A Guide to Market Opportunity Assessment

Skip the guesswork. Our guide to market opportunity assessment helps you find profitable niches and launch with confidence. Learn a real-world process.

Let's be honest—"market opportunity assessment" sounds like something you'd hear in a stuffy MBA lecture where the professor's voice puts you to sleep. But forget the jargon. It's really just a smart way to figure out if your big idea is a potential goldmine or a spectacular dud.

Way too many founders skip this step, dive in headfirst, and then wonder why they're broke. It's a classic, avoidable screw-up.

Why Even Bother With a Market Opportunity Assessment?

Think of it like this: you could wander into the woods hoping to find a unicorn, or you could check a map that shows you exactly where the unicorns hang out. This assessment is your map. It’s your shield against wasting time, money, and your precious sanity on a project that was doomed from the start.

It’s the data-driven reality check every entrepreneur desperately needs. It's easy to fall in love with your own idea, but passion alone doesn't pay the bills. This process forces you to look at the cold, hard facts, which is the only way to make smart moves.

Ditching Guesswork for Growth

Instead of just running on gut feelings and caffeine, a market opportunity assessment gives you a clear roadmap. It helps you nail down the answers to those big, scary questions that keep founders staring at the ceiling at 3 AM.

- Will people actually pay for this? This is about validating demand beyond your mom and your supportive best friend.

- How big is this playground, really? This gives you a real sense of the total market size and your potential slice of the pie. Is it a tiny cupcake or a giant wedding cake?

- Who am I really up against? You’ll uncover competitors—both the obvious ones and the sneaky ones you never even knew existed.

- What are the hidden traps? This is where you spot potential landmines, like new regulations or weird shifts in customer behavior, before they blow up in your face.

By tackling these questions early, you’re not just hoping for the best; you're building a strategy from a position of strength. You can put your limited resources—cash, time, your last brain cell—where they'll actually make a difference. As you dig in, it's also worth it to understand your market opportunity score to get a sharper picture of your odds.

> A market assessment isn't about proving your idea is perfect. It's about finding the truth about its potential in the real world. That truth, good or bad, is the most valuable thing you can have.

The Core Components of a Market Opportunity Assessment

Before you get overwhelmed, let's break this down into the essentials. A solid assessment isn't a six-month research project that results in a 100-page PDF nobody reads. It's a series of quick, focused dives into different parts of the market.

Here's the cheat sheet that cuts right to what matters.

| Component | What It Really Means | Why It Matters | | :--- | :--- | :--- | | Market Sizing | Figuring out if you're fishing in a small pond or a giant ocean. | It tells you if the potential reward is worth the risk and the inevitable headaches. | | Competitive Analysis | Legally spying on the other players to find their weak spots. | You can't win the game if you don't know who you're playing against (or if the game is even worth playing). | | Customer Analysis | Getting inside your ideal customer's head to understand what they really want, not what you think they want. | This ensures you're building something people will actually throw money at. | | Regulatory & Trend Analysis | Looking for incoming curveballs like new laws or tech shifts that could ruin your day. | It helps you dodge nasty surprises and spot opportunities before everyone else does. |

Nailing these four areas will give you the clarity you need to move forward with confidence or pivot before you've mortgaged your house.

Gauging Your Market Size: The TAM, SAM, SOM Framework

Alright, let's talk acronyms. I know, I know—but these three are actually useful: TAM, SAM, and SOM. It might sound like something out of a dusty business textbook, but this is one of the most practical ways to figure out if your idea has a shot at making real money.

Getting a handle on these numbers is non-negotiable. It’s what tells you (and potential investors) if your brilliant idea has commercial legs. It also helps you set goals that are ambitious but not completely delusional.

TAM: The Big Picture

First up is the Total Addressable Market (TAM). Think of this as the absolute ceiling. It’s the total revenue you could possibly generate if every single person who could theoretically use your product actually bought it. This is your "if I had a magic wand and captured 100% of the market" number. It’s hilariously unrealistic, but it sets the outer boundary.

