Monitoring The Competition Without Losing Your Mind

A practical guide to monitoring the competition. Learn how to track rivals, find opportunities, and make smarter decisions without the obsession.

Keeping tabs on your rivals is all about tracking their strategies, pricing, marketing, and products. The goal? To make smarter moves for your own business. It’s less about creepy spying and more about strategic people-watching for business, so you can react, adapt, and maybe even get a step ahead.

Why Bother Monitoring The Competition, Anyway?

Let's be real, you're busy. Adding "stalk the competition" to your never-ending to-do list sounds awful. But what if it's the one thing that could stop you from getting lapped? Flying blind is a great way to get blindsided by a rival you never saw coming.

This isn't about copying every dumb move they make. It's about knowing the lay of the land—spotting opportunities and sniffing out threats before they turn into full-blown dumpster fires.

Spot Game-Changing Shifts Early

Sometimes, the smallest ripple signals a coming tidal wave. A tiny price tweak, a new feature, or a change in their marketing copy can reveal a huge strategic pivot. Catch these signals early, and you have time to react thoughtfully instead of scrambling to play catch-up later.

Think about it: your top competitor quietly rolls out a new pricing tier. If you're not paying attention, you might not notice for months. By then, they could have already siphoned off a good chunk of your customers.

> The real goal isn't just to see what your competitors are doing today; it's to figure out where they're trying to go tomorrow. This is what lets you be proactive, not just a copycat.

In e-commerce, this is a high-stakes game. Nearly 90% of online shoppers compare prices before buying. A price gap of just 5% is often enough to send them clicking over to a competitor. For businesses that aren't watching, this blind spot can cost them 15-20% of their potential revenue. Ouch.

Avoid Reinventing The Flat Tire

Your competitors have already made plenty of mistakes and stumbled upon things that work. Why put yourself through the same pain if you don’t have to? By watching them, you can learn from both their wins and their face-plants.

For example, you can learn from their:

- Marketing Wins: Did their latest ad campaign catch fire? Figure out what made it so good and see if you can apply those lessons to your own strategy.

- Product Flops: Did they launch a shiny new feature that fell completely flat? That’s pure gold. It tells you exactly what the market doesn't want.

- Keyword Goldmines: Big tools like Ahrefs or Semrush are great for seeing which keywords your competitors rank for, but man, they can be expensive. An alternative like already.dev can give you similar insights without the hefty subscription fee, helping you uncover SEO opportunities they might be overlooking.

For a deeper dive, this ultimate guide to competitor analysis is a great resource. It's all about working smarter, not harder, by learning from the homework others have already done.

Building Your Competitor Hit List

You think you know your competitors, right? It’s easy to get tunnel vision, focusing only on the big dogs while a scrappy startup quietly eats your lunch. Getting this part wrong is like training for a boxing match against one opponent, only to get knocked out by someone you never even saw step into the ring.

So, your first real step is building a proper competitor "hit list." This isn't some giant, unmanageable spreadsheet of every company that vaguely does what you do. It’s a smart, tiered map that shows you exactly where to focus.

