Understanding Every Type of Competitors You Face

Stop guessing who you're up against. Learn to identify every type of competitors—from direct rivals to silent threats—and use that knowledge to win.

Figuring out your type of competitors seems simple, right? It's just the other guy who sells the exact same thing you do.

Well, not quite. Focusing only on your direct clone is like prepping for a boxing match when you’re actually in a multi-team dodgeball game. Threats can, and will, come from anywhere.

Who Are You Really Competing Against Anyway?

Let's be real, you probably have a mental list of your top rivals. But the competitive landscape is a wild ecosystem, not a clean head-to-head duel. Thinking you only have one type of competitor is a rookie mistake that leaves you wide open to threats you never saw coming.

Imagine you run a local coffee shop. The other cafe across the street? Obvious rival. But what about the Starbucks two blocks away? Or the office vending machine that sells cheap espresso shots? Or even the energy drink aisle at the grocery store? They all solve the same core problem: "I need a caffeine boost, NOW."

This is the key mindset shift. Competition isn't just about who offers a similar product; it's about who is vying for the same customer dollar to solve the same underlying need. To truly understand your market, you need a solid grasp of competitive intelligence.

The Main Flavors of Competition

In most business school textbooks, competitors fall into a few key buckets. You have your direct rivals, who are basically your evil twin. Then there are the folks who solve the same problem with a totally different solution, and even those who offer a substitute that satisfies the same customer itch.

> Think of it this way: your competition isn't just who your customers might choose instead of you, but anything that could prevent them from choosing you in the first place.

