How to Find a Company's Competitors (Without Crying into a Spreadsheet)

Tired of basic Google searches? Learn how do i find a company's competitors with clever, practical strategies that uncover the rivals you're missing.

Alright, let's talk about finding who you're really up against. And no, I don't mean just Googling your biggest rival and calling it a day. We need to dig deeper to find both the obvious players and the sneaky ones lurking in the shadows.

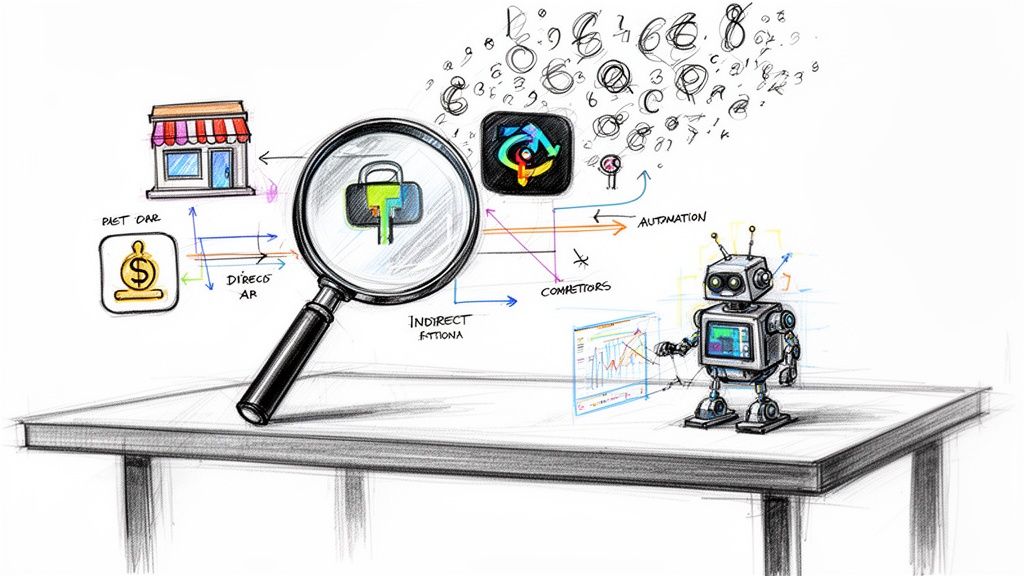

We're talking about direct competitors—the ones offering the same stuff to the same people—and indirect competitors, who solve the same problem but in a totally different way. To find them, you have to know where they live. Think app stores, weird industry forums, job boards, and even patent filings. It's time to become a digital detective.

Stop Using Google Like a Boomer

Let's be real. You’ve already typed "[Your Product] alternative" into Google. You got a list of the usual suspects and it felt… meh. That’s because finding all of a company's competitors isn't about running a few lazy searches; it's about putting on your detective hat and getting your hands dirty.

The real goal is to find the competitors you don't see coming. The ones solving the same customer problem but with a completely different solution. Ignoring them is like building a sandcastle and not noticing the tide is coming in. It's a rookie mistake that will quietly drown your business.

This guide is your playbook for moving past the surface-level junk and into a deep-dive analysis that actually gives you an edge.

Direct vs. Indirect Competitors

First things first: stop thinking about "competitors" as one big scary blob. They come in two distinct flavors, and knowing the difference is key to not messing up your strategy.

Here's a quick cheat sheet to help you sort the companies you find so you know who to obsess over.

Direct vs. Indirect Competitors: Why It Matters

| Competitor Type | What They Offer | Example (For a New Project Management App) | Why You Should Care | | :--- | :--- | :--- | :--- | | Direct | The same (or very similar) solution to the same target customer. | Asana, Jira, Trello | These are your head-to-head rivals. You're fighting for the same money, features, and glory. | | Indirect | A different solution to the same core problem. | Spreadsheets, Google Docs, a physical whiteboard, yelling across the office. | They solve the customer's "job to be done" differently. They can make your solution look over-engineered or ridiculously expensive. |

Why does this matter so much? Because your customers don't live in neat little product categories. They just want their problem gone. If a simple spreadsheet gets the job done for free, you aren't just competing with Asana—you're competing with Google Sheets.

