A Founder's Guide to Gathering Competitive Intelligence

Stop guessing and start winning. Learn how to gather competitive intelligence with a practical, no-fluff guide for founders, PMs, and investors.

Figuring out how to gather competitive intelligence just means you’re strategically spying on what your rivals are up to—their products, their marketing, their sales tactics. It's the difference between making calculated moves and just winging it. Honestly, it's what gives your business a real edge.

Stop Flying Blind And Start Spying Smart

Let's be real, "competitive intelligence" sounds like something out of a spy movie, complete with trench coats and secret briefcases. In reality, it's just a fancy way of saying you should probably check if someone else is already building the exact same "unique" thing you are.

Ignoring your competition is like driving with a blindfold on. Sure, you're moving, but you're probably headed straight for a tree. This guide is all about ditching the corporate jargon and getting down to what this really means for you and your business.

Why Bother Snooping?

Whether you're a founder sketching ideas on a napkin or a product manager trying to build a sensible roadmap, a little smart snooping can save you a mountain of time, money, and heartache.

It's about avoiding that gut-wrenching moment when you discover a clone of your brilliant idea has been live for six months and already has paying customers. The goal isn't just to copy what others are doing. It's to understand the playground you're in. This proactive approach helps you find gaps in the market, dodge mistakes others have already made, and build something genuinely better.

For a deeper dive, check out our guide on what is competitive intelligence and why it's a must-have skill.

> The core idea is simple: You wouldn't build a house without checking out the neighborhood first. Why would you build a product without checking out the market?

The Real-World Impact

Think about the last time you saw a product launch and thought, "Wow, they really get it." That's not magic; it's the result of carefully gathering competitive intelligence. It informs everything from your feature set and pricing to the very words you use in your marketing copy.

Here’s what a little intel can do for you:

- Validate Your Idea: Discover if your "revolutionary" concept is actually a well-trodden path.

- Refine Your Positioning: See how competitors talk about themselves and find a unique angle for your own brand.

- Price with Confidence: Understand what customers are already willing to pay and avoid a race to the bottom.

- Build a Better Product: Pinpoint features your competitors are missing or places where their user experience completely drops the ball.

This guide is your practical, no-nonsense playbook to start spying smart. We’ll show you how to find the right information, make sense of it all, and use those insights to make decisions that actually move the needle.

Mapping Your Battlefield: Who Are You Really Fighting?

Think you know your competitors? Most of us have that one big, scary name in our heads—the Goliath to our David. That’s a start, but it’s like looking at a map of the world and only seeing New York City.

The market is a messy, crowded place, and your real competition is often hiding in plain sight. To do this right, you need a full map of the terrain. This isn’t just about the obvious players; it's about everyone and everything fighting for your customer’s attention and budget. Forgetting this is how you get blindsided.

