Master Your Market with Competitive Landscape Analysis

Discover how to perform a competitive landscape analysis to uncover opportunities and outperform rivals. Learn step-by-step strategies today.

Let's cut the corporate jargon. A competitive landscape analysis is basically legal business spying. Think of it like a football coach watching game tapes of every other team in the league. You're not just looking at their star quarterback; you're studying their entire playbook, from their trickiest offensive plays (marketing campaigns) to their leaky defense (bad customer reviews).

What This Spying Is Really About

A competitive landscape analysis is your treasure map. It shows you who you're up against, what they’re doing right, where they're totally dropping the ball, and where the hidden gold is buried. It’s not about mindlessly copying your rivals. It’s about being smarter, faster, and way more strategic.

This process is the secret sauce for any smart business strategy, helping you avoid those "oh crap" moments. Instead of reacting when a competitor drops a surprise product, you'll see the signs months ahead, giving you time to cook up your own counter-move. It’s the difference between driving with GPS and driving with a blindfold on.

Why Every Business Needs This

Ignoring your competition is like assuming you're the only car on the highway—a monumentally bad idea. Every business, from a two-person startup in a garage to a Fortune 500 giant, needs to keep an eye on the playing field. Here’s a quick rundown of what this actually does for you:

- Spot Hidden Threats: You’ll see new companies creeping into your space before they start poaching your customers.

- Find Market Gaps: You'll discover what customers desperately need but your competitors are completely ignoring.

- Sharpen Your Strategy: It helps you figure out what makes you different and better, so your marketing actually sounds like a human talking to another human.

- Make Smarter Bets: Your leadership team gets real data to make informed choices, not just wild guesses.

This whole process is a huge part of competitive intelligence, which is the ongoing work of gathering and analyzing info about your market. You can learn more about the bigger picture in our guide on what competitive intelligence is. It shows how this analysis fits into your grand plan.

It's More Than Just a List of Competitors

A classic rookie mistake is thinking this is just about listing companies that do what you do. Nope. A real competitive landscape analysis digs into their entire business. This kind of deep dive is a key part of broader market evaluations, often used in serious stuff like fundamental analysis.

The world is also changing, fast. Power is shifting, and new markets are emerging. This isn't just boring economic news; it’s changing the rules of the game for everyone. You can get a peek into these massive global shifts in the DNI's official report. This wider view ensures you're not just worried about the guy down the street but also the global trends that could make or break you.

> The big reason for doing this is to help our leaders make good decisions. This isn’t just about a strengths and weaknesses list – it’s about making sure we don’t get blindsided by some new threat we never saw coming.

Ultimately, this analysis gives you the guts to make bold moves, pivot when you have to, and build a business that can take a punch. It's not a one-off project; it's a workout that keeps your business lean and mean.

Why You Absolutely Can't Afford to Ignore Your Competitors

Thinking your idea is so revolutionary that you have zero competitors is the fastest way to become a business school case study on failure. Spoiler alert: you always have competitors. Even if no one sells your exact widget, your customers are solving their problem somehow right now—and that's your real competition.

Thinking your idea is so revolutionary that you have zero competitors is the fastest way to become a business school case study on failure. Spoiler alert: you always have competitors. Even if no one sells your exact widget, your customers are solving their problem somehow right now—and that's your real competition.

Ignoring the other players is like trying to merge onto the freeway with your eyes closed. You might get lucky for a second, but a fiery crash is inevitable. A solid competitive landscape analysis is your secret weapon for navigating the market without getting flattened.

It's not just about dodging disaster; it's about carving out your own path to glory.

Find and Own the Gaps in the Market

Your competitors, bless their hearts, are not perfect. They have weaknesses, blind spots, and entire groups of customers they're accidentally ignoring. A good analysis shines a giant spotlight on these gaps.

Maybe their pricing is a confusing nightmare for small businesses. Perhaps their customer support is famous for putting people on hold for eternity. Maybe they’re all chasing giant corporate whales, leaving a massive, untapped ocean of mid-sized companies totally alone. These gaps are goldmines.

When you figure out what your competitors aren't doing well, you can swoop in and be the hero. You stop being "just another option" and become the obvious answer to a problem everyone else is overlooking.