Sorting Your Rivals Into Buckets

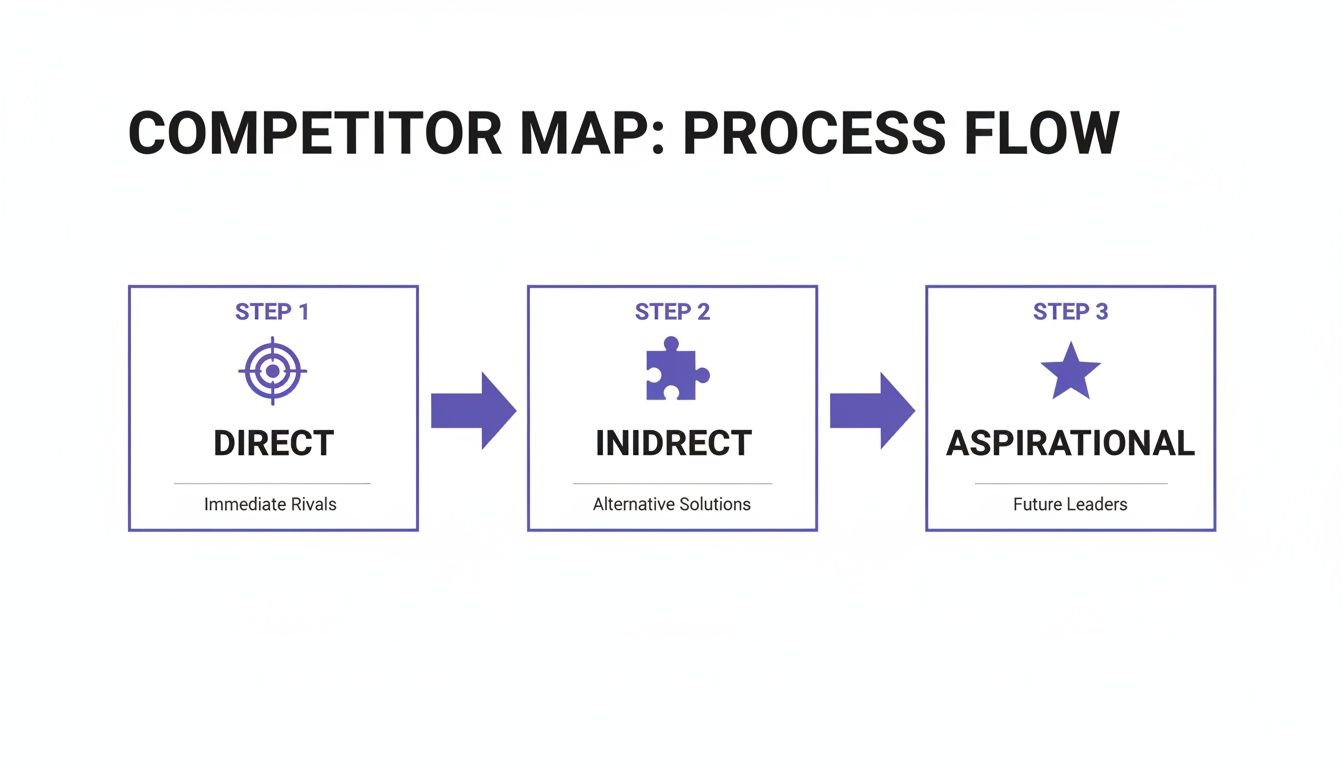

I’ve found it’s best to think about competitors in three buckets. This simple framework is a lifesaver.

-

Direct Competitors: The obvious ones. They're selling a similar product to the same audience, fighting you for the exact same customer. Think Coke vs. Pepsi. You’re both in the sugary brown liquid business.

-

Indirect Competitors: The ones people forget. They solve the same core problem you do, but with a completely different solution. If you sell project management software, an indirect competitor might be a company selling whiteboards or a simple to-do list app. They're all scratching the same itch—getting organized—just in a different way.

-

Aspirational Competitors: The brands you look up to. They might not even be in your direct market, but you admire their killer marketing or fanatical brand loyalty. Watching them can spark incredible ideas. Think of a local coffee shop studying how Starbucks crafts its entire brand experience.

> The biggest mistake I see is companies only watching direct competitors. Indirect competitors often signal where the market is actually heading, and they can blindside you if you're not paying attention. Your customers don't care about these neat categories; they just want their problem solved.

Putting this list together can feel like a chore, but it doesn't have to be. Start by brainstorming, then dig deeper. Powerful (and pricey) tools like Ahrefs or Semrush can uncover rivals by showing you who you’re up against for SEO keywords.

For a more streamlined and affordable approach, already.dev can automate this discovery process, often finding competitors you never even knew you had. If you want a detailed walkthrough, check out our guide on how to find your competitors.