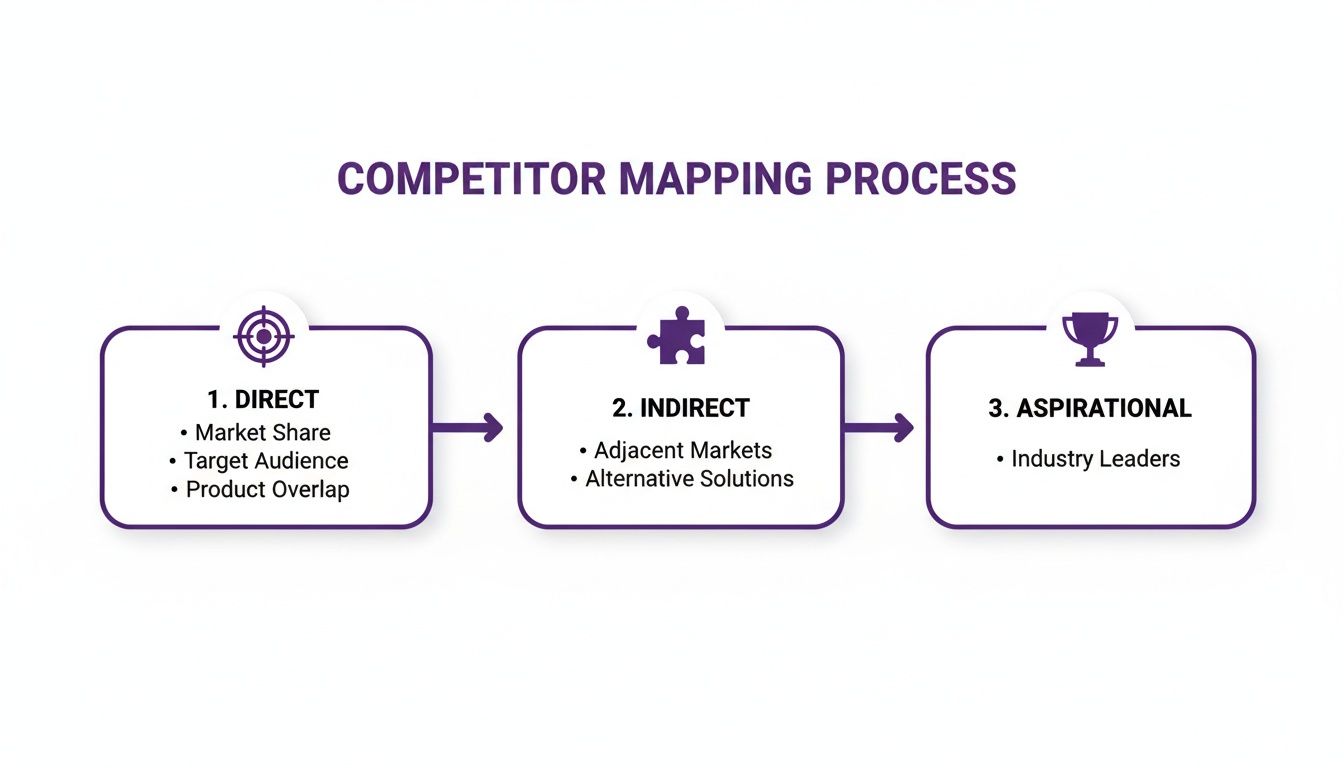

The Three Flavors of Competition

Your competition really comes in a few different flavors. Knowing how to sort them helps you figure out where to focus your energy.

Let’s get practical. Imagine you’re launching a new project management tool called “TaskBlaster.”

-

Direct Competitors: These are the ones you see in your sleep. They offer a very similar solution to the same audience. For TaskBlaster, this is Asana, Trello, and Monday.com. They’re playing the same game, on the same field, by the same rules.

-

Indirect Competitors: Now it gets interesting. These companies solve the same core problem, but with a totally different approach. What’s the real job of a project management tool? Keeping teams organized. So who else does that? Slack. A shared Google Doc. Hell, even a physical whiteboard and a pack of sticky notes are your indirect competitors.

-

Aspirational Competitors: These aren't direct rivals today, but they're the companies you secretly admire. Maybe it’s a company in a different industry with brilliant branding or a user experience that’s just a joy to use. For TaskBlaster, this could be Figma—not a PM tool, but a company known for its incredible community and product-led growth. Studying them helps you set a higher bar.

> The biggest threats often don't look like you at all. Blockbuster wasn't killed by another video store; it was killed by a mail-order DVD service that became a streaming giant. Always ask yourself: "What's another way my customer could solve this problem?"

Finding the Ghosts in the Machine

One of the most valuable sources of intel is the graveyard of failed startups. These are the ghosts who tried to build something similar to you… and failed. Their stories, often found on old Product Hunt pages or forgotten blog posts, are pure gold.

Why did they fail? Did they burn through their cash? Build a solution nobody wanted? Get their pricing completely wrong? These post-mortems offer priceless lessons that you don’t have to learn the hard way. They've already paid the tuition for you.