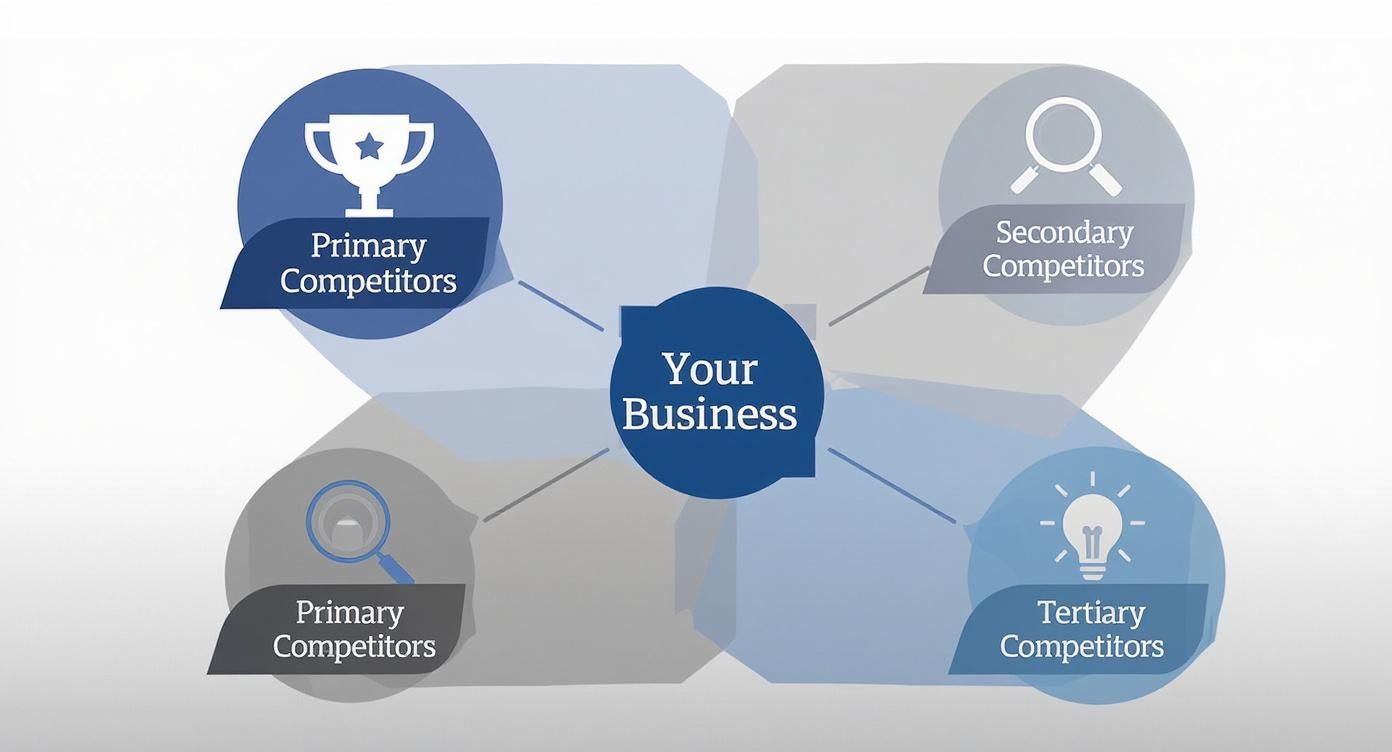

Understanding these different categories is the first step toward building a strategy that doesn't fall apart at the first sign of trouble. According to the smart people who write strategy books, rivals are often classified as primary, secondary, and tertiary, each posing a different level of threat to your business.

Before we dive deep into each specific type, here's a quick cheat sheet to get you started.

Quick Guide to Competitor Types

This table breaks down the main categories so you can quickly get a handle on who's who in your market.

| Competitor Type | What They Are | Coffee Shop Example | | :--- | :--- | :--- | | Direct | Sells a nearly identical product to the same audience. | The other independent coffee shop on your block. | | Indirect | Solves the same core problem with a different solution. | A smoothie bar selling caffeinated green tea smoothies. | | Substitute | Fulfills the same customer need with a different product. | An energy drink or a caffeine pill from the pharmacy. |

Keep these categories in mind as we explore each one in more detail. You’ll be surprised at who you're actually up against.

The 5 Flavors of Competition You Need to Know

Alright, let's get one thing straight. "Competition" isn't some big, scary monolith. It's more like a crowded room filled with different characters. You’ve got your direct rivals, the ones who look and act just like you. Then there are the folks solving the same problem but in a completely different way. And you can't forget the ones lurking by the door, thinking about crashing your party.

To come out on top, you have to know who you're dealing with. So, let’s break down the five main types of competitors you’ll actually run into.

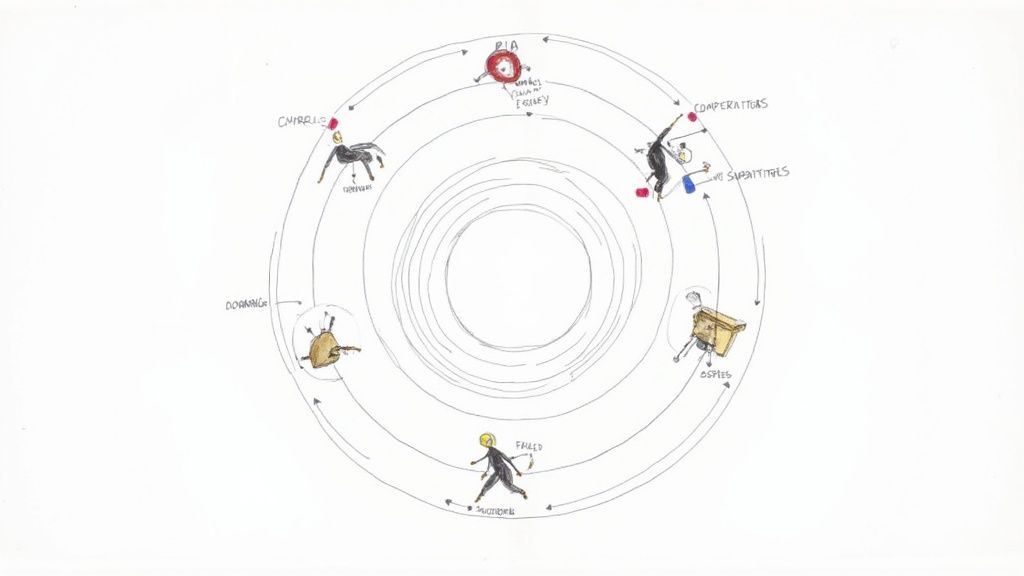

This map gives you a bird's-eye view of how these different players relate to your business, from the most obvious threats to the ones hiding in plain sight.

