Your Guide to Competitor Pricing Data

Stop guessing. This guide shows you how to legally get and use competitor pricing data to set smarter prices, boost sales, and outsmart the market.

Think of competitor pricing data as your industry's cheat sheet. It's the inside scoop on what everyone else is charging, revealing whether your prices are way off, right on the money, or somewhere in between. Flying blind without this info is a fancy way of guessing, and guessing is a terrible business strategy.

Why Competitor Pricing Is Your Secret Weapon

Let's be honest, setting prices without looking at the competition is a recipe for disaster. It's like wandering through a new city without a map—you might get somewhere eventually, but you're bound to make some costly wrong turns. Ignoring what your rivals are doing is the fastest way to leave money on the table or, worse, price yourself completely out of the game.

This data is your strategic map. It shows you the entire landscape, pointing out where the opportunities are and where the landmines are buried. It's the key to making smart, calculated decisions instead of just trusting your gut.

Find Your Place in the Market

Are you aiming to be the premium, top-shelf option? The go-to for budget-conscious buyers? Or are you carving out a space in the middle? You can't really answer these questions until you see what others are charging. Competitor pricing data gives you that immediate context, showing you exactly how you stack up.

This is all about defining your market position. For instance, if you discover a key competitor is consistently charging 30% more for a nearly identical offering, that’s a pretty strong signal. It could mean you have significant room to raise your own prices without alienating your customer base.

Dodge Disastrous Price Wars

One of the worst mistakes I've seen businesses make is getting sucked into a race to the bottom. It starts with a simple price cut to undercut a competitor, but it rarely ends well. This strategy demolishes your profit margins, cheapens your brand, and trains your customers to wait for the next sale. It's a lose-lose situation.

> Having solid competitor data lets you play chess, not checkers. Instead of a knee-jerk reaction to a price drop, you can take a step back and analyze. Is it a flash sale? Are they just trying to offload old stock? Understanding the why behind their move helps you respond strategically, not emotionally.

Uncover Hidden Opportunities

Keeping tabs on your rivals isn't just about damage control; it's about spotting openings they've missed. When you track pricing strategies over time, you start to see patterns and, more importantly, gaps in the market.

Maybe you'll notice that none of your competitors offer a mid-tier package. That's a golden opportunity for you to step in and serve a whole segment of the market they're ignoring.

Or maybe you see everyone stuck on a rigid, flat-rate model. This could be your cue to introduce a more flexible, usage-based plan that attracts a completely different kind of customer. While powerful (and expensive) tools like Ahrefs or Semrush can offer broad insights, a dedicated, affordable tool like Already.dev can automate this specific research, giving you the data without the heavy lifting.

Alright, so you're ready to start spying on your competitors' pricing. Good. But how do you actually get that intel without drowning in a sea of spreadsheets? Let's get into the nitty-gritty of how you can gather this data.

Honestly, there are a few ways to go about it. They range from the "I've got more time than money" approach to the "let the robots handle it" strategy. Which one you pick really boils down to your budget, your timeline, and frankly, how much you value your sanity.

The Old-Fashioned Way: Manual Data Digging

The most basic method is exactly what it sounds like: you roll up your sleeves and do it yourself. This means heading over to your competitors' websites, one by one, and manually copying their prices into a spreadsheet. Think of it as the digital equivalent of putting on a trench coat and taking notes in their store.

The upside? It costs nothing but your time. The major downside? It's incredibly tedious, and it's super easy to make mistakes. If your competitors are constantly tweaking their prices, this quickly becomes a full-time job you never wanted.

