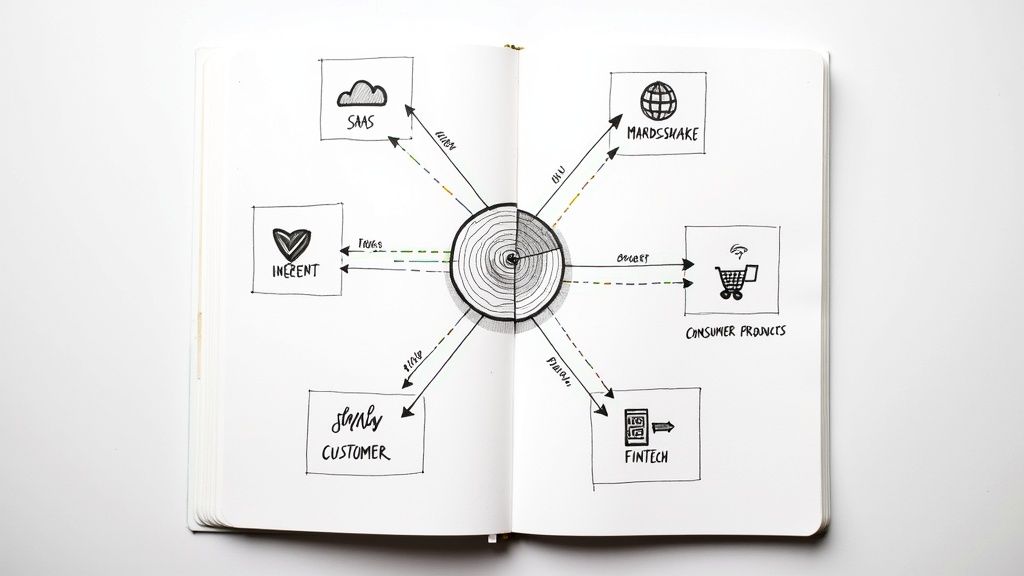

indirect competitors examples: 4 ways they sneakily steal your customers

Discover indirect competitors examples and learn 4 subtle strategies they use to attract your customers, so you can defend your market share.

Got your direct competitors locked in your sights? Cool. You track their every move, maybe even have a secret Slack channel dedicated to roasting their latest feature release. But while you’re busy staring down the obvious rival, a totally different company might be quietly eating your lunch. Welcome to the wacky world of indirect competition, where the real surprise attacks happen.

These aren't the businesses making a knock-off of your product. Nope. They solve the same core customer problem, but with a completely different solution. Think of it like this: if you run a pizza shop, your direct competitor is another pizza shop. Your indirect competitor? The grocery store selling frozen lasagna, the meal-kit delivery service, or even a diet app helping people avoid carbs altogether. They're all fighting for the same "what's for dinner?" budget.

Ignoring these guys is a huge, super-common mistake. They can change what customers expect and make your whole industry look old and busted before you even see them coming. This article is your field guide to spotting these sneaky threats and opportunities. We're diving deep into 7 specific indirect competitors examples, from software to snacks.

For each one, we'll break down:

- The Players: Who they are and what they're slinging.

- The Core Problem: The shared customer headache they both solve.

- Strategic Takeaways: Stuff you can actually use to build a better defense and find new ways to grow.

This isn't just a boring list. It's a new way to think about your market so you can be the one doing the disrupting, not the one getting disrupted. Let's do this.

