Market Research for Startups Done Right

Tired of bad advice? Our guide to market research for startups shows you how to validate ideas, find customers, and grow faster by avoiding common mistakes.

Let's be real for a second. When most founders hear "market research," their eyes glaze over. They picture dusty reports and endless spreadsheets—a total waste of time when you could be building. But that’s a huge mistake.

Proper market research for startups isn't about creating busywork. It’s your secret weapon. It’s how you find the shortcuts, dodge the money pits, and build something people are actually itching to buy. We’re not talking about academic theory here; this is a practical playbook for sidestepping the classic blunders that tank otherwise brilliant companies.

Stop Guessing, Start Knowing

That whole "build it and they will come" idea sounds great in a movie montage, but in the real world, it's a fast track to burning through your savings. You wouldn't build a house on a hunch, right? So why would you build a business on one? Good market research isn't about writing a hundred-page report; it’s about systematically killing your riskiest assumptions.

The uncomfortable truth is that most startups don't make it. It’s rarely because the idea was fundamentally flawed. More often, they simply ran out of runway while trying to solve a problem no one was losing sleep over. In fact, around one in five startups fail within their first year, and those odds don't get much better as time goes on. A huge reason for this is a failure to truly understand the market and validate the need before going all-in. For a deeper dive into the startup ecosystem's tough realities, the latest Startup Genome report is always an eye-opener.

What You're Really Trying to Accomplish

Think of research as your startup’s compass. Its job isn't to give you a simple "yes" or "no" but to point you toward the path of least resistance. For a founder, that means zeroing in on a few critical questions:

- Pinpoint the Pain: What's a real, nagging problem that a specific group of people would gladly pay to make disappear?

- Validate Your Solution: Does your idea actually fix that problem in a way that’s noticeably better than what they’re doing now?

- Find Your First Believers: Who are the people feeling this pain most acutely? These are your early adopters, the ones who will champion your product.

> "The aim of marketing is to know and understand the customer so well the product or service fits him and sells itself." - Peter Drucker

This quote from Peter Drucker is everything. Your research isn't about figuring out how to sell. It’s about understanding so deeply that the product practically sells itself.

It Doesn't Take a Big Budget

This is the biggest myth out there: that market research for startups is some expensive, enterprise-level luxury. Sure, giant corporations drop fortunes on formal focus groups and massive data buys, but as a startup, you have a superpower they don't: agility. You can jump on a call with a potential customer this afternoon. You can dissect a competitor’s strategy from your couch. You can test a new value proposition with a $50 ad spend.

This is all about adopting the right mindset from the start.

Smart Startup Research vs. Common Mistakes

Here's a quick look at the mindset that gets results versus the habits that waste time.

| The Founder's Edge (Effective) | The Founder's Folly (Ineffective) | | ------------------------------------------------------------------ | ------------------------------------------------------------------ | | Asks: "What problem am I solving and for who?" | Says: "My idea is revolutionary!" | | Talks to at least 20 potential customers before writing a line of code. | Talks to friends and family who politely nod. | | Looks for evidence that disproves their idea. | Looks for any data that confirms their bias. | | Focuses on a small, niche group of early adopters. | Tries to build a product for "everyone." | | Spends time understanding the "why" behind user behavior. | Spends money on ads before knowing the "what." | | Views research as a continuous loop of learning. | Treats research as a one-time task to check off a list. |

Getting into the "Founder's Edge" column isn't about having more resources; it's about being more resourceful and honest with yourself.