Step 2: Set Up Your Digital Listening Posts

Alright, you’ve built your hit list. Now for the fun part: setting up digital listening posts so you can actually monitor them without living on their websites 24/7. This is where we shift from knowing who to watch to how to watch them effectively.

Forget manual checks. We're going to zero in on signals that are pure gold—website changes, new blog posts, social media chatter, and even job postings. Seriously, a sudden hiring spree for "AI Engineers" tells you a lot more about their future plans than any polished press release ever will.

This is all about categorizing your competition so you know where to focus your energy. You have the direct rivals you battle daily, the indirect players solving the same problem differently, and the aspirational brands you look up to.

Mapping out your competitors like this helps you allocate your attention properly. It ensures you don't get blindsided by an indirect threat or miss a brilliant idea from a market leader.

What to Track and What Tools to Use

When it comes to tools, you've got options. You can go from free and scrappy to powerful and… well, expensive.

Your toolkit really depends on what signals you want to track. Are you focused on their SEO strategy? Their social media voice? Or their product and pricing changes?

Here’s a quick breakdown of what to track and the tools you can use.

Your Competitor Monitoring Toolkit

| What to Track | Free & Simple Tools | Advanced (But Pricey) Tools | Affordable All-in-One Alternative | | :--- | :--- | :--- | :--- | | Website & Content Changes | Visualping (for visual changes), Feedly (for blogs via RSS) | Ahrefs (Site Explorer), Semrush (Content Analyzer) | Already (tracks everything automatically) | | SEO & Keyword Rankings | Google Search (manual checks), Google Alerts | Ahrefs (Rank Tracker), Semrush (Position Tracking) | Already (SEO performance monitoring) | | Social Media Activity | Native platform notifications, manual checks | Brandwatch, Talkwalker | Already (social post aggregation) | | Pricing & Product Updates | Manual checks, email newsletter sign-ups | N/A (often requires custom solutions) | Already (pricing page & feature monitoring) | | Company News & Mentions | Google Alerts, social media searches | Cision, Brandwatch | Already (news and mention tracking) |

While free tools get you started, they create a lot of noise and require you to piece everything together manually. The big platforms are amazing for deep dives into specific areas like SEO, but their price tags can make your finance department wince.

> The real challenge isn't finding data; it's getting the right data delivered to you without getting buried in notifications. The goal is to get alerts on what actually matters, not a notification every time they fix a typo on their homepage.

Automate the Grunt Work

Let's be real—effective monitoring requires a system. This is the heart of competitive intelligence gathering—creating a process to collect relevant data automatically so you can spend your time on analysis, not data entry.

The competitive intelligence (CI) market has ballooned to $50.9 billion for a reason: AI-powered platforms can do this tedious work for you. Companies with solid CI systems often see up to 20% better market positioning because they can spot gaps and opportunities their competitors completely miss.

This is exactly where an affordable, automated tool like already.dev comes in. Instead of juggling a dozen different alerts and expensive subscriptions, it pulls all these different signals—from SEO changes to new pricing tiers—into one clean feed. It automates the collection and gives you the insights without the manual labor.

If you want to explore all the options out there, we've put together a full breakdown of the https://blog.already.dev/posts/best-competitor-analysis-tools to help you find the right fit for your budget.

Turning Raw Data Into Smart Decisions

So, your alerts are pinging and the data is rolling in. You’ve got a mountain of competitor intel. Now what?

Collecting data is the easy part. Staring at a pile of raw information won't magically reveal your rival's grand strategy. This is where you put on your detective hat, connect the dots, and turn all that noise into a clear signal.

Think of it like a pile of LEGOs. They're just a colorful mess until you have a blueprint. The point is to move from "huh, that's interesting" to "okay, here’s exactly what we’re going to do about it."

Analyzing What Actually Matters

It's easy to get lost in the weeds, so focus on the competitor moves that could actually impact your bottom line. Let's walk through a few common scenarios.

