Nail Your Competitive Market position

Stop guessing and start winning. Learn how to define your competitive market position with practical frameworks and real-world examples that work.

Let's skip the MBA jargon. Your competitive market position is just the answer to one simple question: Why should a customer pick you over everyone else?

It’s about carving out a memorable spot in your customer's mind. The goal is that when they have a problem you can solve, your brand is the first one that pops into their head. Simple as that.

What Is A Competitive Market Position Anyway?

Picture a neighborhood with a dozen pizza places. Every corner is slinging pepperoni and cheese. If you open another pizza joint claiming you have "better" sauce, you're in for a rough time. You’re just another voice in a very loud, greasy room.

But what if you rolled up with the only taco truck in that entire neighborhood? Suddenly, you're not just another option—you're the only option for something different. You’ve just found a competitive market position. You're not battling the pizza places on who has the best crust; you're the undisputed taco king.

That’s the essence of it. A strong position isn't about trying to be perfect for everyone. It’s about being the absolute perfect choice for a specific group of people with a specific need.

Why Being Different Beats Being Better

Trying to be "better" is a trap. It almost always leads to a race to the bottom. Your competitors add a new widget, so you rush to copy it. They slash their prices, so you feel pressured to slash yours. It's an exhausting, profit-killing game you can't win.

Being different, on the other hand, lets you change the rules of the game entirely. You step outside of that direct, feature-for-feature deathmatch. When you have a clear and distinct position, everything else gets easier.

- Your marketing gets way easier: You know exactly who you’re talking to and what to say. No more shouting into the void and hoping someone listens.

- Your sales process becomes smoother: Potential customers show up already knowing why you're the right choice because your value is obvious.

- Your product development stays focused: You stop trying to build everything for everyone. Instead, you build exactly what your target audience actually wants.

> In essence, your position is your story. It’s the answer to "What do you do?" that makes people lean in and say, "Tell me more," instead of just nodding politely and backing away slowly.

Before you can pick your spot, you have to know who's already on the field. This is where you start spying on your rivals. You can get a much deeper look into this process by understanding what is competitive intelligence and how it informs your entire strategy.

The whole point is to find that "taco truck in a pizza neighborhood" opportunity for your own business.

Finding Your Place In The Market

Alright, enough theory. Time to roll up our sleeves and map out the battlefield. Figuring out your competitive market position isn’t some mystical art form; it’s just good old-fashioned detective work. And luckily, there are some classic, no-nonsense frameworks to guide you, no marketing degree required.

Think of it this way: you wouldn't build a house without a blueprint, right? These frameworks are your blueprints for figuring out where to build your business so a competitor doesn't immediately bulldoze it. They turn all that abstract market chatter into something you can actually use.

This diagram is a great way to visualize how your business fits into the bigger picture—it's right at the intersection of what your customers need, what your competitors are doing, and what makes you, you.

Your sweet spot, that perfect market position, lives where these three circles overlap. It's the space where you solve a customer's problem in a way that your competitors can't (or just don't).

Your Detective Toolkit: Frameworks That Actually Work

Let's dive into a few of the greatest hits. These aren't just for stuffy corporate PowerPoints; they are genuinely useful tools for any startup trying to get a foothold.

First, a quick overview to help you pick the right tool for the job.

Quick Competitive Framework Comparison

| Framework | What It Does | Best For | | :--- | :--- | :--- | | SWOT Analysis | Lists internal Strengths/Weaknesses and external Opportunities/Threats. | Getting a quick, brutally honest snapshot of your current situation. | | Positioning Maps | Visually plots you and your competitors based on two key things (e.g., price, quality). | Finding uncontested "blue ocean" space in the market. | | Competitive Grids | Compares features, pricing, and who you sell to side-by-side in a spreadsheet. | Spotting specific feature gaps or pricing advantages. | | TAM, SAM, SOM | Defines the total market size, the slice you can serve, and what you can realistically capture. | Making sure your market is big enough to be worth the trouble. |

Each of these frameworks gives you a different lens to look through. Let's break down how to use them without putting ourselves to sleep.