Refine Your Strategy and Messaging

Without a clue what your rivals are up to, you're just shouting into the void. How do you know if your pricing is competitive or if you're leaving a pile of money on the table? How do you write a marketing message that stands out if you don't even know what you're competing against?

A deep dive into the competitive landscape gives you the cheat codes.

- Price with Confidence: You can see where you fit. Are you the fancy premium choice, the scrappy budget option, or somewhere in between? Then you can price accordingly.

- Craft a Unique Voice: By seeing how your competitors talk, you can find a completely different—and better—way to talk to your customers. This is also where you can figure out how to calculate your share of voice to see how much noise they’re making.

- Innovate Smarter: You can spot the missing features in their products and build what customers actually want, instead of just guessing.

This whole process turns your strategy from a shot in the dark into a series of laser-guided missiles.

> A competitive landscape analysis isn't about copying everyone else. It's about understanding the game so well that you can change the rules. It gives you the power to be different on purpose.

Survive in a Cutthroat Environment

The business world isn't a friendly potluck; it's a battlefield where companies are constantly fighting for territory. Big corporations are always hunting for smaller companies to buy just to get an edge.

In fact, over the last decade, giant mergers and acquisitions have redrawn the map for entire industries. Deals over $1 billion jumped by 19%, and those over $5 billion shot up by 16%. This just shows how aggressively companies are moving. You can see more of these deal trends on PwC.com.

And this isn't just a "big company" problem. A well-funded startup can pop up overnight and completely flip the script. Ignoring this is how you get blindsided. Continuous analysis is your early-warning system—it gives you time to adapt and defend your turf before it's too late.

How to Analyze Your Competitors Step by Step

Alright, let's get our hands dirty. Enough with the theory—this is where we actually start digging. Think of this as your simple, no-fluff playbook for doing your own competitive landscape analysis. We’re going to make this easy, actionable, and focused on what really matters.

The goal isn't to create a 100-page report that collects dust. It's about finding those golden nuggets of info that help you make smarter moves. Let's start with figuring out who you're even fighting.

Step 1 Identify Your Real Competitors

First thing's first: who are you actually competing with? This sounds simple, but it’s trickier than you'd think. Your competition comes in a few flavors, and you need to watch them all.

- Direct Competitors: These are the obvious ones who sell a similar thing to the same people. If you sell project management software, so do they.

- Indirect Competitors: These guys solve the same problem but with a different tool. For that project management software, an indirect competitor could be a simple spreadsheet or even a bunch of sticky notes. Don't laugh; sometimes the "good enough" solution is your biggest enemy.

- Emerging Competitors: These are the new kids on the block who could become direct competitors tomorrow. They might be small now, but they could be building the next big thing in their basement.

So, how do you find them? Ask your sales team who they keep hearing about from customers. Then, do some good old-fashioned Googling using the exact words your customers would use to find you.

Step 2 Gather the Essential Data

Once you have your list, it's time to put on your detective hat. You need to gather intel on a few key areas to get the full picture. You don't need a massive budget for this; a ton of great info is just sitting out in the open.

Here's what to look for:

- Products and Services: What do they actually sell? Check out their features, watch their demos, and read their case studies to understand what makes their product tick.

- Pricing and Business Model: How do they make money? Is it a subscription? A one-time fee? Figure out their pricing tiers and what you get for your money.

- Marketing and SEO Strategy: How do they get customers? Look at their blog, social media, and what keywords they rank for. This tells you who they're trying to reach and how.

- Customer Reviews and Reputation: What are real people saying? Scour sites like G2, Capterra, and even Reddit to find honest, unfiltered feedback—the good, the bad, and the ugly. This is where you find their biggest weaknesses.

> The most valuable insights often come from what your competitors' customers are complaining about. Every one-star review is a business opportunity waiting to happen.

Step 3 Use the Right Tools for the Job

Gathering all this data by hand can be a real pain. Luckily, there are tools that can speed things up.