As you can see, your primary competitors are the ones you'll clash with daily. But the secondary and tertiary ones represent broader threats that you ignore at your own peril.

1. Direct Competitors (The Obvious Rivals)

These are the companies that probably keep you up at night. They're your head-to-head rivals, selling a nearly identical product to the very same audience you are. You’re all tackling the same problem, for the same people, in pretty much the same way.

The classic example? Slack vs. Microsoft Teams. Both are team communication platforms built for businesses. They offer channels, DMs, and integrations. When a company decides it needs a new collaboration tool, you can bet these two are on the final shortlist.

With direct competitors, the fight comes down to features, price, and who has the stronger brand.

2. Indirect Competitors (The Different Solution)

This is where it starts to get more interesting. Indirect competitors are gunning for the same customer, but they're coming at the problem from a totally different angle. They aren’t a carbon copy of your product; they’re a different beast entirely.

Think about a tool like Asana versus a simple Google Sheet. Both can be used to manage a project, right? But Asana gives you a structured, feature-packed environment with Kanban boards and timelines. Google Sheets, on the other hand, is a blank-slate spreadsheet that's flexible and free. Same job to be done (tracking a project), but two wildly different tools for it.

> An indirect competitor is any company whose product can get your customer to the same finish line, even if their vehicle is completely different from yours. Forgetting about them is a rookie mistake.

Keeping an eye on these guys is smart. They often show you how customers are really thinking about their problems, which can spark great ideas for your own product or marketing.

3. Substitute or Tertiary Competitors (The Same Need, Different Product)

Now we’re getting into the sneakiest category. Substitute competitors aren't even in your product space, but they scratch the same fundamental itch for your customer. They’re competing for the same slice of your customer's budget or, just as importantly, their time.

The textbook case is Netflix vs. a board game. One is a digital streaming empire, the other is a box of cardboard. But on a Friday night, they are absolutely competing for your "what should we do for fun?" budget. In fact, Netflix famously said its biggest competitor was sleep. That's the kind of big-picture thinking you need.

This forces you to zoom out. You're not just up against other SaaS tools; you're competing against any alternative that satisfies that core human need. If you want to get organized about this, running a competition matrix analysis can be a huge help in mapping out these different threats.

4. Potential or Emerging Competitors (The Up-and-Comers)

These are the ones that aren't a problem... yet. Potential competitors could be a tiny startup still in stealth mode, a huge company in an adjacent market sniffing around your turf, or even a former partner.

A perfect example is how Uber started with its black car service before launching UberX and becoming a direct, ferocious competitor to Lyft. Before that, Uber was just a potential threat in the mainstream ridesharing game. Another signal to watch for is when a big company acquires a small tool that fits nicely into their existing suite—it's often a dead giveaway they plan to expand.

Tracking these future rivals means keeping your ear to the ground. You have to be watching industry news, funding announcements, and product launches from companies that are one step away from your market.

5. Failed Attempts (The Ghosts of Markets Past)

This is easily the most underrated source of intel out there. Failed attempts are the companies that tried to do what you're doing and, well, failed. They are a free education in what not to do.

Why did they go under? Was their pricing off? Did they pick the wrong customer segment? Was the product a nightmare to use? Picking apart their downfall can save you from making the exact same blunders. Places like Product Hunt, Crunchbase, and even old tech blogs are graveyards full of priceless lessons.

The AI space shows these dynamics playing out on a massive scale. You have giants like IBM, Amazon, Google, and Microsoft as direct competitors, all in a race for AI dominance. At the same time, they're constantly acquiring or watching emerging AI startups (potential competitors) and learning from the many AI ventures that didn't survive (failed attempts).

How to Find Your Competitors in the Wild

Alright, so you’ve met the cast of characters. You know the difference between a direct rival and a sneaky substitute competitor. But knowing the theory is one thing; actually finding these folks out in the wild is a whole different ball game.

Let's skip the generic "just Google it" advice. Finding every single one of your competitors requires a bit of detective work, mixing old-school sleuthing with modern tools. This is your field guide to spotting them before they spot you.

This kind of manual research, sketching out your market, is a great starting point for understanding who you're up against. But to really dig deep, you need to know where to look and what signals to watch for.

