How to Do a Product Competition Analysis Without Going Crazy

Tired of guessing? Our guide to product competition analysis helps you uncover rival secrets, find market gaps, and build a product that truly stands out.

Let's be real, the phrase 'product competition analysis' sounds like something cooked up in a stuffy boardroom, destined for a spreadsheet nobody ever reads. But it's actually your secret weapon—a treasure map that shows you where the gold is buried and where all the traps are.

It’s not about creepy spying; it’s about being smart.

Why Even Bother With This Stuff?

Ignoring your competition is like driving with a blindfold on. Sure, you might get somewhere, but it's probably not where you intended to go, and you might hit a few trees. A proper analysis gives you the clarity to navigate your market, dodge fatal mistakes, and build something people genuinely want to throw money at.

Think of it this way: every competitor, whether they’re crushing it or flopping hard, has spent a ton of time and money figuring things out. Their journey is a collection of expensive lessons you get to learn for free. By studying them, you can reverse-engineer what works and avoid their blunders without spending a dime of your own cash.

Spot Opportunities Everyone Else Missed

Your rivals aren't perfect. They have gaps in their products, customers they're ignoring, and complaints they keep sweeping under the rug. These aren't just weaknesses; they are massive, flashing neon signs pointing to your next big opportunity.

A deep dive into their customer reviews can reveal feature requests they’ve brushed off or pain points their product creates. That's your opening.

> By looking at what competitors aren't doing, you can find what makes you special. This is how you stop competing on price and start competing on value, building a fan club that sees you as the only real solution.

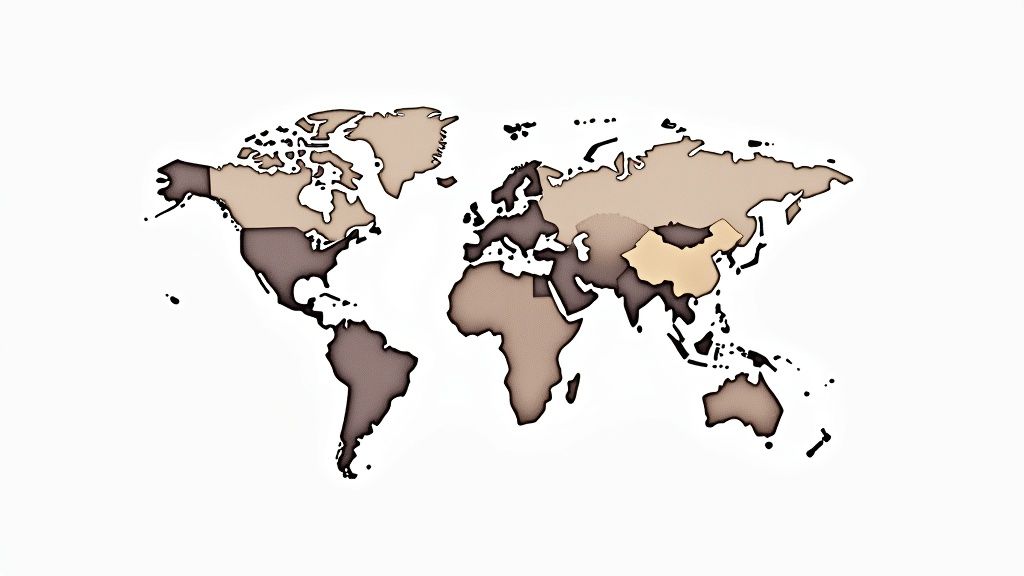

The digital world is only getting more crowded. Global digital commerce sales are projected to hit $7.5 trillion by 2025, and with about 85% of consumers worldwide now shopping online, the heat is on. That intense environment means you can't afford to guess what customers want; you have to know.

Build a Smarter Product Roadmap

Ultimately, this whole exercise is about more than just gathering data—it's about building a better product. It informs every single decision, from your pricing and feature set to the marketing message you put out there.

This process is a core part of what’s known as competitive intelligence, a vital skill for any founder or product manager. Understanding your competitors gives you the confidence to build a product with a real, defensible advantage in the market.

This isn’t just busywork; it's the foundation of a winning strategy.