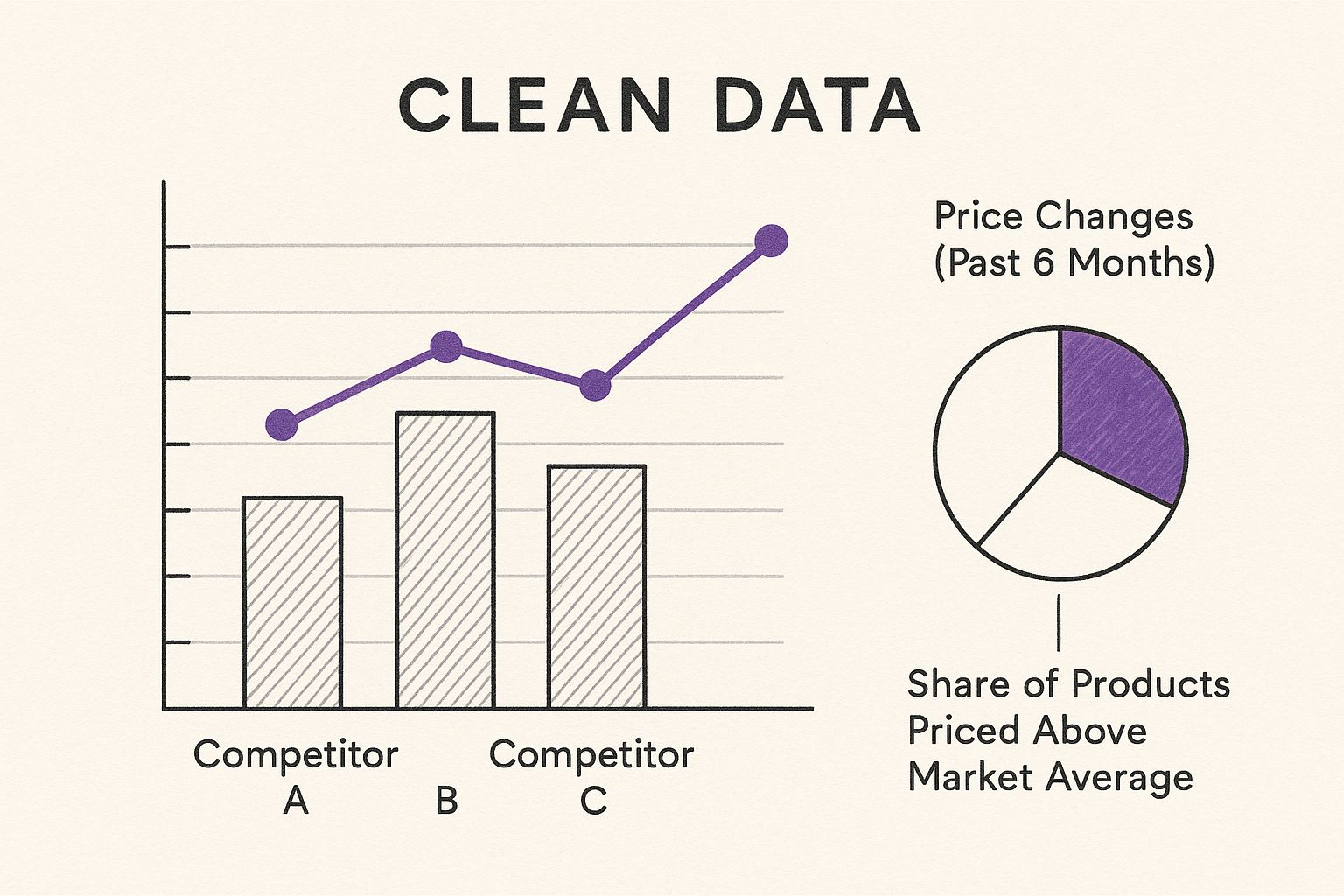

Once you have the data, visualizing it is where the magic happens. A simple chart can show you who the premium player is, who’s the budget option, and who changes prices with the seasons.

See? This kind of visual instantly tells a story—one competitor is always pricey, while another seems to be running sales or promotions constantly.

Buying the Big, Expensive Toolkits

Another option is to lean on one of the big all-in-one marketing platforms. I’m talking about tools like Ahrefs or Semrush. They're powerful, no doubt, but they also come with a hefty price tag that can be a tough pill to swallow for smaller companies.

While they're great for SEO and content marketing, tracking competitor pricing isn't really their main thing.

