A Guide to Competitors Price Comparison Without Going Broke

Stop guessing on pricing. This guide breaks down competitors price comparison step-by-step, showing you how to collect data, analyze it, and win your market.

A competitors price comparison is just a fancy way of saying you're figuring out what your rivals charge for their stuff. This isn't about mindlessly copying their prices—that’s a rookie move. It’s about getting the lay of the land, spotting opportunities everyone else missed, and making smarter pricing decisions so you stop leaving cash on the table.

Why Your Current Pricing Is Probably a Guessing Game

Let's be honest. For most businesses, setting prices feels a lot like throwing darts in a dark room. You either peek at what a competitor is charging and slap that number on your own product, or you just pull a number out of thin air that feels right.

This "winging it" approach is a fast track to some painful blunders. You might price a premium product like it belongs in the bargain bin, or worse, get sucked into a price war you have zero chance of winning. This isn't just a gut feeling; the numbers back it up.

Recent studies show that companies are struggling to get the prices they actually set, with average price realization falling to a sad 43%. That means businesses are bleeding nearly 57% of their potential profit because of discounts, haggling, and pressure from the competition. If you're a glutton for punishment, you can read the full Simon-Kucher study.

The Perils of Pricing in a Vacuum

When you ignore what’s happening in the market, you make some classic, facepalm-worthy mistakes. Spotting them is the first step to not making them. This whole exercise is a key part of what's called competitive intelligence, and every serious business should be doing it.

- Under-valuing Your Awesomeness: You built something fantastic, but you're too scared to charge what it's worth. You end up overworked, underpaid, and wondering where it all went wrong.

- Over-pricing and Getting Ghosted: You set a price based on your costs plus a nice profit, totally ignoring that a competitor offers 90% of your value for half the price. The sound of crickets is deafening.

- Joining the Race to the Bottom: A competitor drops their price, so you drop yours. They retaliate. Before you know it, you're both fighting over scraps.

> The goal here isn’t to scare you. It’s to show you that with a little structure, pricing can go from your biggest headache to your secret weapon. And a systematic competitors price comparison is how you get there.

This guide will give you that structure. We’ll walk through how to see what your rivals are charging and, more importantly, how to figure out why.

Identifying Competitors Worth Your Time

Before you start a caffeine-fueled mission to screenshot every pricing page on the internet, let’s hit the brakes. Not all competitors are created equal. Tracking the wrong ones is like training for a marathon by watching TV—a complete waste of time. A smart competitors price comparison starts with a focused hit list.

Think of your competition in three main buckets. This isn't about some perfect spreadsheet; it's about knowing who to watch with a microscope versus who just needs a glance.

The Main Event: Direct Competitors

These are the obvious ones. They sell a solution so similar to yours that your customers are basically flipping a coin between you. You’re both solving the same problem for the same people in pretty much the same way.

For instance, if you sell project management software for small creative agencies, another company selling the exact same thing is your direct competitor. You’re in the same ring, throwing the same punches.

The Side-Hustlers: Indirect Competitors

These guys are sneaky. They solve the same core problem you do, but from a totally different angle. They’re not in your boxing ring; they’re across the street teaching martial arts.

Imagine you sell that same project management tool. An indirect competitor could be a company selling super-powered spreadsheets with ready-made templates for agencies. They aren't a direct software rival, but they’re definitely stealing your potential customers. Ignoring them is a huge mistake because they often hint at where the market is going next.

The Rockstars: Aspirational Competitors

These are the big names in your space. You might not be fighting them for customers today, but you should absolutely be studying their playbook. They're the market leaders you want to become or, one day, dethrone.

> Analyzing their pricing isn't about blindly copying them. It’s about understanding the value they communicate to justify those premium price tags. What features do they put behind a paywall? How do they structure their tiers? These are free lessons in market positioning.

To really nail down who all these players are, you've got to do a proper competitive analysis. If you need a roadmap, there are some great guides on how to conduct a comprehensive competitive analysis that can walk you through it.

