How to Do Market Research for a Startup: Tips to Get Started

Learn how to do market research for a startup with our expert tips. Discover affordable strategies to understand your market and grow your business.

Got a brilliant startup idea? That's awesome. But before you drain your savings account building it, you need to answer one critical question: will anyone actually pay for this?

This is the entire point of market research—figuring out if your idea has legs before you start running.

Your Pre-Launch Reality Check

So, you’ve got a world-changing idea. Welcome to the club. It's incredibly easy to fall head-over-heels for your own concept, picturing launch day and maybe even ringing that NASDAQ bell one day. But let's pump the brakes for a second. The startup graveyard is absolutely littered with amazing ideas that, it turns out, nobody actually wanted to buy.

This is where market research comes in, and it's not the scary, expensive beast you might be picturing. Think of it as your pre-flight check. It’s all about asking the right questions before you write a single line of code or order that first pallet of inventory. Skipping this is the number one rookie mistake.

Why This Is Non-Negotiable

Ignoring the market is like trying to navigate a new city with a blindfold on. You're going to hit a wall, guaranteed. In fact, a huge number of startups fail within their first year for a simple reason: they either misjudged what people needed or burned through their cash building something nobody would buy.

Getting this right from the start can dramatically improve your odds. You can find more details in our complete guide to market research for startups.

Good research helps you tweak your business model and nail down your marketing plan before spending serious money. This isn't just about dodging failure; it's about laying a rock-solid foundation for growth and, frankly, making your idea way more attractive to investors.

> "The goal of market research isn't just to confirm your genius—it's to find the truth. The truth might be that your idea needs a tweak, a pivot, or a complete overhaul. Finding that out early is a gift, not a failure."

Pinpointing What You Really Need to Know

Okay, time to put on your detective hat. Your mission is to uncover some core truths about your potential business. The good news? You don't need a fancy degree or a massive budget. All you need is a healthy dose of curiosity and a clear plan.

Before you dive in, it helps to frame your investigation. This simple checklist will get you started on the right foot, ensuring you're asking questions that lead to real, actionable insights.

Your Initial Market Research Checklist

A quick-glance table to help you define your research objectives before you dive in.

| Question You Need to Answer | Why It Matters | Simple Way to Find the Answer | | :--- | :--- | :--- | | Who is my ideal customer? | If you try to sell to everyone, you sell to no one. You need a laser-focused target. | Create a simple customer persona. Talk to 5-10 people who fit that description. | | What problem am I really solving? | People don't buy products; they buy solutions. Is their pain point a mild annoyance or a "hair on fire" problem? | Ask potential customers about their biggest challenges related to your idea. Listen more than you talk. | | Are they willing to pay to solve it? | This is the million-dollar question. A problem isn't a business opportunity unless someone will pay to fix it. | Ask "how are you solving this now?" or "what would you pay for a solution?" Gauge their reaction. | | Who am I up against? | Your idea doesn't exist in a vacuum. Knowing the competition is crucial. | Search online. Read their customer reviews—especially the bad ones. That's where your opportunity lies. |

This isn't about creating a 100-page report filled with charts nobody will read. It’s about gathering just enough intelligence to make your next decision with confidence. Let's get started.

Finding Market Insights Without Spending a Dime

Alright, let's get into the good stuff: research you can do right now, probably in your pajamas, without spending a single dollar. This is all about leveraging information that’s already out there. The official term is secondary research, but I just think of it as being a savvy internet detective. You're piecing together clues to see if your big idea has a real shot.

It's amazing what you can find. You can get a solid lay of the land—getting a feel for market trends, sizing up the actual opportunity, and seeing who you'd be up against—just by knowing where to poke around. This isn't about finding some magical report that screams "YES, BUILD THIS!" It's about building a foundation of knowledge so you can ask much smarter questions down the line.

Become a Digital Eavesdropper

Your future customers are already online, complaining about their problems and wishing out loud for better solutions. Your job is simply to find these conversations and listen in. Forget sterile focus groups for a minute; this is the raw, unfiltered truth.