> You might find some useful nuggets of information, but it’s like paying for a five-star hotel buffet when all you really wanted was a cup of coffee. It’s often overkill if your only goal is to track prices.

If you’re already paying for one of these suites for other marketing tasks, then sure, see what you can get out of it. But sinking that kind of budget just for pricing intel isn't the smartest move. There are much more focused and affordable tools out there. For instance, Already.dev focuses specifically on this problem without the bloat.

The Smart Way: Automation with AI

This brings us to the automated approach, which for most people, is the sweet spot. Instead of doing the grunt work yourself, you use specialized tools or AI agents designed specifically for this task. You tell an AI agent which websites to watch and what data to grab, and it does all the crawling and collecting for you.

This is where things get really efficient. It’s the perfect blend of cost, accuracy, and time-savings.

Here's why this is such a game-changer:

- You get your time back. What takes hours of manual clicking can be done in minutes.

- The data is always current. You can set up agents to run daily or even hourly, so you’re never working with old info.

- It grows with you. Monitoring five competitors is just as simple as monitoring fifty.

Platforms like already.dev are built for exactly this. They give you a sharp, focused solution without the bloat and scary price tag of the giant marketing suites. If you're looking to explore more options, our guide on the best competitor analysis tools is a great place to start. This way, you get the critical intel you need and can get back to what you do best: running your business.

Data Gathering Methods Compared

Choosing how to get your hands on competitor pricing data can feel overwhelming. To make it a bit clearer, here’s a quick breakdown of the three main methods, so you can see at a glance which one might be the best fit for you.

| Method | Pros | Cons | Best For |

| :--- | :--- | :--- | :--- |

| Manual Data Entry | - Completely free (money-wise)

- Total control over data points | - Extremely time-consuming

- Prone to human error

- Impossible to scale | - Startups with zero budget

- One-off projects with very few competitors |

| All-in-One Toolkits | - Part of a larger marketing suite

- Can offer broad market insights | - Very expensive

- Pricing data is often a secondary feature

- Overkill for just price tracking | - Businesses already subscribed for SEO/content

- Teams needing a wide range of marketing data |

| AI Agents | - Fast, accurate, and automated

- Scalable and cost-effective

- Data is always up-to-date | - Requires a modest budget

- Initial setup of agents | - Most businesses (from startups to enterprise)

- Anyone who needs regular, reliable pricing intel |

Ultimately, while the manual approach has its place for a quick look, an automated, AI-driven method is going to give you the consistent, accurate data you need to make genuinely smart pricing decisions without burning out your team.

Let AI Do the Tedious Work for You

Let's be real. Manually checking five competitor websites every morning might sound manageable at first. But what happens when you’re tracking ten products across ten competitors? All of a sudden, that “quick check” has ballooned into a soul-crushing, full-time job. You'll go cross-eyed staring at spreadsheets.

This is exactly where automation becomes your secret weapon. Instead of burning hours on mind-numbing copy-pasting, you can hand off the grunt work to an AI agent. Think of it as hiring a super-fast intern who never sleeps, never complains, and works 24/7.

Tools like already.dev were built for this specific headache. You can deploy an AI agent to automatically visit your competitors' sites, pull the exact pricing information you need, and drop it all into a clean, organized spreadsheet. It’s the difference between digging a trench with a spoon and bringing in an excavator.

How It Works in Practice

So, what does this actually look like?

Imagine you run an online shop selling high-end coffee beans. You’ve got your eye on five key competitors who are constantly tweaking their prices. Your goal is to track the daily price of their "Signature Espresso Blend."

Instead of the old-school manual slog, you can:

- Set up an AI agent using a platform like already.dev.

- Feed it the URLs of the five product pages you want to watch.

- Tell it exactly what to grab—in this case, the price.

- Schedule it to run every morning at 8 AM sharp.

While you're sipping your first coffee of the day, the agent is already hopping between sites, snagging the latest prices, and updating your central spreadsheet. You get an email with the fresh data, ready for you to analyze. No manual labor required.

