A Guide to Market Research for Product Development

Discover how market research for product development helps you build things people actually want. Get practical, no-fluff advice to avoid costly mistakes.

You've got a brilliant idea. The kind that keeps you up at night, sketching on napkins. But how do you make sure it's not a dud? That's where market research for product development comes in.

It's about gathering intel on your future customers and checking out the competition before you write a single line of code. Think of it as your secret weapon to avoid building something nobody wants.

Why Market Research Isn't a Dumb Chore

I know, I know. You're fired up and ready to build. That energy is gold, but jumping in blind is like trying to find your keys in the dark after three margaritas. You'll be busy, but you won't get far.

Good market research isn't about making boring reports. It’s your best defense against catastrophic, soul-crushing failure. It’s the only way to prove that people besides your mom will actually want to buy your thing.

The Graveyard of Good Intentions

History is littered with well-funded products that bombed because they skipped this step. Remember Google Glass? A technical marvel that solved a problem no one had, all while making people look like they'd escaped a low-budget sci-fi movie.

Then there was Juicero, the infamous $400 Wi-Fi juicer that squeezed pre-packaged fruit. Turns out, people's hands could do the same job for free. Who knew?

These cautionary tales have one thing in common: they were solutions desperately looking for a problem. They focused on the "what" without ever asking "why" or "for whom."

> Key Takeaway: Market research is your insurance policy against your own brilliant, but totally wrong, assumptions. It forces you to listen to the market, not just the echo chamber in your head.

Following the Money Trail

Still not convinced? Just look where the money's going. The global market research industry is on a tear, growing from $71.5 billion in 2016 to a projected $150 billion by 2025. You can check out the full report on industry trends if you're into big numbers.

Companies aren't dropping billions on this for kicks. They know every dollar spent understanding the customer saves them ten on marketing a product nobody wants. This is how you build something that actually matters.

Getting Inside Your Customer's Head

Okay, let's get to the fun part: doing the actual research. This is where you stop guessing and start listening. Think of yourself as a detective, piecing together someone's real struggles.

You've got two main ways to gather intel. Primary research is you, rolling up your sleeves and collecting brand-new info. Secondary research is you, cleverly using data someone else already gathered. You'll need both.

Talking to Actual Humans

Primary research is your best friend for raw, unfiltered feedback. This isn't about stuffy interrogations. It's about having real conversations.

Here’s how to do it without being weird:

- Casual One-on-One Interviews: Grab a coffee (virtual or real) with people who fit your ideal customer profile. Ask open-ended questions about their problems, not your solution. Your goal is to hear their pain points in their own words.

- Online Surveys (That Don't Suck): Keep them short and mobile-friendly. A few multiple-choice questions and maybe one or two "tell me more" questions at the end is all you need.

- Focus Groups Disguised as Conversations: Get a small group of potential users together and just let them talk. Seriously. You'll be amazed at what comes up when they start riffing off each other.

