The Product Market Grid a Simple Growth Guide

Stop guessing your growth strategy. Learn how to use the Product Market Grid (Ansoff Matrix) with simple examples to find your best path forward.

Alright, let's be real for a second. The term "product market grid" sounds like some jargon-heavy concept cooked up in a boardroom to make everyone's eyes glaze over. But stick with me here, because it's actually a super simple, four-box tool that can completely change how you think about growing your business.

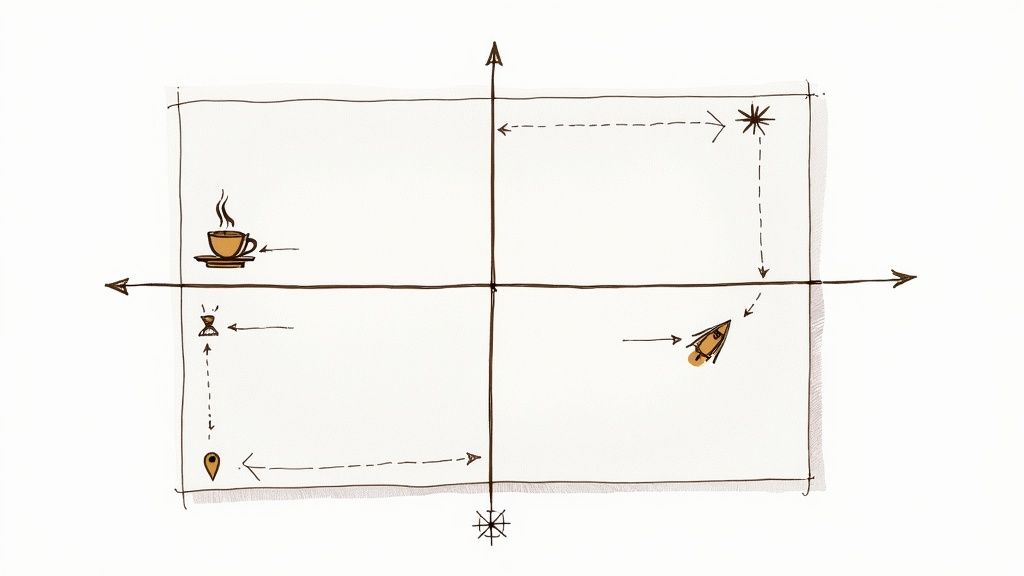

Think of it less like a spreadsheet and more like a treasure map. It gives you four clear routes to your next big move, helping you stop guessing and start planning.

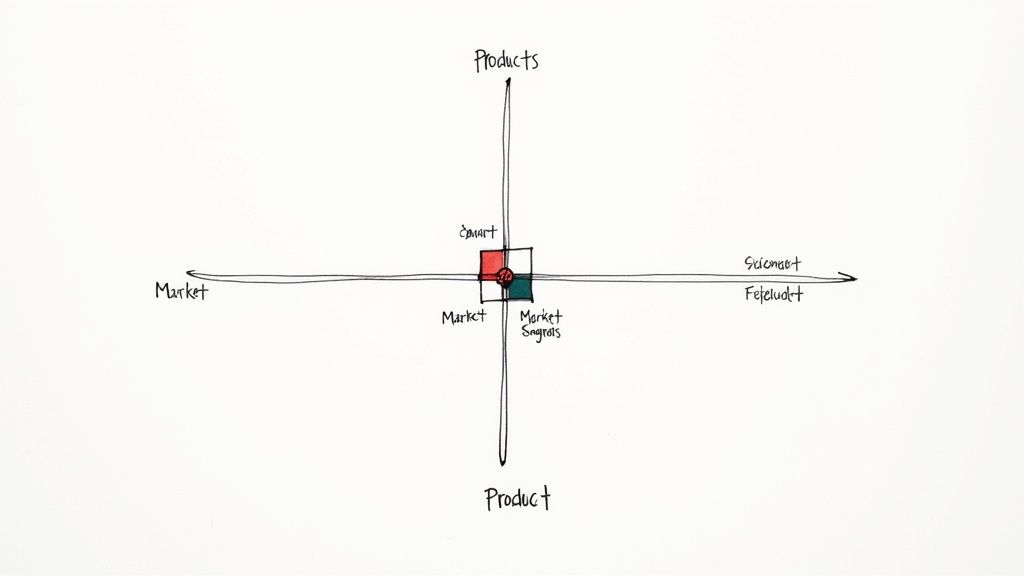

So, What Is a Product Market Grid Anyway?