Let's imagine you're launching a new brand of artisanal, gluten-free cat food. Your TAM would be the total amount of money spent on all cat food—kibble, canned, raw, whatever—in the world.

SAM: Your Realistic Playground

Now we get to the Serviceable Available Market (SAM). This is where we start to get our feet back on the ground. SAM is the slice of that big TAM pie that you can actually reach with your current business model and sales channels.

For our cat food company, the SAM isn’t every cat owner on the planet. It’s the subset of owners in the cities you can ship to, who shop at specialty pet stores, and are already searching for "premium" or "healthy" pet food. You’ve just gone from "everyone with a cat" to "people who might actually buy this." This is the market you'll actually be competing in.

> That leap from TAM to SAM is where the real thinking starts. It forces you to get honest about logistics, your ideal customer, and the practical limits of your business.

SOM: Your First Bite

Finally, we have the Serviceable Obtainable Market (SOM). This is your immediate, short-term target. It’s the piece of your SAM you can realistically capture in the first few years, factoring in your competition, your tiny budget, and your non-existent brand awareness.

For our startup, the SOM might be capturing just 5% of those health-conscious cat owners in three specific launch cities. This is a tangible goal. It’s a number you can build a business plan around, and it answers the critical question: "What can we actually achieve next year?"

Figuring out these numbers often boils down to good data analysis. For a deeper look at using data effectively in your strategy, it’s worth checking out resources on B2B marketing analytics.

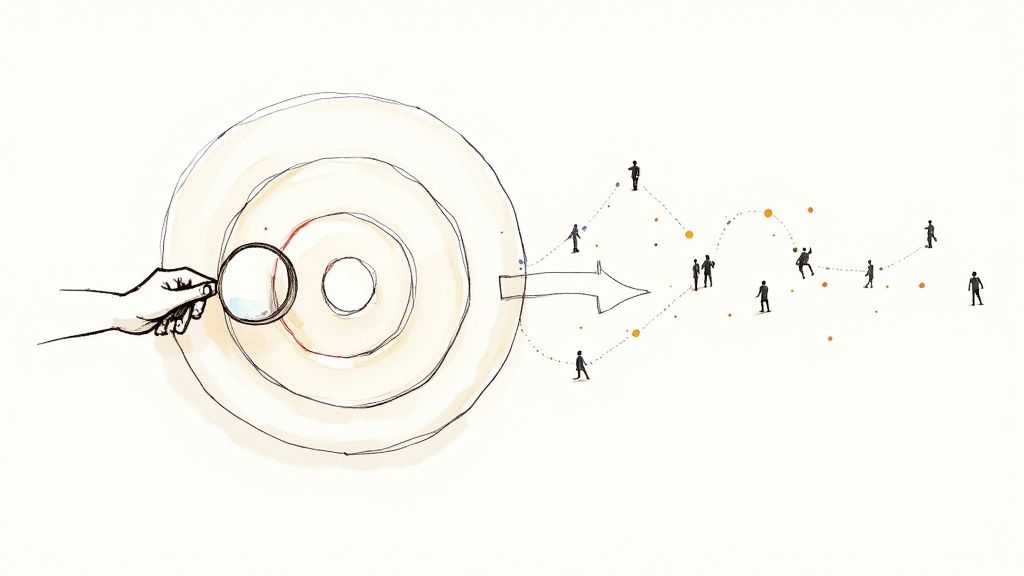

This handy infographic breaks down how to narrow your focus from a giant, vague market to a specific group of people you can actually sell to.

.

This handy infographic breaks down how to narrow your focus and define the customers that will actually make up your SAM and SOM.

As you can see, moving from a broad market to a specific target is all about layering on filters until you find the people who matter.

A Quick Back-of-the-Napkin Example

Let's put this into practice. Imagine you're building a project management SaaS tool specifically for small marketing agencies in the US.

- TAM: There are roughly 13,000 marketing agencies in the US. If a typical agency spends $1,000/year on this type of software, your TAM is $13 million a year.

