12 Best Market Research Tools for Startups in 2025

Stop guessing. We reviewed the top market research tools for startups to help you find competitors, survey users & size your market without a huge budget.

Got a killer idea? Awesome. Now, how do you make sure someone will actually pay for it before you sink your life savings into building it? The answer isn't just to 'move fast and break things'. It's market research. But forget stuffy reports and six-figure retainers. We're talking about lean, mean, get-answers-today tools that help you figure out if you're building a rocket ship or a really expensive paperweight.

This isn't your typical AI-generated list of obvious choices. We've dug through the noise to find the best market research tools for startups that deliver real answers, not just vanity metrics. We’ll show you how to find out what your potential customers really think, who you're actually competing against, and if your brilliant idea has legs. Ultimately, the goal is to deeply understand customer needs without spending a fortune.

We'll cover everything from uncovering competitors you never knew existed (the scary ones!) to validating your pricing without awkward conversations. For each tool, we’ll give you the real scoop with screenshots, direct links, and no-fluff analysis on what it’s good for, what’s the catch, and how much it'll actually cost you. Some of the big platforms like Semrush can be expensive, so we'll highlight cost-effective alternatives like already.dev that give you what you need without the enterprise price tag. Let's get to it.

1. Already.dev

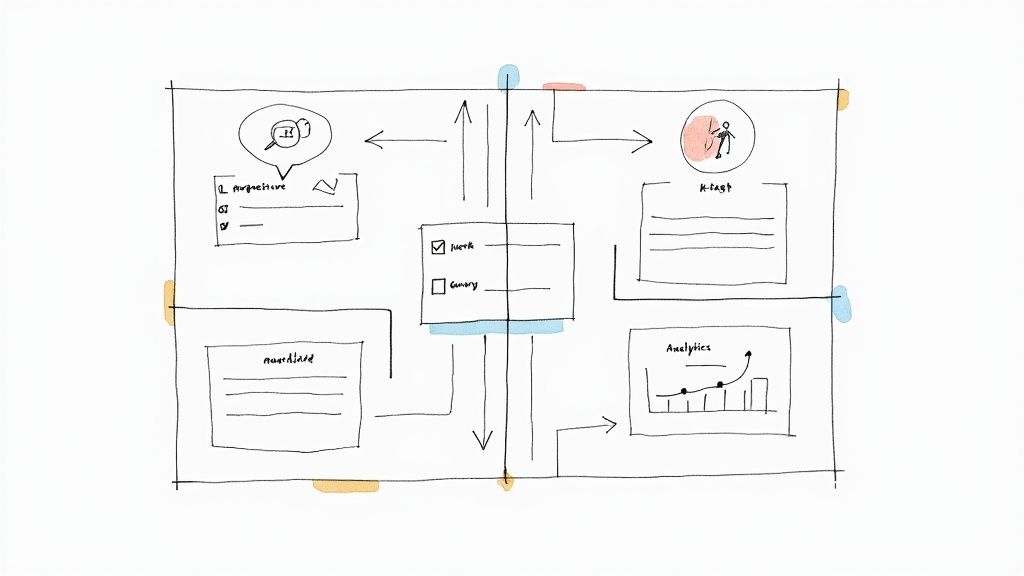

Already.dev is an AI-powered competitive intelligence platform designed to eliminate the soul-crushing, tab-heavy nightmare of manual market research. Instead of spending weeks Googling your startup idea, you describe it in plain English. The platform then deploys automated agents to crawl specialized sources most people miss, like app stores, GitHub, Product Hunt, Reddit, and niche industry directories.

It's a game-changer for early-stage teams. While tools like Ahrefs and Semrush are powerful for SEO-focused competitive analysis, they can be seriously expensive and don't uncover non-traditional or pre-launch competitors. An alternative like already.dev is laser-focused on the startup ecosystem, delivering a comprehensive landscape view in minutes.

Why It's Our Top Pick for Startups

What makes Already.dev stand out is the sheer speed and quality of its output. The platform claims to condense 40 hours of research into a 4-minute report, a stat backed by numerous founder testimonials. This isn't just a list of links; it’s actionable intelligence. You get visual feature grids, side-by-side pricing comparisons, and smart keyword analysis.

