Price Comparison With Competitors: A Simple, No-BS Guide

Stop guessing on pricing. This guide on price comparison with competitors shows you how to find data, normalize plans, and win without starting a price war.

Doing a price comparison with competitors isn't about nervously peeking at their numbers so you can undercut them. It's about gathering intel to prove your own price is right. Slashing 10% off whatever they're charging might feel like a slick move, but it’s a race to the bottom that only attracts cheapskates who'll ditch you for the next shiny discount.

Why Copying Competitor Prices Is A Terrible, Horrible, No Good, Very Bad Idea

Let's be real, we've all been tempted. You see what the other guys are charging, lop a few bucks off, and call it a day. Congratulations, you've just fallen into one of the biggest traps in business. When you just copy their price, you’re playing their game by their rules, and you're probably going to lose.

This knee-jerk reaction completely ignores what makes your business unique: your value, your costs, and the actual humans you're trying to sell to. Your competitor might have a totally different cost structure, a wacky business model, or a product that’s missing your one killer feature.

> Key Takeaway: Pricing isn't a spectator sport. When you just copy someone else, you're letting their homework dictate your final grade. That’s a gamble you can’t afford to make.

The Real Goal of Competitive Pricing Analysis

Instead of just copying, the real mission is to figure out the why behind their numbers. This is a crucial piece of what smart people call competitive intelligence. If you want to go deeper, check out our guide on what competitive intelligence actually is and see how it goes way beyond just looking at prices.

A smart price comparison gives you the data to make confident decisions instead of just panicking. It helps you answer the important questions:

- Are they leaving a giant pile of money on the table that you could be scooping up?

- Is their "cheap" plan just a useless, stripped-down version that makes your mid-tier offering look like a fantastic deal?

- Are their customers secretly miserable about the value they're getting for the price?

Getting these answers requires a real system. You're not just glancing at a number; you're dissecting their entire game plan. Here’s a quick look at the lazy approach versus the smart one.

| Aspect | Copycat Pricing (The Bad Way) | Strategic Comparison (The Smart Way) | | :--- | :--- | :--- | | Focus | Their final price number. | The value they offer for that price. | | Outcome | A price war that eats into everyone's profits. | A strong market position built on your unique strengths. | | Customer | Attracts disloyal, price-sensitive shoppers. | Attracts customers who value what you specifically offer. | | Strategy | Reactive and short-sighted. | Proactive and backed by data. |

Doing a proper competitor price comparison isn't about being cheaper; it’s about being smarter. It’s how you build a pricing model that reflects your true worth and sets you up for long-term growth. You stop reacting and start leading.

How To Find Competitor Pricing Data

Alright, let's put on our detective hats. You're ready to run a real price comparison with competitors, but where do you actually find the goods? This isn't just about a quick peek at their homepage—you need to dig a lot deeper to get the full story.

The first and most obvious place is their public pricing page. This is your starting point, but treat it like the cover of a book. It’s not the whole story. Note down the tiers, the features listed, and the sticker prices. This is the low-hanging fruit.

Of course, many companies, especially in B2B, hide their pricing behind a "Contact Us for a Demo" button. Don't let that stop you. Your mission, should you choose to accept it, is to get that information anyway. They're not protecting state secrets; they're just trying to get you on a sales call.

Digging Deeper Than The Homepage

To really understand what a customer gets for their money, you have to go beyond the marketing fluff. The real value—and the hidden gotchas—are often tucked away in the user experience and the fine print.

Here’s where you can look:

- Sign Up for Free Trials: This is non-negotiable. You have to get inside the product to see how it actually works. Pay close attention to limitations, annoying upsell pop-ups, and any features that are technically included but are clunky or painful to use.

- Read Customer Reviews: Check out sites like G2, Capterra, or Trustpilot. Customers are usually brutally honest about pricing and value. Look for comments like, "The basic plan is useless because you have to pay extra for X," or "Their pricing is confusing and full of hidden fees."

- Annual Reports (for Public Companies): If your competitor is publicly traded, their annual and quarterly reports are absolute gold mines. They often talk about pricing strategies, average revenue per user (ARPU), and market positioning in plain English.

> It’s a bit like being an archaeologist. The pricing page is just the top layer of dirt. The real artifacts—the genuine insights into their strategy—are buried much deeper. You have to be willing to get your hands dirty.

Automating Your Intelligence Gathering

Let’s be real: manually checking dozens of competitor websites every week is a one-way ticket to burnout. The market moves fast, and you need a system to keep up without losing your mind. You have to automate.

