Share of Voice vs Share of Market: What Actually Matters?

Confused about share of voice vs share of market? This guide breaks down what they are, how to measure them, and which one to focus on for growth.

Let’s get straight to the point: Share of Voice is how much people are talking about you, and Share of Market is how much they’re actually buying from you. One is about buzz; the other is about bucks. Simple.

What Are Share of Voice and Share of Market? It's a Pizza Party.

To cut through the jargon, imagine your entire industry is one massive pizza party.

Share of Market (SOM) is the number of actual slices of pizza you get to eat. It’s your tangible, measurable piece of the pie—the cold, hard sales figures.

On the other hand, Share of Voice (SOV) is how loudly everyone at the party is chanting your name, hoping you’ll grab the next slice. It’s all the buzz, the online chatter, and the general visibility your brand commands.

You could be a tiny startup that no one is buying from yet (low SOM), but if your launch video goes viral, you might suddenly have the biggest SOV at the party. In contrast, a huge, established company might be selling tons of pizza (high SOM) without anyone really making a fuss about it (low SOV).

> Key Takeaway: Share of Voice is a leading indicator—it’s the crystal ball that can hint at future growth. Share of Market is a lagging indicator—it’s the report card on how you've already performed.

The "Official" Definitions

Getting a bit more technical, Share of Market (SOM) is your company's slice of the total industry sales. If the entire UK packaged goods industry is worth £1 billion and your company brings in £75 million in sales, your market share is 7.5%. Simple as that.

Share of Voice (SOV), however, measures your brand's presence in the overall conversation. This is calculated by looking at your brand's percentage of media mentions, ad impressions, or social media chatter compared to your competitors. If you want a deeper dive, there's a great breakdown of SOV and market share that explores these definitions further.

SOV vs SOM at a Glance

Before we go deeper, here’s a quick table to make the distinction crystal clear.

| Attribute | Share of Voice (SOV) | Share of Market (SOM) | | ------------------ | -------------------------------------------------- | -------------------------------------------------- | | What It Measures | Brand awareness and conversation dominance | Percentage of total market sales or revenue | | Focus | How much attention you get (visibility) | How much money you make (profitability) | | Indicator Type | Leading (predicts future growth) | Lagging (reports past success) | | Primary Goal | To be seen, heard, and discussed | To sell products and increase revenue | | Analogy | The loudest fan club at the game | The final score on the board |

In the end, knowing the difference between how much people talk about you versus how much they buy from you is the first real step toward building a smarter growth strategy.

How a Loud Voice Can Fatten Your Wallet

We've established that Share of Voice (SOV) is all about the conversation, while Share of Market (SOM) is about the cash. But the real magic happens when you see how they're connected. It’s a classic cause-and-effect loop: making more noise can quite literally lead to making more money.

The key to this is a simple but powerful concept known as Excess Share of Voice (ESOV). It’s a bit of marketing jargon, but all it means is that your share of the conversation is bigger than your share of the market. Let's say you have 10% of the market (your SOM) but you're generating 20% of the buzz (your SOV). That extra 10% is your ESOV.

This isn't just a neat theory—it's a time-tested growth strategy. When you consistently make more noise than your market position would suggest, you start capturing attention that would otherwise go to the big guys. More attention leads to more customers, and that's how your market share starts to climb.

The ESOV Effect in Action

For years, marketers operated on the gut feeling that more advertising meant more sales. Now, we have the data to prove it. The link between out-shouting the competition and growing your slice of the pie is predictable and measurable.

Research from Nielsen actually put a number on this relationship. Their study found that for every 10% of Excess Share of Voice a brand maintains, it can expect its market share to grow by an average of 0.5% per year. This is a game-changer because it proves that simply matching your current market share with your marketing voice is just a recipe for staying put.

> In simple terms, if your Share of Voice equals your Share of Market, you've hit equilibrium. You'll likely hold your ground, but you won't grow. If your voice gets quieter (SOV < SOM), expect your market share to start slipping.

It just makes sense, right? If you stop showing up in conversations, people will eventually forget you and turn to the brands that are still making themselves heard.

From Shouting to Selling

Let’s bring this to life with a real-world example. A few years ago, the meal-kit delivery space was dominated by Blue Apron, which had a massive SOM. But then challengers like HelloFresh and Home Chef burst onto the scene and started making a ton of noise.