Spotting Your Real Competitors

When you think "competitor," a few big names probably pop into your head. That's natural. But the rivals who can really throw a wrench in your plans are often the ones flying completely under your radar. A truly effective competition analysis has to look beyond the usual suspects.

I like to think about the competitive landscape in three distinct layers. Each one brings its own unique challenge and, frankly, requires a different game plan.

Direct Competitors: The Ones You Already Stalk

These are the companies you’re likely already keeping tabs on. They offer a product that’s a whole lot like yours, and they’re chasing the exact same customers.

Think about it this way: if you sell project management software, then Asana and Trello are your direct competitors. They're tackling the same problem for the same audience with a very similar toolkit.

Finding them is usually pretty easy. Just hop on Google and search for things like "best project management software" or "Asana alternative." The big players will show up right away.

Indirect Competitors: The Sneaky Threats

Okay, this is where it gets more interesting. Indirect competitors are out there solving the same core customer problem you are, but they're doing it with a completely different solution.

Let’s stick with that project management software example. An indirect competitor isn't another app. It could be:

- A ridiculously organized Google Sheets template.

- A classic whiteboard covered in sticky notes.

- A freelance virtual assistant who keeps projects on track.

None of these are SaaS products, but they are absolutely competing for your customer's budget to solve that "help me get organized" problem. You can't afford to ignore them. Why? Because they often highlight the fundamental needs your fancy product might be over-engineering.

> The real competition isn't always another piece of software. It’s any solution—even a simple habit—that solves the customer's problem. Getting this is the first step to building something people genuinely can't live without.

Emerging Competitors: The New Kids on the Block

These are the scrappy startups who are hungry and looking to make a name for themselves. They might not have much market share yet, but they’re often nimble, innovative, and hyper-focused on a niche you might have dismissed.

Finding these guys requires more than a simple Google search. You have to be a bit of a detective. Start by scouring platforms like Product Hunt and BetaList, and hang out in industry-specific forums where your customers are.

SEO tools are also your friend here. While heavy-hitters like Ahrefs and Semrush are great for seeing who ranks for your target keywords, they can be super expensive. A tool like already.dev is a great alternative that can actually automate this discovery work for you, surfacing these emerging players before they become a big problem.

For a deeper dive, our complete guide on how to identify competitors will walk you through building a full map of your market. Getting this initial legwork right is crucial; it’s the foundation for everything else you’ll do.

What to Look For When Analyzing Rivals

So, you've got your list of competitors. Awesome. Now for the part where so many people drop the ball: they just click around on their rivals' websites for an hour and call it "research."

That's not analysis; that's just procrastinating.

To pull out insights you can actually use, you need a plan. Think of yourself as a detective, searching for clues across four critical areas. This framework helps turn a messy pile of data into a crystal-clear picture of where you stand and where you can win.

To help you get started, here's a quick-reference table to guide your investigation.

Core Areas for Competitor Analysis

| Analysis Area | What to Look For | Why It Matters | | :--- | :--- | :--- | | Product & UX | Core features, onboarding flow, "Aha!" moments, user friction points | Reveals feature gaps and opportunities to create a smoother, more intuitive experience. | | Pricing & Positioning | Pricing tiers, free plans, hidden fees, target customer | Uncovers their business model, target audience, and how they communicate their value. | | Marketing & Acquisition | Social media, content, SEO, paid ads (Google, social) | Shows you which channels they've proven work in your market, saving you time and money. | | Customer Voice | G2/Capterra reviews, Reddit threads, social media comments | Provides direct, unfiltered feedback on their strengths and, more importantly, their weaknesses. |

This table gives you a solid starting point. Now, let's dig into what each of these areas looks like in the real world.

Product Features and User Experience

This is usually the first stop, but it’s easy to get this wrong. Don't just make a checklist of what features they have. You need to get your hands dirty and understand how they actually work. My advice? Sign up for their free trial (use a burner email if you have to) and truly become a user.

Ask yourself these questions:

- Does it actually work? How well does the product deliver on its promise? Is it zippy and intuitive, or are you fighting against a clunky, confusing interface?

- Where's the "Aha!" moment? How quickly do you "get it"? What do they do exceptionally well to make a new user feel like a genius?

- What drives you nuts? Pay close attention to the little things that are just... annoying. Every frustrating workflow or missing feature is a golden opportunity for you to build something better.

