Matrix Competitor Analysis for Smart Growth

Unlock growth with our matrix competitor analysis guide. Learn to map rivals, find market gaps, and make smarter decisions with this simple framework.

A competitor analysis matrix is really just a fancy way of saying "a chart that lines you up against the competition." Think of it like a fantasy football draft board for your business. You're scouting everyone's stats—their features, pricing, marketing game—to figure out where you have a winning edge. It's a simple grid that takes a messy pile of data and turns it into a clear snapshot of the market.

So, What Exactly Is This Matrix Thing?

Let's be real, the last thing anyone needs is another complicated spreadsheet to keep up with. But a competitor matrix isn't busywork; it's a shortcut to making smarter, faster decisions. It’s a visual tool, usually a simple table, that gives you a quick, no-fluff look at where you actually stand.

Imagine you're launching a new project management tool. Your matrix would have your product in one column and your top competitors—say, Asana, Trello, and Monday.com—in the others.

Along the rows, you’d list the things that actually matter to your potential customers:

- Pricing Tiers: What's their free plan like? What does the premium plan cost?

- Key Features: Do they have Gantt charts? Time tracking? Automations?

- Target Audience: Are they built for small teams, big enterprises, or freelancers?

- Customer Reviews: What’s their average rating on G2 or Capterra?

Once you fill this out, you can see at a glance who’s the budget-friendly option, who’s the feature king, and where you might be able to carve out a niche for yourself.

To help you get started, here's a quick look at the core dimensions you should be tracking.

Key Dimensions of a Competitor Matrix

| Dimension | What to Look For | Why It Matters | | :--- | :--- | :--- | | Features | Core functionalities, unique selling points (USPs), and missing capabilities. | This tells you if you're ahead or behind in product development and where the feature gaps are in the market. | | Pricing | Pricing models (subscription, one-time), different tiers, and free trial offerings. | Helps you position your own pricing competitively and justify your value. | | Target Audience | Who are they talking to? Startups, enterprises, specific industries? | Ensures you aren't fighting for the exact same customers and helps you find underserved markets. | | Marketing & Sales | Channels they use (social, SEO, ads), messaging, and overall brand voice. | Uncovers their go-to-market strategy and reveals opportunities for you to stand out. | | Strengths & Weaknesses | What do customers love or hate about them? Check reviews and forums. | This is your roadmap for what to emulate and what to avoid. Their weakness is your opportunity. |

Tracking these categories gives you a solid foundation for building a strategy that's based on reality, not just gut feelings.

Why It’s a Secret Weapon

This simple chart helps you answer the big questions without getting lost in a sea of data. It's not just about listing facts; it's about spotting opportunities. If you want to dive deeper into the whole process, you should check out our complete guide on how to conduct competitive analysis.

The whole point is to move from guessing to knowing. Instead of thinking, "I feel like our pricing is in the right ballpark," you can confidently say, "We're priced 15% higher than Competitor A, but we offer a built-in CRM they don't have, which justifies the cost for our target customer."

That kind of clarity is a game-changer. It sharpens your marketing message, guides your product roadmap, and helps you explain your value to customers. It’s basically your strategic cheat sheet.

So, Why Bother With Yet Another Chart?

I get it. The last thing you probably want is another spreadsheet to manage. But trust me, this one's different. A competitor analysis matrix isn't just about keeping tabs on the competition; it's about discovering your own unique edge in the market. Think of it less like a spreadsheet and more like a treasure map for your business strategy—one that shows you exactly where the gold is buried.

This simple chart is your best defense against building features nobody actually wants. It’s your concrete justification for the price you charge. Instead of just hoarding data that collects digital dust, you’re turning raw information into a clear, actionable roadmap for growth.

Spot Opportunities Everyone Else Missed

Here's a secret: your competitors aren't perfect. Not even close. They have blind spots, they have customers they're unintentionally ignoring, and they have features that sound way better on a sales page than they are in real life. A well-built matrix makes these gaps jump off the page.

Maybe you'll discover every single competitor is chasing huge enterprise clients, leaving a wide-open field for a nimble tool built for small businesses. Or perhaps they all boast a million features, but a quick search reveals their customer support is notoriously slow. These aren't just weaknesses; they're invitations for you to swoop in and win.

> A competitor matrix helps you stop chasing your rivals and start serving your customers better. It shifts your focus from "what are they doing?" to "what does the customer actually need that nobody is providing?"

This isn't just a nice theory, either. A 2018 survey found that companies actively using competitive matrices were 2.3 times more likely to report above-average market share growth. You can dig into the full report to see how a competition matrix propels business growth.