> The biggest threat often comes from the indirect competitor you never saw. They're the ones who redefine the market by making your fancy solution seem overcomplicated or overpriced.

Building Your Competitor Radar

Think of your competitive landscape as a radar screen. Those big, angry blips in the middle? Those are your direct competitors. They’re loud, obvious, and pretty easy to track.

But the real opportunities—and threats—are the faint blips on the outer edges of the screen.

These faint blips could be:

- A niche tool that serves a tiny, but fanatical, audience.

- A single feature buried inside a giant platform that solves your core problem.

- An open-source project that the DIY nerds are flocking to.

To truly understand how to find a company's competitors, you need to map out this entire ecosystem. Sure, powerful tools like Ahrefs or Semrush can show you who is ranking for similar keywords, but they can be crazy expensive and often miss the indirect players entirely. A more focused alternative like Already.dev can automate this discovery process for you, finding both direct and indirect rivals without that soul-crushing price tag.

Before we dive into the clever hunting techniques, let this idea sink in. Your goal isn't just to make a long list of company names. It's to understand all the different ways your potential customers are currently solving their problems. Get this right, and everything else gets easier.

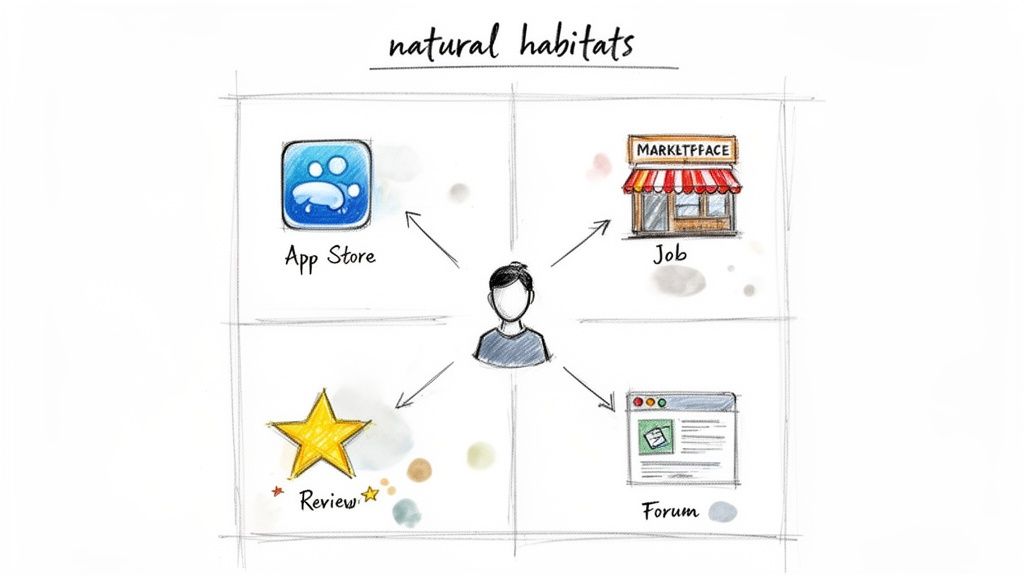

Find Competitors Where They Actually Live

If you're only looking for competitors on Google, you're missing half the story. The best intel comes from finding rivals where they actually hang out and talk to customers—their digital habitats. This means going beyond basic search engines and digging into the specific platforms where your target audience already shops for solutions.

Think about it. Your ideal customer probably isn't just typing random keywords into a search bar. They’re browsing the Shopify App Store, hunting for integrations on the Salesforce AppExchange, or scrolling through mobile apps. By looking for competitors in these ecosystems, you find companies that have already been vetted by the platforms and trusted by the very users you want to steal.