> "I ran three of my potential deals through Already.dev. Two were ridiculously crowded, but one had genuine whitespace. We invested, and it's already a 10x return." - Angel Investor Testimonial

It even uncovers failed startups in your niche, so you can learn from their mistakes instead of repeating them. This makes it one of the most effective market research tools for startups looking to validate an idea before sinking six figures into development.

How to Use It

- Describe Your Idea: Go to the site and type a simple description of your product or service.

- Run the Search: The AI agents get to work, scanning hundreds of sources.

- Analyze the Report: Dive into the visual comparisons and chat with the AI to understand the competitive landscape and identify gaps in the market.

Pricing: You can run your first search for free without a credit card. After that, it uses a flexible credit system: a Single Report is $93, a 10-report "Founder Pack" is $191, and a 30-report "Scale Pack" is $293. The credits never expire.

- Website: https://already.dev

2. SurveyMonkey

SurveyMonkey is the undisputed king of DIY online surveys, and for a good reason. It's the tool you turn to when you have a burning question and need answers yesterday. For startups, this speed is a massive advantage, allowing you to quickly validate an idea, test a new feature concept, or get a gut check on your messaging before spending a dime on development.

What really makes it one of the essential market research tools for startups is its built-in panel, SurveyMonkey Audience. This feature lets you buy targeted survey responses on demand, even with a free account. Need feedback from 200 US-based project managers under 40? You can specify your audience, pay per response, and get data back in a few days. For more advanced needs, their paid plans unlock methodologies like pricing sensitivity and MaxDiff analysis, helping you move beyond simple questions.

The Lowdown

- Best For: Fast concept testing, message validation, and quick user feedback from a specific demographic.

- Pricing: Starts with a limited Free plan. Paid plans range from around $25/month (billed annually) for individuals to enterprise-level tiers. SurveyMonkey Audience responses are purchased separately and pricing varies based on targeting and survey length.

- Key Feature: The integration of a user-friendly survey builder with the on-demand SurveyMonkey Audience panel is a game-changer for startups without a pre-existing email list.

| Pros | Cons | | :--- | :--- | | Incredibly fast and easy to deploy surveys. | Per-response costs for Audience can add up quickly. | | Audience credits can be used on a Free account. | Response limits and overage fees on some paid plans. | | Massive library of templates and question types. | Advanced analysis features are locked behind higher-tier plans. |

Pro Tip: Before you launch your first big survey, it's a good idea to understand the basics of structuring your questions. Our guide can help you learn more about how to conduct effective market research so you get clean, actionable data from your SurveyMonkey sends.

3. Qualtrics

If SurveyMonkey is the scrappy speed boat, Qualtrics is the enterprise-grade aircraft carrier of the survey world. This platform is what startups graduate to when their market research needs become more complex and mission-critical. It's built for deep, sophisticated analysis, offering advanced methodologies like conjoint and MaxDiff analysis right out of the box, which are essential for serious pricing strategy and feature prioritization.

Qualtrics really shines in a growing team environment. It offers robust governance, security, and integration capabilities that are crucial as more people get involved in research. While you can access global respondent panels through their partners, the platform's core strength is its analytical power. For startups with funding, a dedicated research function, or the need to present rigorous data to investors, Qualtrics provides the credibility and depth that simpler tools lack, making it one of the most powerful market research tools for startups scaling up.

The Lowdown

- Best For: Startups with dedicated research teams, complex product/pricing studies, and the need for enterprise-level security and collaboration.

- Pricing: Custom and enterprise-oriented. You'll need to contact sales for a quote, but expect it to be a significant investment compared to other survey tools.

- Key Feature: Its suite of advanced analytical methodologies (conjoint, MaxDiff, etc.) and role-based governance for scaling research operations securely across a team.

| Pros | Cons | | :--- | :--- | | Scales across teams with compliance and security controls. | Custom/enterprise pricing can be expensive and opaque. | | Deep methodology support for complex research studies. | Likely overkill for simple surveys or one-off projects. | | Robust analytics and reporting capabilities. | Can have a steeper learning curve than simpler tools. |

Pro Tip: Don't jump into a tool like Qualtrics just for a simple 5-question feedback form. Its power is in its complexity. Use it when you need to answer foundational business questions like "Which combination of features will maximize market share at this price point?" for your next big launch.