You could use big, expensive tools like Ahrefs or Semrush to find these competitors, but that can get pricey fast. Alternatively, a platform like Already.dev can automatically map out your competitive landscape for you. It shows you direct, indirect, and even failed competitors, so you can build your watchlist without all the manual grunt work. The goal is a focused list that gives you maximum insight with minimum noise.

How to Collect Competitor Pricing Data

Alright, let's get into the nitty-gritty. This is where the thrill of market research bumps up against the reality of some serious grunt work. It can be tedious, messy, and honestly, a bit of a drag. But this is where you find the gold, so let’s get digging.

The journey usually starts with the old-fashioned manual grind. This means you're playing digital detective—scouring competitor websites, taking endless screenshots of pricing pages, and probably signing up for free trials with a burner email. We've all been there. Sometimes, it even involves that awkward dance of chatting with a sales rep, trying to coax out pricing details without blowing your cover.

The Manual Grind Versus Smart Automation

Doing this by hand is like trying to build a house with a spoon. It's painfully slow, you’ll get exhausted, and by the time you're done, your competitors have probably changed their pricing anyway. It's a necessary evil if you're on a shoestring budget, but it’s far from smart.

Once you know who your competitors are, the real chore is gathering their pricing data consistently. For a deeper dive into this, there are some solid strategies for monitoring competitor prices that outline more structured approaches.

Eventually, you'll realize you need to work smarter, not harder. This is where tools come in. You’ve probably heard of the big marketing suites like Ahrefs or Semrush. While fantastic for many things, they can be seriously expensive and aren’t built for deep pricing analysis. They’ll give you a 10,000-foot view, but you need to be on the ground.

> The real challenge isn't just snagging a price point. It’s about tracking pricing tiers, feature gates, usage limits, and all those sneaky hidden fees over time. Manual spreadsheets just can't keep up.

This is exactly why a whole market of specialized tools has popped up. Modern platforms can track unlimited competitors, analyze product variants, and even help you set dynamic pricing rules. Costs are all over the map, with some starting around $69 per month and scaling up from there.

The Automated Breeze: A Better Way

Instead of wrestling with spreadsheets or overpaying for a tool that's not quite right, you can use a platform built for this job. For instance, a tool like Already.dev automates this entire headache. It’s designed to do the boring work for you.

You can go from spending a week building a messy spreadsheet to getting a full report in minutes. The platform crawls your competitors' sites, pulls out their pricing structures, and lays it all out in a clean, comparable format. We've put together a more detailed look at how to gather competitor pricing data that dives into the specifics.

When you put the two methods side-by-side, the choice becomes pretty clear:

- Manual Slog: Days of mind-numbing work, a high chance of human error, and data that’s stale the second you finish.

- Automated Breeze: A few minutes of setup, consistently fresh data, and more time for you to actually think and make smart moves.

Let's be real—your time is better spent on strategy, not data entry. Automating this stuff isn't a luxury anymore; it's a necessity if you want to stay competitive without burning out.

Making Sense of the Pricing Data You've Gathered

Okay, you survived the data collection phase. Your desktop is probably a mess of screenshots, and you’re staring at a spreadsheet that looks like modern art. But having the data is just step one; making it tell you something useful is where the real magic happens.

You’re likely looking at a wild mix of pricing models. Competitor A charges per user, Competitor B has a weird usage-based system, and Competitor C offers a huge annual discount but hides a setup fee in the fine print. It feels like you're trying to compare apples, oranges, and some mystery fruit that might be a coconut.

Normalizing Your Data for a Fair Fight

Before you can find any real insights, you have to get everything speaking the same language. This is called data normalization, and it’s way less scary than it sounds. The goal is to create a common ground so your comparisons actually make sense.

Here’s how you can start untangling that mess:

- Standardize the Billing Cycle: The easiest win is to convert everything to a monthly cost. If a competitor only lists an annual price of $1,200, divide it by 12 to get a $100/month equivalent. Make a note of that annual discount—that’s a valuable insight on its own.