They went all-in, not just with traditional ads but by taking over social media feeds, sponsoring every podcast under the sun, and flooding the zone with influencer content.

- Their strategy: They aimed for a huge SOV that completely dwarfed their tiny initial market share.

- The result: They quickly became household names. All that shouting eventually converted into sales, and they started stealing customers directly from Blue Apron.

That’s the ESOV principle in action. They invested in being louder than their size, and it directly translated to a bigger bottom line. Building these metrics into an effective marketing strategy is how you turn that initial buzz into a real, sustainable pipeline of customers.

At the end of the day, the dynamic is straightforward. Being loud gets you noticed. Being noticed builds familiarity. Familiarity builds trust. And in business, trust is what convinces people to open their wallets.

How to Measure These Metrics Without a PhD

https://www.youtube.com/embed/m3pgY0sJwNY

Alright, let's roll up our sleeves. All this talk about "voice" and "market" is great, but it's pretty useless if you can't actually measure it. The good news? You don't need a lab coat or a supercomputer.

We’ll start with the easy one first: Share of Market. It’s definitely the more straightforward of the two because it deals with cold, hard cash.

Nailing Down Your Share of Market

Calculating your Share of Market (SOM) is refreshingly simple. Seriously, it's just basic math.

The formula is: Your Total Sales ÷ Total Market Sales = Your Share of Market.

So, if your company sold $1 million worth of widgets last year and the entire widget market was worth $20 million, you own a tidy 5% of the market. The real challenge here isn't the division; it's getting your hands on that "Total Market Sales" number. This data usually comes from industry reports, market research firms, or trade associations, and yeah, it often comes with a price tag.

Tackling the Trickier One: Share of Voice

Now for the fun part. Share of Voice (SOV) is a bit more slippery because "the conversation" happens all over the place. You really have to measure it channel by channel to get a clear picture.

Measuring SOV isn't about finding one single number. It's about understanding your visibility on different battlegrounds. Think of it less like a final score and more like individual stats for the different players on your team.

Organic Search: Your Digital Shelf Space

In the world of organic search, your SOV is all about visibility on search engine results pages (SERPs). The question is, how often does your brand pop up when people search for important keywords in your industry?

This is where powerful SEO tools come into play. You’ve probably heard of the big names like Ahrefs or Semrush. They are fantastic for tracking keyword rankings and estimating search visibility for you and your competitors, but let's be real—they can be ridiculously expensive, especially for a new business.

A more accessible alternative is already.dev, which helps you get a quick read on the competitive landscape without needing to take out a small business loan.

Tools like this cut through the noise, showing you who your real digital competitors are and which keywords they're showing up for. This gives you a direct, actionable way to measure and start improving your search SOV.

Social Media: The Digital Megaphone

On social media, SOV is all about who's dominating the chatter. You can track this by keeping an eye on a few key things:

- Brand Mentions: How many times is your brand name getting dropped versus your competitors?

- Hashtags: Are people using your branded hashtags more than the competition's?

- Engagement: Tally up the total likes, shares, and comments you get compared to everyone else in your space.

> The goal isn't just to be mentioned, but to own the conversation. If your competitors are getting mentioned in complaints and you're getting mentioned in praise, your quality of voice is much higher.

Paid Ads: Buying a Bigger Voice

In paid advertising, like with Google Ads, the metric is literally called Impression Share. It tells you the percentage of times your ads were shown out of the total number of times they could have been shown.

If your Impression Share is 30%, it means your competitors are gobbling up the other 70% of potential views for those keywords. Bumping up your budget or improving your ad quality score can directly boost this number, effectively letting you buy a louder voice.

Measuring these metrics is the first step to actually influencing them. To put these ideas into practice, a practical guide on how to calculate your Share of Voice offers some great step-by-step instructions. And if you're looking for an even deeper playbook, check out our complete guide on how to calculate share of voice to really master the process.

Choosing Your Focus: SOV or SOM?

