Your Guide to the Marketing Positioning Matrix

Stop guessing where you stand. This guide shows you how to build a marketing positioning matrix to find market gaps and outsmart your competition.

A marketing positioning matrix is your business's treasure map. It's a simple chart that shows where your brand and your competitors stand in the market, all from your customer's point of view. Think of it as a cheat sheet that reveals who owns the high ground (like premium quality at a high price) and who’s fighting in the trenches (budget-friendly with basic features).

Your Secret Map to Market Domination

Let's be honest, "marketing positioning matrix" sounds like something you’d fall asleep to in a business school lecture. In reality, it's one of the most powerful—and surprisingly simple—tools you can have in your back pocket. It cuts through the jargon and shows you the entire competitive battlefield in a single glance.

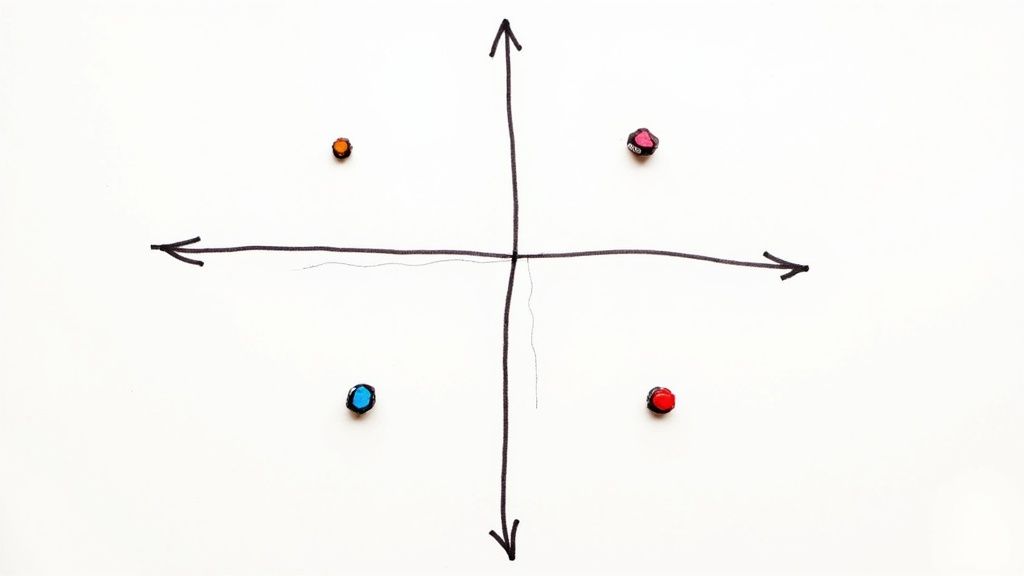

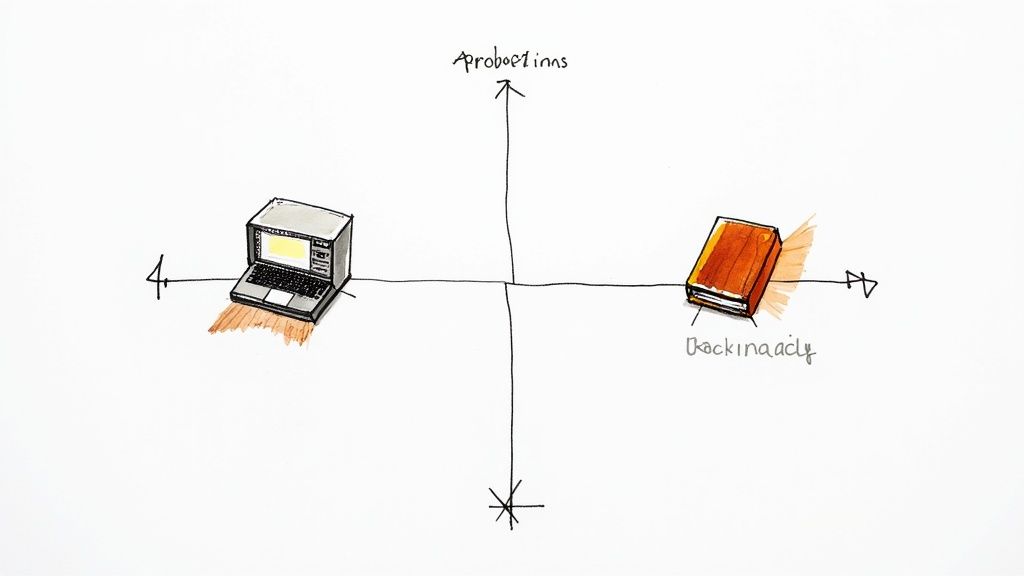

At its core, it's just a two-axis graph. That's it. You pick two key factors that customers really care about in your industry, like "Price" on one axis and "Quality" on the other. Then, you just start plotting where your brand and your competitors land.