- Account for Hidden Costs: Did you spot a one-time setup fee? You need to factor that in. A simple way is to spread that cost over a year (divide by 12) and add it to the monthly price to get a truer picture of the first-year cost.

- Decode Per-Seat vs. Usage-Based: This is often the trickiest part. For per-seat models, calculate the cost for a typical team size, like 5 users. For usage-based plans, estimate the usage of that same 5-person team. This creates a comparable scenario, even when the models are totally different.

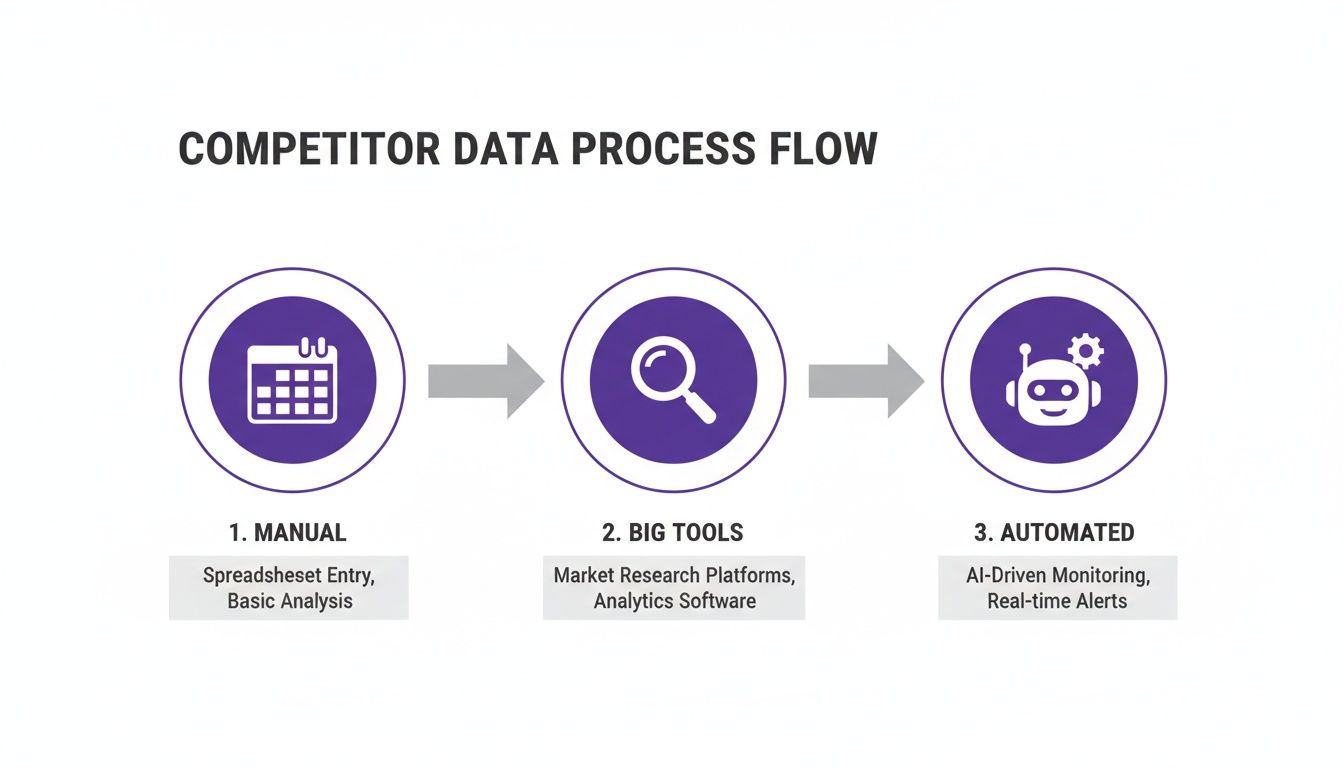

This whole process—from manual data entry to automated analysis—is a journey. As you scale, you'll naturally move from messy, time-consuming methods to a more streamlined, AI-driven approach.

As you can see, technology exists to handle the tedious stuff for you, freeing you up to focus on strategy.