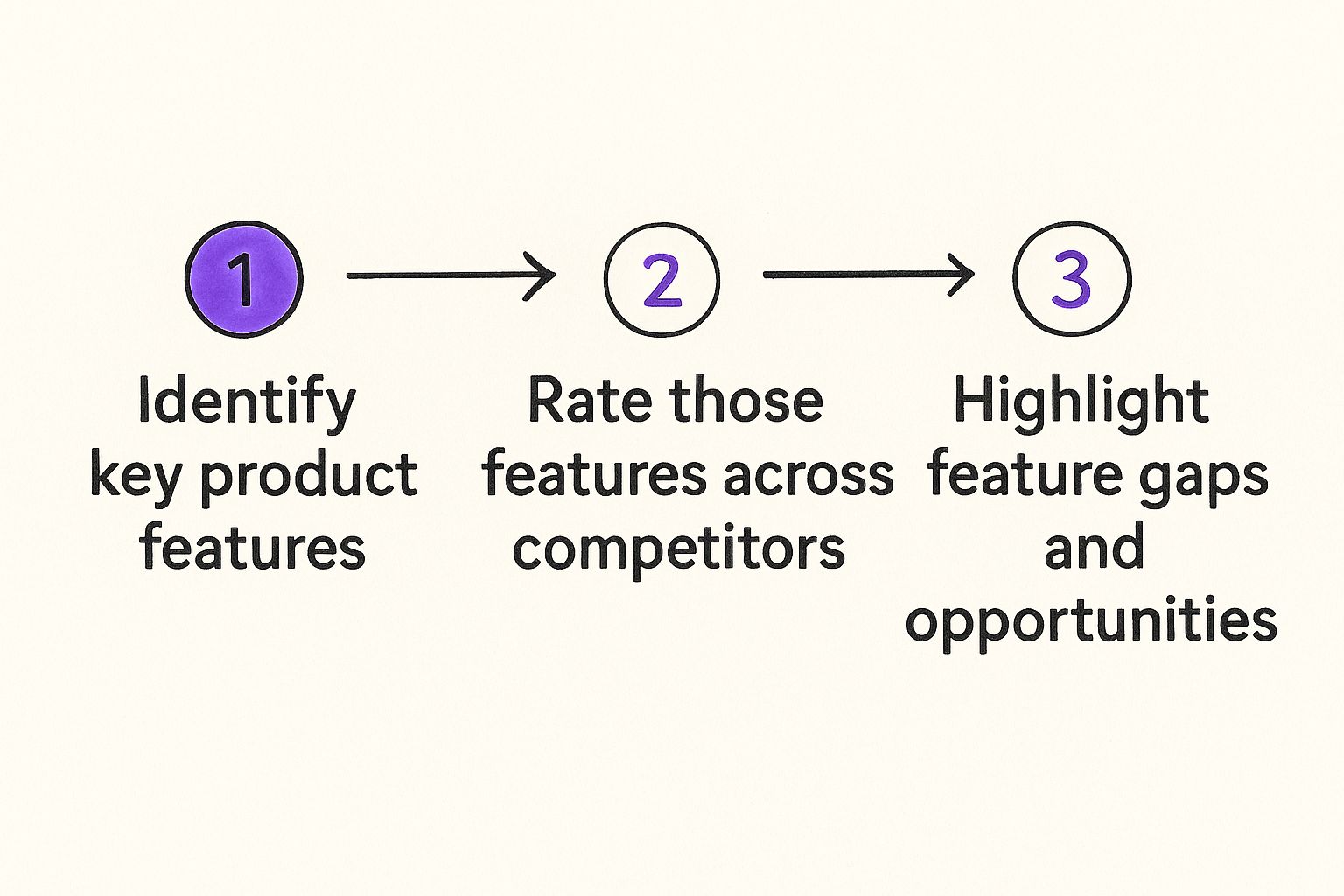

Think of it like this: first, you map out the features that customers actually care about. Then, you score each competitor on how well they deliver. Suddenly, the gaps in the market become glaringly obvious.

This kind of feature-gap analysis isn't just an academic exercise. It's your product roadmap for building something that solves real problems your competitors have ignored.

Pricing and Positioning

A price tag is never just a number; it’s a billboard that screams who the product is for. Your competitor’s pricing page is a treasure trove of strategic information.