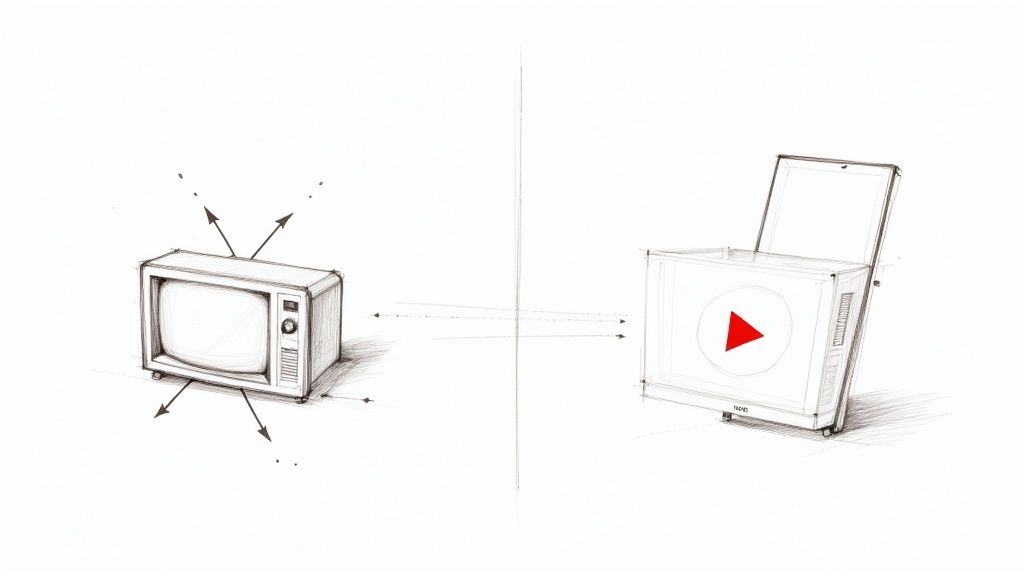

1. Streaming Services vs. Traditional Cable (Entertainment Industry)

The showdown between streaming services and cable is one of the most classic indirect competitors examples ever. At first glance, they seem totally different. Cable gives you a giant bundle of live, scheduled channels for one big monthly bill. Streaming platforms like Netflix and Disney+ give you a library of on-demand stuff for a separate, usually smaller, fee.

But here’s the thing: they are both fighting for the exact same stuff: your time and your entertainment money. When you flop on the couch after a long day, you're not thinking, "Hmm, do I want an on-demand service or a linear broadcast service?" You're thinking, "What should I watch?" That’s the real job to be done, and both are desperate to be the answer.

This fight isn't about features; it’s about a massive shift in how people want to live. Streamers didn't just offer a cheaper product; they offered a totally different, way more convenient way to watch TV. This is a huge lesson: your biggest threat might not be the company that looks just like you.

Strategic Analysis & Tactical Takeaways

The rise of streaming is a masterclass in how to outsmart a giant, sleepy industry by solving the same problem in a better way.

-

Focus on What Annoys People: The cable model was rigid. People were sick of paying for 500 channels they never watched, being stuck in long contracts, and having to record shows like it's 1999. Netflix fixed all of this with its on-demand, no-contract, curated library. Simple.

-

Weaponize Your Business Model: Amazon Prime Video is a killer example. By throwing streaming in with its super popular Prime membership, Amazon turned its TV shows into a powerful glue to keep people hooked on its main shopping business. It's not just about the content; it's about making the whole ecosystem stickier.

> Key Insight: Your indirect competitor might not attack your product's features. They'll attack your business model's weaknesses. The best defense is to figure out the real job your customers are hiring your product to do.

Actionable Tips for Your Business

So, how can you use these lessons?

- Make Your Own "Exclusive Content": For Netflix, it’s original shows. For your SaaS, it could be unique data, exclusive integrations, or workflow templates they can't get anywhere else. Build a "moat" that makes you hard to leave.

- Offer Flexible, Unbundled Pricing: Ditch the one-size-fits-all plan. Use tiered pricing to appeal to different people, just like streamers offer basic, standard, and premium plans. Let people pay only for what they actually need.

- Obsess Over User Experience (UX): Part of the magic of streaming is how easy it is to use. The slick interface, the personalized recommendations—it just works. A clunky UX can send customers running to simpler solutions, even if your product is technically more powerful.

Spotting these quiet competitors is the first step. If you're struggling to figure out who's really after your customers' attention, it helps to map out the entire customer journey. Learning how to identify competitors, both direct and indirect, is a skill that can save your business from getting blindsided.

2. Digital Wallets vs. Credit Card Companies (Financial Services Industry)

The explosion of digital wallets is a perfect example of how tech creates new indirect competitors examples practically overnight. On the surface, Apple Pay and a Visa card do different things. Visa gives you credit and runs a massive payment network. Apple Pay just digitizes the cards you already own. Not direct rivals, right?