- SAM: But you’re only targeting small agencies—those with fewer than 10 employees. That’s about 60% of the market, or 7,800 agencies. Now your SAM is $7.8 million.

- SOM: You believe you can realistically win over 10% of that segment in your first two years. Your SOM is $780,000.

See? It's not rocket science. The numbers don't need to be perfect, but the exercise forces you to think critically about who you’re selling to and what’s actually achievable.

It's also crucial to remember your market doesn't exist in a vacuum. Broader economic trends can make or break your projections. With global GDP growth expected to slow to around 2.9% in 2025, businesses will be watching their wallets. This makes an honest SOM calculation more critical than ever.

Finding the data for this can feel like a hunt. Sure, big-name tools like Ahrefs or Semrush are great for gauging search demand, but they can be ridiculously expensive. An alternative like already.dev can give you the market and competitive data you need without the soul-crushing price tag, helping you build out your TAM, SAM, and SOM with confidence.

How to Spy on Your Competition on a Budget

Knowing your market is essential, but knowing who you’re up against is how you win. And don't worry, you won't need a trench coat and a fake mustache. All it takes are a few smart, affordable tools and the right mindset.

Let’s get one thing straight: this isn't just about Googling your most obvious rivals. A real market opportunity assessment means digging deeper to uncover the indirect competitors who are quietly solving the same problem for your customers, just in a completely different way.

A simple chart can instantly show you where you and your competitors overlap. More importantly, it shows you where they don't. That empty space? That's often where your best opportunity is hiding.

Ditch the Expensive Tools, Get Smart Instead

Look, big platforms like Ahrefs and Semrush are absolute powerhouses for seeing what your competitors are up to online. But let's be real—they can be wildly expensive, especially when you're just starting out.

Thankfully, you don't need an enterprise-level budget to get game-changing insights. This is where AI-powered tools come in handy. A platform like already.dev, for instance, can deliver deep competitive insights—from a rival's SEO strategy to the glaring gaps in their product—for a fraction of the cost. It automates the painful, manual parts of research so you can focus on strategy instead of getting lost in spreadsheets. To keep all this research focused, it’s a great idea to build a winning competitor analysis framework.

What to Look for When You're Spying

Once you’ve got your tools ready, what are you actually looking for? It’s about way more than their feature list. You need to dissect their business to find the chinks in their armor.

Here’s your budget-friendly spy checklist:

- Pricing & Packaging: How do they structure their plans? Is it confusing? Does it seem way overpriced for what you get? These are weaknesses you can exploit.

- Customer Reviews (The Good, The Bad, and The Ugly): Scour sites like G2, Capterra, and even Reddit. The gold is in the 3-star reviews; that's where you'll find brutally honest feedback on what’s almost good but still sucks.

- Their Marketing Message: How do they talk about themselves? Are they the "cheapest," the "easiest," or the "most powerful"? This tells you exactly how they’re positioning themselves, which helps you find a different, more compelling angle.

- Content & SEO Gaps: What keywords are they ranking for? Even better, what important keywords are they not ranking for? These are your openings to create content that answers questions your competition is completely ignoring.

This kind of analysis is the very heart of competitive intelligence. It’s about turning raw data into a strategic advantage. If you want to dive deeper, our guide on what is competitive intelligence is a great place to start.

> Your goal isn’t to copy your competitors. It's to understand them so well that you can show up where they aren't and offer something they can't.

Finding Your Niche in Unexpected Places

Let's be real—the most obvious market opportunities are also the most crowded. You can spend all your time and money fighting for scraps in a bloody war with established players, and honestly, it's exhausting. The real magic happens when you look where nobody else is looking.

This is the whole "blue ocean" idea. Instead of battling sharks in a blood-red ocean of competition, you’re sailing into calm, clear waters where you get to make the rules. It’s all about connecting the dots between big-picture trends and specific customer pain points that everyone else has written off as too small or too weird.

Following the Money Beyond the Stock Market

A great way to find these hidden gems is to stop obsessing over the public markets (like the S&P 500) and start paying attention to where private money is flowing. Public markets mostly represent mature, saturated industries. The real forward-looking action is often in private markets, where smart investors are placing bets on what’s coming next.

