A Guide to Go To Market Strategy That Actually Works

Tired of jargon? This guide breaks down how to build a go to market strategy that gets results. Learn practical steps for a successful product launch.

A go-to-market (GTM) strategy is basically your playbook for launching a product and getting it into the hands of real, paying customers. It’s the game plan that gets your product, sales, and marketing teams on the same page, aiming for the same goal.

Forget the dry, academic definition. Think of it like this: you wouldn't set off on a cross-country road trip without a map, right? A GTM strategy is that map for your product launch. It stops you from driving in circles.

What Is A Go To Market Strategy Anyway

So, what are we really talking about? At its heart, a go-to-market strategy boils down to answering a few straightforward—but absolutely critical—questions:

- Who are we actually selling this to? (And no, "everyone" is not an answer.)

- What problem are we solving for them? Like, a real, hair-on-fire problem.

- Where do these people hang out, and how do we reach them without being annoying?

- How will we convince them our solution is the one they need?

It’s the crucial bridge between a great product idea and a profitable business. Without one, you’re just chucking your product out into the world and hoping someone stumbles upon it. That’s not a strategy; that’s a prayer. A solid GTM plan forces you to think through every single step of the customer journey.

Why You Can't Afford To Skip This

Let’s be honest, startups and product teams are always stretched thin. The temptation to just dive into coding the next feature or launching a quick ad campaign is real. But skipping the GTM planning phase is one of the most common—and costly—mistakes I see teams make. It's the reason so many great-looking products launch to the sound of crickets.

A well-crafted plan brings much-needed clarity to the whole operation. Suddenly, everyone knows what they're doing and why.

- Your product team gets a crystal-clear picture of who they're building for.

- Your marketing team knows the exact message that will grab that audience's attention.

- Your sales team has a detailed profile of their ideal customer and a playbook for how to sell to them.

This kind of alignment isn't just a nice little bonus. It’s a massive competitive advantage. It saves you time, money, and a whole lot of stress when launch day rolls around. A huge piece of this puzzle is making sure you actually have product-market fit before you even think about scaling.

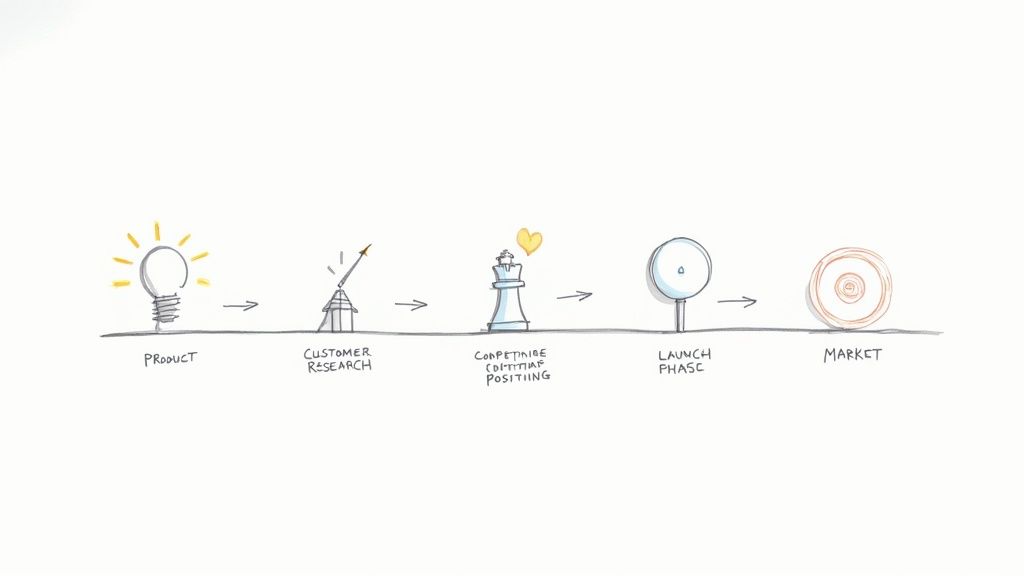

The image below gives a great high-level view of the process, showing how everything kicks off with deep market research.

As you can see, you can't build a solid plan without first understanding the world your customers live in.

The Proof Is In The Planning

Don't just take my word for it. The numbers tell a clear story. There’s a huge performance gap between companies that map out their launch and those that wing it. In fact, some studies show that a staggering 85% of businesses with a detailed GTM strategy see it as highly effective for hitting their revenue goals.

To give you a better idea of what goes into one of these plans, here's a quick breakdown of the essential components.

