7 Examples of Market Research Reports You Can Actually Learn From

Discover 7 compelling examples of market research reports to inspire your next analysis. Learn key insights with our comprehensive guide.

Ever feel like you’re just guessing what customers want? You're not alone. The biggest names in business don't guess—they use market research to make billion-dollar decisions. But what does a truly killer market research report actually look like? Not the snooze-fest templates from business school, but the real-deal documents that convince execs to launch a new product, enter a new market, or bet millions on a wild new strategy.

This ain't another boring, theoretical guide. We’re going to dissect 7 real-world examples of market research reports that shaped major companies like Tesla, Netflix, and Apple. We'll break down the structure, expose the critical insights, and give you actionable takeaways you can use immediately. You'll see how they figured out what people wanted, understood their customers, and clobbered the competition.

The goal is to show you how to move from "I think people want this..." to "I know people want this, and here's the proof." You'll learn how to structure your own research, what questions to ask, and how to present your findings in a way that makes people sit up and listen. Forget the fluff; let's look at what actually works.

1. Tesla Model 3 Market Research Report - Pre-Launch Consumer Analysis

Tesla didn't just stumble into success with the Model 3; they launched a disruptive product into a super skeptical market by actually doing their homework. This pre-launch report is a fantastic example of market research report because it shows how to de-risk a massive product bet. Instead of just guessing what "mass market" meant for electric cars, Tesla combined surveys with hard data to get a crystal-clear picture of who they were selling to.

This report aimed to answer the billion-dollar questions: What will people actually pay for an EV? What are their biggest fears (like getting stranded)? And where does a new, more affordable Tesla fit into a world of gas-guzzlers?

Strategic Breakdown

Tesla’s research was genius because it didn't just focus on the car; it analyzed the whole shebang. They knew the car's success depended on stuff like charging stations. By surveying both EV nerds and regular folks driving their Ford F-150s, they got a full picture of the market's hopes and fears, not just the opinions of their superfans.

> Key Strategic Insight: For a game-changing product, you have to research beyond the product itself. Look at the surrounding ecosystem, infrastructure, and the psychological hang-ups of the entire target market, not just your existing fans.

