How to Do Competitive Research Without Going Insane

Learn how to do competitive research without the spreadsheets and headaches. This guide shows you how to find competitor weaknesses and win your market.

Competitive research is a fancy way of saying you need to figure out who your rivals are, what they're selling (and how), and where you can find an edge to beat them. Honestly, it’s all about asking the right questions before you sink your time and money into a new project. A little homework up front is often the difference between a smart launch and a seriously expensive flop.

Why 'Spying' on Competitors Is Your Smartest First Move

Let's cut through the corporate-speak for a minute. "Competitive research" sounds like you need a team of analysts and a six-figure budget. But really, it’s just about figuring out if your brilliant idea is actually brilliant, or if ten other companies are already doing it better.

Think of it as the ultimate pre-flight check. You wouldn't launch a rocket without making sure all the parts are working, right? So why on earth would you launch a business without checking the market first? A bit of snooping now saves you a world of pain and wasted cash later.

This isn't about creating massive, soul-crushing spreadsheets. It's about getting a feel for the terrain you're about to enter.

The Real Goal of Your First Look

The point isn't to copy your competitors—it's to understand their playbook so you can write a better one. This means you need to avoid the endless rabbit holes of useless data and focus on what truly matters.

You’re basically looking for answers to a few simple but powerful questions:

- Who is already solving this problem? You have to know who's in the ring with you.

- How are they solving it? This shows you what the market currently expects and accepts.

- What are they getting wrong? Every customer complaint, bad review, and missing feature is a golden opportunity.

- How do they talk about their solution? Their marketing language tells you exactly who they think their customer is.

This isn't some "nice to have" exercise; it's statistically tied to whether a new product survives. Research from firms like Deloitte has shown that around 72% of new consumer products fail to achieve their revenue targets, often because the team misjudged what competitors were offering and what customers really wanted.

It's no surprise the market research industry's projected growth is set to hit $140 billion in 2024. More and more companies understand how critical this process has become, and you can learn more about how companies use market research to stay ahead.

Your Pre-Research Sanity Check

Before you start digging, it helps to have a clear idea of what you're looking for. A quick sanity check like this prevents you from getting lost in data and keeps your research focused and actionable.

| Question to Answer | Why It Matters | A Simple Way to Find Out | | :--- | :--- | :--- | | What problem am I really trying to solve? | Defines your core value. If you can't state it simply, you're not ready. | Write it down in one sentence. Ask three friends if it makes sense. | | Who is my ideal customer? | Guides everything from product features to marketing copy. | Create a simple one-paragraph persona. Who are they? What do they do? | | What are my "must-have" product features? | Sets the baseline for what your MVP needs to be competitive. | List the top 3-5 features your product can't launch without. | | What does "success" look like in 6 months? | Gives you a tangible goal to work towards (e.g., 100 users, $10k revenue). | Set one key metric. Just one. This keeps you focused. |

Answering these questions first will give your research a clear purpose and make the entire process much more effective.

Keeping It Simple and Actionable

The biggest mistake people make is overcomplicating things. They try to analyze every single competitor on 50 different data points and quickly drown in the noise.

> Don't aim for a perfect, all-encompassing report. Aim for one or two "aha!" moments that give your strategy a clear direction. That's the real win.

The goal is to move from guesswork to informed decisions. Are your competitors targeting small businesses or enterprise clients? Is their pricing cheap and cheerful or premium and exclusive? Each detail is a clue that helps you find your unique spot in the market.

Powerful tools like Ahrefs or Semrush can help you dig into the nitty-gritty details, but they can be expensive. For a more automated and accessible approach, platforms like Already.dev can do the heavy lifting, delivering key insights without the steep learning curve.

Ultimately, this initial phase is your foundation. It's all about finding the gaps your competitors have left wide open so you can build something that truly stands out.

Finding Your Real Rivals—Not Just the Obvious Ones

You probably think you know who you're up against. It's that one company with the similar logo, the one whose ads follow you around the internet. Easy, right? But here’s the thing: you’re likely only seeing half the picture, and the other half is where the real danger lurks.

