9 Market Research Best Practices You Can't Ignore in 2025

Stop guessing and start winning. Learn 9 essential market research best practices to uncover real customer needs, spy on rivals, and build a better product.

Look, we've all been there. You have a world-changing idea, spend months locked away building it, and then launch to the sound of... crickets. Ouch. It’s a painful, expensive lesson many startups learn the hard way. The brutal truth is that most products fail not because they're poorly engineered, but because they solve a problem nobody was losing sleep over. This is where market research steps in, not as a boring academic exercise, but as your secret weapon to avoid building expensive-but-useless things.

Think of this guide as your cheat sheet. We’re skipping the dense theory and cutting straight to nine actionable market research best practices. This isn't about creating hundred-page reports that gather dust. It’s about getting real answers to the questions that actually matter: Who are my real customers? What do they actually want? And how can I build something they're itching to pay for?

We’ll cover everything from defining sharp objectives and spying on your competitors to asking questions that don't accidentally sabotage your results. You'll learn how to validate your assumptions and turn a mess of data into a clear roadmap. These aren’t just abstract concepts; they are the fundamental steps to de-risk your venture and find that magical product-market fit. Ready to stop guessing and start building with confidence? Let’s dive in.

1. Practice #1: Stop Winging It—Define Your Mission First

Before you even think about firing up a survey or stalking your competitors, hit the brakes. The single biggest mistake startups make is jumping into research without a clear mission. It's like setting sail without a map; you'll just drift around, burn through cash, and end up with a bunch of useless trivia. This first step is non-negotiable and the foundation of all good market research best practices.

Think of it this way: your research mission is your North Star. It guides every decision you make, from the questions you ask to the data you collect. A solid mission keeps you from getting distracted by interesting but ultimately irrelevant "shiny objects" along the way.

How to Define Your Research Mission

The goal is to go from a vague thought like "I wonder what our competitors are up to" to a specific, actionable question. Start by asking yourself: What is the single most important business decision this research needs to inform?

Your answer will help you craft a clear objective. Let's look at a practical example.

> Scenario: A B2B SaaS startup is losing trial users after the first week. > > * Vague Goal: "Find out why users are leaving." (Yeah, good luck with that.) > * Specific Mission: "Identify the top three friction points in our onboarding flow that cause new trial users to bail within the first seven days."

See the difference? The second one is specific, measurable, and gives you a clear target. This clarity ensures your research delivers a battle plan, not just a pile of confusing data.

Actionable Tips for a Solid Mission

- Frame it as a question: Turn your objective into a direct question. Like, "What pricing model will make freelance graphic designers actually open their wallets?"

- Focus on one problem: Don't try to boil the ocean. If you have multiple questions, you might need multiple research projects. One mission at a time.

- Talk to your team: Grab input from sales, marketing, and product. They're on the front lines and know what problems are actually costing you money.

2. Use a Mixed Methods Research Approach

Relying on just one type of data is like trying to understand a city by only looking at a map. You see the layout, but you miss the culture, the noise, and the people. The best market research practices involve mixing quantitative data (the "what") with qualitative data (the "why") to get the full picture.

This mixed-methods approach gives you the best of both worlds. Quantitative data from surveys or analytics tells you what is happening at scale, like "70% of users drop off at this step." Qualitative insights from interviews or focus groups tell you why it's happening, revealing the frustrations and "aha!" moments that numbers can't. It’s the difference between knowing a joke bombed and understanding why it wasn’t funny.

How to Blend Quantitative and Qualitative Data

The key is to let one method inform the other. You don't just collect both types of data and mush them together; you use them strategically to build a deeper understanding. This stops you from making dumb assumptions based on half the story.

> Scenario: A mobile gaming app sees high downloads but low daily active users. > > * Quantitative First: They analyze in-app analytics (quantitative) and discover a massive user drop-off after the tutorial level. The data shows where the problem is but not why. > * Qualitative Follow-up: They conduct one-on-one user interviews (qualitative) with people who ghosted them. They learn the tutorial is confusing and the controls feel like trying to text with mittens on. This is the missing piece of the puzzle.

By combining these insights, the team can confidently redesign the tutorial knowing they're fixing a real, user-validated problem. Way better than just guessing.