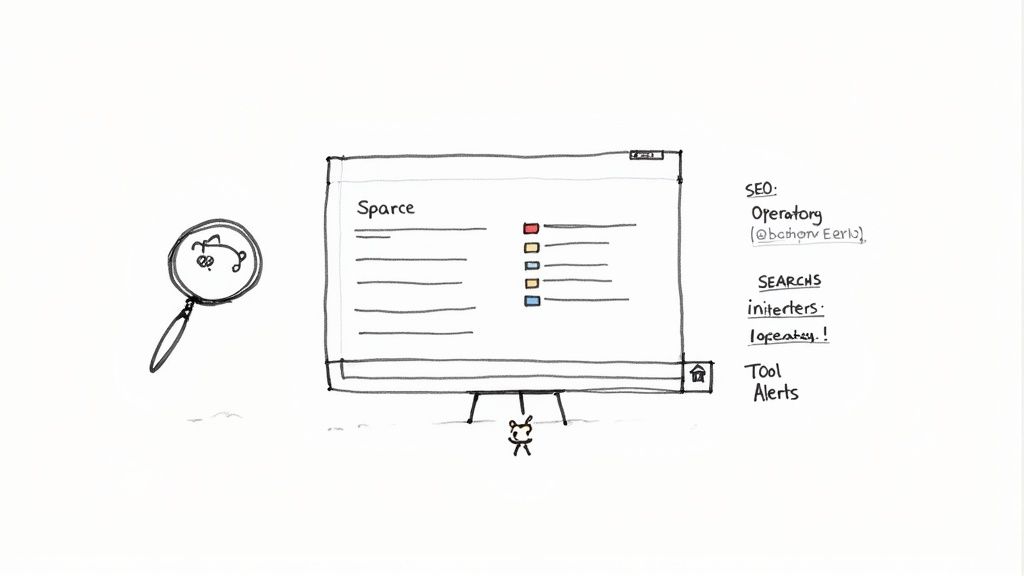

Start With Savvy Google Searches

Google is your best friend here, but only if you know how to talk to it. Instead of just typing in your main keyword, you need to use search operators to dig up hidden gems. Think of them as secret handshakes that tell Google to be more specific.

Try these out:

"your keyword" vs"your keyword" alternativeinurl:blog "your keyword"

These simple commands filter out a ton of noise. The vs and alternative searches show you who your customers are actively comparing, which is pure gold for identifying direct and indirect competitors. The inurl:blog command helps you find companies creating content around your topic—a strong signal they're playing in your space.

Lurk in the Right Online Communities

Your customers don't live on Google's search results page. They hang out in niche communities, asking questions, complaining about problems, and recommending solutions. This is where you’ll find the unvarnished truth about who they really consider your competition.

You need to become a professional lurker in places like:

- Reddit: Subreddits related to your industry (e.g., r/saas, r/ecommerce) are goldmines. Search for threads where people ask for tool recommendations.

- Industry Forums: Every niche has its own forums. Find them and see what products are being discussed.

- Quora and Facebook Groups: People constantly ask for "the best tool for X." The answers will give you a list of every type of competitors your audience is aware of.

> Pay close attention to the language people use. They won't always use your polished marketing terms. They’ll describe their problems in their own words, which can lead you to indirect and substitute competitors you'd never find otherwise.

When looking to identify competitors in specific markets, resources that categorize companies by sector, such as a database of relevant ecommerce SaaS companies, can also be invaluable for this process.

Using Tools to Automate the Hunt

Manual searching is a fantastic start, but let's be honest, it's a massive time sink. Eventually, you’ll want to bring in some bigger guns to do the heavy lifting for you. This is where competitive intelligence tools come in, but they're not all created equal.

You’ve probably heard of the big SEO platforms like Ahrefs or Semrush. They're great for analyzing keyword overlaps and seeing who you're bumping up against in search results. The catch? They can be expensive, often running hundreds or even thousands of dollars a month, which is a tough pill to swallow for most startups. They’re also primarily focused on SEO, which means they might miss competitors who don't rely on content marketing.

This is where a different approach becomes powerful. Instead of just focusing on keyword data, you need a tool that looks at the entire market.