> The real game-changer here is scalability. Once you have it running for one product, adding ten more is trivial. This kind of automated competitor pricing data collection used to be something only massive corporations could afford. Not anymore.

Why This Isn't Just for the Big Players Anymore

Using AI for pricing isn't some far-off concept; it’s happening right now. Companies are automating price changes and analyzing demand in real-time, moving at a speed that manual methods could never touch. If you want a peek into the future, you can check out these 2025 pricing predictions from industry pros.

Sure, the big SEO platforms like Semrush or Ahrefs are powerful, but they can be incredibly expensive and overkill for this task. Specialized AI automation tools like already.dev are much more accessible. They’re leveling the playing field, giving small and medium-sized businesses access to powerful competitor pricing data that was previously out of reach.

If you're curious about how this fits into your bigger strategy, our guide on AI-powered market research walks through the whole process.

Ultimately, this shift lets you trade mind-numbing data entry for what really matters: making smart, data-backed decisions that actually move the needle for your business.

So, You’ve Got the Data. What’s Next?

Alright, you did it. You’ve wrangled a mountain of competitor pricing data, and it’s all sitting there in a spreadsheet that’s equal parts beautiful and terrifying. Now what? Because let’s be honest, gathering the data is just the ticket to the game—turning it into actual money is how you win.

Don't sweat it. You don't need a Ph.D. in data science to pull this off. We’re aiming for simple, practical analysis that gives you real-world insights, not a migraine. The whole point is to translate those raw numbers into smart business moves that either win you more customers or seriously boost your profit margins.

Sizing Up the Competition

First things first: let's get a feel for the room. A quick look at your data will immediately show you where you stand in the market. You can pretty easily sort your rivals into a few distinct buckets.

- The Premium Players: These are the brands consistently charging a premium. Are they just coasting on a strong brand name, or are they genuinely offering better features or killer customer service?

- The Budget Brawlers: These are the folks in a race to the bottom. Their whole strategy is built on being the cheapest, which is a tough—and often bloody—game to play.

- The Copycats: You'll spot these competitors shadowing your every price move. It's a dead giveaway that they're watching you just as closely as you're watching them.

Let's imagine you run an online store for specialty coffee beans called "Bean Scene." Your data shows that "Grindhouse Coffee" consistently prices their beans about 20% higher than you, while "Budget Brews" is always 15% cheaper. Boom. Right there is your starting point. You're holding the middle ground, which gives you a ton of strategic flexibility.

Spotting Trends and Making Your Move

This data you've collected isn't just a static picture; it's a story unfolding over time. Start looking for the patterns. Does one competitor always launch a flash sale on the first Friday of the month? Does another slash prices on certain items every weekend to move old inventory?

> This is where the real gold is. Knowing your competitor's playbook before they even run the play gives you an incredible advantage. If you know "Budget Brews" is about to discount their Ethiopian Yirgacheffe beans this weekend, you could preempt them with a promotion on your own single-origin beans and steal their thunder.

Understanding these pricing rhythms helps you decide when to stand your ground and when to make a change. For example, maybe you notice that "Grindhouse Coffee" never puts its premium Geisha beans on sale. That tells you they’ve built a strong brand perception around that product, which might mean you can also protect the price of your own top-tier products without worrying about losing customers to them.

If you want to go deeper, exploring different methods for market research data analysis can give you a more structured way to uncover these kinds of insights.

This is how raw data becomes a strategic weapon. You can finally make decisions based on solid information—not just gut feelings—about how to price your products to grab more market share or simply make more money.

Building a Killer Pricing Strategy

Alright, so you've got a pile of competitor pricing data. Awesome. Now for the fun part: actually putting it to work for you. Let’s get one thing straight—a smart pricing strategy isn’t about finding the lowest number out there and racing to the bottom. That's a surefire way to start a price war, and trust me, nobody wins those, especially not your profit margins.

The real magic happens when you start connecting the dots. Your pricing needs to be a reflection of your entire business, not just a knee-jerk reaction to what the other guys are doing. Think of this data as your benchmark, a reality check—not a rigid set of rules you have to follow.

