What Is Competitive Price Monitoring Software?

Stop guessing and start winning. Learn what competitive price monitoring software is, how it works, and if it's the secret weapon your business is missing.

Let’s be honest, trying to keep track of your competitors' pricing is a huge pain. It's a never-ending, mind-numbing task that feels like you're constantly playing catch-up. Competitive price monitoring software is your way out of that cycle. It’s an automated tool that spies on what your rivals are charging, so you don't have to waste hours doing it yourself.

Think of it as a smart alarm that goes off the second a competitor runs a surprise sale or quietly adjusts their pricing.

A Spy Drone for Your Pricing Strategy

Imagine trying to win a marathon while wearing a blindfold. You might be a great runner, but you have no clue if you’re about to hit a wall or if the person next to you just found an extra gear. Running a business without knowing what your competitors charge is exactly like that—a recipe for disaster.

This is where competitive price monitoring software comes into play. In simple terms, it’s like having a personal spy drone that constantly scans your rivals' websites, landing pages, and product listings, reporting back what it finds in real time. No more tedious manual searches. No more getting blindsided by a flash sale you only hear about a week later.

Let’s Use a Coffee Shop Analogy

Picture two coffee shops on the same street: "Your Awesome Brew" and "The Other Guys Coffee." If you were trying to keep tabs on their prices manually, it would be a nightmare. You’d have to send a friend in every single day to peek at their menu, scribble down the prices for a latte, a cappuccino, and a muffin, then run back and plug it all into a spreadsheet.

What happens if they change prices at noon? You'd miss it. What if they launch a two-hour "buy one, get one free" deal? You're completely in the dark.

Price monitoring software automates this entire clumsy process. It’s like having a tiny, invisible robot that sits in their shop 24/7, sending you instant alerts:

- Price Drop Alert: "The Other Guys just dropped their latte price by 50 cents!"

- New Product Alert: "They just added a 'Mega Muffin' for $3.99."

- Promotion Alert: "Heads up, they launched a 'Free Donut Friday' campaign."

This intel lets you react intelligently. You don’t have to get dragged into a race to the bottom, but now you have the hard data to decide if and how you should respond. Maybe you counter with a loyalty program instead of a price war. The key is, you’re making strategic decisions based on facts, not guesswork.

Manual Price Checks vs Automated Software

Here's a quick look at why using software beats doing it all by hand.

| Aspect | Manual 'Stalking' | Automated Software | | :--- | :--- | :--- | | Speed | Painfully slow. Takes hours or days. | Instant. Real-time data collection. | | Accuracy | Prone to human error (typos, missed details). | Highly accurate and consistent. | | Scale | Impossible to track more than a few competitors. | Easily monitors hundreds of rivals and thousands of products. | | Frequency | A snapshot in time, maybe weekly or monthly. | Continuous 24/7 monitoring. | | Insight | Just raw numbers. No trends or analysis. | Provides analytics, historical data, and alerts. | | Cost | "Free" but costs a ton in employee time. | Subscription-based, but delivers massive ROI. |

Simply put, the manual approach just can't keep up.

The Old Way vs The New Way

Not too long ago, getting this kind of market information was slow and expensive. You might have turned to big platforms like Ahrefs or Semrush, but these tools can be incredibly pricey and often overwhelm you with data you don't actually need. That old approach costs a lot of time and money.

The good news? Modern AI is flipping the script. The need for these automated solutions is exploding; the competitive intelligence software market has ballooned to a $2.6 billion valuation. Businesses are ditching outdated methods because they simply can't afford to leave money on the table.

Newer, AI-powered platforms are built for speed and clarity. A tool like Already.dev, for instance, skips the weeks of setup and delivers deep competitive insights in minutes. It’s a massive shift from slow, clunky software to fast, actionable intelligence. This gives founders and product managers the power to stay ahead without breaking the bank. If you want to dive deeper into this topic, you can explore the fundamentals of competitive intelligence in our guide.

The Core Features You Actually Need

Let's cut through the marketing noise. Not all competitive price monitoring software is created equal. Some tools are so bloated with features you'll never touch that they feel like a spaceship cockpit when all you need is a steering wheel. Others are too basic to give you a real edge.