Predict Your Competitor's Next Move

When you start tracking your competitors' marketing campaigns, hiring sprees, and product updates, you begin to see the patterns. Are they suddenly hiring a ton of mobile developers? You can bet a new app is on the horizon. Did they just acquire a smaller company in a niche you were eyeing? It's a safe bet they're about to integrate that new tech.

This isn't about having a crystal ball. It’s about making smart, educated guesses based on the evidence you've gathered. Having this kind of foresight allows you to be proactive instead of constantly playing catch-up. You can prepare a counter-offer, beef up your own mobile experience, or double down on what makes you different long before their big press release drops. A little time spent here will save you a world of headaches later on.

Building Your First Competitor Analysis Matrix

Alright, let's roll up our sleeves and get this done. We're going to build your first competitor analysis matrix from the ground up, and I promise, you don't need a fancy business degree to pull it off. Think of it less like a scary homework assignment and more like building with LEGOs—it’s all about connecting the right pieces.

The goal here isn't to create some monstrous spreadsheet that makes your team's eyes glaze over. We’re building a simple, powerful tool that gives you a crystal-clear picture of the battlefield. Let's break it down into a few manageable steps.

Step 1: Find Your Real Competitors

First things first: who are you actually up against? This sounds ridiculously obvious, but it's a classic trap. Your real competitors aren't just the big names that pop into your head. They're anyone solving the same core problem for your ideal customer.

Don't just fixate on direct competitors (the ones offering a nearly identical product). You need to keep an eye out for:

- Indirect Competitors: These guys solve the same problem, just with a completely different solution. If you have a project management tool, an indirect competitor could be a simple spreadsheet or even a physical whiteboard.

- Emerging Competitors: These are the new kids on the block. They might be small now, but they could be quietly building the next big thing that blindsides everyone.

A good starting point is just Googling the same keywords your customers would use. But to really dig deep without spending a fortune, you'll need a bit more firepower.

Step 2: Gather Your Intel (Without Going Broke)

Once you've got a list of rivals, it’s time to start gathering data. This is where a lot of people get intimidated, picturing huge bills from expensive market research and SEO platforms.

Look, tools like Ahrefs or Semrush are incredible, but their price tags can make your eyes water, especially if you're just starting out. They’re definitely not for everyone.

This is where a smarter, more focused approach comes in handy. A platform like already.dev can give you the crucial insights you need—like competitor features, pricing, and market positioning—without the enterprise-level cost. It automates the most painful parts of the research, turning what used to be a week-long manual slog into just a few minutes of work.