More Than Just a Price Tag

Take a step back and think about why a customer chooses you. Is it your lightning-fast shipping? Your customer support team that sounds like actual, helpful humans? Maybe your product has one killer feature that nobody else has even thought of yet. These are your secret weapons, and they have real, tangible value.

This is where your competitor data becomes so powerful. It gives you the context you need to play to your strengths. If your main rival is 10% cheaper but takes a week to ship and their customer service is a black hole, you've got a massive advantage. You can hold your higher price with confidence because you're not just selling a product; you're selling a far better experience.

> This data gives you the confidence to make bold decisions. It’s the proof you need to say, "Yes, we charge more, and here’s exactly why it’s worth every penny."

Weaving Data into Your Strategy

So, how does this look in the real world? Let's say you sell premium, handmade leather wallets. Your data, maybe pulled using an AI agent from a tool like already.dev, shows your biggest competitor sells a similar-looking wallet for $20 less. Time to panic? Not a chance.

This is where you bring in your unique selling points to paint the full picture:

- Superior Materials: You use ethically sourced, full-grain leather. Theirs is a lower-grade material.

- Lifetime Warranty: You stand by your craftsmanship forever. They cap out at a 30-day return policy.

- Stellar Reviews: Your customers can't stop talking about the quality and durability.

Suddenly, that $20 price difference makes perfect sense. Your marketing can now highlight these exact points, framing your competitor's lower price as a red flag for lower quality. It's a powerful shift. When you blend pricing intel with what you know about your customers, the results speak for themselves. In fact, one retailer saw a 4% sales increase in just six months by fine-tuning their strategy this way. You can actually explore the findings on consumer thinking here to see how they did it.

At the end of the day, this data gives you confidence. It allows you to deliberately choose your spot in the market—whether you want to be the affordable go-to or the undisputed premium leader.

Got Questions About Snooping on Competitor Prices?

Jumping into competitor pricing analysis can bring up a few… sticky questions. I get it. Let's tackle the big ones I hear all the time, no sugar-coating involved.

Isn't This a Bit… Shady?

It’s a fair question, and one I hear a lot. Let’s be crystal clear: looking at publicly available information is standard practice. Think of it as market research, not corporate espionage. The prices your competitors display on their websites are out there for the whole world to see. You're just paying attention.

The line gets crossed when companies use this intel to coordinate and set prices together. That’s called price-fixing, and it’s illegal. Big difference.

> Your goal is to be informed, not to collude. You’re using competitor pricing data to understand the market, not to rig it. It’s the difference between doing your homework before a test and cheating off the person next to you.

How Often Should I Actually Check Competitor Prices?

Honestly, it depends entirely on your market. If you’re in a fast-paced world like e-commerce, things can shift daily, sometimes even hourly. In that kind of environment, you need frequent, automated checks. Relying on last week’s data is like using an old weather forecast—you’re going to get soaked.

But for other sectors, say a B2B SaaS company, a weekly or even monthly check-in might be perfectly fine. The real trick is to find a cadence that matches your industry’s pulse. The last thing you want is to be blindsided by a major price cut from your biggest rival because you weren't looking.

What’s the Best Way to Actually Get This Data?

You've got a few paths, but they're not all created equal.

You could go the old-school route: manually slogging through websites, copying prices, and pasting them into a spreadsheet. I've been there. It’s a soul-crushing time-suck, and you'll fall behind fast.

Then there are the big-gun SEO tools like Ahrefs or Semrush. They're powerful, for sure, but they’re also wildly expensive, and price tracking isn't really their main purpose. It's like buying a bulldozer to plant a few flowers.

For most businesses, the smartest move is an automated, specialized tool. A platform like already.dev can send out an AI agent to do all that grunt work. You get fresh, accurate data delivered right to you, without the manual labor or the hefty price tag of an all-in-one suite.

Ready to stop guessing and start making decisions based on solid data? Already.dev automates your competitive research, giving you the pricing insights you need in minutes. See how it works at https://already.dev.