The goal isn't to find the tool with the most buttons; it's to find the one with the right buttons. Forget the fluff. We're going to focus on the core capabilities that actually drive results—the non-negotiables that turn raw data into a strategic weapon.

The Engine Room: Automated Price Scraping

At its heart, any good price monitoring tool needs an engine. Automated price scraping is that engine. It’s the behind-the-scenes workhorse that automatically visits your competitors' websites and grabs their pricing information, so you don't have to.

Think about it. You could manually check a rival’s site every day, but what about the ten other competitors you haven't even found yet? A solid tool finds them and tirelessly collects data 24/7. This isn’t just about saving time; it's about achieving a scale of awareness that’s humanly impossible.

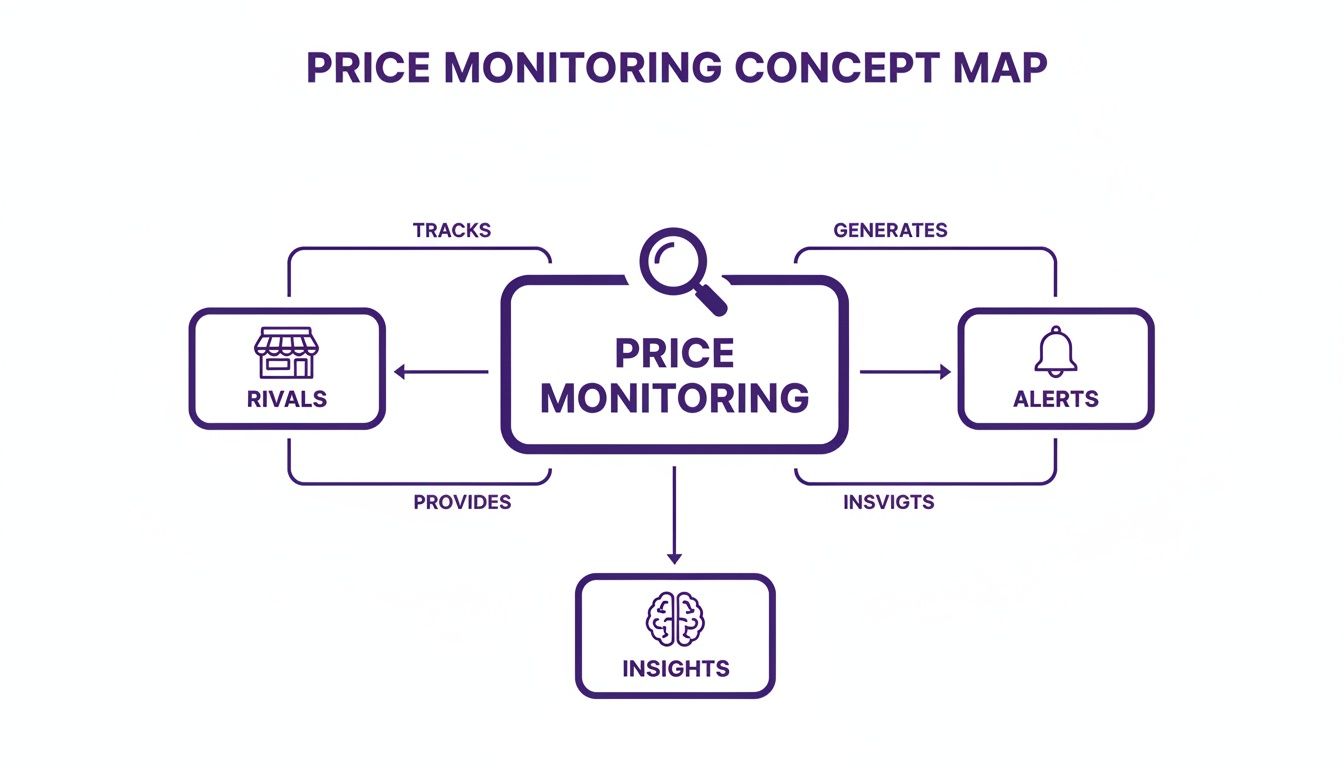

This map shows how it all connects—tracking rivals, getting alerts, and gaining insights.

It’s a simple loop, really. The software watches your rivals, tells you when something important changes, and gives you the intelligence to act on it.

