How to Find Competitor Websites Without Losing Your Mind

Tired of endless searching? Learn how to find competitor websites with smart techniques that go beyond page one and give you a real, actionable edge.

Figuring out how to find competitor websites usually starts with a quick Google search for your main keyword. But let's be honest, that’s barely scratching the surface. It's like trying to understand an entire ocean by just looking at a single wave.

The competitors who can really sneak up on you—the ones who can steal your lunch—are almost never that obvious.

Stop Guessing and Start Finding Real Competitors

Most of what passes for "competitor research" is just typing a keyword into Google and calling it a day. That’s not a strategy. It's a shot in the dark, and it’s a terrible way to map out who you're actually up against. This approach only shows you who has the best SEO for a single term, not who’s truly solving the same problems for your customers.

I've seen too many startups fail because they thought their only rivals were the names on Google's front page. They get completely blindsided by a new app, a different type of solution from another industry, or a scrappy newcomer who hasn't even started ranking yet.

Why Surface-Level Searches Fail You

Simply Googling your main service misses the whole point. Before you even start looking for websites, you need a crystal-clear picture of your own market. The best way to do this is to identify your target audience, including competitors first. That crucial first step frames everything else.

Once you know who you're serving, you'll realize your true competitive landscape is way bigger than a single search results page. It includes players you'd never find that way:

- Indirect Competitors: These guys solve the same core problem you do, but with a completely different tool. Think of a project management app competing with a mix of Google Sheets and Slack. They aren't direct substitutes, but they’re absolutely fighting for the same customer budget.

- Aspirational Competitors: These are the big dogs, the market leaders you admire. You might not be going head-to-head with them today, but their strategy, pricing, and features are a goldmine. They show you what works at scale.

- Up-and-Comers: These are the hungry startups lurking on Product Hunt, in niche subreddits, or fresh out of an accelerator program. They have zero SEO juice but might be sitting on a brilliant solution that's about to catch fire.

> The goal is to reframe your mindset. You're not just 'finding websites'—you're mapping your entire competitive ecosystem. A simple list is useless; a categorized map of your rivals is a strategic weapon.

Sure, powerful tools like Ahrefs or Semrush can uncover some of these players, but they can be expensive. More focused and affordable alternatives like Already.dev can automate this discovery, digging through hundreds of different sources to give you the complete picture without the enterprise-level cost.

This guide is all about giving you the practical, no-fluff methods to find the rivals that actually matter.

Master Advanced Search Like a Digital Detective

Alright, it's time to stop using Google like a beginner. Just typing in your main keyword is like fishing with a single worm on a hook. We're about to show you how to use a giant net. This is all about mastering Google Search Operators—think of them as secret commands that tell Google exactly what you want.

Instead of just seeing the usual suspects at the top of page one, you can become a digital detective. You'll start finding those hidden competitors lurking on page 10 that your rivals have completely missed. These simple text commands turn a basic search into a precision tool.

Uncover Look-Alike Competitors with related:

The easiest and often most mind-blowing operator is related:. It's almost too simple. You just plug in the website of a known competitor, and Google serves up a list of sites it considers similar. It's like asking Google, "Hey, who else is in this club?"

Let's say you run a project management SaaS and you know Asana is a big player. You'd search:

related:asana.com

Instantly, you get a list of direct competitors like Monday.com, Trello, and maybe some niche players you’ve never even heard of. No joke, this single command can build out 50% of your initial competitor list in about five seconds.

> Forget what you think you know about your market for a second. The related: operator reveals who Google's algorithm thinks your competitors are, which is often more important than who you think they are. It’s a completely unbiased look at your digital neighborhood.

Hunt for Competitors by Feature or Niche

This is where you can get really clever. By combining operators, you can create "recipes" that dig up specific types of rivals. Let's imagine you're launching an e-commerce store that sells sustainable, eco-friendly pet toys.

You could hunt for other blogs writing about this topic to find competitors who are big on content. Try this search:

"sustainable pet toys" inurl:blog

This tells Google to only show results that have the exact phrase "sustainable pet toys" in them and have the word "blog" in the URL. Suddenly, you're not just seeing product pages; you're seeing who is actively trying to capture an audience with content marketing.

This approach helps you find competitors based on their strategy, not just their product listings. It’s a powerful way to understand how to find competitor websites that are playing the long game with SEO.

To help you get started, here's a quick cheat sheet with some of the most useful operators for this kind of detective work.