This simple act of drawing it out is where the magic happens. Suddenly, you’re not just guessing about your competition; you’re seeing the market exactly as your customers do.

Why It's More Than Just a Pretty Chart

The real power of a positioning matrix isn't just knowing where everyone is, but in seeing where they aren't. Those empty spaces on your map are potential goldmines—untapped market opportunities where customer needs are being ignored.

> A positioning matrix helps you stop reacting to competitors and start making smart, proactive decisions. It’s the difference between wandering in the dark and navigating with a GPS.

By plotting everything out, you can instantly spot:

- Crowded Spaces: Areas where way too many competitors are fighting over the same customers. Maybe it's time to steer clear.

- Market Gaps: Unserved or underserved customer segments. This is your "blue ocean," a space where you can thrive without a dogfight.

- Your True Rivals: You might think your main competitor is the big-name brand, but the matrix could reveal you’re actually in a much closer fight with a smaller, niche player.

To get a quick feel for how this works, a classic Price vs. Quality matrix breaks down the market into four distinct zones.

The Four Quadrants of a Basic Positioning Matrix

| Quadrant | Description | Example Brand Type | | :--- | :--- | :--- | | High Price / High Quality | The premium players. These brands offer top-tier stuff and charge accordingly. Think luxury or best-in-class. | Luxury cars, high-end electronics | | Low Price / High Quality | The value champions. This is a tough spot to own, offering great quality for less money. It's a huge competitive advantage. | Brands like Costco or certain direct-to-consumer startups | | Low Price / Low Quality | The budget options. These brands compete purely on price, offering a no-frills solution for the most price-sensitive customers. | Discount airlines, dollar stores | | High Price / Low Quality | The danger zone. Brands here charge a premium without delivering the quality to back it up. They often rely on brand legacy but are super vulnerable. | Outdated brands that haven't innovated but still charge high prices |

This simple breakdown shows how quickly you can categorize the market and see where different business models fit.

A Tool for Speed and Clarity

In a fast-moving market, understanding your position is everything. The marketing positioning matrix, also called a perceptual map, is a visual shortcut that helps businesses see their competitive landscape with total clarity. In fact, studies show that companies using positioning matrices can respond 30-50% faster to competitive threats because they can visualize market shifts almost instantly. You can find out more about how positioning matrices give companies a competitive edge.

This isn't just about tweaking your marketing campaigns. It's a fundamental strategic tool that aligns your entire team. When everyone can see the same map, it becomes much easier to agree on which direction to head next.

Before we dive into building your own, just remember this: you can't choose your spot on the map if you don't know what the map looks like in the first place.

So, Why Is This Simple Chart Such a Big Deal?

At first glance, it’s just a chart with a few dots. You could probably sketch one out on the back of a napkin in about five minutes. But don't let its simplicity fool you. That little napkin sketch is less of a doodle and more of a secret weapon.

Think of it like this: it’s the difference between trying to get into a packed nightclub by waiting in the massive line out front, or knowing about the secret side entrance with no wait at all. This simple visual is your superpower because it forces you to stop guessing and start seeing. It replaces vague feelings about your market with a clear, honest picture of where you actually stand.

You might feel like you’re the cool, innovative option, but what if your customers see you as the expensive, complicated one? That's the reality you need to face, and this chart puts it right in front of you. It gives you that 10,000-foot view of the competitive battlefield, preventing you from accidentally setting up your brand-new lemonade stand right next to a Coca-Cola bottling plant.

Finding Your Own Private Island in a Crowded Sea

The absolute best thing a positioning matrix does is help you find the "blue oceans"—those beautiful, untapped market gaps where you can thrive without getting dragged into a brutal price war every other week. These are the spots on the map where no one else is playing.