4. Typeform

If SurveyMonkey is the king of raw data collection, Typeform is the master of making that collection feel less like a chore and more like a conversation. Its one-question-at-a-time, beautifully designed interface is famously mobile-friendly and can dramatically increase completion rates. For startups, this means getting more feedback from every person you send a link to, whether it's for customer discovery, a quick feature poll, or a simple contact form.

Typeform shines when user experience is paramount. You can embed its forms seamlessly into your website or app, making the research process feel native to your brand. Its standout feature is Logic Jumps, which lets you create dynamic, branching surveys that adapt based on user answers, asking more relevant follow-up questions. This makes it one of the most engaging market research tools for startups looking to gather nuanced qualitative feedback without overwhelming users.

The Lowdown

- Best For: Creating highly engaging, branded surveys, user screeners, and lead capture forms that people actually enjoy filling out.

- Pricing: Offers a Free plan with limited responses. Paid plans start at around $25/month (billed annually), with tiers offering more responses and advanced features.

- Key Feature: Its conversational, one-question-at-a-time interface and powerful Logic Jumps make for a superior user experience that drives higher completion rates, especially on mobile devices.

| Pros | Cons | | :--- | :--- | | Incredible UX that boosts survey completion rates. | Response quotas on paid plans can be limiting. | | Generous template library and branding controls. | Advanced analytics are basic compared to dedicated tools. | | Strong integrations to automate workflows (e.g., Slack, HubSpot). | Can get pricey as your response needs grow. |

Pro Tip: Use Typeform's Hidden Fields feature to pass data you already know about a user (like their name or customer ID) into the form. This personalizes the experience ("Hey, Alex!") and saves them from re-entering information, further improving your completion rates. You can learn more at https://www.typeform.com.

5. Hotjar

Hotjar is like having a one-way mirror into your users' minds as they navigate your website or app. While analytics tools tell you what users are doing (e.g., 50% drop-off on the pricing page), Hotjar tells you why it's happening. For startups, this is qualitative gold, showing you where users get confused, frustrated, or delighted in real-time.

What makes Hotjar one of the most practical market research tools for startups is its suite of passive and active feedback tools. You can watch session replays to see how real users interact with your site, use heatmaps to identify where they click, and deploy on-site surveys or feedback widgets to ask questions at the perfect moment. It bridges the gap between raw data and human behavior, helping you quickly validate design choices, test messaging, and uncover product friction.

The Lowdown

- Best For: Understanding user behavior on your live website/app, identifying usability issues, and gathering in-context qualitative feedback.

- Pricing: A generous Free plan offers unlimited heatmaps and up to 35 daily session recordings. Paid plans start around $32/month (billed annually) for more sessions and advanced features.

- Key Feature: The combination of session recordings and on-site surveys in one platform allows you to see a problem (e.g., users rage-clicking a broken button) and immediately ask them about their experience without leaving your site.

| Pros | Cons | | :--- | :--- | | Incredibly easy to set up with a simple code snippet. | Research is naturally skewed toward your existing site visitors. | | Free plan is powerful enough for early-stage validation. | Recruiting external participants for interviews costs extra. | | Provides actionable qualitative context that numbers alone can't. | Advanced features like user interviews are on higher-tier plans. |

Pro Tip: Combine Hotjar's session replays with your analytics. If you see a high drop-off rate on a specific page in Google Analytics, filter Hotjar recordings for that URL to watch exactly what users are doing right before they leave.

6. UserTesting

Sometimes, a survey just doesn't cut it. UserTesting is where you go when you need to see and hear genuine human reactions to your product, website, or concept. It's a platform for moderated and unmoderated video-based feedback, letting you watch as real people navigate your prototype, react to your pricing page, or talk through their first impressions. For startups, this qualitative insight is pure gold, revealing the "why" behind the data you get from other tools.

The platform’s strength lies in its global participant network, allowing you to recruit highly specific user personas from over 60 countries. You can run live, one-on-one "Live Conversation" interviews or set up unmoderated tests that users complete on their own time. It's one of the more powerful market research tools for startups because it closes the gap between what users say they do and what they actually do, providing rich, unfiltered video feedback that can fundamentally shape your product strategy.

The Lowdown

- Best For: Deep qualitative insights, usability testing, prototype validation, and understanding user emotion.

- Pricing: Quote-based. It's an enterprise-grade tool, so expect pricing to be significantly higher than DIY survey platforms. Not ideal for very small, one-off projects.