To see who's actively bidding against you online, a solid Google Ads competitor analysis can reveal who's trying to capture your target audience right now.

Building Your Competitor Map

Don’t just keep this list in your head—that's a recipe for disaster. Create a simple spreadsheet or a document.

When you start digging, heavy-duty tools like Ahrefs or Semrush are great for finding who ranks for your keywords, but they can be expensive. For a more automated and budget-friendly approach, a tool like Already.dev can crawl hundreds of sources to find direct, indirect, and even those failed competitors you’d never spot on your own.

Start by listing them out and putting them into the categories we talked about. This map isn't a one-and-done project; it’s a living document. The market shifts, new players emerge, and today's indirect competitor can become tomorrow's biggest threat. Keep it updated, and you’ll always know exactly who you’re fighting—and where the real opportunities are hiding.

Your Intelligence Gathering Toolkit: Manual vs. Automated

Alright, you’ve identified who you’re up against. Now for the fun part: how do you actually gather intelligence without spending your entire life stalking their every move? This is where we get into the nuts and bolts of data collection. It’s a classic tale of two approaches—the old-school manual grind and the smarter, automated way.

The Manual Grind: Getting Your Hands Dirty

Let's be honest, everyone starts with the manual grind. It’s like being a detective, piecing together clues one by one. This hands-on approach is fantastic for developing a real gut-level understanding of a competitor’s strategy.

So, what does that actually look like? It's you, a browser, and a whole lot of clicking.

- Become a Subscriber: Get on every competitor's newsletter. This is your direct pipeline into their marketing cadence, product announcements, and the special offers they dangle to hook new customers.

- Social Media Stalking (Ethically, of course): Follow them on LinkedIn, X (formerly Twitter), Instagram—wherever they live online. You’ll see how they talk to their audience, what content they promote, and get a feel for their brand's true personality.

- Deep Dives into Reviews: Block out a few hours for sites like G2, Capterra, or Trustpilot. Customer reviews are an absolute goldmine for understanding a rival's strengths and, more importantly, their weaknesses. Every one-star review is a potential opportunity.

> The real magic of manual research is the nuance. You're not just collecting data points; you're feeling the market. You see the frustrated customer comments, notice the subtle shift in their website copy, and start connecting dots that an algorithm might miss.

To get the most out of your efforts, it helps to apply proven research frameworks. A great primer on this is mastering market research methodology. But, as you've probably guessed, this whole process is painfully slow.

This brings us to the other side of the coin: automation.

Let the Robots Do the Heavy Lifting

While manual work gives you a great feel for the landscape, it just doesn't scale. You have a business to run, not a full-time job as a competitor analyst. That’s where automated tools come in to save your sanity and your schedule.

When people think of automation, big names like Ahrefs or Semrush often come to mind. They are SEO powerhouses, but let's be real—they can be seriously expensive, especially when you're just starting out. This is where a simple competitor map comes in handy. It helps you visualize and categorize the companies you'll be tracking, whether you're doing it by hand or with a tool like Already.dev.

This kind of flow helps you prioritize your efforts, focusing on the most direct threats while keeping an eye on the indirect and aspirational players who are shaping the market.

Smarter Automation That Works For You

This is where a new breed of tools enters the picture. Instead of just tracking keywords, a platform like Already.dev uses AI to act as your personal research agent. You can tell it your idea in plain English, and it goes to work, crawling hundreds of sources you’d never have time to find on your own.

Think about it—it’s digging through:

- Niche forums where your target audience complains about existing solutions.

- App store descriptions and update logs to see a competitor's feature release history.

- Startup directories like Product Hunt and BetaList to spot emerging threats before they hit the mainstream.

Instead of spending a week building a messy spreadsheet, you get a full report in minutes. The AI doesn’t just dump raw data on you; it organizes it, showing you clear feature grids, pricing comparisons, and market positioning at a glance. For more ideas on what to look for, check out our guide on the best competitive intelligence tools available today.