When you start plotting your competitors, you’ll almost always see them clustering together. Maybe everyone is duking it out in the "cheap and basic" corner. Or perhaps there’s a traffic jam in the "premium and feature-heavy" quadrant.

> The real magic isn't in seeing where your competitors are. It's in seeing where they aren't. That empty space on the chart is your golden opportunity.

Spotting these gaps allows you to deliberately position your brand to serve an audience that everyone else is ignoring. This isn't just a clever marketing trick; it’s a proven strategy for growth. Studies have shown that when companies successfully identify and cater to these gaps, they can boost their market share by 10-15% within two years, simply by tailoring their offerings to that underserved niche. You can read more about how this strategy drives market growth.

A Communication Tool That Gets Everyone on the Same Page

Have you ever been in one of those meetings where it feels like everyone is talking about a completely different company? Sales thinks you're the budget-friendly choice, marketing is pushing a luxury message, and the product team is building something that lands awkwardly in the middle. It's organized chaos.

A marketing positioning matrix cuts right through that confusion. It acts as a single source of truth that aligns the entire team.

Here’s how it helps:

- It Creates Real Alignment: The matrix gives everyone a clear, visual goal. When the whole team can see "we're aiming for that empty spot," making decisions suddenly gets a lot easier.

- It Guides Product Development: It gives your product team a roadmap. If your goal is to be the "simple and reliable" option, they know to stop wasting resources on adding a hundred complicated features nobody asked for.

- It Focuses Your Marketing Message: Your marketing team finally knows exactly what story to tell. They can build campaigns that hammer home the specific things that make you different, instead of just shouting generic slogans into the wind.

Think of it as the North Star for your entire company. No matter what department someone is in, they can look at the map and instantly understand where the business is headed and, more importantly, why. It’s not just about knowing your place in the market; it’s about everyone agreeing on the territory you want to claim and working together to hold it.

How to Build Your Own Positioning Matrix

Alright, enough theory. It’s time to roll up our sleeves and actually build this thing. Creating a marketing positioning matrix isn't some dark art reserved for consultants with expensive suits; it's a practical process you can get done right now. Let’s cut the jargon and get straight to a step-by-step guide for mapping out your market.

The whole point is to turn those vague ideas you have about your competition into a clear, visual battlefield map. We'll do this by figuring out what your customers actually care about, spying on your rivals (ethically, of course), and then plotting it all out to see where the golden opportunities are hiding.

Step 1: Find the Right Axes for Your Map

First thing’s first: you need to choose the two axes for your map. These aren’t just random labels; they represent the two most important factors your customers weigh when they’re deciding whether to buy. The classic combo is Price vs. Quality, and while it's a great starting point, you definitely shouldn’t feel locked into it.

The real magic happens when you pick axes that are super specific and meaningful to your market. For instance, a software company might use “Ease of Use vs. Number of Features.” A local coffee shop could go with “Speed of Service vs. Ambiance.”

To nail this down, just ask yourself a few simple questions:

- What are the two biggest deciding factors for my ideal customer?

- Which attributes create the most obvious separation between my competitors?

- What do customers rave about or complain about the most in reviews?

Getting these axes right is the foundation of a truly useful matrix. If you pick the wrong ones, your map will be totally misleading. But if you get them right, the insights will practically jump off the page.

Step 2: Gather Your Competitor Data on a Budget

Now it's time to play detective. You need to figure out where each of your competitors falls on the axes you just defined. This might sound intimidating, but you really don't need a massive budget to dig up good data.

Sure, powerful SEO and market research tools like Ahrefs or Semrush can give you a mountain of data. But let's be real—they can be expensive, especially if you're just starting out. A more focused tool like already.dev is a great alternative that can pull key competitor insights without the hefty price tag.

Here’s how you can gather solid intel without spending a fortune:

- Read Customer Reviews: Scour sites like G2, Capterra, Yelp, or even Amazon. Customers are brutally honest about what they see as high-quality, cheap, innovative, or just plain clunky.

- Analyze Their Marketing: Check out their website copy, social media posts, and ads. How do they talk about themselves? Are they the "affordable choice," the "premium solution," or the "easiest to use"? Their words are a huge clue.