That’s where a tool like Already.dev comes in. It’s built from the ground up to automatically and continuously discover all types of competitors—not just the ones ranking on Google. You can describe your product idea, and it scours hundreds of sources to find direct rivals, indirect threats, and even emerging players you didn't know existed. It’s a more accessible way to get a complete picture without breaking the bank.

To really get a handle on this, think about all the places you can look for clues. The table below breaks down some key channels and what to watch for.

Competitor Discovery Channels and Signals

| Channel | Signal to Watch For | Likely Competitor Type | | ---------------------- | ------------------------------------------------------- | ----------------------------------------------------- | | Google Search | "vs" or "alternative" queries, top rankings for core keywords | Direct, Indirect | | Online Communities | Product recommendations in Reddit/Quora threads | Direct, Substitute | | Product Hunt | New launches in your category or solving a similar problem | Direct, Emerging, Potential | | App Stores | Similar app descriptions, "Customers also bought" sections | Direct, Indirect | | Industry News | Funding announcements, new feature releases, acquisitions | Direct, Potential, Emerging | | Job Boards | Hiring for roles that signal a new product direction | Potential, Emerging |

This kind of multi-channel listening is the difference between checking the weather forecast once a month and getting a real-time alert on your phone when it’s about to rain. One gives you a snapshot; the other gives you a continuous advantage. By combining manual sleuthing with smart automation, you’ll never be caught off guard again.

So You Found Them. Now What?

Okay, you did the detective work. You’ve got a list of competitors longer than your arm—direct ones, indirect ones, and a few weird substitutes you never expected. High five!

Now, promptly ignore most of them.

Seriously. A list of 100 competitors is a recipe for anxiety, not a strategy. A prioritized list of 10? That’s a superpower. The goal isn't to create a phone book of rivals; it's to build a strategic map that tells you where to focus your limited time, energy, and money.

This isn’t just some academic exercise. It’s the difference between fighting every battle on every front and picking the fights you can actually win.

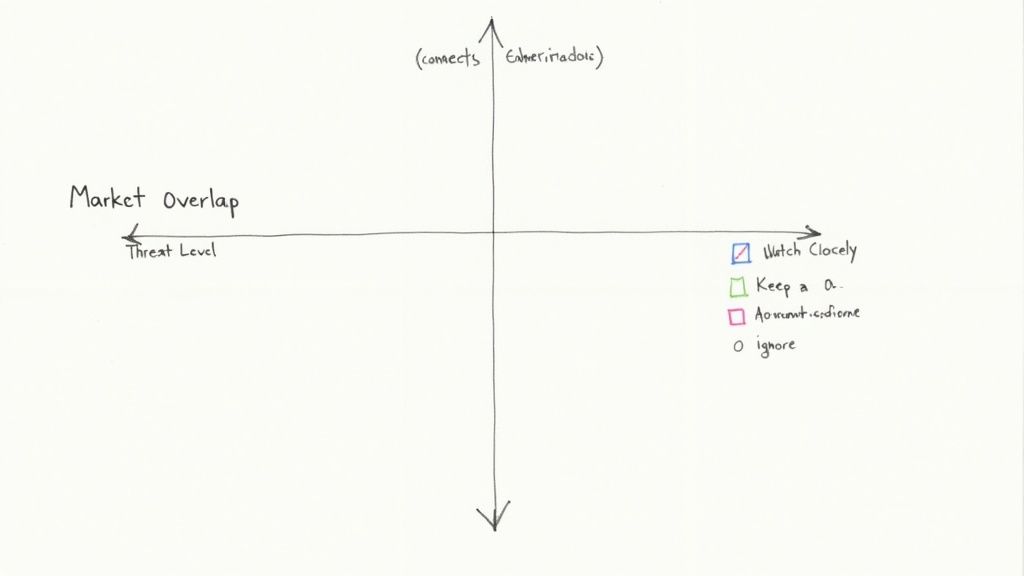

Creating Your Competitor Priority Matrix

Let’s get practical. The easiest way to sort this mess out is with a simple two-axis matrix. Forget complicated frameworks. All you really need are two questions:

- How much do we overlap? (Market Overlap)

- How much can they hurt us? (Threat Level)

Market Overlap is all about the audience. Are they targeting the exact same customers, with the exact same messaging, in the exact same places? Or are they serving a totally different slice of the pie? A high overlap means you're bumping into them constantly in sales calls and search results.