This is where automation tools come in. For broad market analysis, something like Ahrefs or Semrush can give you a high-level view of a competitor's online presence, but they can be expensive and aren't built specifically for price tracking. A good alternative is a specialized tool like Already.dev, which is designed for exactly this kind of work. To effectively gather competitor pricing data, it helps to understand the technical methods involved; you can learn more about how to scrape a website to see how this works under the hood.

For a more focused and automated approach, a platform like Already.dev is built for this exact task. It automates the data collection, tracking pricing pages, features, and positioning shifts so you always have a current dataset to work with. This frees you up to do the important part: analyzing the data, not just collecting it. Our guide on gathering competitor pricing data offers more advanced techniques you can use.

Ultimately, your goal is to build a reliable, living dataset. It’s not a one-and-done task but an ongoing intelligence operation that keeps your business one step ahead.

Comparing Plans Without Comparing Apples To Oranges

So, you’ve got your hands on your competitors' pricing info. Great. Now for the hard part—and frankly, this is where most people screw up. You can't just line up your "Pro" plan against their "Pro" plan and call it a day. That's a recipe for making terrible decisions based on a pretty little chart.

Think about it. Their "Pro" plan might give users 10,000 API calls and charge per seat, while your "Pro" plan offers unlimited seats but caps storage at 50 GB. A direct comparison is totally useless. It's like asking which is a better deal: a pound of feathers or a pound of bricks. They weigh the same, but one is clearly better for building a house.

To get a real, honest comparison, you have to normalize the data. This just means breaking down every plan into a common denominator—a single, core value metric that your customers actually care about.

Find Your Golden Value Metric

Your value metric is the "per something" in your pricing model. It’s what customers are really buying. This can vary wildly depending on your industry, but figuring it out is the key to unlocking an accurate comparison.

Here are a few common examples to get you thinking:

- SaaS: Price per user, per contact, per GB of storage, or per project.

- API-based products: Price per 1,000 API calls or per transaction.

- E-commerce: Price per item, per shipment, or even the value of included shipping insurance.

- Marketing Tech: Price per 1,000 email sends or per tracked keyword.

> Don’t overcomplicate it. Your value metric should be the one thing that, if a customer needs more of it, they'd happily upgrade their plan. That's your North Star for this whole exercise.

Once you’ve locked this in, you can calculate an effective price for every plan out there. This turns a jumbled mess of features and limits into a single, clean number. For instance, if Competitor A charges $100/month for 5 users, their effective price is $20 per user. If you charge $120/month for 10 users, your effective price is just $12 per user. Bam. You're the more affordable option for bigger teams.