At its core, this grid is a visual way to get your growth ideas out of your head and onto paper. Instead of just throwing spaghetti at the wall and hoping something sticks, the grid forces you to consider four distinct, strategic paths.

It's not about complicated theory. It's about bringing crystal-clear focus to the two most important levers you can pull in your business: what you sell (your products) and who you sell it to (your markets).

The product market grid is just one of many strategic decision-making frameworks, but its power is in its simplicity. It lays out all your options so you can make smarter, more deliberate choices about where to invest your time and money.

The Four Paths to Glory (or at Least, Growth)

The grid forces you to answer one fundamental question: To grow, should we double down on what we already know, or should we venture into new territory? This simple question immediately splits your options into four main strategies, each with its own level of risk and potential reward.

Here are the four core strategies the grid helps you visualize:

- Market Penetration: This is your "play it safe" option. You’re focusing on selling more of your current products to the people who are already buying from you. Think loyalty programs or grabbing a bigger slice of your existing market pie.

- Market Development: Ready for a little adventure? Here, you take your tried-and-true products and find new groups of people to sell them to. This could mean expanding to a new city, targeting a different demographic, or finding a new use case for what you already make.

- Product Development: This path is all about innovation for your loyal fans. You create new products to sell to your existing customer base. They already know you and trust you, so why not offer them something more?

- Diversification: This is the grand adventure, the high-risk, high-reward play. You're creating totally new products and trying to sell them to totally new markets. It's the toughest path, but the payoff can be massive.

> Fun fact: This entire framework is often called the Ansoff Matrix, named after the guy who came up with it, Igor Ansoff, way back in 1957. His goal was to give companies a simple way to classify their growth strategies and understand the risks involved. Market Penetration is the safest bet, while Diversification is the biggest gamble.

Of course, before you can decide which path is right for you, you need a solid understanding of the landscape. A great first step is to conduct a thorough market opportunity assessment to see where the real potential is hiding. This kind of groundwork ensures your grid is built on solid data, not just daydreams.

Exploring the Four Paths to Business Growth

So, how do you actually use the Product Market Grid? Let's break down the four quadrants into plain English. Forget the stuffy business school definitions for a minute.

Imagine you run a local coffee shop. You’ve got a good thing going, but you want to grow. Each quadrant of the grid represents a different path you could take, and they all come with their own levels of risk and reward.

Market Penetration: Doubling Down on Your Home Turf

This is your safest bet. You're not reinventing the wheel here. You're simply selling more of what you already have—your amazing coffee—to the people who already know and love you: your local regulars.

You're playing on familiar ground. For our coffee shop, this looks like:

- Launching a loyalty card. "Buy nine coffees, get your tenth on us!"

- Running a "two-for-one" special on Tuesday mornings to bring in more of the usual crowd.

The whole game here is to grab a bigger slice of your existing market. You're trying to get your current customers to visit more often and spend a little more each time. It's all about maximizing what you’ve already built.

Market Development: Planting a Flag in New Territory

Okay, so what if you’ve tapped out the local scene? Market development is about taking your tried-and-true product to a brand-new audience. You know your coffee is great, but now you need to find new people to drink it.

This is where the risk starts to creep up, since you're venturing into the unknown.

For our coffee shop, this could mean:

- Opening a second location in the next town over.

- Launching an e-commerce store to ship their coffee beans across the country.

- Creating a corporate catering service to target local office buildings.

The key is finding fresh markets for the product you’ve already perfected.