Online communities are absolute goldmines for this. People are brutally honest when they think they're just talking to their peers. Here’s where I'd start digging:

- Reddit: Find subreddits related to your industry or the specific problem you're trying to solve. Look for threads where people are asking for product recommendations, venting about existing tools, or sharing the clunky workarounds they've cobbled together. Search terms like "anybody know a tool for," "how do you deal with," or "I'm so frustrated with" are your new best friends.

- Twitter/X: The advanced search function is your secret weapon here. You can hunt for conversations around specific keywords or hashtags, filtering by date, location, and even sentiment. It’s a great way to see what people are saying to (and about) your potential competitors.

- Facebook Groups: Niche groups for specific professions, hobbies, or life stages can be incredibly revealing. Join a few relevant ones and just be a fly on the wall. What questions get asked over and over again? What are the common frustrations?

You're not looking for one-off comments; you're looking for patterns. If you see ten different project managers in a subreddit all complaining about the same clunky feature in a popular software, you’ve just stumbled upon a potential opportunity.

Uncovering What People Are Searching For

Another massive clue is understanding what your potential customers are actually typing into Google. This is where keyword research comes into play. And trust me, it’s not just for SEO nerds—it’s a direct window into what your customers want and what’s causing them pain.

Every search query is an expression of a need. Analyzing these searches helps you understand the exact language people use to describe their problems, which is priceless when it comes to writing marketing copy or even naming features in your product.

> A classic startup mistake is assuming you know what your customers call their problem. Keyword research often reveals they use completely different terms. Aligning with their vocabulary is the first step to ever getting found.

Now, the big-name SEO tools like Ahrefs or Semrush are incredible, but they're also incredibly expensive, often running hundreds of dollars a month. That's a tough pill to swallow when you're just starting out. They offer amazing competitive insights, but you can get the ball rolling without that hefty price tag.

For a more budget-friendly approach, you can start with free tools like Google Trends to see how interest in certain topics ebbs and flows. For more concrete data, an affordable alternative like already.dev can help you spot content gaps and search trends without breaking the bank. It gives you the essential insights you need to find your footing.

Digging into Free Data and Reports

Finally, don't sleep on the "boring" stuff. Government agencies and big research firms publish a staggering amount of data for free. It might not be a thrilling read, but it can give you that high-level, 30,000-foot view of your market size and industry trends.

A few places to start your treasure hunt:

- Government Data: Sites like the U.S. Census Bureau or the Bureau of Labor Statistics are packed with data on demographics, industry employment, and economic trends.

- Industry Reports: Big consulting firms like Deloitte, McKinsey, and Gartner often publish free summary reports or whitepapers. A simple Google search for something like "[Your Industry] market report PDF" can unearth some real gems.

This kind of research won't tell you exactly what to build, but it will tell you if the pond you want to fish in is a growing lake or a shrinking puddle. When you combine these broad industry stats with the specific, on-the-ground chatter from online communities, you start to get a powerful, well-rounded picture of your market.

Getting Real Answers from Real People

Okay, the internet detective work is a great start, but it will only get you so far. Now it’s time for the part of market research that most founders secretly dread: actually talking to humans. I know, I know—it can feel a little scary. But trust me, this is where you'll dig up the juicy insights that no report or keyword tool can ever give you.

This is where your assumptions get a reality check. All that secondary research tells you what people did. Primary research—getting on the phone or a Zoom call with real people—tells you why they did it. And that "why" is where your competitive advantage is hiding.

Getting Hard Numbers with Simple Surveys

Before jumping into one-on-one conversations, it's smart to get a quick pulse on what a larger group of people thinks. Online surveys are perfect for this. They help you validate some of your bigger assumptions with quantitative data—real numbers you can actually point to.

You don't need fancy, expensive software for this. A simple survey can help you answer questions like:

- Which of these three features is most important to you?

- How much do you currently spend to solve this problem?

- On a scale of 1-10, how frustrating is this specific issue?

The goal here isn't to ask a million questions. Keep it short and sweet; nobody wants to fill out a 30-minute survey for a startup they've never heard of. A few highly-focused questions will give you the clear data points you need.