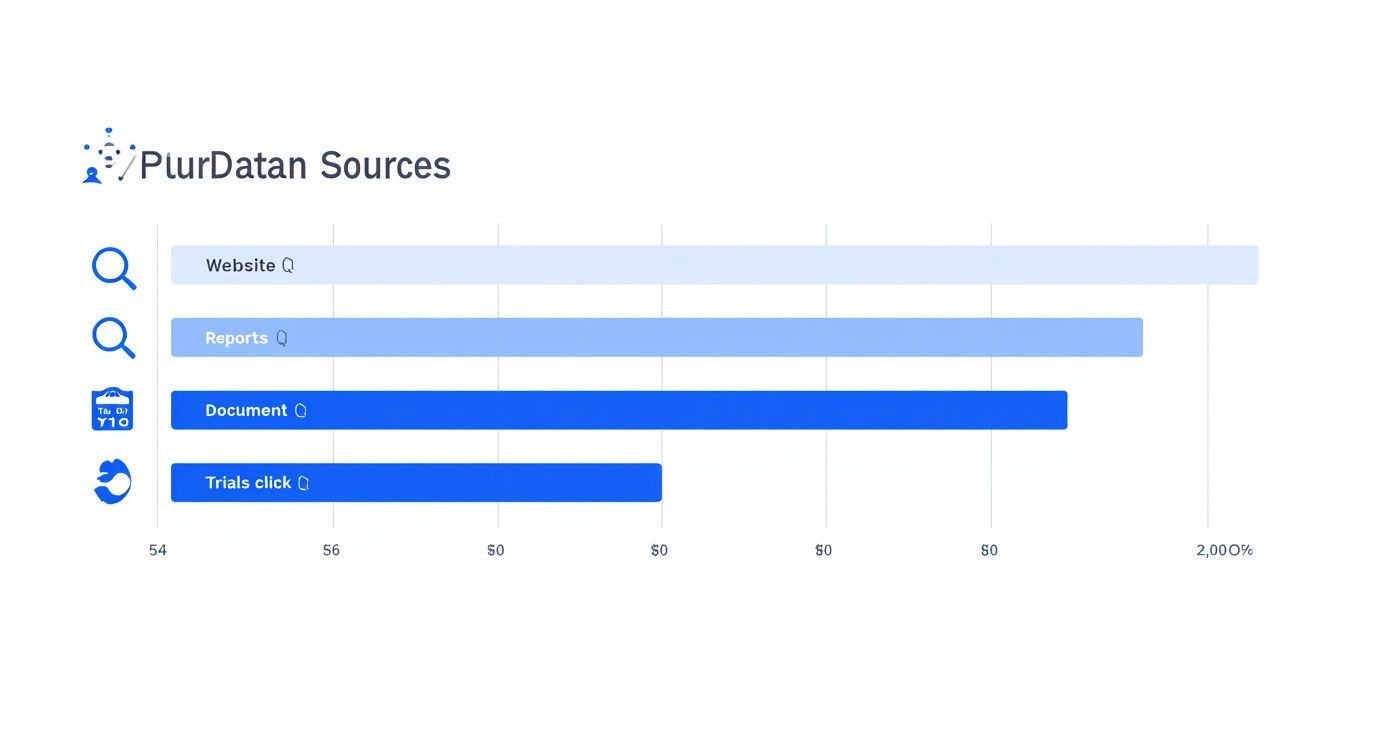

This visual shows some of the best places to dig up the data you need to make these calculations.

As you can see, public websites are a good start, but the real gold is often buried in industry reports or discovered by actually signing up for a free trial to see how the sausage is made.

How to Normalize Pricing Data Manually

You can get started with a basic spreadsheet—no advanced formulas needed. The goal is just to lay everything out so you can see it clearly.

Here's a simple example of how to break down competitor plans to find the true cost.

Competitor Plan Normalization Example

| Competitor | Plan Name | Monthly Price | Core Feature Units (e.g., Users) | Normalized Price (Per User) | | :--- | :--- | :--- | :--- | :--- | | You | Pro Plan | $120 | 10 | $12.00 | | Rival Inc. | Pro Plan | $100 | 5 | $20.00 | | CompeteCo | Growth Plan | $150 | 15 | $10.00 |

Look at that. With just a few columns, you get a ton of clarity. Rival Inc. looks cheaper with its $100 price tag, but CompeteCo is actually the most affordable on a per-user basis, and you're positioned right in the middle. This is the kind of insight that lets you build a real strategy instead of just reacting to a competitor's sticker price.

Of course, this gets tricky fast. What about annual discounts? Overage fees? Optional add-ons? Trying to do this for ten competitors across four plans each can feel like a full-time job.

This is where automated tools come in clutch. Big market research suites like Ahrefs or Semrush can offer some competitive context, but they're pricey and aren't built for this kind of nitty-gritty pricing analysis.

A specialized platform like Already.dev automates this entire normalization process for you. It pulls the data, identifies the core value metrics, and spits out visualizations that make these comparisons instantly clear. It turns hours of spreadsheet headaches into a few clicks, freeing you up to focus on strategy instead of data entry.

Analyzing Metrics Beyond The Sticker Price

Once you've done the hard work of normalizing your competitor’s data, you get to dig in for the good stuff. The sticker price is just the tip of the iceberg; the real story is always hiding just below the surface. A simple price comparison with competitors based only on what's on their homepage will almost always lead you astray.

This is where you shift from being a data collector to a data strategist. You start asking the big questions. Are they secretly going after a different market? Is their super-cheap entry plan just a hook to reel people into wildly expensive upsells? That boring spreadsheet is about to become your secret weapon.

Calculating Average Revenue Per User (ARPU)

First up is Average Revenue Per User (ARPU). It’s just a fancy way of asking, "On average, how much is each of their customers really paying them?" Calculating it can be a bit of a guessing game unless they’re a public company, but you can definitely put together a solid estimate.

You do this by looking at their plan distribution and making an educated guess about where most of their customers probably land. Are most of their users sticking to the cheap plan, or is the mid-tier where the action is?

- Step 1: Estimate the percentage of customers on each pricing tier.

- Step 2: Multiply that percentage by the price of that tier.

- Step 3: Add up the results for all tiers.

This simple math can tell you a ton. If a competitor has a high ARPU despite a low entry price, it’s a massive clue that they are masters of the upsell. Their business isn't built on that cheap plan; it's built on getting customers to upgrade, and fast.