A Closer Look At The Frameworks

-

SWOT Analysis (The Brutally Honest Version): You've probably seen this one: Strengths, Weaknesses, Opportunities, and Threats. The trick is to be mercilessly honest. A "strength" isn't "we have a great team." It's "our proprietary algorithm cuts data processing time by 50%." A "weakness" isn't "we could work harder." It's "our entire business relies on a single developer who has a passion for skydiving." Get specific. Get real.

-

Positioning Maps: This is where things get visual. Just draw a simple X-Y graph. Label the axes with two attributes your customers genuinely care about—like Price (Low to High) and Quality (Basic to Premium). Now, start plotting where your competitors fall on the map. The empty spaces are your potential gold mines. Are all your rivals clustered in the "High Price, High Quality" corner? Maybe there’s a massive opening for a "Low Price, Good-Enough Quality" hero.

-

Competitive Landscape Grids: Think of this as your personal scorecard for the industry. Open up a spreadsheet. List your top competitors down the first column. Across the top row, list out the things that matter: key features, pricing tiers, target customers, etc. Now, fill it in. Who's targeting enterprise clients? Who's the cheapest? Who has that one killer feature everyone talks about? This simple grid makes gaps in the market practically jump off the page.

> A strong competitive position isn’t just about having one advantage. It’s built on multiple things, like being efficient, having solid tech, and not falling over when things get bumpy. This is true for massive economies and for tiny startups.

This idea is mirrored in global analyses like the IMD World Competitiveness Ranking, which shows top countries succeed by excelling in multiple areas, not just one. You can see how national competitiveness is measured and apply that same multi-faceted thinking to your business.

Sizing Up The Playground: TAM, SAM, SOM

Finally, we have the alphabet soup of TAM, SAM, and SOM. It sounds way more complicated than it is. It's really just a way to figure out if you're fishing in a tiny puddle or a vast ocean.

- Total Addressable Market (TAM): The biggest-possible-dream market. Example: The global market for coffee.

- Serviceable Available Market (SAM): The piece of that pie you can realistically reach. Example: The market for specialty espresso pods in North America.

- Serviceable Obtainable Market (SOM): The slice of that piece you can realistically capture in the next few years. Example: 5% of the specialty espresso pod market in major U.S. cities.

This simple exercise keeps you grounded. It stops you from chasing a market that’s too small to sustain a business or one that's so massive you'll get crushed. To do this right, you first need a crystal-clear picture of your ideal buyer. If you're struggling with that, our guide on how to identify your target customers is a great place to start.

While you can definitely gather all this data manually, competitive intelligence tools can save you a ton of time. Powerhouses like Ahrefs and Semrush are fantastic but can be super expensive. For a more startup-friendly approach, a platform like Already.dev can automate a lot of this research, helping you build out your competitive grids and maps without the sticker shock.

Are You a Big Fish or Just Bait?

Alright, you've got the frameworks and maps. Now comes the hard part: honest self-reflection. Is your competitive market position actually strong, or are you just another face in a massive crowd?

It’s time for a gut check to figure out if you're the big fish in a small pond or just bait waiting for a bigger predator to swim by. This isn't about complex metrics. It's about asking some brutally honest questions. And don't just think about them—write the answers down.

The 30-Second Challenge

Imagine a new customer lands on your website. After 30 seconds, can they explain what you do in one simple sentence? If the answer is no, you’ve got a positioning problem.

A weak position is fuzzy and complicated. It forces potential customers to do mental gymnastics just to figure you out. A strong position? It's instantly graspable. It’s clear, concise, and sticks in their brain. If you find yourself using a lot of "ands" and "alsos" to describe your business ("we do this, and also that, and sometimes this other thing..."), you're likely all over the place.

> “Building a strong brand helps companies avoid commoditization. It requires close attention to managing consumer relationships and investing continuously to expand and deepen brand awareness and brand knowledge.”

This clarity is critical. When customers are confused, they default to the easiest comparison point they have: price. And that leads us to the next uncomfortable question.

Are You Just the Cheap Option?

Is the main reason customers choose you because you're cheaper? Let’s be blunt: competing on price is a dangerous, soul-crushing race to the bottom.

There will always be someone willing to do it for less, even if it means running their business into the ground. If your only advantage is your price tag, you don't have a competitive market position; you have a temporary discount.