Wrong. They are both fighting for the #1 spot in your "wallet," whether it's made of leather or pixels. When you're at the checkout, you're not thinking about payment infrastructure; you're just trying to find the quickest, easiest way to pay. The core job is "buy this thing without a hassle," and both are fighting to be your default choice.

This battle isn't about interest rates; it’s about owning the user interface of shopping. Digital wallets from Apple, Google, and PayPal didn't invent a new way to spend money, but they made the old way faster, safer, and frankly, cooler. This is a critical lesson: you can be disrupted not by a new product, but by a better front-end experience for your own.

Strategic Analysis & Tactical Takeaways

The growth of mobile payments is a brilliant playbook on how to become the essential layer between a customer and a huge, old industry.

-

Focus on What Annoys People: Pulling out a wallet, finding the right card, and swiping is a dance with little annoying steps. Digital wallets got rid of them. Tapping your phone or watch is just a better experience. Giants like Alipay and WeChat Pay in China went even further by building payments right into the social and shopping apps people already used all day.

-

Weaponize Your Business Model: Apple Pay doesn't charge you, but it makes the Apple ecosystem stronger. It’s another reason to buy an iPhone and a powerful tool that gives Apple leverage over the banks who are desperate for their cards to be the default. The service itself isn't the product; locking you into Apple hardware is.

> Key Insight: Your indirect competitor can win by hiding your product. They don't need to replace you if they can become the main way customers interact with you.

Actionable Tips for Your Business

How do you fight back against this kind of "interface" competitor?

- Integrate Seamlessly: If you can’t beat them, join them. For banks, this meant getting on Apple Pay and Google Pay. For your SaaS, this could mean building powerful integrations with the platforms where your users live, like Slack, Microsoft Teams, or HubSpot.

- Be the Most Secure and Trustworthy Option: A key selling point for digital wallets is security (fancy tech, biometrics). Double down on security features and certifications in your own product. Make "trust" a core part of your brand, not just a checkbox.

- Make Onboarding Stupidly Simple: The magic of setting up Apple Pay is how fast it is. How can you make your own sign-up process feel just as easy? Kill every unnecessary step, field, and click. A frictionless start can create a loyal user for life.

Understanding who is competing for your customer's "tap" is crucial. If you're struggling to see these threats, it's worth the time to learn how to identify competitors beyond the obvious players in your space.