Manual vs Automated CI Methods

Here's a quick look at the pros and cons of doing the legwork yourself versus letting the robots handle it.

| Method | Pros | Cons | Best For |

| :--- | :--- | :--- | :--- |

| Manual | - Deep, nuanced understanding

- Catches subtle shifts in tone/strategy

- No tool cost | - Extremely time-consuming

- Doesn't scale well

- Prone to human bias | - Deep-diving on 1-2 key competitors

- Getting initial "feel" for the market |

| Automated | - Fast and comprehensive

- Tracks hundreds of sources 24/7

- Uncovers hidden competitors | - Can miss qualitative nuance

- Potential for data overload

- Subscription costs | - Broad market monitoring

- Ongoing tracking of multiple players

- Scaling CI efforts |

Ultimately, a hybrid approach is your best bet. Use manual methods to get that initial "feel" for your top 1-2 competitors. Then, let automation handle the broad, ongoing monitoring. This gives you both the deep, qualitative insights and the wide, quantitative data you need to make smart decisions—without burning out.

Analyzing The Loot: What To Do With All This Data

So, you’ve done it. You have a giant pile of competitor data—screenshots, pricing pages, customer reviews, the works. Congratulations, you’re now a data hoarder.

But here’s the hard truth: a mountain of information is completely useless if you don't know what it means. This next step is where you stop being a collector and start being a strategist. It's about turning that raw data into actual, game-changing insights.

And forget about building gigantic, soul-crushing spreadsheets that no one will ever read. We're talking about simple, powerful comparison frameworks that actually tell a story.

Dissecting Pricing And Features

The fastest way to get inside a competitor's head is to look at what they charge for and what they offer. Their pricing page isn’t just a list of numbers; it’s a strategic document that screams their priorities from the rooftops.

Start by looking for patterns. Who are they actually building for?

- The Freemium Player: Are they dangling a free plan to capture a massive user base, hoping a small percentage will upgrade? This signals a volume play.

- The Mid-Market Contender: Do they have three or four neat tiers, with the middle one probably labeled "Most Popular"? They're targeting established businesses with clear budgets.

- The Enterprise Whale Hunter: Is their pricing hidden behind a "Contact Us" button? They're chasing big contracts and don't want to scare off smaller fish (or show their hand to rivals).

This initial pass tells you who they think their customer is. Next, you map their features against these tiers. What do they give away for free? What's the core feature you have to pay for? And what’s the big, shiny feature reserved for their highest-paying customers?

This feature-to-price mapping reveals their core value proposition without you having to read a single line of their marketing copy.

> A pricing page is a company's philosophy distilled into a few columns. It tells you who they value most, what they believe is essential, and what they consider a luxury.

Cloud-based tools are taking over because they're scalable, flexible, and integrate easily into startup workflows. With AI turbocharging this analysis, tools like Already.dev can deliver bespoke research plans in minutes, spotting rivals across directories, forums, and communities that manual scans would miss.

Moving From Spreadsheets To Visual Grids

Okay, now for the fun part. Ditch the endless rows of Excel. The human brain processes visual information a staggering 60,000 times faster than text. Let’s use that to our advantage.

It's time to create visual comparison grids.

Imagine a simple chart. Down the left side, list the key features or "jobs to be done" in your market (e.g., "Team Collaboration," "Reporting," "Integrations"). Across the top, list your top 3-4 competitors and your own company. Now, fill it in. You can use simple checkmarks, color-coding, or brief descriptions.

This isn't just about who has what feature. It’s about spotting the patterns at a glance.

- Table Stakes: Which features does everyone have? If you don't have these, you're not even in the game.

- The Ghost Town: Is there a row that’s mostly empty? That’s a market gap. It could be a massive opportunity for you to swoop in and own a niche.