Your Competitive Analysis Toolkit

Some of the big-name tools for this stuff are super powerful, but they can be ridiculously expensive. The good news is you don't have to sell a kidney to get good data. This table breaks down your options.

| Tool Category | Examples (Expensive!) | Great Alternative | What It Helps You Analyze | | :--- | :--- | :--- | :--- | | SEO & Content | Ahrefs, Semrush | already.dev | Keywords, backlinks, top-performing content, organic traffic | | Social Media | Brandwatch | Hootsuite | Audience engagement, brand mentions, content strategy | | Customer Reviews | Trustpilot (Enterprise) | G2, Capterra, Reddit | Strengths, weaknesses, common complaints, feature requests |

For digging into SEO and finding out who's winning the keyword wars, a tool like already.dev is a fantastic alternative. It's built to give you the competitive dirt you need without the eye-watering price tag of the big guys.

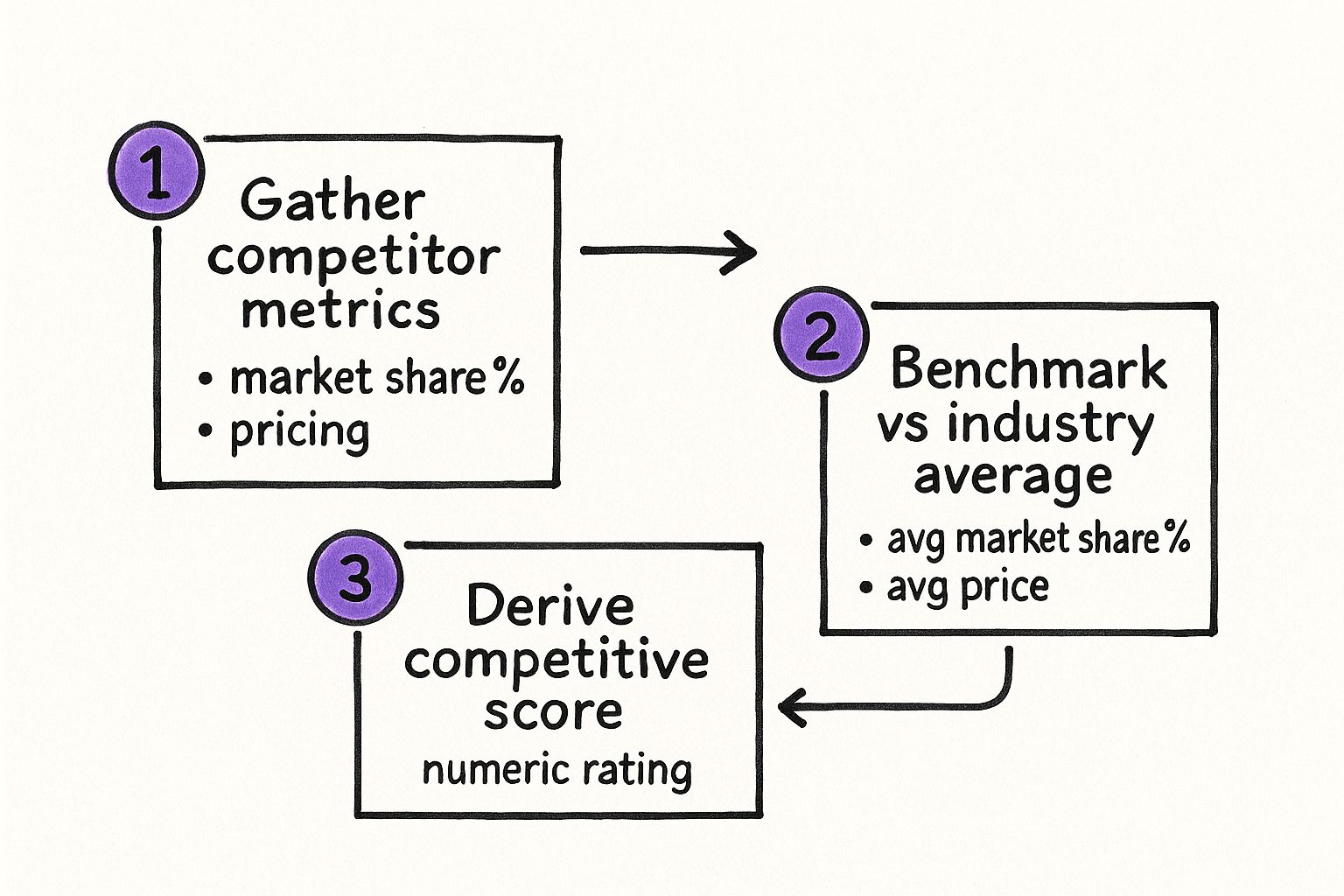

This infographic shows a simple way to process the data you gather, turning raw numbers into a clear competitive score.