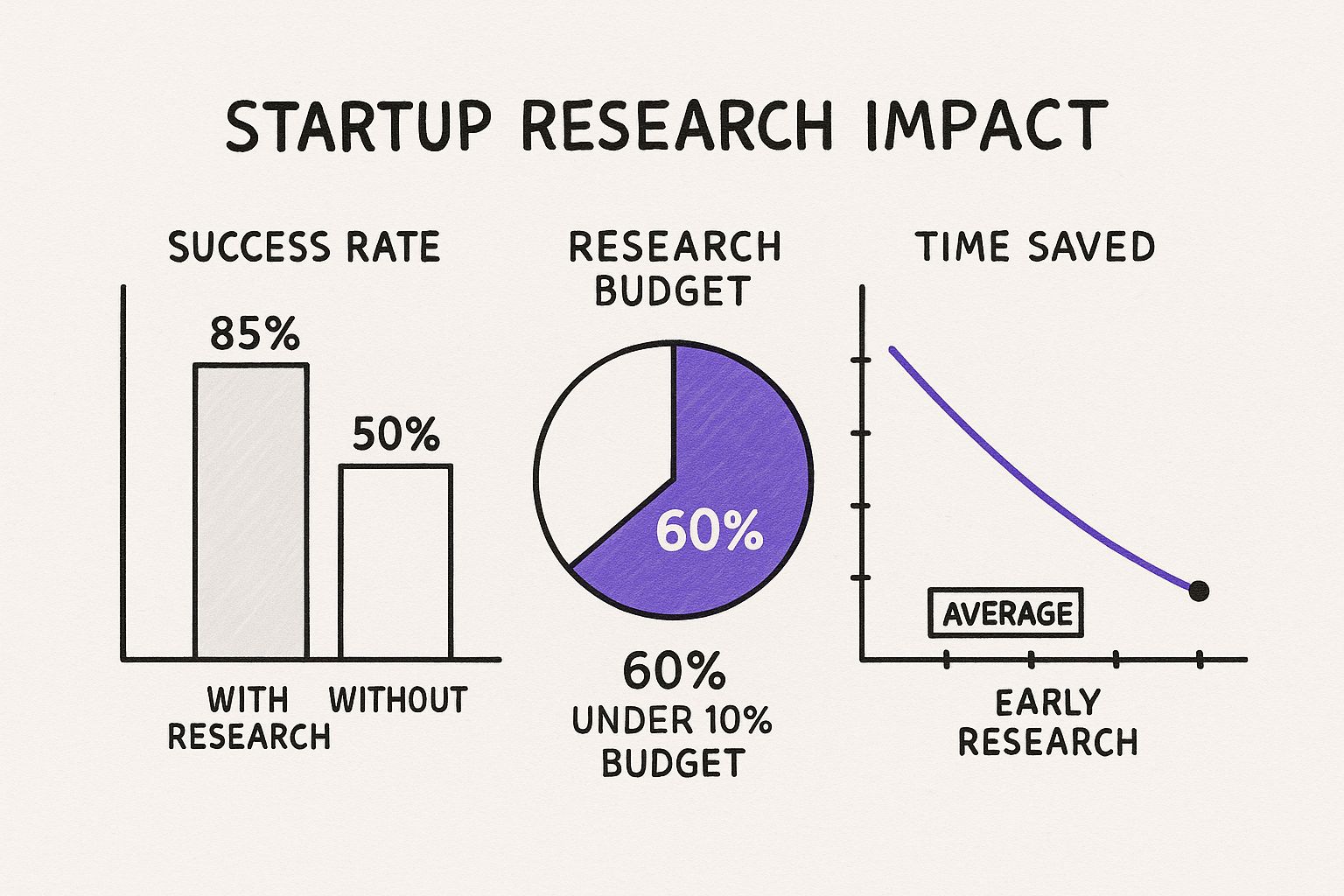

The numbers don't lie. A small, upfront investment in understanding your market dramatically improves your odds and saves you from wasting precious time and money. Despite this, too many founders put a laughably small portion of their effort into it. This is the low-hanging fruit that separates the breakout successes from the cautionary tales.

You don't need to splurge on heavyweight tools like Ahrefs or Semrush right out of the gate, especially since they can be pretty expensive. A simple, affordable tool like already.dev can deliver the competitive intel you need to make smart decisions without torching your budget.

Get Out of the Spreadsheet and Talk to Actual Humans

It’s so tempting to hide behind spreadsheets. You can spend weeks crafting perfect charts and pivot tables that seem to prove your idea is a guaranteed winner. But here’s the hard truth: that data tells you what is happening, but it rarely tells you why.