A strong position gives customers a reason to pay what you're asking—and maybe even a premium—because they believe they can't get what you offer anywhere else. It’s not about being the cheapest; it's about being the only one who does what you do.

The Liquid Death Litmus Test

Need an example? Look no further than the masterclass in being different: Liquid Death. In a world saturated with bottled water brands all chirping about pristine mountain springs, they did something completely different.

They sell water. In a tallboy beer can. With a heavy metal aesthetic and the tagline "Murder Your Thirst." It's absurd, hilarious, and utterly unforgettable.

Liquid Death didn't try to make "better" water. They created a different experience around it. They went after a completely different audience—people who hate corporate marketing, love punk rock, and want something that looks cool in their hand.

They built a brand so distinct that people proudly share it on social media. That's a powerful position. They aren't just selling water; they're selling an identity. This is a perfect example of how to make your share of market vs share of voice punch way above its weight by simply being weird and memorable.

So, ask yourself: what’s your Liquid Death angle? What can you do that is so uniquely you that comparing you to the competition feels completely pointless?

That's the question that will lead you from being bait to becoming the biggest fish in your pond.

Automating Your Competitive Research

Trying to manually keep tabs on every competitor is a recipe for burnout. It’s like trying to bail out a sinking boat with a teacup—a massive, soul-crushing time-suck. You can burn weeks digging through websites, social media, and news articles, only for your data to be stale the second you finish. There's a better way.

It’s time to hand off the grunt work to technology so you can focus on what actually matters: strategy. Competitive intelligence tools are built to do the heavy lifting, acting like a team of spies who work around the clock to bring you the intel you need.

Choosing Your Automation Tools

When you hear "competitive intelligence," you might think of the big, powerful platforms like Ahrefs or Semrush. They're fantastic, offering a ton of data on everything from SEO to ad spend. But let's be honest—they can also be eye-wateringly expensive, especially for a lean startup.

Thankfully, you don't have to break the bank. A tool like Already.dev is designed specifically for this, offering continuous monitoring without the enterprise-level price tag. The point is to build a system that automatically pipes crucial insights straight to you, freeing you up to think, plan, and execute.

> The real power of automation isn’t just about saving time—it’s about consistency. An automated system catches the subtle shifts you’d miss, like a small price change, a new feature announcement, or a tweak in messaging. These are often the first signs of a bigger strategic pivot.

It’s these automated insights that help you defend and strengthen your competitive market position over the long haul.

A Simple Workflow That Works

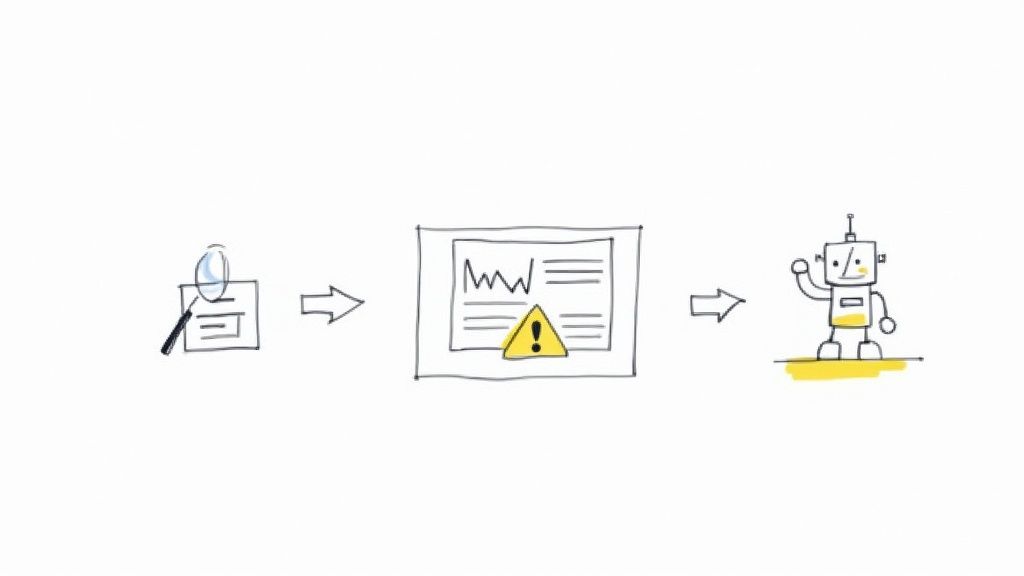

You don't need a complex setup to get started. At its core, you’re just telling a tool what to watch and how to notify you. Here’s a straightforward workflow you can put in place right now:

-

Track Website Changes: First, set up monitoring for your top competitors' websites. You want instant alerts when they tweak their homepage copy, change their pricing, or add a new product. This is your frontline intelligence.