- The Lone Wolf: Does one competitor have a feature nobody else does? That's their key differentiator. Now, how are they marketing it?

Of course, creating these manually is a total pain. You have to visit every site, copy-paste features, and wrestle with formatting. This is where automation saves the day. For a deeper dive into making sense of this information, check out our guide on market research data analysis.

Ultimately, analyzing the data you gather is all about connecting the dots. It's about looking at a competitor's pricing, features, and marketing language to build a complete picture of their strategy. Do this, and you'll find the openings you need to not just compete, but to win.

Turning Insights Into Action (And Staying Legal)

Alright, you've done the digging and unearthed some killer insights about your competition. High five! But now what?

The biggest mistake I see teams make is letting this goldmine of information rot in a forgotten Google Drive folder. Gathering competitive intelligence is one thing; actually using it is what separates the winners from the... well, the people who get blindsided.

This isn’t about creating a massive, scary report nobody has time to read. It's about weaving these little nuggets of intel into the fabric of your team's everyday work.

Turning Intel Into Team Fuel

Different teams need different things. The same piece of intelligence can be a game-changer for product but just noise for sales. The key is to deliver the right insights to the right people so they can take immediate action. Don't just dump a spreadsheet on them; give them the "so what?"

-

For Product Teams: Your intel can validate or kill a new feature idea before a single line of code gets written. Did you discover your top competitor’s most-requested feature is something you could build in a week? That’s a huge, actionable win. Your CI report becomes a direct input for the roadmap, helping prioritize what will actually move the needle.

-

For Marketing Teams: This is pure gold. Found a keyword your rival is ranking for but has terrible content? Go steal that traffic. Noticed their messaging is all about "efficiency" while their customer reviews scream about bugs? That's your cue to position your product around rock-solid reliability. Your intel helps sharpen every ad, blog post, and landing page.

-

For Founders: Need to build a stronger pitch deck for your next investor meeting? A solid competitor slide shows you've done your homework. Demonstrating a deep understanding of the market gaps and your unique position is far more compelling than just saying, "We're like Uber for cats."

> Competitive intelligence isn't a history project; it's a playbook for the future. The goal is to make small, informed adjustments consistently, not one giant, panicked reaction once a year.

Creating a CI Rhythm

You don't need a dedicated "Chief of Spying" to make this work. A simple, repeatable process is all it takes to build a culture of awareness.

I recommend setting up a quick monthly competitor check-in. It can be a 30-minute meeting where someone shares the top 3-5 most interesting things a competitor did last month. Did they launch a new feature? Change their pricing? Get a flood of bad reviews? Just discuss it, decide if you need to react, and move on.

Automation makes this a breeze. While enterprise tools like Semrush or Ahrefs can be incredibly expensive, a platform like already.dev can run automated checks for you, delivering fresh reports that make these monthly check-ins fast and ridiculously productive.

Staying On The Right Side Of The Law

Now for the important, don't-get-sued part. When we talk about how to gather competitive intelligence, we're talking about being a smart business person, not a corporate thief. There's a Grand Canyon-sized difference between strategic research and shady espionage.

Think of it like this: it’s perfectly fine to walk into a competitor's store and check their prices. It's not okay to sneak into their backroom and steal their inventory list.

Here are the golden rules for keeping it ethical:

- Stick to Public Information: Your playground is anything a regular customer could find. This includes their public website, press releases, social media accounts, published pricing, and customer reviews.

- Respect Terms of Service: When you sign up for a competitor's product to test it out (which is a smart move!), actually read their terms. Don't try to reverse-engineer their code or do anything that violates the agreement you just clicked "I Agree" on.

- Don't Lie or Misrepresent Yourself: This is a big one. Never pretend to be a potential customer just to trick a sales rep into giving you confidential information. It's not only unethical, but it can also land you in serious legal trouble.

The goal is to play fair while playing to win. Good competitive intelligence uses brains, not backdoors. By integrating these insights ethically and creating a simple rhythm, you'll turn data into a real, sustainable advantage.