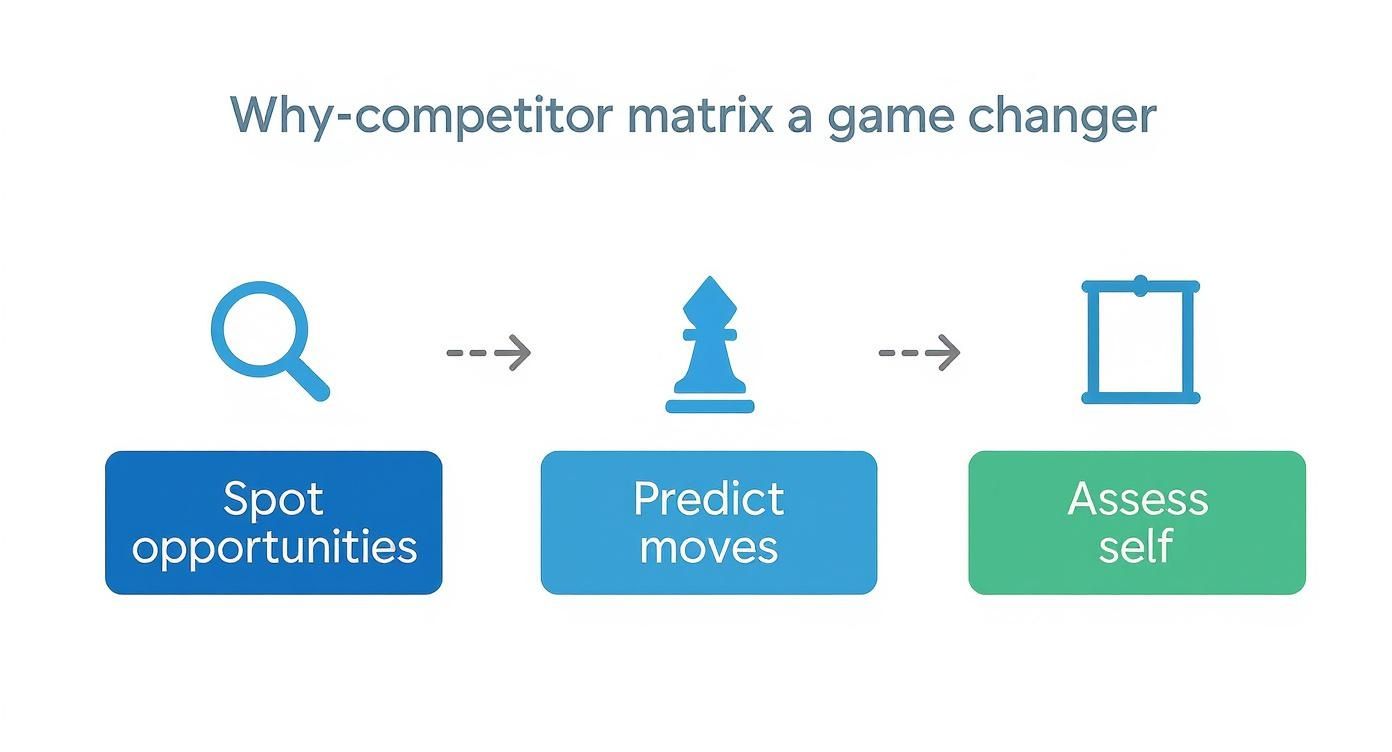

This visual really nails it: a matrix isn't just about collecting data. It’s a strategic process for spotting opportunities, predicting what’s coming next, and figuring out where you truly stand. The flow from spotting gaps to understanding your own position is what makes this a true game-changer.

Step 3: Choose Your Battlegrounds

You can't compare everything, or you'll drown in data. You need to pick the factors that actually influence a customer's decision to buy.

> The trick is to analyze this from your customer's point of view, not your own. What features are they always asking for? What pricing objection do you hear over and over? That's where you start.

Here are the essential categories to get you going:

- Core Features: List out the 5-10 "must-have" features for any product in your space.

- Pricing Model: How do they charge? Compare free tiers, monthly costs, and annual discounts.

- Target Audience: Who are they talking to? Is it startups, giant enterprises, or freelancers?

- Unique Selling Proposition (USP): What’s their one big claim to fame? What's the one thing they shout about?

- Customer Reviews: A quick glance at their G2 or Capterra rating tells a powerful story.

Of course, your insights are only as good as the information you put in. Making sure the data in your matrix is clean and useful requires a solid understanding of data strategy and governance.

Once you have these columns and rows filled out, you’ve done it! You have a living, breathing competitor analysis matrix. If you need a head start, grab this awesome free competitor analysis template to get going even faster. Now you're ready for the fun part: turning all this data into winning moves.

Seeing the Competitor Matrix in Action

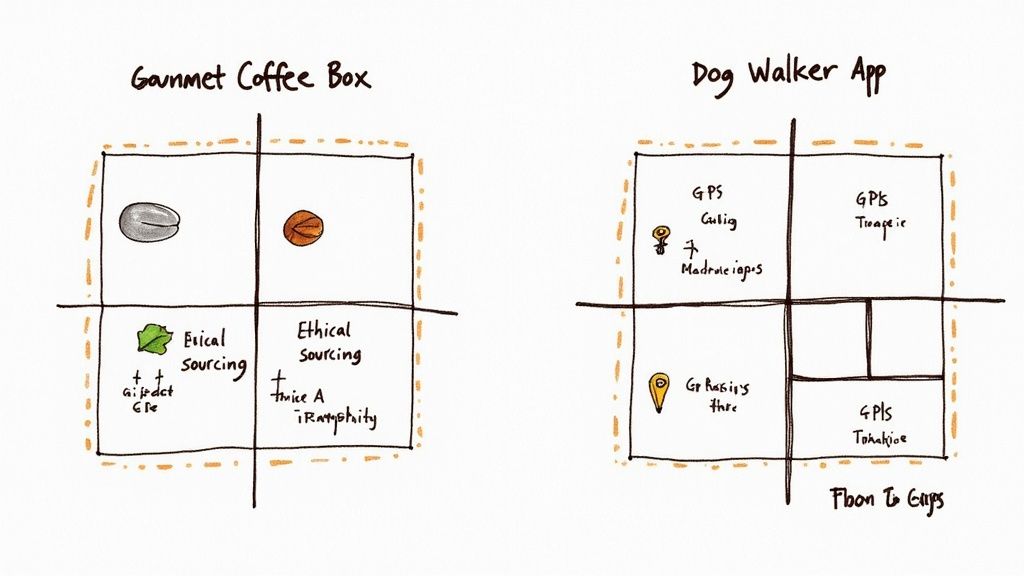

Theory is all well and good, but the real magic happens when you see a competitor matrix in the wild. Let's move past the abstract and dive into a couple of real-world-style examples to show how this simple grid can unearth some seriously game-changing ideas. The beauty of this framework is that it works whether you're selling coffee or coding apps.