-

Monitor SEO and Content Strategy: Next, keep an eye on their content. Get notified whenever they publish a new blog post or start targeting a new keyword. This tells you exactly where they’re trying to capture market attention.

-

Get Alerts on Key Events: Configure alerts for specific triggers. You could get an email when a competitor gets a mention in the press, posts new job openings (a great signal of growth), or launches a new app version.

This diagram shows how a simple automated workflow can turn raw competitor activity into useful intelligence.

What you're building isn't just a list of rivals; it’s a living feed of their strategic moves. By automating the data gathering, you transform a tedious chore into a quick, daily check-in. The end game is to shift from being reactive and constantly playing catch-up to being proactive and always one step ahead.

How to Sharpen Your Competitive Edge

All that analysis is great, but now what? Finding your spot on the map is one thing; defending it is the real game. This is where you turn all those charts and grids into actual business decisions that make you tougher to beat.

It’s time to move from thinking to doing.

Your competitive market position isn't a "set it and forget it" deal. It's a living thing that needs constant attention. This means translating what you've learned into your website copy, your pricing, and your product roadmap. It’s all about leaning into what makes you unique and trimming away the things that make you look like everyone else.

Turn Insights Into Action

Let's get practical. You’ve identified your unique strengths and pinpointed the gaps in the market. Now, it's time to shout it from the rooftops, starting with the first place most customers will look: your website.

-

Tweak Your Website Copy: Take a hard look at your homepage. Does your headline scream your unique value in under five seconds? If you found you’re the only one who serves a specific niche, that needs to be front and center. Ditch the generic buzzwords and get brutally specific about who you help and how you do it differently.

-

Adjust Your Pricing: Your analysis might reveal that you’re underpriced for the value you deliver, or maybe you’re accidentally competing with the budget options when you’re a premium service. Use your positioning to justify your price. If you’re the high-quality, white-glove service, your pricing should reflect that confidence.

-

Prioritize Your Product Roadmap: Stop trying to build every feature your competitors have. Your roadmap should be a direct reflection of your competitive position. Double down on the features that reinforce your unique strengths and unapologetically ignore the ones that don't.

Let Your Customers Be The Judge

Here’s a secret: you don’t get to decide your market position. Your customers do. What you think your position is can be wildly different from how they actually see you. The only way to know for sure is to ask them.

And don't overcomplicate it. You don't need a massive research budget.

> A simple five-question survey sent to your best customers can be more revealing than a month of internal meetings. Ask them things like, "How would you describe what we do to a friend?" or "What's the main reason you chose us over other options?"

Their words are pure gold. If their answers line up with your intended position, you’re on the right track. If they don’t, it's a clear signal that your messaging isn't landing and you need to fix it.

Staying ahead also means keeping your house in order. If you're facing tight deadlines or risk losing enterprise deals due to compliance, understanding how to fast-track your audit can be a huge competitive advantage. For some, this involves looking into Emergency SOC 2 Compliance Strategies to secure key partnerships.

Ultimately, a strong competitive market position needs to be defensible, not just from competitors but also within regulatory frameworks. As global competition heats up, so does scrutiny. The OECD Competition Trends report shows increasing enforcement globally to ensure fair play, making a clear, defensible position more critical than ever. You can learn more about these global competition insights from the OECD.

Common Positioning Mistakes And Why Investors Care

Let's talk about the traps. After all the hard work you’ve put into mapping your market, it’s surprisingly easy to stumble at the finish line. I’ve seen it happen countless times: a company with a brilliant idea falls into a few classic positioning pitfalls that quietly sink the business.

Think of this as your chance to dodge the common, costly errors that others have made. A weak competitive market position isn't just a marketing problem; it's a fundamental business flaw that makes investors run for the hills.