- Check Their Pricing Pages: This is an obvious one for the "Price" axis, but it also reveals how they bundle their features, which gives you hints about their perceived quality and who they're trying to sell to.

A marketing positioning matrix is only as good as the data you feed it. Seriously, try to avoid relying on your own assumptions. What you think about a competitor is way less important than what their actual customers are saying.

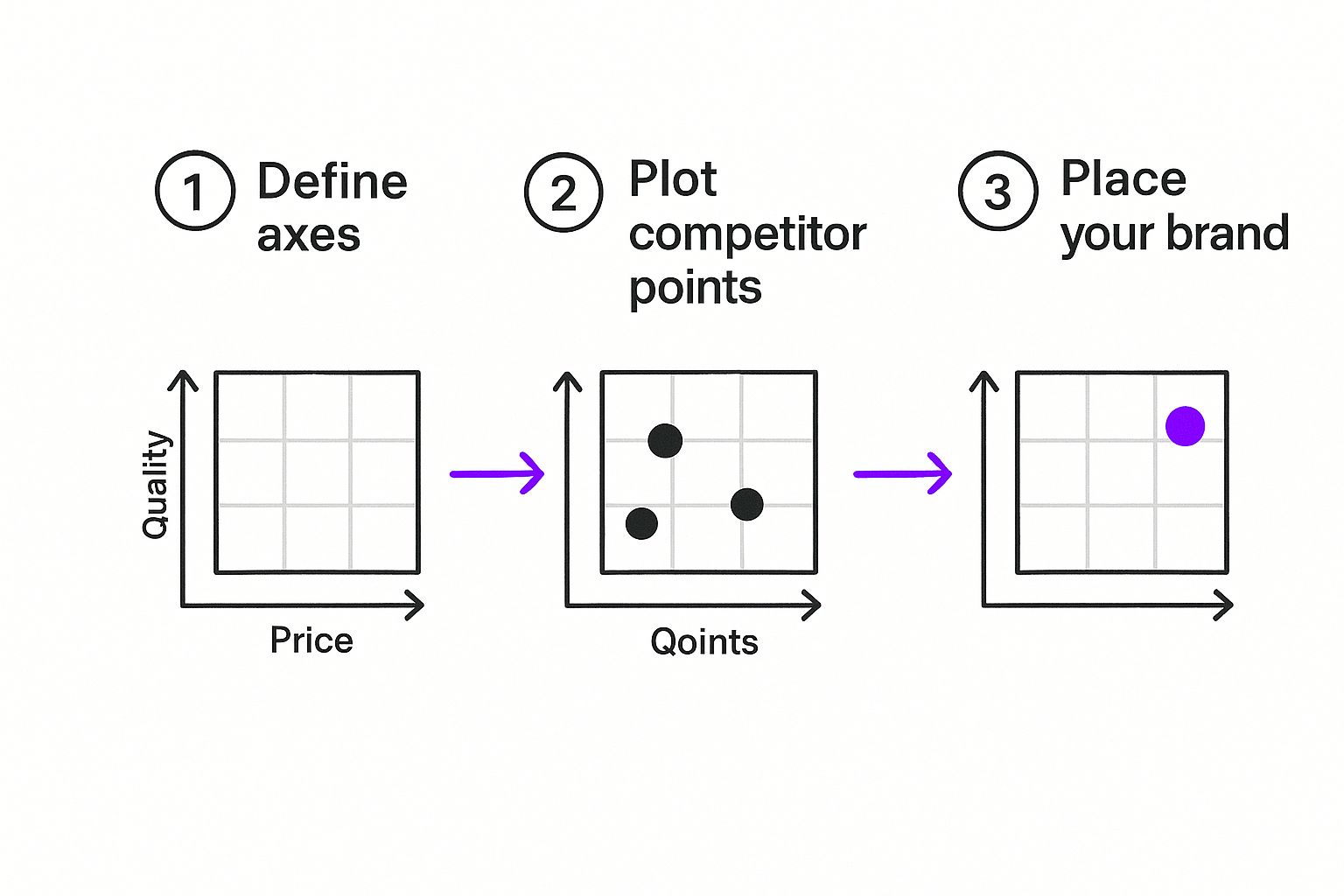

Step 3: Plot Everyone on the Map

You’ve got your axes and your data. Now for the fun part: plotting the dots. Grab a whiteboard or open up a simple design tool and draw your two axes. Then, one by one, place each competitor—and your own brand—on the map based on the research you just did. Don't overthink it; the goal here is to get a general sense of the landscape.