Imagine you're about to launch a new gourmet coffee subscription box. It's a crowded space, right? You've got big names and tiny indie roasters all vying for the same caffeine-loving customers. A quick matrix is the perfect tool to help you find your unique spot.

Example 1: The Gourmet Coffee Subscription Box

Let's call your new venture "The Daily Grind." You need to figure out how you're going to compete against established players like BeanBox and Blue Bottle Coffee. Your initial analysis might look something like this:

| Feature/Attribute | BeanBox | Blue Bottle | The Daily Grind (You!) | | :--- | :--- | :--- | :--- | | Pricing | $20-$24/bag | $18-$22/bag | To be determined | | Bean Sourcing | Multi-roaster | Single-origin | To be determined | | Ethical Sourcing | Not emphasized | Mentioned | Potential Opportunity | | Customization | High | Low | Potential Opportunity | | Target Audience | Adventurous tasters | Brand loyalists | To be determined |

Boom. Almost immediately, a couple of gaps jump right off the page. While both competitors have fantastic coffee, neither is shouting from the rooftops about ethical sourcing or deep customization. That's your opening.

You could build your entire brand around transparently sourced, fair-trade beans. Or maybe you let customers dial in their exact roast profile and grind size. The matrix didn't hand you the answer, but it sure did point a giant, flashing arrow right at it.

Example 2: The Productivity App for Dog Walkers

Okay, let's switch gears entirely. Say you've built "WalkieDoggie," an app designed to help professional dog walkers manage their schedules, clients, and routes. Your main competition is the big dogs in the space, Rover and Wag!.

For this business, your matrix would track a completely different set of features:

- GPS Tracking for Owners: Can owners follow the walk in real-time?

- In-App Payments: How seamless is it to bill clients and collect tips?

- Scheduling Features: How well does it handle recurring walks and complex schedules?

- Service Fees: What cut does the platform take from each walk?

After you fill this out, a clear pattern emerges. Rover and Wag! are fantastic marketplaces for finding new clients, but their tools for managing an existing dog-walking business are a bit clunky. Neither offers serious route optimization or detailed client management features.

There's your niche. WalkieDoggie can be positioned as the go-to tool for serious professionals who already have a client base but need smarter software to run their business like a well-oiled machine.

And trust me, this isn't just a fun exercise for startups. In the cutthroat smartphone industry, giants like Apple and Samsung live and die by this kind of deep analysis. After a competitive matrix review in 2019, Apple spotted a gap in the mid-range market. The result? The more affordable iPhone SE. This single move helped Apple grab a 12% increase in its global market share by 2020, proving that insights from a simple grid can lead to massive strategic wins. You can discover more about how landscape analysis drives strategy in this fantastic breakdown.

Turning Your Data Into Winning Moves

So, you’ve built your beautiful, color-coded matrix. It looks professional, it’s packed with data, and you’re probably feeling pretty good about it. Now what?

A chart full of checkmarks and bullet points is just a pretty document if you don't know what it's trying to tell you. This is the moment where your research goes from being a classroom exercise to becoming a powerful business weapon.

Think of yourself as a detective staring at a corkboard full of clues. All those individual pieces of data—the pricing tiers, feature lists, customer reviews—are just facts on their own. The real magic happens when you start connecting the dots and seeing the story they tell about the market. This is where your matrix competitor analysis really starts to pay off.

Finding the Hidden Patterns

Your first job is to step back from the tiny details and look for the big patterns. Don't get lost comparing one specific feature to another. Instead, zoom out and ask yourself some high-level questions.

-

Where is the herd? Look for the features, pricing models, or marketing messages that every single one of your competitors has. This is the "sea of sameness." If everyone offers a "Pro Plan" for $49/month with the exact same core features, that's a sign of a very crowded space. You probably don't want to compete there head-on.