Google Search Operator Cheat Sheet for Finding Competitors

This quick-reference table has some powerful search operators and shows you how to use them to uncover hidden competitor websites.

| Operator | What It Does | Example Usage |

| :--- | :--- | :--- |

| "keyword phrase" | Finds the exact phrase. | "crm for small business" |

| site: | Limits the search to a specific website. | "integrations" site:hubspot.com |

| inurl: | Finds a keyword within the URL. | "case studies" inurl:blog |

| intitle: | Finds a keyword in the page title. | intitle:"project management tips" |

| filetype: | Searches for a specific file type. | "market research report" filetype:pdf |

| - (minus sign) | Excludes a word from the search. | "email marketing tool" -mailchimp |

Don't be afraid to mix and match these! For example, intitle:"competitor analysis" -site:yourdomain.com filetype:pdf is a great way to find competitor reports you can learn from.

While these manual searches are incredibly effective, they can get tedious if you're digging deep. Big SEO suites like Ahrefs or Semrush can automate some of this, but they can be expensive.

For a more focused and affordable approach, a tool like Already.dev can run these kinds of deep-dive searches for you across hundreds of different sources. It's a massive time-saver, delivering a full report in just a few minutes.

Look Beyond Google Where Your Competitors Actually Hang Out

Thinking all your competitors are duking it out on Google's front page is a classic rookie mistake. A huge chunk of the action happens in specialized ecosystems where your customers are already shopping, complaining, and actively searching for solutions. This is your treasure map to those hidden hunting grounds.

Relying solely on search engines creates massive blind spots. There’s a reason competitive analysis tools have exploded in popularity. The audience analytics market was valued at $1,722.0 million and is on track to nearly double by 2030. That growth is fueled by one simple fact: a standard Google search misses the rivals thriving on other platforms. You can dive deeper into the competitive intelligence market with this detailed market analysis.

Dig into Digital Storefronts and Directories

If you sell software, an app, or even a physical product, your competitors are living on platforms built for discovery. These places are absolute goldmines because the people there have high purchase intent. They aren’t just browsing; they’re ready to pull out their wallets.

Start your search in these key areas:

- Software Directories: Sites like G2, Capterra, and TrustRadius are the battlegrounds for SaaS companies. Search for your category (e.g., "social media scheduling") and see who pops up. The "alternatives to" sections are basically a pre-made competitor list handed to you on a silver platter.

- App Stores: For any mobile app, the App Store and Google Play are ground zero. Search for your core function and see who has the most downloads and best reviews. The "You might also like" suggestions are a gift from the algorithm.

- Marketplaces: Selling a physical product? Your rivals are all over Amazon, Etsy, and eBay. Look at who's ranking for your product type and, just as importantly, who's paying for sponsored ads to get in front of customers.

This isn't just about finding names; it's about understanding how they position themselves where it truly matters. For more on this, check out our guide on what is competitive intelligence.

> Your real competitors are wherever your target customers go to solve their problems. If that place is a subreddit and not Google, then you need to be snooping around Reddit.

Eavesdrop in Online Communities

Online communities are where you find the raw, unfiltered truth. People aren't trying to rank on Google here; they're just trying to solve a problem, and they complain loudly about solutions that fail them. This is where you find out what people really think.

- Reddit: Find subreddits related to your industry (think r/smallbusiness or r/podcasting). Search for phrases like "any tool for," "how do you handle," or "alternatives to [a known competitor]." You'll find direct competitors and, more importantly, discover the exact pain points your audience is struggling with.

- Product Hunt: This is the launchpad for new tech products. Scour its history for products in your category. You’ll find brand-new startups and even see which ones failed to gain traction—ghosts that have valuable lessons to teach you.

The big SEO tools like Ahrefs or Semrush are great, but they are expensive and often miss these niche community discussions entirely. A more focused tool like Already.dev automates this process, scanning these exact kinds of sources to give you a complete picture without the manual grunt work or the hefty subscription fee.