The Translator: Data Normalization and Matching

Scraping data is step one. Making sense of it is the real challenge. Competitors don't make it easy for you—they might call their "Pro Plan" a "Business Tier" or bundle features in a totally different way. This is where data normalization comes in.

It’s the crucial process of cleaning up all that messy, inconsistent data and organizing it into a clean, apples-to-apples comparison. It makes sure you're comparing the same things, even if your competitors are calling them something else.

A huge part of this is product matching. The software has to be smart enough to recognize that "Nike Air Max 270 - Size 10" on one site is the exact same product as "Men's Air Max 270s (10)" on another. Without this, your reports are just a jumble of meaningless numbers.

The Alarm Bell: Real-Time Alerts

A pricing report that's a week old is about as useful as yesterday's lottery numbers. The market moves fast, and you need to know about important changes the moment they happen. Real-time alerts are your alarm bell.

You should be able to set up custom triggers that ping you about specific events, like:

- A key competitor drops their price below a certain threshold.

- A rival launches a new product or pricing tier.

- A competitor kicks off a major promotional campaign.

These alerts let you react quickly and strategically, turning a potential threat into an opportunity before it's too late.

The Brain: Pricing Analytics and Insights

Finally, the data has to tell a story. This is where pricing analytics comes in—it’s the brain of the whole operation. This isn't just about showing you a list of prices; it's about spotting the patterns and trends hidden within the data.

> Think of analytics as your pricing "weather forecast." It helps you see historical trends, understand your market position, and even predict what your competitors might do next.

This is where many tools fall short. Big, all-in-one SEO platforms like Ahrefs or Semrush can give you some high-level market data, but they are often incredibly expensive and just not built for deep pricing analysis. You end up paying a premium for a mountain of features you don't even need.

A focused platform like Already.dev provides the specific, actionable competitor pricing data you need without the bloated price tag. It uses AI to give you clear, visual comparisons so you can spend less time digging through spreadsheets and more time making smart decisions.

How Founders and PMs Turn Pricing Data into Wins

So, you have a pile of competitor pricing data from your new monitoring tool. What now? Raw data is just noise until you use it to make smarter business decisions. This is where the real value lies—turning those numbers into a winning strategy.

This isn't just about peeking at what your rivals charge. It’s about using hard data to answer those big, intimidating questions that keep you up at night, whether you're a founder starting from scratch or a product manager steering a well-known product.

For Founders Trying to Get it Right From Day One

Let's say you're a founder launching a new project management app. Your biggest fear isn't building a great product; it's pricing it wrong and going bust in six months. Competitive intelligence is your secret weapon here.

Instead of throwing a dart at a board, you can use a pricing report to see the entire market landscape at a glance. You might spot a huge opportunity: the market is flooded with cheap, basic tools and a couple of super-expensive enterprise platforms, but there’s nothing in between. That's your opening—a powerful, mid-tier solution for growing teams.

> A simple pricing report can be the difference between a brilliant market entry and a costly false start. It gives you the confidence to launch with a price that’s not a guess, but a strategic move backed by solid evidence.

Now you can walk into a pitch and say, "Our Basic plan is 10% cheaper than Competitor X, but we give you double the features. And our Pro plan serves the power users everyone else is ignoring." That’s a story that wins your first customers.

For Product Managers Defending Their Next Big Feature

Okay, now picture yourself as a product manager (PM) at a bigger SaaS company. You’ve just poured your heart into a new AI feature and want to sell it as a premium add-on. But the finance team is raising eyebrows, and sales is worried customers will balk at the price.

This is where competitive pricing data becomes your best friend in the boardroom. You can pull a report showing exactly how your top three competitors are packaging and pricing their advanced features.

- Competitor A: Sells basic automation for an extra $20/user/month.

- Competitor B: Locks their AI tools away in an expensive "Enterprise Only" tier.

- Competitor C: Hasn't even built anything like it yet.

Armed with this, your argument is suddenly bulletproof. You can confidently state, "Our new AI is lightyears ahead of Competitor A's, and we can offer it for just $15/user/month. We'll undercut them while opening a brand-new, high-margin revenue stream." Just like that, you’ve used data to justify your roadmap and get everyone on board.

Turning Raw Numbers into a Compelling Story

Different roles need different insights from the same data. It’s all about asking the right questions to get the answers that drive your business forward.