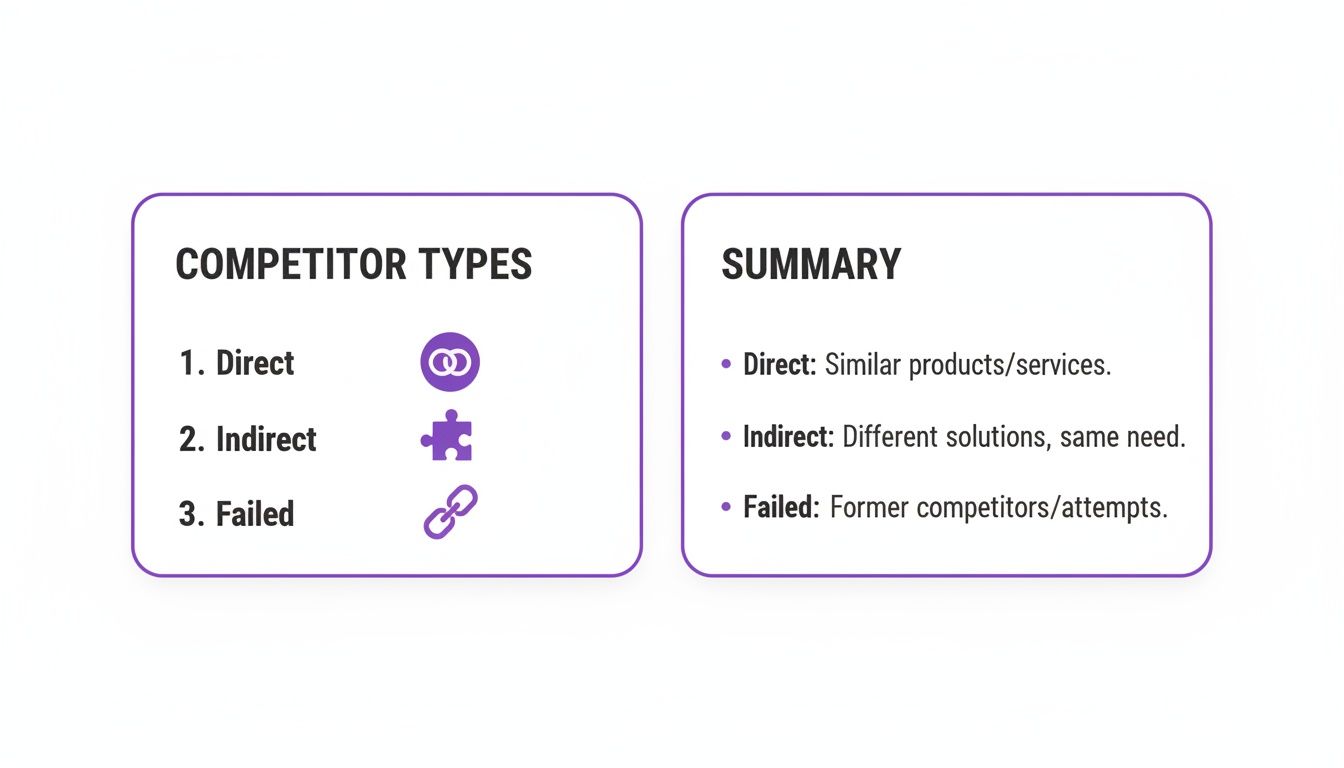

It's simple enough to spot the direct rivals—the ones selling a near-identical widget to yours. The tricky part is uncovering your indirect competitors. They solve the exact same customer problem you do, just in a totally different way.

Think of it like this: if you run a pizza place, your direct competitor is another pizza place. But your indirect competitors? They're the taco truck down the street, the grocery store selling frozen dinners, and that meal-prep delivery service everyone's talking about. They all solve the "what's for dinner?" problem. Ignoring them is like walking into a boxing ring blindfolded; you'll get knocked out by a punch you never even saw coming.

Going Beyond a Simple Google Search

So, how do you find these hidden rivals? You have to get scrappy. Forget the expensive corporate databases for a minute. The real intelligence is usually hiding in plain sight, right where your actual customers are hanging out.

You need to become a bit of a digital detective. The goal is to map out the entire competitive landscape, not just the usual suspects. If you want a full playbook on this, our guide on how to find your competitors is a great place to dig in.

Here are a few unconventional places to start your hunt:

- Reddit Threads and Niche Forums: Dive into subreddits where your ideal customers complain about their problems (think r/saas or r/smallbusiness). What tools are they mentioning? What are they hacking together with spreadsheets? That’s where your real competition often lies.

- App Store Reviews: Look up your direct competitors on the app stores and go straight to the one-star reviews. What other apps are those frustrated users threatening to switch to? Boom, you've just found a new list of competitors.