Threat Level is about their solution. How directly does their product solve your customer’s core problem? Is it a perfect 1-to-1 replacement, or is it more of a "good enough in a pinch" alternative? A high threat level means a customer choosing them is a customer you’ve likely lost for good.

Plotting your competitors on this grid is the quickest way to see who really matters.

Tiering Your Competitors

Once you’ve mapped everyone out, they’ll naturally fall into a few simple categories. This is how you decide who gets your attention and who gets gracefully ignored.

-

Tier 1 (Watch Closely): These are the ones in the top-right corner—high overlap, high threat. They're your direct rivals and the most dangerous type of competitors. You need to track their every move: pricing changes, feature launches, and marketing campaigns. This is your core battlefield.

-

Tier 2 (Keep an Eye On): These folks are in the middle. Maybe they have a high overlap but a lower threat (like an indirect competitor), or a high threat but a lower overlap (targeting a different niche). Check in on them quarterly. They could become a major problem later, but they aren't a five-alarm fire today.

-

Tier 3 (Acknowledge and Ignore): This is everyone else. Low overlap, low threat. You know they exist, and that’s about it. Put them on a list, check it once a year, and get back to work. Spending any more time on them is just a distraction.

This kind of ruthless prioritization frees you from the noise. It helps you focus your competitive energy where it will have the biggest impact on your product roadmap and marketing.

> The point of competitive analysis isn't to know everything about everyone. It's to know the right things about the right few, so you can make smarter decisions faster.

The demand for this kind of strategic focus is growing like crazy. The global market for competitor analysis was valued at around $4.32 billion in 2021 and is on track to hit $6.6 billion by 2025. This explosion shows that companies are realizing that raw data isn't enough; they need actionable intelligence to gain a real advantage. You can discover more insights about the competitive intelligence market growth and its key drivers.

Automating Your Competitor Radar with Modern Tools

Let's be real—manually tracking your competitors is a soul-crushing chore. You can spend days building the perfect spreadsheet, but it's already out of date the second you close the tab. It feels like you're trying to bail out a sinking boat with a teaspoon.

"Work smarter, not harder" isn't just a cheesy poster slogan; it's a survival tactic. Automation isn't some luxury reserved for giant corporations anymore. For anyone who wants to stay in the game without burning out, it's an absolute necessity.

Think of it this way: you wouldn't stand outside manually checking the sky for rain every 10 minutes. You’d just set up an alert on your phone. That’s exactly what modern competitive intelligence tools can do for your business.

Why Manual Tracking Is a Losing Game

Trying to keep tabs on every single one of your types of competitors by hand is basically impossible. While you’re busy checking one rival’s blog, another one is launching a game-changing feature that you completely miss. You're always playing catch-up, making decisions based on old news.

This reactive approach always puts you on the back foot. You’re making strategic calls based on a six-month-old report while the market has already moved on. It’s a surefire way to get left behind.

Let the Robots Do the Dirty Work

This is where automation completely flips the script. Modern tools can monitor the entire market for you, 24/7, without ever needing a coffee break. They become your personal radar, constantly scanning the horizon for any signal that matters.

These tools can automatically:

- Flag new entrants the moment they pop up, so an emerging competitor never catches you by surprise.

- Track feature launches from your key rivals, giving you a real-time feed of their product roadmap.

- Analyze shifts in marketing language, showing you exactly how they’re tweaking their positioning to win over customers.

This continuous monitoring means curated, relevant intelligence lands right in your inbox or Slack channel. For a deeper dive, check out our guide on the best competitive intelligence tools to see what’s out there.

Finding the Right Tool for the Job

You’ve probably heard of the big SEO platforms like Ahrefs or Semrush. They’re great for seeing who you’re bumping shoulders with on Google, but they can also be expensive. And honestly, they only show you a small piece of the puzzle.

A more focused approach can save you a ton of time and money. A tool like Already.dev is built specifically for this job. It automates the entire discovery process, finding direct, indirect, and even failed competitors by scanning hundreds of different sources—not just search results. You get the whole story, not just a single chapter.