This process helps you standardize your findings, making it easy to see where each competitor stands.

Step 4 Organize Your Findings

Now you have a pile of data. To make it useful, you need to organize it. A simple spreadsheet is your best friend. Create columns for each competitor and rows for each thing you're tracking (features, price, top keywords, customer complaints, etc.).

This isn't just boring data entry; it’s about creating a single command center. It lets you see everything at a glance and start spotting patterns. For a head start, you can grab our free competitive analysis template to see how to structure your data.

With everything laid out, you can start to see the opportunities. Maybe every single competitor is ignoring a key feature, or their pricing is too confusing for normal humans. This step turns messy research into a clear map for your next move.

Turning Competitor Data Into Winning Insights

Okay, you did it. You’ve gathered a mountain of data. Your spreadsheet is a work of art. Now what? Raw information is as useless as a screen door on a submarine. It’s time to turn that data into a winning game plan.

This is the fun part—where you connect the dots and find the story hidden in the numbers. It’s less about complex formulas and more about asking smart questions. You need to transform that messy spreadsheet into a clear action plan that gives you a real edge.

Frameworks are handy here. And no, these aren't just boring business school exercises; they’re simple tools to help you organize your thoughts and spot things you would have missed.

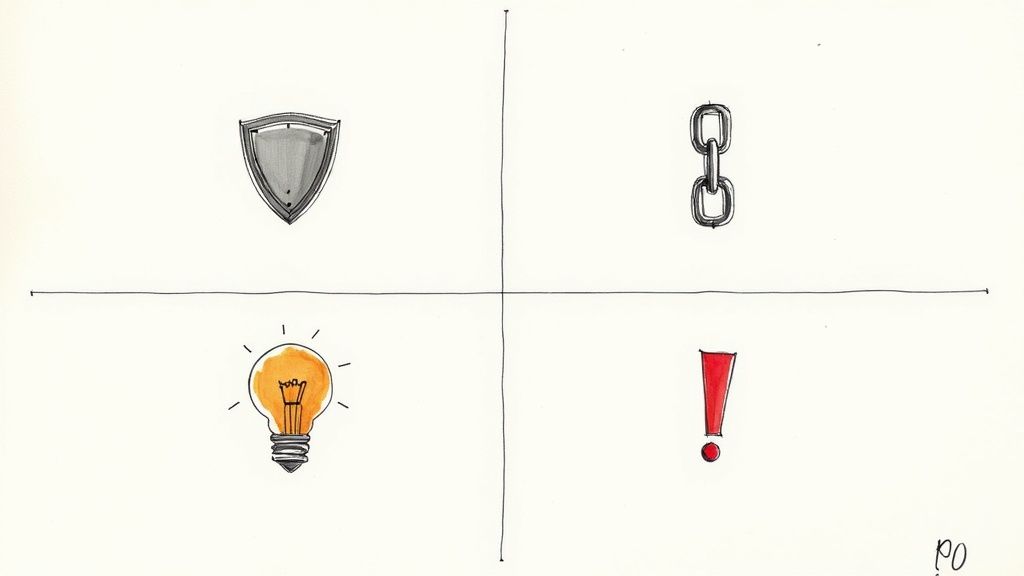

Using SWOT to Make Sense of the Chaos

One of the oldest and simplest tools is the SWOT analysis. It stands for Strengths, Weaknesses, Opportunities, and Threats. Think of it as four buckets to sort your findings into. It’s a beautifully simple way to cut through the noise.

Let’s break down what you’re looking for:

- Strengths (Your Company): Where are you clearly better than everyone else? Be specific. Maybe your customer support is legendary, or your product has one killer feature they can't touch.

- Weaknesses (Your Company): Time for some brutal honesty. Where are you getting clobbered? Is your pricing too high? Does your website look like it was designed in 1999?

