitive Map

The fastest way to make sense of your market is to actually see it. Forget complex charts and diagrams that make your eyes glaze over. We’re talking about a simple competitive map—a basic two-axis grid that instantly shows you where everyone stands.

Imagine a chart with Price on the vertical axis (from low to high) and Customer Service Quality on the horizontal axis (from poor to excellent). Now, start plotting. Where does your company sit? Where do your competitors land?

Suddenly, the landscape becomes crystal clear. You’ll immediately see the crowded corners of the market where everyone is fighting over the same customers. More importantly, you'll spot the wide-open spaces—the underserved areas where you can plant your flag and dominate.

This simple visualization is a core part of a solid competitive landscape analysis framework because it forces you to stop thinking in lists and start seeing relationships.

Define What Makes You Different

Your competitive map does more than just show you where the gaps are; it helps you sharpen your unique value proposition (UVP). This is the one thing that makes you the obvious, no-brainer choice for your ideal customer.

Look at your map. Is there a quadrant that’s completely empty?

- Maybe everyone is competing on low prices but offers terrible support. This is a huge opportunity to be the "affordable but amazing service" option.

- Perhaps all the high-end players have incredibly complex products. You could win by offering a premium, simple solution for customers who feel overwhelmed.

Your UVP isn’t just a slogan; it’s the strategic position you’re choosing to own. It’s the answer to the question, "Why should I buy from you and not the other guys?"

> A great value proposition isn't about being better at everything. It’s about being undeniably the best at the one thing your target customer cares about most. Don't try to win their game; make them play yours.

To really nail this down, you need to get specific. Don't just say "better service." Say "24/7 live chat support with a real human in under 60 seconds." That’s a value proposition that means something.

Build Your One-Page Game Plan

Now it's time to pull everything together into a document that you can actually use. The goal isn't a 50-page report nobody will read; it’s a clear, one-page summary that anyone on your team can look at and immediately understand the plan.

This game plan should answer three simple questions:

- Where will we compete? This comes directly from your competitive map. Clearly state the market gap you’re targeting. For example, "We will compete in the high-quality, mid-price segment for small businesses that value ease of use over excessive features."

- How will we win? This is your unique value proposition in action. What’s your knockout punch? "We will win by offering the most intuitive user interface on the market, backed by industry-leading customer support."

- What are our next moves? This is the most critical part. Turn your strategy into a short list of concrete, actionable steps. Don't be vague. Instead of "Improve marketing," write "Launch a three-part blog series highlighting our superior customer support by the end of Q3."

This one-pager becomes your strategic north star. It’s what you’ll reference in meetings, share with new hires, and use to make sure every decision is aligned with your winning strategy. It transforms your competitive analysis from a research project into a powerful tool for growth.

Common Questions About Competitor Analysis

Alright, you've got the frameworks and the tools. But as you start digging in, a few common questions always seem to pop up. Let's tackle them head-on.

How Often Should I Analyze My Competitors?

Think of it like planning a road trip. You do a huge, deep-dive mapping session before you leave, but you still check for traffic and weather updates along the way.

You don't need to do a massive, soul-crushing analysis every single week. That’s just a recipe for burnout.

Aim for a major, in-depth competitive landscape analysis about once a year. This is your big strategy session where you step back and look at the entire market with fresh eyes.

The real key, though, is to do smaller, informal check-ins much more frequently. I’m a big fan of a quarterly pulse check. Just block off a few hours to do a little recon:

- Website & Social Stalking: Pop over to their websites. Have they rolled out new pricing? Are they making a big deal about a new killer feature?

- Review Mining: Spend 20 minutes on sites like G2 or Capterra. Are customers suddenly complaining about something you could solve?

- Ad Spying: Check their social media ad libraries on platforms like Facebook. What are they actually putting money behind? This is a dead giveaway for what they believe are their strongest selling points.

Markets move fast. These quarterly check-ins are your early warning system, keeping your strategy agile, not ancient.

What Are The Biggest Mistakes People Make?

Oh, I've seen some good ones. But a few classic blunders show up again and again. If you can sidestep these three, you’re already ahead of 90% of the pack.

The absolute number one mistake is analysis paralysis. This is where you get so buried in spreadsheets and data that you never actually make a decision. You have charts for your charts. Don't fall into this trap. Zero in on the 3-5 competitors that really matter and look for insights you can act on this quarter, not next year.

The second biggest misstep is wearing blinders. It’s easy to get so obsessed with your direct competitors that you completely ignore the indirect ones. Remember Blockbuster? They were laser-focused on Hollywood Video, while Netflix—a totally different kind of service—was quietly eating their lunch. Your biggest threat often isn't the rival you know, but the one offering a better way to solve the problem.

> The point of a competitive analysis isn't to create a perfect mirror of your competitors' strategies. It's to find the cracks, the gaps, and the things they aren't doing well. Use their playbook for inspiration, not as a blueprint to copy.

Finally, resist the urge to just copy your rivals. This is a huge trap. If they launch a podcast, your knee-jerk reaction might be to launch a podcast, too. Stop. Your analysis should show you where they're weak, not just what they're doing. The goal is to zig when they zag.

How Do I Find Competitors In A New Niche?

Fantastic question. You’ve built something totally new, and you're thinking, "I have no competitors!" I hate to break it to you, but you're probably wrong. You always have competition, even if it doesn't look like a traditional rival.

Just ask yourself this one simple question: "How did people solve this problem before my product existed?"

The answer is your competition. It might be a messy combo of different tools, a clunky manual process, or even just doing nothing because the old way was such a pain.

Let’s use an example. Say you've built the world's first AI-powered tool for organizing family recipes. Who are you competing against?

- The Spreadsheet: The classic, "good enough" solution.

- A Messy Notes App: Scraps of text scattered across a phone.

- A Physical Recipe Box: The old-school, analog method.

- "Just Google It Every Time": The path of least resistance.

Your job is to analyze these alternatives just like any other competitor. What are the weaknesses of using a spreadsheet? It’s clunky, it’s not easily shareable, and let’s be honest, it's ugly. Boom. Your entire marketing can be built around showing how your beautiful, seamless solution makes that old way completely obsolete.

Ready to stop guessing and start knowing? already.dev uses AI to do the heavy lifting, uncovering every competitor in your space—direct, indirect, and even the ones you never knew existed. Get the insights you need in minutes, not weeks. Check out how it works at already.dev.