Pricing Insights for Different Roles

| Role | Key Question | Actionable Insight | | :--- | :--- | :--- | | Founder | "Where is the untapped pricing opportunity in my market?" | Identify underserved segments and price gaps to define the initial go-to-market strategy. | | Product Manager | "How can I price a new feature to maximize adoption and revenue?" | Benchmark against competitor feature bundles to create a compelling, data-backed pricing tier. | | Investor | "Does this startup have a defensible pricing model?" | Analyze the competitive landscape to assess market positioning and long-term profitability. | | Sales Leader | "How can my team effectively counter pricing objections?" | Equip reps with battle cards showing how your product offers more value for the price than rivals. |

Ultimately, it’s about using data to tell a convincing story. Whether that story is for an investor, your executive team, or a new customer, it has to be grounded in reality. Detailed analytics, like Amazon price history data, can reveal market trends that give you an undeniable edge.

Competitive pricing data gives you the plot, the characters, and the proof that your strategy is the one that’s going to win.

Finding the Right Tool Without Breaking the Bank

Alright, let's talk about the fun part—shopping for software. It can feel like walking through a minefield of confusing jargon, pushy salespeople, and hidden fees that jump out at you later. Choosing the right competitive price monitoring software shouldn't require a finance degree or a leap of faith.

This is your simple, no-nonsense buyer's guide. We're skipping the marketing fluff and focusing on what actually matters when you're trying to find a tool that fits your budget and doesn't waste your time. It’s about helping you make a smart call, not helping a salesperson hit their quota.

The Big Questions to Ask Before You Buy

Before you even glance at a pricing page, you need a checklist. Don't get distracted by shiny features you'll never use. Ask these questions to cut right to the chase and find a tool that actually works for you.

- How accurate is the data? Garbage in, garbage out. If the tool can't reliably pull the right prices, nothing else matters. Ask how they ensure accuracy and how often data is refreshed.

- How fast can I get insights? In a fast-moving market, waiting a week for a report is a lifetime. You need to know if you can get insights in minutes or if you're signing up for a lengthy setup process.

- Is it actually easy to use? Some tools look powerful but require a PhD to operate. If your team can't figure it out in the first 15 minutes, they will never adopt it. Look for a clean, intuitive interface.

- What kind of support is available? When something goes wrong (and it will), can you talk to a human, or are you stuck with a chatbot that just says, "Have you tried turning it off and on again?"

Pricing Models That Don't Suck

Software pricing can be a wild ride. You'll see everything from eye-watering annual contracts to more flexible options. Let's break down the two most common models.

> The old guard of enterprise software loves to lock you into a massive annual contract. You pay a fortune upfront, whether you use the tool every day or just once a quarter. This model is great for their revenue forecast but terrible for a startup's cash flow.

Tools like Ahrefs or Semrush are famous for this—they're powerful but can be really expensive, bundling in tons of features you might not need. The newer, smarter approach is a flexible, credit-based system. This model lets you pay for what you actually use, which is a game-changer for founders and PMs.

You can spin up a deep-dive report when you need it without committing to a hefty subscription. This is exactly how Already.dev works. It offers a much faster and more affordable entry point for teams who need high-quality data now but aren't ready to sign a five-figure check. You can get started and uncover the market landscape in minutes. If you are looking for more options, you can explore some of the best competitor analysis tools in our detailed guide.

Getting Started in Under Five Minutes

Theory is great, but let's be honest—the term "competitive research" probably conjures up images of massive spreadsheets, late nights, and a whole lot of caffeine. What if you could get the same deep insights in less time than it takes to make a cup of coffee?

Let's walk through how ridiculously fast you can map out your entire competitive landscape using a modern AI platform. No need for complex search queries, coding skills, or bugging that one tech-savvy friend for a favor. We'll use Already.dev as our example to show you how this works in the real world.