Actionable Tips for a Mixed-Methods Approach

- Start with 'Why': Do a few qualitative interviews first to hear how real people talk about the problem. Use their language to write a smarter, more relevant quantitative survey.

- Segment and Dig Deeper: Use your quantitative data to find interesting groups (like "power users" or "quick quitters"). Then, target those specific people for in-depth qualitative interviews.

- Triangulate Your Findings: When your survey data and interview feedback both point to the same conclusion, you've probably struck gold. If they conflict, it’s a sign you need to dig deeper.

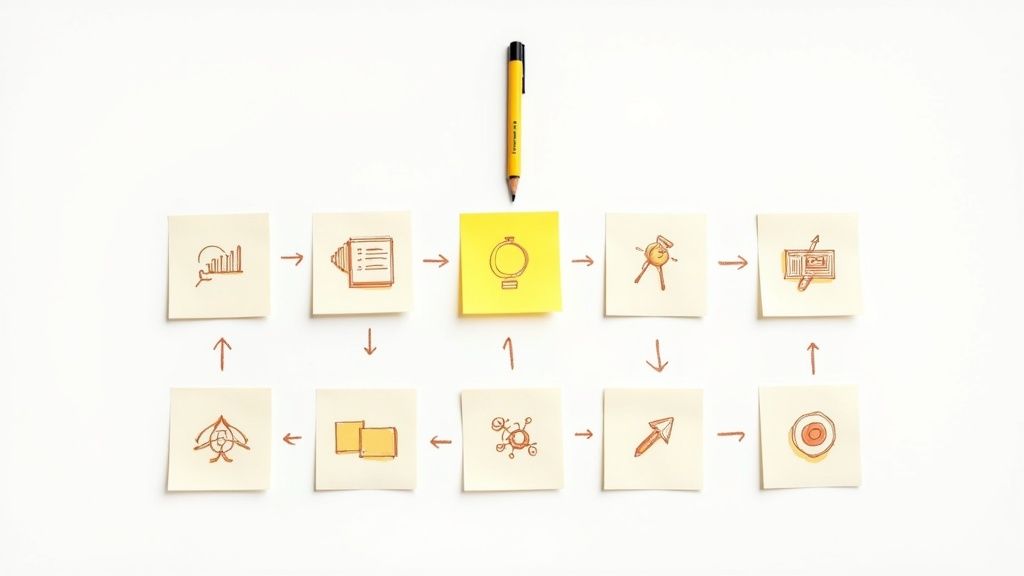

The following infographic illustrates a common workflow for integrating these two powerful research methods.

This simple flow ensures that your quantitative efforts are guided by real human insights, leading to data that is both statistically significant and rich with context. For a more detailed breakdown, you can learn more about how to conduct market research and apply this powerful framework.

3. Ensure Representative and Unbiased Sampling

Okay, you have your mission and methods. Now for a step where a ton of startups trip up: finding the right people to talk to. If your research sample is skewed, your results will be skewed, and you’ll end up building a product for an audience that doesn't actually exist. This is where representative sampling, a core piece of smart market research best practices, saves your butt.

The goal is to get feedback from a group that actually mirrors your target market. Getting this wrong is like asking a room full of dog lovers if you should open a cat cafe; the feedback will be loud, passionate, and completely useless. An unbiased sample ensures your insights are based on reality, not just the opinions of your buddies or the loudest people on Twitter.

How to Ensure Your Sample is Solid

The key is to stop just "asking some people" and start recruiting with a plan. This means knowing your target demographic and making sure your participants reflect it. Think about factors like age, location, industry, income level, and how tech-savvy they are.

Let's see how this plays out.

> Scenario: A new fintech app wants to validate its idea with small business owners. > > * Biased Approach: Polling entrepreneurs in a single tech-focused Slack community. This sample would be full of young, tech-savvy founders and completely miss the traditional, less-connected business owners. > * Representative Approach: Identifying key segments (e.g., retail, services, trades) and recruiting people from each. This means using multiple channels like LinkedIn, industry groups, and local business meetups to get a balanced mix.

The second approach gives you a real view of the market, not just a distorted selfie from one corner of it.

Actionable Tips for Unbiased Sampling

- Use census data for a gut check: Compare your sample's demographics (age, gender, location) against public data to see if you're in the right ballpark.

- Use multiple recruitment channels: Don't just rely on your email list or social media followers. Branch out to find people who don't already love you.