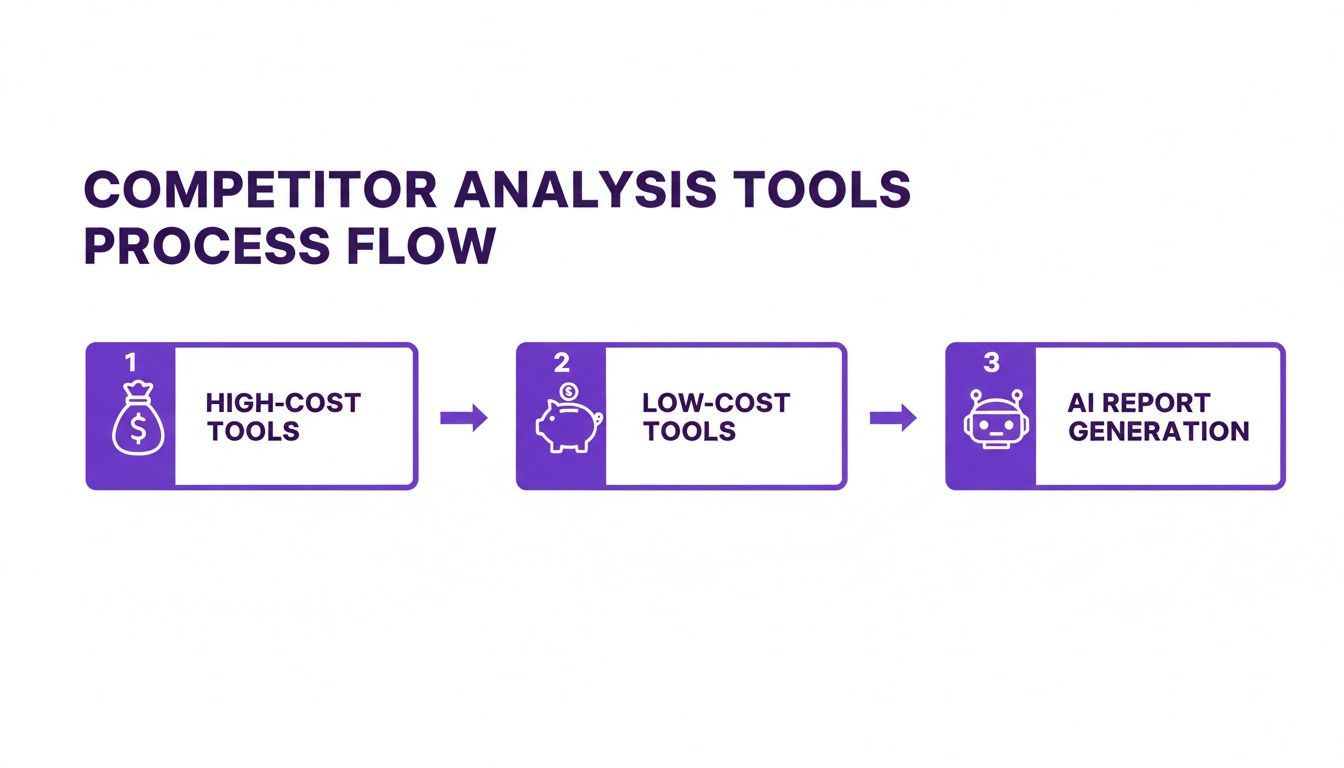

Use Pro Tools Without Breaking the Bank

Okay, let's be real. All that manual searching is great, but eventually, you need to bring in the heavy machinery. I’m talking about professional SEO and competitive intelligence tools.

The big players like Ahrefs and Semrush are the gold standard for a reason. They're like giving yourself x-ray vision, letting you see every keyword a competitor ranks for and every single website linking to them. It's powerful stuff.

But—and it's a big but—they can be expensive, costing a small fortune. Dropping hundreds of dollars every month just isn't realistic for everyone, especially when you're just starting out. Here’s a little secret, though: you don't actually need their entire, sprawling feature set to get the most valuable insights.

Focus on Keyword and Backlink Gaps

If you only learn two terms from this guide, make them keyword gap and backlink gap. These are the two most powerful, high-impact analyses you can run, and they're simpler than they sound.

- Keyword Gap: This is a list of all the keywords your competitors rank for, but you don't. Think of it as a pre-made roadmap showing you exactly where you're missing out on traffic.

- Backlink Gap: This finds all the websites that link to your competitors but not to you. It's basically a personalized outreach list of potential partners and PR targets.

Honestly, running these two analyses can build about 80% of a killer SEO and content strategy. You’re letting your competitors do the hard work of figuring out what resonates with your audience. All you have to do is swoop in and fill the gaps they’ve revealed.

> The goal isn't just to find more competitors; it's to find the strategic cracks in their armor. A keyword gap isn't just a list of words; it's a list of customer problems your rivals are solving that you're completely ignoring.

The web analytics market is set to explode, projected to hit $20.09 billion by 2032, which just shows how critical this kind of data has become. In the past, advisors would spend weeks doing manual scans, only to miss the smaller, niche players that are often the real threat. If you're curious about this trend, you can discover more insights about the web analytics market here.

The Smarter, Cheaper Alternatives

So, how do you get your hands on this game-changing data without taking out a second mortgage? One surprisingly effective (and free) way is to explore social media investigation tools, which can often sniff out brand accounts and indirect competitors you hadn't considered.

For a more focused, automated approach, you can turn to specialized tools. This is exactly where something like Already.dev fits in. Instead of paying for a massive platform with a hundred features you’ll never use, you get a concentrated, AI-powered report that does the heavy lifting for you. It automates the gap analysis and digs through sources that even the big platforms sometimes overlook, giving you the key insights faster and for a fraction of the cost.

If you're weighing your options, our guide on the best competitor analysis tools breaks down the pros and cons of different platforms.

Turn Your Messy List into a Smart Strategy

So, you've done the digging. You've used the search tricks, snooped around communities, and now you have a giant, chaotic list of websites. Awesome! Except… now what?