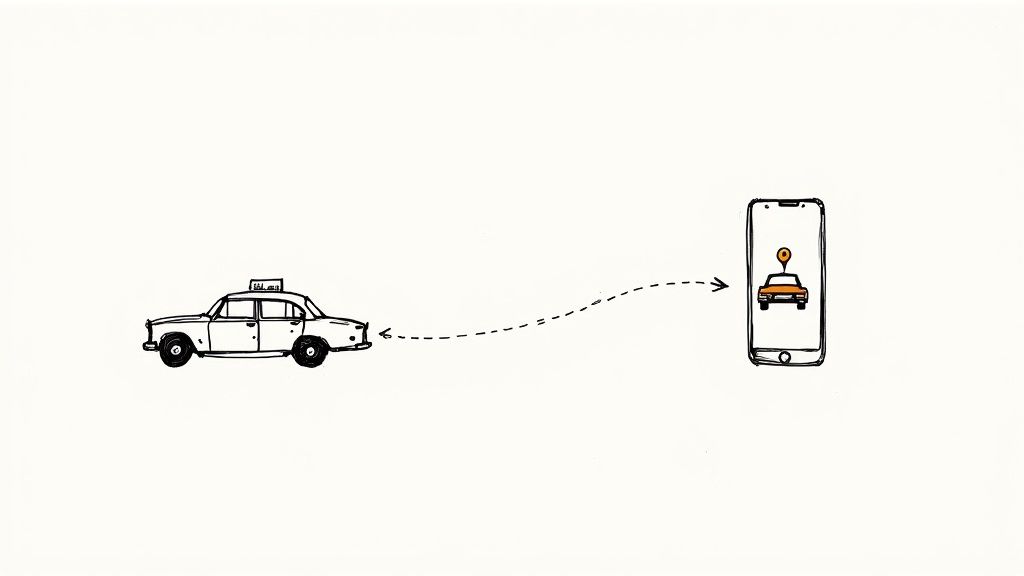

3. Ride-Sharing Services vs. Traditional Taxi Companies (Transportation Industry)

The way ride-sharing apps like Uber and Lyft completely wrecked the taxi industry is a textbook case of how indirect competitors examples can totally redraw a market map. On the surface, they seem like direct competitors—both get you from point A to point B. But their entire models were so different, which is what made the competition indirect at its heart. Taxis had medallions, street hails, and dispatchers. Ride-sharing built a giant two-sided marketplace on a phone app.

The core job was identical: "I need a ride, now." But how they solved it was worlds apart. Taxis were familiar and regulated, but often a huge pain. Ride-sharing platforms like Uber and Grab in Southeast Asia offered on-demand convenience, clear pricing, and a slick digital experience that old-school cabs just couldn't touch.

This wasn't just about a better car; it was about a better system. By using tech, ride-sharing didn't just compete with taxis; it made their whole way of doing business feel like a fossil. The threat wasn't another cab company with a different phone number; it was a tech company that re-imagined the entire experience from the ground up.

Strategic Analysis & Tactical Takeaways

The rise of ride-sharing shows how a better user experience, powered by a different business model, can crush a century-old industry.

-

Solve for Annoyance, Not Just Function: Hailing a cab sucked. You had to find one, you never knew the cost, paying was often a cash-only fumble, and the service was a total crapshoot. Uber and Lyft fixed every single one of those problems with GPS tracking, upfront pricing, cashless payments, and a two-way rating system. They didn't invent the car ride; they perfected everything around it.

-

Leverage Underused Stuff: The taxi model was limited by the number of crazy-expensive medallions. Ride-sharing unlocked a massive new army of drivers by letting anyone with a decent car sign up. This "asset-light" approach let them scale insanely fast, overwhelming the fixed supply of traditional cabs.

> Key Insight: Your biggest advantage might not be your product, but the experience you build around it. Removing customer friction can be more powerful than adding new features.

Actionable Tips for Your Business

How can you apply the lessons from the ride-sharing revolution?

- Map and Destroy Friction: Look at your entire customer journey. Where do people get stuck, confused, or annoyed? A clunky sign-up process, confusing pricing, or terrible customer support are all open doors for a nimble indirect competitor to waltz in with a smoother experience.

- Digitize the Core Experience: The taxi industry was mostly analog. For a concrete example, consider how digital tools like taxi booking apps completely changed the game. Ask yourself: What core part of my industry is still stuck in the stone age? That's your opportunity.

- Build a Community and Trust Machine: The two-way rating system was genius. It made both drivers and riders accountable, building a layer of trust that was missing from the anonymous world of taxis. Use feedback loops, reviews, or community features to build trust and make your platform self-policing.