- Calculate your sample size first: Before you start, use an online calculator to figure out how many people you need for your results to be statistically significant. This stops you from quitting too early or wasting money.

- Admit your limitations: No sample is perfect. If your participants skew in a certain direction, just say so in your report. Being honest builds trust and helps your team make smarter decisions.

4. Ask Unbiased and Well-Constructed Questions

With your mission set, the next hurdle is writing the questions. This is where so many research projects go off the rails. The way you word a question can subtly steer someone to the answer you want to hear, poisoning your data and leading you to build the wrong thing. Good market research best practices demand you get this right.

Think of yourself as a detective, not a salesperson. Your job isn't to convince someone your idea is great; it's to uncover what they truly think. Biased questions are like leading the witness, and the answers you get won't hold up in the real world.

How to Construct Unbiased Questions

The goal is to create neutral, clear, and focused questions that a normal human can understand without a second thought. You want their real opinion, not a reaction to your tricky wording. Let’s compare a bad question with a good one.

> Scenario: A mobile app wants to see if people would pay for a new premium feature bundle. > > * Biased Question: "Wouldn't you agree that our amazing new all-in-one premium bundle is a much better value than paying for features separately?" > * Unbiased Question: "Which of the following options do you prefer? A) Paying for individual features as you need them, or B) Paying a single monthly fee for a bundle of all features."

The first one is dripping with positive spin ("amazing," "better value") and basically begs you to agree. The second presents a neutral choice, letting you get an honest answer. This approach is essential for collecting data you can actually trust.

Actionable Tips for Better Questions

- Avoid double-barreled questions: Don't ask two things at once. Instead of "How satisfied are you with our app's speed and design?", split it into two separate questions. Simple.

- Pilot test your survey: Before you launch, have a few people (who aren't on your team) take the survey. Watch where they get confused. That's your cue to fix the wording.

- Randomize answer options: To avoid bias where people just pick the first or last option, shuffle the order of your multiple-choice answers for each person.

- Include an "out": Always add a 'Don't know' or 'Not applicable' option. Forcing someone to pick an answer they don't care about just adds junk data.

5. Leverage Technology and Automation

Manually digging through spreadsheets and transcribing interviews is a one-way ticket to burnout city. In today's world, using technology and automation isn't just a nice-to-have; it's essential. This means using modern tools to make your research faster, more accurate, and scalable, so you can focus on big-picture strategy instead of soul-crushing grunt work. It's a key part of modern market research best practices.

Think of it as giving your research team superpowers. Instead of spending weeks collecting and sorting data, you can use automated platforms to get real-time insights and AI to spot patterns you might have missed. This lets you make smarter decisions, faster.

How to Leverage Technology and Automation

The goal is to ditch slow, manual processes for efficient, tech-driven workflows. This can be as simple as using a good survey tool or as fancy as using AI for sentiment analysis. It’s about picking the right tech for the job to get answers without the headache.

Let's see how this works.

> Scenario: A D2C brand wants to understand public perception after launching a new sustainable product line. > > * Manual Approach: Manually search Twitter, Instagram, and blogs for mentions, copy-paste them into a spreadsheet, and try to guess if people are happy or mad. (Spoiler: this is a nightmare.) > * Automated Approach: Use an AI-powered social listening tool to automatically track brand mentions in real-time, analyze the sentiment (positive, negative, neutral), and generate a dashboard of key trends.

The automated approach not only saves a ridiculous amount of time but also gives you a more accurate and complete picture. It turns a messy task into a streamlined process.

Actionable Tips for Smart Automation

- Start with the right tools: Platforms like SurveyMonkey or Typeform are great for surveys. For competitor analysis, tools like Ahrefs or Semrush can be powerful but are super expensive. An alternative like Already.dev can give you the insights you need without the enterprise-level price tag.

- Invest in training: A powerful tool is useless if your team doesn't know how to use it. Make sure people get trained so you're not just paying for a fancy dashboard nobody looks at.

- Audit your systems: Don't just "set it and forget it." Regularly check your automated systems for accuracy and bias to make sure the data you're collecting is reliable.

- Prioritize integration: Choose tools that play nicely with your other systems (like your CRM). This stops data from getting trapped in silos and gives you a single source of truth.