The real insights—the kind that build great companies—come from real human conversations. This is what we call primary research. It means getting out of the building (or just off your couch) and actually talking to the people you hope will one day pay you for your product.

I get it. It can feel messy and a little intimidating. But it’s a thousand times more valuable than any generic market report you can download. We’re not talking about launching a massive survey to 10,000 people. The goal here isn't statistical significance; it's deep, genuine understanding.

How to Find People to Talk To (Without Being Weird)

Okay, so where do you find these people who hold the keys to your startup's future? It's way easier than you think, and it doesn't require any shady tactics.

-

Your (Extended) Network: Don't just ask your mom and your best friend. Fire up LinkedIn and look for second-degree connections who fit your ideal customer profile. A warm introduction from a mutual contact works wonders. People are surprisingly open to helping when the ask is as simple as, "Could I pick your brain for 15 minutes about your experience with X?"

-

Online Communities: Dive into the digital watering holes where your audience lives. This could be a specific Reddit subreddit, a niche Slack channel, or a private Facebook group. The key is not to just show up and spam your idea. Become part of the conversation, offer some value, and then ask if a few members would be open to a quick chat.

-

Your Competitor's Unhappy Customers: This is my favorite sneaky-smart tactic. Go find people complaining about your competitors on Twitter or in product reviews. They are literally raising their hands and screaming, "I have a problem you can solve!" Reach out with a simple, empathetic message: "Hey, I saw you were frustrated with [competitor's product]. I'm exploring some ideas in this space and would love to hear more about your experience."

> "There are no facts inside your building, so get the heck outside." > — Steve Blank, Startup Guru

This should be your mantra. Every assumption you have is just a guess until it’s validated by a real customer. Trust me, twenty focused conversations with the right people will give you more actionable insights than a thousand survey responses from the wrong ones.

The Art of Asking Questions That Actually Work

Your mission here is to uncover problems, not to pitch your solution. The second you start selling, the conversation shifts. You'll get polite nods and vague encouragement instead of the brutal honesty you desperately need.

Your questions should always be open-ended. Focus on their past behavior, not their predictions about the future. People are terrible at predicting what they will do but are excellent storytellers about what they’ve already done.

Good Questions to Ask:

- "Can you walk me through the last time you had to deal with [the problem]?"

- "What was the most frustrating part of that process?"

- "What have you tried to do about it? Anything you've paid for?"

- "If you had a magic wand and could fix anything about this, what would it be?"

Terrible Questions to Ask:

- "Would you buy my amazing product if it did X, Y, and Z?" (Of course they'll say yes. It's polite and hypothetical.)

- "How much would you pay for this?" (They have no context, so they'll either lowball you or give a random number.)

- "Do you think my idea is good?" (This is just fishing for a compliment, not gathering data.)

Pay close attention to emotion. When does their voice change? When do they sound annoyed, frustrated, or even resigned? That's where the real pain points—and your biggest opportunities—are hiding.

Listen for the problems they actually have, not the solutions they think they want. Henry Ford famously quipped that if he'd asked people what they wanted, they would have said "a faster horse." Your job is to hear "faster horse" and understand the real need is "getting from point A to point B more efficiently." That’s the very essence of great market research for startups.

How to Spy on Your Competition for Cheap

Let's be clear: competitive analysis isn't a license to be a copycat. If your brilliant startup idea is to just do what the big guys are doing but with a different logo, you’re setting yourself up for failure. Think of it less like copying and more like detective work.

You’re on the hunt for clues your rivals have left behind—the gaps they've missed, the customer complaints they're ignoring, and the marketing channels they haven't even touched. This is where you find your opening. Good market research for startups is all about learning from their wins and their face-plants to carve out your own space.

Digging for Digital Gold in Their Backyard

Your spy mission starts right where your competitors live online: their website and marketing channels. No secret agent gadgets needed, just some good old-fashioned observation of what they’re broadcasting to the world.

-

Tear Down Their Website: What's the very first thing they ask you to do? Is it "Request a Demo"? "Start a Free Trial"? Their homepage is basically a giant billboard screaming their main value proposition. Dive into their case studies and testimonials to see the exact problems they claim to solve.