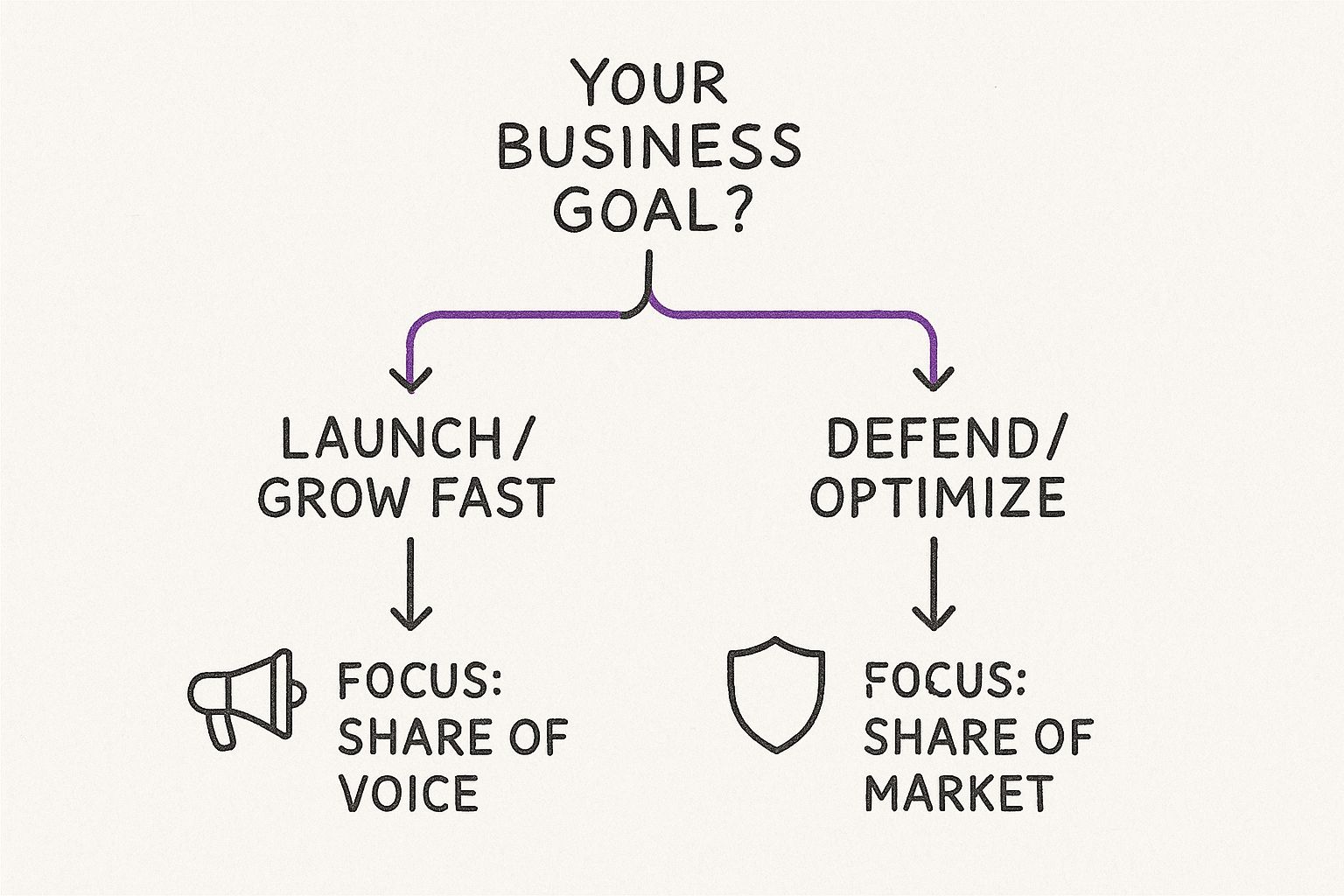

So, you're staring at two key metrics, Share of Voice (SOV) and Share of Market (SOM), and trying to figure out which one is more important. Here’s the deal: it’s not an either/or situation. You absolutely need both, but your primary focus will shift depending on whether you're trying to build a rocket ship or defend a castle.

Think of it like picking the right tool for the job. You wouldn’t use a hammer to bake a cake, would you? Deciding where to pour your resources—either into shouting louder (SOV) or counting your sales (SOM)—is a strategic choice that needs to align with your current business goals.

This decision tree gives you a quick visual breakdown. Are you trying to launch and grow, or defend and optimize?

As you can see, your main objective points you to your primary metric. It’s all about knowing whether to grab the bullhorn or the shield.