- Key Feature: The ability to get high-quality, screen-recorded video feedback from a highly targeted global audience, complete with their spoken thoughts and facial expressions.

| Pros | Cons | | :--- | :--- | | Invaluable qualitative video feedback. | Pricing is quote-based and can be expensive for startups. | | Access to a massive, well-segmented user panel. | More geared toward enterprise needs and contracting. | | AI-powered tools help speed up insight analysis. | Can be overkill if you just need simple, quantitative answers. |

Pro Tip: Watching users interact with your product is a crucial step in development. To see how this fits into a larger strategy, check out our guide on using market research for product development to connect qualitative feedback with your roadmap.

7. Prolific

If SurveyMonkey Audience is the quick-and-easy way to get survey responses, Prolific is the academic-grade, high-quality version. It’s a platform designed specifically for recruiting vetted research participants, making it one of the most reliable market research tools for startups that need to be absolutely sure about their data quality. Instead of a survey builder, it's a marketplace of highly engaged and fairly compensated participants you can direct to your own survey, wherever it’s hosted.

The real power of Prolific lies in its incredibly deep and precise audience filtering. You can screen participants on hundreds of demographic, behavioral, and technical attributes before they ever see your study. This means you’re not wasting money surveying people outside your ideal customer profile. You build your survey in another tool (like Google Forms or Qualtrics), paste the link into Prolific, set your screener, and launch. The platform handles payments and ensures the data coming back is from real, attentive humans.

The Lowdown

- Best For: High-quality, niche B2C and B2B survey sampling, academic-level research, and studies requiring very specific participant criteria.

- Pricing: Purely pay-as-you-go. You pay a participant fee (minimum £6.00/$8.00 per hour) plus a 30% service fee. There are no subscriptions or monthly commitments.

- Key Feature: The extensive and reliable pre-screening filters combined with a highly vetted participant pool. This significantly reduces the risk of low-quality or fraudulent responses that can plague other panels.

| Pros | Cons | | :--- | :--- | | Exceptionally high data quality from vetted participants. | You must build and host your survey on a separate platform. | | Pay-as-you-go model means no subscription needed. | Can be more expensive per response than other panels. | | Powerful and granular audience targeting filters. | Participant pool is smaller than massive consumer panels. |

Pro Tip: Combine Prolific with a free tool like Google Forms or Tally to run sophisticated research without paying for a separate survey platform subscription. Just be sure to set up the completion redirect correctly so Prolific can track who finished your study.

8. Statista

When you need to drop a powerful statistic into a pitch deck to justify your market size, Statista is where you go. It's a massive digital library of statistics, reports, and industry outlooks, essentially serving as a shortcut for the tedious desk research that every startup needs to do. Instead of spending hours hunting through obscure industry reports, you can quickly find data to validate your TAM, SAM, and SOM, making it one of the most efficient market research tools for startups preparing for a fundraise.

What makes Statista so valuable is its breadth and accessibility. It aggregates data from thousands of sources and presents it in clean, downloadable formats like PPT and XLS. This saves you an incredible amount of time when building investor materials or conducting competitive analysis. For startups, this means you can quickly ground your assumptions in third-party data, adding a layer of credibility that gut feelings alone can't provide.

The Lowdown

- Best For: Validating market size (TAM/SAM/SOM), finding industry benchmarks, and sourcing data for investor pitch decks.

- Pricing: A limited free account offers basic access. Paid plans start around $199/month for a single user, with more comprehensive corporate and enterprise plans available.

- Key Feature: The sheer volume of aggregated data across 1,000+ industries, presented in ready-to-use formats, is its biggest strength.

| Pros | Cons | | :--- | :--- | | Huge time-saver for desk research and benchmarking. | The subscription can be expensive for early-stage startups. | | Data is regularly updated and covers a vast array of industries. | Full datasets and advanced features are locked behind pricey corporate plans. | | Downloadable charts (PPT, XLS) make it easy to use in presentations. | Some free data can be found elsewhere with more digging. |

Pro Tip: Use Statista's free charts to get a high-level overview of a market. If you see a promising trend, you can decide if a paid plan is worth it to access the full underlying dataset for a deeper analysis.