-

Dissect Their Pricing: The pricing page is a treasure trove of information. Are they charging per user, per feature, or on a usage-based model? This tells you a ton about their target customer. A sky-high price probably means they're chasing enterprise clients, leaving a wide-open lane for you to serve small businesses.

-

Read Between the Lines of Reviews: This is where the real dirt is. Head over to sites like G2, Capterra, and Trustpilot. Skip the glowing 5-star raves and the angry 1-star rants. The gold is in the 3 and 4-star reviews, where people say things like, "The product is great, but I really wish it had X." That "but" is your opportunity knocking.

This initial sweep gives you a solid foundation. If you want a more structured approach to this first step, our guide on how to identify competitors lays out a great framework.

Finding the Gaps They Can't See

Once you've done your surface-level snooping, it's time to dig a little deeper into their customer acquisition strategy. This is the part where most founders assume they need to drop a small fortune on fancy software.

Sure, platforms like Ahrefs or Semrush are incredibly powerful for deep-dive SEO, but their monthly fees can give a bootstrapped founder a heart attack. You don’t need a bazooka to hunt a rabbit.

> A competitor's marketing strategy is just a collection of assumptions they're testing with their own money. Your job is to figure out which of those assumptions are wrong.

This is where a smarter, more affordable tool becomes your secret weapon. Instead of paying for a bloated platform with a million features you'll never touch, you can get the critical insights you need without the sticker shock.

Take a look at how a tool like already.dev can cut through the noise, showing you exactly where competitors are active—and more importantly, where they aren't.

What you're seeing here isn't just a boring list of rivals; it's a strategic map. The platform automatically surfaces not just the obvious big players but also the indirect competitors and even past failures in the space. That’s a complete competitive landscape that would honestly take you weeks to piece together by hand.

Turning Their Content into Your Playbook

A competitor's content strategy is a direct window into what they think their customers care about.

Go binge-read their blog, their help documentation, and their YouTube channel. What topics do they talk about over and over again? That’s what they’re trying to own in search results. What questions pop up in the comments? That’s your audience telling you exactly what they need help with.

Using a focused tool like already.dev automates a huge chunk of this SEO and content research. It can quickly show you the keywords they rank for and which articles drive their traffic. From there, you can spot the underserved topics and create content that answers the questions they're completely ignoring. This isn't about stealing their ideas—it's about serving their audience better than they do.

Finding Your Niche in a Crowded Market

Let's be real: the world is a noisy place. If you try to build a product for everyone, you'll end up building one for no one. It's a classic startup mistake that almost guarantees you'll fade into the background. You absolutely have to find your corner of the universe—a specific, profitable niche where you can not only survive but thrive.

This is where all that research you’ve been doing finally starts to pay off. You've talked to actual humans and done some digging on your competitors, leaving you with a beautiful, messy pile of insights. Now, the real work begins: connecting those dots to find a gap in the market that's just waiting for your idea.

> "The riches are in the niches."

It's a bit of a cliché, but it's true for a reason. The entire point of market research for startups isn't just to confirm that a huge market exists. It's about finding a small, passionate group within that market whose problems you can solve better than anyone else. That's your foothold.

Think Globally, Not Just Locally

The startup scene isn't confined to Silicon Valley anymore. The whole game has changed, and huge opportunities are popping up in places most founders aren't even looking. To find your niche, you need to zoom out and see the bigger picture.

The startup ecosystem is undergoing a massive shift. While the United States is still a heavyweight, its grip is loosening. Today, only 22% of the top 1,000 startup cities are in the U.S., a figure that's been on a steady decline.

Meanwhile, the Asia Pacific region is absolutely booming. China's ecosystem has surged by 45.9%, and Singapore's has grown by an incredible 44.9%. These aren't just abstract statistics; they represent massive, hungry markets with their own unique problems and competitive landscapes.

What this tells you is that your "niche" could be geographic. The fintech idea that’s a dime-a-dozen in North America might be a game-changer in Southeast Asia. Your research should help you spot these cultural, economic, and regulatory differences to find a market that's not just big, but actually ready for what you're offering.

