Competitive Marketing Analysis That Actually Gets Results

Tired of useless reports? Learn how to do competitive marketing analysis that uncovers real gaps, sharpens your strategy, and helps you win market share.

Let's be real. When you hear "competitive marketing analysis," you probably picture a soul-crushing spreadsheet that took weeks to build, only to be filed away and never looked at again. It's usually a total snooze-fest.

Why Most Competitor Research Is a Waste of Time

Most competitor reports are dead on arrival. They become these monster projects where someone manually scrapes websites, stalks social media, and crams it all into a document that's outdated the second they hit "save."

This old-school approach is totally broken, especially if you're a startup trying to move fast. You either fall into "analysis paralysis"—spending weeks gathering data instead of doing anything with it—or you get obsessed with vanity metrics like a competitor's follower count, which tells you almost nothing about their actual business.

The Problem with Stale Data

The biggest issue? By the time your beautiful report is finished, the market has already moved on. Your competitor just launched a new feature, changed their pricing, or kicked off a marketing campaign you completely missed. That static report is a snapshot of the past, not a roadmap for the future.

This is a huge problem when you realize that a staggering 75% of product failures happen because of a bad read on the market. That's a mistake that having a real-time pulse on the competition could have helped prevent.

> The goal isn't to build a museum of competitor facts. It's to get an ongoing, real-time pulse on your market that helps you make quick, smart moves and avoid becoming another statistic.

A Smarter Way to Spy

It's time for a mindset shift. Instead of just stalking the same three companies everyone finds on Google, a modern competitive analysis is all about getting actionable intel. You need a system, not just a spreadsheet. This means ditching the manual labor for smarter strategies that deliver insights in hours, not weeks.

Let's quickly compare the two approaches.

Old School vs. New School Competitor Research

Here's a quick look at why the old, manual way of spying on competitors is busted and how a modern approach gets you better intel, faster.

| Method | Time Investment | Key Focus | Typical Outcome | | :--- | :--- | :--- | :--- | | Old School | Weeks or Months | Manual data entry, social stalking | A static, outdated spreadsheet | | New School | Hours or Days | Automated data collection, strategic analysis | A living playbook with prioritized actions |

As you can see, the new school isn't just faster; it's focused on producing insights you can actually use to make decisions. It's less about building a pointless archive and more about creating a living strategy. To do this right, you need to understand what competitive intelligence is and how it's fundamentally different from just looking stuff up.

Ultimately, a killer competitive analysis should help you:

- Spot real opportunities: Find underserved customer segments your rivals are totally ignoring.

- Avoid costly mistakes: See what crashed and burned for others so you don't repeat their blunders.

- Sharpen your positioning: Clearly and confidently explain why you're the better choice.

- Make data-backed decisions: Move forward with conviction instead of just guessing.

The good news? You don't need to spend a fortune on expensive tools like Ahrefs or Semrush to get this done. A platform like Already.dev is built to automate the grunt work, giving you a complete view of your market without all the painful manual effort.

Finding Your Real Competitors—Not Just the Obvious Ones

Spoiler alert: your competition isn't just the top three names that pop up on Google. If your competitive analysis stops there, you're flying blind. The real threats—and often the biggest opportunities—are lurking just out of sight.

Most people make the same mistake. They search for their main keyword, jot down a few familiar logos, and call it a day. That's like a boxer training for a single opponent when there's an entire tournament waiting. This narrow view means you completely miss the scrappy upstarts, the indirect players solving the same problem differently, and even the failed projects that hold invaluable lessons.

The real mission is to build a 360-degree map of your market, not just a shortlist of the usual suspects. This means getting inside your customer's head and understanding every single alternative they consider.

Look Beyond Direct Competitors

You have to think bigger. It’s not just about who has a similar feature set; it’s about what your customer does instead of using your product.

- Indirect Competitors: These are companies solving the same problem but with a different tool. Think of a project management tool like Asana versus a simple spreadsheet. For many teams, a Google Sheet is the go-to alternative, making it a very real (and often underestimated) competitor.

- Aspirational Competitors: These are the big players in a related space. They might not be in your market today, but they could parachute in tomorrow. Watching them helps you see where the whole industry is headed.