Moving From Price to Value

Once your numbers are lined up, the real analysis begins. The goal isn't just to find out who's cheapest. It’s to figure out who offers the most value for a specific type of customer. To do that, you need to find the value metric—the core thing your customers actually care about and pay for.

Is it the number of contacts in a CRM? The amount of storage? The number of projects? Pinpoint this for your market. Now, you can map each competitor’s price against that metric. For instance, you might discover:

- Competitor A: $50/month for 1,000 contacts ($0.05 per contact)

- Competitor B: $75/month for 2,500 contacts ($0.03 per contact)

Suddenly, Competitor B looks like the better deal, even though its sticker price is higher. This is how you shift the conversation from "Competitor A is cheaper" to "Competitor A is cheaper but offers 50% less value."

> This entire process is about turning a flat list of prices into a 3D map of the market. You stop seeing numbers and start seeing strategic positions.

Creating a comparison grid in a spreadsheet is a fantastic way to visualize all of this. If you need a solid starting point, check out our guide on building a great competitor analysis template that you can adapt for pricing.

Of course, maintaining this spreadsheet can quickly become a full-time job. This is where dedicated tools really shine.

Manual vs Automated Competitor Price Analysis

Let's be real: the manual spreadsheet route has its limits. As you grow, tracking prices by hand becomes a major time-sink. Here’s a quick breakdown of how the old-school way stacks up against an automated approach.

| Aspect | Manual Spreadsheet Method | Automated Tool (e.g., Already.dev) | | :--- | :--- | :--- | | Time Investment | High. Hours or days spent on data collection and updates. | Low. Initial setup is quick, then data is updated automatically. | | Data Accuracy | Prone to human error (typos, miscalculations, outdated info). | High. AI scrapers pull data directly from the source. | | Scalability | Poor. Adding more competitors exponentially increases the workload. | Excellent. Easily track hundreds of competitors without extra effort. | | Cost | "Free" in terms of software, but very expensive in terms of your time. | A monthly subscription fee, but delivers a huge ROI by saving time. | | Strategic Value| Limited. By the time you finish, the data might already be stale. | High. Frees up your team to focus on strategic decisions, not data entry. |

The takeaway is pretty clear. While a spreadsheet is fine for a one-off project, an automated tool like Already.dev is built for continuous monitoring. It doesn’t just grab prices; it automates the normalization and generates those value-based comparison grids for you. This means you can spend your time on strategy, not on fighting with VLOOKUP formulas.

Turning Your Analysis into a Winning Pricing Strategy

So, you've waded through the spreadsheets and made sense of the data. You finally have a clear picture of where you stand. Now what? Raw data is just trivia until you use it to make a move. Let's turn that research into a real plan.