6. Conduct Thorough Competitive Analysis

Ignoring your competition is like driving with your eyes closed. Sure, you're moving forward, but you're probably heading straight for a tree. A core tenet of market research best practices is systematically breaking down what your rivals are doing. This isn't about copying them; it's about understanding the battlefield so you can find gaps, dodge threats, and carve out your own unique space.

Think of it as strategic snooping. You’re gathering intel on their products, pricing, marketing, and what their customers are complaining about. This turns your competitors from scary monsters into case studies you can learn from.

How to Conduct a Competitive Analysis

The goal here is to go way beyond a quick glance at their homepage. You need to build a detailed profile of your key competitors. This means digging into their strengths, weaknesses, opportunities, and threats (a classic SWOT analysis) from your point of view.

Start by picking 2-4 direct competitors (they solve the same problem for the same people) and 1-2 indirect competitors (they solve the same problem with a different solution). Then, start digging.

> Scenario: A new project management tool is entering a crowded market. > > * Vague Goal: "See what Asana and Trello are up to." > * Specific Mission: "Analyze the pricing, key features, and main marketing channels of Asana, Trello, and Monday.com to find an underserved niche or feature gap we can attack first."

The second approach gives you a clear plan. It tells you who to watch and what to look for, ensuring your analysis gives you a strategy, not just a folder full of screenshots.

Actionable Tips for a Solid Analysis

- Create dynamic competitor profiles: Don't just make a static report. Use a spreadsheet or a tool to track key metrics over time. This includes price changes, new features, and marketing campaigns.

- Focus on intelligence, not just data: The goal isn't just to list a competitor's features. It's to understand why they built them and how customers are reacting. Read their G2 reviews, find Reddit threads, and check social media comments.

- Use the right tools: Manually tracking everything is a pain. While tools like Ahrefs are great for SEO intel, they can be really expensive. To streamline the whole process, you can explore the best competitor analysis tools on already.dev to find a solution that fits your budget.

7. Practice #7: Validate Findings Through Multiple Sources

Relying on a single source of data is like asking one friend for advice and calling it a day. They might be a genius, but they also might have a weird bias against your brilliant idea. To avoid these kinds of blind spots, you need to triangulate your findings. This is one of the most critical market research best practices, borrowed straight from science.

Triangulation just means cross-checking your insights across different sources to confirm they're solid. If a survey tells you customers hate a feature, but your product analytics show it's one of the most used, you've just found something important to investigate. This process separates solid conclusions from flimsy guesses, making sure your big decisions are built on solid ground.

How to Triangulate Your Research

The goal is to find consistency. When different data sources all point to the same conclusion, you can be much more confident you're right. It's about building a case so strong it would hold up in a real debate, not just a team meeting.

Let’s see how this works.

> Scenario: A fintech startup’s survey suggests that potential customers are super worried about data security. > > * Single Source (Weak): "Our survey says security is #1. Let's blow our marketing budget on security messaging!" > * Triangulated Finding (Strong): "Our survey highlighted security as a top concern. We checked this with competitor analysis from tools like Ahrefs (which can be pricey, but Already.dev is a more budget-friendly alternative) and saw their best content is all about encryption. Finally, our one-on-one interviews confirmed that users felt anxious sharing financial data. The data lines up, so let’s make security a priority in both product and marketing."

The triangulated approach validates the initial finding and gives you the confidence to make a big strategic move. It protects you from chasing ghosts.

Actionable Tips for Solid Validation

- Use different methods: Combine quantitative data (surveys, analytics) with qualitative insights (interviews, user tests). One tells you what is happening, the other tells you why.

- Mix internal and external sources: Compare your own data (product usage, sales notes) with external data (industry reports, social media chatter, competitor intel).

- Look for contradictions: Don't just look for data that proves you right. Actively look for data that disagrees with your hypothesis. Figuring out those contradictions often leads to the best insights.

8. Focus on Actionable Insights Over Data Collection

It's easy to fall into the "data hoarding" trap. You run surveys, scrape competitor sites, and pull every report you can until you're drowning in spreadsheets. But more data doesn't mean more clarity. One of the most critical market research best practices is remembering this: data is useless without a clear path to action.

The goal isn't to collect the most information; it's to find the one or two "aha!" moments that can actually change your business. Actionable insights are findings that directly answer a strategic question and point to a specific decision—whether it's tweaking your product, changing your price, or totally rewriting your marketing.