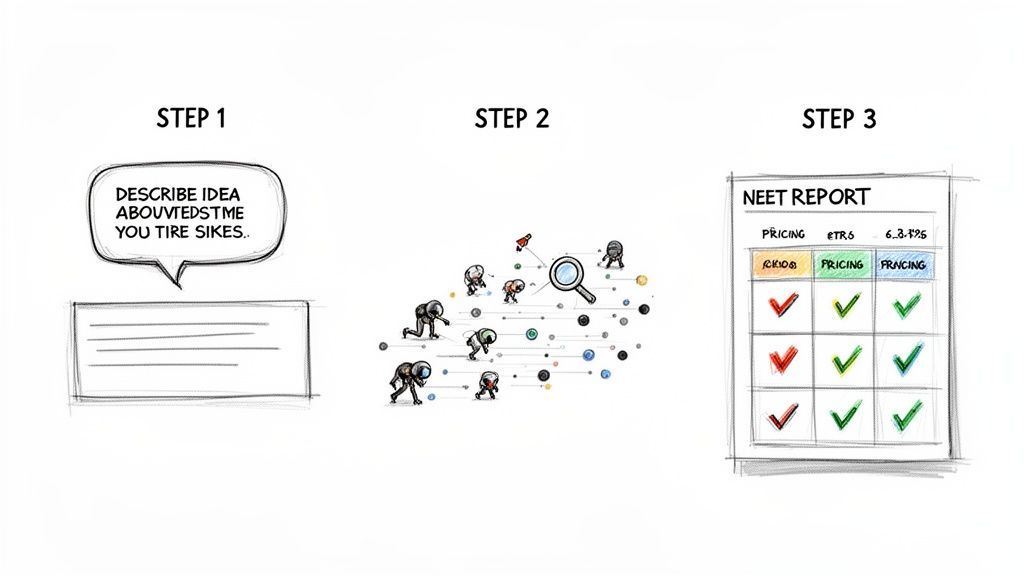

Step 1: Describe Your Idea in Plain English

First things first, forget the jargon. Just describe what you're building like you’re explaining it to a friend over lunch. You don't have to spend hours hunting for the perfect keywords or crafting complicated Boolean searches.

Let's imagine a founder named Priya. She has a killer idea for a project management tool built specifically for small, remote marketing teams. She’s personally fed up with clunky, enterprise-grade software that costs a fortune and is overkill for her needs.

Instead of dedicating a week to mind-numbing Google searches, Priya just types her idea straight into the platform:

> "I'm building a simple project management tool for remote marketing agencies with 5-20 people. It needs to have kanban boards, time tracking, and easy client reporting. The key is that it's super intuitive and affordable."

That’s literally it. The entire setup. No complex configuration or drawn-out onboarding process.

Step 2: Let the AI Agents Do the Heavy Lifting

The second Priya hits "go," a team of AI agents gets to work. These aren't just basic web scrapers pulling the top results from Google. They're designed to think like a seasoned market researcher, digging through hundreds of sources all at once.

They comb through everything:

- Startup Directories: Searching sites like Product Hunt and BetaList to find both new and established players.

- Review Sites: Analyzing platforms like G2 and Capterra to see what actual users are saying.

- Niche Communities: Scouring Reddit threads and niche industry forums for those candid, unfiltered conversations.

- App Stores: Looking for any mobile-first competitors she might have otherwise missed.

This kind of deep dive would easily take a human researcher 40+ hours of tedious, repetitive work. The AI agents get it done in about four minutes flat. They uncover every direct and indirect competitor—even the failed startups that offer priceless lessons on what not to do.

Step 3: Get Your Report and Find Your Opening

Before her coffee has even had a chance to cool, Priya gets her report. It’s not some dense, 50-page PDF you’ll never read. It’s a clean, visual grid that lays out every competitor's pricing tiers and core features, side-by-side.

This is what that competitive pricing and feature grid actually looks like inside the platform.

This visual approach makes it incredibly easy to spot market gaps and pricing opportunities with just a quick scan.

Right away, Priya notices a pattern. The cheap tools are missing client reporting features, while the tools that do have good reporting start at a steep $50/user/month—way out of budget for her target customers. And just like that, she’s found her opening. She can now confidently price her product at $25/user/month, offering a must-have feature the budget tools lack at a price the expensive ones can't touch.

This is how abstract AI concepts become a real, tangible business advantage. While traditional competitive price monitoring software often focuses on tracking historical data, this AI-first approach helps you nail your market position from day one. Of course, tracking price histories over 12-24 months is still vital for long-term strategy, but getting the initial landscape right is half the battle. You can even see how end-users rate these features on SoftwareReviews to get a feel for what matters most.