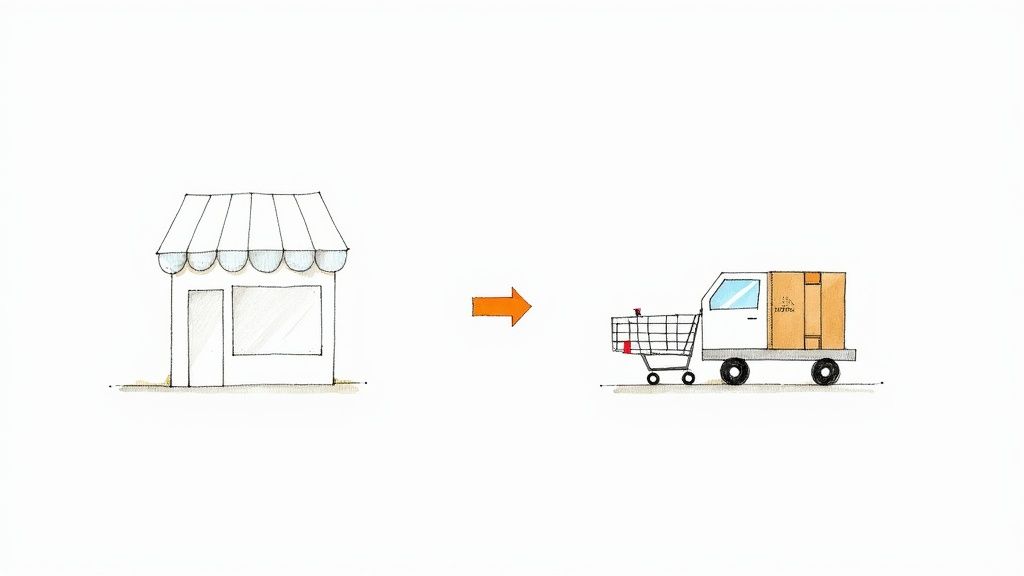

4. E-commerce Platforms vs. Physical Retail (Retail Industry)

The rise of e-commerce versus physical retail is another textbook case of indirect competitors examples playing out on a massive scale. A brick-and-mortar store like Target sells stuff off its shelves, while a platform like Amazon sells stuff from a giant warehouse. On the surface, they're just different ways to sell things.

But they are in a deathmatch for the same customer wallet and the same basic "job": buying stuff. When you need new headphones, you're not debating distribution models; you're deciding where you'll get the best price, selection, and convenience. The channel doesn't matter as much as the outcome.

This fight isn't just about moving sales online. It’s a complete disruption of the entire retail machine, from supply chains to customer experience. E-commerce didn't just build a digital storefront; it built a new, more efficient model for retail itself, forcing old giants to either adapt or die.

Strategic Analysis & Tactical Takeaways

The e-commerce boom, led by titans like Amazon's Jeff Bezos and Alibaba's Jack Ma, offers a powerful lesson in using tech to flip an industry's old assumptions on their head.

-

Attack the Inconvenience: Physical retail is limited by location, hours, and what's in stock. E-commerce platforms exploited these weaknesses by offering a nearly infinite "shelf," 24/7 access, and delivery to your door. Amazon Prime, with its two-day shipping, wasn't just a loyalty program; it was a direct assault on retail's last big advantage: getting stuff right now.

-

Lower the Barrier to Entry: Platforms like Shopify, founded by Tobi Lütke, gave millions of small entrepreneurs the power to compete with big brands. They didn't have to build their own stores; they could rent a world-class digital one. This blew the market wide open and created an army of new competitors for traditional stores.

> Key Insight: Your indirect competitor's biggest weapon might be their ability to completely change the cost or accessibility of your industry. They win by rewriting the rules of the game.

Actionable Tips for Your Business

How can you apply these retail lessons, even if you're not in e-commerce?

- Develop an Omnichannel Strategy: Don't make customers choose. Blend your physical and digital experiences. Let people order online for in-store pickup, offer easy in-store returns for online buys, and make sure your customer support is seamless everywhere.

- Invest in "Logistics": For a retailer, this means fast shipping. For a SaaS company, this means a super-fast onboarding, instant access to help, and a frictionless experience. Shrink the time it takes for your customers to get value.

- Use Data for Hyper-Personalization: E-commerce thrives on recommendation engines. Use the data you have to personalize experiences, tailor marketing, and guess what customers need before they even know. Make your service feel like it was built just for them.

Understanding the competitive landscape is crucial, especially when threats come from weird places. A deep dive into retail competitor analysis can reveal hidden patterns and opportunities to stay ahead.

5. Plant-Based Alternative Foods vs. Animal Agriculture (Food & Beverage Industry)

The rise of plant-based foods is a perfect case study in indirect competition, changing the very definition of "meat" and "dairy." A traditional beef burger company and a company like Impossible Foods don't use the same supply chains, but they are fighting for the same prize: the center of your plate. This is one of the most transformative indirect competitors examples reshaping a multi-trillion-dollar global industry.

They aren't competing on who's a better cattle rancher. Instead, they solve the customer's craving for a "burger experience" by targeting totally different values like health, sustainability, and animal welfare. When a customer at Burger King chooses the Impossible Whopper, the cattle industry loses a sale, even though Impossible Foods doesn't own a single cow.