From Playing Catch-Up to Setting the Pace

Alright, let's bring it all home. Think of competitive intelligence not as a one-off project you cram into a Tuesday afternoon, but as a fundamental shift in how you see the market. The point was never to just copy what everyone else is doing. It’s about deeply understanding the entire playground so you can find your corner and build something truly remarkable for the people there.

When you consistently keep a pulse on the market, you get to stop playing defense. You shift from that reactive panic—"Oh crap, they just launched that feature!"—to a proactive, strategic mindset: "We see where the puck is going, and we're already building the rink." It’s the difference between getting swamped by the wave and already being on the surfboard, ready to ride it.

> The market never sleeps. With a smart approach to competitive intelligence, neither will your strategic edge.

So, where do you start today? Here’s a quick checklist to get the ball rolling. Think of it as your "break glass in case of a surprise competitor launch" kit. Your real mission is to turn these one-time actions into ingrained habits for your team.

- Map the Whole Field: Don't just look at the obvious players. Get a handle on your direct, indirect, and even your aspirational competitors.

- Put Collection on Autopilot: Your time is too valuable for manual grunt work. Use a tool like already.dev to save your time and your sanity.

- Find Your Cadence: You don't need a massive report every week. Start with a quick, focused CI check-in once a month and build from there.

Competitive Intelligence FAQs

Got questions? I get it. When you're first diving into competitive intelligence, a lot of things can feel a bit fuzzy. Here are some of the most common questions I hear from teams just starting out.

How Often Should We Be Doing This?

Think of competitive intelligence less like a one-off project and more like a rhythm you build into your business. For most companies, especially in fast-moving industries like SaaS, a major deep-dive every quarter is a good cadence. This is your big-picture strategic review.

But you don't want to go dark for three months. I always recommend a lighter "pulse check" at least once a month. This is more of a quick scan to see if a competitor dropped a surprise feature or if there's a shift in their marketing message. The idea is to never be completely blindsided.

> The goal isn't to hit the panic button every time a rival makes a move. It's to have a radar that's always on, quietly scanning the horizon so you can see things coming from a mile away.

What's The Biggest Mistake You See People Make?

Hands down, the most common trap is analysis paralysis. This is where you collect an absolute mountain of data—spreadsheets with 37 tabs, charts galore, a 50-page document—and then do precisely nothing with it. The report is so overwhelming that it just gathers digital dust in a shared drive.

The second biggest screw-up is tunnel vision. It's so easy to get obsessed with your direct competitors, the ones who look and talk just like you. But while you're busy watching them, you completely miss the indirect threats or the scrappy startup solving the same customer problem in a totally different way. My advice? Start small, focus on finding just one or two actionable insights, and always keep an eye on the periphery.

Is This Possible On A Shoestring Budget?

You bet. You don't need a huge budget to get started. While enterprise-grade tools like Semrush or Ahrefs are incredibly powerful, their price tags can make your eyes water. The good news is, you can get surprisingly far for free.

Here are a few of my go-to budget-friendly tactics:

- Mine the Reviews: Customer reviews on sites like G2 and Capterra are an absolute goldmine for finding your competitors' weaknesses.

- Get on Their List: Subscribe to every competitor's newsletter. Let their marketing and product updates come straight to you.

- Set Up Google Alerts: This is a classic for a reason. Set up alerts for your competitors' brand names. It's free and a fantastic way to track what people are saying about them online.

If you have a small budget and want a massive efficiency boost, a platform like Already.dev is a great middle ground. It automates a ton of the grunt work with AI-driven reports, giving you high-quality insights for a fraction of what those big enterprise tools cost.

Ready to stop guessing and start knowing? Already.dev uses AI to do the heavy lifting, crawling hundreds of sources to deliver a comprehensive competitive report in minutes, not weeks. Get data-driven confidence and build a better product today.