Spotting Your Slice of the Pie

So, how do you take all this data—from global trends to interview notes—and nail down a real, defined niche? You're looking for the sweet spot where three key things overlap.

-

A Specific Audience: Who are these people, really? Don't just say "millennials." Get granular. Think "millennial remote workers who are part of a 2-person marketing team at a B2B SaaS company." The more specific you are, the easier they are to find and talk to.

-

An Unsolved Problem: What's the nagging, persistent pain point this specific group complains about? Your interviews should have made this crystal clear. It's that "I really wish someone would just fix X" comment you heard again and again.

-

A Unique Angle: How are you going to solve their problem differently? This is your secret sauce. Maybe you're cheaper. Maybe you're way easier to use. Or maybe you focus on one key feature the big players have ignored. This is what makes you stand out.

Let’s say you're building a project management tool—a brutally crowded market. But through your research, you discovered that freelance graphic designers who juggle multiple clients can't stand the bloated, overly complex tools out there. They just want a simple way to track feedback and file versions.

Boom. There's your niche.

Your Niche: Freelance graphic designers. Their Problem: Managing client feedback on visual projects is a chaotic mess of endless email threads and conflicting file versions. Your Angle: A dead-simple, visually-focused tool for feedback and version control, with none of the bloated enterprise features.

Once you have this level of clarity, every decision becomes simpler, from the features you build to the copy on your homepage. A great way to keep sharpening this angle is to consistently watch what your competitors are up to. To make that less of a headache, check out our framework of competitive analysis for a repeatable process.

This focused approach is the heart of effective market research for startups. It’s not about finding a market with millions of potential users on day one. It's about finding your first 100 true fans who can't imagine their lives without what you're building. From there, you can expand.

Tell a Story That Gets You Funded

https://www.youtube.com/embed/kghcAk7l6eA

So, you've done all this work. You've talked to customers, snooped on competitors, and crunched the numbers. But all that research is just a pile of data until you can convince the people with the money to care.

This is the final boss battle of your market research journey: turning that data dump into a compelling story that actually gets you funded.

Let’s be brutally honest. Venture capitalists (VCs) don't throw money at cool ideas. They've heard a million pitches for "the next big thing." What they're really looking for is a founder who can walk in with hard evidence and prove, beyond a shadow of a doubt, exactly how their startup is going to make money.

This is your moment to shift from "I think this is a neat idea" to "I have a plan, backed by real-world evidence, that shows a clear path to dominating a market." Your research isn't just a talking point; it's your biggest competitive advantage.

Weave Your Research into an Unbeatable Pitch

Your pitch deck isn't just a collection of slides. It’s a narrative, and your research provides the entire plot. It’s your job to connect all the dots for them so they can see the happy ending—for their investment, that is.

- The Pain: Start with the very real, frustrating problem you heard about over and over in your customer interviews. Use direct quotes. Make the pain palpable. Don't just tell them people have a problem; show them.

- The Fix: Position your product not just as a bunch of features, but as the only logical, perfect answer to that specific pain point you just described.

- The Proof: This is your knockout punch. Bring in your competitive analysis. Point out the glaring gap in the market you discovered and show precisely how your rivals are dropping the ball and failing to fill it.

When you do this, your pitch transforms from a hopeful plea into a logical, almost inevitable conclusion. You’re no longer just asking for their belief; you're presenting an opportunity so obvious they'd feel foolish for passing it up.

> An investor doesn't fund a startup because they like the idea. They fund it because they believe the market will pay for the idea. Your research is the bridge between their checkbook and your vision.

Nail Your Market Size (Without Looking Like You're Making It Up)

Every investor on the planet is going to ask about your Total Addressable Market (TAM). This is where so many founders trip up, pulling a massive, unbelievable number out of thin air.

"The global market for our widget is $50 billion!"

Saying that is a fast track to losing all credibility. Your research, however, lets you build a much more believable, bottom-up TAM that you can actually defend.

- Start Small: Go back to that super-specific customer profile you defined. How many of those people actually exist?

- Price It Right: Based on your research, what can you realistically charge this niche group for your solution?