Common Questions People Ask

Alright, let's get into the questions I hear all the time about competitive price monitoring. No corporate speak, just straight-up answers to help you sort this out.

Is This Whole Price Spying Thing Even Legal?

Yes, absolutely. Let's knock this one out first.

Monitoring publicly available information—like the prices your competitor has right there on their website for the whole world to see—is 100% legal. It’s just good old-fashioned market research, but supercharged with technology.

Think of it this way: you could pay an intern to walk into your competitor's store every day and jot down prices. All this software does is automate that tedious job. The only time you'd cross a line is if you were trying to hack into their private servers or steal internal financial reports, which is obviously not what these tools are for. They're researchers, not digital cat burglars.

How Often Should I Check Their Prices?

This is a classic "it depends" scenario, but I'll give you a better answer than that. The right frequency really comes down to your industry and how fast things move.

- Fast-Paced E-commerce: Selling electronics or other hot products? Prices can swing multiple times a day. Daily, or even hourly, monitoring is pretty much table stakes if you want to compete.

- SaaS and B2B: If you're running a software company, pricing changes are more of a big deal. They don't happen every Tuesday. Checking in weekly or monthly is usually plenty to keep a pulse on the market without drowning in data.

The beauty of modern tools is flexibility. A platform like Already.dev is perfect for getting a full snapshot of the entire market exactly when you need it—say, right before a big product launch or a quarterly planning session. You get that deep-dive intelligence without paying for constant monitoring you might not even need.

Can This Software Just Change My Prices for Me?

Some of the really high-end (and incredibly expensive) enterprise platforms offer something called "dynamic repricing." This feature automatically adjusts your prices based on a complex set of rules you create. It’s kind of like setting a thermostat for your revenue.

Frankly, for most startups, founders, and SaaS businesses, this is complete overkill. It can also be really risky if it's not managed perfectly. The real power isn't in letting a robot run your business; it's using the data to make smarter, more informed decisions yourself. You want insights that guide your strategy, not a system that takes the wheel and drives you off a cliff.

> The goal is to gain a strategic advantage, not to outsource your decision-making to an algorithm. Use the data to empower your own judgment, not replace it.

Won't This Just Start a Race to the Bottom?

This is the number one fear I hear, and honestly, it’s a total myth. The point of smart competitive price monitoring software isn't to blindly slash your prices until you're practically giving your product away. It’s about understanding your true position in the market.

Think about it:

- You might find out you’re actually underpriced for the value you deliver. The data would give you the confidence to raise your prices.

- You could discover that rivals are charging extra for features you include as standard. That becomes a killer marketing message that highlights your superior value.

This isn’t about being the cheapest. It's about being the smartest. It’s about justifying your price—whether it's high or low—with solid, undeniable market data. It’s about pricing with confidence.

What Is the Difference Between Price Monitoring and Price Scraping?

Great question. They sound similar, but they're not the same thing. Think of it like cooking a meal.

Price scraping is just one ingredient. It’s the technical act of automatically pulling raw price data from a website. It’s the digital version of just yanking all the groceries off the shelf.

Price monitoring, on the other hand, is the whole recipe. It includes the scraping part, sure, but it also involves cleaning up that data, organizing it, analyzing it for trends, and sending you alerts when something important happens. It turns raw numbers into a finished, actionable meal. You need both, but monitoring is the complete solution.

How Do I Know If the Data Is Accurate?

Data accuracy is everything. Bad data leads to bad decisions, period. When you're looking at different tools, you have to ask how they make sure their data is the real deal.

Most reputable tools use a mix of methods, like cross-referencing multiple data points and using smart algorithms to spot weird inconsistencies. For example, if a price suddenly plummets by 99%, a good system will flag that as a likely error, not a fire sale.

Some platforms, particularly massive enterprise tools like Ahrefs, aggregate enormous amounts of data, which can sometimes be slow to update. This can be a pricey option. A more focused, AI-driven tool like Already.dev is built to deliver a highly accurate, real-time snapshot of the market, making sure the insights you get are fresh and reliable. Always ask a potential provider about their data validation process before you commit to anything.

Ready to stop guessing and start knowing? The biggest competitive blind spots often hide in plain sight on your rivals' pricing pages. Already.dev uses AI to uncover the entire competitive landscape in minutes, giving you the clarity and confidence to price your product perfectly from day one.