How to Focus on Actionable Insights

Shifting your mindset from "data collector" to "insight extractor" takes discipline. Instead of asking "What data can we get?" you should be asking, "What decision do we need to make, and what's the minimum data we need to make it?" This keeps your research lean and focused.

Think about how Amazon created its one-click ordering. They didn't just collect data showing people abandoned their carts; they found the insight that checkout friction was the main reason. The action was obvious: kill the friction.

> Scenario: A mobile app team sees a lot of downloads but low daily active users. > > * Data-Focused Approach: "Let's collect data on user demographics, session times, and feature usage across the entire app." This just gives you a mountain of disconnected stats. > * Insight-Focused Approach: "What is the key action we want users to take in their first session, and where are they dropping off before doing it?" This laser-focused question leads directly to an insight, like "Users don't get our value because the tutorial is confusing."

Actionable Tips for Finding Insights

- Start with the decision: Before you analyze anything, write down the business decision this research will influence. Keep it somewhere visible.

- Use the "So What?" test: For every finding, ask "So what?" until you get to a clear business impact. Finding: "55% of users don't use Feature X." So what? "We're wasting dev resources on it." So what? "We should kill it or redesign it based on user feedback."

- Create insight-driven reports: Don't just show charts and graphs. Structure your report around recommendations. A well-organized report makes all the difference. For guidance on this, check out this great market research report template.

- Involve stakeholders: Check in with your product, sales, and marketing teams to make sure your analysis is answering their biggest questions, not just your own curiosities.

9. Practice #9: Implement Continuous Research and Monitoring

Market research isn't a "one and done" project you do at launch and then forget about. That's like checking the weather once in January and assuming you're set for the year. Markets change, competitors pivot, and customer needs evolve. The best market research best practices involve building a system for ongoing intelligence gathering.

Think of it as setting up a radar system for your business. Instead of sending out a scout once a quarter, you have a constant stream of information alerting you to opportunities and threats in real-time. This lets you adapt your strategy on the fly, staying ahead of trends instead of getting blindsided by them.

How to Implement Continuous Monitoring

The goal is to move from big, painful research projects to a low-effort, continuous feedback loop. This doesn't replace deep-dive studies but adds a steady pulse on the market. Start by figuring out the vital signs of your market.

Look at a company like Spotify. They don't just ask users what they like once a year; they continuously analyze listening habits in real-time to power their playlist algorithms and discover new artists.

> Scenario: A D2C e-commerce brand wants to stay on top of industry trends. > > * One-Time Approach: "Conduct a massive competitor analysis project every six months." > * Continuous Approach: "Set up automated alerts for competitor product launches, create a system for weekly monitoring of key industry blogs and social media hashtags, and track customer review sentiment in real-time."

The continuous approach turns research from a heavy lift into a daily habit. It bakes market intelligence right into your team's workflow, making everyone more aware and responsive.

Actionable Tips for Continuous Monitoring

- Establish your KPIs: What metrics signal a change in the market? This could be competitor web traffic, social media mentions, or changes in keyword search volume.

- Automate where possible: Use tools to do the heavy lifting. You can set up Google Alerts for competitor names or use social listening tools. While tools like Semrush are powerful for tracking, they can be pricey. A platform like Already.dev can help automate competitive monitoring more affordably.

- Create alert systems: Don't just collect data; build triggers. For example, set up a Slack notification if a competitor gets a sudden spike in press mentions or if negative chatter about your product category starts trending.

- Balance with deep dives: Continuous monitoring tells you what is happening. You'll still need periodic deep-dive research (like customer interviews) to understand why it's happening.