- Up-and-Coming Competitors: These are the new kids on the block, often found on startup directories or in niche forums. They’re hungry, nimble, and can quickly start eating into your market share if you’re not paying attention.

Getting this full landscape right is a huge deal. There's a reason the competitive intelligence market hit $50.9 billion last year and is on track to hit $122.8 billion by 2033. Companies are scrambling for a complete market view because they know that misreading it is a death sentence—especially when 70% of startups fail for this very reason. You can dive deeper into these competitive intelligence trends and their impact.

Where to Uncover Your Hidden Rivals

So, where do you find these elusive competitors? It’s time for a digital scavenger hunt. Forget page one of Google for a minute and start digging where your actual customers hang out.

- Niche Forums and Communities: Get into the trenches. Dive into Reddit subs, Slack channels, and industry-specific forums. Look for threads where people are asking, "What tool do you use for X?" The answers are a goldmine of alternatives you've likely never heard of.

- Startup Directories: Browse sites like Product Hunt, BetaList, and Crunchbase. These are breeding grounds for new companies trying to disrupt the status quo.

- App Stores and Marketplaces: If you're in SaaS, check out the marketplaces for platforms like Shopify, Salesforce, or HubSpot. You'll uncover tons of smaller, specialized tools solving very specific problems.

> The goal is to think like your customer. Before they even know your brand exists, what are they searching for? Where are they asking for help? The answers will lead you straight to your true competitors.

This kind of deep-dive research is incredibly valuable, but let's be real—it can be a 40-hour manual slog. You have to sift through endless threads and try to organize it all into something useful. If you want to learn more about the old-school approach, we've got a detailed guide on how to find your competitors.

Or, you can just skip the pain. Modern tools are built for this. While some platforms like Ahrefs or Semrush can be expensive and complex, an AI-powered tool like Already.dev automates this entire discovery process. You just describe your idea, and it crawls hundreds of sources—forums, app stores, directories, and more—to deliver a full landscape report in about four minutes. This gives you the map you need without sacrificing a week of your life to get it.

Stealing Their Secrets: What to Actually Look For

Okay, you've got your list of competitors—the big names, the upstarts, and the sneaky ones. Now for the fun part.

Your first instinct might be to go full-on secret agent, creating burner emails to sign up for every newsletter. Pump the brakes. That's a surefire way to drown in useless data.

The goal isn't to be a professional stalker; it's to be a spy with a plan. We're going to zero in on the intel that really matters.