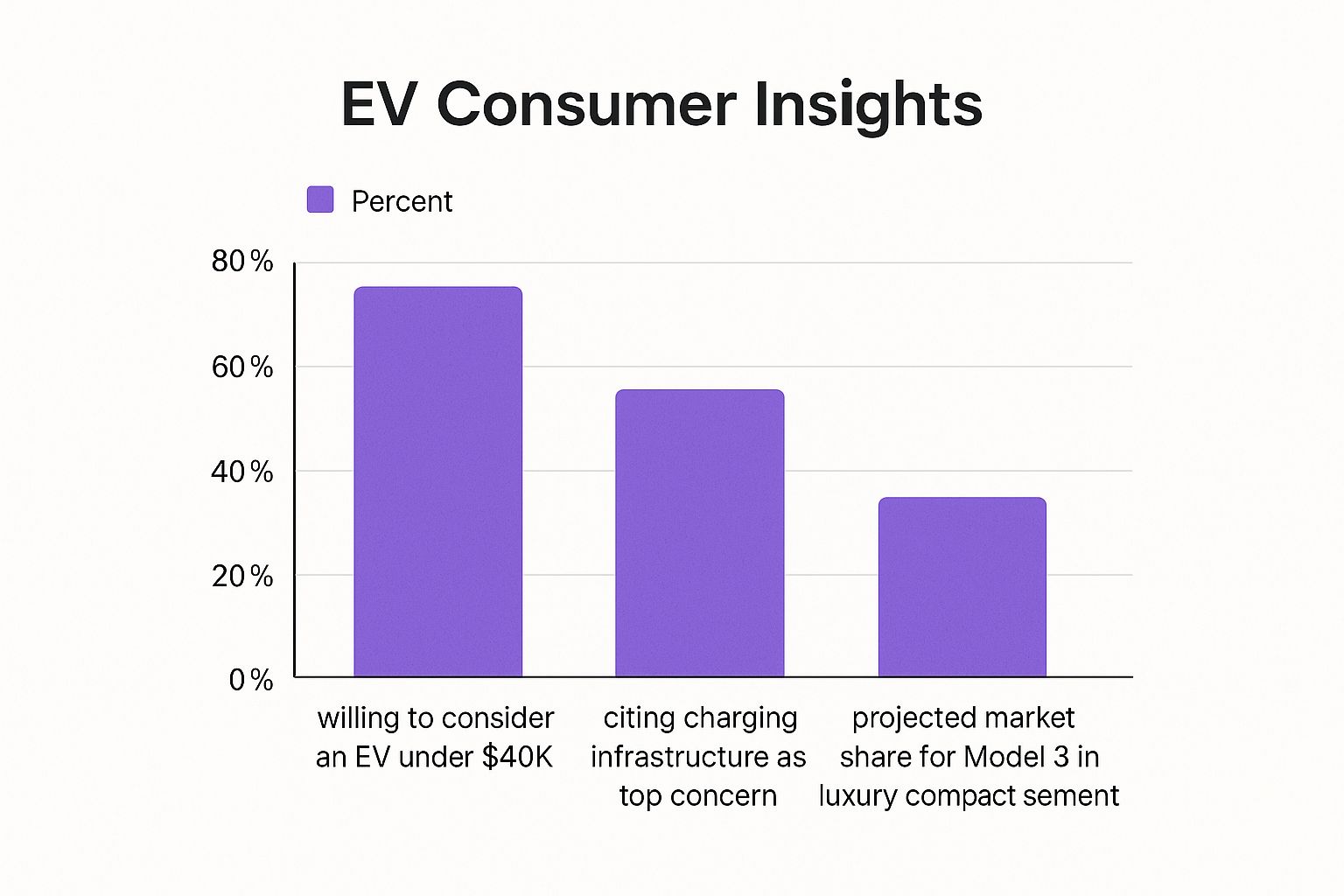

The following bar chart visualizes some of the critical data points uncovered in their research, showing the clear relationship between price, infrastructure concerns, and market potential.

This data paints a clear picture: a huge market was ready for an EV at the right price, but the main thing holding them back was the fear of being stranded without a charger.

Actionable Takeaways

How can you apply Tesla's playbook?

- Test Multiple Price Points: Don't just ask, "Would you buy this?" Test specific prices to find that sweet spot where you get tons of buyers but still make a profit. The sub-$40k price was a direct result of this kind of research.

- Address the Biggest Fear Head-On: The report identified charging as the top concern. Tesla's response? They went on a rampage building out their Supercharger network before and during the Model 3 rollout, turning a huge weakness into a killer advantage.

- Mix Your Methods: Combine hard numbers (surveys, market stats) with qualitative insights. This gives you not just the "what" (e.g., 43% are worried about charging) but the "why," letting you build a smarter strategy.

2. Netflix Original Content Strategy Report - Global Streaming Market Analysis

Netflix didn't become a global content powerhouse by throwing money at a wall to see what stuck. Their multi-billion dollar content budget is guided by one of the most sophisticated market research engines on the planet. This internal report is a masterclass example of market research report because it shows how to blend massive behavioral data sets with traditional research to predict global hits. Instead of guessing what a global audience wants, Netflix analyzes viewing patterns, completion rates, and even social media chatter to pinpoint specific content niches with explosive potential.

This report moves beyond simple viewership numbers to answer crucial strategic questions: Which local-language stories have global appeal? How does genre preference change by region? And how can our recommendation algorithm better serve undiscovered content to the right viewers?

Strategic Breakdown

Netflix's genius lies in treating content creation like a data-driven product launch. They use their platform's vast treasure trove of user data (what you watch, when you pause, what you re-watch) as their primary research tool. This behavioral data is then combined with qualitative research like surveys and focus groups to understand the "why" behind viewing habits. For example, data showed a growing appetite for Korean dramas outside of Asia, directly informing the investment in what would become the global phenomenon, Squid Game.

> Key Strategic Insight: Your own platform's user data is a goldmine for market research. Analyze user behavior (not just what they say they want) to uncover unmet needs and predict future trends before your competitors even know they exist.