Key Parts of a GTM Strategy

A quick look at the essential pieces of any solid GTM plan.

| Component | The Question It Answers | Why You Can't Skip It | | :--- | :--- | :--- | | Market Definition | "Who are our potential customers and what is our target market?" | Without this, you're shooting in the dark. Blindfolded. | | Ideal Customer Profile (ICP) | "Who is the perfect customer for our product?" | This helps you focus your efforts where they'll have the most impact. | | Product-Market Fit | "Does our product actually solve a problem people will pay for?" | This is the foundation; everything else is built on top of it. | | Positioning & Messaging | "How are we different, and how do we talk about it?" | This is how you stand out in a crowded market. | | Pricing Strategy | "How much will we charge and what's the model?" | Get this wrong, and you could kill your business before it starts. | | Distribution Channels | "Where will we sell our product and how will it get to the customer?" | You have to meet your customers where they already are. |

These are the core pillars. Nailing each one is what separates a chaotic launch from a successful one.

> A go-to-market strategy isn't about creating some rigid, 100-page document that nobody ever reads. It’s about building a living, breathing guide that helps you make smarter decisions, faster. Think of it as your North Star for winning customers and growing your business.

Pinpointing Your Ideal Customer

Alright, let's get one thing straight right away: if your target audience is "everyone," you're actually targeting no one. It’s the fastest way to burn through your cash and wonder why nobody cares about your amazing product. A successful go-to-market strategy hinges on being brutally honest about who your product is really for.

This isn't just about listing off generic demographics like "males, 25-40, living in cities." That’s a cardboard cutout, not a customer. We need to dig deeper into the messy, human stuff—the psychographics. This is the why behind their decisions.

What’s the one problem that keeps them staring at the ceiling at 3 AM? What specific frustration with their current tools makes them want to throw their laptop out the window? These are the golden nuggets of information that transform your strategy from a guess into a plan.

Moving Beyond Cardboard Cutouts

To build a truly useful Ideal Customer Profile (ICP), you have to become a bit of a digital detective. Your mission is to find where your potential customers are already talking about their problems. You'd be surprised how much people share when they think no one important is listening.

Here are a few sneaky (but effective) places to start your investigation:

- Competitor Review Sites: Head over to G2, Capterra, or even the App Store. Ignore the 5-star "this is amazing!" reviews. The real gold is in the 2, 3, and 4-star reviews. This is where people detail exactly what’s missing, what’s annoying, and what they wish the product could do.

- Reddit & Niche Forums: Find the subreddits where your target audience hangs out. If you're selling a tool for developers,

r/developersis your goldmine. For marketers, find the marketing subs. People here don't hold back; they’re brutally honest about their day-to-day struggles. - Amazon Book Reviews: Look up the top-rated books in your industry. Read the reviews for books that promise to solve the very problem you're tackling. You'll find out what concepts resonated and what advice fell flat, giving you direct insight into your audience's mindset.

This process isn't just about gathering data; it's about building empathy. You're trying to understand your customer so well that you can describe their problem better than they can.

> The goal is to create an ICP so detailed it feels like you're talking about a real person you know. When you can do that, writing copy, building features, and making sales calls becomes ten times easier because you're just having a conversation with a friend.

Putting It All Together

Once you've gathered your intel, it's time to assemble your ICP. Think of this not as a static document, but a living profile you’ll refine over time. But even your first version needs to be sharp enough to guide your entire go-to-market strategy.

This whole approach is rooted in a classic framework known as the "Three Cs," which focuses on understanding your Customers, your Company, and your Competition. Take, for instance, how a major U.S. retailer nailed this by targeting parents with specific income levels and shopping behaviors for their back-to-school promotions. They aligned their product bundles, marketing timing, and store placement perfectly, allowing them to capture a huge piece of an annual market worth around $27 billion. You can find more insights on how segmentation drives success at Zendesk.com.

The key is to translate raw data into a narrative. Don't just list facts; tell a story about your ideal customer. Give them a name, a job title, and a list of their biggest headaches. What software do they already use and hate? What does a successful day look like for them? The more specific you get, the more powerful this tool becomes.

This level of detailed research can feel overwhelming, but modern tools are making it much faster. To dive deeper into this, check out our guide on AI-powered market research to see how you can automate a lot of this detective work.

Ultimately, your ICP is your north star. Every decision you make—from the features you build to the ads you run—should be filtered through one simple question: "Would [Your ICP's Name] care about this?" If the answer is no, you know what to do.