- Opportunities (The Market): These are the golden nuggets you’ve been digging for. What market gaps did you find? Is there a type of customer everyone is ignoring? This is where your competitors’ weaknesses become your playground.

- Threats (The Market): What’s lurking around the corner that could ruin your day? A new competitor with a ton of funding? A new technology that could make you obsolete?

The real magic of SWOT isn't just filling out the boxes. It's about seeing the connections. How can you use your strengths to jump on an opportunity? How can you fix a weakness to defend against a threat?

Asking the Right Questions

Once your data is organized, you can start asking the kind of questions that lead to breakthroughs. Your analysis should give you clear answers to these.

Don’t just glance at the data; put it on trial.

- Where are they crushing it? Figure out what your competitors are amazing at. Is their blog bringing in tons of traffic? Is their Instagram game on point? Don’t just get jealous—figure out why it’s working.

- Where are they dropping the ball? Look for the one-star reviews and angry Reddit threads. What are their customers always complaining about? Every public complaint is a roadmap for how you can be better.

- What’s their game plan? Are they trying to be the cheapest? The most exclusive? The best for a specific niche? Understanding their strategy helps you define yours.

- Where is the empty space? Look at the market as a whole. Is everyone fighting over the same big clients while ignoring small businesses? That empty space is your chance to build an empire.

> The goal isn’t to create a perfect report. The goal is to find one or two brilliant ideas that you can act on immediately. A single, actionable idea is worth more than a hundred pages of useless data.

Spotting Patterns and Finding Gold

As you sift through everything, patterns will start to pop out. Maybe you’ll notice that all your top competitors are terrible at onboarding new customers. Or perhaps none of them offer a specific integration that people are begging for online.

These patterns are where the real value is. You might discover a competitor just got a huge round of funding, which means a big marketing push is coming. Or you might find another rival has a high rate of employee turnover, which could point to internal problems.

To make this even more powerful, you’ll need the right tools. While big platforms like Ahrefs or Semrush can do this, they often come with a painful price tag. For teams that need focused competitive insights without the enterprise cost, a tool like already.dev is a fantastic alternative for keeping a constant pulse on the market.

Ultimately, turning data into insights is about shifting from "what are they doing?" to "so what?" Every piece of competitor data is a clue. Your job is to follow those clues to find your next winning move.

Putting Your Analysis Into Action

So, you've done the hard work. You've got a spreadsheet full of juicy competitor data, and your SWOT analysis is a thing of beauty. But let's be real—an analysis that just sits in a folder is a complete waste of time. It’s like buying all the ingredients for a gourmet meal and then ordering a pizza.

So, you've done the hard work. You've got a spreadsheet full of juicy competitor data, and your SWOT analysis is a thing of beauty. But let's be real—an analysis that just sits in a folder is a complete waste of time. It’s like buying all the ingredients for a gourmet meal and then ordering a pizza.

Now comes the fun part: turning all that knowledge into actual results. This is where you use your insights to make specific, strategic changes that will actually grow your business. It's time to stop watching the game tapes and start calling your own winning plays.

From Insights to Action Items

The goal here isn't to freak out and react to every little thing your competitors do. That’s how you end up running around like a headless chicken. Instead, you want to pick a few key areas where you can make a huge impact based on what you’ve learned.

Think of it this way: your competitive landscape analysis didn't just give you a pile of data; it gave you a treasure map. Now you just have to follow it.

Here are a few ways to turn findings into action:

-

You find a product gap: You discover your biggest rival's customers are constantly complaining online about a missing feature.

- Your Action: You immediately push "build that exact feature" to the top of your product roadmap. You can even use their customers' own words in your marketing to show you listened.

-

You spot pricing confusion: Your analysis shows a competitor's pricing is ridiculously complicated, and people are getting frustrated.

- Your Action: You make your own pricing page the simplest and clearest in the entire industry. "No-nonsense pricing" becomes a huge selling point.

-

You uncover terrible support: You find a Reddit thread a mile long about how awful another company's customer service is.

- Your Action: You invest in your support team and make "Legendary Support" a core part of your brand. Then you plaster amazing customer testimonials all over your homepage.