> This is a classic strategic play. Lure them in with a low price, then show them all the shiny features they could have if they just paid a little more. Understanding their ARPU helps you see right through the illusion.

This insight also changes how you think about your own market position. A competitor with a low ARPU might be all-in on high-volume, low-touch sales, which could mean the more demanding (and profitable) enterprise clients are wide open for you.

Finding The Feature-Adjusted Price

Next, let's talk about the Feature-Adjusted Price. This is how you actually put a number on the value of those awesome features you have that your competitors don't. It helps you answer the question, "If all features were equal, who would really be more expensive?"

Think about a feature that’s a major selling point for you—maybe it’s advanced security, premium support, or a killer integration. How much is that worth to your ideal customer? Successful pricing strategies demand a deep dive into all aspects of cost, including potential 'hidden fees', just as in understanding costs beyond the sticker price for other services.

Putting a dollar value on a feature is part art, part science. You can base it on what it would cost a customer to get that same functionality somewhere else, or how much time and hassle it saves them. Once you have that value, you can "adjust" your price for a more honest comparison. For example, if your plan is $20 more but includes a feature worth $50, you're actually the better deal.

This analysis is also critical for your marketing and sales teams. It’s not just about price; it’s about demonstrating overwhelming value. This is tied directly to how you communicate your brand's authority in the space. For a deeper dive, you might find it useful to read about how to calculate your share of voice in the market.

Consumer behavior is now heavily shaped by these comparisons. With AI-driven personalization influencing over 50% of online purchases, shoppers are more equipped than ever to find the best value. This highly competitive landscape, where one in four shoppers makes cross-border purchases for better deals, means you must clearly articulate why your price is justified. You can discover more insights about e-commerce trends that highlight this global shift. By analyzing metrics beyond the sticker price, you can build a narrative that proves your value, turning a simple price check into a strategic advantage.

Building a Winning Pricing Strategy From Your Data

Alright, you've survived the data collection trenches and wrestled your spreadsheets into submission. You’re now sitting on a pile of clean, normalized competitor data. So... what now? This is the fun part, where all that grunt work turns directly into revenue.

The goal isn't just to know what your competitors are doing; it's to use that intelligence to build a pricing strategy that makes your product look like a no-brainer. Your analysis is the ammunition you need to confidently position your product, justify your price, and win more deals. This is where your price comparison with competitors evolves from a defensive chore into an offensive weapon.

Turning Insights Into Actionable Strategy

Your data tells a story. Maybe it reveals that your main rival's "unlimited" plan is actually throttled so badly it’s useless for power users. Or perhaps you discover their cheapest tier is missing a single, critical feature that your target customers can't live without. These are the golden nuggets you'll build your entire strategy around.

Let’s break down the three main plays you can run based on what you’ve found.

-

Value-Based Pricing: You lead with the incredible value you offer, not the price tag. If your analysis proved your product delivers 2x the performance for just a slightly higher price, you can now confidently price based on that superior value—and you have the data to back it up.

-

Competitive Positioning: This is where you position yourself directly against a competitor. If your analysis shows a competitor is the "cheap" option but has terrible support, you can frame yourself as the premium, reliable alternative for businesses that can't afford downtime.

-

Cost-Plus Pricing (With a Twist): This is the old-school "our costs + profit margin" model. But with competitive data, you get to add a strategic layer. You know your floor, but the competitive analysis tells you just how high the ceiling is.

> Your research isn't just a report that gathers dust. It’s a playbook. It tells you exactly where your competitors are weak and where you are strong, giving you the confidence to set a price that reflects your true worth.

Arming Your Sales Team With Battle Cards

One of the most powerful things you can do with this data is create simple "battle cards" for your sales team. Think of them as one-page cheat sheets that arm them with everything they need to shut down the competition when a prospect brings them up.

A great battle card isn't a long laundry list of features. It’s a tactical tool that instantly answers a few key questions:

- When they say "[Competitor X] is cheaper," we say... "They are! But did you know their plan doesn't include [Critical Feature Y]? For most businesses like yours, that ends up being a deal-breaker."

- Where we win: We offer 24/7 support with an average response time under 5 minutes. They only have email support with a 48-hour SLA.

- The hidden gotcha: Their low price doesn't include overage fees, which can get incredibly expensive. Our plan has predictable, flat-rate pricing.

This kind of intelligence is gold, especially in a market where price competition is fierce. The global retail landscape is a perfect example; while brick-and-mortar still accounts for 80.1% of sales, the explosive growth of e-commerce has sparked intense price wars across both channels. With global retail sales projected to hit $31.3 trillion in 2025, every single competitive edge matters. You can read the full retail statistics report to see just how deep these trends go.