Their Pricing Strategy

Did your main rival just become the new budget-friendly option, or are they suddenly getting fancy with premium pricing? A price change is never just a price change. It’s a massive signal about who they’re targeting.

- Scenario: Competitor X just slashed their mid-tier plan by 20%.

- Wrong Question: "Should we lower our prices, too?"

- Right Question: "Why now? Are they struggling to attract mid-market customers? Are they trying to squeeze out a smaller player? Is our own sales data showing we're losing deals to them on price?"

Their Feature Releases

Are they launching groundbreaking features, or just playing catch-up by copying everyone else? Tracking their product updates gives you a window into their innovation engine—or lack thereof.

- Scenario: Competitor Y just launched a new AI-powered analytics tool.

- Wrong Question: "Do we need an AI tool right now?"

- Right Question: "Is this a direct response to customer demand we’re also hearing? Does this solve a genuine pain point, or is it just a shiny object to grab headlines?"

Their Marketing Keywords

Figuring out where your competitors show up in search results can feel like cheating, but it’s just smart business. Sure, tools like Ahrefs or Semrush are incredibly powerful for this, but their enterprise plans can cost a small fortune. A more focused and affordable tool like already.dev can deliver the crucial keyword insights you need without that eye-watering price tag.

- Scenario: Competitor Z is suddenly ranking on the first page for "small business accounting software."

- Wrong Question: "How do we rank for that same keyword?"

- Right Question: "Is this a new market for them? What kind of content did they create to earn that spot? Does this signal they're shifting away from their traditional enterprise focus?"

> The trick isn't just seeing what they did, but digging into the why. That’s the gap between simple data collection and true competitive intelligence.

From Insight to Action: The Monthly Check-In

Analysis paralysis is real. The best way to avoid it is to set up a simple, recurring monthly check-in. Just get the right people in a room for 30 minutes to review the most significant competitor moves.

Keep the agenda dead simple:

- What happened? A quick, no-fluff review of the key alerts.

- So what? Discuss the potential impact on our business.

- Now what? Decide on one or two concrete actions to take. That's it.

This simple framework forces you to turn your findings into actual decisions. Maybe the action is to tweak your ad copy, bump a feature up on your roadmap, or simply keep a closer eye on a new threat. You can dive deeper into this process by reading our guide on market research data analysis.

Even governments are getting serious about this. Global enforcement agencies now actively track competitive activities across 69 jurisdictions. With over 1,000 cartel investigations launched in 2023 alone, this regulatory focus is helping level the playing field. Businesses in monitored markets report 25% fewer unfair practices from their rivals. It just goes to show that keeping an eye on the competition is a core part of a healthy, fair market.

How To Stay Ahead Without Becoming Obsessed

There’s a razor-thin line between smart awareness and a full-blown obsession that turns you into a professional rival-watcher. If all you do is react to their every move, you’ve already lost. You're permanently one step behind, driving your business by looking in the rearview mirror.

The goal isn't to perfectly mirror what they're doing. It’s to understand the game so deeply that you can start changing the rules. Think of your competitor’s playbook as a reference guide, not a sacred text.

Focus On Innovation, Not Imitation

Let’s get real. When a competitor launches a flashy new feature, the gut reaction is to panic and scramble your dev team to build the same thing. Don't. Take a breath and ask why they built it. What's the customer problem they were actually trying to solve?

Nine times out of ten, you’ll uncover a better, more creative way to solve that same problem—one that actually aligns with your brand.

- See a Price Drop? Instead of immediately slashing your prices, dig deeper. Is it a sign of desperation? Maybe this is your cue to double down on the premium quality and stellar customer service that sets you apart, rather than joining a race to the bottom.

- They Rank for a New Keyword? Don't just spit out a similar article. The big (and expensive) SEO platforms like Ahrefs or Semrush can flag this. But a tool like already.dev can surface the same intel and help you find a completely fresh, underserved angle on that topic.