This competition isn't about small improvements; it’s about completely reframing the product. Plant-based brands didn't just create another veggie burger; they engineered products to mimic the taste, texture, and even the "bleed" of meat, directly challenging the old guard's core experience while offering a different reason to buy.

Strategic Analysis & Tactical Takeaways

The plant-based movement offers a brilliant playbook for disrupting a legacy market by redefining the "job" the product is hired to do. It's not just "food," it's "sustainable, ethical, and healthy food that tastes like the real thing."

-

Focus on the Core Experience, Not the Product: Impossible Foods and Beyond Meat obsessed over recreating the sensory experience of eating meat: the sizzle, the texture, the flavor. They knew that to win over meat-eaters, they couldn't just offer a healthy alternative; they had to deliver a satisfying "burger" experience.

-

Weaponize Distribution Through Partnerships: Instead of building a new brand from scratch, these companies piggybacked on the massive distribution of giants like Burger King, Starbucks, and major grocery stores. This put their products right in front of their target customers, making plant-based options feel normal and mainstream.

> Key Insight: You can win by changing the "why" behind a customer's purchase. The meat industry sold on tradition and taste; plant-based brands sell on ethics and sustainability, while aggressively closing the taste gap.

Actionable Tips for Your Business

How can you apply this disruption model to your own industry?

- Invest in R&D to Match the Incumbent's 'Magic': For plant-based foods, it was taste and texture. For your software, it might be recreating the core "aha!" moment of a competitor's product but with a more efficient, affordable, or ethical tech stack.

- Build a Powerful Story Around Your 'Why': Your mission matters. Oatly didn't just sell oat milk; it sold a witty, post-milk lifestyle. Connect your product to a bigger movement or value system that clicks with a growing slice of your market.

- Forge Strategic Partnerships for Credibility and Reach: Who are the trusted gatekeepers in your industry? Partnering with them can give you instant credibility and access to a customer base that would take years to build on your own. It's a classic Trojan Horse strategy.

6. Telemedicine Platforms vs. Traditional Healthcare (Healthcare Industry)

The rise of telemedicine platforms like Teladoc and Amwell presents a powerful case study in indirect competitors examples in healthcare. On the surface, a virtual consultation seems different from an in-person doctor's visit. One is on a screen, the other is in an office.

But they're both competing for the same fundamental "job": solving a health problem. When you wake up with a sore throat, you're not debating digital versus physical medicine. You're asking, "How can I feel better as fast and easy as possible?" A trip to the clinic and a video call with a doctor are both potential answers, pulling from the same pool of patient needs and healthcare dollars.

This competition isn't about who has a better stethoscope; it's about access and convenience. Telemedicine didn't invent a new cure; it just removed the hassle of scheduling, traveling, and waiting. It proves that your biggest competitor might not be the clinic across the street but the app on your customer's phone.

Strategic Analysis & Tactical Takeaways

The rapid adoption of telemedicine, boosted by the COVID-19 pandemic, offers critical lessons on how to disrupt a traditional service industry by attacking its biggest inconveniences.

- Solve for Time and Effort: Traditional healthcare is a notorious pain. It means taking time off work, driving, and sitting in a waiting room, often for a simple 10-minute chat. Telemedicine platforms went straight for this pain point, offering on-demand access to doctors from home.

- Leverage Ecosystem Partnerships: Amwell didn't try to replace the whole healthcare system. Instead, it partnered with major health systems and insurance companies, plugging its tech into their existing setups. This turned potential enemies into powerful distribution channels, helping them scale fast.

> Key Insight: Convenience can be a more powerful weapon than incumbency. Your indirect competitor wins by making the customer's goal radically easier to achieve, even if the core service is basically the same.

Actionable Tips for Your Business

How can you apply the telemedicine disruption model to your own industry?

- Integrate Seamlessly into Workflows: For a traditional service, this could mean integrating with major electronic health record (EHR) systems. For a SaaS product, it means building deep integrations with the tools your customers use all day, like Slack, Salesforce, or Google Workspace. Become part of their existing process.