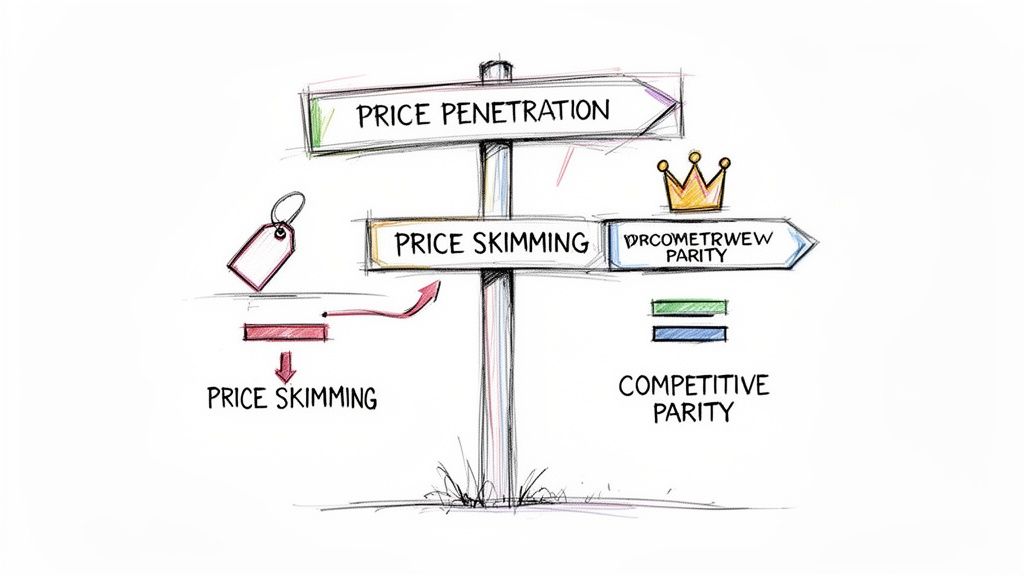

Based on everything you’ve learned from your competitors price comparison, your next play will likely fall into one of three classic strategies. Think of these as your core playbook.

Price Penetration, Skimming, or Parity: Picking Your Play

This isn't about picking a strategy out of a hat. The right choice has to line up with your product, your place in the market, and what you’re ultimately trying to achieve.

Let's break them down.

-

Price Penetration (The Disruptor): This is the "go big or go home" approach. You deliberately price yourself lower than everyone else to gobble up market share, fast. It's a powerful move for new players who need to build a user base from scratch. But be warned: it can cheapen your brand and attract fickle customers who will bolt the second a better deal comes along. Defending the "cheapest" spot is exhausting.

-

Price Skimming (The Premium Choice): Do you have a genuinely killer product that leaves the competition in the dust? This one’s for you. You launch with a high price tag to capture the top of the market—those early adopters willing to pay a premium for innovation. Later, you can gradually lower the price to pull in everyone else. The big risk? If your product doesn’t live up to the hype, you just look arrogant.

-

Competitive Parity (The Safe Bet): This is all about pricing your product right in line with the market average. You’re not the bargain bin option, but you're not the luxury choice either. This strategy takes price off the table and forces the conversation to focus on your unique value—be it better features, incredible customer service, or a stronger brand. It's a solid, stable approach, but it means you won't stand out on price alone.

> Don't just guess. Your data should be practically screaming the answer at you. If your competitors are all bunched up at a high price point with so-so features, a penetration strategy could be your golden ticket.

The world of pricing is moving incredibly fast, largely thanks to AI. In fact, over 40% of companies are already using AI for pricing analysis, with giants like Amazon reportedly adjusting prices every 10 minutes. This is exactly why startups need smart tools to keep pace. You can get a deeper look into how AI is shaping competitive pricing.

Crafting Your Market Position

The price itself is only half the story. The other half is how you position it. How you talk about your price is just as important as the number on the tag. Your pricing page isn't a menu; it's a sales pitch.

Here’s how to frame your position using the data you collected:

- The Value Choice: Your core message is "get more for your money." You might not be the absolute cheapest, but the bang for the buck is off the charts. Your copy should be direct: "Get all the features of Competitor X's pro plan for the price of their basic."

- The Premium Choice: Here, you're selling outcomes, not just features. Your copy needs to radiate confidence, focusing on quality and guaranteed results. Back it up with powerful social proof, like testimonials from industry leaders.

- The Innovator Choice: You’re selling the future. Your product does something completely new that no one else can match. Your pricing page needs to hammer this home, making the price feel like a small detail compared to the incredible new power customers are getting.

At the end of the day, your competitors price comparison gives you the map. These strategies are the different routes you can take. Choose your path wisely, communicate it clearly, and turn that hard-won data into a pricing strategy that actually wins.

Common Pricing Traps and How to Sidestep Them

You’ve done the hard work of gathering competitor data. Awesome—you're already ahead of 90% of businesses! But this is where things can go sideways fast. I've seen it happen countless times, so let me share some classic blunders to help you avoid the same fate.

The number one mistake? Playing follow-the-leader on pricing. Just because your biggest rival charges $99/month, it doesn’t mean you should too. It’s a tempting shortcut, but it's almost always a terrible idea.