Scour Industry Marketplaces and App Stores

Every niche has its own digital town square. If you're building a SaaS product, these marketplaces are where your most relevant competitors are already on display. They’ve had to jump through hoops just to get listed, which means they’re serious players.

The trick is to search these platforms not for your solution, but for the problem you solve.

- App Stores (Apple & Google Play): Use keywords your customers would actually type. Check out the top-ranked apps, of course, but don't forget to scroll way down and find the newer, hungrier startups.

- Platform-Specific Marketplaces: Think Shopify App Store, Salesforce AppExchange, HubSpot Marketplace, or the Atlassian Marketplace. These are absolute goldmines for B2B competitors.

- Niche Directories: To really find your competition, you need to go beyond broad searches. For instance, if you're in fintech, diving into a curated list of Fintech SaaS companies will give you a laser-focused view of who you're up against and what they offer.

Don’t just write down a list of names. Click into their profiles. Read their descriptions, check their pricing, and—most importantly—read the user reviews to see what people love and hate. This is ground zero for understanding who is already winning over your future customers.

Decode Clues from Job Boards

Want a sneak peek at a company's secret roadmap? Look at who they're trying to hire. Job boards like LinkedIn, Indeed, or niche industry sites are treasure troves of strategic intel.

A single job posting can tell you so much. If your competitor posts a listing for a "Senior AI Engineer specializing in Natural Language Processing," it’s a massive tell. They're not just hiring—they're building a new AI-powered feature. See a sudden flood of ads for "Enterprise Sales Executives"? That's a huge sign they're moving upmarket to chase bigger clients.

This isn't just being nosy; it’s strategic foresight. You’re seeing their next move months before it ever hits their marketing site. For a deeper dive, check out our guide on how to perform a complete website competitor analysis to see how their hiring plans line up with their online presence.

Let Customer Review Sites Do the Work for You

Sites like G2, Capterra, and TrustRadius are fantastic for finding competitors because customers literally tell you who else they were considering. It’s like having a free focus group you can spy on.

Look up a known competitor on one of these platforms and pay close attention to the comparison sections. Features like G2's "Users Also Considered" or Capterra's "Alternatives" automatically spit out a list of direct rivals based on real user behavior.

This kind of user-generated comparison is incredibly powerful because it mirrors the exact evaluation process your potential customers are going through.

> Pro-Tip: Don't just read the five-star reviews. The two- and three-star reviews are where the real gold is hidden. They reveal feature gaps, customer service failures, and pricing frustrations—all of which are opportunities for you.

This whole process is about being smart and efficient. Instead of trying to boil the ocean with endless Google searches, you’re going straight to the source. Sure, tools like Semrush and Ahrefs can map out keyword competitors, but they're expensive and often miss the crucial context these digital habitats provide.