Are they the cheap and cheerful, no-frills option? Or are they the premium, "you get what you pay for" player? Look at their pricing tiers, what they offer in a free plan, and any sneaky add-ons or hidden fees. This tells you exactly where they think their value lies and the kind of customer they’re hoping to attract.

Marketing and Customer Acquisition

How are your rivals getting in front of people? You need to become a student of their marketing machine. This isn’t about blindly copying their tactics; it’s about understanding which channels are already working in your industry.

> A competitor’s marketing strategy is a collection of expensive experiments they’ve already paid for. Your job is to analyze the results for free and learn from their wins and losses.

Check out their social media, their blog content, and the ads they're running. A deep dive into a Google Ads competitor analysis, for example, can give you incredible insight into their paid strategy. While powerful tools like Ahrefs and Semrush are great for this, they can be pricey. A tool like already.dev is a great alternative to see where their traffic is coming from without that enterprise price tag.

The Voice of the Customer

Okay, here's where you'll find the real gold: customer reviews. This is the raw, unfiltered truth from the people who are actually using the product every single day.

Make it a habit to scour sites like G2, Capterra, and even Reddit for threads about your competitors.

You’re looking for patterns. What features do people absolutely rave about? And what bugs or missing functions drive them up the wall? These reviews are a direct pipeline into your market's biggest headaches and unmet needs—use them.

Smart Tools for Your Spy Kit

Let's be real, you could do all this detective work manually, armed with nothing but a spreadsheet and a boatload of caffeine. But why would you want to? The goal here is to work smarter, not harder, and the right tools can save you a ridiculous amount of time.

This isn't about buying a bunch of flashy software you'll never use. It's about picking a few key tools that automate the tedious parts of product competition analysis, freeing you up to focus on the actual strategy. Think of them as your own personal team of research assistants who work 24/7.

SEO and Traffic Analysis Tools

One of the first questions you should ask is, "How are my competitors getting customers?" SEO tools are perfect for answering this. They peek under the hood of a competitor's website to see which keywords they rank for on Google, where their website traffic comes from, and who is linking to them.

Industry giants like Ahrefs and Semrush are incredibly powerful for this kind of work, but let's be honest—they can also be incredibly expensive, often running hundreds of dollars a month. They're amazing if you have the budget, but that's a tough pill to swallow for early-stage startups or smaller teams.

> The big secret is that you don't need an enterprise-level tool to get enterprise-level insights. You just need the right tool that focuses on giving you actionable data without the fluff.

This is where a more focused tool like already.dev comes into play. It's designed to give you powerful competitive insights without needing to take out a small business loan. For example, you can get a quick snapshot of the competitive landscape and see how everyone is positioned. This view instantly shows you who the key players are and how they position themselves, saving you hours of manual digging.

Finding the Right Toolkit

Beyond just SEO, you need a way to monitor what people are actually saying about your competitors. This is where social listening and review monitoring tools come in handy. They scan social media, forums, and review sites for mentions of your rivals, giving you a live feed of customer praise and (more importantly) complaints.

To gain a significant edge, it's crucial to utilize effective technology, and you can explore various competitive analysis tools available to streamline your research. The key is to build a small, affordable stack of tools that covers your specific needs. You might only need one or two to get started.

For those just starting to build out their toolkit, we've put together a comprehensive list of the best competitive intelligence tools that covers a range of budgets and use cases. Remember, the best tool is the one that gets you the data you need quickly so you can get back to building a better product.

So, What Do You Do With All This Intel?

Alright, you've done the legwork. You've got spreadsheets, notes, and maybe a slightly paranoid feeling that you know way too much about your competitors. Gathering all that data is fun, but here's the critical part: turning that pile of information into an actual game plan.

This is where you stop looking over your shoulder and start paving your own path forward. It's about connecting the dots to build a strategy that doesn't just keep up, but puts you in the lead.

Pinpoint Your "Why You" Story

This is all about finding what makes you different. Forget the jargon for a second. It's simply the reason someone should choose you. It's the clear, confident answer to the question, "Why should I buy from you instead of the other guys?"