Think about it: you have no idea what’s happening behind their curtain. You don't know their costs, their profit margins, or that massive enterprise deal they just quietly landed. Copying their price is like cheating off someone's test when you don't even know if you're in the same class. Their pricing is built for their business, their costs, and their goals—not yours.

The Race to the Bottom That Nobody Wins

Another massive pitfall is sparking a price war. You see a competitor is a bit cheaper, so you undercut them by 10%. They notice and retaliate with a 15% price drop. Before you know it, you're in a death spiral.

We call this the "race to the bottom," and trust me, it’s a game only the most deep-pocketed behemoth in the market can win. (Spoiler: that's probably not you). This strategy tanks your margins and trains customers to see you as a cheap commodity. You'll attract bargain-hunters who will bolt the second a slightly better deal comes along.

> The point of a competitors price comparison isn't to find the lowest price and beat it. It's to find a unique, defensible position in the market based on the value you offer, not just your price tag.

Don’t let all your hard work drag you into a fight you're destined to lose. Use the data to find the gaps—the places where you can offer something unique that justifies a price that actually supports your business.

Dodging Analysis Paralysis and Pricing Stagnation

Two final traps snag even the sharpest founders: setting your price in stone and getting stuck in spreadsheet purgatory.

-

"Set It and Forget It" Pricing: Markets move. Your competitors are always tweaking their plans, your own costs change, and customer expectations evolve. Pricing is not a one-and-done task; it’s a living part of your business. That analysis you did six months ago? It's already ancient history. You have to keep a constant pulse on the market.

-

The Perfection Trap: On the other end is over-analyzing everything until you’re too scared to make a move. You can spend months modeling what-if scenarios, but at some point, you just have to ship a price. Don't let the hunt for the "perfect" price prevent you from getting real-world feedback.

This is where automating the data collection really pays off. Big, general-purpose tools like Ahrefs or Semrush can be expensive overkill and aren't built for this. A specialized platform like Already.dev handles the tedious, ongoing monitoring for you. It helps you avoid stagnation without drowning you in data, freeing you up to focus on strategy instead of getting tripped up by these common mistakes.

Your Competitor Pricing Questions Answered

Alright, let's tackle some of the common questions that always pop up when you start digging into competitor pricing. Think of this as the rapid-fire round.

How Often Should I Check Competitor Prices?

This really depends on your industry. If you're in a cut-throat market like e-commerce, you might need to look at prices weekly, or even daily. For most B2B SaaS businesses, a monthly check-in is usually enough to spot trends without getting whiplash.

The biggest mistake is treating this as a one-off task. Markets are always moving, so your analysis has to be a continuous process, not a dusty report you look at once a year.

> The goal isn't to get into a constant state of price-watching that causes knee-jerk reactions. It's about having a steady pulse on the market so a major pricing shift from a rival never catches you completely by surprise.

What About Competitors Who Hide Their Prices?

Ah, the classic "Contact Us for a Demo" wall. It’s frustrating, but it’s a data point in itself. It signals they’re gunning for larger, enterprise clients and use a high-touch sales process.

You've got a few ways to handle this:

- Become a Prospect: If you have the time, sign up for a demo with a burner email. You'll have to sit through a sales pitch, but you might get the intel you need.

- Hunt for Clues: Scour review sites like G2 or Capterra. You'd be surprised how often users drop hints about pricing in their reviews.

- Make an Educated Guess: Look at their features, target customers, and positioning. You can usually place them into a pricing tier relative to other competitors who are transparent.

What If a Huge Rival Slashes Their Prices?

First: don't freak out. A huge price drop from an established competitor is often a defensive play. The absolute worst reaction is to immediately match their price—that's how you get dragged into that race to the bottom.

Instead, double down on what makes you different. Re-emphasize your value. Is it your best-in-class customer support? Your killer user experience? Use a competitor's price move as an excuse to talk to your own customers, not as a reason to panic and slash your own prices.

Ready to stop guessing and start knowing? Already.dev automates the entire competitor price comparison process, turning weeks of manual work into a clean, actionable report in minutes. Get the data-driven confidence you need to price smarter. Check it out at https://already.dev.