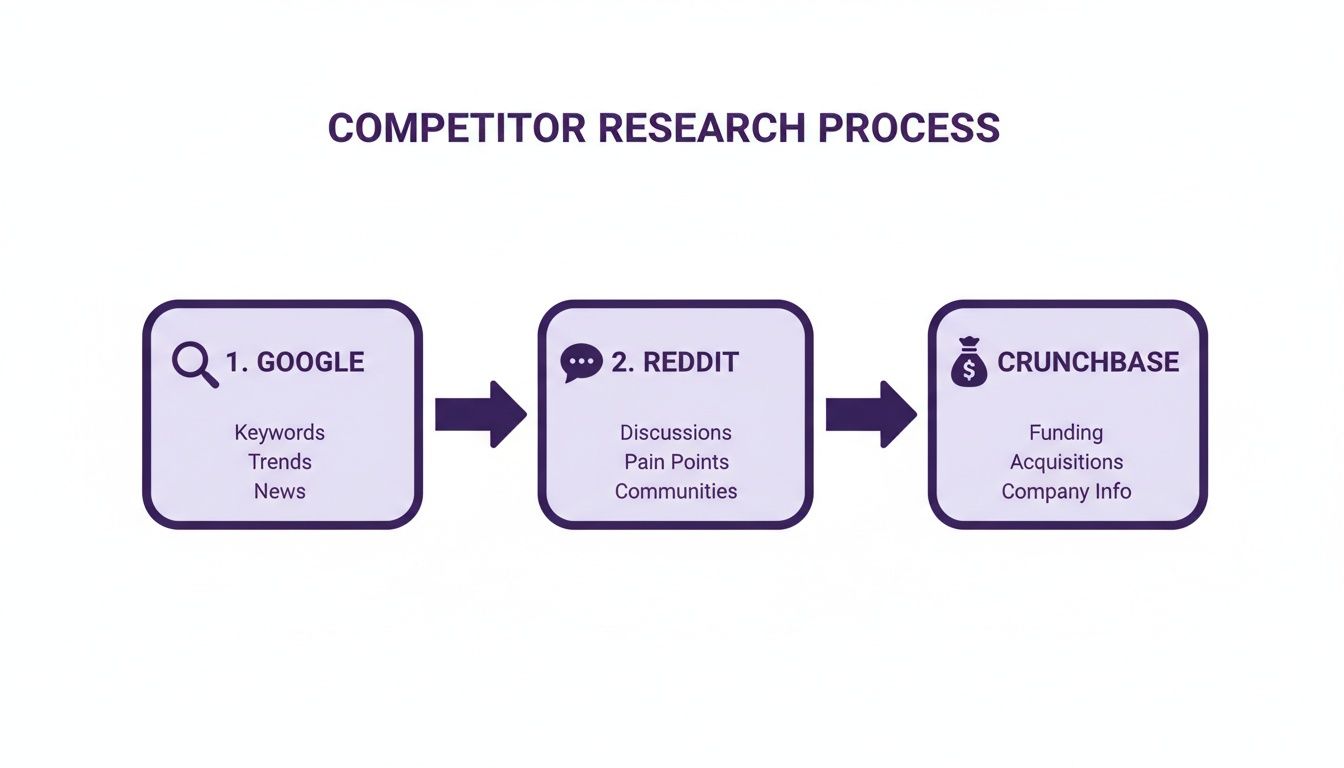

Use Search Operator Magic to Dig Deeper

Alright, you've checked the obvious places. Now it's time to get a little nerdy. Think of this next part as learning the secret handshake of search engines to turn a basic Google search into a high-powered intelligence mission.

I’m talking about search operators—those little symbols and commands that let you slice through the noise and find exactly what you’re looking for. Forget just typing in keywords. Using operators is like having a superpower for market research, surfacing competitors and candid conversations you'd otherwise never see.

This simple workflow shows how you can combine a few platforms to get a much richer picture.

As you can see, you can start broad with Google, zoom in on real user discussions on Reddit, and then validate what you've found with hard data on Crunchbase.

Unleash the Power of Google Operators

Think of Google as a giant, disorganized library. Search operators are your special passcodes to the restricted section. They tell Google exactly how and where to look.

Here are a few of my favorite, copy-paste-ready queries you can use right now:

-

related:[competitor's domain].comThis is the OG and still one of the best. Just pop in the URL of a known competitor (e.g.,related:asana.com), and Google will spit back a list of sites it considers similar. It’s like asking the search engine, "Who else is playing in this sandbox?" -

"best * for project management"The asterisk (*) is a wildcard that tells Google to fill in the blank. This query is perfect for finding those "best of" articles and comparison lists that review a bunch of tools at once, revealing competitors you might have missed. Just swap "project management" with your niche. -

site:reddit.com "is there a tool for *"This one is pure gold. It limits your search to Reddit and hones in on phrases where people are actively asking for a solution to a problem. You’ll find raw, unfiltered customer language and often discover small, up-and-coming tools that the big review sites haven't even heard of yet.

> Using operators isn't about being a tech wizard. It’s about being smarter with your searches. A single, well-crafted query can deliver more insight than an hour of random clicking.

Follow the Money Trail

Smart investors spend millions researching markets before they cut a check. Why not piggyback on their hard work? Following the money is a brilliant way to spot emerging competitors before they even hit the mainstream.