> Pro Tip: Don't obsess over getting a "statistically significant" sample size at this stage. Seriously. Getting thoughtful answers from 30-50 people who are actually in your target audience is a thousand times more valuable than 1,000 sloppy answers from a random group.

You can whip up these surveys for free using tools like Google Forms or the free tier of Typeform. Once it's ready, share the link in those same online communities you were snooping in earlier. Just be cool about it—offer to share the results or maybe a small gift card to encourage quality responses.

The Art of the Customer Interview

Surveys give you the "what." Customer interviews give you the "why." This is where you dig deep into the emotions, frustrations, and workarounds that drive buying decisions. Forget those stiff, formal focus groups you see in the movies. We're talking about casual, 20-minute conversations. Your only job is to understand their world.

You're not pitching your idea. In fact, you should barely mention it. Think of yourself as a journalist trying to uncover a great story.

Your script should be built around open-ended questions that get people talking. Here are a few of my favorites to get things rolling:

- "Tell me about the last time you dealt with [the problem you solve]..."

- "What's the hardest part about that?"

- "What have you tried to do to fix this? Did any of it work?"

- "If you had a magic wand and could change anything about this process, what would it be?"

That "magic wand" question is pure gold. It gets people to stop thinking about existing solutions and start describing their ideal world. That's where the best product ideas are often found.

Finding the Right People to Talk To

So, where do you find these people? It’s easier than you think. You can start with your own network, but be careful—friends and family will try to be nice. You need honest, unbiased feedback.

A much better approach is to go back to those online communities on Reddit, Facebook, or LinkedIn. Post a simple, transparent message: "Hey, I'm doing some research on [topic] for a new project. I'm not selling anything. Would anyone be open to a quick 20-minute chat? I've got a $15 Starbucks card for your time."

You’d be surprised how many people are willing to talk, especially if they're passionate about the problem you're exploring. Aim for 5-10 quality interviews. Once you start hearing the same pains and frustrations over and over again, you'll know you're onto something real.

This direct interaction is beyond crucial. The entire market research industry, valued at around $140 billion, is built on this stuff. While quantitative methods like online surveys are used by 85% of professionals, it's the qualitative methods—like the in-depth interviews we're talking about—used by 34% of researchers that provide the nuanced understanding startups desperately need. If you want to dive deeper, you can discover more about how startups can apply these methods from the pros at Drive Research.

Ethically Spying on Your Competition

Let’s be real: your startup doesn't exist in a vacuum. While you were sketching out your brilliant idea, other companies were already out there, serving the very customers you want to win over. They’ve already spent a ton of time and money figuring out what works—and what doesn't.

It’s time to learn from their expensive mistakes.

This isn't about some shady corporate espionage mission. It's about smart, ethical competitor analysis. We're going to dig much deeper than a quick glance at their homepage. The mission is to dissect their entire strategy: their marketing, their pricing, their product features, and most importantly, what their customers are actually saying about them.

The goal isn't to copy them. It's to find the gap in the market they've completely missed. That gap? That's where your startup wins.

Decoding Their Marketing Playbook

First things first, we need to figure out how your competitors are getting customers. Are they social media wizards? Do they own the top spots on Google? Understanding their go-to-market strategy gives you a massive clue about what your audience responds to.

You need to become a student of their online presence. Seriously. Sign up for their newsletter, follow them on every social media channel, and pay attention to their ads. Notice the language they use, the benefits they highlight, and the offers they push. This isn't just passive observation; you're looking for patterns.

- Content & SEO: What topics are they constantly blogging about? What keywords do they rank for on Google? This tells you exactly what problems their (and your) customers are trying to solve.

- Social Media: Where are they most active? Which platforms get them the most engagement—the likes, comments, and shares? This is a dead giveaway for where your target audience hangs out online.

- Paid Ads: Are they running ads on Google, Facebook, or LinkedIn? The copy in these ads is often their core value proposition, boiled down to its most potent form.

This whole process of gathering intel is often called competitive intelligence. It's a critical step. For a deeper look at the tech side of this, check out our guide on the best competitive intelligence tools that can automate a lot of this detective work.