Take the AI boom, for instance. The obvious play is building another chatbot. The unexpected opportunities are in the boring stuff that makes it all possible—like the massive, power-hungry data centers needed to train these models. Suddenly, a boring real estate play becomes a hot tech opportunity.

This isn't a small shift. Recent data shows that private markets are grabbing a bigger slice of the capital pie, partly because companies are just waiting longer to go public. This is creating high-growth pockets in surprising areas like specialized healthcare facilities and, you guessed it, data centers. You can read more about these 2025 market outlook trends to see how these capital flows are carving out new niches.

A Quick Sanity Check for Hidden Niches

Okay, so you think you’ve spotted a potential niche. How do you know if it’s a brilliant move or a total dead end? You need a quick, simple way to vet these ideas.

Here’s a simple framework:

- Is the Pain Point Specific and Urgent? Great niches solve a very specific problem for a very specific group of people who are desperate for a solution right now. "Helping businesses grow" isn't a niche. "Helping Shopify-based candle makers manage their seasonal inventory" absolutely is.

- Is the Audience Underserved? Look for customers who are currently stuck using clunky spreadsheets, frustrating workarounds, or nothing at all. These are the people who will be thrilled that someone finally gets them.

- Is There a Clear Path to Reach Them? A perfect niche is useless if you can't find your customers. Are they all hanging out in a specific online community, part of a trade association, or active on a certain subreddit? If so, you’re onto something.

> The goal isn’t to find a market with no competition. It’s to find a market where the existing solutions are lazy, outdated, or just plain bad. That’s your opening.

Let's Put It All Together

Let's walk through a quick scenario. You notice the "creator economy" is a huge trend. But instead of jumping in to build another platform for influencers, you dig deeper. You follow the private investment money and see funds pouring into tools that support the business side of being a creator.

Now you run it through the framework:

- Pain Point: Creators are brilliant at making content but often suck at managing their finances, taxes, and sponsorships. It's an urgent, stressful problem.

- Audience: They are massively underserved. Most are trying to make generic accounting software work for their weird and unpredictable income streams. It's a nightmare.

- Path to Reach Them: They’re highly concentrated on platforms like YouTube and TikTok, and they flock to specific creator-focused newsletters and communities.

Boom. You’ve just identified a potentially massive niche—financial management software for full-time creators—by looking past the obvious and connecting the dots.

Time to Create Your Go-To-Market Action Plan

All that research you just finished? It's completely worthless if it just sits in a folder collecting digital dust. The entire point of a market opportunity assessment is to spark action. So, this is where we turn those insights into a real-world game plan.

Don't think of this as some formal report. It's more like a battle plan for the next 90 days. We're going to boil everything down into a simple, prioritized to-do list. The goal is a living plan, not a static document you’ll never look at again.

This is how you make sure your assessment becomes the launchpad for actual growth.