Venture capital (VC) firms often specialize in certain industries. If you find a VC that invested in a known competitor, there's a good chance their portfolio is packed with other companies trying to solve similar problems.

How to Find Competitors by Following VCs

- Start on Crunchbase or PitchBook: Look up a competitor you already know and see who their early investors were.

- Visit the VC's Website: Head over to that investor’s site and click on their "Portfolio" page. You'll find a curated list of companies they believe are future winners.

- Look for Patterns: Do they have a bunch of investments in "B2B SaaS" or "creator economy" tools? Any company in their portfolio solving a similar customer problem is a potential indirect competitor worth tracking.

This method does more than just help you find a list of names; it shows you where the market is heading. If top VCs are pouring money into a specific type of solution, that's a massive signal about future trends.

Of course, manually digging through all this can be a grind. Powerful SEO tools like Ahrefs or Semrush can help with keyword analysis but come with a hefty price tag that can be overkill. A more focused tool like Already.dev can automate this entire discovery process, using AI to scan these sources and more to deliver a comprehensive report without the enterprise-level cost.

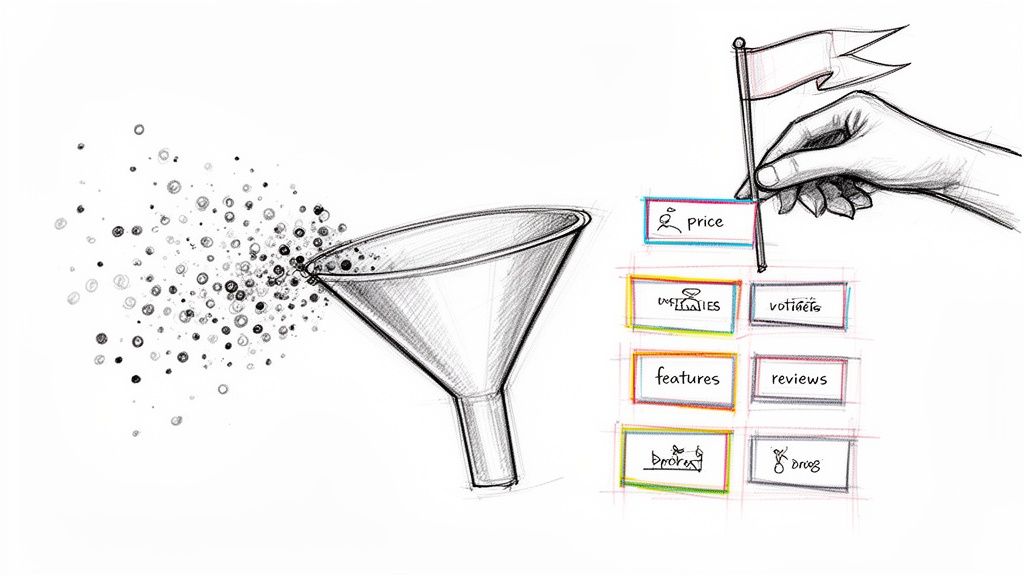

Turning Your Long List into a Smart Strategy

So, you’ve done the detective work and unearthed a giant list of companies. Awesome. Now what?

A spreadsheet with 100 names is just noise; a prioritized list of your top 10 is a strategic weapon you can actually use. Let’s be honest, you can’t meaningfully track every single player. It’s a surefire way to get overwhelmed and do nothing. The real goal now is to turn that raw data into actual intel by figuring out who really matters.

This is how you find the signal in the noise.

Separate the Contenders from the Pretenders

Not all competitors are created equal. Some are genuine threats breathing down your neck, while others are just background chatter. To figure out who’s who, you need a simple framework to score and rank them.

Think of it like a fantasy football draft. You wouldn’t just pick players at random—you’d evaluate them based on specific metrics. We’ll do the same, but instead of touchdowns and passing yards, we’ll look at market position, features, and what their customers are screaming about online.