When to Go All-In on Share of Voice

Are you a scrappy startup, launching a new product, or a challenger brand trying to break into an established market? If that sounds like you, then Share of Voice is your new best friend.

Right now, nobody knows who you are. Your SOM is likely so small it's a rounding error. Obsessing over sales figures is a waste of time when you haven’t even properly introduced yourself to the market. Your mission is simple: get noticed.

Putting your energy into SOV means focusing your efforts on:

- Content Creation: Churn out useful, entertaining, or even provocative content that gets people talking in your niche.

- Social Media Blitz: Show up everywhere your potential customers are hanging out online. Be part of the conversation.

- PR and Outreach: Get your brand name featured in articles, mentioned on podcasts—anywhere you can steal a bit of the spotlight.

The goal here is to create a massive Excess Share of Voice (ESOV). You want to make so much noise that the market leaders have no choice but to turn around and ask, "Who the heck is that?" This initial buzz is what builds the awareness you need to eventually drive sales and build your market share from the ground up.

When to Obsess Over Share of Market

Okay, let's flip the script. What if you're an established player, a market leader, or a brand that already owns a comfortable slice of the pie? Your focus needs to pivot to defending and optimizing your Share of Market.

You've already built a solid customer base, so your primary job is to keep them happy and protect your turf. While you can't totally ignore SOV, your main concern is the bottom line. You should be monitoring your sales, revenue, and customer retention like a hawk.

But here’s the twist: while you’re laser-focused on your own SOM, you have to keep a close eye on your competitors' SOV. That next disruptive startup is probably already trying to out-shout you. Tracking their rising SOV is your early warning system, and it’s a critical part of building out your competitive intelligence capabilities.

> If a scrappy competitor's SOV starts climbing fast, that’s a direct threat to your future SOM. It's your signal to either turn up the volume on your own marketing or get ready for a fight.

To figure out where your focus should be, think about your current business situation. This table breaks down a few common scenarios.

Your Strategic Focus: Shifting Your Priority Metric

| Business Scenario | Primary Metric Focus | Why It Matters | | :--- | :--- | :--- | | New Market Entry | SOV | You have zero brand recognition. Your first job is to get on the radar before you can even think about sales. | | Product Launch | SOV | Awareness is everything. You need to build buzz and educate the market about your new offering. | | Market Leader | SOM | Your priority is defending your position. You need to protect revenue, retain customers, and monitor profitability. | | Facing New Competition | Both (SOV as a leading indicator) | An upstart's rising SOV is a red flag. You need to track it to protect your future SOM. | | Entering a Growth Phase | SOV | To accelerate growth, you need to out-shout your market share. This is how you attract new customers and steal share. |

Ultimately, your strategy will dictate which metric you lean on, but you can't afford to ignore either one.

The Balancing Act

The interplay between these two metrics is what really fuels growth. Research has consistently shown that when a brand’s SOV is higher than its SOM—what’s known as the equilibrium level—its market share is very likely to grow.

For example, in the telecommunications industry, a market leader with a 30% market share often needs to maintain a SOV of 35–40% just to keep growing. The game is about constantly pushing your voice just ahead of your market position.

In the end, you need a dashboard that tracks both. One metric tells you what you've already earned, while the other gives you a glimpse into where you're headed. The real skill is knowing which one to steer by at any given moment.