And for a really granular look at how the market is performing, you can turn to things like app performance leaderboards, especially those that let you zero in on specific metrics like new or low-MRR startups.

> Automation transforms competitor analysis from a dreadful quarterly task into a continuous strategic advantage. You stop reacting to the past and start anticipating the future.

By letting technology handle the grunt work, you free up your brain to focus on what actually matters: building a better product and outsmarting everyone else.

Turning Knowledge Into Action: Your Game Plan

We’ve really dug in deep. You can now spot the difference between a direct competitor breathing down your neck and an indirect one quietly solving the same problem. More importantly, you know where to find them and how to sift through the noise.

But let's be honest, all that knowledge is just trivia if you don't act on it. So, let’s tie it all together. This is your game plan for turning competitive insights into a real strategic advantage, not just another spreadsheet that gets forgotten in a week.

Your Quick-Start Checklist

Jumping into competitive analysis can feel overwhelming, like you have to track every move everyone makes. You don't. Think of it less like a massive one-time project and more like a simple, ongoing habit.

Here’s a ridiculously simple checklist to get the ball rolling today:

- List the Usual Suspects: Grab a coffee and list your top 3-5 direct competitors. You know who they are. No need to overthink this.

- Go Where Your Customers Are: Spend 30 minutes on Reddit, Quora, or a relevant Slack community. Search for the problems you solve. What other tools, apps, or even manual workarounds pop up in the comments? Add those to your list.

- Map It Out: Sketch out that "Market Overlap" vs. "Threat Level" grid we talked about. A napkin or a whiteboard works perfectly. Plot your competitors on it. Seriously, this takes 10 minutes.

- Find Your "Tier 1": Circle the competitors who landed in that scary top-right corner. For now, these are the only ones you need to obsess over.

- Automate One Thing: Pick your biggest threat from that group and set up a Google Alert for their brand name. Done. You've officially started automating your intelligence gathering.

> The goal isn’t to boil the ocean. It's to take small, consistent steps that give you a massive long-term advantage. Competitive awareness isn't a task; it's a mindset that helps you build a smarter, more resilient business.

This whole process is about creating an unfair advantage. It’s about being smart enough to know which fights are worth your time and which ones are just distractions. That way, you can pour all your energy into what actually matters: winning.

Alright, time to get started. Your competitors certainly aren't waiting around.

Got Questions? We've Got Answers.

Still have a few things rattling around in your head? Let's clear up some of the most common questions people ask about digging into their competition.

How Often Should I Actually Do This?

Think of it less like a massive, one-time project and more like a simple, ongoing habit. For your Tier 1 direct competitors—the ones breathing down your neck—a quick check-in weekly or bi-weekly is a smart move.

For everyone else in Tier 2, a quarterly review is usually plenty. The real win comes from consistency, not cramming it all in at once.

What’s the Biggest Mistake I Could Make?

The classic blunder is getting tunnel vision and only focusing on your direct competitors. It’s so easy to obsess over the company that looks and acts just like you.

But the real knockout punches often come from the indirect or substitute competitors you never even saw coming until it was too late.

How Can My Tiny Startup Compete with the Goliaths?

Don't even try to out-feature or out-spend them. That's a game you're destined to lose. Instead, find a way to out-niche them.

Giants have to serve a massive, broad market, which almost always means they're just "okay" for specific groups of people. Find a small, forgotten corner of their customer base and build something that solves their exact problem so well they can't imagine living without it. Be the nimble speedboat that runs circles around their giant, slow-turning battleship.

> Your goal isn't to beat them at their own game. It's to create a whole new game they aren't even equipped to play.

I'm a Complete Beginner. What’s the Very First Step?

Just start. Seriously. Don't get paralyzed by the thought of finding every single competitor on day one.

Give yourself 30 minutes to identify your top three direct rivals. That's it. Then, find a tool to help you automate the rest of the discovery process. Some of the big names like Semrush or Ahrefs can get pricey fast, but alternatives like Already.dev are specifically built to map out your entire competitive landscape quickly, without the hefty enterprise price tag.

Ready to stop guessing and start knowing who you're really up against? Already.dev automates your competitive research, delivering a full market map in minutes, not weeks. Get started for free and uncover your true competitors today.