Here’s a simple visual that shows this three-step flow of defining your axes, plotting your competitors, and finding your own spot.

As you can see, building the matrix is all about setting a framework and then filling it in to see how the market is really structured.

Step 4: Decode the Results and Find Your Spot

Okay, stand back and take a look at what you’ve created. This is where the lightbulb moments happen. You’re not just looking at a bunch of logos on a grid; you’re looking at the hidden structure of your entire market.

> The most important parts of your map are often the empty spaces. These are the market gaps—the unmet needs and underserved audiences that your competitors are completely ignoring.

Here’s what to look for:

- Clusters: Do you see a bunch of competitors all crowded together, fighting for the same piece of turf? That’s a red ocean—a bloody battleground you probably want to steer clear of. A similar tool for seeing this is a https://blog.already.dev/posts/competition-matrix-analysis, which can help you dive deeper into specific feature comparisons.

- Empty Spaces: Where is nobody playing? An empty quadrant could represent a massive opportunity. Is there an opening for a high-quality, low-price offering? Or a simple, elegant solution in a market full of overly complex tools? This is your blue ocean.

- Your Position: Where do you currently sit? Are you stuck in a crowded cluster, or are you dangerously isolated with no clear audience? More importantly, where do you want to be?

This map gives you the clarity to make your next move with confidence. It tells you whether you need to pivot your strategy, double down on what’s working, or even create a whole new category for yourself. When you're ready to put this into practice, seeing a concrete example like this B2B SaaS positioning map template can be incredibly helpful for visualizing your own market.

Choosing the Right Axes for Your Matrix

Alright, you're ready to draw your map. This is where things get really interesting, because the secret sauce of a positioning matrix is all in the axes you choose. Think of them as the North-South and East-West coordinates on your market treasure map. Pick the wrong ones, and you'll end up digging for gold in a swamp.

But pick the right ones? You'll find exactly where 'X' marks the spot.

The classic Price vs. Quality combo is the vanilla ice cream of positioning axes. It’s a decent starting point, sure, but it's rarely where the most exciting insights are hiding. The real goal is to identify the two factors that truly drive customer decisions in your specific industry. What are the two things your customers are secretly weighing in their heads right before they click "buy"?

That's what you need to figure out.

Moving Beyond Price and Quality

To build a matrix that's genuinely useful, you have to think like your customer. What actually separates the winners from the losers in their eyes? It’s almost never just about who's cheapest or who has the shiniest features.

Consider some of these more nuanced pairings:

- Convenience vs. Selection: Think of a local corner store versus a giant supermarket. One offers speed; the other offers endless choices. Where do you and your rivals land on that spectrum?

- Innovation vs. Tradition: Is your brand the new kid on the block with futuristic ideas, or are you the trusted, reliable name that’s been around for decades? This is a massive factor in industries like finance or healthcare.

- Simplicity vs. Customization: Does your product work perfectly right out of the box with zero learning curve? Or is it a powerful, flexible tool that users can tweak to their heart's content?

The key is to pick axes that create a real spread among the players in your market. If everyone is clustered around the same price point, then "Price" is a useless axis—it won't reveal anything new.

How to Find Your Golden Axes

Choosing your axes shouldn't be a wild guess. It takes a bit of detective work to ensure your matrix reflects reality, not just your own assumptions. Gathering the right data is a crucial first step, and this guide on how to conduct market research offers a great tactical playbook to get you started.

Once you're in the right headspace, ask yourself these questions:

- What language do my customers use? Dive into customer reviews, Reddit threads, and social media comments. Are people constantly talking about "customer support," "ease of use," or "brand aesthetic"? Those are your clues.

- What's the core pain point we solve? The best axes often tie directly to the problem your product solves. If you're selling project management software, the axes might be Individual Productivity vs. Team Collaboration.

- What trade-offs are customers forced to make? Often, customers have to choose one benefit at the expense of another. These trade-offs make for incredibly powerful axes. For example, in the fast-food world, it's often Speed vs. Healthiness.