This approach allows Netflix to de-risk massive content investments. They know, for instance, that 70% of viewing hours come directly from their recommendation algorithm, making thumbnail and description A/B testing a critical part of their marketing research, not just a simple UI tweak.

Actionable Takeaways

How can you apply Netflix's data-first strategy?

- Combine Behavioral and Survey Data: Don't just rely on what customers tell you. Analyze how they actually use your product or service. Pair this "what they do" data with surveys to understand "why they do it" for a complete picture.

- Test Concepts in Niche Markets: Before a full-scale launch, test your product or content concept with a smaller, targeted audience. Netflix often gauges international interest in a genre before greenlighting a big-budget production.

- Monitor Your Competitors' Content: Keep a close eye on what competitors are doing and how audiences are reacting. A thorough competitor analysis can reveal market gaps and opportunities they might be missing.

3. Airbnb Market Entry Report - Expansion into New Geographic Markets

Airbnb’s global dominance wasn't an accident; it was the result of a replicable, data-driven expansion strategy. Their market entry report is a prime example of market research report for any company looking to expand geographically. Instead of just launching everywhere and hoping for the best, Airbnb developed a standardized framework to analyze local regulations, competition, cultural nuances, and supply-and-demand dynamics before committing resources.

This systematic approach allowed them to answer critical questions for each new city: Is there a legal path to operate? What do local travelers and hosts need? And can we offer a unique value that the existing market lacks? This methodology guided their successful expansion into over 220 countries and regions.

Strategic Breakdown

Airbnb’s brilliance was in creating a scalable research model that balanced global consistency with local customization. They understood that what works in San Francisco wouldn't necessarily fly in Tokyo. By studying both tourist and business travel patterns, they could identify specific accommodation gaps. For instance, research in Japan revealed a unique hospitality culture and a need for features that catered to different guest expectations, leading to platform modifications specifically for that market.

> Key Strategic Insight: Don't use a one-size-fits-all approach for global expansion. Create a standardized research framework, but build in flexibility to adapt your product, marketing, and operations to local cultural norms, regulations, and consumer behaviors.

This approach also helped them proactively identify major roadblocks. Early research flagged significant regulatory hurdles in cities like New York and Barcelona, allowing them to engage with local experts and prepare for legal challenges instead of being blindsided after launch. For more on how to apply these principles, check out this guide on market research for startups.

Actionable Takeaways

How can you replicate Airbnb's international playbook?

- Analyze Both Supply and Demand: Don't just look at the number of potential customers. Study the existing accommodation supply (hotels, guesthouses) to find gaps your service can fill. Are they too expensive? Do they lack kitchens? Find the unmet need.

- Engage Local Experts Early: Regulations can make or break your entry. Before investing heavily, hire local legal and cultural consultants to understand the on-the-ground reality. This is a small upfront cost that can save you millions later.

- Test Marketing with Local Focus Groups: A marketing message that resonates in one country might be confusing or even offensive in another. Use local focus groups to test your value proposition, imagery, and tone to ensure it connects with the target audience.

4. Starbucks Store Location Optimization Report - Site Selection Analysis

Starbucks doesn't just randomly plop a store on every corner; their insane ubiquity is the result of a hyper-disciplined, data-driven site selection process. This report is a prime example of market research report for physical businesses because it moves beyond gut feelings and into predictive analytics. Instead of just looking for a busy street, Starbucks built a sophisticated model that combines demographic data, traffic patterns, and competitive analysis to forecast a new store's success with spooky accuracy.

This research aims to answer a critical question for any brick-and-mortar business: Where is the absolute best place to open our next location to maximize revenue and avoid cannibalizing our existing stores?

Strategic Breakdown

The genius of Starbucks' approach lies in its "Atlas" platform, a proprietary mapping and business intelligence tool. It layers dozens of data points onto a single map, including local income levels, population density, competitor locations, and even daily traffic flows. By analyzing morning commute patterns, they discovered that placing a store on the "going to work" side of the street significantly outperformed locations on the "coming home" side.