And guess what? Your competitive analysis is the ultimate cheat sheet for figuring this out. Go back to your notes on competitor weaknesses and all those customer complaints you unearthed. That's not just a gripe list; it's a goldmine of opportunity.

- Did you notice that every competitor has a clunky, confusing setup process? Your angle could be "The easiest setup in the industry, guaranteed."

- Are customers fed up with hidden fees and surprise charges? Your angle could be "Transparent pricing. No BS."

- Is the market flooded with bloated, overly complicated tools? Your angle could be "The one tool that does one thing perfectly."

> Your unique angle isn't about being slightly better at everything. It's about being the absolute best at the one thing your ideal customer truly cares about. Stop trying to win their game; create a new one and make them come to you.

Find and Fill the Gaps

Once you've nailed your unique angle, it's time to build your entire strategy around it. Let your analysis be the blueprint for everything from your product roadmap to the words you use on your homepage. This is how you carve out a space in the market that is undeniably yours.

Let's say your research reveals that all the big players are laser-focused on huge enterprise clients, leaving small, local businesses completely out in the cold. That's a massive gap. We're seeing a huge shift in consumer behavior, with around 47% of people worldwide saying they prefer to support locally owned businesses. This single insight can shape your entire strategy, influencing which features you build and how you market them. You can discover more about how consumer trends are creating these kinds of openings.

Tweak Your Price and Your Pitch

How you price your product and how you talk about it should be a direct reflection of your competitive intel. If you discovered your main rival is the bargain-bin option, getting into a price war with them is a race to the bottom you likely won't win.

Don't do it. Instead, use your analysis to justify a premium price point. Your messaging can become a direct counter to their biggest flaws.

- Their weakness: "Their product is cheap, but it's buggy and unreliable."

- Your pitch: "Engineered for reliability. Because your work is too important for crashes."

This isn't about trash-talking the competition. It's about drawing a clear contrast that shows customers why you are the smarter, safer choice. You're using what you've learned to tell a story where your product is the obvious hero.

Frequently Asked Questions

Got questions? We've got answers. It's totally normal to have a few "wait, what?" moments when you first dive into product competition analysis. Let's clear up a few of the most common head-scratchers with some simple, straight-to-the-point answers.

How Often Should I Actually Do This?

Let's get one thing straight: this isn't a "one and done" task you can check off a list and forget about. The market is always shifting, new players pop up, and old ones change their strategy. Think of it like checking the weather before you leave the house—it’s a regular habit, not a once-a-year event.

Here's a good rhythm that works well:

- Quarterly Deep Dive: Once a quarter, block out time for a major, in-depth analysis. This is where you go through all the steps we've talked about.

- Monthly Pulse Check: At least once a month, do a quick scan. Look for any new competitors or see if a major rival just dropped a game-changing update. This keeps you from being blindsided.

How Many Competitors Should I Analyze?

Please don't try to boil the ocean. Attempting to analyze every single company in your space is a surefire way to get overwhelmed and accomplish absolutely nothing. Be selective and focus on who really matters.

My recommendation? Start with 3 to 5 key competitors. This should include a mix of direct rivals, indirect players, and maybe one emerging startup you've got your eye on. This gives you enough data to spot meaningful patterns without drowning in spreadsheets.

> You'll learn far more from a deep analysis of three relevant competitors than a shallow look at twenty. Quality over quantity is the name of the game here.

Can I Do This With Free Tools?

Absolutely! You don't need a massive budget to get started. While big platforms like Semrush and Ahrefs are fantastic, they can be really expensive. You can pull together a ton of valuable intel using free resources.

Here's where to look:

- Google: Simple searches and Google Alerts are your best friends for tracking mentions and news.

- Social Media: Just lurking on Twitter, Reddit, and LinkedIn can reveal a goldmine of raw customer feedback and complaints about your rivals.

- Review Sites: Places like Capterra and G2 are public repositories of your competitors' biggest strengths and weaknesses, straight from their users.

When you're ready to get more serious without breaking the bank, a tool like already.dev can automate a lot of the heavy lifting. It helps surface insights that are nearly impossible to find by hand.

Ready to stop guessing and start building with data-driven confidence? Already.dev automates your competitive research, turning hours of manual work into a clear, actionable report in minutes. Find your competitive edge and avoid costly mistakes.

Discover your true competition with a free analysis at Already.dev