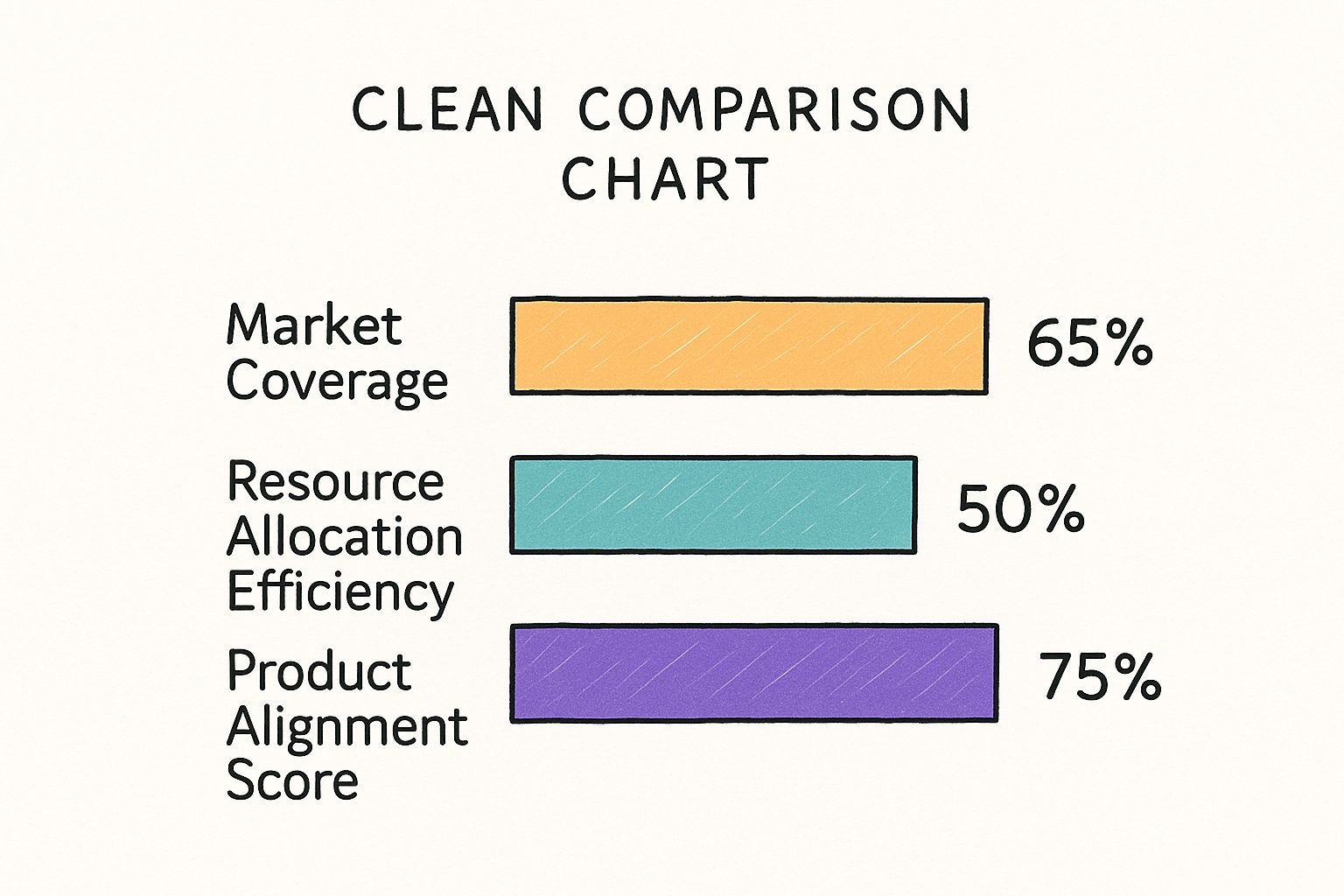

As you can see, you need to think about things like how well your product fits the new market—a 75% product alignment score is a good start. But you also have to consider your resources. If your efficiency is only at 50%, jumping into a new market could stretch you too thin.

Product Development: New Tricks for Your Old Dogs

With this strategy, you flip the script. Instead of finding new customers, you create new products for your existing ones. Your regulars already trust you for coffee, so what else might they buy?

This is a bit riskier than just selling more coffee, because developing new products takes time, money, and a bit of guesswork.

Our shop might decide to:

- Start selling branded mugs, t-shirts, and tumblers.

- Introduce a full line of gourmet pastries and sandwiches to go with the coffee.

Of course, before you start dreaming up new products, it's a good idea to make sure your current fans are actually happy. A huge part of this is measuring product market fit for what you already sell.

Diversification: The High-Risk, High-Reward Gamble

And now for the riskiest move of them all. With diversification, you're doing two new things at once: creating a brand-new product and taking it to a brand-new market. The chance of falling flat on your face is real, but the potential payoff is massive.

> This is our little coffee shop deciding to launch a line of small-batch, coffee-infused ice cream and get it into the freezer aisle at local supermarkets.

It's a totally different product, sold through a completely different channel, to a potentially different customer. It's a whole new ballgame.

This kind of big swing needs a rock-solid plan. If you're thinking about a move this bold, our guide to building a go-to-market strategy is a must-read.