Analyzing Your Competition Without The Guesswork

Knowing your competition is half the battle. But let’s be clear: this isn't about creating a "borrowed" version of their product. It's about understanding the battlefield so you can pick your fights, find their blind spots, and carve out a space that's uniquely yours. A proper go-to-market strategy absolutely depends on this intel.

Forget just listing their features in a spreadsheet. That’s amateur hour.

A real competitive analysis is more like being a detective. You need to dissect their messaging, pricing, customer reviews, and marketing channels to find the cracks in their armor.

Digging for Competitive Gold

So, where do you start looking? The best intel often comes from the places where people are brutally honest: customer reviews and online forums. This is where you find out what customers are constantly complaining about. That’s not just a bad review; it's your invitation to build something better.

Think about it. If a dozen reviews for a competitor’s software all say, "It's great, but the reporting feature is a nightmare," you’ve just found a massive opportunity. That pain point is your opening.

Here’s where to focus your detective work:

- Their Pricing Page: This tells you more than just the cost. It reveals who they think their ideal customer is. Are they targeting small businesses with a cheap entry plan or going after big enterprise clients with custom quotes? This helps you decide if you want to compete on price or go after a different segment entirely.

- Customer Reviews: Don't just skim them. Read the 3-star reviews. These are from people who wanted to love the product but were let down by something specific. That "something" is pure gold for your go-to-market strategy.

- Their Marketing Channels: Where are they spending their time and money? Are they all over LinkedIn ads, or are they killing it with a blog and SEO? This tells you where the established players are, which can help you decide to either challenge them there or find a less crowded channel to dominate.

Finding Your Unfair Advantage

The goal of all this snooping isn't to feel bad about how far ahead your competitors are. It’s to find the gaps.

Where are they completely absent? Maybe they ignore a certain type of customer or have zero presence on a social media platform where your ideal customer lives. That's not a gap; that's a wide-open door for you.

> A competitive analysis isn't about copying what works for others. It’s about discovering what doesn't work for their customers and building your strategy around solving those exact problems. Their biggest weakness can become your greatest strength.

This is where you start to piece together your unique angle. By combining the insights from your ideal customer profile with the weaknesses of your competitors, you can craft a position in the market that no one else occupies.

For a structured way to lay all this out, a good template can make all the difference. In fact, our competitive analysis report template can help you organize your findings without missing a beat.

The Right Tools for the Job

Now, you could spend weeks doing all this manually, but that's a massive time sink. There are powerful SEO and competitive analysis tools out there like Ahrefs or Semrush that can automate a lot of this research. The catch? They can be seriously expensive, especially for a startup just getting off the ground.

This is where a more focused tool comes in handy. For example, the image below from already.dev shows how you can get a quick, AI-driven overview of the competitive landscape.

Instead of just getting raw data, platforms like already.dev are designed to give you actionable insights quickly and affordably. They can help you spot direct and indirect competitors, analyze their positioning, and find those all-important market gaps without draining your budget. It’s about working smarter, not just harder, to build a go-to-market strategy based on data, not guesswork.

Crafting A Message That Actually Connects

Alright, you’ve done your homework. You know who you're selling to and you’ve sized up the competition. Now for the part where so many startups stumble: telling a story that actually makes people listen.

This isn’t about making a laundry list of features or trying to sound smart with industry jargon. It’s all about answering one simple, brutally honest question that every potential customer is thinking: "So what?"

This is the very soul of your positioning. If someone lands on your homepage and can't figure out what you do, for whom, and why you’re the best choice in under five seconds, you've lost them. Your entire go-to-market plan hinges on nailing this message.

Finding Your Unique Value Proposition

First thing's first: you have to lock down your unique value proposition (UVP). This is the one powerful sentence that explains why you’re different and better. Forget catchy slogans for a minute; this is about making a clear, compelling promise.

Let's break it down. Your product has features, sure. But nobody buys features. They buy the outcome those features create. They buy a solution to a problem that’s been bugging them for weeks, months, or even years.

Your job is to be the translator, turning your cool tech into real-world wins for your customer.

- You have: "Our software has a real-time analytics dashboard."

- They hear: "Stop guessing and see exactly which marketing campaigns are making you money right now."

See the shift? One is about what your product is. The other is about what your product does for them. That second one is what gets people to pull out their wallets.

A killer UVP lives at the intersection of your unique strength and a specific customer pain point. It's where your product's magic bullet meets your customer's biggest headache.

> Here's my favorite litmus test: Your UVP should be so clear that a slightly tipsy person at a loud party could understand it. If it takes you five minutes to explain, it's too complicated. Back to the drawing board.