Synthesizing Your Findings

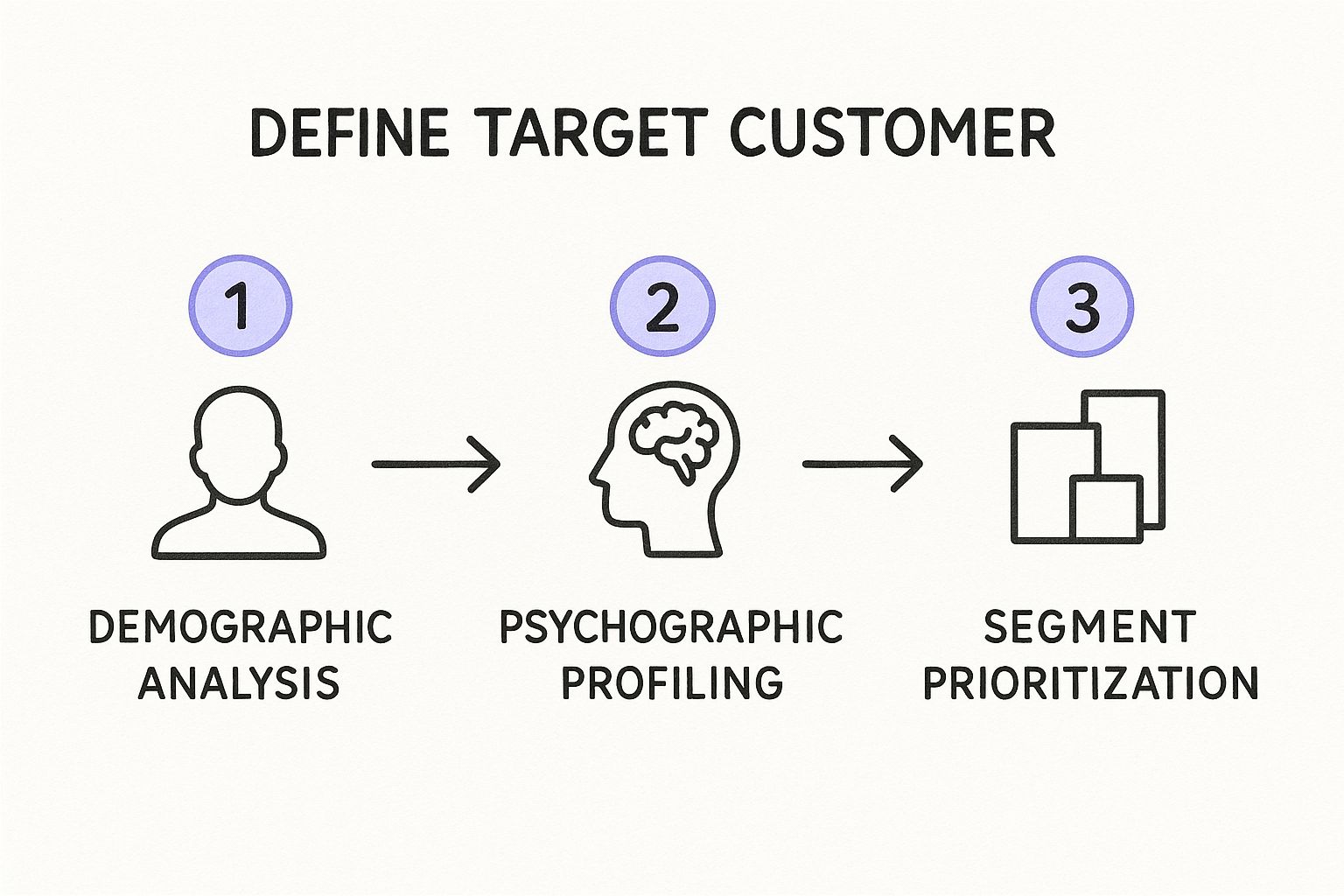

First things first, let's pull out the most important nuggets from your research. You've probably got pages of notes, and it's easy to get lost in the weeds. We need to distill it all down to the absolute essentials.

Grab a whiteboard (or just a clean doc) and answer these three critical questions:

- Who is my first customer? I don't mean "everyone." Based on your SOM and niche analysis, describe the one specific persona you will target first. Be painfully specific—what's their job title? What tools do they hate using? Where do they complain online?

- What is their biggest unsolved pain? Looking at your research, what's the one problem that existing solutions either ignore or solve poorly? This becomes the emotional hook for everything.

- What is my 'different and better' story? Based on where your competitors are weak, how will you talk about your solution? This isn't a feature list; it's your core message. For example, "While they're clunky and expensive, we're simple and affordable for freelancers."

Answering these crystallizes your focus. Without this clarity, you'll end up trying to be everything to everyone, which is a surefire way to be nothing to anyone.

Building Your First 90-Day Sprint

Forget about five-year plans. In these early stages, anything beyond three months is pure fantasy. We need to focus on a short, intense sprint with clear, measurable goals. This approach builds momentum and forces you to learn fast.