9. Similarweb

Similarweb is like having x-ray vision for your competitor's website traffic. While tools like Ahrefs or Semrush can feel overwhelmingly focused on SEO and can be expensive, Similarweb gives you a broader, top-level view of where a site's visitors are coming from. For startups, this is crucial for understanding the digital landscape, sizing up potential markets, and finding untapped acquisition channels your rivals are already using. For a more startup-focused approach, check out already.dev.

It answers the big-picture questions: Are they getting traffic from social, direct, or search? What specific websites are sending them referral traffic? Which countries are their biggest markets? This intelligence helps you build a go-to-market strategy based on proven tactics rather than guesswork. Instead of just seeing what keywords they rank for, you see their entire digital funnel, making it one of the most powerful market research tools for startups looking to deconstruct a competitor's playbook.

The Lowdown

- Best For: Competitive analysis, understanding traffic sources, and identifying partnership or referral opportunities.

- Pricing: Offers limited free access. Paid "Starter" plans begin around $125/month (billed annually), with more advanced enterprise tiers available.

- Key Feature: Its ability to break down a competitor's traffic sources (direct, search, social, referral, etc.) provides a clear, actionable overview of their marketing mix.

| Pros | Cons | | :--- | :--- | | Provides rare visibility into competitors’ digital funnels. | Historical data depth is limited on lower-tier plans. | | Self-serve entry plan makes it more accessible than some rivals. | The Starter plan still represents a notable monthly cost for bootstrapped startups. | | Excellent for identifying referral traffic and partnership targets. | Granular filtering (like by country) is often gated behind expensive enterprise plans. |

Pro Tip: Use the "Referrals" report to find websites sending traffic to your competitors. These sites are prime targets for your own outreach, whether for guest posts, affiliate partnerships, or advertising, giving you a pre-qualified list of potential growth channels.

10. Crunchbase

Think of Crunchbase as the LinkedIn for companies, especially those in the tech and startup world. It’s a massive database that tracks who got funding, who invested, who acquired whom, and which new players are entering your space. For startups, it's an indispensable tool for mapping out your competitive landscape, identifying potential investors, and finding strategic partners before they even hit the mainstream news.

What makes Crunchbase one of the essential market research tools for startups is its focus on the private market signals that matter. You can set up alerts to get notified when a competitor raises a new round, a key executive joins a rival company, or a new startup appears in your niche. This isn't just data; it's competitive intelligence that helps you understand market momentum and make smarter strategic decisions without needing a giant research budget.

The Lowdown

- Best For: Competitive landscape analysis, investor prospecting, and tracking funding trends in your industry.

- Pricing: Offers a limited free version. The "Starter" plan is around $29/user/month (billed annually), with a "Pro" plan at about $49/user/month that unlocks exports and integrations.

- Key Feature: The advanced search and alerting system allows you to build dynamic lists of companies based on funding stage, industry, location, and recent activity, giving you a real-time view of your market.

| Pros | Cons | | :--- | :--- | | Unparalleled coverage of private company funding data. | Financial details can be sparse and require external validation. | | Month-to-month Pro plan is great for short-term projects. | The free version is quite limited for deep research. | | Excellent for identifying investors active in your space. | Best used as a starting point, not the single source of truth. |

Pro Tip: Use Crunchbase's search to build an initial list of competitors, then dive deeper. Our guide offers more tactics on how to find and analyze your competition to build a complete picture.

11. NIQ Byzzer (NielsenIQ Byzzer)

For CPG startups trying to break into retail, getting real sales data can feel impossible. NIQ Byzzer is NielsenIQ’s answer to this problem, offering access to its legendary retail sales data on a self-serve platform built specifically for emerging brands. Instead of five-figure enterprise contracts, you can finally get the data you need to prove your product’s value to buyers at Target, Walmart, or Kroger.

This tool is a game-changer for pitch meetings. Byzzer provides weekly updated retailer and category-level trends, so you can walk into a buyer meeting armed with hard data on your brand’s performance versus competitors. It even has auto-generated "Stories" that build presentation-ready slides, saving you hours of prep time. This platform democratizes access to the kind of robust data that was once reserved for industry giants, making it one of the most powerful market research tools for startups in the CPG space.

The Lowdown

- Best For: CPG startups needing to analyze retail performance, identify market opportunities, and create data-backed pitches for major retailers.

- Pricing: Offers various ad-hoc reports and subscription bundles. Pricing is tailored to small brands and is significantly more accessible than traditional NielsenIQ enterprise contracts.