The Four Growth Strategies at a Glance

To make it even clearer, here’s a quick-reference table that boils down each strategy.

| Strategy | What You're Doing | Risk Level | Simple Example | | :--- | :--- | :--- | :--- | | Market Penetration | Selling existing products to existing markets | Low | A coffee shop's loyalty program | | Market Development | Selling existing products to new markets | Medium | Opening a shop in a new city | | Product Development | Selling new products to existing markets | Medium | The coffee shop adds pastries | | Diversification | Selling new products to new markets | High | The shop starts selling ice cream |

Understanding these four paths is the first, most important step. Now you can start thinking about which one makes the most sense for where your business is today and where you want to take it tomorrow.

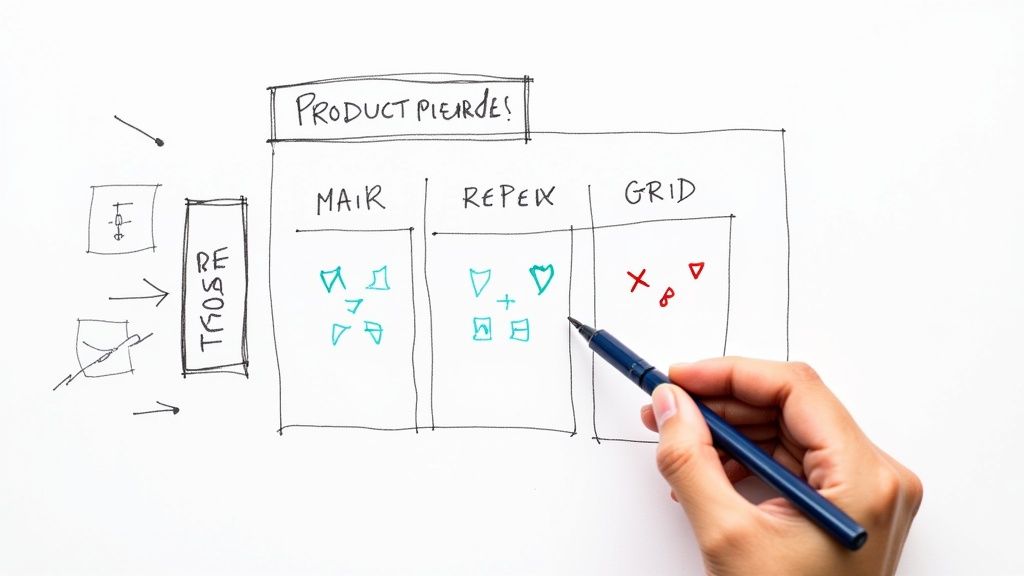

How to Actually Build Your Own Grid

Alright, enough theory. Let's get our hands dirty and actually build one of these things. The best part is, you don't need any fancy software or a business degree. A whiteboard, a giant sticky note, or even the back of a napkin will do just fine.

The whole point is to take those fuzzy ideas floating around in your head and turn them into a visual plan your team can rally around. Just draw a big plus sign in the middle of your page. That's it. You've just created the four quadrants that will frame your entire growth conversation.

Step 1: Brainstorm Your Quadrants

Now for the fun part: filling in the boxes. Get your team together and just start throwing ideas at the wall for each of the four sections. Don't worry about what's "good" or "bad" yet—just let the creativity flow.

Need a little nudge? Here are some questions to get the ball rolling:

- Market Penetration (Existing Product, Existing Market): How do we convince our current customers to buy more of what we already have? Maybe that’s a loyalty program, a clever product bundle, or just cranking up the marketing volume to the people we already know.

- Product Development (New Product, Existing Market): What else would our happy customers buy from us? This could be anything from a premium "pro" version of your main product to a brand-new tool that solves a related problem for the folks who already trust you.

- Market Development (Existing Product, New Market): Who else out there needs what we've already built? Think about different age groups, new cities or countries, or even entirely different industries that are dealing with the same core problem your product solves.

- Diversification (New Product, New Market): What’s the craziest idea we have? This is your moonshot quadrant. It's for those "what if" ideas that might feel totally out of left field but could become your next big thing.

Step 2: Gather Some Real-World Data

Once you’ve got a healthy list of ideas, it's time to bring them back down to earth. A grid based on pure speculation is just a wish list. To make it useful, you need to find out which of your brainstorms actually have potential. That means doing a bit of homework.