Start by asking these three simple questions for each company on your list:

- Market Position: Are they the cheap-and-cheerful budget option, the all-in-one enterprise behemoth, or the premium, white-glove service?

- Feature Overlap: How much of their product does the exact same thing as yours? A 10% overlap makes them a distant, indirect rival; an 80% overlap makes them a direct threat.

- Customer Rage-Love: What do their G2 or Capterra reviews say? Are customers constantly complaining about a missing feature you plan to build? That's a huge opportunity.

This quick sorting process helps you filter your massive list down to a manageable few. For a structured approach, you can grab our free competitive analysis template to organize this data and make smarter comparisons.

Why Small and Scrappy Can Be a Big Threat

Don't make the classic mistake of focusing only on the big, established players. Sometimes the most dangerous competitor is the small, agile one you barely noticed.

It's a pattern we see everywhere, even on a global scale. The IMD World Competitiveness Ranking often shows smaller, nimble countries outperforming economic giants, with top spots held by nations with populations under 10 million. These rankings prove how agility and focus can beat sheer size—a lesson every startup should take to heart when scanning for rivals.

> Just because a competitor is small doesn't mean they're insignificant. A small team with intense focus can often outmaneuver a slow-moving giant, capturing a niche market before the big guys even notice.

Prioritize Based on Strategic Fit

Okay, now you have a ranked list. It's time to decide who gets your attention. I find it’s easiest to group competitors into three simple tiers. This becomes your battle plan.

Tier 1: The Arch-Rivals (Top 3-5) These are your direct competitors with major feature overlap and a similar target audience. You need to know their every move—pricing changes, new features, and marketing campaigns. Set up alerts and check on them weekly.

Tier 2: The Contenders (Next 5-10) These are either strong indirect competitors or direct rivals who target a slightly different market segment. Keep an eye on them quarterly. They could pivot into your space or reveal a new market opportunity you hadn't considered.

Tier 3: The Watchlist (Everyone Else) This is your "good to know" list. These companies are either in adjacent markets or are too small to pose an immediate threat. A quick check-in every six months is plenty.

Automate the Hunt with AI-Powered Tools

Let's be real. Manually digging through all the sources we've covered is a massive time-suck. It’s crucial work, but it can easily swallow days you just don't have. This is where you bring in the cheat codes.

Sure, big-name SEO and market research platforms like Ahrefs or Semrush can tell you who's ranking for what. The problem? They're often incredibly complex and carry a price tag that’s total overkill for most startups. They can be expensive and you don't need a sledgehammer to crack a nut.

This is where automation becomes your best friend. Instead of losing a week to spreadsheets and endless browser tabs, you can get the same—or better—results in minutes. And for this, Already.dev is an awesome alternative.

Work Smarter, Not Harder

The whole point of automation is to hand off the tedious, repetitive tasks so you can focus on what matters—like actually building your business. The competitive landscape isn't waiting for you to catch up; it's changing faster than ever.

Think about it: over the past 20 years, the market cap of the top 12 high-growth industries surged nearly tenfold. The "shuffle rates" within these industries show just how quickly leaders can fall and new players can emerge. This volatility is exactly why a static analysis is so dangerous. A shocking 42% of failed startups cite ‘no market need,’ which is often just another way of saying they were blindsided by competition they never saw coming.

> Manual research gives you a snapshot in time. Automated research is like having a live satellite feed of the entire battlefield, constantly updating you on new threats and opportunities.

AI Is Your Secret Weapon for Speed and Scale

For a focused, fast, and affordable approach, there's Already.dev. It's built specifically for this one job: finding every single competitor so you don't have to. Instead of spending your week hunting, you just describe your idea in plain English and let its AI agents do the heavy lifting.

In just a few minutes, you get back a comprehensive report that doesn't just list direct and indirect competitors but actually analyzes their pricing, features, and market position.

Here’s what you get from a dedicated, automated tool:

- Speed: Reports that used to take me 40 hours now take about four minutes.

- Scale: AI agents can scan hundreds of sources simultaneously—from app stores and forums to VC portfolios and patent filings.