- Key Feature: The platform's ability to provide retailer-specific POS data and presentation-ready reports gives small brands the same analytical firepower as their largest competitors.

| Pros | Cons | | :--- | :--- | | Access to premium Nielsen-quality data without an enterprise contract. | Highly specialized for CPG and retail; not useful for SaaS or other industries. | | Flexible bundles and ad-hoc reports designed for startup budgets. | Meaningful, ongoing access requires a paid subscription or bundle purchase. | | Purpose-built reports and "Stories" save massive amounts of time on pitch prep. | The dataset is powerful but can have a learning curve for newcomers. |

Pro Tip: Use Byzzer’s Brand Score feature to quickly benchmark your performance against key competitors within a specific retailer. This single metric can be a powerful anchor point in a conversation with a category buyer, showing them exactly where you stand.

12. Capterra

Think of Capterra as the Yelp for B2B software. When you're lost in a sea of options and don't know which market research tool to even start with, Capterra is where you go to build a shortlist. It’s not a tool you use for research, but a platform you use to find the right tools, which is a critical first step. For a startup, this meta-research saves hours of aimless Googling and sales calls.

Capterra shines by aggregating hundreds of software options into filterable categories. You can browse its "Market Research Software" section, then narrow down the list by pricing models, user ratings, and key features. The real value comes from the verified user reviews, which give you an unfiltered look into what it's actually like to use a tool, warts and all. This helps you quickly separate the marketing hype from the on-the-ground reality, a crucial filter for any cash-strapped startup.

The Lowdown

- Best For: Creating a shortlist of potential tools based on budget, user reviews, and specific feature needs.

- Pricing: Free to use for browsing and comparing. You pay the software vendor directly if you decide to purchase a tool you find.

- Key Feature: The combination of detailed filtering options with a massive library of verified user reviews lets you quickly identify the top 3-5 candidates for your specific market research needs.

| Pros | Cons | | :--- | :--- | | Free to use and a fast way to scan many options. | Sponsored placements can influence listing order. | | Covers tools from SMB to enterprise-level budgets. | You still have to do your own deeper research on vendor sites. | | Verified reviews provide honest user feedback. | Capterra doesn't host or integrate the tools themselves. |

Pro Tip: Use the comparison feature to select two or three promising tools and view their features and ratings side-by-side. Pay close attention to reviews from companies of a similar size to yours for the most relevant insights.

Top 12 Market Research Tools for Startups — Comparison

| Tool | Core features ✨ | UX / Quality ★ | Value & Pricing 💰 | Best for 👥 | |---|---:|:---:|:---:|:---| | 🏆 Already.dev | Automated agents crawl app stores, GitHub, forums, directories; visual feature grids; smart keyword analysis | ★★★★★ Fast, actionable reports + AI chat | 💰 Free trial; Single $93 · Founder $191 (10) · Scale $293 (30) | 👥 Early-stage founders, PMs, VCs, advisors | | SurveyMonkey | 500+ templates; AI survey builder; Audience panel | ★★★★ Widely adopted, easy to deploy | 💰 Free tier; pay-per-response / audience costs vary | 👥 Product teams, marketers, quick concept tests | | Qualtrics | Conjoint/MaxDiff, governance, enterprise integrations | ★★★★★ Enterprise-grade analytics & controls | 💰 Quote-based enterprise pricing | 👥 Large enterprises, advanced research teams | | Typeform | Conversational forms; AI-assisted creation; integrations | ★★★★ High completion rates, mobile-first UX | 💰 Transparent self-serve plans; quotas per tier | 👥 SMBs, growth teams, designers | | Hotjar | Heatmaps, session replays, on-site surveys & feedback | ★★★★ Fast qualitative context from real users | 💰 Free tier; paid for recruiting/interviews | 👥 Product/UX teams, conversion-focused teams | | UserTesting | Global participant network; moderated & unmoderated video tests | ★★★★★ High-quality video feedback; enterprise security | 💰 Quote-based, typically higher for on-demand testing | 👥 UX researchers, enterprise product teams | | Prolific | 200k+ participants; 300+ filters; API & integrations | ★★★★ High data quality, fast completes | 💰 Pay-as-you-go + participant pay & platform fee | 👥 Academic/research teams, survey hosts | | Statista | Downloadable industry stats, datasets, API | ★★★★ Time-saver for TAM/SAM/SOM and trend validation | 💰 Subscription/API can be expensive | 👥 Analysts, investors, pitch-deck creators | | Similarweb | Traffic, keyword & referral insights; market share | ★★★★ Visibility into competitors’ digital funnels | 💰 Self-serve starter → enterprise (tiered cost) | 👥 GTM teams, digital marketers, analysts | | Crunchbase | Private-company database, alerts, exports, API | ★★★★ Strong coverage of startups & funding signals | 💰 Pro month-to-month; higher tiers for enrichment | 👥 VCs, BD, market-mapping teams | | NIQ Byzzer (NielsenIQ) | Retailer-level sales trends, Brand Score, auto reports | ★★★★ Nielsen-quality retail insights for CPG | 💰 Ad-hoc reports or subscription bundles | 👥 CPG startups, retail strategy teams | | Capterra | Software directory, verified reviews, side-by-side filters | ★★★ Useful for quick shortlists and vendor discovery | 💰 Free to use | 👥 Buyers shortlisting market-research & SaaS tools |