This is where your price comparison with competitors becomes a revenue-generating machine. Instead of getting defensive about your price, your team can proactively reframe the conversation around value, turning a potential objection into a winning argument.

Common Price Comparison Mistakes To Avoid

Alright, let's talk about the landmines. Running a price comparison with competitors feels straightforward, but it’s shockingly easy to mess up and end up with bad data that leads to even worse decisions. Think of this as your field guide to not stepping on the obvious stuff.

One of the biggest blunders is getting tunnel vision. You lock onto that one big competitor—the one that keeps you up at night—and build your whole strategy around them. The problem is, you're completely ignoring the dozen smaller, hungrier players quietly eating your lunch from the bottom up.

A solid analysis has to cover the whole market, not just the 800-pound gorilla. You need to see the full spectrum of choices your customers are actually considering.

Ignoring The Squishy Stuff

Here's another classic mistake: treating pricing like it's just a math problem. You line up features in a spreadsheet, calculate a per-unit cost, and declare a winner. But people don't buy products on a spreadsheet; they buy solutions from companies they trust.

Forgetting about qualitative data is a huge misstep. These are the "squishy" factors that are tough to quantify but massively impact what someone is willing to pay:

- Brand Reputation: Are they the trusted old guard or the scrappy new kid on the block?

- Customer Support: Is their support team legendary for solving problems, or is it a ghost town of unanswered tickets?

- Ease of Use: Is the product a dream to use, or does it feel like it needs a PhD and a prayer just to get it running?

> A competitor might be 20% cheaper, but if their customer support is a nightmare, you don't have a pricing problem—you have a massive value advantage. Make sure you highlight that.

Using Old, Stale Data

Finally, the most dangerous mistake of all is treating your competitive analysis as a one-and-done project. You spend a week pulling data, create a beautiful report, and then let it gather digital dust for the next six months.

The market moves at lightning speed. Prices change, new features drop, and competitors pop up overnight. Using outdated intel is like trying to navigate with a six-month-old map—you're going to end up in a ditch.

This needs to be a living, breathing process. While big market intelligence platforms like Ahrefs or Semrush are great for snapshots (and can be expensive), they aren't designed for continuous price tracking. A purpose-built tool like Already.dev can automate the monitoring, making sure your data is always fresh and your decisions are based on what's happening right now, not what was happening last quarter.

Frequently Asked Questions

Let's be real—kicking off a full-blown price comparison with competitors can feel like a massive chore. So, here are some straight-up answers to the questions that pop up most often.

How Often Should I Check Competitor Prices?

More often than you probably think. In fast-moving spaces like SaaS or e-commerce, things can change in a flash. Prices can easily shift quarterly, if not monthly.

A good baseline is to do a big, deep-dive review every quarter. Between those sessions, you should have some kind of automated alert set up to catch any big moves. Thinking of this as a one-time project is a surefire way to fall behind. The market doesn't stand still, and neither should your analysis.

What’s The Best Tool For Competitor Price Tracking?

This really boils down to your budget and how much you enjoy mind-numbing manual data entry. You can always start with a spreadsheet, but that gets painful—and outdated—very quickly.

Tools like Ahrefs or Semrush are great for spotting broad market trends, but they come with a hefty price tag and weren't built for price tracking specifically. If you want to automate the tedious work of monitoring pricing pages, plans, and feature lists, you need a tool built for the job. A platform like Already.dev is designed to pull you out of spreadsheet hell for good.

My Competitor Doesn’t List Their Prices Publicly. What Now?

Ah, the infamous "Contact Us for a Demo" button. It's a classic move, but it's not a dead end. It just means you need to put on your detective hat.

> Don't see this as a roadblock. Think of it as a clue. Companies that hide their pricing usually have a complex or high-ticket offer, and just knowing that is valuable intel.

Here are a few ways to get the information you need:

- Scour Review Sites: Check out platforms like G2 or Capterra. You'd be amazed at how often customers will mention pricing—whether they're complaining or celebrating—in their reviews.

- Talk to Your Customers: If you share customers with your competitor, just ask them. You'll find that people are often surprisingly transparent about what they’re paying other vendors.

- Hunt for Case Studies: Companies sometimes drop clues about ROI or total cost for a customer in their case studies. It’s not a full price list, but it’s a breadcrumb worth following.

Stop guessing and start knowing. Already.dev automates your competitive research, turning hours of manual work into a four-minute report. Get the clarity you need to build a winning strategy and discover your unfair advantage at https://already.dev.