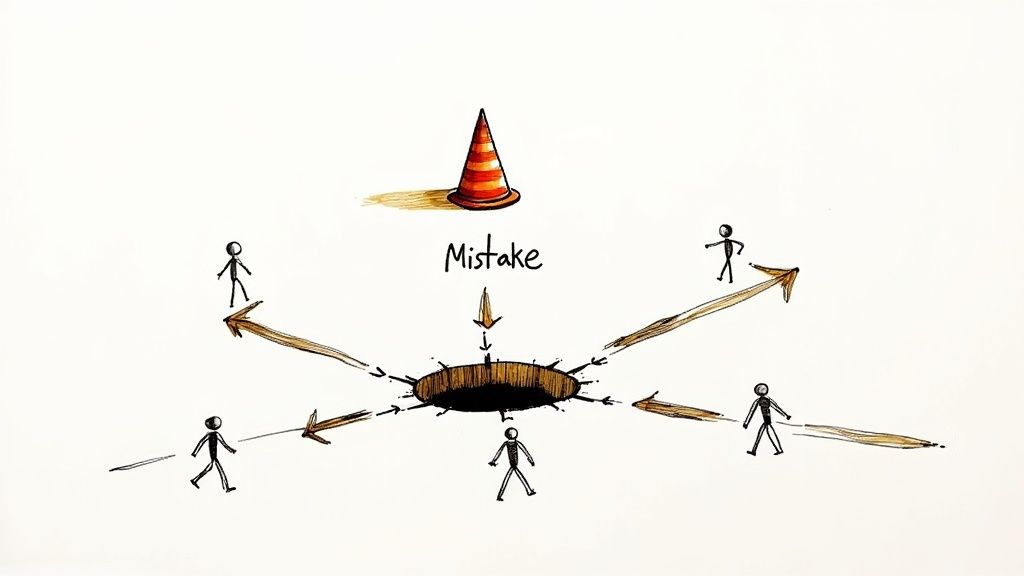

Common Mistakes to Avoid (Please Read This)

Alright, so you're geared up to track your share of voice and share of market. Before you dive headfirst into the data, let’s talk about the common traps people fall into. Consider this a friendly warning to save you a few headaches down the line.

It's surprisingly easy to misinterpret these metrics or use them in ways that send your strategy completely off course. Knowing what not to do is just as valuable as knowing what you should be doing. Let's walk through the big ones.

Only Watching the Big Dogs

One of the most common blunders is tunnel vision—focusing only on your main, direct competitors. You know, the ones you name-drop in every marketing meeting. While it’s smart to keep an eye on the market leaders, completely ignoring the smaller, scrappy up-and-comers is a huge mistake.

These are often the brands making a ton of noise. Their market share might be tiny right now, but a rapidly growing share of voice is a flashing red light signaling they're coming for your customers. They’re usually more agile and can steal the spotlight while you’re busy battling the other giants.

> How to avoid it: Widen your competitive lens. Don't just track the top three players. Identify the loudest new voices in your niche and monitor their SOV. They're your early warning system for future market shifts.

Putting All Your Eggs in One Channel

So, you’re absolutely crushing it on Twitter. Your brand mentions are through the roof, and your SOV looks fantastic. Great! But if you assume that Twitter success reflects the entire market conversation, you’re flying blind.

Your audience might be spending their time on TikTok, industry forums, or Reddit, where a competitor could be quietly dominating. Measuring SOV on just one channel gives you a dangerously incomplete picture. It's like judging an entire movie by watching a single scene.

The Fix:

- Map your channels: Figure out where your audience actually hangs out online.

- Measure broadly: Track your SOV across organic search, social media, paid ads, and relevant online communities.

- Pull it all together: Combine insights from different channels to get a much more accurate view of your overall brand presence.

Confusing a Viral Moment with a Strategy

Your latest meme went viral, and your SOV shot up by 500% overnight. Time to break out the champagne, right? Well, yes and no. A temporary spike in attention is fantastic, but it’s not a sustainable growth strategy.

These viral moments are like fireworks: bright, loud, and over in a flash. Relying on them is a recipe for wildly inconsistent results. Real brand growth comes from a steady, consistent effort to be part of the conversation, not just a one-off hit. It’s the difference between a sugar rush and a nutritious meal.

Panicking Over Every Little Dip

Finally, we have the biggest mistake of all: freaking out over every minor fluctuation in your numbers. Your SOV will dip. A competitor will have a good week. It’s just the nature of the beast. Panicking and making drastic strategy changes based on short-term data is a terrible idea.

Good strategy is a marathon, not a sprint. Look for long-term trends, not daily blips on the radar. A consistent downward trend over a full quarter is a reason to act. A bad Tuesday is just a bad Tuesday. Take a breath. It’s going to be okay.

Building Your Competitive Analysis Plan

Okay, you've got the theory down, you know how to calculate the metrics, and you’ve seen the common pitfalls. So... what now? It's time to put all that knowledge into action.

Let's walk through how to build a simple, sustainable routine for tracking Share of Voice (SOV) and Share of Market (SOM). This isn't about creating some massive, one-off report that will just sit on a server collecting digital dust. It's about building a rhythm.