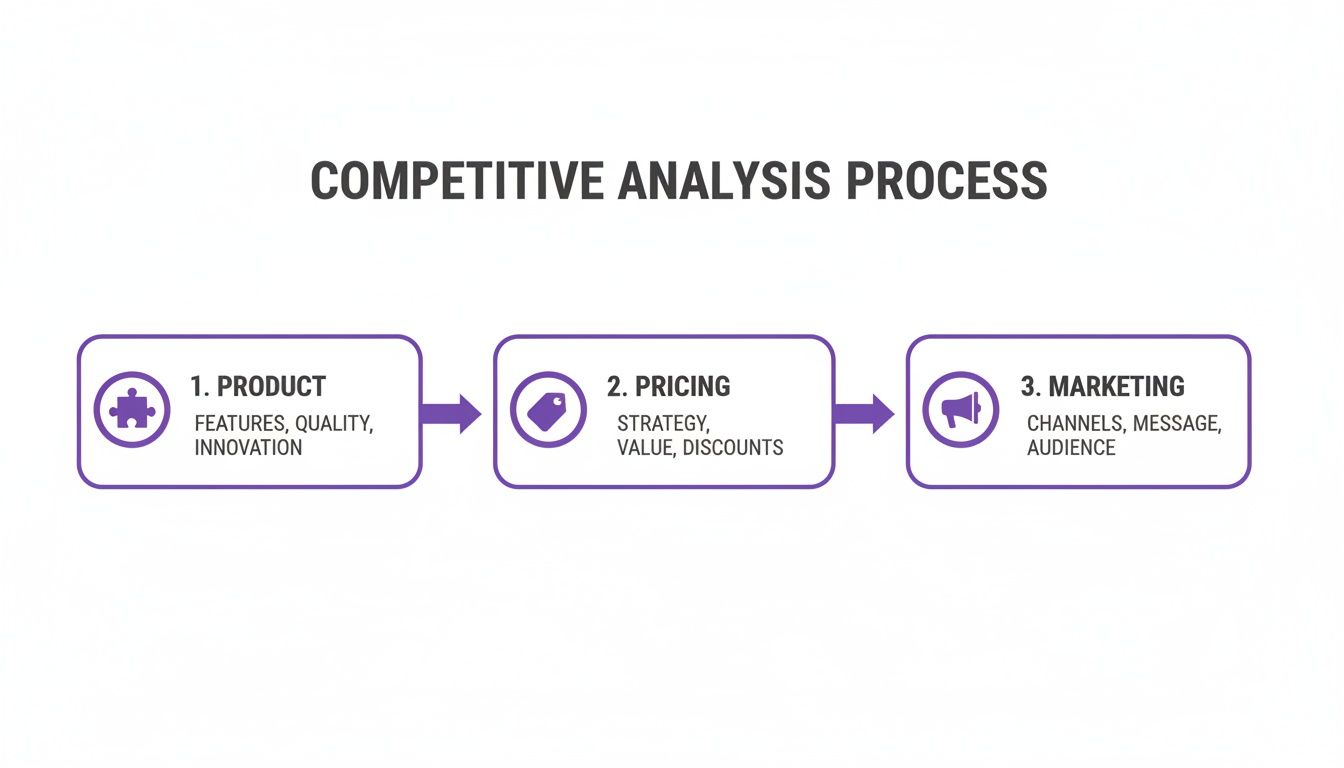

Their Product and Features

This is ground zero. What does their product actually do? Don't just take their marketing page at face value. Get your hands on it. Sign up for a free trial and click around like a real user. Your mission is to understand their core value from the inside out.

A simple feature grid is your best friend here. Seriously, just open a spreadsheet. List your competitors across the top and the features that matter down the first column. Then, fill in the blanks.

- Core Features: What are the non-negotiables? The things a customer just expects.

- Differentiators: What’s their "killer feature"? And what's yours that they don't have?

- "Table Stakes" Gaps: Are they missing something so basic it’s almost funny? That's a weakness.

This isn’t about building a clone. It's about spotting obvious gaps and seeing where they've placed their bets.

> A feature grid isn't just a checklist. It's a map of the market's priorities. If every single competitor has a specific feature and you don't, you'd better have a very good reason why.

Their Pricing and Packaging

Pricing is never just a number—it’s a story. How a competitor packages their plans tells you exactly who they think their customer is and what they value.

Are they chasing scrappy startups with a generous free plan? Or are they going after enterprise whales with that classic "Contact Us" button?

Look for these clues:

- Pricing Model: Is it a simple subscription, a one-time fee, or something complicated like usage-based pricing?

- Target Customer: Look at the language. Are their plans called "Solopreneur," or "Business" and "Enterprise"?

- Value Metric: This is the big one. What are they actually charging for? Is it per user, per project, or per GB of storage? This reveals what they believe is most valuable.

When you dig into their pricing, you start to see the underserved parts of the market. If everyone is fighting for enterprise clients, maybe the real opportunity is with mid-market companies that everyone else is ignoring.

To keep it all straight, it helps to break down your intel gathering into four key areas. Think of it as your spy-craft cheat sheet.

The Four Pillars of Competitor Intel

Here’s a quick-and-dirty guide on what data to grab, the core question you’re trying to answer, and a few tools that can help without breaking the bank.

| Pillar | Key Data Points to Collect | Core Question to Answer | Helpful Tools | | :--- | :--- | :--- | :--- | | Product | Feature list, user onboarding flow, integrations | What problem are they really solving for the user? | Their own website, review sites (G2, Capterra) | | Pricing | Pricing tiers, billing model, value metric, free trial | Who is their ideal customer, and what do they value? | Their pricing page, archived versions on Wayback Machine | | Marketing | SEO keywords, ad copy, top traffic sources, social channels | Where are they finding their customers? | Ahrefs/Semrush (pricey), Already.dev | | Messaging | Website headlines, tagline, customer testimonials | What specific pain point are they promising to fix? | Their homepage, case studies, customer reviews |

This simple framework ensures you're gathering genuine intelligence you can act on, not just collecting data for fun.