- "Alternatives to" Articles: Just search for "[Your Competitor] alternatives." These listicles are absolute gold mines. Beyond the big names, exploring articles that are specifically identifying competitors' alternatives to established platforms can reveal a much wider field of both direct and indirect rivals you hadn't considered.

Using Review Sites to Map the Market

Review platforms like G2, Capterra, and Trustpilot are treasure troves. They literally categorize software and services for you, handing you a market map on a silver platter. You can instantly see who the big players are, who the up-and-comers are, and how they all stack up based on real, unfiltered user feedback.

For instance, a quick search on G2 for a crowded space like "project management software" gives you an immediate visual of the entire market.

This grid doesn't just give you a list of names. It shows you who users are genuinely happy with versus who just has a massive market presence. That gap between presence and satisfaction? That's often where the best opportunities are hiding.

> The explosion of e-commerce has made competitive blind spots incredibly expensive. According to UNCTAD, global business e-commerce sales shot up nearly 60% from 2016 to 2022, hitting about $27 trillion. In markets this huge and fast-moving, a missed competitor isn't a small oversight—it can mean you accidentally enter a saturated niche or price yourself against the wrong benchmark entirely.

Learning from the Dead

Don't just look for successful companies. You need to hunt for the failed ones, too. Startup graveyards like Failory or the post-mortems on CB Insights are basically free business school classes.

Why did they go under? Did they burn through their cash? Build something nobody wanted? Was the market just not ready? Their mistakes are incredibly valuable lessons you don't have to pay to learn. Sometimes, finding out that three other companies have already tried and failed at your exact idea is the most important discovery you can make.

Uncovering this full spectrum of rivals—direct, indirect, and even the ghosts of competitors past—is the bedrock of any solid research strategy. Sure, expensive tools like Ahrefs and Semrush can help you analyze their online footprint, but they can't replace the initial legwork of truly understanding the landscape. An automated platform like Already.dev can do this detective work for you, scanning hundreds of sources to build a complete map in minutes. The goal is simple: avoid walking blindly into a crowded arena.

Tearing Down Your Competitors (In a spreadsheet, not real life)

Alright, you’ve got your list of rivals. Time for the fun part: putting on your detective hat and taking their whole operation apart, piece by piece.

This isn’t about becoming a copycat. It's about reverse-engineering their business so you can find your own unique, undeniable advantage. We're going to focus on the three areas that tell you almost everything: their features, their pricing, and their message.

Think of it as getting a peek at their playbook before the big game. You're not stealing their plays—you're learning them so you can anticipate their moves and run circles around them.

To get started, it helps to keep a clear picture of the different kinds of competitors you're up against, from the direct rivals to the indirect threats and even the ones who've already failed.

Each type of competitor tells a different story and reveals different weaknesses and opportunities in the market. Keeping this spectrum in mind helps you see the full picture.

Mapping Out Their Features

Instead of just making a giant, overwhelming list of every single feature a competitor has, let's do something way more useful: map them out. This is a game-changer for spotting who's over-serving a niche and who's leaving customers high and dry.

Grab a spreadsheet or even just a piece of paper. List your top 3-5 competitors across the top. Down the side, list the core features or "jobs-to-be-done" that actually matter to your target customer. Now, just put a checkmark in the box if a competitor offers that feature.

Suddenly, patterns just jump off the page.

- Competitor A has a million features, but do customers really use them all? Maybe their product is just bloated and confusing.

- Competitor B is missing a key feature that customers are constantly begging for on Reddit. That’s a gap you can drive a truck through.

- Competitor C only does one thing, but they do it perfectly. That's a huge clue that there’s a solid market for a specialized tool.

This isn’t about matching them feature-for-feature. It’s about understanding their product philosophy. Are they a Swiss Army knife or a scalpel? Knowing the answer helps you figure out where to position yourself.

Decoding Their Pricing Strategy

Pricing is never just a number; it’s a story. How a company charges for its product tells you exactly who they think their ideal customer is and what that customer values most.

Don’t just glance at the price tag. You need to dig into their pricing model:

- Subscription (SaaS): They’re betting on long-term relationships and predictable revenue. This is the standard for most software, but look at the tiers. What features do they hold back to force an upgrade? That’s what they consider their most valuable stuff.

- One-Time Fee: Common for things like software licenses or digital downloads. It usually targets customers who hate recurring bills, but it might also signal an older, less agile business model.

- Usage-Based / Metered: This is perfect for services where value is tied directly to consumption, like cloud storage or API calls. It tells you they’re targeting users who want to start small and scale up without a big upfront commitment.