-

Where is the ghost town? Now, flip it around. What crucial customer need is everyone ignoring? Maybe every single competitor has a clunky mobile app, or their customer support is notoriously slow. That’s not just a weakness; it’s a golden opportunity with your name written all over it.

-

Who is the odd one out? Is there one competitor doing something completely different? Maybe they're laser-focused on a weirdly specific niche or using a totally unconventional pricing model. Pay close attention to them. They might be onto something big, or they could be failing spectacularly. Either way, you learn something valuable.

> The goal isn't just to find out where you're better or worse. It's to find out where you can be different in a way that actually matters to a specific group of customers.

This kind of analysis has a real impact. A 2022 study found that companies using competitive matrices reported a 27% higher rate of successful product launches compared to those who didn't. You can read the full research on competitive matrices to see just how much data-driven thinking improves your odds.

Turning Insights Into Action

Once you’ve spotted these patterns, it’s time to turn them into actual business moves. This is where your analysis starts to shape your product roadmap, your marketing messages, and your entire strategy.

To really make smart decisions, it helps to understand key market indicators like the difference between Share of Market vs Share of Voice. It's one thing to know who the players are, and another to know who is shouting the loudest.

If you’ve identified a promising gap in the market, the next step is to figure out if it’s a gap worth filling. This is where other strategic frameworks can come in handy. For a deeper look at finding your unique place, check out our guide on building a product-market grid. It’s the perfect follow-up to your matrix analysis.

By combining these tools, you move from simply knowing what the competitive landscape looks like to actively shaping it in your favor.

Got Questions? Let's Talk Strategy

You've made it this far, so you're well on your way to mastering the competitor matrix. But even the sharpest strategists run into questions when they're deep in the weeds. Let's tackle a few common ones I hear all the time. No jargon, just straight answers so you can get back to business.

How Often Should I Update My Competitor Matrix?

Think of your matrix as a living document, not a "set it and forget it" project. If you let it gather dust for a year, you’ll come back to a digital fossil that’s completely out of touch with reality.

In fast-paced markets like SaaS or e-commerce, a quarterly refresh is a good rule of thumb. Things just move too quickly to wait any longer. If your industry is more stable (say, high-end furniture manufacturing), you might get away with a bi-annual or even annual review.

The real trigger, though, isn't the calendar—it's the market. You should be jumping back into your matrix anytime there's a major shake-up:

- A new player pops up on your radar.

- A key rival rolls out a game-changing feature or product.

- Someone in your space makes a dramatic pricing change.

Go ahead and set a recurring reminder in your calendar right now. Trust me, your future self will thank you for it.

What's the Biggest Mistake People Make With This?

Hands down, the single biggest trap I see people fall into is analysis paralysis. It’s a classic. You spend weeks gathering every possible data point, building the world's most detailed spreadsheet, and then... nothing. It just sits there.

> Remember, the point of the matrix isn't just to have the data; it's to use that data to make a smarter move. Don't let your beautiful chart become a monument to inaction.

The runner-up mistake? Tunnel vision. It's so easy to get obsessed with the handful of direct competitors you see every day that you completely miss the indirect or up-and-coming players who are solving the same customer problem, just in a totally different way. That’s how you get blindsided.

Do I Really Need Expensive Tools for This?

Absolutely not. 100% no. While powerful SEO suites like Semrush or Ahrefs are fantastic, they're often overkill for this specific task and come with a hefty price tag. You don't need a huge budget to gather great intel.

You can uncover a goldmine of information for free just by putting on your detective hat. Sign up for your competitors' trials, read their G2 and Capterra reviews, and see what their customers are saying on social media. It’s amazing what you’ll find just by paying close attention.

If you want a more streamlined approach that won't break the bank, a tool like already.dev is a great middle-ground. It helps you zero in on competitor features, pricing, and positioning without the enterprise-level cost.

How Do I Choose Which Features to Compare?

This one is key. Don't make the mistake of listing every single bell and whistle. Your matrix will quickly become a bloated, unusable mess. The secret is to focus only on the features that your customers actually care about.

Put yourself in their shoes: what are the "must-have" features that make or break their decision to buy? The best way to figure this out is to read customer reviews—for your own product and your competitors'. Your customers will tell you, loud and clear, what matters most.

Start with 5-10 core features that truly differentiate the products in your space. You can always expand from there, but keep it lean and focused on what drives the purchase.

Ready to stop guessing and start knowing? Already.dev uses AI to build your competitor matrix for you, turning weeks of painful manual research into a detailed, actionable report in just minutes. Get the clarity you need to build a winning strategy. Start your free trial at already.dev.