> Your axes are right when they make you say, "Aha!" They should reveal a tension in the market that you can either resolve with your product or lean into with your brand's story.

Don't be afraid to experiment! Sketch out a few different matrices with different axis pairs. One of them will inevitably make the market landscape "click" into focus in a way the others don't. That’s the one you want. This process is less about finding the one "correct" answer and more about finding the most insightful view.

Choosing Your Matrix Axes by Industry

To give you a powerful starting point, here are a few ideas to get the wheels turning. Don't just copy them; use them as inspiration to find the perfect fit for your unique market.

| Industry Example | Effective Axis Pair 1 | Effective Axis Pair 2 | What It Reveals | | :--- | :--- | :--- | :--- | | SaaS Software | Simplicity vs. Power | Niche-Specific vs. General Purpose | Whether the market is split between easy tools for everyone and complex tools for experts. | | Coffee Shops | Speed of Service vs. Ambiance | Community Focus vs. Grab-and-Go | The difference between fast caffeine fixes and "third place" destinations for work or socializing. | | Fashion Brands | Trend-Focused vs. Timeless | Exclusivity vs. Accessibility | How brands cater to either fast-fashion lovers or those making long-term investments in style. | | Consulting Firms | Strategic Guidance vs. Tactical Implementation | Broad Expertise vs. Deep Specialization | The gap between firms that only give advice and those that do the hands-on work. |

Ultimately, choosing the right axes is the most strategic part of this whole exercise. Get this right, and the rest of the process becomes a clear path to finding—and owning—your perfect spot in the market.

Real-World Positioning Wins and Fails

Theory is great, but the real lessons are in the stories. A marketing positioning matrix isn't just some abstract chart from a business school textbook; it’s a tool that explains some of the most legendary wins—and epic fails—in business history.

Let's dive into a couple of examples to see how this plays out when the stakes are sky-high. These stories prove that getting your positioning right isn’t about a clever slogan. It’s about deliberately choosing your battlefield and owning it completely.

The Win: The iPhone Creates Its Own Map

Think back to the mid-2000s. The smartphone market was a jumbled mess. If you mapped it out on axes like "Business Productivity vs. Consumer Simplicity," you’d see BlackBerry absolutely dominating the business quadrant. Meanwhile, brands like Nokia and Motorola were scrapping over the consumer side with flip phones and clunky physical keyboards.

Then, in 2007, Apple didn't just find an empty spot on the map—it redrew the whole thing. The launch of the iPhone wasn't just another product release; it was a market disruption. By creating a new value quadrant centered on a touch interface and an app ecosystem, Apple left competitors like Motorola scrambling. They had been playing a different game entirely. You can read more about this strategic shift on hbr.org.

Apple essentially created a brand-new axis: App-Based Ecosystem vs. Fixed Functionality. All of a sudden, the old guard looked like they’d brought a knife to a gunfight. They were still competing on call quality while Apple was busy building a universe of apps. It was a masterclass in not just finding a gap, but creating a whole new category where they were the only player.

The Fail: When "New Coke" Lost Its Way

For a classic tale of a positioning disaster, we have to talk about the infamous "New Coke" blunder of 1985. For decades, Coca-Cola's position was crystal clear: it was the original, the classic, the timeless taste. On a matrix of "Traditional vs. Modern," it owned the "Traditional" corner. No question.

But then, panic set in. Blinded by taste tests showing people preferred the sweeter flavor of Pepsi, Coca-Cola made a drastic move. It abandoned its legendary position and launched "New Coke," desperately trying to leapfrog into Pepsi's quadrant of "Sweet & Modern."

The backlash was immediate and brutal.

> Consumers didn't just want a sweet soda; they wanted their Coke. The company had abandoned its core identity, its most powerful asset, in a desperate attempt to be more like its rival.

They completely misread their own map. They thought the fight was about "taste" when their real, unshakeable strength was "authenticity." The failure was so spectacular that the company had to reverse course just 79 days later, reintroducing the original formula as "Coca-Cola Classic" and basically apologizing for trying to be something it wasn't.

How to Apply These Lessons

These stories aren't just for mega-brands with billion-dollar budgets. They hold crucial lessons for anyone trying to carve out a space in the market. Your first step is always to get a clear picture of the current battlefield. To do that, you need a deep, honest view of your competitors. Our guide on how to conduct competitive analysis can walk you through gathering the intel you need to build an accurate map.