> Key Strategic Insight: For location-based businesses, success isn't just about being in a good area; it's about being in the right spot within that area. Micro-factors like which side of the street you're on or proximity to complementary businesses can make or break a new location.

This level of detail allowed them to achieve an over 80% success rate for new stores. Their analysis was so precise it could predict how a new location would impact sales at nearby Starbucks, allowing them to optimize placement to minimize self-competition and grow the overall market.

Actionable Takeaways

How can you apply Starbucks' site selection science?

- Map Your Customer's Daily Journey: Don't just analyze where your customers live. Use surveys or observational data to map their daily routines. Are they stopping by before work, during their lunch break, or on the way home? This dictates optimal placement.

- Layer Multiple Data Sources: Combine quantitative data (demographics, traffic counts) with qualitative, on-the-ground knowledge. A location might look great on paper, but a local expert might know about upcoming construction that will disrupt traffic for a year.

- Analyze Your "Co-Tenants": Look for non-competing businesses that attract a similar demographic. A Starbucks often thrives next to a high-end grocery store because they share a customer profile, creating a mutually beneficial ecosystem.

5. Apple iPhone Consumer Behavior Report - Smartphone Market Segmentation Study

Apple's dominance in the premium smartphone market isn't accidental; it’s the result of relentless, deep-dive consumer research. This type of report is a masterclass example of market research report because it showcases how to move beyond basic demographics and into psychographics and behavioral analysis. Instead of just asking who buys iPhones, Apple’s research aims to understand why they buy, how they use the entire ecosystem, and what keeps them so darn loyal.

This report is focused on dissecting user behavior to inform product development and marketing. It answers critical questions like: Which features truly drive purchasing decisions? How powerful is the "walled garden" effect? And how can we turn user concerns, like privacy, into a core brand pillar?

Strategic Breakdown

Apple’s research genius lies in its obsession with the user's complete journey and ecosystem interaction, not just the device itself. They understand that an iPhone is a gateway to a larger world of services, apps, and accessories. By studying how users interact with iCloud, the App Store, Apple Music, and even their Macs and Apple Watches, they get a holistic picture of customer loyalty and lock-in.

> Key Strategic Insight: Your product is more than just its features; it's part of a user's lifestyle. Effective research analyzes the entire ecosystem to identify what creates "stickiness" and drives long-term value, turning one-time buyers into lifelong fans.

This approach revealed that while a competitor might launch a phone with a slightly better camera, an iPhone user's investment in the Apple ecosystem made switching a much bigger decision. For more details on this kind of analysis, you can learn more about market research data analysis on blog.already.dev.

Actionable Takeaways

How can you apply Apple's playbook?

- Study the Full Ecosystem: Don't just analyze how customers use your product; map out how they use adjacent tools and services. This reveals opportunities for integration, partnerships, and creating a "sticky" environment that increases retention. Apple found this ecosystem lock-in increased retention by over 30%.

- Identify the Real Purchase Drivers: Go beyond surface-level feature preferences. Apple's research confirmed that for 45% of its target segment, camera quality wasn't just a feature; it was the primary emotional and practical reason for upgrading. Isolate your product’s "hero" feature and build your marketing around it.

- Turn Concerns into Strengths: The report highlighted growing user concerns about digital privacy. Instead of treating this as a problem, Apple turned it into a core marketing differentiator, positioning itself as the pro-privacy choice against competitors. Listen to your market's fears and find a way to be their solution.

6. Amazon Prime Video Content Acquisition Report - Streaming Competition Analysis

In the cutthroat streaming wars, Amazon Prime Video couldn't just throw money at content and hope for the best. This competitive analysis report is a prime example of market research report that demonstrates how to find a unique advantage in a crowded market. Instead of just copying Netflix, Amazon’s research dug deep into subscriber behavior and competitive gaps to inform its massive content spending spree.

The report’s goal was to figure out how to make Prime Video a "must-have" service, not just a "nice-to-have" perk of a Prime membership. It aimed to answer critical questions: What kind of content makes people stick around? Where are our competitors weak? And how can our content strategy not only attract viewers but also strengthen the entire Amazon Prime ecosystem?