Building Your Strategic Action Plan

Don't let these brilliant ideas disappear. You need a simple action plan to hold your team accountable. This doesn't need to be some 50-page corporate document; a simple list or project board works fine.

For each opportunity you've identified, write down:

- The Insight: A one-sentence summary. (e.g., "Competitor X doesn't integrate with popular accounting software.")

- The Action: What are you going to do? (e.g., "Build an integration with QuickBooks and Xero.")

- The Owner: Who on your team is in charge? (e.g., "Sarah, Head of Product.")

- The Deadline: When will it be done? (e.g., "End of Q3.")

- The Goal: How will you know if it worked? (e.g., "Reduce churn by 5% by making accounting easier.")

Once your analysis is done, you can use these insights to sharpen your business development best practices and get the whole team rowing in the same direction.

> Your analysis isn't a history report; it's a launchpad. The value comes from what you do with the information, not from the information itself.

Continuously Innovate and Differentiate

This whole process isn't about copying your rivals. It's about learning from their playbook to build something way better and different. After all, innovation is one of the most powerful forces in business. By 2025, the number of annual patent applications worldwide hit 3.5 million—a clear sign of the intense global race to be first.

Your competitive landscape analysis gives you the clues you need to innovate in the right direction. It ensures you’re not just building features for the sake of it, but creating real value that solves a proven weakness in the market.

Remember, your competitors aren’t standing still, so neither can you. This is a living process that keeps your business sharp, relevant, and always one step ahead.

Got Questions About Competitive Analysis?

You're not alone. When you start digging into this stuff, a lot of questions pop up. Let's tackle some of the most common ones.

Think of it like this: getting to know your competition is like dating. You wouldn't stop learning about your partner after a year, right? It's a continuous effort, and the same goes for keeping tabs on your rivals.

How Often Should I Do a Competitive Analysis?

This is definitely not a "one and done" task. The market is always moving. A good rule of thumb is to do a major deep-dive once a year, with lighter check-ins every quarter.

For those quarterly updates, you don't have to start from scratch. Just focus on things that change fast:

- Any new marketing campaigns?

- Any sudden price changes?

- Did they just roll out a new feature?

If you're in a super fast-paced industry like e-commerce or tech, you might even want weekly alerts. The goal is to build a rhythm so you're never surprised. You want to see the storm clouds long before the hurricane hits.

What's the Biggest Mistake to Avoid?

The single biggest screw-up is "analysis paralysis." This is when you get so bogged down in collecting data that you never actually do anything with it. You end up with a monstrous report that no one on your team even wants to open.

> The goal isn't to know everything. It's to find a few key, actionable insights you can use to make your own business better. A single smart move is worth more than a hundred pages of data nobody reads.

A close second is the urge to just copy what your competitors are doing. The point of a competitive landscape analysis is to figure out how to be different and better—not to become a cheap knockoff of the market leader.

Can I Really Do This on a Small Budget?

Absolutely. You don't need a huge budget to get amazing insights. A shocking amount of the best information is just sitting out there for free if you know where to look.

You can learn a ton just by:

- Reading customer reviews on sites like G2 or Capterra.

- Following your competitors' social media accounts.

- Subscribing to their email newsletters.

When you're ready for more technical data on things like SEO, the big tools like Ahrefs or Semrush are powerful, but they can be painfully expensive. Fortunately, you don't need them to get started. You can use focused alternatives like already.dev to get the competitive data you need without that eye-watering price tag. A small business can win by being scrappy and smart, not by outspending everyone.

Is This the Same Thing as Market Research?

They're related, but not the same. Think of it like this: market research is the wide-angle shot of the entire landscape, while competitor analysis is the close-up of the other players.

Market research looks at the whole market—its size, customer demographics, and big trends. It answers questions like, "How big is the market for project management software?"

A competitive landscape analysis zooms in on the specific players. It answers, "Who are the top five project management tools, what do they charge, and what are their customers complaining about?" You need both to build a winning strategy.

Ready to stop guessing and start knowing exactly who you're up against? Already.dev uses AI to do the heavy lifting, delivering a comprehensive competitive landscape analysis in minutes, not weeks. Uncover every rival, analyze their strategies, and find your unique path to victory. Start your free trial and turn your blind spots into your biggest advantages.