Finding the Cracks in Their Armor

Okay, now for the fun part: finding out where they're dropping the ball. The single best place to discover your competitors' weaknesses is in their customer reviews. This is where you find the raw, unfiltered truth.

Get ready to dig through sites like G2, Capterra, and Trustpilot, not to mention Reddit threads and app store reviews. Here’s a pro tip: ignore the glowing 5-star reviews and the furious 1-star rants. The real gold is hidden in the 2, 3, and 4-star reviews. These are written by people who wanted to love the product but were let down by something specific.

> Look for recurring complaints. Phrases like "I just wish it could..." or "It's great, but it's missing..." are basically treasure maps pointing you directly to your biggest opportunity. If 10 different people are complaining about the same missing feature or awful customer service, you've just found a gap you can fill.

Analyzing your competitors' SEO and content is another great way to spot weaknesses. Big-name enterprise tools like Semrush and Ahrefs are fantastic for this, but their price tags can be brutal for an early-stage startup. A more budget-friendly tool like already.dev gives you the competitive insights you need to find opportunities without needing a VC-sized budget.

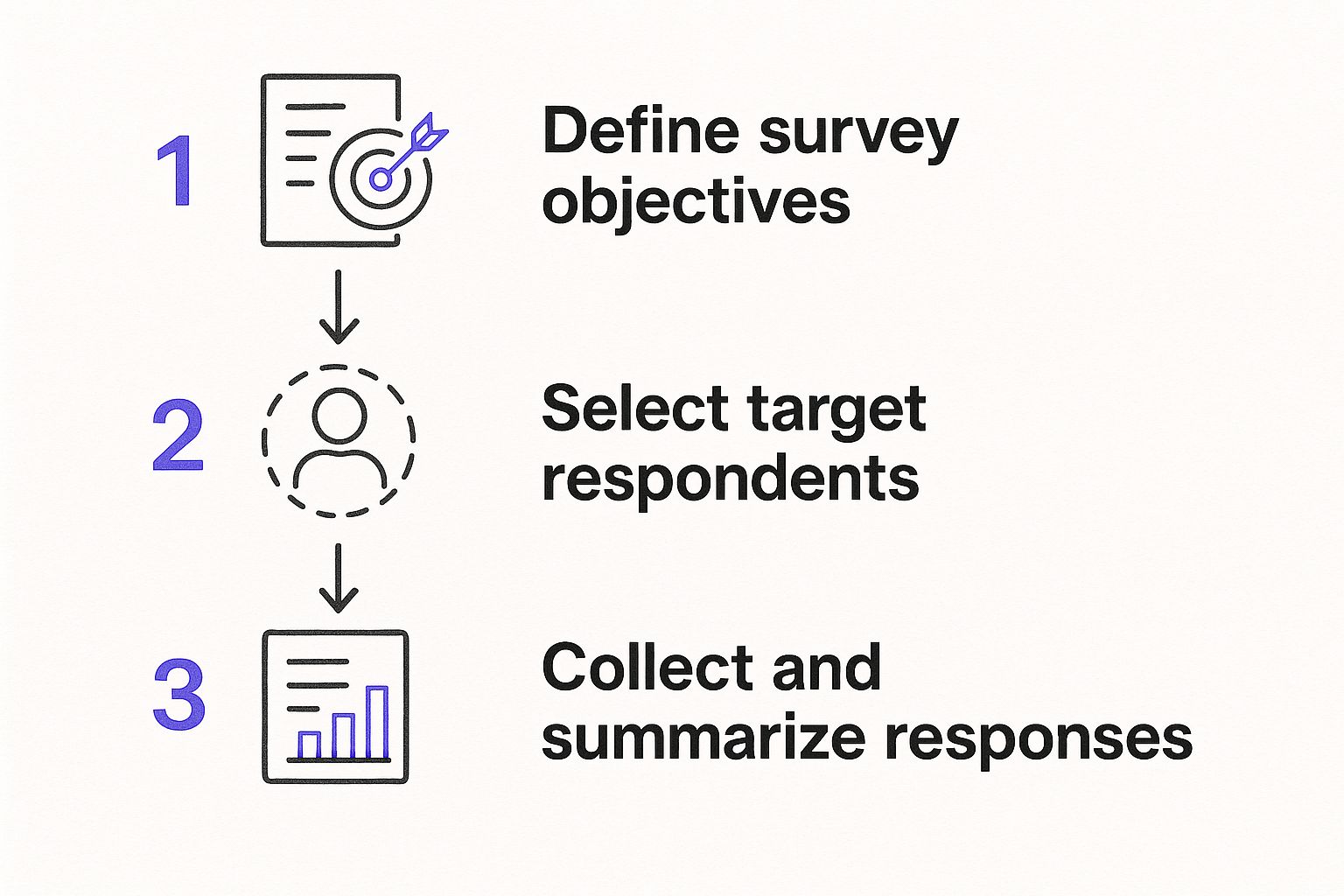

This infographic lays out a simple way to define your objectives before you dive into any kind of research, whether it's surveys or competitor deep dives.

Following a clear process like this keeps your research focused. It prevents it from turning into a massive, overwhelming data-gathering exercise with no real purpose.

Putting It All Together

Once you've done your homework, you have to organize it. Don't just let your notes rot in a random document. A simple comparison table can bring stunning clarity to your analysis and help you spot opportunities at a glance.

To keep from getting overwhelmed, I recommend creating a simple framework to systematically compare your top competitors. It helps turn a messy pile of observations into a clear strategic overview.

Simple Competitor Analysis Framework

| Competitor | What They Do Well | Where They Stumble (Your Opportunity!) | Their Pricing Strategy | | :-------------- | :----------------------------------------------- | :-------------------------------------------------------------------- | :------------------------------------------- | | Competitor A | Sleek user interface and strong brand presence. | Users complain about the high price and lack of key integrations. | Premium pricing, tiered by features. No free plan. | | Competitor B | Very affordable with a generous free plan. | The product is buggy, and customer support is notoriously slow. | Freemium model, focused on user volume. | | Competitor C | Excellent customer support and a loyal community. | Their feature set is outdated and feels clunky compared to newer tools. | Mid-range pricing with annual discounts. |