- Build Trust with Credentials and Compliance: Telemedicine platforms shout about their HIPAA compliance and certified doctors. Whatever your industry, highlight the security, compliance, and credentials that matter to your customers. Make them feel safe choosing you.

- Create a Clear Path for Escalation: Telemedicine providers know when a virtual visit isn't enough and a patient needs to be seen in person. Your business should have a similar "escape hatch." Provide excellent support and clear next steps for complex issues that your slick solution can't fully solve on its own.

7. Cloud Computing Services vs. On-Premise IT Infrastructure (Technology Industry)

The shift from on-premise servers to cloud computing is a massive change that offers one of the clearest indirect competitors examples in tech. At first, buying and maintaining your own physical servers seems totally different from renting virtual computing power from Amazon Web Services (AWS) or Microsoft Azure. One is a huge upfront cost, the other is a monthly bill.

But they are fighting for the exact same prize: the corporate IT budget. When a company needs to run an app or store data, it's not asking, "Should I buy hardware or rent a virtual machine?" It's asking, "What's the most efficient, scalable, and cost-effective way to run our tech?" That’s the core job, and cloud providers completely flipped the traditional answer on its head.

This wasn't just swapping one product for another; it was a fundamental business model disruption. Cloud services didn't just offer a cheaper server; they offered a new world of elasticity, pay-as-you-go pricing, and outsourced maintenance that made the old way look slow, expensive, and rigid.

Strategic Analysis & Tactical Takeaways

The dominance of the cloud is a lesson in how to turn an opponent’s greatest strength—in this case, physical hardware—into a massive weakness.

-

Focus on the Core User Pain Point: Managing physical servers is a nightmare. It involves huge upfront costs, complex maintenance, impossible capacity planning, and hiring expensive specialists. Cloud providers like AWS looked at these headaches and just... deleted them. Need more power? Click a button. Traffic spike? Scale automatically. Hardware fails? That's Amazon's problem, not yours.

-

Weaponize Your Business Model: The pay-as-you-go model was a game-changer. Instead of betting a fortune on a server that might be too big or too small, companies could start small and scale up or down as needed. This de-risked innovation and let tiny startups compete with giants, something that was unthinkable before.

> Key Insight: Your indirect competitor wins by changing the math. Cloud computing turned a giant capital expense into a predictable operational expense, making powerful tech accessible to everyone.

Actionable Tips for Your Business

How can you apply the cloud playbook to your own market?

- Turn a Product into a Service: Is there something in your industry that customers usually have to buy, own, and maintain? Find a way to offer it as a flexible subscription. This is the secret sauce of the entire "as-a-service" (SaaS, PaaS, IaaS) economy.

- Embrace Elastic and Transparent Pricing: Don't lock customers into rigid, long-term contracts if you can help it. Offer usage-based or tiered pricing that grows with them. This lowers the barrier to entry and builds trust.

- Build an Ecosystem, Not Just a Product: AWS won by offering a huge menu of connected services, from storage and databases to machine learning. Think about what complementary services or integrations you can offer to become the one-stop-shop for solving your customer's core problem.