- Freemium: They’re playing the volume game, hoping to convert a small percentage of free users into paying customers. Here, the real product isn't just the software; it's the onboarding experience that convinces people to finally pull out their wallets.

> The pricing page is one of the most honest pages on any company's website. It’s where they’re forced to declare what they believe is truly valuable and who they’re willing to leave behind.

Dissecting Their Marketing Message

Finally, let's break down the story they're telling the world. Their positioning and marketing language reveal who they want to be and, more importantly, how they want customers to feel.

Just go to their homepage. What’s the first thing you read?

Is the big promise about saving money? Saving time? Being more creative? That headline is their core value proposition, right out in the open.

Now, compare that promise to what real customers are saying in reviews on sites like G2 or Capterra. Does reality match the marketing hype? If a company claims to have "world-class support" but all their reviews complain about 24-hour response times, you've found a major weakness to exploit.

A great way to organize all this is with a simple teardown grid. This helps you compare everyone at a glance and really zero in on your unique angle.

Quick Competitor Teardown Grid

A simple comparison of key strategic elements across competitors can instantly reveal market gaps and opportunities.

| Competitor | Core Feature Set | Pricing Model | Target Audience (as stated) | Your Unique Angle | | :--- | :--- | :--- | :--- | :--- | | RivalCorp | All-in-one platform, 50+ features | Tiered Subscription | "Enterprise teams" | Too complex and expensive for startups. | | NicheTool | Does one thing perfectly (e.g., reporting) | Usage-Based | "Data analysts" | Doesn't solve the full workflow for a team. | | FreebieApp | Basic features, ad-supported | Freemium | "Hobbyists, students" | Not powerful enough for professional use. |

Laying it all out like this makes your path forward much clearer.

Performing this kind of teardown doesn’t have to take weeks. While big-name tools like Ahrefs and Semrush are incredibly powerful, they can also be really expensive. For a faster, more focused approach, a tool like Already.dev can automate much of this analysis, pulling feature, pricing, and positioning data into an easy-to-read report in minutes.

The point is to understand their playbook so you can write a better one.

Uncovering Their SEO Strategy and Customer Language

Want a shortcut to reading your customers' minds? Stop guessing and start looking at what your competitors are ranking for on Google. Seriously. Their entire SEO strategy is a treasure map leading directly to what your audience is searching for, in the exact words they use.

This is your crash course in ethical SEO spying. We're going to figure out which keywords are sending a flood of traffic to your rivals and, more importantly, what those keywords tell you about why people are searching. Are they looking for a "cheap alternative," or are they hunting for a "premium enterprise solution"? The answers are all in the data.

Finding the Keywords That Matter

First things first: we need to find the search terms that are actually making your competitors money.

When a rival pours resources into ranking for a specific phrase, it’s a massive signal that the phrase converts. They’ve already spent the time and money figuring this out for you. Your job is to learn from it.

This process is often called a keyword gap analysis, and it used to be a huge pain. But it's absolutely essential. It shows you the valuable search terms they rank for that you're completely missing. Performing a thorough website competitive analysis focused on these keyword gaps is one of the fastest ways to find strategic content opportunities.

Think of it this way: if your competitor ranks #1 for "best project management tool for small teams," you know that's a high-intent phrase worth fighting for. But if they're ignoring "how to create a project timeline in excel," that could be an underserved niche you can swoop in and own.

The Expensive Tools vs. The Smart Tools

So, how do you actually get this data? The old-school way involves big, powerful SEO platforms.

- Ahrefs and Semrush: These are the industry giants. They can give you incredibly detailed reports on everything from keyword rankings to backlink profiles. The downside? They’re really expensive, often costing hundreds of dollars per month, which is tough to justify for a new project.

- Already.dev: This is the smarter, more automated approach. Instead of you manually digging through data, an AI agent does the work for you. It identifies your competitors' top keywords, analyzes the customer language they're using, and delivers a clear, actionable report in minutes, not hours.

While the big tools are great, they often require a ton of expertise to interpret. An automated platform gives you the insights without the headache.

> Your competitors' top-ranking content isn't just a list of keywords; it's a focus group in disguise. It reveals the exact pain points, questions, and desires of your target audience, straight from the source.

From Keywords to Customer Intent

Okay, you have a list of keywords. Now what? The real magic is translating those phrases into an understanding of what the customer actually wants. This is where you put your detective hat back on.