Their Marketing Channels

Next up: where are their customers actually coming from? It's a waste of time and money to pour your budget into LinkedIn ads if you find out all your competitors are crushing it with SEO. You need to become a traffic detective.

While the big-gun tools like Ahrefs or Semrush are fantastic, they can be expensive. For a more focused and budget-friendly look, a platform like Already.dev can uncover these channels for you without the four-figure monthly bill.

Your goal is to answer one simple question: If I were a customer looking for their solution, where would I find them?

Look for patterns in their:

- Organic Search (SEO): What keywords do they show up for on Google? Do they have a blog, and is it actually driving traffic?

- Paid Ads (PPC): Are they running Google Ads? Facebook ads? What's the hook in their ad copy?

- Social Media Presence: Which platforms are they actually active on? Don't be fooled by a dead profile with 3 posts from 2019.

Knowing this saves you from reinventing the wheel. If a competitor has already spent thousands figuring out their audience hangs out on TikTok, learn from their investment.

Their Customer Messaging

This is arguably the most important—and most often overlooked—piece of the puzzle. What story are they telling? The words on their homepage and in their ads are a direct window into the pain points they're trying to solve.

Read their website as if you were their ideal customer.

- What's the very first headline you see? Does it talk about a feature, or does it promise a better life?

- What words do they repeat constantly? "Easy," "fast," "secure," "collaborative"—these are all clues.

- Who are their case studies about? What specific results are they bragging about?

Dissecting their messaging helps you pinpoint their exact position in the market. More importantly, it helps you find a different story to tell—one that resonates with the customers they might be ignoring. When you're digging into this, leveraging the right resources is key. For a list of great platforms, check out the best competitive analysis tools for marketers to help you gather this kind of qualitative data.

Connecting the Dots to Find Your Winning Angle

Having a giant pile of competitor data is great, but it’s useless until you turn it into a real strategy. It’s like having all the ingredients for a cake but no recipe. This is where we stop collecting and start analyzing—turning raw facts into your winning angle.

This isn’t about making another pretty chart. It’s about finding a clear, data-backed battle cry. You’re looking for that "aha!" moment that sounds like, "They're all chasing enterprise clients, but we can dominate by serving small businesses with a simpler, cheaper tool."

To get there, we’re going to use two powerful (and surprisingly simple) techniques: Gap Analysis and Keyword Opportunity Analysis.

Finding the Gaps in Their Armor

First up is the Gap Analysis. This sounds fancy, but it’s really just asking, "What are they all missing?" You’ll take the feature grids, messaging docs, and pricing info you gathered and look for holes.

Think of yourself as a detective looking for clues everyone else missed.

Here are the kinds of gaps to hunt for:

- The Feature Gap: Is there a critical feature that customers are begging for, but none of your competitors offer? This is often a goldmine.

- The Pricing Gap: Are all your rivals locked into a high-end price war, leaving a massive opening for a more affordable option? Or maybe the opposite—everyone is cheap, but nobody offers a premium, white-glove service.

- The Audience Gap: Look closely at who they’re talking to. If every competitor’s website is plastered with corporate jargon, they’re probably ignoring freelancers and startups. That’s your opening.

This process transforms your messy spreadsheet into a treasure map, pointing you toward the underserved customers your rivals are completely ignoring.

Listening to What Customers Are Actually Searching For

Once you have a hunch about a potential gap, it's time to validate it with a Keyword Opportunity Analysis. This is how you confirm that real people are out there looking for the solution you're dreaming up. You need to figure out the exact words they're typing into Google.

This is where AI is having a massive impact. Companies using AI tools are seeing conversion rates jump by 25% and acquisition costs drop by 37% because they can get incredibly specific. A basic Google search can miss up to 80% of the threats, but specialized AI agents, like those in a tool like Already.dev, can crawl hundreds of sources to find what people really want. You can dig into more on how AI is changing the game in these insightful marketing statistics.

Powerful tools like Ahrefs or Semrush are the industry standards here, but let's be real, they can be terrifyingly expensive. A more integrated and affordable platform like Already.dev gives you this crucial keyword data without the scary price tag.