When you map out the landscape like this, the unmet needs become glaringly obvious. Maybe there's a space for a product with Competitor A's great design, Competitor B's affordability, and Competitor C's amazing support.

That’s not copying—that’s innovating.

Turning Research into a Battle Plan

Alright, let's get this done. You've waded through all the interviews, surveys, and competitor deep dives. Your desktop probably looks like a digital crime scene, littered with spreadsheets and notes. But all that raw data is just noise until you turn it into a clear, actionable plan.

This is where you connect the dots. It’s less about crunching numbers in a lab and more about spotting the patterns that reveal your startup's biggest opportunities.

Nail Down Your Ideal Customer Persona

First thing's first: let’s build a customer persona. I'm not talking about some fluffy document with a stock photo and a cheesy name like "Startup Steve." A real, useful persona is a practical tool built from the hard data you just gathered. It’s a snapshot of the actual person you're trying to serve.

Ground your persona in the real frustrations you heard in your interviews. Don't make stuff up. Pull direct quotes and pain points straight from your notes.

A solid persona should answer a few key questions:

- What's their core problem? Use their own words to describe the struggle.

- How are they trying to solve it now? This reveals their current frustrations and who you're up against.

- What does their dream solution look like? Remember that "magic wand" question? The answer goes right here.

- What are their biggest hesitations or fears? Gold for your marketing copy.

This persona is your compass. Every time you debate a new feature, a pricing change, or even a simple email subject line, you need to ask, "What would [Persona's Name] think?" It’s the simplest way to stay focused on your customer.

> A great persona isn't fiction; it's journalism. You're reporting the facts you've uncovered about your customer's world—their struggles, their hopes, and what they truly value. It’s a constant reminder of who you’re actually building for.

Synthesize Everything Into a Simple Plan

With your persona locked in, it's time to boil it all down to a one-page summary. This document is your secret weapon for refining your business model and pitching your idea with confidence. Trust me, you don't need a 50-slide deck; you need clarity.