Let's break down what different types of keywords might tell you about a searcher's mindset:

| Keyword Type | What It Reveals About the Customer | Example Phrase | | :--- | :--- | :--- | | Problem-Aware | They know they have a problem but aren't sure of the solution. They're deep in research mode. | "how to track team tasks" | | Solution-Aware | They know what kind of tool they need and are now comparing options. This is a high-value searcher. | "best task management software" | | Brand-Aware | They're specifically looking for your competitor, likely ready to buy or compare you directly. | "monday.com pricing" | | Feature-Specific | They have a very specific need and are looking for a tool that solves it perfectly. | "software with gantt charts" |

Understanding this intent is crucial. It tells you precisely what kind of content to create to intercept these users at just the right moment. To effectively monitor competitor performance and identify these opportunities, some teams use robust tools like enterprise rank tracking software to keep a constant pulse on the market.

By analyzing the language your competitors use to attract these different searchers, you can stop guessing what your customers want to hear and start speaking their language. It's the most direct path to creating messaging that connects and content that converts.

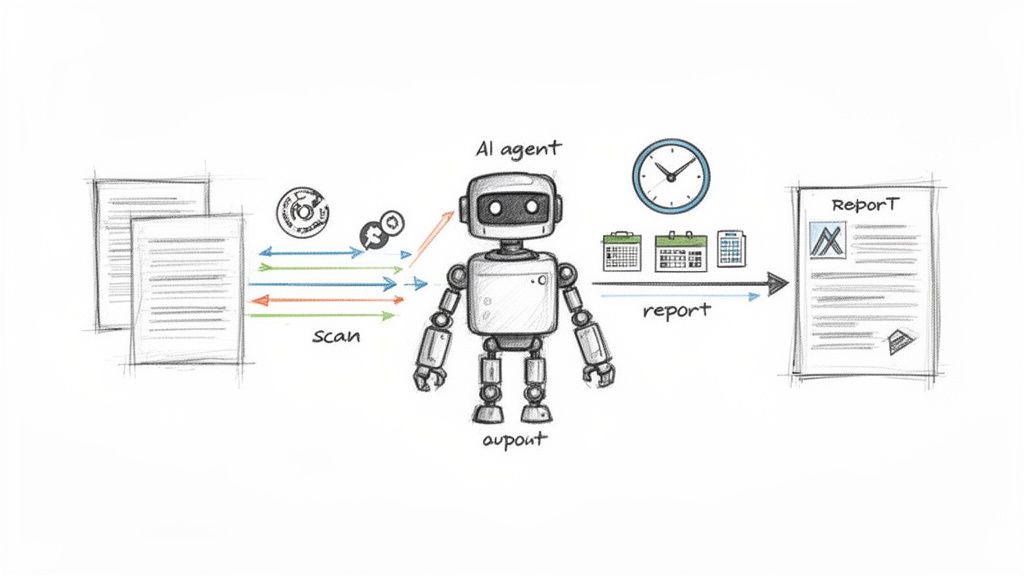

How to Automate the Grind with AI

Let’s be real for a second. Everything we've covered so far sounds like a metric ton of manual, mind-numbing work. Because it is. The old-school way of doing competitive research means weeks of clicking, copying, and pasting into spreadsheets until your eyes glaze over and you forget what you were even looking for.

It's a necessary evil, but what if it didn't have to be evil at all?

This is where we talk about the modern, smarter way to get this done. Forget the spreadsheet grind. We’re going to show you how AI completely changes the game, turning a month-long headache into a 10-minute coffee break.

The Old Way vs. The AI Way

Traditionally, competitive research was this huge, expensive project. You’d either lose a few weeks of your life doing it yourself or pay a consultant a small fortune to do it for you. It was slow, painful, and by the time you got the report, the market had probably already shifted.

The AI-powered approach is just fundamentally different. Instead of you hunting for data, automated agents do the crawling, analysis, and summarizing for you. You just describe your idea or your company in plain English, and the AI builds a research plan, scans hundreds of sources, and delivers an actionable report in minutes.

> This shift from slow, one-off projects to continuous, AI-driven workflows is happening fast. Team leaders point to budget constraints (42%) and the slow speed to insights (40%) as their biggest research challenges. An AI workflow that returns results in four minutes represents a >99% reduction in cycle time compared to a 40-hour manual analysis.

This frees you up to do what you’re actually good at: thinking about strategy, not drowning in data entry.

How Automated Agents Do the Dirty Work

So, how does this actually work under the hood? Platforms like Already.dev use AI agents that act like a team of tireless research assistants. You give them a mission—say, "find all competitors for a new AI-powered grammar checker"—and they get to work.