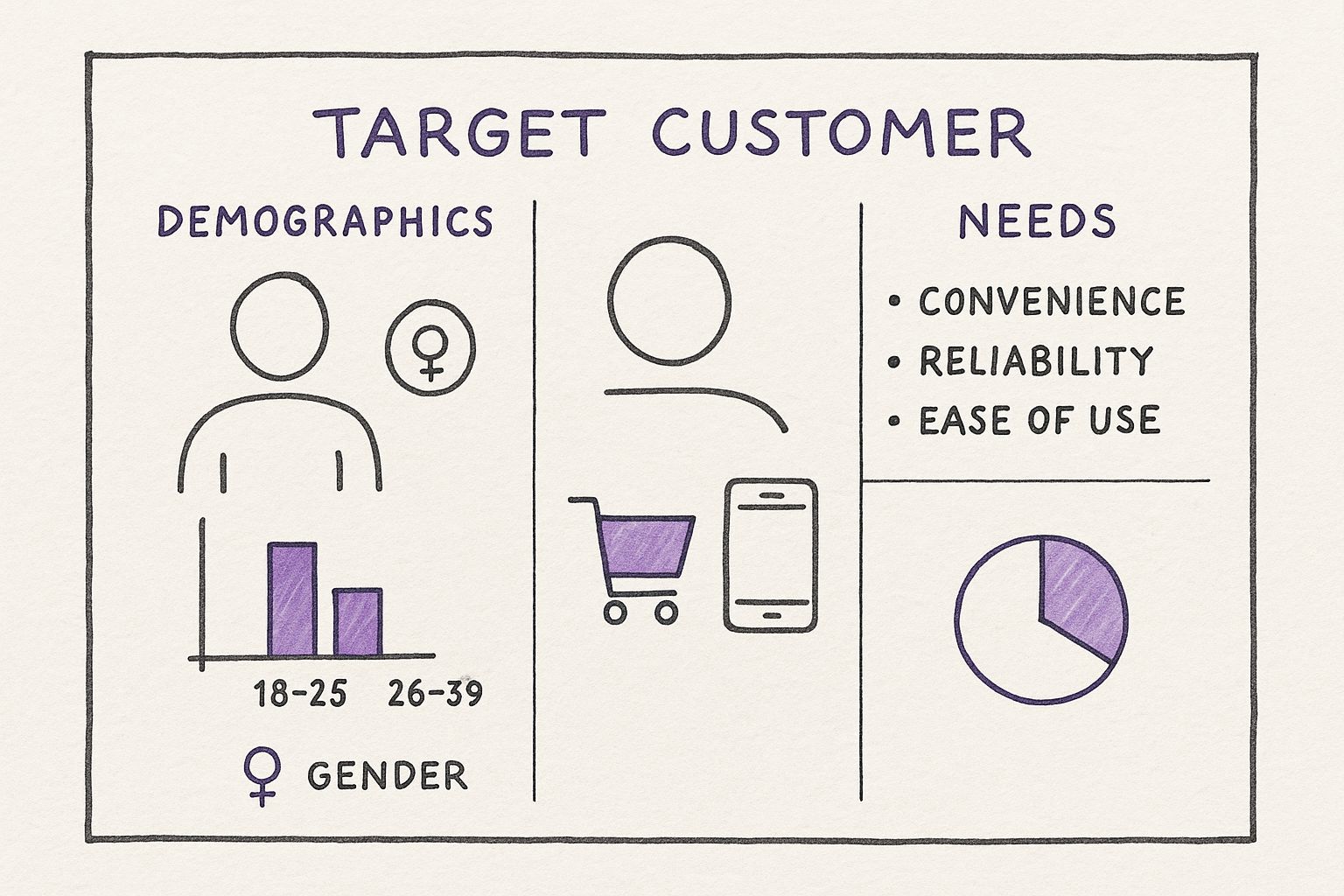

To make sense of it all, you need to know who you're building for.

A good persona turns dry data into a real person. It’s step one to building something people actually care about. If you're stuck, our guide on how to identify target customers is a lifesaver.

Choosing Your Research Method

Deciding how to gather feedback can feel like a pop quiz. Just match the method to your question. Are you trying to understand the "why" or the "how many"? This table should help.

| Method | Best For | Pro Tip | | :--- | :--- | :--- | | Surveys | Getting numbers from a large group fast (e.g., "What % of users prefer Feature A?"). | Keep it under 10 questions. Offer a shot at a gift card to get more responses. | | Interviews | Deeply understanding the "why" behind someone's pain. | Record the call (with permission!). You can't listen and take perfect notes at the same time. | | Focus Groups | Seeing how people influence each other's opinions. | Have a moderator who can keep things from going off the rails and make sure Timmy doesn't hog the mic. | | Usability Testing | Watching what people actually do with your product, not what they say they'll do. | Don't help them. Let them struggle. That's where you find the gold. |

The best approach is usually a mix. Use surveys to find a trend, then do interviews to hear the stories behind the numbers.

Using Data That Already Exists

Secondary research is your secret weapon for understanding the big picture without breaking the bank. You're basically using reports and data that other people already paid for.

For instance, companies are pouring money into keeping customers happy, with 20.7% of research spending going to satisfaction surveys. Another 14.2% goes to user experience (UX) surveys. This stuff tells you what the big players care about. You can find more of these nuggets in market research industry statistics on scoop.market.us.

> Pro Tip: Don't just look for data that confirms what you already believe. That's called an echo chamber. Actively hunt for info that challenges your assumptions. It's better to have your feelings hurt by a statistic now than your bank account emptied by a failed launch later.

How to Ethically Spy on Your Competition

Your competitors are a goldmine of free lessons. I'm not talking about putting on a trench coat and hiding in the bushes. This is about smart analysis to see what they’re doing right and—more importantly—where they're screwing up.

Think of their product as a finished homework assignment you get to grade. By dissecting their features, pricing, and customer reviews, you can pinpoint the exact gaps in the market. That's your opening.

Become a Product Detective

First things first: get your hands dirty. Sign up for free trials. Buy their product. Use it like a real customer.

Pay close attention to the user experience. Where does it feel clunky? What makes you say, "Wow, that's clever"?

I always keep a list of notes on these three things:

- Onboarding: How hard is it to get started? If you feel lost, that's a huge opportunity for you.

- Key Features: What's the core job their product does? Is it polished, or does it feel tacked on?

- The "Aha!" Moment: When did you finally get it? If it took too long, you can do better.

This hands-on approach gives you a gut feeling that no report can match. For a deeper dive, our guide on what is competitive intelligence breaks down the whole process.

Digging for Digital Clues

Once you've used their product, it's time to see how they perform in the wild. This is where tools come in handy. Powerhouses like Ahrefs or Semrush are incredible for this, but let’s be honest—they can be expensive. Like, "sell a kidney" expensive.

> The good news? You don’t need an enterprise-level budget. A tool like already.dev automates a ton of this detective work as an alternative. Just describe your product idea, and it finds your competitors and maps out their features for you.

Here's a quick look at how the platform can visualize the competitive landscape.

A report like this instantly shows you who the key players are and where your idea fits. It can save you dozens of hours of boring manual work.