Start Small and Stay Consistent

The single biggest mistake people make is trying to boil the ocean. Seriously, don't start by tracking twenty competitors across ten different channels. You'll burn out faster than a free trial of a pricey new tool.

Instead, keep it simple:

- Pick Your Nemesis: Start with just 2-3 of your most direct competitors. Maybe it's the established market leader and that scrappy up-and-comer everyone's talking about.

- Choose Your Channels: Zero in on 1-2 channels where the conversation truly matters for your business. If you're a B2B SaaS company, that’s probably organic search and LinkedIn. If you're a D2C brand, it might be TikTok and Instagram.

Once you’ve got your focus dialed in, set a schedule. A monthly check-in is a fantastic starting point. It's often enough to catch emerging trends but not so frequent that you feel like you're drowning in data.

> Remember, the goal here is consistency over intensity. A simple report you actually finish every single month is infinitely more valuable than a complex one you create once and never look at again.

Who Owns This Process?

On a small team, this responsibility probably lands on the founder or the lone marketer's shoulders. As you scale, it’s a smart move to assign clear ownership. Typically, the marketing lead or a dedicated competitive intelligence analyst will be the one gathering and making sense of the data.

Your workflow could look something like this:

- Data Pull (Monthly): The owner uses their tools to pull the latest SOV and SOM data. Sure, massive platforms like Ahrefs or Semrush can do this, but they often come with a hefty price tag. A more focused and affordable tool like already.dev gives you the competitive insights you need without the eye-watering cost.

- Quick Analysis (The "So What?"): Don't just dump raw numbers on the team. The owner's job is to answer the crucial question: "What does this actually mean for us?" For instance, "Competitor X's SOV jumped 15% because they launched a new podcast. Is that a space we should be exploring?"

- Share Findings (Quarterly): Present the most important trends and takeaways to the wider team or key stakeholders. Keep it brief, visual, and focused on things you can actually do. Trust me, nobody wants to sit through a 40-slide deck of charts.

Following a plan like this turns abstract metrics into a powerful compass for making smarter decisions. For a deeper dive into structuring your research, our guide on how to conduct competitive analysis lays out a fantastic framework. The key is to create a simple, repeatable process that provides real, tangible value.

Got Questions? We've Got Answers

Still have a few things rattling around in your head about share of voice and share of market? Let's clear up some of the most common questions we hear.

Can a Brand Have a Huge Share of Voice but a Tiny Share of Market?

You bet. It happens all the time, especially with newcomers.

Imagine a startup drops a brilliant, laugh-out-loud video that goes viral. Their Share of Voice (SOV) could absolutely explode overnight. Suddenly, everyone's talking about them.

But here's the thing: all that chatter doesn't mean cash registers are ringing. Their Share of Market (SOM) could still be hovering near zero because people know them, but they haven't started buying yet. For new brands, a high SOV is often the first step toward building a bigger SOM down the road.

How Often Should I Actually Be Checking These Numbers?

This isn't something you need to obsess over daily. For most businesses, finding a regular, strategic rhythm is key.

- Share of Voice (SOV): A monthly check-in is a great cadence. It’s frequent enough to catch emerging trends and see if your marketing is making waves, but not so often that you get bogged down by meaningless daily blips.

- Share of Market (SOM): This metric is a slow burn. Big market shifts don't happen overnight. Looking at SOM quarterly or even annually usually gives you a much clearer picture, since it reflects longer-term sales performance and strategic growth.

In 2024, Does Share of Voice Even Matter Anymore?

Absolutely. In fact, it might be more important than ever. The world is saturated with content, and SOV is your best signal for whether you're actually breaking through the static.

It’s no longer a simple game of who has the biggest ad spend. Modern SOV is a reflection of your brand's cultural resonance, how visible you are on Google, and whether you're part of the important conversations in your niche. While SOM tells you the story of your past performance, SOV offers a glimpse into your future potential.

Tools like Ahrefs or Semrush are great for tracking this, but they can come with a hefty price tag. A more focused tool like already.dev gives you that crucial competitive visibility without breaking the bank.

Ready to stop guessing and start knowing where you stand against the competition? Already.dev uses AI to deliver comprehensive competitive research reports in minutes, not weeks. Get the data-driven confidence you need to build a smarter strategy. Start your free trial at https://already.dev today.