You’re looking for keywords that show two things:

- High Intent: These aren’t just informational searches like "what is project management." You want "buy-intent" keywords like "best project management tool for small agencies."

- Low Competition: The sweet spot is finding keywords that get a decent number of searches but aren't being targeted by every big player in the market.

This process flow chart visually breaks down how you can connect product, pricing, and marketing intelligence in your analysis.

As you can see, a successful analysis isn't just one thing; it's about synthesizing insights from multiple areas to form a complete picture.

> Connecting these dots is the most critical step. It's the bridge between a folder full of data and a strategy that actually wins.

By combining the "what they're missing" from your gap analysis with the "what customers want" from your keyword research, you build an unshakeable foundation for your strategy. You're no longer guessing. You're making calculated moves based on solid evidence, and that’s how you find your unique, defensible place in the market.

Turning Insights Into Action (Not Just a Pretty Chart)

Let's get one thing straight. A competitive marketing analysis that ends up as a PDF buried in Google Drive is a complete failure. All that hard work—the spying, the spreadsheets, the late-night data entry—is worthless if it doesn't lead to actual change.

This final step is all about escaping the "analysis graveyard." We're going to give you some practical, no-fluff advice on how to weave your findings directly into your product roadmap and marketing strategy. The goal is to make your analysis a living, breathing part of your company, not just a one-off project.

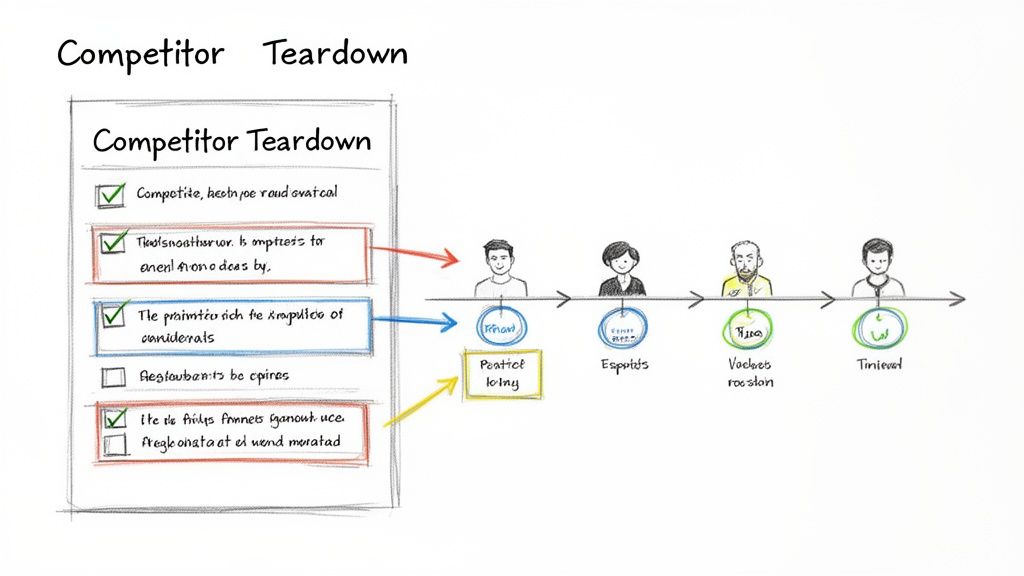

Create a 'Competitor Teardown' One-Pager

Nobody has time to read a 50-page report. Seriously. Your first job is to distill your most explosive findings into a simple, one-page document that even the busiest executive can digest in five minutes. Think of it as the movie trailer for your full analysis.

This "Competitor Teardown" should be brutally simple and visual. To make sure your hard work actually drives action, lean into the best practices in data visualization to make your points land with real impact.

Your one-pager should scream the answers to these questions:

- Who did we look at? List the 3-5 key competitors.

- What's their biggest strength? (e.g., "Crushing it on SEO for 'small business accounting.'")

- What's their dumbest weakness? (e.g., "Their onboarding is a nightmare, and customers hate it.")

- What's our single biggest opportunity? (e.g., "Nobody is targeting freelance creatives. We can own this market.")

This isn't the place for nuance. It's the place for action. Slap it on the wall, share it in Slack, and make it impossible to ignore.