The Voice of the Unhappy Customer

Finally, go where the real tea is spilled: customer reviews. I'm talking about sites like G2, Capterra, Reddit, and the App Store.

Here’s a pro tip: filter for the 3-star reviews. These are often the most thoughtful, highlighting both what people love and what drives them nuts.

Look for patterns. Are customers always begging for a specific feature? Do they complain about terrible customer service? Every one-star review is a potential feature for your product. Your competitors' biggest weaknesses can become your greatest strengths.

Finding the Gold in Your Research Data

So, you've waded through surveys and transcribed interviews. Your desk is covered in sticky notes and your brain feels like a shaken-up snow globe. Now what?

Don't panic. This is where you become a data whisperer. It's not about complex statistics; it's about spotting patterns and finding the story your data is trying to tell you.

Turning Noise into Actionable Insights

First, separate your qualitative data (interview notes, open-ended answers) from your quantitative data (survey percentages, market size).

For the qualitative stuff, start grouping feedback into themes. Use a spreadsheet or colored highlighters. When five different people complain about a "clunky interface," that's not a coincidence—it's a theme.

For the numbers, you're looking for significance. Did 75% of survey takers say they’d pay more for a specific feature? That’s a giant blinking sign. The blend of "what" people do (quantitative) and "why" they do it (qualitative) is where the magic happens. Our guide on market research data analysis is a great place to start.

Data-Backed Decisions Get the Green Light

Let's be real: gut feelings are great for choosing a lunch spot, but they don't convince investors. In the U.S., quantitative research makes up 59% of market research investments compared to just 18% for qualitative. And nearly 90% of companies use online surveys to get that feedback. You can explore more about these market research statistics on research.aimultiple.com.

> This isn't about ignoring the human stories. It's about using solid numbers to back them up.

This is how you go from saying "I think users are frustrated" to "Our research shows 68% of users find the current solution too complicated, creating a massive opportunity for a simpler product." See the difference? One is an opinion; the other is a business case.

From Insights to a Product People Actually Want

Alright, this is the best part. All that digging is about to pay off. We turn that raw intelligence into an actual product plan.

The temptation is to build every feature that came up. Don't. The magic is connecting the biggest, most painful problems with the simplest features that make that pain go away.

Turning Pain Points into Must-Have Features

Grab a whiteboard. On one side, list the top 3 to 5 customer problems you found. Be specific. "Bad UI" is useless. "Users spend 10 minutes trying to find the export button" is gold.

Now, on the other side, brainstorm the simplest feature that solves each problem. These are your non-negotiables. If you do this right, every single thing on your roadmap should point back to a real, validated customer problem.

This is how your market research for product development becomes the foundation for every decision you make.

> Key Takeaway: If you can’t trace a feature back to a specific customer problem from your research, ask yourself why the hell you're building it. Gut feelings are for hypotheses, data is for decisions.

Carving Out Your Unique Spot in the Market

Now, let's use that competitor analysis. You already know where they're dropping the ball because you’ve read their 1-star reviews. This is your opening.

Your unique selling proposition (USP) lives right where your audience's needs and your competitors' failures meet.

- Competitor's pricing confusing? Make yours radically simple.

- Their main features buggy? Make stability your obsession.

- Their customer service a joke? Make fast, friendly, human support a core feature.

By zeroing in on these gaps, you stop being just another alternative and start becoming the obvious choice. You’re not just building another tool; you’re building the solution.

Your Top Market Research Questions, Answered

Alright, let's clear up some common questions before you dive in.

How Much Should I Budget for This?

Honestly, anywhere from $0 to the price of a small car.

You can get started for free. Whip up a survey on Google Forms, spend an afternoon digging through competitor reviews on G2 or Capterra, or just have five virtual coffees with people in your target audience. On the flip side, hiring a dedicated agency can cost tens of thousands.

> The most important thing is that doing something is infinitely better than doing nothing. I've seen three good customer conversations save a company from a six-figure mistake.

So, How Do I Know When I'm Done?

This is the golden question. The real answer has nothing to do with hitting a magic number of interviews.

You’re close when you can predict what people are going to say. When the "aha!" moments get rarer and conversations start confirming what you already know, you've hit data saturation.

At this point, you should be able to confidently answer three questions:

- Who is my ideal customer, really?

- What's the core problem I'm solving for them?

- How is my solution genuinely different from what they're doing now?

If you have solid, evidence-backed answers, you're good to go.

Can I Do This for a Totally New Product Idea?

Absolutely! In fact, this is the most critical time to do it. When you're researching for new product development, the focus isn't on your brilliant idea—it's on the problem you think it solves.

Don't ask, "Would you use my cool new app?" That's a useless question. Instead, ask, "Tell me about the last time you struggled with [the problem your app solves]."

Your mission is to become an expert on their pain. Find out how they're currently fixing it. Is it a messy spreadsheet? A weird combo of three different tools? These workarounds are gold—they're proof that the problem is real and painful. This is how you validate the need before you ever write a line of code.

Ready to stop guessing and start building with confidence? Already.dev automates your competitive research, giving you a detailed market map in minutes, not weeks. Get your free report today and see exactly where your idea fits into the market.