The key takeaways are simple but incredibly powerful:

- Don't Fight on Their Turf: Apple didn't try to build a better BlackBerry. It changed the entire game.

- Know Your Strengths: Coca-Cola forgot its "classic" identity was its superpower, not a weakness to be fixed.

- Find the Unmet Need: Stop looking only at what competitors are doing and start looking for what customers are genuinely missing.

Your marketing positioning matrix is the tool that helps you spot these opportunities and avoid these massive blunders. Use it to find your unique spot, plant your flag, and tell a story that only you can tell.

Common Questions About Positioning Matrices

So, you've mapped out your market, stared at all those dots on the grid, and maybe even had that "aha!" moment. That's a great start. But the initial excitement often gives way to some tricky follow-up questions. Let's tackle them head-on.

You've built this shiny new marketing positioning matrix, but is it a one-and-done deal? Not even close. Think of it less like a framed painting you hang on the wall and more like a live weather map. It’s only useful if it reflects current conditions.

How Often Should I Update My Matrix?

The short answer? Probably more often than you think. Markets don't stand still, and your map will get outdated faster than last year's iPhone.

A good rule of thumb is to give it a proper refresh at least once a year. That said, certain events should trigger an immediate update.

You'll want to pull it out and re-evaluate whenever:

- A new competitor crashes the party: Did a new player just cannonball into your pool? It's time to see where they landed and what kind of ripples they're making.

- An existing competitor makes a sharp turn: Maybe your main rival just launched a budget version of their flagship product, or acquired a company that completely changes their game. You need to get that on the map, fast.

- You're about to make a big move yourself: Before you launch a new product or go through a rebrand, use the matrix to war-game the decision. See if that spot you’re aiming for is actually as wide open as it looks.

Staying on top of this keeps your strategy from getting stale. A map from two years ago is a historical document, not a tool for making decisions today.

What Are the Biggest Mistakes People Make?

Building a positioning matrix seems simple on the surface, which is exactly why it's so easy to mess up. I’ve seen people fall into a few classic traps that turn a potentially powerful tool into a useless (and misleading) piece of wall art.

The biggest blunder, by far, is relying on your own assumptions. You might think your brand is the "most innovative," but what if your customers see you as the "most complicated"? If that’s the case, your entire map is built on a fantasy. Your matrix has to reflect market reality, not your company's internal wishful thinking.

> The most dangerous part of building a positioning matrix is believing your own hype. Your customers' perception is the only truth that matters here.

Another common mistake is choosing lazy or irrelevant axes. It’s easy to just slap "Price" and "Quality" on your chart and call it a day. But if everyone in your market really competes on customer service and integration options, your map won't tell you anything useful. The axes must represent the real factors your customers use to make decisions.

What Do I Do After Finding a Market Gap?

Okay, this is the million-dollar question. You've spotted it: a beautiful, empty space on your map. An underserved audience with an unmet need. Now what? Don't just admire the view—act on it. Finding the gap is only step one.

The next move is to turn that observation into an actionable strategy.

- Validate the Opportunity: First, make sure that empty space is empty for a good reason. Is it a genuine opportunity, or is it a "market desert" where there's simply no demand? Go talk to potential customers in that segment. Do they actually want the thing you’re thinking of building?

- Define Your Position: If the gap is real, it’s time to craft a crystal-clear positioning statement. This becomes your North Star. It should declare who you're for, what unique value you offer, and why you're the only one who can deliver it.

- Align Everything: This is the hard part, where the real work begins. Your product roadmap, your marketing messages, your pricing, and even your customer support style must all align with this new position. If you decide to own the "Simple and Affordable" quadrant, your product team can't be off adding complex, expensive features.

Finding a gap on your marketing positioning matrix is an invitation to lead. It's your chance to stop fighting in the crowded, bloody red oceans and start creating a new space where you get to make the rules.

A marketing positioning matrix is a powerful starting point, but getting real-time, in-depth data on your competitors is what truly brings it to life. Instead of spending weeks on manual research, you can use Already.dev to get a comprehensive competitive report in minutes. Find out who your true rivals are, what customers are saying, and where the real market gaps are—all before you write a single line of code.