Strategic Breakdown

Amazon's research was brilliant because it connected content decisions directly to the broader business goal of boosting overall Prime retention. They didn't just measure viewership; they measured how specific content genres influenced a subscriber's likelihood to renew their annual Prime membership. By analyzing competitor libraries and social media sentiment, they identified underserved but highly valuable niches.

> Key Strategic Insight: In a bundled service model, content value isn't just about eyeballs. Your research must measure how specific content assets impact the perceived value and retention of the entire bundle, turning a cost center (content) into a driver of ecosystem-wide loyalty.

This approach revealed that while movies and TV shows were table stakes, unique content like live sports could be a powerful differentiator to attract and retain high-value customers who might not otherwise engage with the video service.

Actionable Takeaways

How can you apply Amazon's playbook to your own strategy?

- Analyze Bundling's Impact on LTV: Don't just look at how one feature is used in isolation. Research how it affects overall Customer Lifetime Value (LTV). Amazon found that Prime members who watched Prime Video had a significantly higher retention rate, justifying the massive content investment.

- Identify Competitor Content Gaps: Systematically analyze what your competitors are not offering. Amazon saw that major streamers were light on live sports, identified it as a high-engagement category, and went all-in on securing deals like the NFL's Thursday Night Football. This created a unique reason for sports fans to subscribe.

- Monitor Social Sentiment for Content Strategy: Track what audiences are saying about competitor shows and your own. This qualitative data provides crucial context for your quantitative viewership numbers, helping you understand why certain content resonates and what new opportunities are emerging.

7. Coca-Cola Global Brand Health Report - Consumer Sentiment and Market Position Analysis

Coca-Cola isn’t just selling a beverage; they're managing a global icon. To stay on top for over a century, they rely on continuous, large-scale research. Their Global Brand Health Report is a masterful example of market research report for any company operating at scale, demonstrating how to maintain brand relevance across wildly different markets. This isn't a one-off study; it's an ongoing system that tracks consumer sentiment, competitive threats, and cultural shifts in over 200 countries.

This report answers the critical questions for a legacy brand: Are we still cool? Are new health trends eroding our base? And where is the next big growth opportunity? By standardizing key metrics while allowing for local nuance, Coca-Cola gets a unified yet culturally-sensitive view of its global standing.

Strategic Breakdown

Coca-Cola’s research strategy is built on the principle of "think global, act local." They track universal metrics like brand awareness and purchase intent but also dive deep into regional trends. For example, while North American research might focus on the shift to zero-sugar options, research in emerging markets might prioritize affordability and distribution channels. This dual focus prevents them from applying a one-size-fits-all strategy that would inevitably fail.

By combining traditional surveys with modern social listening, they capture both what people say in a structured setting and what they feel in spontaneous, online conversations. This provided critical data, like identifying that health consciousness was driving a 20% decline in traditional cola consumption in developed markets, while simultaneously revealing a 15% annual growth potential in certain emerging economies.

> Key Strategic Insight: For a global brand, consistency is key, but customization is king. Standardize your core brand health metrics for global comparison, but empower regional teams to add custom questions that capture local market dynamics and cultural trends.

Actionable Takeaways

How can you apply Coca-Cola's global playbook?

- Integrate Social Listening: Don't just rely on surveys. Use social listening tools to monitor real-time, unfiltered consumer sentiment. This helps you catch emerging trends and potential PR crises before they show up in your quarterly tracking study.

- Track Health and Wellness Trends: No matter your industry, consumer priorities are shifting toward health and sustainability. The report showed this was a key purchase driver for 35% of consumers. You must actively monitor how these macro-trends impact your brand's perception and be ready to innovate.

- Differentiate Aided vs. Unaided Awareness: It’s one thing for people to recognize your brand when they see it (aided), but another for it to be the first one they think of (unaided). Tracking both helps you understand if you're a category leader or just another option in the crowd.