This is the step where a lot of people freeze up, picturing massive, expensive research projects. It doesn't have to be that way.

> The most brilliant strategy on paper is worthless if it's based on a total guess. A little data goes a long way in turning a brainstorm into a viable plan.

Sure, powerhouse tools like Semrush or Ahrefs can give you a firehose of market data, but they can be expensive. You can start much smaller. Even some smart Google searches can tell you a surprising amount about different customer groups and what keeps them up at night.

For more focused insights without the hefty price tag, a tool like already.dev can help you quickly peek at what competitors are doing and spot those underserved niches.

This research phase is all about validation. It’s how you move from "I think people want this" to "the data suggests a real opportunity here." You can even use a market research report template to organize what you find. The goal is to make your finished grid feel less like a dream board and more like a treasure map with actual, verifiable landmarks.

How Real Companies Use the Grid to Win

The theory behind the product market grid is great, but seeing it in action with real-world heavyweights is where it really clicks. Let’s break down how some of the biggest names in business have used this simple four-box tool to inform their most game-changing moves.

These aren't just corporate case studies; they're stories about choices. Some companies played it safe, sticking to what they knew best. Others bet the farm on a wild new idea. The grid gives us a clean way to understand the why behind those decisions.

Apple: The Master of Product Development

If you think of Apple, you probably picture a company that’s perfected the art of selling new, exciting gadgets to the same people over and over again. You're not wrong. They are the undisputed champions of the Product Development quadrant.

Their entire strategy is a masterclass in keeping an existing, incredibly loyal market buzzing.

- Think about it: they drop a new iPhone every single year, fully aware that their massive customer base is ready to upgrade.

- They launched AirPods, creating an entirely new, billion-dollar product category aimed squarely at people already locked into the Apple ecosystem.

- The Apple Watch was another genius move—a brand-new product designed to be sold directly to their existing iPhone users.

Apple rarely ventures into totally new markets. Instead, they double down on building amazing new toys for the massive fan club they've already cultivated. It's a lower-risk approach that has paid off for them in a huge way.

Virgin Group: The Diversification Daredevils

On the complete opposite end of the spectrum, you've got Richard Branson’s Virgin Group. These guys practically live and breathe in the Diversification quadrant. They seem to look at almost any market and think, "Yeah, we could give that a shot."

Their history is one big series of high-risk, high-reward leaps into completely unrelated industries.

> Virgin kicked things off as a record label, then jumped to airlines, then trains, mobile phones, and now they're literally launching people into space with Virgin Galactic. There is absolutely no logical thread connecting a record store to a spaceship, but that's the whole point of diversification.

This strategy is definitely not for the faint of heart. It demands deep pockets and a serious appetite for risk, because you’re essentially starting from square one in markets where you have zero track record.

Coca-Cola: The King of Penetration

For a classic example of just sticking to your guns, look no further than Coca-Cola. For decades, their game was all about Market Penetration. The goal was simple: get more people who already drink Coke to drink even more Coke.

This approach explains why some companies seem to do the same thing forever—because it works. Plenty of research shows that most businesses lean toward lower-risk strategies like this one. For a giant like Coca-Cola, it meant fighting for every inch of shelf space and running massive ad campaigns to stay top-of-mind, all without taking risky leaps into unknown territory. You can get the full rundown on Coca-Cola's classic strategy over at themarketingagenda.com.

Ultimately, these examples show there’s no single "best" path. The right move on the product market grid depends completely on your brand, your resources, and just how much you’re willing to gamble.

Common Mistakes to Avoid When Using the Grid

The product market grid is a fantastic tool for getting your growth thoughts organized, but it's not a magic eight ball. It’s surprisingly easy to get it wrong. Think of this section as a friendly warning sign—the "slippery when wet" cone for your strategic planning.

Let's dive into some of the most common ways people stumble.

Relying on Guesswork, Not Data

One of the biggest blunders? Pure guesswork. It's easy to get excited and fill out the grid with shiny new product ideas and untapped markets. The problem is, this is often based on what you think customers want, not what they've actually told you.

When you do this, your grid becomes a work of fiction. And building a business strategy on a fantasy novel rarely ends well.

Misjudging the Real Costs

Another classic mistake is underestimating the true cost of a new venture. That "Product Development" idea for a fancy new software feature might sound great in a meeting, but have you actually talked to your engineers about what it will take?