The Swiss Army Knife Problem

The most common mistake is trying to be everything to everyone. You have a product that could solve a dozen different problems, so you try to chase them all. The result? Your message becomes a watered-down, generic mess that doesn’t really connect with anyone.

You end up being the Swiss Army Knife of your industry. Sure, it has a lot of tools, but you’d never use those tiny scissors to build a house. When you try to be the solution for everything, you become the perfect solution for nothing.

> Specialization can feel scary, but it’s where the money is. Being the #1 choice for a specific, well-defined group is infinitely more powerful than being the #10 choice for everybody.

Trying to please the whole world just creates noise and confusion. It’s a fast track to being ignored.

Picking Fights You Can't Win

Another classic blunder is picking a direct fight with a market Goliath. You might genuinely believe your product is 10% better than the massive, 800-pound gorilla in your space, but that’s rarely enough to convince their loyal customers to go through the pain of switching.

Winning isn't about being slightly better; it’s about being fundamentally different. Don't try to beat them at their own game. Instead, change the game. Find the niche they overlook, the customer they misunderstand, or the service they’re too big and slow to offer. Your goal is to make them irrelevant to your target audience, not to beat them in a head-to-head battle.

Why Investors Are Obsessed With This

When you're pitching for funding, investors are listening for one thing above all else: a compelling story. And the core of that story is your competitive market position. It's the answer to their two most critical questions:

- How will you win? They need to see a clear, believable path to victory. A fuzzy position tells them you don't have a real strategy.

- Is there a moat around this business? A "moat" is a defensible advantage that stops competitors from easily copying you. A unique market position is one of the strongest moats you can build.

Investors will dig deep into your competitive positioning. They follow a comprehensive process, often guided by a detailed due diligence checklist, to poke holes in your claims. They want to see that you've not only found a great spot in the market but that you also have a plan to defend it.

Your pitch deck needs to nail this. Show them the map, point to where you are, and explain precisely why that small piece of turf is yours to own. A sharp, defensible position turns a risky bet into a smart, investable opportunity.

Frequently Asked Questions

You've got questions, we've got answers. Trying to nail your competitive market position can feel like aiming at a moving target, so let's tackle some of the most common head-scratchers.

How Often Should I Re-Evaluate My Position?

Think of your market position like your car's alignment. You don't need to check it every day, but if you let it go for too long, you'll drift into the wrong lane. A good rule of thumb is to do a serious deep-dive at least once a year.

That said, you should absolutely do a quick gut-check anytime a major event shakes things up:

- A major new competitor crashes the party.

- You’re about to launch a significant new product.

- Your growth mysteriously stalls.

The key is not to let your analysis gather dust. Your market is a living thing, and your position has to adapt with it.

A Huge New Competitor Just Appeared. What Now?

First off, take a breath. Don't panic. A new giant lumbering into your space feels intimidating, but it's also a great opportunity to get crystal clear on what makes you different. Big companies are often slow, clunky, and have to water down their message for the masses.

You, on the other hand, are nimble. This is your cue to get even more specific about the niche you serve.

> A new competitor doesn’t just steal your customers; they give you a new reason to remind your audience why they chose you in the first place. Focus on your niche, over-deliver for them, and let the giant chase the masses.

They might have a bigger marketing budget, but you have a direct line to your customers. Use it.

What's The Real Difference Between Positioning and Marketing?

This one trips up a lot of people, but it's simple. Here’s the easiest way to break it down:

- Positioning is your core strategy. It's the choice you make about who you are, who you're for, and why you're the only logical choice for them. It’s the blueprint for your house.

- Marketing is how you tell that story. It’s the paint, the furniture, and the "Welcome" mat. It’s the ads, the content, and the emails you send to bring that story to life.

In short, your positioning defines your message. Your marketing spreads that message. You can't have great marketing without a rock-solid position—you'd just be shouting generic noise into the wind. Getting your positioning right makes every single dollar you spend on marketing work ten times harder.

Stop guessing and start winning. Already.dev gives you the complete competitive picture in minutes, not weeks, so you can build a market position that's not just different, but defensible. Discover your true competitive landscape today.