A raw list of URLs is about as useful as a phone book with all the names ripped out. This is where the real work begins—turning that messy data into actual strategic intelligence. Without context, your list is just noise. The goal is to transform it into a prioritized map of your competitive landscape, giving you a data-driven plan for how to win.

Sorting the Good, the Bad, and the Aspirational

First things first: stop thinking of them as one big blob of "competitors." They’re not all the same, and they don't all pose the same threat. Let's break them down into a few simple categories.

- Direct Competitors: These are the obvious ones. They do exactly what you do, for the same customers. Think of them as the rival team in the championship game.

- Indirect Competitors: These guys solve the same core problem you do, but in a totally different way. A project management app isn't just competing with other project apps; it's also up against a chaotic mix of spreadsheets, Slack channels, and sticky notes.

- Aspirational Competitors: These are the big players you secretly admire. You might not be directly fighting them for customers today, but their marketing, pricing, and features are a free masterclass in what works at scale.

This simple sorting process immediately brings clarity. You can start to see who you need to watch daily versus who you should just learn from. For a structured way to organize this, grab a good competitive analysis template to keep everything neat and actionable.

Are They Even a Real Threat?

Next, you need to quickly figure out if a company on your list is a real, breathing threat or just a digital ghost. A slick website doesn’t automatically mean a thriving business. You need to look for signs of life.

Check their blog. Has it been updated since 2019? What about their social media—are they actively posting, or is it a wasteland of forgotten corporate announcements? This quick validation step helps you weed out the zombies and focus your energy on the rivals who are actually in the race.

The process has definitely evolved. The old way involved expensive, clunky tools, but today's workflow is much smarter, often leaning on AI to get the job done faster.

The key takeaway here is that deep strategic analysis no longer requires a massive budget. In a global website analytics market valued at $6.5 billion, manual searching is just too slow. It also misses the big picture, like the fact that 61% of users will bounce to a competitor if a site isn't mobile-friendly. Speed and accuracy have become the name of the game.

Common Questions About Finding Competitors

So, you've done the hard work, pulled together a list, and started thinking strategically. But there are always a few questions that pop up along the way. Let's tackle some of the most common ones I hear, so you can keep your competitive research on point.

Think of this less as a one-and-done project and more like building a muscle for market awareness.

How Often Should I Look for New Competitors?

This is definitely not a set-it-and-forget-it task. The market moves way too fast for that. For most businesses, a deep-dive analysis every quarter is a pretty good rhythm. A new startup can go from stealth mode to major player in a matter of months.

That said, you should always have your ear to the ground. The real goal is continuous awareness. Here’s a simple way to stay on top of things without it becoming a huge time-suck:

- Fire up Google Alerts: Set up alerts for your main keywords and the names of your top competitors. You’ll get a heads-up delivered right to your inbox whenever they make a move.

- Schedule quick scans: Block out an hour or two each month to poke around places like Product Hunt, relevant subreddits, and industry forums.

This proactive approach means you’re far less likely to be blindsided by a new player who seemingly came out of nowhere.

What Is the Biggest Mistake People Make?

Tunnel vision. Hands down, the biggest mistake is focusing only on the companies that rank #1 on Google for your main keyword. This creates a massive blind spot, and it's often in that blind spot where your most dangerous rivals are hiding.

When you only look at the usual suspects, you completely miss:

- The scrappy startups getting early buzz on Product Hunt.

- The niche players that are beloved within a specific online community.

- The indirect competitors who solve the same customer problem with a completely different solution.

> True competitive intelligence isn't about confirming the names you already know. It's about uncovering the entire ecosystem, especially the threats you haven’t seen yet.

How Do I Know if a Competitor Is a Real Threat?

Okay, you have a list. Now you need to quickly figure out who’s a genuine threat and who’s just digital noise. A slick website doesn't automatically mean a business is killing it. You need to look for signs of life.

Ask yourself a few simple questions:

- Is their blog fresh? If the last post is from 2021, they probably aren't a top priority.

- Are they active on social media? Consistent, recent posts show they're actually engaging with an audience.

- What does their online footprint look like? A quick search can turn up recent funding announcements, news mentions, or a steady stream of customer reviews.

A company with a beautiful landing page but zero recent activity is likely not an immediate threat. Focus your energy on the ones who are clearly active, growing, and fighting for the same customers you are. While big tools like Ahrefs or Semrush can give you traffic estimates, they can be expensive. A more focused tool like already.dev can often give you the context you need without the hefty price tag.

Ready to stop guessing and start winning? already.dev uses AI to automate the entire competitor discovery process. It crawls hundreds of sources to deliver a comprehensive report in minutes, not weeks, giving you the clarity you need to build a smarter strategy. Find your real competitors at https://already.dev.