Turning Features Into Feelings

With your core UVP in place, it's time to build out your messaging pillars. Think of these as the 2-4 key themes that support your main promise. They become the backbone for everything you write—from website copy and sales decks to your social media posts.

This is where you start connecting your product’s benefits to your customer’s emotions. We all like to think we're logical, but people make buying decisions with their hearts and then justify them with their heads. It’s no surprise a recent Gartner report noted that 62% of companies are now leaning into product-led growth, which is all about communicating value directly and emotionally.

Let’s run a quick scenario. Say you’re selling project management software built for creative agencies.

- The Pain: Creative directors are pulling their hair out chasing down feedback and approvals. They feel more like professional cat-herders than creatives.

- Your Feature: Centralized commenting and approval workflows.

- The Emotional Win: "Get back to doing the creative work you love instead of being a professional email-chaser. Feel the relief of a streamlined, chaos-free project."

That’s how you do it. You’re no longer just selling software; you’re selling peace of mind, more time for creativity, and an end to daily frustration.

Keeping Your Story Straight

Once you have your story, you have to stick to it. Consistency is everything. Your messaging pillars act as a guardrail, making sure every single piece of content reinforces the same core ideas.

This is how you build a recognizable brand and earn trust over time.

Your voice and message should be the same whether a customer is reading a blog post, talking to a salesperson on a demo call, or seeing one of your LinkedIn ads. This unified front is the hallmark of a killer go-to-market strategy. It shows you know who you are and what you stand for, giving customers the confidence to choose you over everyone else.

Choosing Where to Sell and Market Your Product

You’ve got a killer product, a message that hits all the right notes, and you know your customer inside and out. Awesome. Now comes the million-dollar question: where do you actually find these people and get them to buy?

This is the "market" piece of your go-to-market strategy. It's about picking your battlegrounds. I've seen too many startups just throw money at every channel they can think of—SEO, paid ads, social media, direct sales—and hope something sticks. That's not a strategy; it's a great way to set your budget on fire.

The real goal here is to be surgical. You have to pick the right channels based on your product, where your ideal customer hangs out, and—let's be honest—your budget. It’s all about building momentum without burning out your team or your bank account.

Finding Where Your Customers Live

The first rule of picking marketing channels is simple: go where your audience already is. Seriously. Don't try to drag them to a new platform or force them to change their habits. If your ideal customer lives on LinkedIn and devours industry newsletters, then pouring money into TikTok ads is probably a complete waste of time.

Think back to the detective work you did when building your Ideal Customer Profile. Where were they complaining about their problems? That’s almost certainly where they’re looking for solutions, too.

Here are the usual suspects to consider:

- Content Marketing & SEO: This is the long game, but it's powerful. You create genuinely helpful content—blog posts, guides, videos—that answers your customers' burning questions. Over time, you build trust and start ranking on Google, bringing in a steady stream of people who are actively searching for what you offer. This is a perfect play for more complex products that require a bit of education.

- Paid Advertising (PPC): This is your fast lane to visibility. You pay platforms like Google or LinkedIn to put your message right in front of your target audience. It delivers quick results and is fantastic for testing your messaging, but it can get expensive fast if you don't know what you're doing.

- Social Media: This can be a brand-building exercise (through organic posts) or a direct lead-gen machine (with paid ads). The key is choosing the right playground. B2B SaaS companies often kill it on LinkedIn, while a direct-to-consumer brand might find its tribe on Instagram or Pinterest.

- Direct Sales: If you're selling a high-ticket item to big companies, a direct sales team is often non-negotiable. This is a high-touch, relationship-driven approach that's pretty much required for those long, complex sales cycles.

The trick is to not do everything at once. Pick one or two channels that feel like a slam dunk and get really, really good at them before you even think about expanding.

Deciding On Your Go To Market Model

Beyond just the marketing channels, you have to think about your overall GTM model. This is the fundamental way you get your product into your customers' hands. For SaaS especially, one of the most effective models out there is the freemium or free-trial approach.

Mailchimp is the classic poster child for this. They launched with a generous freemium plan aimed at small businesses, which let them build a massive, loyal user base with almost no acquisition cost. This product-led growth strategy created an army of fans who happily upgraded as their own businesses grew. It’s an incredibly powerful flywheel, and today, around 70% of SaaS companies have adopted a similar freemium or free-trial model. If you want to nerd out, you can dig into some more of the data behind these GTM models.

> Your GTM model isn't just about pricing—it's a core part of your strategy. A freemium plan can be your best salesperson, working 24/7 to show users your product's value without a single demo call.