Market Research Report Examples Comparison

| Report Title | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ | |-----------------------------------------------------|----------------------------------------------|------------------------------------------------|------------------------------------------------------|----------------------------------------------------------|------------------------------------------------| | Tesla Model 3 Market Research Report | High – mixed surveys, focus groups, modeling | High – large sample size, diverse data sources | Market positioning insights; price sensitivity | Disruptive product launches; EV market strategy | Robust mixed methodology; actionable insights | | Netflix Original Content Strategy Report | Very High – big data analytics & A/B testing | Very High – advanced data infrastructure | Precise audience targeting; content ROI modeling | Global streaming content strategy; real-time adaptation | Massive proprietary dataset; real-time insights | | Airbnb Market Entry Report | High – regulatory & competitive analysis | High – extensive local market research | Risk reduction; regulatory compliance; demand forecast | Geographic expansion; market entry risk management | Systematic, comprehensive regulatory approach | | Starbucks Store Location Optimization Report | Medium-High – GIS mapping & predictive models | High – specialized tech and data | Optimized site selection; market coverage | Retail expansion; location-based decision making | Accurate performance prediction; ROI focused | | Apple iPhone Consumer Behavior Report | High – surveys, ethnographic & behavioral data | High – longitudinal and complex analytics | Deep user insights; premium market capture | Premium segment product development; ecosystem expansion | Integrated behavioral & attitudinal data | | Amazon Prime Video Content Acquisition Report | High – competitive analysis and econometrics | High – extensive content and customer data | Content gap identification; retention improvement | Streaming content acquisition; competitive differentiation | Comprehensive competitive intelligence; ecosystem integration | | Coca-Cola Global Brand Health Report | Very High – global brand tracking & sentiment analysis | Very High – global scale data and social monitoring | Brand health monitoring; trend identification | Global brand management; cross-market comparison | Consistent methodology worldwide; actionable global insights|

Your Turn: Go from 'Example' to 'Execution'

So, there you have it. Seven deep dives into how the giants of the industry use data to make game-changing decisions. We've gone from Tesla's pre-launch price point gymnastics to Airbnb's blueprint for global domination, and even peeked behind the curtain at how Netflix decides what show to greenlight next.

The golden thread connecting every example of market research report we analyzed? They weren't just about collecting data; they were about finding specific, actionable answers to brutally important business questions. Market research isn't a stuffy academic exercise designed to produce a doorstop-sized report. It’s a strategic weapon.

The Real Takeaway: It's All About Clarity

Let's boil it all down. Whether you're a startup founder trying to find product-market fit or a product manager at a SaaS company trying to outmaneuver a competitor, your goal is the same: clarity.

- Tesla taught us to obsess over what customers will actually pay for, not just what they say they want.

- Airbnb showed us that successful expansion requires a deep understanding of local culture, not just a one-size-fits-all approach.

- Apple reminded us that knowing who your customer is, down to their daily habits and deepest motivations, is the foundation of a brand that people love.

- Coca-Cola's playbook highlighted the importance of constantly monitoring brand health, because perception is reality in the consumer world.

The most powerful insight is that you don’t need a Fortune 500 budget to get started. You just need curiosity, a clear objective, and a smart strategy for finding answers. Forget the idea that you need an army of analysts. Start small, be specific, and focus on one critical question at a time.

Your First Step: From Inspiration to Action

Gathering competitive intelligence and customer data can feel overwhelming. You might look at tools like Ahrefs or Semrush and think, "Great, but I don't have a spare grand a month lying around." And you're right; they are powerful but can be seriously expensive.

But the cost of inaction is even higher. Making decisions based on gut feelings and assumptions is a recipe for disaster. The good news is, there are more accessible ways to get the data you need. For digging into your competitors’ strategies and understanding the market landscape, specialized tools can automate the heavy lifting. Platforms like Already.dev are built specifically for this, turning the painful process of manual research into a quick, automated report.

The point is to begin. Use the reports we've dissected as your inspiration, not as an intimidating benchmark. Pick a strategy that fits your scale, your budget, and your most urgent question. Start making decisions with the confidence that comes from knowing you’ve done your homework. Go from looking at an example of market research report to creating your own.

Feeling inspired but not sure where to start with your own competitive analysis? Already.dev automates the entire research process, delivering a comprehensive report on any company's strategies in minutes, not weeks. Get the actionable insights you need without the hefty price tag or manual grunt work at Already.dev.