They don't just scrape the first page of Google. These agents dig through:

- Startup Directories: Sites like Product Hunt and Crunchbase to find the new kids on the block.

- App Stores: To see what mobile-first solutions are out there.

- Niche Communities: Reddit threads and forums where your potential customers are complaining about existing tools.

- Review Sites: G2 and Capterra to understand customer sentiment and glaring feature gaps.

Instead of you spending hours on each of these platforms, the AI does it all at once. It identifies direct rivals, indirect threats, and even failed companies, then neatly organizes them by features, pricing, and market positioning. This isn't just a simple data dump; it's a synthesized report that gives you the lay of the land, fast.

Time, Cost, and Sanity: The Real Benefits

The difference between doing this manually and letting AI handle it is staggering. Let's break it down.

| Aspect | Manual Research | AI-Powered Research | | :--- | :--- | :--- | | Time | 30-50 hours of work | 5-10 minutes | | Cost | Hundreds in tool subscriptions, thousands for a consultant | Low-cost, flexible plans | | Depth | Limited by your own patience and time | Scans hundreds of sources you'd never find | | Sanity | Often leads to burnout and analysis paralysis | Frees you to focus on strategy and action |

While powerful tools like Ahrefs or Semrush can uncover a ton of data, they can be incredibly expensive and still require you to do all the heavy lifting yourself. An AI platform like Already.dev is built to deliver the insights directly, saving you both time and money. Our guide on AI-powered market research digs deeper into how these automated workflows can give you a massive competitive edge.

Ultimately, using AI for competitive research isn't just about speed. It’s about getting a more complete, unbiased view of the market so you can build with confidence, not guesswork.

Got Questions? Let's Talk Competitive Research

You’ve made it this far, which means you’re probably neck-deep in tabs, spreadsheets, and maybe a little bit of that "what have I gotten myself into?" feeling. Don't worry, that’s a totally normal part of the process. As you start digging into what everyone else is doing, a bunch of questions always pop up.

Let's get you some quick, no-fluff answers to the most common hurdles you'll face.

How Often Should I Actually Do This?

Think of competitive research like a regular health check-up, not a one-time, major surgery. You absolutely need to do a deep, comprehensive dive before any big product launch or a major shift in your business strategy. That’s non-negotiable.

But after that initial plunge? A quick "maintenance" check every quarter is a great habit to get into. Markets move fast. New players can pop up out of nowhere, and your rivals are definitely tweaking their strategies. Staying on top of things doesn't have to become a full-time job.

This is where automated tools can be a lifesaver. A quick scan can alert you if a new competitor has hit the scene or if an old one just dramatically changed their pricing. It's about staying ahead of the curve without letting the research consume your life.

What If Someone Already Built My Exact Idea?

First, take a deep breath. Seriously. This is actually good news—it proves there's a real market for the problem you want to solve. Congratulations, you just got free validation that people might actually pay for a solution.

The goal isn't always to be the first. It's to be better for a specific group of people. Your mission has just been clarified. Now, your job is to find your competitor’s weak spots and exploit them mercilessly (in a friendly, business-like way, of course).

- Is their pricing model a confusing mess?

- Is their product a total pain to actually use?

- Are they completely ignoring a certain type of customer?

Your idea isn't dead. It just got a new, more focused mission: find the gap they left wide open and build your castle right there.

Is It Shady To Sign Up for a Competitor's Free Trial?

Not in the slightest. It's not just okay; it's standard operating procedure and one of the best ways to get a firsthand feel for their user experience. You're not trying to steal their code—you're there to learn from their customer journey.

Just be honest and use your real information. There’s nothing to hide. Your goal is to see what they do well and where they completely drop the ball. Pay close attention to what feels smooth and what feels clunky. Every point of friction you find in their product is a potential strength for yours.

What's the Biggest Mistake People Make?

Getting completely stuck in "analysis paralysis." It’s a classic trap. I’ve seen people create these massive, beautiful, color-coded spreadsheets with every data point imaginable… and then never actually make a decision.

> The goal of research isn't to create a perfect, all-knowing report. It's to find one or two key insights that give you enough confidence to make your next move. Just get enough information to be directionally right, then get back to building.

Don’t let the quest for perfect data stop you from making good progress.

Feeling the grind of manual competitive research? Already.dev uses AI agents to automate the whole shebang, giving you deep insights on competitor features, pricing, and strategy in minutes, not weeks. Stop guessing and start building with confidence. See how it works at https://already.dev.