7-Point Indirect Competitors Comparison

| Approach | 🔄 Implementation Complexity | ⚡ Resource Intensity | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages | |---|---|---:|---|---|---| | Streaming Services vs. Traditional Cable | Moderate — platform + licensing and content ops | High — content production, CDN and platform costs | Shift to on‑demand viewing; subscriber migration from cable | On‑demand viewers, global & niche audiences, binge consumption | Convenience, personalization, scalable distribution | | Digital Wallets vs. Credit Card Companies | Low–Moderate — integration, tokenization, compliance | Moderate — partnerships, security, payment rails | Increased contactless payments; reduced physical card use | Retail checkout, mobile‑first users, loyalty integration | Faster checkout, improved fraud protection, richer transaction data | | Ride‑Sharing Services vs. Traditional Taxi Companies | Moderate — app platform, dynamic pricing, regulatory work | Moderate — driver network, routing, payments | On‑demand rides, transparent pricing, expanded urban coverage | Urban trips, short‑notice rides, flexible driver supply | Convenience, tracking, rating accountability | | E‑commerce Platforms vs. Physical Retail | Moderate — platform, fulfillment and returns logistics | High — warehousing, last‑mile delivery, platform ops | Growth in online sales; 24/7 availability; broader selection | Price‑sensitive shoppers, long‑tail inventory, cross‑border sales | Scale, assortment, lower fixed retail overhead | | Plant‑Based Alternative Foods vs. Animal Agriculture | High — R&D, formulation, food safety approvals | Moderate–High — specialized processing and ingredient sourcing | Gradual market share gains; sustainability positioning | Health/environment conscious consumers, foodservice partners | Lower environmental footprint, animal‑welfare messaging, scalability | | Telemedicine Platforms vs. Traditional Healthcare | Moderate — video/records integration and compliance (HIPAA) | Low–Moderate — platform, clinician network, secure data | Increased access and convenience; fewer routine in‑person visits | Remote consultations, rural access, triage and follow‑ups | Reduced wait times, lower routine visit costs, improved access | | Cloud Computing Services vs. On‑Premise IT Infrastructure | Moderate — migration, governance and architecture changes | Variable — lower CapEx but ongoing OpEx and training | Elastic scaling, faster deployments, reduced maintenance burden | Variable workloads, rapid scaling, dev/test and SaaS delivery | Scalability, pay‑as‑you‑go model, managed services and agility |

Okay, So How Do You Actually Find These Guys?

Alright, we’ve seen a ton of indirect competitors examples, from plant-based burgers sneakily taking on Big Beef to cloud computing making physical servers look like museum pieces. Seeing these battles is one thing, but the real question is: how do you spot the ones creeping up on your business?

The biggest mistake is thinking your competition looks just like you. Your true rivals aren't just the companies with a similar feature list. They're any alternative that solves the same core problem. As we saw with Netflix vs. cable, the "job" wasn't "watch scheduled TV." The job was "I'm bored and want to be entertained." That's the mindset you need. You're not just competing on features; you're competing for budget, time, and attention.

This means your competitive landscape is way bigger and weirder than you think. The real threats often come from totally different industries, using different tech, and speaking to customers in a way you might not even recognize.

Shifting Your Radar: From Direct to Indirect

So, how do you actually do this? You have to become a detective of customer behavior. The goal is to find the "hacks," workarounds, and other tools people use when your product isn't around.

Here are a few places to start looking:

-

Dive into Online Communities: Go hang out where your customers live online. Think Reddit subs, niche Slack groups, or industry forums. Search for the problem you solve, not your product category. Look for phrases like "How do you handle X?" or "Any cheap alternatives for Y?" This is where you'll find people recommending spreadsheets or a pen-and-paper system instead of a dedicated SaaS tool.

-

Analyze Search Behavior (The Smart Way): Your customers aren't just Googling "Your Product vs. Your Direct Competitor." They're searching for the pain point. They're typing in stuff like "track project hours free" or "easy way to share files." Big tools like Ahrefs or Semrush can help you with this, but they can be expensive. A tool like already.dev can often find these patterns for you automatically. Understanding these queries shows you the full range of solutions people are considering. For a practical application, you might explore methods like understanding how to conduct competitor analysis on modern platforms to see how users discover and compare solutions.

-

Follow the Money (and the Hype): Pay attention to where venture capital is flowing in nearby industries. If you're in project management, are VCs suddenly dumping money into "no-code" automation tools? That's a huge signal. Those tools might not look like your product today, but they're solving the same underlying problem of organizational chaos.

The key takeaway from all the indirect competitors examples we've covered is that tunnel vision is a startup killer. If you only watch the rivals in your rearview mirror, you'll get blindsided by someone in a completely different lane. Mastering the art of spotting these hidden competitors is what separates a reactive company from a visionary one. It lets you see market shifts coming, find new partners, and build a tougher product that truly solves the core customer need, no matter what form the solution takes.

Tired of spending weeks on manual research just to find a fraction of your competitors? Already.dev uses AI agents to map your entire competitive landscape, including those sneaky indirect rivals, in about four minutes. Stop guessing and start strategizing with a complete picture of the market.