Weave Insights Directly into Your Roadmap

Now that you have everyone's attention, it’s time to make your findings real. That beautiful Gap Analysis you created shouldn't just be an interesting observation—it should become a weapon for prioritizing what you build next.

Bring the feature gaps and audience gaps you found directly into your product planning sessions. When you do, frame the conversation around market opportunities, not just adding features.

> Instead of saying, "We need to build an integration with X," try this: "Competitor A is ignoring the entire marketing agency segment because their tool doesn't integrate with Google Data Studio. If we build that, we can start stealing their customers."

See the difference? One is a feature request; the other is a strategic market-grab backed by cold, hard evidence. This approach turns your product team from ticket-takers into business builders and connects their daily work directly to winning. That’s way more motivating.

Tweak Your Marketing to Hit Their Weak Spots

Your analysis is also a goldmine for your marketing team. You now know exactly what your competitors' customers are complaining about. Use this intel to sharpen your own copy and campaigns.

Did you discover their pricing is a confusing mess? Your new headline should be: “Finally, Simple Pricing You Can Actually Understand.”

Did you find out their customer support is notoriously slow? Your next ad campaign should feature testimonials praising your lightning-fast response times. It's not about being mean; it's about being smart. You're directly addressing the pain points that you know your rival is creating for their own customers.

This is how you turn a competitive analysis from a passive report into an active playbook for growth. You can start building this playbook right now by grabbing a free competitive landscape analysis template to organize your findings and get your team aligned.

The goal is to create a continuous loop. You analyze, you act, you measure, and then you analyze again. The market doesn't stand still, and neither should your understanding of it. By making this a regular, lightweight process, you stop reacting to your competitors and start making them react to you. That’s a much more fun game to play.

Your Competitive Analysis Questions, Answered

Got questions? We've got answers. Here are the most common things people ask when they're getting their hands dirty with competitive analysis. I'll keep it short and sweet so you can get back to building.

How Often Should I Do This?

Not just once. The old-school approach of doing a massive, once-a-year deep dive is dead. The market moves way too fast. A much better approach is a continuous, lightweight process.

Do a full-blown analysis when you're making a big move, like launching a new product. For everything else? A quarterly pulse check is perfect. This keeps you on top of new players and pricing shifts without burning out your team.

> Your competitive analysis shouldn't be a "project." It should be a habit. A quick, regular check-in is far more valuable than a massive, outdated report gathering digital dust.

How Many Competitors Should I Actually Track?

Please, don't try to boil the ocean. Tracking 50 competitors is a one-way ticket to analysis paralysis. You'll spend all your time gathering data and zero time actually doing anything with it.

A good rule of thumb is to lock in on a core group of 3 to 5 direct competitors. These are the companies you're constantly bumping into. Then, add another 2 to 3 indirect or aspirational competitors to keep an eye on broader trends. This gives you a manageable list that provides a clear picture without completely overwhelming you.

What's the Single Most Important Thing to Look For?

If you only have time for one thing, make it their customer messaging. Features can be copied and pricing can be matched, but how a company talks to its customers reveals its entire strategy.

Read their homepage. Dissect their ad copy. Comb through their customer reviews. Are they selling speed? Simplicity? A luxury experience? Understanding the story they tell is the fastest way to find their weaknesses and the market gaps they're leaving wide open for you.

What Tools Do I Really Need?

Honestly, you can get pretty far with a spreadsheet and some focus. But if you want to speed things up, a few tools are game-changers. Big platforms like Ahrefs or Semrush are incredibly powerful for deep SEO analysis, but they can be expensive.

For a more focused and affordable approach, you'll want tools that automate the tedious parts.

- Social Listening Tools: Great for tuning into what customers are saying.

- SEO Tools: Essential for seeing what keywords your rivals are ranking for.

- AI-Powered Platforms: An all-in-one solution like already.dev can automate the whole process—from finding competitors to analyzing their features and keywords. It literally saves you dozens of hours.

The right tool depends on your budget. Just remember, the tool doesn't do the thinking for you—it just makes the "doing" a heck of a lot faster.

Stop guessing and start winning. Already.dev automates the painful parts of competitive research, delivering a full market landscape report in minutes, not weeks. Get data-driven confidence to build your next move.