Building Your Action Plan

Okay, time to get practical. You can't boil the ocean, so you have to prioritize. A solid, focused plan is what gives your launch the best shot at success. For a more detailed walkthrough, you can grab our product launch strategy template to help map this all out.

Here’s a simple way I like to think about it:

- Pick Your Primary Channel: Choose the one channel where you are most confident you can win. This gets the lion's share of your time and budget. No excuses.

- Select a Secondary Channel: Pick one more channel to experiment with. This gives you another plate to spin if your main bet doesn't pay off as quickly as you'd like.

- Set Clear Goals: What does success look like in the first 90 days? Is it 100 sign-ups? 10 paying customers? 50 demo requests? Get specific and be realistic.

- Measure Everything: Track your progress relentlessly. If something isn't working, don't be afraid to kill it and shift your focus. Your initial plan is just a hypothesis; the data will tell you if you were right.

This focused approach keeps your team from getting stretched too thin and lets you put all your energy into making one or two channels work brilliantly. Once you’ve got those humming, then you can start expanding your reach.

Go-To-Market FAQs

You've made it this far, so you're clearly serious about building a go-to-market strategy that actually works—not one that just gathers dust in a forgotten Google Drive folder. But even the best plans can leave you with a few nagging questions.

Let’s clear up some of the most common ones we hear. No fluff, just straight talk.

How Is a GTM Strategy Different From a Marketing Plan?

This question comes up constantly, and it’s a good one. The simplest way to think about it is that your marketing plan is a crucial chapter, but the GTM strategy is the entire book.

A marketing plan is laser-focused on awareness and lead generation. It’s the playbook for your ads, your content, your social media presence, and your SEO efforts. It answers the question, "How will we get people's attention and make them interested?"

A go-to-market strategy is the whole enchilada. It orchestrates every single moving part needed to get a product successfully into the hands of customers. It includes the marketing plan, but it also defines:

- Your Target Audience: Who exactly are we selling to? (Remember that ICP we spent so much time on?)

- The Product: How is it packaged, positioned, and differentiated?

- The Price: What’s the full pricing and monetization model?

- The Channels: Where and how will we actually sell this thing? (Direct sales, online, partners, etc.)

- Customer Retention: What’s our plan for support and success to keep customers from leaving?

Basically, the marketing plan brings people to the door. The GTM strategy makes sure the door is open, the price is right, the sales team knows what to do, and the customer has a great experience once they're inside.

How Long Does It Take to Create a GTM Strategy?

Ah, the million-dollar question. The honest, non-consultant answer is: it depends entirely on your situation. Anyone who gives you a hard number without knowing your context is just guessing.

If you’re a lean startup launching your first product to a niche you know inside and out, you could probably knock out a solid, well-researched plan in a few intense weeks. You’re agile and can move fast.

But if you're an established company entering a new international market with a complex product? You're easily looking at several months of rigorous research, data analysis, and validation.

> The goal isn't speed, it's accuracy. A GTM plan you rushed in two weeks based on a pile of unverified assumptions is a recipe for disaster. It's far better to take an extra month to talk to real customers and properly size up the competition. Don't cheap out on the foundation.

Nail down the fundamentals first: your ICP, your unique value proposition, and your core sales and marketing channels. Getting those right will save you a world of hurt down the road.

Can I Change My GTM Strategy After Launch?

Not only can you, you absolutely must. A go-to-market strategy should never be treated like a sacred text carved in stone. Think of it as a living, breathing document.

Your initial GTM strategy is really just your best-educated guess. It’s a hypothesis. The second your product hits the market, you stop guessing and start collecting cold, hard data. And that data is pure gold.

You'll quickly learn where you were a genius and where... well, where you were a little off the mark.

- Maybe that "guaranteed winner" of a marketing channel is a total flop, while an overlooked one is bringing in amazing leads.

- You might find customers are using a minor feature for something you never even considered, opening up a whole new use case.

- Perhaps early feedback shows your pricing is a steal—or way too expensive for the value perceived.

The companies that win are the ones that treat their GTM like a dynamic playbook, not a static report. They're constantly watching the data, listening to customers, and aren't afraid to tweak their approach. Your willingness to pivot based on what the market is actually telling you is what separates success from stubbornly sticking to a plan that isn't working.

Ready to build your GTM strategy on a foundation of real data, not guesswork? With Already.dev, you can uncover your entire competitive landscape in minutes, not weeks. Stop wondering who your rivals are and start winning.

Find your competitors before they find your customers at already.dev