- Clarity: The data comes back automatically organized, categorized, and presented in easy-to-read charts and tables.

This approach frees you up to focus on strategy instead of getting bogged down in data entry. If you want to enrich this data even further, you can explore lists of the top B2B data providers to add more layers to your findings.

Putting AI-Powered Research Into Action

Using a tool like Already.dev completely changes how you approach market validation. You can quickly run multiple reports for different angles of your idea to see which one has the clearest path to success. We dig into this workflow much deeper in our guide to AI-powered market research.

It’s not about replacing your brain; it’s about giving it better, faster data to work with. Automation doesn’t make the decisions for you, but it removes all the friction standing between you and a smart, informed decision. It's the difference between guessing where your competitors are and knowing exactly where they are, what they're doing, and where their customers are unhappy.

Your Competitor Research Questions Answered

Alright, you've been digging through app stores, decoding job listings, and maybe you've gotten a little too invested in some obscure Reddit threads. Now you're probably left with a few nagging questions. Let's clear up some of the common things that trip people up.

Think of this as the quick-fire round to tackle the practical stuff and get you unstuck.

How Often Should I Look For New Competitors?

Think of it like checking your mirrors while driving. You need one massive, deep-dive analysis at the very beginning—before you write a single line of code or spend a dollar on marketing. After that, it’s all about quick, regular glances to make sure no one is sneaking up on you in the fast lane.

A thorough check-in every quarter is a pretty smart move. Markets can change in a heartbeat. New players pop up out of nowhere, and old ones pivot to entirely new strategies. Honestly, staying on top of this manually can be a real drag.

This is where an automated tool can make these check-ins painless.

- Initial Deep Dive: A comprehensive, multi-day effort before you launch. Go all in.

- Quarterly Check-in: A quick review to spot new entrants or major strategy shifts from your rivals.

- Annual Review: A more in-depth look to re-evaluate who your top 3-5 rivals really are now.

What If I Can't Find Any Direct Competitors?

First, enjoy that feeling. Then, get a little paranoid. No direct competitors usually means one of three things, and only one of them is good news.

You've either:

- Found a truly untapped market. This is the unicorn. It's incredibly rare, but if you've done your homework and this is it, congratulations!

- Used the wrong search terms. This is the most common reason. You're too focused on your solution and not the problem people are trying to solve. Think about how a frustrated customer would describe their pain point on Google, not how you'd describe your product features.

- Discovered there's no market for it. This is the tough one to swallow. A lack of competition can be a massive red flag that others have tried and failed because nobody was willing to pay. If this might be the case, your next step is to go talk to potential customers immediately.

> A complete lack of competitors isn't always a good sign. It can often mean there isn't a paying market for the problem you think you're solving. Validation from real customers becomes your top priority.

Is It A Bad Sign If There Are Lots Of Competitors?

Not at all! In fact, a crowded market is often a fantastic sign. It's validation that people are actively spending money to solve the exact problem you're tackling. Your job isn't to be the only option; it's to be a better or different one.

A field full of competitors gives you a ton of free data. You can see what their customers complain about in online reviews, find feature gaps they've all ignored, or spot a niche audience they aren't serving well. It’s much easier to grab a slice of an existing, proven pie than it is to convince the world to try a type of pie they've never even heard of.

This constant discovery is non-negotiable, especially with global rivalries heating up. With 86% of employers expecting AI to reshape entire sectors, manual scans of directories and forums can miss up to 60% of threats that pop up in niche communities or from global shifts. You can find more insights about these forces reshaping global business on BCG.com.

Using powerful tools like Ahrefs or Semrush can definitely help, but they can be expensive. For a more focused and affordable alternative, a tool like Already.dev automates this entire process, ensuring you don't get blindsided.

Finding and analyzing your competitors is a continuous process, not a one-and-done task. Let Already.dev handle the heavy lifting. Our AI agents can do in minutes what used to take days of manual research, giving you a clear, actionable map of your competitive landscape so you can build with confidence. Try it today at https://already.dev.