- Do the Math: Multiply the number of potential customers by your annual price. That’s your real TAM. It's a number grounded in reality, not fantasy.

This simple calculation instantly shows investors you've done your homework. You aren't just dreaming; you're a serious founder who calculates their moves.

Why Your Story Is More Critical Than Ever

Getting this story right has never been more important. The pressure is on.

Right now, there are about 1,245 "unicorns" globally—startups valued at over a billion dollars. Many of them, especially in scorching-hot sectors like AI and digital health, lock down massive funding rounds before they even have a single paying customer. For instance, digital health startups recently raked in over $10.1 billion in venture funding. That kind of investor confidence is built on one thing: solid data that points to massive market potential.

You can learn more about these startup investment trends and see how data shapes unicorn trajectories.

Your research is what gets you a seat at that table. It’s what separates you from the thousands of other founders who just have an idea and a dream. You have an idea, a dream, and a stack of undeniable evidence to prove you’re a smart bet.

Common Questions Founders Ask About Market Research

Alright, you've stuck with me this far. That tells me you're either serious about doing this right, or you're just here for my brilliant wit. Either way, let's get into the questions that always seem to trip founders up when they're trying to figure this all out without burning through their cash.

Here are some straight-up answers to the questions we get constantly.

How Much Should I Spend on Market Research?

In the very beginning? As close to $0 as you can possibly get. Seriously. Your most valuable asset right now isn't cash; it's your time and energy.

Pour that time into talking with potential customers. Get lost in Reddit threads and industry forums. Use smart, free, or low-cost tools to see what your competitors are up to. The only real "cost" at this stage should be your own hustle.

Down the road, when you have some real traction and you're prepping for a serious funding round, maybe you can budget a few thousand for more advanced tools or super-specific surveys. But never, ever let it come at the expense of keeping the lights on. The best research early on is scrappy and founder-led.

Can I Just Do All My Research Online?

You can, and you absolutely should, do a ton of your research online. It’s an incredible way to map out the competitive landscape and see what's trending. You can get a huge head start without ever changing out of your sweatpants. Isn't that the dream?

But here's the catch: making it your only source of truth is a classic rookie mistake.

> Online data tells you what is happening. Talking to people tells you why. You need both. Period.

Think of it like this: your online research gives you the map of the terrain. But your primary research—actually talking to humans—is like hiring a local guide who shows you the hidden trails and warns you about the dead ends. The winning formula is always a smart blend of the two.

What if My Research Shows My Idea Is Terrible?

If this happens, congratulations! You just saved yourself months, maybe even years, of building something nobody wants. I'm not kidding—go celebrate. This is a massive win.

Getting a "bad idea" verdict from your research isn't a failure. It's a critical discovery that gives you the chance to pivot intelligently before you've sunk your life savings and emotional sanity into a dead end.

The feedback you gathered isn't a roadblock; it’s a treasure map pointing you toward what your customers actually care about. Embrace what you've learned, be thankful you found out now, and use those insights to shape your next idea into something the market will genuinely pay for. This is the whole point of doing the work.

How Do I Know When I’ve Done Enough Research?

Ah, the million-dollar question. The truth is, research is never really "done." But you’ll know you’ve done enough for this initial phase when you can practically predict what your next interviewee is going to say.

When you start hearing the same pain points, the same frustrations, and the same desires over and over from different people... you've found the signal. You've identified a real pattern.

The goal isn't to eliminate every single ounce of risk—that's impossible in a startup. The goal is to reduce risk enough to confidently build your Minimum Viable Product (MVP). Once you launch, the research just shifts into gathering user feedback and figuring out what to build for V2.

This whole process gets a lot easier when you have the right toolkit. Instead of dropping a fortune on expensive enterprise platforms like Ahrefs or Semrush, you can get the core competitive insights you need with a more focused tool like already.dev. For a practical look at how this works, check out our detailed guide on how to do competitor research.

Ready to stop guessing and start building with confidence? Already.dev is the AI-powered competitive research platform built for founders just like you. Ditch the endless spreadsheets and get a complete market map in minutes, not weeks. Discover your real competitors and find your opening in the market with Already.dev.