> The real gold you get from watching competitors isn’t a checklist of features to copy. It’s spotting the unmet customer needs they are clumsily trying to address, giving you a wide-open opportunity to do it right.

Build a Sustainable Monitoring Habit

Obsession leads to burnout and frantic, reactive decisions. A sustainable habit gives you calm, strategic clarity. You do not need to check their Twitter feed every ten minutes.

Build a simple, manageable routine. Just 30 minutes a week is all it takes to review the signals that truly matter. Automate the grunt work of data collection with a tool like already.dev so you can spend your time on insights, not sifting through data.

Focus on the big-picture shifts. Are they suddenly hiring a bunch of data scientists? Did they overhaul their core marketing message? These are the strategic breadcrumbs that reveal where they're heading long-term. This kind of intelligence informs your strategy without ever derailing it, helping you lead the market instead of just chasing it.

Got Questions? We've Got Answers.

When it comes to competitor monitoring, a few questions pop up time and time again. Let's tackle them head-on. Don't worry, there are no dumb questions—only sneaky competitors.

How Often Should I Be Watching My Competition?

Honestly, it depends on your industry. If you’re in a fast-and-furious space like e-commerce or SaaS, a weekly check-in on key signals like pricing changes is a smart move. For more stable, slow-moving industries, a deep dive once a month might be all you need.

The secret is consistency. Block out a recurring time in your calendar—say, every Friday morning with your coffee—to quickly review your alerts. This keeps it from becoming a dreaded, multi-hour project you'll never actually do.

> The key isn't how often you look, but that you always look. A consistent, quick check-in is infinitely more valuable than a massive deep-dive you only do twice a year.

Getting the data collection automated with a tool like already.dev turns this into a breezy, 15-minute task instead of a soul-crushing spreadsheet session.

What's The Single Most Important Thing To Track?

If I had to pick just one thing—and please, track more than one—it would be their strategic shifts. This isn’t a single metric you can chart, but a pattern you piece together over time.

Are they suddenly flooding social media with content for a totally new type of customer? Did their careers page just light up with job postings for a dozen data scientists? Did they quietly kill their cheapest pricing plan?

These moves are breadcrumbs leading to their future plans. They tell you where the puck is going, not just where it’s been. Tracking their daily social media "likes" is vanity; tracking their strategic direction is survival.

Is It Unethical To Monitor My Competitors This Closely?

Not at all, as long as you're playing in the public sandbox. Everything we’ve talked about—tracking their website, social media, press releases, and pricing—is 100% ethical and just plain good business. It’s called competitive intelligence, not corporate espionage.

You're not hacking their servers; you're just reading the flyers they're handing out on the street. The line gets crossed when you try to access private, confidential information through shady means. Stick to what's publicly available, and you're simply being a smart business owner.

My Competitors Are Huge. How Can I Possibly Keep Up?

Don't even try to match them dollar-for-dollar. That’s a game you’ll lose. Your superpower as a smaller, nimbler player is agility.

A huge competitor is like a battleship—incredibly powerful, but it takes five miles to make a turn. You're a speedboat. You can zip right around them.

Focus your monitoring on one or two specific areas where you can realistically win.

- Customer Service Gaps: Are their customers constantly complaining online about slow response times? That's your opening to shine with lightning-fast support.

- Niche Keywords: They might dominate broad terms, but you can own long-tail keywords they've completely ignored. The big, expensive tools like Ahrefs or Semrush are great for keyword research, but an alternative like already.dev can help you pinpoint these overlooked SEO opportunities without the hefty price tag.

Use competitive intelligence to find their blind spots and then strike with precision. You don't need to out-muscle them; you just need to out-smart them.

Stop guessing what your competitors are up to. already.dev uses AI to do the heavy lifting, delivering the insights you need to make smarter, faster decisions. Get started for free at https://already.dev.