Your one-pager should hit the absolute most critical insights from your research. Think of it as your startup's ultimate cheat sheet. If you're wondering what a final report can look like, we put together a great example of a market research report you can check out.

The startup world is no joke. Worldwide, there are roughly 1,245 billion-dollar startups, but a solid one in five fails in the first year. Your research is what gives you an edge. It helps you grasp both the massive potential—the AI industry alone is on track to hit $243.7 billion—and the very real risks, so you can tailor your pitch and navigate the market. For more on this, ff.co has some great insights on the competitive startup landscape.

Turn Your Insights into Action

Finally, you have to translate your findings into actual, concrete steps. Don't let your research collect dust in a folder somewhere. Every key insight needs a "So what?" moment.

Here’s a simple way to think about it:

- Insight: "Every single person I talked to complained about how long it takes to get support from Competitor X."

- Opportunity: "There's a massive opening for a solution with ridiculously fast, human-powered support."

- Action: "Our MVP must have a live chat with a 'response in under 60 seconds' promise. We'll make that a core part of our launch messaging."

See how that works? You just turned a common complaint into a killer differentiator. This is the whole point—making your research drive your decisions. It isn't just an academic exercise; it's the blueprint for building a business people will actually love and, more importantly, pay for.

Common Market Research Questions Answered

https://www.youtube.com/embed/b-hDg7699S0

So you’re ready to dive into the world of market research. Awesome. But if you’re like most founders, you probably have a few nagging questions bouncing around in your head. Let's tackle the most common ones we hear so you can move forward with confidence.

How Much Should a Startup Budget for Market Research?

Honestly? Way less than you think. You can do incredibly effective research for under $500, or even for free if you're scrappy.

Your biggest investment here isn't cash; it's your time. Your best friends are free tools like Google Forms for surveys, Reddit for eavesdropping on your future customers, and government databases for high-level stats. Don't fall for the trap of thinking you need a five-figure budget and a fancy consulting firm.

If you do have a small budget, paid survey platforms can get you quick answers for a few hundred bucks. But instead of stressing about a big number, just dedicate 20-40 hours to this process. The insights you gain will save you thousands in development and marketing mistakes down the road. You can get 80% of the value for 1% of the cost by doing it yourself.

What If My Research Shows My Idea Is Bad?

First, take a deep breath. Then, celebrate! Seriously. You just saved yourself months, maybe years, of your life and a mountain of cash chasing an idea that wasn't going to work. This is the entire point of doing market research—to find the truth, not just to get a pat on the back for your genius idea.

Negative feedback is a gift. But don't immediately trash the entire concept. Dig into the "why."

- Is the problem not as painful as you assumed?

- Is your proposed solution totally missing the mark?

- Is your pricing strategy completely out of whack?

> Often, research points to a pivot, not a dead end. The most successful founders are the ones who listen to the market and adapt their vision. Consider this a massive win, not a failure.

How Do I Know When I have Done Enough Research?

Ah, the million-dollar question. The truth is, you'll never be 100% certain, and that’s perfectly okay. The goal of research isn’t to eliminate all risk; it’s to shrink it down to a manageable, less terrifying size.

You've probably done enough digging when you start hearing the same feedback over and over again. When you can practically predict what your interviewees are going to say about their biggest problems and frustrations, you're on the right track. It's a sign you've reached a point of pattern recognition.

By the end of your initial research sprint, you should be able to confidently answer these three questions with data, not just gut feelings:

- Who is my customer? (And I mean really know them).

- What is their core, hair-on-fire problem?

- How does my solution fix it better than anything else out there?

Once you have solid, data-backed answers to these, it’s time to stop researching and start building. You’ve gathered enough intel to make your next move. The rest of the learning will happen in the real world, with a real product and real customers.

Feeling overwhelmed by competitor research? Already.dev can help. Our AI-driven platform does the heavy lifting, delivering a comprehensive competitive landscape report in minutes, not weeks. Find out who you're really up against at https://already.dev.