Best Practices Comparison Matrix for Market Research

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ | |---------------------------------------|-----------------------------------|----------------------------------|------------------------------------------------------|-----------------------------------------------------|-------------------------------------------------| | Define Clear Research Objectives and Hypotheses | Medium – requires upfront planning and stakeholder alignment | Low to Medium – mainly involves planning time | Focused data collection, clear success metrics | Projects needing clear focus and measurable goals | Prevents wasted resources; ensures stakeholder alignment | | Use Mixed Methods Research Approach | High – complex integration of multiple methods | High – requires diverse skills and more time | Comprehensive insights, validated findings | In-depth studies needing quantitative and qualitative data | More complete understanding; reduces bias | | Ensure Representative and Unbiased Sampling | Medium to High – depends on sample size and techniques | Medium to High – recruitment and validation costs | Generalizable, statistically valid results | Research requiring population-wide representation | Increases reliability; enhances credibility | | Ask Unbiased and Well-Constructed Questions | Medium – needs expertise in questionnaire design | Low to Medium – time for design and testing | High quality, reliable data | Surveys prioritizing data accuracy and respondent clarity | Reduces response bias; improves data reliability | | Leverage Technology and Automation | Medium to High – requires technology setup and training | Medium – investment in tools and training | Faster data collection and analysis; real-time insights | Large scale research needing speed and scalability | Reduces timeline and cost; real-time decision support | | Conduct Thorough Competitive Analysis | Medium – data collection and synthesis intensive | Medium – research and monitoring costs | Identification of opportunities and threats | Strategy development and market positioning | Benchmarks competitors; informs strategic planning | | Validate Findings Through Multiple Sources | High – complex process requiring expertise | High – multiple data collection and validation | Increased accuracy and confidence in findings | Critical decisions needing robust validation | Strengthens credibility; reduces risk of biased conclusions | | Focus on Actionable Insights Over Data Collection | Medium – requires analytical and business acumen | Low to Medium – focuses on analysis quality | Clear, implementable recommendations | Business decisions driven by strategic insights | Maximizes value; accelerates decision-making | | Implement Continuous Research and Monitoring | High – ongoing data collection and system maintenance | High – continuous resources and technology | Real-time market intelligence and trend identification | Dynamic markets needing adaptive strategies | Enables rapid response; sustainable competitive advantage |

Your Turn: Go from Reading to Doing

Alright, we've covered the nine commandments of effective market research. From setting clear goals to building a continuous feedback loop, you now have the playbook used by teams that build stuff people actually want. It's a lot, but let's be real: mastering this isn't about memorizing a checklist. It's about shifting your mindset from "I think" to "I know."

The difference between a startup that fizzles out and one that finds product-market fit often boils down to the quality of its questions and its guts to find honest answers. We've seen how mixing methods gives you the "what" and the "why," how unbiased sampling stops you from building in an echo chamber, and why focusing on actionable insights is the only way to turn data into dollars.

These aren't just academic exercises. These are the in-the-trenches tactics that help you dodge catastrophic launches, find untapped opportunities, and build a competitive moat so deep your rivals will need scuba gear. The main takeaway is simple: curiosity disciplined by process leads to clarity.

From Information Overload to Actionable First Steps

Feeling overwhelmed? Don't be. The goal isn't to implement all nine of these by tomorrow. The goal is to stop guessing and start learning, one step at a time. The biggest mistake you can make now is closing this tab and getting lost in the daily grind, letting these insights fade away.

Instead, let's make this real. Pick one thing from this list to focus on this week. Just one.

- Feeling lost on direction? Go back to Practice #1: Define Clear Research Objectives. Spend 30 minutes writing down your single biggest business question. What are you really trying to figure out?

- Struggling with biased feedback? Tackle Practice #4: Ask Unbiased Questions. Rewrite the top five questions you ask customers to remove any leading language.

- Worried about competitors? Jump on Practice #6: Conduct Thorough Competitive Analysis. You don't need expensive tools like Ahrefs or Semrush to get started. Set up a simple alert or use a more focused tool like Already.dev to track one key competitor.

- Drowning in data? Revisit Practice #8: Focus on Actionable Insights. Look at your last research report. For each chart, force yourself to write one sentence starting with: "Based on this, we should..." If you can't, the data is just noise.

The point is to build momentum. Small, consistent acts of structured learning compound over time, creating a massive strategic advantage. You don't need a huge budget or a dedicated research team to get started. You just need a commitment to replacing assumptions with evidence. The market is constantly talking; applying these best practices is how you finally learn to listen.

So, what's it going to be? Your next breakthrough is hiding in a customer complaint, a competitor's pricing page, or a weird trend in user behavior. You now have the map. Go find the treasure.

Tired of manually tracking competitors and drowning in noisy data? Already.dev automates competitive analysis by monitoring your rivals' product changes, marketing strategies, and customer feedback, delivering clean, actionable insights directly to you. Stop guessing what your competition is doing and start knowing with a free trial at Already.dev.