Your go-to-market (GTM) strategy is the engine that drives this sprint. It’s just your plan for reaching, engaging, and winning over that first group of customers. For a detailed guide, check out our post on how to create a go-to-market strategy.

Here’s a simple, no-fluff template for your 90-day plan:

- Month 1 Goal (Validation): Get 10 people from your ideal customer profile to have a real conversation with you about their problems. The goal isn't to sell; it's to confirm your assumptions are actually correct.

- Month 2 Goal (Build & Test): Create your Minimum Viable Product (MVP) and get 5 of those initial people to actually use it. Your job here is to collect brutally honest feedback.

- Month 3 Goal (Launch & Learn): Officially launch to the specific online community where your first customers live. The only goal that matters is getting your first paying customer.

This structure forces you to focus on learning and iteration. Each month has one primary objective, making it dead simple to track progress.

> The perfect plan you never start is infinitely worse than the good-enough plan you execute today. Your first GTM plan will be wrong. The goal is to figure out how it's wrong as quickly and cheaply as possible.

The Test, Measure, Learn, Adjust Loop

Your 90-day plan is your hypothesis. Now you have to treat it like a science experiment. The most successful founders live in a constant cycle of testing, measuring, learning, and adjusting.

Here’s how to make that practical:

| Action | What It Really Means | Example | | :--- | :--- | :--- | | Test | Put an assumption out there in the wild. | Run a small ad campaign with your core marketing message targeting one specific LinkedIn group. | | Measure | Track a single, meaningful metric. | Don't just count clicks. Measure how many people from that ad actually sign up for your waitlist. | | Learn | Ask "why" the result happened. | Was the message wrong? Was it the wrong audience? Did the landing page stink? | | Adjust | Change one variable and run the test again. | Tweak the ad copy to focus on a different pain point and relaunch the campaign to the same group. |

This loop is the most critical part of turning your market opportunity assessment into a successful business. It's the engine of growth. You're not failing; you're just discovering what doesn't work on your way to what does.

A market assessment isn't a one-and-done activity. It's the beginning of a continuous conversation with your market.

Common Market Assessment Questions Answered

Still got a few questions bouncing around? I get it. A market opportunity assessment can feel like a huge, intimidating task.

Let's clear things up with some straight-to-the-point answers.

How Often Should I Do a Market Assessment?

Think of this less as a one-time project and more like a regular check-up. A really deep dive is essential before you launch something new or pivot into a new market. That’s your foundation.

After that, a lighter "check-in" once a year is a smart move, or anytime the market feels weird—a hot new competitor shows up, a new technology emerges, or your customers start acting differently. Staying current keeps you from getting caught flat-footed.

> The point isn't to be stuck in research paralysis. It's about building a habit of market awareness so you can react intelligently instead of panicking.

Can I Really Do This on a Shoestring Budget?

You absolutely can. You don’t need to hire a big consulting firm. Honestly, the scrappy approach is often better because it forces you to be creative and focus on what actually matters.

Here’s your low-budget toolkit:

- Free Government Data: Seriously. Resources from the Census Bureau or the Bureau of Labor Statistics are pure gold for market data.

- Customer Conversations: Just talking to 10 potential customers will give you more actionable insights than a $10,000 report. Ask about their problems, not your solution.

- Affordable, Smart Tools: While big players like Ahrefs or Semrush are powerful, they come with a hefty price tag. A tool like already.dev can give you AI-powered competitive insights without making your wallet cry.

What’s the Biggest Mistake People Make?

The single biggest trap is confirmation bias. It’s that human tendency to only look for information that confirms the idea we've already fallen in love with. You get excited, and you subconsciously start hunting for proof that you're a genius.

A proper market assessment is about finding the truth, even if it’s an inconvenient truth that tells you your brilliant idea is flawed. You have to be willing to poke holes in your own assumptions. The goal isn't to prove you were right; it's to find the right way forward.

Ready to stop guessing and start building with confidence? Already.dev is your secret weapon. Our AI-powered platform takes the pain out of competitive research, delivering the clarity you need to spot your market opportunity and nail it. Get started for free at https://already.dev.