The real cost—in time, money, and team sanity—can easily be 10x what you initially scribbled on the whiteboard. The grid helps you map out ideas, but it won't calculate your budget for you.

Getting Stuck in Analysis Paralysis

It’s also incredibly easy to fall into the "analysis paralysis" trap. This is where you spend weeks, maybe even months, perfecting your product market grid. You’re constantly tweaking, researching, and debating every single entry until it's a color-coded masterpiece.

> The problem? A perfect plan that never leaves the whiteboard is completely useless. The grid is supposed to be a catalyst for action, not a reason to avoid it.

Don't let the quest for the perfect grid stop you from actually doing something. The goal here is to make a reasonably informed decision and get moving.

Forgetting Your Financial Reality

Finally, let's talk about the riskiest quadrant of all: Diversification. Jumping into this box without a serious war chest is a recipe for disaster. It’s the business equivalent of seeing a cool trick on TV and immediately trying a backflip off your garage roof.

Diversification requires a ton of cash and a team that can handle starting something brand new from scratch. Underestimating the resources needed for this high-risk play is probably the fastest way to run your business into the ground.

Your grid needs to reflect what’s possible for your company right now, not what you wish was possible. Keep it real, and your grid will be a useful guide instead of a dangerous delusion.

Why This Old-School Tool Still Works Today

In a world buzzing with AI, viral growth hacks, and a new "must-use" marketing tool every Tuesday, why should you care about a simple four-box grid from the 1950s? Because it just plain works. The greatest strength of the product market grid is its beautiful, almost brutal simplicity.

It cuts through the noise and forces you to stare at the only two things that actually grow a business: what you sell and who you sell it to. There's nowhere to hide from the big questions. It acts as a reality check before you go chasing the next shiny object, providing a stable, clear-headed foundation for your entire strategy.

A Universal Language for Growth

One of the grid's superpowers is getting everyone on the same page. When your marketing lead, product manager, and CEO all look at the same four boxes, they can finally have a conversation that makes sense to everyone.

Instead of vague ideas like "let's innovate" or "we need to expand," the grid demands specifics. Are we talking about a new product for our current fans (Product Development) or finding a new city for our existing stuff (Market Development)?

> This clarity isn't just nice to have; it's essential for getting your entire team aligned and pulling in the same direction. It turns a messy brainstorm into a focused, actionable plan.

The grid isn't about being old-school; it's about being fundamentally sound. Its durability is no accident. Since its creation, it has been a cornerstone of strategic planning for businesses all over the world.

In fact, surveys of marketing professionals show that over 70% still use the matrix or some version of it to map out their growth opportunities. Its core design has even inspired more detailed versions, proving its adaptability over decades. You can find more insights on how this simple grid became a global standard on rapidbi.com.

Ultimately, the product market grid survives because it focuses on the timeless fundamentals of business. As long as companies sell things to people, this framework will remain an essential tool for figuring out how to do it better.

Frequently Asked Questions

Got some lingering questions? You're not alone. Let's tackle some of the most common ones that come up when people start working with the product market grid.

How Often Should I Update My Grid?

Think of your grid as a living, breathing part of your strategy, not a "set it and forget it" document carved in stone. You’ll want to pull it out and take a fresh look at least quarterly.

That said, the real answer is: update it whenever something significant changes. A major competitor makes a move? A new technology emerges? Your customer feedback starts trending in a new direction? Those are all perfect triggers to revisit your grid and make sure your growth plan still makes sense.

Is the Product Market Grid Just for Big Companies?

Not at all. In fact, it might be even more valuable for startups and small businesses. When you're small, you can't afford to waste time or money chasing every shiny object. You have to be smart and focused.

The grid is a fantastic tool for this because it forces you to place your bets deliberately. It helps you pinpoint the most promising growth paths without needing a huge budget or a dedicated strategy team. It’s all about making calculated moves.

How Is This Different from a SWOT Analysis?

This is a great question because they can feel similar at first glance. A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is essentially a snapshot of your company right now. It's an internal and external audit of your current position.

The product market grid, on the other hand, is a forward-looking roadmap. It’s not about where you are, but where you could go. It’s an action-oriented framework designed specifically for mapping out your next growth moves. While SWOT is a diagnostic tool, the grid is a strategic playbook.

Stop guessing what your competitors are up to. Already.dev uses AI to do the heavy lifting, delivering deep competitive insights in minutes, not weeks. Get your data-driven advantage today at already.dev.