So, What's the Right Tool for You?

We’ve just thrown a dozen market research tools at you, from heavy-hitters like Qualtrics and Similarweb to nimble, startup-focused platforms like Already.dev. Feeling a little overwhelmed? That’s completely normal. The sheer number of options can lead to "analysis paralysis," where you spend more time comparing tools than actually getting answers.

Let's cut through the noise. There is no magical "best" tool. The right tool is simply the one that helps you answer your most urgent question, right now, without draining your runway. The biggest mistake you can make as a startup isn't picking the wrong tool; it's doing nothing at all because you're afraid to commit. An imperfect answer based on real data is infinitely more valuable than a perfectly-researched guess.

How to Choose Your Starting Stack

Instead of trying to build a comprehensive, enterprise-level research stack, think lean. What is the single biggest unknown threatening your startup's survival today? Frame your choice around that one critical question.

-

"Is my idea even unique? Who are my real competitors?" Your first stop should be a competitive analysis tool. Instead of manually digging through search results for weeks, a platform like Already.dev can give you a clear map of the competitive landscape in minutes. This isn't just about finding direct rivals; it’s about understanding market saturation, identifying overlooked niches, and seeing what customers are already complaining about.

-

"Do people actually want what I'm building?" This is the moment for customer discovery and validation. Don't spend another dime on development until you have some signal here. A simple survey tool like Typeform or SurveyMonkey is perfect. Create a short, focused survey and use a service like Prolific to get it in front of your ideal customer profile. The goal isn’t statistical perfection; it's directional feedback.

-

"How are users interacting with my MVP or website?" If you have a product, even a basic one, you need to see how people behave. This is where qualitative tools shine. A platform like Hotjar gives you the "what" with heatmaps and session recordings. You can literally watch where users get stuck, confused, or frustrated, providing a direct pipeline to improving your user experience.

-

"What are people searching for that relates to my product?" This question is all about understanding market intent and finding your audience. While giants like Ahrefs and Semrush offer incredibly deep data, their price tags can be terrifying for an early-stage company. A more focused tool like already.dev can help you uncover relevant keywords and content opportunities without the enterprise-level cost, keeping your focus on practical, actionable insights.

Beyond the Tools: The Research Mindset

Remember, these tools are just instruments. The real magic comes from the questions you ask and the mindset you adopt. Market research isn't a one-and-done task you check off a list. It's a continuous loop of asking, listening, learning, and iterating.

As you grow, your needs will evolve. You might start with free tools and eventually graduate to more sophisticated platforms for analyzing consumer trends and brand perception. For those exploring various options beyond the major players, guides comparing alternatives for social listening platforms can help uncover suitable solutions for monitoring social conversations and sentiment. The key is to stay curious and never assume you have all the answers.

Your mission is simple: find some truth. Pick one tool from this list that addresses your biggest fear, run one small experiment this week, and get one piece of data. That single data point will be the foundation for your next decision, and that’s how great companies are built. Now, go find your answer.

Ready to stop guessing and start knowing? Already.dev was built specifically to give startups the competitive intelligence and market validation data they need, without the enterprise price tag. Get a clear view of your market, find your first customers, and build with confidence. Try Already.dev today and turn your biggest unknowns into your biggest advantages.